Who pays the tax

The Federal Tax Service is the body that is responsible for tax control.

The service has divisions in populated areas. The choice of branch for payment is carried out on a territorial basis using UTII KBK. A general rule has been established: tax is paid at the place of activity. According to the law, the payer is obliged to timely repay tax debts to the state. UTII is no exception. Specific payment deadlines are set out in the Tax Code of the Russian Federation (Article 346.32). A quarter is recognized as a period. The deadline is the 25th day of the month following the last tax period.

The UTII taxation system is a preferential tax payment regime provided for by law for certain categories of taxpayers subject to certain conditions and requirements. This system, also called “imputation,” allows you to pay only one instead of a whole series of taxes. Accordingly, not only costs are reduced, but also reporting. “Imputement” replaces four taxes:

- Personal income tax (but only for individual entrepreneurs);

- VAT;

- property tax;

- income tax.

There are restrictions on exemption from fees, they are specified in Art. 346.26 Tax Code of the Russian Federation.

To switch to this mode, you need to register for special registration. In addition, it is necessary that the type of activity of the subject be included in the list from Art. 346.26 of the Tax Code of the Russian Federation, the number of staff did not exceed 100 people and the requirements for the participation of other organizations in them were met.

In 2020, the Federal Tax Service will continue to monitor the calculation and payment of insurance contributions for compulsory pension, medical and social insurance (with the exception of contributions for injuries). The listed types of insurance premiums in 2020 must be paid to the Federal Tax Service, and not to the funds.

Accordingly, the payment order for payment of contributions in 2020 must be completed as follows:

- in the TIN and KPP field of the recipient of the funds - TIN and KPP of the tax inspectorate;

- in the “Recipient” field - the abbreviated name of the Federal Treasury body and in brackets - the abbreviated name of the Federal Tax Service;

- in the KBK field - budget classification code, consisting of 20 characters (digits). In this case, the first three characters indicating the code of the chief administrator of budget revenues should take the value “182” - Federal Tax Service.

Penalties for insurance premiums: sample payment order

- contributions in a fixed amount for compulsory pension insurance of individual entrepreneurs “for themselves”;

- contributions in a fixed amount for compulsory medical insurance of individual entrepreneurs “for themselves”;

- contributions from employees' salaries for compulsory health insurance;

- contributions from employees' salaries for compulsory pension insurance;

- contributions from employees' salaries for compulsory insurance for temporary disability and maternity.

Step 8. In the payment documents, at the request of the regulatory authorities, in fields 108 and 109 (Document number and date), the details of the document on the basis of which you are making the transfer are duplicated. This could be a tax claim, arbitration awards, etc.

Amounts of fixed payments for individual entrepreneurs for themselves for 2018-20. are defined in Article 430 of the Tax Code of the Russian Federation. Now they do not depend on the minimum wage, and their sizes were approved by Federal Law No. FZ-335 of November 27, 2017.

| Individual entrepreneur income for the reporting year 2020 | Contributions to the Pension Fund (in rubles) | Contributions to the FFOMS (in rubles) | Total contributions (in rubles) |

| Up to 300,000 rubles | 29 354 | 6 884 | 36 238 |

| Over 300,000 rubles | 29,354 1% of the excess amount, maximum 205,478 | 6 884 | Maximum 241,716 |

Changes to the Tax Code of the Russian Federation did not affect the deadlines for paying contributions; they remained the same:

- contributions to pension and health insurance in a fixed amount are transferred no later than December 31 of the current year. You can pay in one amount or in parts, for example, quarterly or monthly;

- Pension insurance contributions for income exceeding 300,000 rubles per year are made until July 1, 2020.

You can generate a payment order for fixed and other payments 2020 IP in several ways:

- online on the official website of the Federal Tax Service (“Filling out a payment document”_;

- in the accounting program according to our instructions;

- using a specialized service.

Fill out the payment form:

- “Payer status” IP 09;

- Enter your Taxpayer Identification Number (TIN) in the appropriate field;

- since individual entrepreneurs are not assigned a reason code for registration, we enter 0 in the “Payer checkpoint” field;

- in the “Payer” field, the entrepreneur enters his last name, first name and patronymic;

- We enter the details of the individual entrepreneur’s account and the bank in which it is opened in the appropriate fields;

- fields concerning the payment recipient's data are filled in with the details of the territorial inspection of the Federal Tax Service - TIN/KPP, name, account number and bank details;

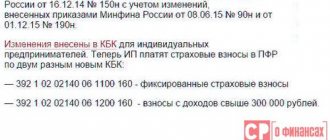

- KBK: When paying insurance premiums to the Pension Fund of Russia in 2020 for an individual entrepreneur, in the payment order we write KBK 18210202140061110160. This code is used for all contributions of an individual entrepreneur for himself, regardless of whether the income exceeded the 300 thousand mark. In the payment for insurance premiums for compulsory health insurance for 2020, the code is BC 18210202103081013160;

- in the “OKTMO” field we insert the code from the municipal classifier that corresponds to the place of residence of the individual entrepreneur;

- as the “Base of payment” the individual entrepreneur puts TP if these are payments of the current period, ZD in case of additional payment of debt, AP if the debt was identified as a result of a tax audit;

- the order of payment is always 5;

- in the “Purpose of payment” field of the individual entrepreneur, it is necessary to indicate that this is a fixed payment, and for pension insurance contributions the words “from income within 300 thousand rubles” or “from income exceeding 300 thousand rubles.”

Payment order for insurance premiums to the Pension Fund in 2020 for individual entrepreneurs for themselves:

- from income up to 300,000 rubles

- with income over 300,000 rubles

An example of filling out a payment order for an individual entrepreneur for a fixed payment for compulsory health insurance 2019

A sample payment slip for insurance premiums in 2020 for individual entrepreneurs can be found here

Read about payment details for insurance contributions to the tax office in 2019 for LLCs here

Fixed payments for individual entrepreneurs “for themselves”

Look at a sample UTII payment slip for the 1st quarter of 2019; BCC is indicated in field 104.

When filling out the form, it is necessary to take into account that the values of the BCC for UTII are set uniformly for all subjects of the Russian Federation, while other details depend on the location of the payer and payment must be transferred to the tax office that controls the territory in which the subject is officially registered as a tax payer under the simplified regime. Only taxpayers engaged in cargo transportation transfer funds to pay the fee at their place of registration.

You can find out the address and details of the Federal Tax Service on the official website of the Federal Tax Service.

In 2012, the Bank of Russia issued Regulation No. 383, which approved a unified form.

| Payment Description | KBK |

| Pension contributions at basic and reduced rates | 182 1 0210 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 1) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 1) | 182 1 0210 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 2) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 2) | 182 1 0210 160 |

| Medical fees | 182 1 0213 160 |

| Social contributions | 182 1 0210 160 |

| Contributions for injuries | 393 1 0200 160 |

When filling out a payment form, no one can be protected from errors, because even a small typo or one incorrectly written number will be considered an incorrect action. In this case, there is no need to be very upset, since the taxpayer only needs to come to the tax authority with an application to clarify the payment.

It should be noted that all these actions are possible if such an error did not cause the specified amount of the Single Tax to not be transferred. If this happens, then the taxpayer will have to pay not only UTII, but also the corresponding penalty that accrued over a certain period.

To avoid having to clarify the payment, individual entrepreneurs and legal entities must follow the procedure for filling out orders. There are some differences here.

KBK and other details of payment orders for UTII for individual entrepreneurs and legal entities

| Payment field | IP | Legal entities |

| 104 “KBK” (payment of tax) | 182 1 05 02010 02 1000 110 | |

| 101 “Payer status” | It is necessary to put the code “09” (Appendix 5 to the order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n). With this status, the TIN or UIN must be filled in (field 22). | You must enter the code “01”, since the company is a taxpayer. |

| 8 "Payer" | Full name and in brackets - “Individual Entrepreneur”, as well as the registration address at the place of residence or the address at the place of stay (if there is no place of residence). Before and after the address information you must put the sign “//” | You must indicate the name of the organization (LLC "Company") |

Sample payment order with KBK UTII 2020 for individual entrepreneurs

Key payment details: treasury account and Federal Tax Service data

Both key details under consideration are determined based on:

- Place of business - the municipality on whose territory, for example, a store owned by the taxpayer is located. This may also be a municipality different from the one in which the UTII payer was registered with the Federal Tax Service as an economic entity. Moreover, if a business is conducted in the territories of several municipalities, then UTII is paid to the Federal Tax Service division that was the first to receive an application for registration from the payer. In general, individual entrepreneurs and organizations on UTII pay this tax precisely at the place of business, regardless of the tax registration of the company itself or the registration of the individual entrepreneur.

- Location of the payer (optionally, the municipality in which he was registered as an economic entity).

This option is applied in the cases reflected in paragraph 2 of Art. 346.28 Tax Code of the Russian Federation. That is, if an individual entrepreneur or legal entity conducts business:

- in the provision of transport services and own a fleet of no more than 20 cars;

- in the format of delivery and distribution trade;

- in the field of advertising on vehicles.

By entering the address of the Federal Tax Service where the application for registration was submitted (in the first accounting option - at the place of business), or the actual address of the company or individual entrepreneur registration (in the second accounting option) on the Federal Tax Service website, the payer will be able to find out both details in question.

Deadlines for paying UTII in 2020

The rules haven't changed. There have been no changes to the timing. There are 4 quarters provided. At the end of each quarter, the merchant is obliged to pay UTII.

| Fourth quarter 2020 | Until January 25, 2020 |

| First quarter of 2020 | Until April 25, 2020 |

| Second quarter 2020 | Until July 25, 2020 |

| Third quarter 2020 | Until October 25, 2020 |

The last day of payment did not fall on a working day. Entrepreneurs paid according to the standard scheme, without transfer to working days. Pay attention to the time of filing the declaration. The deadline differs from the direct payment of the tax - until the 20th of the corresponding month. In other words, the act is submitted earlier than the payment of the obligation.

The norms will remain. Moreover, not a single day will be a holiday - merchants pay according to the standard scheme in accordance with the KBK for paying UTII in 2020. The quarters end in a similar manner - in January, April, July and October, respectively. The deadline for filing the declaration has also not changed.

| Fourth quarter 2020 | Until January 25, 2020 |

| First quarter of 2020 | Until April 25, 2020 |

| Second quarter 2020 | Until July 25, 2020 |

| Third quarter 2020 | Until October 25, 2020 |

According to Article 346.32 of the Tax Code of the Russian Federation, taxes are transferred to the budget for individual entrepreneurs and organizations using UTII until the 25th day of the month following the tax period (quarter). Deadlines for paying UTII in 2020:

- April 25, 2019;

- July 25, 2019;

- October 25, 2019;

- January 25, 2020.

Payment of tax to the budget is possible earlier than the specified deadlines, and the listed dates are the deadlines for making payments. As for fines and penalties, they should be listed as they are recognized. If the tax office requires payment of fines and penalties, be guided by the date indicated in the requirement.

The payment terms are established in Art. 346.32 Tax Code of the Russian Federation. It is the same for all reporting periods (which are quarters) - until the 25th day of the month following the reporting quarter. Thus, in 2019 the deadlines are:

- for the first quarter - until April 25;

- for the second quarter - until July 25;

- for the third quarter - until October 25;

- for the fourth quarter - until January 25, 2020.

In 2020, none of the dates fall on a weekend, therefore, there will be no postponements. But in 2020, January 25 falls on a Saturday, which means the payment deadline is postponed to Monday, January 27.

Penalties will be charged for late payment.

Who is eligible

If a company is going to work on UTII, then first it should understand what types of activities this regime can be used in relation to.

In accordance with current legislation, the use of UTII is provided for when conducting the following types of activities:

- domestic services;

- veterinary services;

- services in the field of repair and maintenance of vehicles;

- services in the field of vehicle parking;

- services in the field of freight or passenger transportation;

- retail;

- organization of public catering;

- advertising placement;

- provision of land plots or premises for living or equipment of retail outlets.

It is worth noting that it is best to familiarize yourself with OKUN in advance, and also make sure that the service is paid and provided exclusively to individuals, since otherwise it cannot be classified as household.

In addition, you need to take into account certain restrictions that are prescribed by law:

- the total number of employees for the previous year should be no more than 100 people;

- the company should not have more than 25% of the authorized capital owned by other organizations;

- a private entrepreneur should not work on a patent or simplified taxation system;

- UTII cannot be used by those organizations that provide services in the field of education, social security, catering or healthcare;

- UTII cannot be applied to organizations whose activities are included in paragraphs 13 and 14 of the established list of activities.

KBK for simplified tax system in 2020

In simplified terms, BCCs depend on the applied object of taxation. Simplified people with a “income-expenditure” object should carefully consider the choice of the KBK when paying the minimum tax: since 2020, a single code has been used for both paying the single tax and the minimum one. If the minimum tax is paid for periods earlier than 2020, a separate BCC is used for it.

| KBK | Decoding |

| KBK simplified tax system 6% 2020 (“income”) | |

| 182 1 0500 110 | Single tax under the simplified tax system “income” |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

| KBK simplified tax system “income minus expenses” 2020 | |

| 182 1 0500 110 | Single tax under the simplified tax system “income minus expenses” (incl., simplifiers transfer the minimum tax to this KBK simplified tax system in 2019) |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

| 182 1 0500 110 | Minimum tax under the simplified tax system (only for tax periods expired before January 1, 2020) |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

KBK: patent tax system 2020

The patent is paid by entrepreneurs, choosing the BCC that corresponds to the type of budget.

| KBK | Decoding |

| 182 1 0500 110 | Patent tax credited to the budgets of city districts |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

| 182 1 0500 110 | Patent tax credited to the budgets of municipal districts |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

| 182 1 0500 110 | Patent tax credited to the budgets of federal cities of Moscow and St. Petersburg |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

KBK for UTII for individual entrepreneurs and organizations in 2020

| PENALIES, INTEREST, FINES | KBK | |

| Penalties, interest, fines on the single tax on imputed income for individual entrepreneurs and legal entities | penalties | 182 1 0500 110 |

| interest | 182 1 0500 110 | |

| fines | 182 1 0500 110 | |

| UTII in 2020 for individual entrepreneur KBK (tax code itself) | 182 1 05 02010 02 1000 110 |

| Penalty code | 182 1 05 02010 02 3000 110 |

| KBK penalty UTII | 182 1 05 02010 02 2100 110 |

Penalty is a sanction that is accrued daily for late payment of an obligation. Unlike a penalty, a fine is imposed for a specific violation. Despite the direct relationship of sanctions to “imputation”, the Code of Criminal Code of fines and penalties differs from the code of the tax itself. It is recommended to save the data so as not to confuse the direction of the money.

| Payment Description | KBK |

| Pension contributions at basic and reduced rates | 182 1 0210 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 1) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 1) | 182 1 0210 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 2) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 2) | 182 1 0210 160 |

| Medical fees | 182 1 0213 160 |

| Social contributions | 182 1 0210 160 |

| Contributions for injuries | 393 1 0200 160 |

| Tax | KBK |

| Personal income tax (individual entrepreneur acts as a tax agent) | 182 1 0100 110 |

| VAT (individual entrepreneur acts as a tax agent) | 182 1 0300 110 |

| VAT on imports from EAEU countries | 182 1 0400 110 |

| Tax | KBK |

| Personal income tax | 182 1 0100 110 |

| VAT | 182 1 0300 110 |

| Tax | KBK |

| Tax under simplified tax system: | |

| - for the object “income” | 182 1 0500 110 |

| - for the object “income minus expenses” (tax paid in the usual manner, as well as the minimum tax) | 182 1 0500 110 |

| UTII | 182 1 0500 110 |

| Unified agricultural tax | 182 1 0500 110 |

If you find an error, please highlight a piece of text and press Ctrl Enter.

The KBK in 2020 is no different from the code that was in force in 2018. It depends on the type of payment that needs to be made - tax, fine, interest or penalties. For example, to pay UTII, you need to enter the following 20-digit code in the appropriate section (field 104) of the payment slip: 182 1 0500 110. In order to pay a fine or penalty, you need to make changes to this code by changing 4 digits. Thus, the final version of the CBC:

- for tax - 182 1 0500 110;

- for penalties - 182 1 0500 110;

- for interest - 182 1 0500 110;

- for fines - 182 1 0500 110.

BCCs differ for different types of payments (tax, penalties, interest or fine) - only in digits from the 14th to the 17th.

Organizations and individual entrepreneurs transfer money to the same cash registers. Payment orders are distinguished by field 101 “payer status” - individual entrepreneurs put the code “09” in it, and legal entities - “01”.

Where is the KBK indicated?

The code values are indicated in the payment order for the transfer of the fee in field 104. This field must be filled in when making settlements with budgets. It is located at the bottom of the form on the left, below the “Recipient” column and above the purpose of the payment.

When filling out a payment order, you must indicate the KBK UTII in 2020 for an individual entrepreneur or organization, depending on the status of the taxpayer. Please note that the budget classification code is the same for all categories of entities. In addition, there are no differences or dependencies on the organizational and legal forms of the “imputation” payers.

In simple words, the KBK UTII 2020 for an LLC, JSC or NPO is exactly the same as for an individual entrepreneur. Be careful, legislators have provided different codes depending on the purpose of the payment. So, when paying the main tax, indicate in the payment slip 182 1 05 02010 02 1000 110, and if you need to pay a penalty, then enter the penalty for UTII in 2020 in the appropriate field of the KBK 182 1 05 02010 02 2100 110.

The budget classification code is indicated in field 104 of the payment order. This column is required when making calculations for tax payments and other transfers to the budget.

KBK UTII 2019 for individual entrepreneurs and legal entities

| TAX | KBK |

| Single tax on imputed income for individual entrepreneurs and legal entities | 182 1 0500 110 |

| KBK | Decoding |

| 182 1 0600 110 | Tax on property not included in the Unified Gas Supply System |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| 182 1 0600 110 | Tax on property included in the Unified Gas Supply System |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

When paying land tax, companies choose BCC in accordance with the territorial location of the site. The choice of land tax penalties by the KBK, as well as “penalty” codes, also depends on the location of the site.

| KBK | Decoding |

| 182 1 0600 110 | Land tax from organizations if the site is located within the boundaries of intra-city municipalities of federal cities |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| 182 1 0600 110 | Land tax for organizations if the site is located within the boundaries of urban districts |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| 182 1 0600 110 | Land tax for organizations if the site is located within the boundaries of urban districts with intra-city division |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| 182 1 0600 110 | Land tax for organizations whose land plots are located within the boundaries of intracity districts |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| 182 1 0600 110 | Land tax for organizations whose land plots are located within the boundaries of inter-settlement territories |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| 182 1 0600 110 | Land tax for organizations whose land plots are located within the boundaries of rural settlements |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| 182 1 0600 110 | Land tax for organizations whose land plots are located within the boundaries of urban settlements |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| KBK | Decoding |

| 182 1 0600 110 | Transport tax from taxpayers-organizations |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

The amendment order will introduce, in particular, BCC for payment of:

- tax on professional income (this tax must be paid by self-employed citizens) - 182 1 0500 110;

- single tax payment of an individual - 182 1 0600 110.

Individual entrepreneurs on UTII must transfer the tax to the main 20-digit KBK UTII - 18210502010021000110. Penalties, fines and interest - to other codes with other numbers in 14-17 digits.

KBK 2020 UTII

| Budget classification codes | |||

| UTII tax | Penalty | Fines | Interest |

| 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

Organizations transfer tax to the same BCCs as entrepreneurs, and within the same time frame.

Deadline for paying UTII in 2020:

- for 1 sq. — April 25, 2020

- for 2 sq. — July 25, 2020

- for 3 sq. — October 25, 2020

Organizations pay imputation tax in the same way as individual entrepreneurs

The deadlines and BCC are no different for them. The recipient of the payment is either the tax office at the place of residence of the entrepreneur, or the tax office at the place of activity on UTII, where the entrepreneur must be registered for certain types of activities.

UTII payment for legal entities | ||

tax | penalties | fine |

| 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

Table of values

BCCs for paying UTII in 2020 were established by Order of the Ministry of Finance No. 132n. It must be filled out when making payments to the budget. The value is the same for all categories of payers: commercial and non-commercial legal entities and individual entrepreneurs. However, when assigning a payment, the code changes: the KBK “UTII Penalty 2020” for legal entities is set differently than when making the main tax payment (the value also does not depend on the legal form of the entity, that is, the same indicator is set for individual entrepreneurs).

Table. KBK UTII 2020 for LLC, JSC, individual entrepreneur and other legal forms of taxpayer.

| Payment type | Core Obligation | KBK "Peny on UTII" in 2020 | Penalties |

| A single tax on imputed income | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

Contents of the act:

- date of preparation and type of payment;

- information about the individual entrepreneur, his name and TIN;

- information about the recipient (indicate BIC, TIN and KPP;

- payment amount in numbers and words.

Since an individual entrepreneur does not have a checkpoint, “0” is indicated in the field. The document is drawn up in printed form on a tangible medium. It is acceptable to prepare an order in electronic format. For ease of perception, below is a sample payment order that will help you avoid errors and typos when filling out.

KBK: resort fee 2019

The fee was introduced in the capital by Moscow Law No. 62 dated December 17, 2014; it is not collected in other regions.

| KBK | Decoding |

| 182 1 0500 110 | Trade tax paid in the territories of federal cities |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

| KBK | Decoding |

| 048 1 1200 120 | Environmental fee |

| KBK | Decoding |

| 182 1 1500 140 | Fee for the use of resort infrastructure (resort fee) |

The list of codes is supplemented by two BCCs for penalties for non-payment of the recycling fee for self-propelled vehicles and trailers for them imported into the Russian Federation from Belarus and other countries (approved by order of the Ministry of Finance of the Russian Federation dated September 20, 2018 N 198n).

| KBK | Decoding |

| 153 1 1200 120 | Recycling fee for wheeled vehicles and trailers imported into the Russian Federation (except for those imported from the Republic of Belarus) |

| 153 1 1210 120 | penalties |

| 153 1 1200 120 | Recycling fee for wheeled vehicles and trailers imported into the Russian Federation from the Republic of Belarus |

| 1 1210 120 | penalties |

| 153 1 1200 120 | Recycling fee for wheeled vehicles and trailers for them produced and manufactured in the Russian Federation |

| 153 1 1200 120 | Recycling fee for self-propelled vehicles and trailers for them, produced or manufactured in the Russian Federation |

| 153 1 1200 120 | Recycling fee for self-propelled vehicles and trailers for them imported into the Russian Federation, except for self-propelled vehicles and trailers for them imported from the territory of the Republic of Belarus |

| 153 1 1220 120 | penalties |

| 153 1 1200 120 | Recycling fee for self-propelled vehicles and trailers for them imported into the Russian Federation from the territory of the Republic of Belarus |

| 153 1 1230 120 | penalties |

kbk 2018