Business lawyer > Accounting > Accounting and reporting > What administrative expenses include: accounting features, write-off methods

Paragraph 20 of PBU 10/99 determines that any enterprise has the right to independently determine in its accounting policies how to recognize expenses, including management expenses. They can become part of the cost by type of business activity: production or sale of goods, provision of services, performance of work (letter of the Ministry of Finance No. 07-05-06/191 dated 02.09.208). When developing accounting policies, you should be guided by the Instructions for the chart of accounts.

What are administrative expenses and how do they differ from commercial expenses?

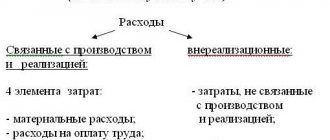

Management costs include costs that do not have a direct connection with the production or sale of goods, services, or work. If costs can be associated with one of the areas of business activity, they are considered commercial (for example, wages and deductions for the head of a production department).

Cost calculation

Management costs can be included in the cost price if they are distributed in proportion to revenue across all types of manufactured products (sold goods, works, services). When developing an accounting policy, an enterprise (organization) must be guided by Law No. 129-FZ and paragraph 4 of PBU 1/2008.

The chart of accounts is developed on the basis of the Plan approved by the Ministry of Finance on October 31. 2000, and based on the scope of activity, legal form, scale and structure of the enterprise. The accounts that will be necessary to account for business activities are selected and supplemented with subaccounts and analytical accounts. If some accounts are not needed, they are not included in the work plan. Administration costs are always included in general business expenses (accounts 26 and 27).

Management budget

When forming a forecast for income and expenses for different areas of spending, it is recommended to calculate standard values or set limits for reporting periods.

The budget can be prepared using one of three methods:

- Traditional, using the linking of the administrative expense limit to the general wage fund (the method is considered obsolete).

- Indexation method - data from the reporting year is taken as a basis and increased by a certain percentage.

- Focus on results - the amount of funds allocated for management needs directly depends on the expected and achieved results of the enterprise.

What is included in management expenses

The composition of this type of costs largely depends on the field of activity, but in general, management costs include funds spent on:

- maintenance of buildings housing administrative personnel: human resources department, legal department, etc.

- salaries and deductions of administrative personnel

- purchasing equipment and office supplies for the office

- office staff business trips

- payment for communication services

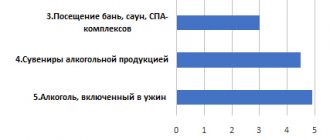

Administrative department - entertainment events

- repair of that part of fixed assets that are not related to the main production activity

- depreciation of fixed assets not related to the main production activities

- rental of premises for general purposes

- property and personnel insurance

- auditors, consultants, information providers

- lighting, water supply, heating, sewerage in administrative staff premises

- taxes paid on fixed assets, transport

- enterprise security, measures to ensure fire safety

- labor protection and product certification

- transportation of workers to and from work place

- taxes not related to the production process: water and transport tax, tax on harmful emissions

- management company services

Each enterprise can add or shorten this list if the specifics of business activity require it.

This could include spending on protective clothing and personal protective equipment, printing services, postal services, cleaning, disinfection of premises, maintenance of the yard and road, bathhouses or showers, canteen, and first aid station. This category also includes the costs of training and advanced training, and the search for new employees.

Administrative and management expenses

Page 1

Administrative and managerial expenses include the cost of depreciation of buildings occupied by departmental staff, basic and additional salaries of administrative and managerial personnel, office, postal, telegraph and other expenses.

Administrative and management expenses are distributed in proportion to the basic salary of production personnel or the planned volume of work in standard shifts for the corresponding groups of machines.

Administrative and managerial expenses are: costs for the basic salary of administrative and managerial personnel with accruals and bonuses; expenses for business trips and transport, office and postal and telegraphic expenses; the cost of maintaining administrative buildings and premises, as well as the cost of depreciation of buildings and equipment and other administrative and management expenses.

Administrative and management expenses are determined based on the current provisions for planning the amounts of maximum allocations for the maintenance of the management apparatus.

Administrative and management expenses of stores, warehouses, bases, vegetable stores, canteens, etc. are reflected together with operating expenses in subaccounts 1 - 5 and are not taken into account in subaccount 7.

Administrative and management expenses of the house management are not included in utilities. Targeted fees for house management are assessed on these households in accordance with the general procedure.

Reflection of management costs in accounting

Administrative expenses do not depend on the volume of business activity, so they cannot be written off to “Main production” at the end of the month (account 20). They are taken into account in “General expenses” (D 26).

Features of accounting are that there are two write-off methods:

Reflection in accounting

- traditional - are recognized as conditionally constant and are fully related to the full cost, carried out as K 26, D 90

- based on the division of administrative costs into semi-fixed and semi-variable

When using the second method, the reduced production cost is calculated, conditionally fixed expenses are written off to “Cost of sales” (D 90-2), that is, they are recognized as costs of the reporting period that reduce income.

There are 3 options for writing off the conditionally variable part:

- K 26, D 20 - if they relate to the main production

- K 26, D 23 - if they relate to auxiliary production

- K 26, D 29 - if they relate to service facilities or production

Administrative costs are included in the cost price after the sale of products (goods) and are written off to “Sales” (account 90). The income statement is reflected in line 040.

Some economists express the opinion that administrative costs can be written off on D 91 if there were no sales during the reporting period.

Disputes with the tax office most often arise over expenses for the services of management companies. If there is an agreement, a document confirming payment, and an acceptance certificate for work performed, there should be no claims. Tax authorities may consider this type of service to be economically unprofitable and aimed at tax evasion. Analyzing the decisions made by the courts in similar cases, we can conclude that most entrepreneurs manage to prove that such expenses are justified.

Administrative and commercial expenses

For accounting purposes, an enterprise is given the right to independently determine the procedure for recognizing management and commercial expenses, which it must necessarily consolidate in its accounting policy (clause 20 of PBU 10/99).

The mentioned expenses may be charged to the cost of production to the extent that they are recognized as expenses of the reporting period for ordinary activities. In addition, administrative and selling expenses can be written off to the cost of products sold, goods, works, services in the full amount of expenses recognized in a given reporting period. The Ministry of Finance recently recalled this in a letter dated September 2, 2008 No. 07-05-06/191.

Before we begin to understand the procedure for recognizing such expenses, we will determine which expenses are called commercial and which are management.

Management expenses include expenses not related to the production or commercial activities of the enterprise: for the maintenance of the personnel department, legal department; for lighting and heating of non-production facilities, as well as for business trips, communication services and other similar expenses.

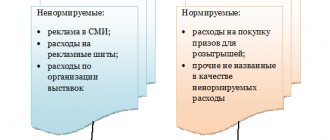

Selling expenses are expenses associated with the shipment and sale of goods. Those enterprises that carry out production activities have the right to include commercial expenses for packaging products; for delivery of products to the departure station, loading into vehicles; commission fees paid to intermediary organizations; product storage costs; for advertising, entertainment and other similar expenses.

In turn, trade organizations can include as sales expenses the funds spent on transporting goods, on wages, on rent, on the maintenance of buildings, structures, premises and equipment; costs of storing goods; for advertising; for entertainment and other similar expenses. Such a list is given in the Instructions for the Chart of Accounts.

Recognition of management expenses

In accounting, management expenses are reflected in the debit of the general expenses account. If, according to the accounting policy, administrative expenses are partially included in the cost of production, they will be written off in one of the following entries:

Debit 20 Credit 26 - if the production of this type of product is the main activity of the organization.

Debit 23 Credit 26 - if auxiliary production produced products and work and provided services to the outside.

Debit 29 Credit 26 - if servicing industries and farms performed work and services outsourced.

If such costs are attributed to accounts 20, 23 or 29, they will be included in the cost price as the products produced are sold, that is, as these costs are written off from accounts 20, 23 and 29 to account 90.

If administrative expenses are recognized in full, then as semi-fixed expenses they will be charged directly to the cost of sales of the reporting period in which they arose. The posting in this case will be as follows: Debit 90 Credit 26

When writing off administrative expenses to account 90, they are fully included in the cost of production in the reporting period when they were recognized as “expenses for ordinary activities.” However, there is one caveat here. This can be done only on the condition that the organization complies with the procedure for generating expenses on account 26, provided for by the Instructions for the Chart of Accounts, approved by Order of the Ministry of Finance dated October 31, 2000 No. 94n. It says that account 26 is provided to reflect information on expenses for management needs not directly related to the production process.

It turns out that account 26 was originally intended to record expenses specifically for managing the organization. However, in practice, it may turn out that this account takes into account not only administrative expenses, but also production costs. In this case, it is incorrect to talk about writing off the entire amount from the general expenses account by posting Debit 90 Credit 26 . You can write off only that part of expenses that are directly administrative.

We also note that when filling out a profit and loss statement, you should remember that the line “Administrative expenses” is filled in only if administrative expenses are not distributed among costing objects, that is, the second option for reflecting costs is selected in the accounting policy and there are no accounting entries Debit 20 Credit 26, Debit 23 Credit 26, Debit 29 Credit 26. Otherwise, management costs are not deducted from production costs and the line “Management costs” is not filled in (clause 21 of PBU 10/99).

What about business expenses?

Commercial expenses are accumulated in the debit of account 44 “Sales expenses”. As noted above, they are written off to the cost of products sold either in full or in proportion to the volume of products sold. In both cases, the write-off is made to the debit of account 90 “Sales”.

Here it is necessary to remember that, recognizing business expenses in an incomplete amount, the company will need to distribute certain types of expenses listed in the Instructions for using the Chart of Accounts.

Firstly, these are the costs of packaging and transporting products in organizations engaged in industrial and other production activities. Distribution is carried out between individual types of shipped products on a monthly basis, based on their weight, volume, production cost or other relevant indicators.

Secondly, these are transportation costs in organizations engaged in trading and other intermediary activities, which are distributed between the goods sold and the balance of goods at the end of each month.

Thirdly, these are the costs of procuring agricultural raw materials and the costs of procuring livestock and poultry in organizations that procure and process agricultural products. Moreover, the first are distributed to the debit of account 15 “Procurement and acquisition of material assets”, and the second - to the debit of account 11 “Animals for growing and fattening”.

S. Lisitsyna , expert at the Federal Financial Information Agency

| Berator of the new generation simplified tax system IN PRACTICE A complete guide for an accountant on accounting using the simplified tax system. Accounting rules that any “simplified” person needs. Connect berator |

Financial analysis of management costs

Management costs in financial analysis are classified as semi-fixed, since their value does not depend on production volume. If the volume of products produced (sold) increases, profit per unit increases due to scale.

Difficult economic conditions force entrepreneurs to take a different look at the administration staffing table. Enterprise managers are trying to combine the functions of departments in order to reduce the number of employees. This allows you to reduce costs for salaries, rent, transportation, office equipment, and business trips. The amount saved is the amount of increased profit.

Some choose a different path - reducing wages, allowances and bonuses while maintaining the size of the administrative apparatus. This option is preferable because it does not increase the unemployment rate or reduce employee loyalty.

A good option is to transfer part of the office staff to the “home” mode, which allows saving on rent of premises, utility bills, and official transport. Almost all staff can work via the Internet.

Competent financial analysis allows you to use the optimization of administrative costs as a means of increasing profits. The funds saved on optimizing the management staff can be invested in development, reorganization, renewal, and innovation.

Top

Write your question in the form below