UTII is a single imputed tax. The tax regime implies that the calculation of the required amount for payment is based on the estimated profit.

Can be used only by certain types of activities, a list of which can be found in the documents of the constituent entity of the Russian Federation. In this parameter it is similar to PSN (a patent is issued only for certain types of activities).

Previously, it was decided that UTII would be abolished in 2020, but in 2016 a bill was passed that officially extended the regime until 2021.

Do not use online cash registers in 2020

The deadline for the mandatory use of cash registers (online cash registers) has been postponed until July 1, 2020, for the following entrepreneurs:

- Individual entrepreneurs and organizations whose leading activities can be applied to UTII (specified in clause 2 of Article 346.26 of the Tax Code of the Russian Federation), except for catering and retail trade

- Individual entrepreneurs conducting retail trade and (or) providing catering services - individually, without hired employees.

- Leading vending business individual entrepreneurs without hired workers

We recommend ModulKassa, which is ideal for retail, online stores, courier services and the service industry. Also, to choose a cash register suitable for your business, use our service Online cash register 54-FZ.

Conditions and procedure for transition

The legislation establishes the conditions under which an individual entrepreneur can switch to the UTII regime. To transfer, the individual entrepreneur must:

- have a staff of at least 100 people;

- have a share of participation of third parties of no more than 25%;

- carry out activities not on the basis of a trust agreement or a simple partnership agreement;

- be located on the territory of the municipality;

- a regulatory act of a subject of the Russian Federation must include the type of activity being carried out.

A ban on the transition to the UTII regime is imposed on legal entities if they are:

- educational organizations;

- organizations that rent out retail space at gas stations;

- largest taxpayers;

- agricultural producer paying the appropriate tax.

Also, the ban applies to those individual entrepreneurs who engage in activities under the patent system.

If the entrepreneur meets the existing requirements, then he can become a taxpayer under the UTII regime. To do this, you need to go to the tax service, which is located at the place of registration of the individual entrepreneur, where the application is submitted within five days after applying the UTII.

The appeal must contain all the information about the entrepreneur and his organization, and also include the composition of managers and authorized persons. The application form will vary depending on the form of business:

- for organizations - UTII-1;

- for entrepreneurs - UTII-2.

Notification of the registration of an organization or individual entrepreneur on UTII will be sent to the applicant within five days.

Calculation of UTII tax in 2020

The single tax on imputed income for one month is calculated using the following formula:

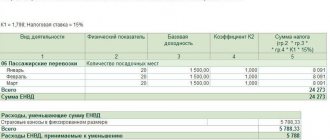

UTII = Basic profitability x Physical indicator x K1 x K2 x 15%

The basic profitability is set by the state per unit of physical indicator and depends on the type of business activity.

physical indicator (usually the number of employees, square meters, etc.).

- Table 1. Basic profitability and physical indicators by type of UTII activity

Activity code Kind of activity Physical indicators Basic income per month 01 Provision of household services Number of employees, including individual entrepreneurs 7 500 02 Provision of veterinary services Number of employees, including individual entrepreneurs 7 500 03 Providing repair, maintenance and washing services for motor vehicles Number of employees, including individual entrepreneurs 12 000 04 Provision of services for the provision of temporary possession (for use) of parking spaces for motor vehicles, as well as for the storage of motor vehicles in paid parking lots Total parking area (in square meters) 50 05 Provision of motor transport services for the transportation of goods Number of vehicles used to transport goods 6 000 06 Provision of motor transport services for the transportation of passengers Number of seats 1 500 07 Retail trade carried out through stationary retail chain facilities with trading floors Sales area (in square meters) 1 800 08 Retail trade carried out through facilities of a stationary retail chain that do not have sales floors, as well as through facilities of a non-stationary retail chain, the area of the retail space in which does not exceed 5 square meters Number of retail places 9 000 09 Retail trade carried out through stationary retail chain facilities that do not have trading floors, as well as through non-stationary retail chain facilities with a retail space exceeding 5 square meters Area of retail space (in square meters) 1 800 10 Delivery and distribution retail trade Number of employees, including individual entrepreneurs 4 500 11 Provision of public catering services through a public catering facility with a customer service hall Area of the visitor service hall (in square meters) 1 000 12 Provision of public catering services through a public catering facility that does not have a customer service hall Number of employees, including individual entrepreneurs 4 500 13 Distribution of outdoor advertising using advertising structures (except for advertising structures with automatic image changes and electronic displays) Area intended for printing (in square meters) 3 000 14 Distribution of outdoor advertising using advertising structures with automatic image changes Exposure surface area (in square meters) 4 000 15 Distribution of outdoor advertising using electronic signs Light emitting surface area (in square meters) 5 000 16 Advertising using external and internal surfaces of vehicles Number of vehicles used for advertising 10 000 17 Provision of temporary accommodation and accommodation services Total area of premises for temporary accommodation and living (in square meters) 1000 18 Provision of services for the transfer for temporary possession and (or) use of retail spaces located in facilities of a stationary retail chain that do not have trading floors, facilities of a non-stationary retail chain, as well as public catering facilities that do not have customer service halls, if the area of each they do not exceed 5 square meters Number of trading places, non-stationary retail chain facilities, and public catering facilities transferred for temporary possession and (or) use 6000 19 Provision of services for the transfer for temporary possession and (or) use of retail spaces located in facilities of a stationary retail chain that do not have trading floors, facilities of a non-stationary retail chain, as well as public catering facilities that do not have customer service halls, if the area of each exceeds 5 square meters Area of a retail space, a non-stationary retail chain facility, or a public catering facility transferred for temporary possession and (or) use (in square meters) 1 200 20 Provision of services for the transfer of temporary possession and (or) use of land plots for the placement of stationary and non-stationary retail chain facilities, as well as public catering facilities, if the area of the land plot does not exceed 10 square meters Number of land plots transferred for temporary possession and (or) use 10 000 21 Provision of services for the transfer of temporary possession and (or) use of land plots for the placement of stationary and non-stationary retail chain facilities, as well as public catering facilities, if the area of the land plot exceeds 10 square meters Area of land transferred for temporary possession and (or) use (in square meters) 1 000 22 Sales of goods using vending machines Number of vending machines 4500

K1 – deflator coefficient. Its value is established for each calendar year by the Ministry of Economic Development of Russia. In 2017, this coefficient is equal to

K1 = 1.798, in 2020 it is 1.868.

K2 – correction factor. It is established by municipal authorities in order to reduce the amount of UTII tax for certain types of activities. You can find out its meaning on the official website of the Federal Tax Service (select your region at the top of the site, after which a legal act with the necessary information will appear at the bottom of the page in the “Features of regional legislation” section).

Please note that from October 1, 2020, local authorities in the regions have the right to change the UTII tax rate. The range of values ranges from 7.5 to 15 percent, depending on the category of taxpayer and type of business activity.

Calculation of UTII tax for the quarter

To calculate UTII for the quarter

It is necessary to add up the tax amounts by month.

You can also multiply the tax amount for one month by 3

, but only on the condition that the physical indicator did not change during the quarter (the new value of the indicator must be taken into account when calculating, starting from the same month in which it changed).

Calculation of UTII tax for less than a month

To calculate UTII for less than a month

, it is necessary to multiply the tax amount for the whole month by the number of actual days of activity for the month and divide by the number of calendar days in the month.

Calculation of UTII tax for several types of activities

If you have several types of activities

falling under UTII, then the tax for each of them must be calculated separately, after which the resulting amounts must be added up.

If the activity is carried out in different municipalities

, then the tax must be calculated and paid separately for each OKTMO.

How to switch to UTII when registering an individual entrepreneur

The deadline for filing an application for UTII after registering an individual entrepreneur is a requirement of the tax legislation regarding the procedure for registering an entrepreneur with the Federal Tax Service. This tax payment system offers preferential conditions for businessmen, but is available only if a number of requirements are met and to a limited number of business entities.

Advantages of this system

UTII (single tax on imputed income) is a type of taxation regime that involves the collection of mandatory payments in the amount of imputed income received in the course of business. Registration of individual entrepreneurs allows UTII only if the conditions for registration are met, as well as when engaged in specifically established types of work.

Imputed income is the amount of profit that is established by the state and does not change taking into account the actual income of the entrepreneur. This indicator is determined based on an assessment of the type of selected activity.

This taxation system is available for a limited number of services and forms of sales of goods:

- veterinary and household services;

- maintenance, car wash, car repair;

- public catering places;

- rental relations;

- some types of retail trade;

- advertising business.

The full list is reflected in official letters of the Federal Tax Service, which exercises control over the activities of entrepreneurs.

UTII provides a number of advantages due to which individual entrepreneurs choose the mode in question:

- The system includes three taxes at once, which are combined and reduce the interest rate to 6%.

- The accounting procedure is simplified, which eliminates the need to hire an accountant.

- Coefficients are provided that lower the established interest rate.

- When receiving additional profit, it is not subject to tax, even if the amount of revenue exceeds that imputed by the state.

Also, business entities existing on UTII may qualify for tax benefits in the process of doing business.

When an individual entrepreneur operates in the UTII mode, then, based on the provisions of the Tax Code of the Russian Federation, the obligation for business entities to pay VAT, taxes on profits and property owned by the person, as well as pension and insurance contributions is abolished.

These payments will be included in a single payment, calculated from imputed income at a fixed interest rate.

How to register correctly

Operating under the tax regime, an entrepreneur has the right to reduce the cost of paying taxes. You should choose a suitable system at the stage of registering an individual entrepreneur; immediately after registration you need to submit an application for UTII, simplified tax system or another regime. This raises the question of how to register.

The first step is to determine the individual entrepreneur’s compliance with the conditions for applying UTII established in the list of tax laws. The regime is limited for some business representatives.

The second step is preparing the necessary documentation. In addition to the application, you will also need a package of papers, which includes:

- application for registration of individual entrepreneurs;

- a receipt confirming the fact of payment of the state duty (800 rubles);

- application for UTII for individual entrepreneurs;

- identification document.

Information is transmitted directly to the Federal Tax Service at the place of registration of the individual; this address will be determined as the legal address for the individual entrepreneur.

https://www.youtube.com/watch?v=fhDdEMPV9hY

When the choice of taxation regime is carried out directly in the process of obtaining individual entrepreneur status, then no additional actions are required, since the article is part of the UTII system. It is enough to prepare a package of papers for the procedure, submit it to the tax service and wait for a response. In the event that you need to switch to UTII, already having a registered individual entrepreneur, the procedure will be different.

A separate issue is the entrepreneur’s compliance with the requirements of the law. An individual entrepreneur must decide on the type of activity before registration, which is done by contacting the All-Russian Classifier with the selection of the appropriate OKEVD (code of the selected business line).

It is also necessary to correctly indicate the place of registration, since errors in the procedure lead to refusal to register a citizen.

If the individual entrepreneur has not sent an application for the transition to UTII along with papers for registration of the status of an individual entrepreneur, then it is allowed to do this after completion of registration.

In this regard, the legislator limits the citizen to a period of five days from the date of receipt of the certificate of registration of the individual entrepreneur.

If the specified period of time is missed, you will have to wait for the next tax period to establish UTII.

Submitting an application

The procedure for transition or initial inclusion of an entrepreneur in the UTII system is carried out on the basis of an application. You need to remember that an application for obtaining individual entrepreneur status and for registration of a taxation system are different documents. Such applications are sent either in one package when registering an individual entrepreneur, or separately.

It is not allowed to require registration of UTII before the official registration of the individual entrepreneur and entering information into the register. Tax payment systems can only apply to existing business entities.

Submitting a UTII application means not only submitting the application to the Federal Tax Service, but also correctly drawing up the document, since errors in drafting lead to refusal to consider the application.

The application is written on a special form provided at the tax office or on the service’s website. the application includes:

- The first line includes the entrepreneur's TIN. Also affixes the page number – 001.

- Code of the tax service where the application is sent. The designation can also be found on the official website of the Federal Tax Service of Russia.

- Entrepreneur's full name. Each word should be placed on a separate line.

- OGRNIP - personal number of the entrepreneur from the registration certificate.

- The start date of work in the imputed income mode, indicated in the lower left part of the page.

- Application. This part of the document reflects the number of circulation sheets.

- Designation of the entity submitting the application. If an entrepreneur submits a document independently, then the indicator is “1”; if through a representative, then “2”.

- If a representative participates, information about this person is entered.

- Contact details (telephone).

- Signature of the person drawing up and sending the application, and the date of submission of the document.

The specified information is filled in on the left side of the form, the right side is filled in by the tax inspector.

The current application form is No. ENFD-2. The form is publicly available and you do not need to contact the inspectorate to obtain a sample. To fill out an application, you can also visit the Federal Tax Service, where sample applications are provided, and you can also contact a lawyer to obtain a guarantee of acceptance and consideration of the papers.

Switching from another mode

Changing the current tax regime or registering one after several months of work according to the general rules of the Tax Code of the Russian Federation is available to business entities without significant restrictions. At the same time, individual entrepreneurs must monitor the deadlines for filing applications and changes in regimes, since some do not allow the transition to UTII in the middle of the year.

When an individual entrepreneur draws up a UTII when registering his status, there are no time limits. It is enough to meet within five days from the date of receipt of the application. If a businessman previously existed under a different regime, then it is necessary to determine the conditions of such before submitting an application to the tax service.

The application form for registration of the imputed income system will not be different, regardless of the reasons for which the entrepreneur decided to switch to this tax payment option.

To answer the question of how to switch to UTII after registering an individual entrepreneur and applying for a different tax regime, he notes a list of papers that will contribute to a positive decision by the Federal Tax Service. You must provide the following information:

- statement;

- identification document;

- certificate of individual entrepreneur registration;

- TIN.

Additional information, in particular about the previous regime, is not required, since the tax service independently verifies the information received.

Of the tax payment regimes established by the Tax Code of the Russian Federation, the simplified tax system creates an obstacle to the transition to UTII.

An entrepreneur cannot change the simplified system to imputed income until the end of the tax period of the simplified tax system, that is, until the end of the calendar year.

Accordingly, when the individual entrepreneur worked on a simplified basis, in order to change the system to UTII you will need to wait until January of the next year and only then submit the necessary papers.

Factors that do not allow switching to the imputed system are also taken into account, which include the following:

- The number of employees of an individual entrepreneur exceeds that of a person.

- The presence in the authorized capital of a private entrepreneur of a 25% share of another organization or individual entrepreneur.

- The activity is carried out in the form of a simple partnership.

- The previous transition to the simplified tax system was due to a patent.

- Previously, a single agricultural tax was applied.

The transition to the imputed regime will be impossible if one of the specified factors is established, even if the general conditions of the procedure are met. Violation will entail a fine of 10 thousand rubles.

Thus, UTII is recognized as a variant of the tax payment system when selling your own business. This regime involves determining the collection from imputed, that is, established by the state, income. In this case, the rate is reduced due to the application of special conditions of the selected system.

Source: https://tvoeip.ru/otkrytie/registratsiya/srok-podachi-zayavleniya-na-envd

Responsibility for tax violations

The UTII regime implies not only relaxations in terms of reporting, but also the introduction of penalties. The individual entrepreneur is responsible for the following offences:

- The legal entity did not register within the prescribed period. The legislation defines a period of five days for registration in the UTII system. A fine of 200,000 rubles is imposed.

- A legal entity operates without registering with the tax service. A fine is imposed in the amount of 10% of the profit for the period of work without registration, but not less than 45,000 rubles.

- Information about the opening or closing of bank accounts of the organization was not transmitted to the tax authorities. A fine of 5,000 rubles is imposed.

- The UTII declaration was not submitted on time. A fine is imposed in the amount of 5% of the tax for each month of delay, but not more than 30% and not less than 1000 rubles.

- The UTII declaration was not submitted on time, and it is zero. A fine of 1000 rubles is imposed.

- Gross violations of the rules and the current control and accounting system. A fine of 10,000 rubles is imposed. Gross violations mean: absence of primary invoices, absence of primary documentation, presence of errors in submitted reporting documents, and inaccurate or erroneous information entered in accounting or tax accounting.

- Gross violations of current legislation for several quarters. A fine of 30,000 rubles is imposed.

- Violation of legislation on maintaining accounting records or expense sheets, and this caused a decrease in the tax paid. A fine is imposed in the amount of 20% of the unaccounted amount, but not less than 40,000 rubles.

- Incorrect or erroneous calculation of the tax base. A fine of 20% of the unpaid amount is imposed.

- Non-payment of taxes or reduction of their amount is carried out intentionally. A fine of 40% of the unpaid amount is imposed.

- The documents required to carry out the tax control procedure for the entrepreneur were not provided. A fine of 200 rubles is imposed for each document.

Fines may also be assessed for other violations. But each of them can be mitigated by circumstances. As a rule, such grounds allow the size of the fine to be reduced by at least half. But if the violation occurs again, the fine will double.

Submission of the declaration and deadlines

The tax return is submitted to the Federal Tax Service. The branch can be determined by the location of the legal entity or by the place of business.

UTII must be paid in accordance with paragraph 1 of Article No. 346.32 of the Tax Code of the Russian Federation, where the regime tax is paid no later than the 25th of the next month. The reporting period is defined as a quarter.

Table for filing a declaration under the UTII regime in 2020:

| For what period is it submitted? | Deadline for filing a declaration | |

| For what year | Quarter | |

| 2019 | 4 | 22.01.2020 |

| 2020 | 1 | 20.04.2020 |

| 2 | 20.07.2020 | |

| 3 | 20.10.2020 | |

| 4 | 22.01.2021 | |

The law prohibits individual entrepreneurs from filing a zero declaration on UTII. The reason for this is the need to pay tax under any circumstances, even if the company is not operating, but there are:

- rented or personal space;

- workers;

- other indicators.

All payments must be made strictly on the 25th of the following month following the reporting period.

UTII is one of those taxation regimes that does not imply the definition of any benefits. However, any other special status will not provide the opportunity to receive benefits from the Federal Tax Service.

On the question of the reasons for

According to statements by representatives of the country's Ministry of Finance, the main reason for the abolition of UTII lies in the fact that entrepreneurs and commercial organizations themselves complain about its inconvenience. However, this is not entirely true. Experts say that the state itself is no longer interested in a single tax. At the time when it was introduced, business was so eager to go into the shadows that it was possible to get some income from it to the treasury by simplifying fiscal collections as much as possible.

Today, when the tax service has significant powers, and control systems are becoming more and more sophisticated, giving businessmen the opportunity to avoid maximum levies is completely unprofitable for the country.

The draft law, which provides for a gradual shift away from paying UTII and a transition to a patent system, was developed back in 2012, and should have become the norm already in 2014, which, however, never happened. It has been said for a long time that in 2020 the ENI system will be completely abolished. However, not long ago a law was signed, according to which the ability to apply a single tax is extended until January 1, 2021.

Loss of the right to use UTII

An organization and individual entrepreneur loses the right to use UTII if at the end of the tax period (quarter) the average number of employees exceeded 100 people, as well as if the share of participation of other organizations was more than 25%.

If an organization and individual entrepreneur use only UTII, then if they lose the right to imputation, they are automatically transferred to the general taxation regime from the quarter in which the violations were committed.

If, along with UTII, you use the simplified tax system, then if you lose the right to imputation, you will automatically be transferred to the simplified tax system as the main tax regime. In this case, re-submitting an application for transition to the simplified tax system is not required.

Disadvantages and advantages

Disadvantages of the UTII system for individual entrepreneurs:

- Tax is mandatory.

- The taxation system cannot be chosen at the discretion of the entrepreneur.

- A basic profitability is established, most often determined without obvious grounds, which means that it does not correspond to the real results of the entrepreneur’s activities.

- The role of the tax rate is insignificant.

- Not a VAT payer (this entails unprofitable partnerships with such an entrepreneur).

- The UTII regime can only be accepted by a certain circle of entrepreneurs.

- The tax amount is fixed.

- The size of UTII increases depending on many factors.

Advantages of the UTII system for individual entrepreneurs:

- There is no need to pay many types of taxes (VAT, property tax, etc.).

- Does not require mandatory accounting.

- Simplified tax accounting system.

- Application of coefficients calculated for each region for adjustment.

- The calculated approximate amount of income received.

- The actual period of work is taken into account.

- The reporting form is greatly simplified.

Individual entrepreneur on UTII takes place. But when choosing this particular system, it is necessary to take into account the existing disadvantages. In some cases it is simply impossible to use, but in others it will be a beneficial solution.

Single tax on imputed income - what is this system?

This taxation system was introduced by legislators in order to simplify the taxation procedure for entrepreneurs and organizations. The basic concepts and methodology of the UTII system are enshrined in the Tax Code of the Russian Federation.

But this tax is levied on the territories of municipalities, therefore local authorities are given the right to adapt the current norms to the business conditions within their municipalities. In this regard, regulation is carried out at their level.

Currently, municipalities determine the types of activities in which this system can be applied, and also establish the values of the adjustment coefficient for each line of business, determined for each territory of the settlement within the municipal territories.

Important: legislative acts provide for a deadline for the existence of UTII.

It is planned until 2021. This is due to the fact that at present there is a gradual transition of imputations to a new preferential regime - the patent taxation system. The current provisions legislatively determine that today UTII is applied on a voluntary basis, and not, as it was in the past, on a mandatory basis. A business entity can switch to it if it carries out the type of activity established by law and meets the criteria for applying UTII.

To the question of what is UTII - in simple words, you can answer the following: this is a tax calculation system on which the subject calculates a single tax based on basic physical performance indicators. They can be the number of employees when providing services, the area of the hall when selling goods, the number of vehicles during transportation, etc.

Attention: entrepreneurs and organizations do not need to record receipts of funds into bank accounts and cash registers for tax purposes. However, current regulations establish a smooth transition to the mandatory use of online cash registers by swindlers.

The norms establish the basic UTII profitability for each type of activity per unit of a specific physical indicator.

Conditional monthly income is calculated by multiplying profitability by the number of physical indicators. After this, the value is adjusted by a certain inflation coefficient and the coefficient for the type of activity in force in the territory of the settlement at the place of activity. At the same time, the k1 coefficient for UTII for 2018 is determined by the federal authorities, k2 - by local authorities.

Important: the main feature, which is the main criterion for choosing this tax regime, is that the tax is calculated not from the profit received, but from the established coefficients. Thus, if the business is highly profitable, there will be clear savings than using, for example, a simplified taxation system.

If a single tax on imputed income is calculated for certain types of activities, then it must be determined and paid to the budget once a quarter. Therefore, the imputed report must also be submitted quarterly.

Documents for applying UTII when opening an individual entrepreneur or LLC cannot be submitted immediately. But you can switch to this preferential treatment after receiving registration documents.

The legislation also provides for the possibility of changing the system to UTII during business activities by submitting a corresponding application to the tax office.