Any business activity involves expenses. You have to spend money on diverse processes and purchases: those needed for the production of products, equipment maintenance, the purchase of raw materials, packaging, and transportation. And also on management processes, not to mention wages. This multifactorial nature of costs indicates the need for their classification and separate accounting.

Let’s understand the concept of “overhead costs”, clarify which costs can be attributed to them and how to recognize them in financial accounting.

What is overhead

Not all costs in production go directly into the product and can be directly planned and taken into account in its cost. Nevertheless, the funds spent turn out to be absolutely necessary for the manufacture of products, their sale, promotion on the market, as well as the management of the organization itself.

The most accurate definition of overhead would be “everything else.” This type of costs is not highlighted in a separate article in the Tax Code of the Russian Federation; naturally, their structure is not spelled out there either. In accounting, it is also impossible to clearly differentiate them.

NOTE! The law establishes a list of overhead costs only in the construction and medical industries. All other enterprises must determine overhead costs themselves, fixing this in their accounting policies.

overhead costs, accepted in business, implies expenses that cannot be attributed directly to technological production processes, accompanying the production process, but not included in the cost of work and raw materials. Another name for overhead costs is indirect costs . They are indicated when planning and drawing up estimates for both the company as a whole and individual structural divisions.

Overhead costs in construction: new standards take the industry beyond the brink of survival

GARASCHENKO O.V., General Director of ECCON GROUP

KLEM-MUSATOVA I.K., Ph.D., Chief Economist, ECCON GROUP

KASHINA I.G., Director of AF Exclusive Consulting LLC

The next “stumbling block” on the path to reforming the regulatory and methodological base of estimated pricing was the approval of the project “Methods for determining the amount of overhead costs in construction.”

As part of the established dialogue between the Russian Ministry of Construction and the professional construction community, an active process of resolving disagreements and contradictions that arise during the reform of the regulatory and methodological base of estimated pricing in construction continues.

On September 6, 2018, an open plenary meeting of the Working Group under the Russian Ministry of Construction on the methodology of estimated pricing was held, which was attended by representatives of the ministry itself, Glavgosexpertiza of Russia, the Research Institute of MGSU and more than 40 of the largest construction companies in Russia.

In addition to updating and agreeing on the issues of introducing changes to the draft methods of estimated pricing for material and labor resources, a heated discussion was again caused by the topic related to overhead cost standards in the draft of the new “Methodology for determining the amount of overhead costs in construction” (hereinafter referred to as the Methodology).

During the consideration of the draft Methodology sent by the Ministry of Construction back in the spring of 2020 to the Working Group, a preliminary assessment of overhead cost standards was carried out, which showed that their level is 2-3 times lower than similar indicators prevailing in Russian construction companies. According to the latter, the introduction of these standards will lead to underfinancing of projects under construction and, as a consequence, unprofitable construction activities.

To substantiate the position of the professional community, the Working Group, with the active assistance of the FDA Rosavtodor, organized the collection of factual data by surveying construction companies using questionnaires specially developed for this purpose. More than fifty of the largest enterprises in the field of infrastructure construction, whose revenue amounted to almost 400 billion rubles, took part in the survey, which made it possible to make a representative comparison of the level of overhead costs prevailing in the construction market with the introduced standards.

At an open meeting on September 6, 2018, such a comparison was assigned to the head of the Working Group, General Director of ECCON GROUP Olga Garashchenko. Conducted by ECCON GROUP specialists with the participation of Deputy. Natalya Breus, General Director for Economics of Mostostroy-11 JSC, and Evgeniy Mishin, Head of the Estimation Department of Mostotrest PJSC, the analysis allowed us to draw the following conclusions:

The overhead cost standards in the Methodology are significantly underestimated, incl. due to:

- unreasonable overestimation of the wage fund (payroll) in direct costs, by 1 rub. from which the standards are calculated;

- unreasonable underestimation of overhead costs adopted for calculating standards.

According to clause 1.5 of the Methodology, overhead cost standards (OS) are expressed as a percentage of the wage fund of construction workers and machinists as part of estimated direct costs (payroll in the PP):

The standard and industry average %NR was:

| on the territory of the Russian Federation (except for the Far North) | in the Far North | |

| Average % HP | 74 | 78 |

| Confidence interval | 72 – 76 | 77 – 80 |

Verification calculations have shown that when forming NR standards, the share of payroll in the PP is taken to be 77% of total labor costs, although according to Rosstat, the share of payroll for workers in general is 59%, and according to construction companies, the share of payroll for construction workers and machinists is 48 %.

Thus, the denominator of the calculation formula is overestimated by more than one and a half times. As a result, the labor costs in the numerator of the formula and the value of the industry-wide standard are underestimated, which in terms of payroll is not comparable with the base from which overhead costs in the estimate should be calculated - wages of construction workers and machinists.

In addition, the numerator of the calculation formula for the HP standard does not include the costs provided for by the Methodology itself:

- expenses for maintenance, operation, repairs of buildings occupied by the AUP, official vehicles, administrative expenses,

- expenses for servicing construction workers,

- a significant part of the costs of organizing work on construction sites.

Overestimation of the denominator and underestimation of the numerator in the formula for calculating overhead costs led to a distortion of the HP .

The overhead cost standards proposed by the Methodology are at least two times lower than the industry average, reflecting the ratio of overhead costs and labor costs, as well as the level of standards in the current MDS 81-33.20041.

Reducing the standards in the Methodology compared to the level established in MDS 81-33.2004 and the prevailing percentage of overhead costs in the industry is not justified, especially taking into account the significant decrease in the share of workers' compensation and the increase in the share of engineers' wages due to scientific and technological progress.

1 Guidelines for determining the amount of overhead costs in construction (MDS 81-33.2004), approved. Resolution of the State Construction Committee of the Russian Federation dated January 12, 2004 No. 6

In accordance with clause 1.6 of the Methodology, the standard value of overhead costs proposed in it “reflects the industry average costs of organizations carrying out construction to cover administrative and business expenses, costs of servicing construction workers, organizing work on construction sites and others...”. To check the adequacy of the standards presented in the Methodology to industry averages, the ratio of overhead costs and workers' compensation costs was calculated using Rosstat data, the results of which are shown in Table 1.

According to Rosstat data on wages of different categories of personnel, the share of workers' compensation in the total labor costs in the construction industry averages 59% . This share is typical not only for construction, but also for other leading sectors of the Russian economy. For example, in general, for the types of activities surveyed it is 38%, for mining – 59%, for manufacturing – 58%.

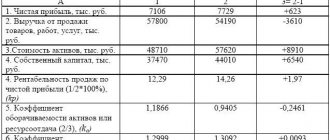

Table 1 (thousand rubles excluding VAT)

| Labor costs | of them: | Insurance contributions to the Pension Fund, Social Insurance Fund, Compulsory Medical Insurance Fund | Other costs | incl. rent | Total HP (4+5+6‑7) | HP percentage (8/3) | ||

| workers | other personnel | |||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| Construction | 407 296 | 240 305 | 166 991 | 112 742 | 156 101 | 58 517 | 377 317 | 157% |

* According to Form 5-Z for 9 months. 2020 and Q1 2020 and the statistical bulletin of Rosstat “On wages of employees of organizations by personnel categories and professional groups of employees for October 2020”

Calculations showed that the industry average ratio of overhead costs to workers' compensation costs was 157%, which is twice as high as the overhead cost standards in the Methodology .

The level of the industry average percentage of overhead costs reflects the ongoing changes in the construction sector, associated, as in the entire Russian economy, with the development of new technologies, active mechanization, automation, and intellectualization of production. These processes lead to an increase in its efficiency, as evidenced, for example, by the increasing dynamics of average monthly output per employee in construction. The displacement of manual labor led to a significant change in the personnel structure towards a decrease in the share of workers and an increase in the share of engineering and technical workers.

In 2004 standards, the share of workers' compensation was about 70%. When these standards are recalculated taking into account the reduction in the share of workers' compensation from 70% to 60%, their level increases by 30% or more (Table 2). For example, the weighted average standard of 127% for 66 companies participating in the survey, when adjusted for structural changes, reaches 162%.

Estimated calculations show that the observed increase in the percentage of overhead costs is an objective circumstance associated with a change in the structure of workers due to scientific and technological progress.

Table 2. Estimation of the percentage of HP under the modern wage structure

| The name of indicators | Indicators | |||

| An example of the level of the NR standard according to MDS 81‑33.2004 | 110% | 120% | 127% | 142% |

| Average share of labor remuneration in HP (Appendix 8 to the IDS) | 30,98% | 30,98% | 30,98% | 30,98% |

| Payroll for other personnel in the HP standard (clause 1*clause 2) | 34,1 | 37,2 | 39,3 | 44,0 |

| Payroll of workers (follows from the standard formula) | 100 | 100 | 100 | 100 |

| Total payroll | 134,1 | 137,2 | 139,3 | 144,0 |

| Share of payroll for other personnel (item 3 / item 5) | 25,4% | 27,1% | 28,2% | 30,6% |

| Share of payroll workers (item 4 / item 5) | 74,6% | 72,9% | 71,8% | 69,4% |

| With a payroll share of workers of 59% | ||||

| Payroll of workers | 100 | 100 | 100 | 100 |

| Payroll of other personnel | 69,5 | 69,5 | 69,5 | 69,5 |

| Insurance premiums | 43,5 | 47,5 | 50,3 | 56,2 |

| Other HP | 40,2 | 41,7 | 41,9 | 44,9 |

| Total HP (item 9-item 11) | 153,3 | 158,7 | 161,6 | 170,6 |

The current level of standardized overhead costs in construction companies generally corresponds to that provided for by the current MDS 81-33-2004, adjusted for changes in the industry wage structure. However, there are a number of costs, the occurrence of which is associated with the introduction of new rules for budget financing of government orders and which are not taken into account by the Methodology.

Factor analysis of data provided by construction companies confirmed the findings that the industry average percentage of overhead costs is approximately 160-170%. The structure of the average percentage of overhead costs, calculated according to construction companies, was:

| Administrative expenses | 120 |

| Costs of servicing construction workers | 49 |

| Costs of organizing work on construction sites | 24 |

| Other overheads | 38 |

| Total | 231 |

| Of these, HP for carrying out construction and installation work on its own | 215 |

| Deviation of the percentage of HP from the average standard level of 127% | 88 |

| incl. due to the following factors: | |

| Values of non-standardized HP | 53 |

| Changes in the wage structure (share of workers' payroll) | 35 |

Total standardized part of the percentage HP = 215 – (53+35) = 127%

The share of wages for main workers in construction companies was about 48%, and the corresponding average percentage of overhead costs was 215%, of which the non-standardized part accounted for 53%, and the standardized part accounted for 162%. Excluding the adjustment factor for changes in the average market wage structure, the average actual percentage of NR is 127% (162-35), which corresponds to the average level of standards established by MDS 81-33.2004 for the companies participating in the survey.

When analyzing the structure of the HP percentage, other factors were identified that require careful study. For example, significant intra-structural deviations for individual items, such as costs for designing work, payments on bank loans, as well as the exclusion of a number of construction-related items from the standardized overhead costs.

A significant increase in the cost of servicing bank loans is caused by the tightening of budget financing procedures, which forces construction enterprises to resort to lending for current activities.

A big problem is a new cost item for contracting organizations associated with services for providing an irrevocable bank guarantee to ensure the execution of a government contract. These costs objectively arise from the conditions of budget financing, but not a single method provides for covering them at the expense of the estimated cost of construction.

The method adopted by the Methodology for calculating overhead costs, based on the amount of estimated labor costs, requires additional study. Analysis of actual data revealed a weak dependence of overhead costs on the payroll of key workers.

In fact, there is a high spread of % HP and a weak dependence of HP on payroll:

As can be seen from the survey participants:

- Payroll and % HP do not change proportionally;

- with a decrease in revenue, the share of HP in it grows faster than the share of payroll;

- there is a dependence of the rate of change in the share of payroll and the share of HP in revenue on the scale of the company.

In the age of total mechanization, automation, and computerization of production, hard human labor is being forced out. The share of intellectual work is increasing.

Focusing on the formation of overhead costs only on the payment of the main workers does not correspond to the logic of scientific and technological progress and does not motivate the construction business to use its results.

In connection with the above, the Working Group considers it necessary:

- Bring overhead cost standards to a level that meets modern market realities. Overhead costs are also a resource, without which neither the organization of the construction process nor its management is possible. And this resource, like others, has a market value.

- Consider the feasibility of differentiating the base for determining overhead costs: those that do not depend on the payroll of the main workers should be calculated based on other budget parameters.

The findings were reported at a meeting of the Working Group on Pricing under the Ministry of Construction of Russia, held on November 7, 2018 at the site of Glavgosexpertiza of Russia, which was attended by Deputy Minister of Construction and Housing and Communal Services Dmitry Volkov, key officials of the Ministry of Construction and Glavgosexpertiza of Russia, the head of the Working Group, General Director of ECCON GROUP Olga Garashchenko, assistant to the deputy of the State Duma of the Russian Federation Andrei Bobrovskikh, representative of the Moscow General Plan Institute Sergei Golovin, representatives of the Ministry of Transport of Russia and the largest construction companies, Stroygazmontazh, Mostotrest, concern Titan-2, Mostostroy-11.

The meeting participants decided that it was necessary for the authors of the Methodology to study all the conclusions and comments made by the Working Group, as well as to include in the IR the costs of obtaining bank guarantees and interest on bank loans. Deputy Minister of Construction D. Volkov instructed to make a list of similar encumbrances in order to prepare proposals to the Russian government to optimize the costs of construction companies.

In addition, to finalize the Methodologies for determining estimated costs, it was decided to organize working groups for each of them and invite all interested parties to them. As D. Volkov assured, not a single Methodology will be approved without agreement with the professional community. The initiative to continue this work was shown by the General Director of the Moscow General Plan Institute, Chairman of the Pricing Committee of the Russian Union of Builders, Sergei Golovin.

November, 2018

Why consider overhead costs?

The most obvious goal is planning future profits, which are affected by all the costs incurred by the entrepreneur. But in terms of overhead costs, this poses certain difficulties. If potential direct costs can be fairly accurately calculated for specific types of products, then it is quite difficult to determine how many indirect costs will result and how they will be distributed when, for example, expanding production or signing a certain contract.

IMPORTANT! To adequately determine the cost of a product, it is necessary to take into account and distribute overhead costs in proportion to direct expenses - calculate production costs .

What is included in overhead costs

Indirect costs can be roughly divided into 4 main groups:

- Management costs:

- his salary;

- money spent on training, certification and advanced training of management.

- Contents: purchase of computers, office supplies, expenses for office needs, including communication services.

- Expenses associated with the process of organizing production:

- maintenance repairs of structures, buildings, premises, equipment belonging to the organization;

- costs of transport owned by the company;

- payment of rent for warehouse premises and/or office;

- waste of money due to downtime, defects, etc.;

- money that needs to be spent on maintaining fixed assets.

- Personnel costs:

- social tax contributions;

- payments to social security and other funds;

- equipment of household premises, canteens, showers, etc.

- Non-production costs:

- advertising expenses;

- payment for consultations and examinations;

- payment of utility bills, etc.

Overhead distribution options

Despite the difficulties of planning indirect costs, this is a necessary procedure that can be carried out in several ways:

- The "working wage" method. If the main production employs a large number of workers, especially if manual labor predominates, overhead costs can be calculated in proportion to the wage fund for their labor.

- The “sales volume” method is advisable to use if automated processes predominate in the company. You can distribute income in proportion to machine hours.

- The unit of production method is applicable when direct costs significantly exceed indirect costs. Then we can take as a basis the ratio of direct costs per unit of goods to the total amount of direct costs.

- Direct counting method. Indirect expenses are summed up separately for each expense item.

- Combined methods are applicable in large companies with a complex structure, where several types of products are produced. For example, you can account for manufacturing overhead on the payroll basis, and general business overhead on the basis of unit cost.

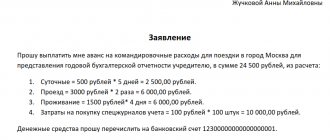

EXAMPLE OF CALCULATION. Avtokoleso LLC is engaged in the transportation of goods. The staff wage fund is 8 million rubles per year. The overhead cost ratio in 2020 was 80%, that is, 6 million 400 thousand rubles. The company decided to reduce overhead costs, for which it fired several people. At the same time, the wage fund decreased by 20%, which means that the overhead costs of Avtokoleso LLC for 2020 can be planned in the amount of 5 million 120 thousand rubles.

How overhead costs are calculated

The cost price of the final price of the GP is the value expression of the resources spent in the production of products. In order to correctly determine the cost of products, it is necessary not only to include direct costs in the price, but also not to forget about the HP part. When pricing, overhead costs and estimated financial profit are included in special design and estimate documentation for the purposes of budgeting, analysis and subsequent monitoring of indicators. In the process, it is important to build on the general methods of generating tables, but the data is established separately for each type of product or service. Thus, the main purpose of standard costing is to determine the consumption of overhead and direct costs per unit of product. The cost is calculated taking into account the pledged profit and taxes.

How to calculate overhead costs in an estimate

To know how to calculate overhead costs, you must first determine the basis for the distribution of amounts. Each enterprise chooses the optimal parameter independently. What types of proportional calculation of the percentage of overhead costs in costing exist:

- The “working wage” method - the calculation of labor costs is based on the earnings (payroll) of workers employed in the main production. This option is effective in those organizations where manual labor is predominantly common, and the number of personnel in the main production cycles is large.

- “Sales volume” method – it is advisable to use this option in companies engaged in the provision of various services or using high-tech equipment. HP are divided in relation to total sales volumes for a given period.

- The “material costs” technique is common in organizations whose production is distinguished by a wide range of raw materials used in the manufacture of products.

- The “machine-hour” method is suitable for enterprises that have automated production stages and rely little on the manual labor of personnel.

Accordingly, it is impossible to say exactly what is included in the overhead costs of an organization’s calculation if you do not know the specifics of its activities. Moreover, in some cases, a combined calculation of the amount of overhead costs according to calculation is allowed - if the company has a complex structure with the production of different types of GP. In this case, part of the HP can be distributed, for example, in proportion to the payroll, and part - to the spent labor resources.

Overhead Ratio - Formula

HP percentage = Total HP / Base x 100%.

If payroll is taken as the base, the percentage of salary = Total amount of payroll / payroll for the period x 100%.

If material costs are taken as the base, the percentage of labor costs = Total amount of labor costs / Amount of materials used in the main production x 100%.

The remaining formulas in determining how to calculate overhead costs for costing are developed in a similar way.

Procedure for calculating overhead costs

Planning and accounting of all expenses, including overheads, is carried out in a certain order:

- The total amount of costs for general business activities of the company is calculated.

- The amount of overhead costs that will need to be included in the estimate per unit of each type from the product range is determined.

ATTENTION! It is necessary to take into account the legal limits for overhead costs for specific items and the standards defined by the company's internal regulations.

Legal limits regarding overhead costs

The law determines the composition and limits of overhead costs in the construction and medical industries.

Construction overhead

In this industry, overhead planning is especially important. An estimate is drawn up, which indicates the average costs for the industry, which are included in the cost of construction products or services.

Cost rationing in the construction industry is regulated by the Methodological Guidelines for determining the amount of overhead costs in construction, approved by the Resolution of the State Construction Committee of Russia (separately for regions of the Far North and equivalent regions). These documents define the coefficient that must be applied to determine overhead costs for a particular construction activity, and also clarify the scope of its application. The wage fund for construction workers is taken as the base. The distribution of coefficients is carried out according to the following main types of construction:

- industrial;

- agricultural;

- transport;

- housing;

- energy;

- related to water management;

- in the field of nuclear energy;

- restoration work;

- major repairs;

- other types.

FOR YOUR INFORMATION! Overhead costs according to construction standards must be applied at the stage of drawing up estimates, as well as when paying for work performed.

Medical overhead

The standards and composition of overhead costs in the medical industry are regulated by Order of the Ministry of Health and Medical Industry of Russia No. 60 dated March 14, 1995. According to the provisions of this order, the cost of medical care must include all annual costs of a medical institution:

- salaries of all types of personnel, except medical personnel, with all accruals;

- expenses for the purchase of furniture, stationery, household goods (everything, except medicines and dressings);

- means for repairs.

The basis is the wage fund of medical personnel providing specific medical services, based on a coefficient of 1.5.

IMPORTANT! Typically, overhead costs are significantly higher in medicine than in construction.

Overhead costs in estimating

What is an estimate and overhead costs in an estimate?

An estimate is a type of plan for calculating various types of activities. An estimate can be drawn up to calculate both income and expenses.

An expense estimate is a complete calculation of expenses for the production or sale of products for a certain period of time. The estimate may include various elements: basic materials; expenses for salaries, expenses for additional materials, etc.

Salaries, taxes and indirect costs are overhead costs in the estimate and they will never be zero.

Overhead costs are that part of the cost of general work according to the estimate, which includes the costs of creating the necessary general working conditions (construction, repair, adjustment and other types of work), as well as the costs of their management, organization and maintenance during the work process.

Amount of overhead costs in the estimate

Depending on the type of main activity, the planned profit, the scale of work or production, the economic department of the enterprise draws up a planned rate of overhead costs in the general estimate.

Accordingly, the amount of overhead costs directly depends on the following factors:

- expenses on wages (FOP - wage fund);

- costs associated with system maintenance;

- management expenses;

- costs associated with installation;

- all expenses for other types of work and related expense items.

The amount of overhead costs depends on the scale of production. And it is best to calculate the amount of overhead costs in the main functional areas.

For example, these could be the following standards:

- by main types of construction;

- for certain types of construction (installation, repair, adjustment and other types of work);

- calculation of individual standards for a specific type of work.

Such calculations of standards and plans will help to more accurately predict total overhead costs and, accordingly, it will be much easier to control the economic activity of the organization.

How to calculate overhead costs?

To correctly calculate overhead costs in the estimate, it is best to adhere to the market value of goods and services (market pricing policy).

The following are included in the calculation:

- price for certain types of work;

- cost of materials , machines, mechanisms;

- payment of wages , etc.

As well as all associated tax and budget costs.

Formula for calculating overhead costs in estimates

To calculate all overhead costs, there is a very simple formula - this is the summation of all overhead cost items in the process of activity.

And it can be formulated as follows:

- Overhead costs = the sum of all overhead cost items + wage fund + tax deductions.

To calculate the % of overhead costs in the total estimate, use the following formula:

- K, % = total amount of overhead expenses / amount of the wage fund for main workers * 100%.

The percentage of overhead costs in the total estimate helps to more accurately determine the size of the possible estimated profit in the following periods.

Composition of overhead costs in the estimate

The overhead cost estimate may contain the following types of items:

- expenses for remuneration of workers in various business areas;

- tax and social contributions to the state budget;

- expenses for operation and maintenance of equipment (necessary for a specific type of activity);

- travel expenses;

- costs of maintaining company vehicles;

- payment for necessary consulting or audit services;

- costs for the functioning of other structural divisions;

- various entertainment expenses;

- bank commissions;

- expenses for personnel training , training or retraining;

- expenses for maintaining the necessary working conditions (sanitary and hygienic standards, certain living conditions, etc.);

- expenses on safety precautions and related to labor protection of the working personnel involved;

- various repair costs (equipment, transport);

- expenses for security of objects and others.