Download work form knd0710096 for 2020

This choice falls on the management of the enterprise. In addition, it is necessary to indicate the type of financial statements in terms of accounting policies. In order for the Federal Tax Service to be able to read encrypted information, it is necessary to prepare reporting KND 0710096 and take into account the rules for filling it out.

They are compiled on the basis of standard plans and recommendations of the Ministry of Finance. In addition to indicating data for the reporting period, you should provide indicators for the previous year in the report on financial success and for two years in the balance sheet.

If this is a zero digit, then dashes must be placed in the lines corresponding to the indicators.

Attention It is approved at the legislative level and helps to quickly read the necessary information.

Accounting reporting form KND 0710096: According to the Federal Law “On Accounting”, starting from January 1, 2013, any organization must maintain financial statements.

In this case, neither the taxation system nor the form of ownership matters. Institutions operating under the simplified tax system, UTII or a combined regime must also keep records and submit the relevant documents to the tax office.

A report is produced every year.

Federal law assumes that individual entrepreneurs with a general or simplified system or with imputed tax are exempt from accounting reporting.

The list of such entities is given in the table: Who can keep simplified records Law regulating the activities of the entity Small enterprises Law

“On the development of small and medium-sized businesses in the Russian Federation”

dated July 24, 2007 No. 209-FZ NPO Law “On Non-Profit Organizations” dated January 12, 1996 No. 7-FZ Companies operating within the framework of the Skolkovo project Law “On the Skolkovo Innovation Center” dated September 28, 2010 No. 244-FZ B At the same time, the listed entities must meet the conditions specified in paragraph.

5 tbsp. 6 of Law No. 402-FZ, for example, not be subject to mandatory audit, not be a government organization, political party, not engage in microfinance, etc. The forms of simplified reports are given in the current version of Order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n.

Accounting (financial) reporting form according to KND 0710099

Copyright: Lori's photo bank At the end of each year, accounting (financial) statements - KND form 0710099 - are submitted by business entities to the tax office. A distinctive feature of these reporting forms is the presence of a special barcode and the possibility of transmission in electronic form.

Let's consider the composition and features of these reporting forms. regulated by Art. 14 of the Law of December 6, 2011

No. 402-FZ. Templates for reporting forms, including simplified ones, were approved by the Ministry of Finance in Order No. 66n dated July 2, 2010. Each form has its own OKUD code.

If reporting is generated for internal users, you can use the forms from Order No. 66n without line codes, the same forms can be used for submission to , (with completed line codes). The tax inspectorate will need the accounting financial reporting form KND 0710099. The reporting submitted to the Federal Tax Service is designed for electronic document management, therefore the reporting forms for KND 0710099 are developed in a machine-readable version.

But they can also be used when submitting a report on paper. Each form page contains a special barcode in the upper left corner.

Accounting statements KND 0710099 consists of the following forms:

- Balance (OKUD 0710001);

- report on changes in capital OKUD 0710003);

- report on the intended use of funds (OKUD 0710006);

- report reflecting cash flow (OKUD 0710004);

- explanations for reporting.

- report on financial results (OKUD 0710002);

The form can be downloaded from or on the website. The forms on these resources are presented with a .tif extension.

They can be printed and filled out by hand, but adjustments cannot be made using a computer. Tax authorities recommend using specialized software.

When it comes to form 0710099, financial statements can be generated using the "" program.

Retained earnings in the balance sheet: line 1370

This line reflects the amount of the authorized capital (share capital, authorized capital) of the organization. When drawing up a separate balance sheet for joint activities, the participant conducting common affairs indicates in the line under consideration the amount of contributions made by the partners.

When filling out line 1310, data on the credit balance of account 80 “Authorized capital” is used as of the reporting date, that is, as of December 31, 2013 (Instructions for the application of the Chart of Accounts for accounting financial and economic activities of organizations, approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 year N 94н (hereinafter referred to as the Instructions for using the Chart of Accounts)).

The amounts of the authorized (share) capital and the actual debt of the founders (participants) for contributions (contributions) to the authorized (share) capital are reflected in the balance sheet separately (paragraph 2 of paragraph 67 of the Regulations on maintaining accounting and financial statements in the Russian Federation, approved by the Order of the Ministry of Finance of the Russian Federation Federation of July 29, 1998 N 34n (hereinafter referred to as Regulation N 34n).

This line of the balance sheet (“Capital and reserves”) involves reflecting the amount of the authorized capital corresponding to that defined in the constituent documents of the enterprise. It does not matter whether any of the founders of the company partially paid their share. Even if any of the investors, in principle, did not contribute the required amount to the authorized capital, the corresponding indicator is recorded in the “Capital and Reserves” section of the balance sheet.

To correctly fill out the line in question, you should use the credit balance of account 80, used in the accounting registers. Next, the accountant needs to reflect the correct information on the company’s own shares.

Filling out the corresponding line in the “Capital and Reserves” section in the balance sheet is a procedure that may have some specific features for companies with the status of JSC and LLC.

Thus, joint stock companies, when preparing reports and reflecting data on them in line 1320, indicate information on their own shares, which were purchased directly from their holders. LLCs record information on the value of shares within the authorized capital, which, in turn, were purchased from the founders of the enterprise.

https://www.youtube.com/watch?v=https:tv.youtube.com

To fill out the line in question in the “Capital and Reserves” section, you must use data on the debit balance within account 81. Next, you need to reflect in the reporting information on additional and reserve capital. Let's study the nuances of this procedure in more detail.

Relevant information is the most important characteristic of such a source as the balance sheet (“Capital and Reserves”). What does it include?

Regarding additional capital, it can be formed in 3 ways:

- upon the fact of additional valuation of assets classified as non-current;

- at the expense of income generated in the process of issuing securities (if, for example, the company’s shares are traded at a value exceeding par value), at the expense of the contributions of the founders - if we are talking about an LLC;

- at the expense of the restored VAT at the time of transfer of this or that property to the authorized capital.

In order to correctly reflect the figures on line 1350, it is necessary to use information within the credit balance of account 83. The reserve capital of the enterprise is also reflected in the “Capital and Reserves” section. The line code in the balance sheet intended to indicate the value of this resource is 1360.

Information about the corresponding type of capital in the financial statements is reflected by companies that have a reserve fund. In the general case, these are joint-stock companies, since, due to the requirements of Russian legislation, they are obliged to form one. The reserve fund of a joint-stock company is formed through mandatory contributions in the amount of 5% of net profit or more.

Of course, an LLC also has the right to form an appropriate fund. Its amount and the procedure for transferring capital in order to create the corresponding resource are determined in the management policy of the organization.

In order to correctly reflect the figures for reserve capital in the balance sheet, it is necessary to use information about the credit balance within account 82. The next information block of the “Capital and Reserves” section in the balance sheet is line 1370. It reflects data on the firm’s retained earnings.

Information on line 1370 of the balance sheet should reflect all companies with commercial turnover. The corresponding indicator can be represented by profit or uncovered losses. In order to enter correct data in the line in question, it is necessary to use information from account 84. In this case, it may be necessary to transfer the debit or credit balance of the corresponding account to the balance sheet.

Another important block in the “Capital and Reserves” section in the balance sheet of a small enterprise is line 1320. It reflects the value of the company’s own shares.

Accounting statements for 2020

> > June 05, 2020 All plot materials - we will have to work on it throughout the first quarter of 2020.

It must be ready by the end of March, since the deadline for its submission to the authorities is March 31. What forms to prepare, how to fill them out, where to submit them, what changes in accounting legislation to take into account - the materials in our hot selection of reporting 2020 will tell you about this and more. Documents and forms will help you: Balance sheet - the first and main financial document from the set of annual financial statements for 2020.

From it you can judge the financial position of the company, see what assets the company has, what its capital and liabilities are. This is a form according to OKUD 0710001, approved by order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n. As of June 1, 2020, a new version of the accounting reporting forms has been in effect, approved by Order of the Ministry of Finance dated April 19, 2020 No. 61n.

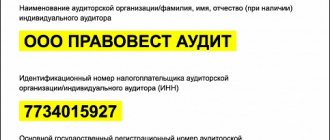

The updated balance sheet form must indicate:

- OKVED 2 instead of the previously valid OKVED.

- name of the auditing firm or individual entrepreneur, as well as INN and OGRN (OGRNIP);

- whether the company is subject to audit;

- figures in thousands of rubles, because unit of measurement “million rubles” excluded;

What a balance sheet might look like, see. In essence, a balance sheet is a table consisting of columns and rows, the sections of which are assets (information about property) and liabilities (information about the sources of acquisition of property). In an asset, property is presented in the context of non-current and current assets.

In liabilities, sources are classified into capital and reserves (these are the enterprise's own funds), long-term and short-term liabilities (these are borrowed funds).

All indicators in the balance sheet are presented as of three reporting dates: December 31 (or other reporting date) of the reporting year and the two previous years.

Read more about the structure of the balance sheet and the composition of its items here.

Each balance sheet item - both in assets and liabilities - has its own line with a special code.

Own shares on balance: 1320

Filling out the corresponding line in the “Capital and Reserves” section in the balance sheet is a procedure that may have some specific features for companies with the status of JSC and LLC.

Thus, joint stock companies, when preparing reports and reflecting data on them in line 1320, indicate information on their own shares, which were purchased directly from their holders. LLCs record information on the value of shares within the authorized capital, which, in turn, were purchased from the founders of the enterprise.

To fill out the line in question in the “Capital and Reserves” section, you must use data on the debit balance within account 81. Next, you need to reflect in the reporting information on additional and reserve capital. Let's study the nuances of this procedure in more detail.

Information on this line can be recorded by both JSC and LLC (if the company buys out certain shares from the founders who are leaving the business). JSCs reflect in the corresponding block the value of securities that were purchased from their owners, LLCs - shares within the authorized capital acquired from the founders.

We invite you to read the Complaint against the management company TEPLOSET

In order to correctly reflect the information in line 1320, the accountant must use data on the debit balance within account 81.

Own shares purchased from shareholders - using this line, joint stock companies reflect the value of their shares purchased from shareholders for their subsequent resale or cancellation.

Business companies or partnerships may reflect on this line the shares of participants acquired by the company or partnership itself for transfer to other participants or third parties.

Own shares transferred to the company in the reporting year, for which the participant must be paid their actual value according to the financial statements for the reporting year, are taken into account in accounting at their nominal value.

KND 0710099 financial statements for 2020 – 2020 download

Today we will consider the topic: “KND 0710099 financial statements in 2020 - 2020 download” and we will analyze it based on examples.

You can ask all questions in the comments to the article. Contents At the end of each year, accounting (financial) statements - form according to KND 0710099 - are submitted by business entities to the tax office.

A distinctive feature of these reporting forms is the presence of a special barcode and the possibility of transmission in electronic form. Let's consider the composition and features of these reporting forms. No video. Video (click to play).

The composition of financial statements is regulated by Art.

14 of the Law of December 6, 2011 No. 402-FZ.

Templates for reporting forms, including simplified ones, were approved by the Ministry of Finance in Order No. 66n dated July 2, 2010. Each form has its own OKUD code.

If reporting is generated for internal users, you can use the forms from Order No. 66n without line codes, the same forms can be used for submission to the statistics body (with completed line codes). The tax office will need the accounting financial reporting form KND 0710099.

The reporting submitted to the Federal Tax Service is designed for electronic document flow, therefore the reporting forms for KND 0710099 are developed in a machine-readable version.

But they can also be used when submitting a report on paper. Each form page contains a special barcode in the upper left corner.

Accounting statements KND 0710099 consists of the following forms: Balance sheet (OKUD 0710001); report on financial results (OKUD 0710002); report on changes in capital OKUD 0710003); report reflecting cash flow (OKUD 0710004); report on the intended use of funds (OKUD 0710006); explanations for reporting.

The form can be downloaded on the website of the Federal Tax Service or on the website of the Federal State Unitary Enterprise GNIVC. The forms on these resources are presented with a .tif extension. They can be printed and filled out by hand, but adjustments cannot be made using a computer.

Tax authorities recommend using specialized software. When

Revaluation of non-current assets

https://www.youtube.com/watch?v=ytcopyright

Commercial organizations have the right to revaluate a group of similar fixed assets at current (replacement) cost once a year. The line “Revaluation of non-current assets” reflects the amount of increase in the value of non-current assets identified based on the results of their revaluation.

Additional capital (without revaluation) - reflects the amount of additional capital of the organization, with the exception of the amounts of additional valuation of non-current assets.

We suggest you read: Is it possible to make corrections in the cash book?

Additional capital is formed due to:

- share premium, which is the amount of the difference between the sale and par value of shares (shares), received in the process of forming the authorized capital of the organization (upon the establishment of the organization, with a subsequent increase in the authorized capital) through the sale of shares (shares) at a price exceeding the par value;

- exchange rate differences associated with settlements with founders on deposits, including contributions to the authorized (share) capital of an organization, expressed in foreign currency;

- the difference arising as a result of the recalculation of the value of the assets and liabilities of the organization, expressed in foreign currency, used to conduct activities outside the Russian Federation, into rubles;

- contributions to the property of a limited liability company;

- the amount of VAT recovered by the founder when transferring property as a contribution to the authorized capital and transferred to the established organization (if the specified amounts are not a contribution to the authorized capital of the established organization).

KND 0710096: simplified financial statements

Contents Simplified accounting reports are submitted at least once a year by absolutely all business entities.

The year is always a calendar year (01/01 – 31/12). Simplified financial statements should be submitted in accordance with the form and sample on time, since each document will be subject to a fine of 200 rubles for lateness. Violations in accounting for income and expenses of taxable objects are also subject to fine:

- 10 thousand rubles for those made in one tax period;

- 30 thousand – if the period is more than one.

We recommend reading: Taxes on children from wages

There are three main forms of financial statements:

- 1.

Balance sheet; - 2.

Income statement; - 3.

Report on the intended use of funds (exclusively for non-profit organizations).

In order to correct errors in simplified forms, you need to submit an adjustment. To do this, a new paper is drawn up, where on the first page it is mandatory to indicate that this is no longer the primary document, and what kind of adjustment it is to the account: Clause 1, Article 14 of Federal Law No. 402-FZ of December 6, 2011 (“On Accounting”) involves filling out three main documents:

- 3. Explanatory note to the annual reporting.

- 1. Balance;

- 2. Statement of financial results;

The sixth paragraph of Order No. 113n of the Ministry of Finance of Russia dated August 17, 2012 approved the first and second forms of simplified financial statements for small enterprises. In addition, in December 2020, by order of the Federal Tax Service, the Federal Tax Service established the procedure for submitting forms electronically.

A sample order can be downloaded for free here: Simplified accounting financial statements for small companies KND 0710096 has a machine-readable format. In electronic form in Excel, sample forms KND 0710096 can be downloaded here: Documents are also convenient to fill out in Adobe Reader, they are filled out in PDF format: form KND 0710096 free download here: Sample of fully completed forms for a small enterprise download free here: Let's look at how to fill out the KND 0710096 form, in more detail: 1.

Accounting statements for 2020

→ Section updated October 3, 2020

Must be submitted no later than March 31, 2020 (inclusive) Attention! It is no longer necessary for organizations to submit financial statements to Rosstat authorities (with some exceptions) Attention! Only organizations belonging to small and medium-sized businesses can submit financial statements on paper. Absolutely all organizations must submit financial statements annually, regardless of the tax regime applied.

Organizations submit their financial statements to the Federal Tax Service at the location of the organization (clauses

5, 5.1 clause 1 art. 23 of the Tax Code of the Russian Federation). In addition, organizations whose annual accounting (financial) statements contain information classified as state secrets in accordance with the legislation of the Russian Federation must submit financial statements to Rosstat (Part 7, Article 18 of the Federal Law of December 6, 2011 N 402-FZ).

Accounting statements are submitted to the Federal Tax Service and to the Rosstat branch (whose responsibilities include submitting financial statements to statistical authorities) no later than three months after the end of the reporting year (clause 5, 5.1, clause 1, article 23 of the Tax Code of the Russian Federation, part 5, art.

18 of Federal Law dated December 6, 2011 N 402-FZ), i.e. no later than March 31 of the year following the reporting year. Moreover, if March 31 falls on a weekend, the deadline for submitting financial statements is postponed to the first working day following this date (clause 7, article 6.1 of the Tax Code of the Russian Federation, clause 7 of the Procedure, approved.

Order of Rosstat dated March 31, 2014 N 220). Accounting statements are submitted exclusively in electronic form via TKS through a special operator (Part 5 of Article 18 of the Federal Law of December 6, 2011 N 402-FZ).

True, small and medium-sized businesses are allowed to submit such reports for 2020 either on paper or in electronic form at their choice (Clause 4, Article 2 of the Federal Law of November 28, 2018 N 444-FZ). As a general rule, the financial statements include (Part 1, Article 14 of Federal Law No. 402-FZ of December 6, 2011):

We submit reports using a simplified scheme

Not a day without instructions × Not a day without instructions

- Services:

Simplified financial statements are special financial forms that have a simplified structure, and the requirements for them are significantly reduced.

Who has the right to submit reports using simplified forms? What is included in such reporting and how to fill out the forms? February 17, 2020 Author: Natalya Evdokimova Maintaining accounting records and submitting reports to tax and statistical authorities is mandatory for all economic entities in Russia.

Financial statements are a set of numerous forms and forms that reflect the results of the financial and economic activities of an enterprise. Preferential conditions are provided for small businesses: they have the right to conduct accounting using a simplified system and report to the Federal Tax Service using simplified forms:

- Income statement.

- Balance sheet.

- Report on the intended use of funds (for non-profit institutions).

The remaining forms may not be drawn up at all if the information on these reporting forms is not essential for assessing the economic activity of a small enterprise.

This right is enshrined in clause 6 of Order of the Ministry of Finance dated July 2, 2010 No. 66n. The relaxing condition for the organization must be specified in the accounting policy, otherwise tax authorities may issue a fine for non-compliance of reporting forms. Simplified financial statements for 2020 (the form can be found below) are provided as usual until March 31 of the year following the reporting year.

But since 03/31/2020 is a Sunday, submit a simplified accounting report before 04/01/2020 (subclause 5, clause 1, article 23 of the Tax Code of the Russian Federation, parts 1, 2, article 18 of the Federal Law of December 6, 2011 No. 402-FZ).

The forms are provided to the Federal Tax Service and statistical authorities in electronic or paper form.

You can submit reports for 2020 until April 1, 2020! Those economic entities that have permission to conduct simplified accounting can report using simplified forms.

Reserve capital on the balance sheet is...

The concept of “organizational insolvency” is associated with the assessment of solvency, the assessment of which uses two criteria: insufficient property to pay the debt and the inability of debtors to pay. The degree of solvency for current liabilities of Ktl is defined as the ratio of current borrowed funds (short-term liabilities) to average monthly gross revenue [2]. However, from the financial results statement we can only obtain the net revenue indicator (see Table 3).

The liquidity of an asset is understood as its ability to be transformed into cash. The shorter the period of possible transformation into cash, the higher the liquidity of assets. The liquidity of an enterprise means that the enterprise has current assets in an amount sufficient to pay off current liabilities [1]. To assess the level of liquidity, indicators of absolute, critical and current liquidity are calculated.

Based on the calculated indicators, we can draw a conclusion about the liquidity of funds of the analyzed enterprise and its solvency for the reporting year.

The absolute liquidity ratio (Ka) characterizes the degree to which current liabilities are covered by cash and cash equivalents as of the reporting date. A value of 0.2-0.5 or more is considered standard.

The critical liquidity ratio (CL) characterizes the degree to which current liabilities are covered by the most liquid assets and expected receipts from buyers. The recommended value of the indicator is greater than or equal to 1.0.

The current liquidity ratio (CLR) characterizes the degree to which current liabilities are covered by working capital, and the optimal ratio is 2/1.

However, the balance sheet reflects the position of current assets and current liabilities at the end of the month, and the situation may change significantly subsequently. These may be problems with delayed payments from buyers and customers, or the emergence of any financial difficulties. To assess solvency, credit organizations usually use current account statements for the analyzed period, analyzing the flow of funds in the organization's current accounts.

| Name | Recommended value | Formula |

| Coefficient of provision of current assets with own working capital (Kss) | greater than or equal to 1.0 | Kss = SOS/OA, SOS = Capital and reserves – Non-current assets; |

| Coefficient of provision of inventories with own working capital (Kmz) | from 0.6 to 0.8 | Kmz = SOS/W |

| Equity capital agility ratio (Kmsk) | 0,5 | Kmsk = SOS/KR |

| Long-term borrowing ratio (Kdz) | less than or equal to 1.0 | Kdz = Long-term borrowed funds / Equity funds |

| Autonomy coefficient (Ka) | greater than or equal to 0.5 | Ka = SC/WB |

| Financial activity ratio (financial leverage) (Kfa) | Kfa = (DZS KZS)/KR | |

| Financial stability coefficient (share of long-term sources of financing in assets) (Kfu) | from 0.5 to 0.7 | Kfu = (KR DZS)/WB |

| where, SOS – own working capital; OA – current assets; Z – reserves; KR – capital and reserves; SK – equity capital; VB – balance sheet currency (total cost of financing sources); DZS – long-term borrowed funds; KZS – short-term borrowed funds | ||

When using the indicated indicators of financial stability in analytical practice, it is necessary to keep in mind that they reflect the financial condition as of a date that has already passed. Therefore, it is advisable to consider them in dynamics over several reporting periods, which will indicate a certain consistency in the activities of the enterprise.

The line “Tangible non-current assets” displays the residual value of fixed assets, as well as incomplete capital investments in fixed assets.

The line “Intangible, financial and other non-current assets” contains the sum of account balances for various research developments, patents, copyrights, deferred tax assets, deposits, as well as other investments in certain tangible assets and other non-current assets.

In the line “Inventories” indicate the amount of balances on the accounts of goods, raw materials and materials, work in progress, spare parts, fuels and lubricants, etc.

The line “Cash and cash equivalents” is intended for entering balances in cash accounts at the cash desk, in the company’s bank account in special accounts, as well as in foreign currency accounts. In addition, funds lying in demand deposit accounts, as well as short-term financial investments, are indicated here.

The line “Financial and other current assets” includes all other assets that cannot be included in cash equivalents or inventories. These are accounts receivable for goods and services, input VAT, investments with a maturity of up to 12 months, etc.

Then the liability is filled in so that the sum of all liability lines equals the sum of all asset lines.

The liability line “Capital and reserves” contains information about the authorized capital of the enterprise (including additional and reserve capital), as well as the amount of retained earnings (or losses).

The line “Long-term borrowed funds” is filled in based on the amount of balances in the accounts of credits and loans, the repayment period of which is more than one year.

In the line “Other long-term liabilities” data is entered on other financial obligations of the enterprise, the due date for which occurs in more than a year. These can be bonds, bills issued, etc.

In the line “Short-term borrowed funds”, record the amount of balance on the accounts of short-term loans, that is, those whose repayment terms do not exceed twelve months.

The line “Accounts payable” includes obligations to pay for goods and services received from suppliers, pay salaries, transfer taxes, contributions to social insurance funds, as well as obligations to other creditors.

The line “Other short-term liabilities” includes other obligations of a non-long-term nature that were not included in the previous lines. This could be a deposited salary, special funds for paying current expenses.

The amount of reserve capital is displayed in line 1360 of the balance sheet, which indicates that reserve capital is a component of the total capital of the organization, reflected in the final line 1300.

The fact that reserve capital is included in the company’s equity capital is also indicated in clause 66 of the Regulations on accounting and accounting, approved by Order of the Ministry of Finance dated July 29, 1998 No. 34n (hereinafter referred to as PVBU).

You can learn about what a company’s equity capital is from our article “Equity on the balance sheet is...”.

The company's capital and reserves are considered its liabilities, so it is logical that reserve capital, as a component of equity capital, is, of course, a liability.

In addition, in accounting, information about the state and movement of reserve capital is summarized in account 82, which is also passive.

Reserve capital is intended to accumulate part of net retained earnings, which will subsequently be spent primarily on covering losses.

You will receive more information about liabilities and assets when studying the article “Balance Sheet (Assets and Liabilities, Sections, Types).”

Unlike LLCs, joint stock companies are required to accumulate reserve capital. For an LLC, the creation of a reserve fund is the right of the company in accordance with paragraph 1 of Art. 30 of the law of 02/08/1998 No. 228-FZ, and not an obligation. At the same time, the size and targeted nature of such a fund for an LLC are not regulated by law, but are prescribed in the charter.

The amount of reserve capital in joint-stock companies cannot be less than 5% of the authorized capital, while the founders can establish a larger size of this fund (clause 1, article 35 of the law of December 26, 1995 No. 208-FZ). The same legislative act specifies the intended use of the fund and the procedure for its formation.

- In accordance with current legislation, the main source of reserve capital formation is deductions from net profit.

In joint stock companies, reserve capital is formed through deductions from net profit, and the amount of annual replenishment of reserve capital should not be less than 5% of net undistributed profit for the reporting period (paragraph 2, clause 1, article 35 of Law No. 208-FZ). Deductions from net profit in favor of the reserve fund are made until the limit established in the charter is reached.

Simplified financial statements - reporting forms, sample filling

Absolutely all business entities submit simplified accounting reports at least once a year.

The year is always calendar (01/01 – 31/12). You should submit simplified financial statements according to the form and sample on time, since each document will be subject to a fine of 200 rubles for lateness. For violations of accounting for income and expenses of taxable objects, a fine is also imposed:

- 10 thousand rubles for those made in one tax period;

- 30 thousand – if the period is more than one.

There are three main forms of financial statements:

- 3.

Report on the intended use of funds (exclusively for non-profit organizations). - 1. Balance Sheet;

- 2.

Income statement;

In order to correct errors in simplified forms, you need to submit an adjustment. To do this, a new paper is drawn up, where on the first page it is mandatory to indicate that this is no longer the primary document, and what kind of adjustment it is. Clause 1, Article 14 of Federal Law No. 402-FZ of December 6, 2011 (“On Accounting”) implies filling out three main documents:

- 1. Balance;

- 2. Statement of financial results;

- 3. Explanatory note to the annual reporting.

The sixth paragraph of Order No. 113n of the Ministry of Finance of Russia dated August 17, 2012 approved the first and second forms of simplified financial statements for small enterprises.

In addition, in December 2020, the Federal Tax Service, by order, established the procedure for submitting forms electronically. You can download a sample order for free. Simplified accounting financial statements for small companies KND 0710096 have a machine-readable format. In electronic form in Excel, samples of KND 0710096 forms can be downloaded. Documents can also be conveniently filled out in the Adobe Reader program, they are filled out in PDF format: KND form 0710096 free fully completed forms for small businesses free download Let's look at how to fill out the KND 0710096 form, more than 1.

Simplified accounting financial statements - KND 0710096

> > > March 11, 2020 All story materials Simplified accounting financial statements KND 0710096 were developed to unify reports that are submitted to the tax authorities using information technology. In this article we will talk about the composition and features of simplified reporting. Documents and forms will help you: Accounting statements are a set of documents of a certain content, compiled according to accounting data (clause.

1 tbsp. 13 ). Keeping accounting records is not mandatory for individual entrepreneurs, private practitioners and divisions of foreign companies that keep records in accordance with the rules of Tax legislation (Clause 2 of Article 6 of Law No. 402-FZ). Accordingly, accounting is not mandatory for them.

But the legal entity must prepare and submit it (subclause 5, clause 1, article 23 of the Tax Code of the Russian Federation). For information on what medium, electronic or paper, it is possible to submit accounting records to the Federal Tax Service, read the material.

Today there are 2 options by which accounting records are formed (order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n):

- simplified, which can be used by legal entities that have the right to conduct accounting according to simplified rules.

- full;

Simplification of reporting implies the possibility of drawing up 3 forms of reporting in a reduced volume:

- .

- ;

- ;

Reports can be submitted both on paper and via electronic communication channels. To submit simplified reporting for 2020 in electronic form, a special electronic format has been established by letter of the Federal Tax Service of Russia dated July 16, 2018 No. PA-4-6/ [email protected] .

The list of such entities is given in the table: Who can keep simplified records Law regulating the activities of the subject Small enterprises Law “On the development of small and medium-sized businesses in the Russian Federation” dated July 24, 2007 No. 209-FZ NPO Law

Net worth formula

Traditional method

The traditional method is characterized by increased simplicity, and therefore it is popular in calculations. Let us recall that within the framework of this method, equity capital is identical to the size of net assets. To determine it, just look at the value of line 1300.

That is, the formula will be as follows: Own capital = Line 1300.

Obviously, an accountant can find out the value of equity within one minute.

Calculations according to the Ministry of Finance

The calculation can be carried out on the basis of Order of the Ministry of Finance No. 84n dated August 28, 2014. This order states that equity includes all assets except liabilities. These indicators are used in calculations:

- Line 1400 (debts with a repayment period of 12 months or more).

- Line 1500 (short-term debts).

- Page 1600 (assets).

Calculations are carried out in accordance with this procedure:

- The values from lines 1400 and 1500 are added together.

- The credit indicators of account 98 (free receipt of property, etc.) are subtracted from the resulting value.

- The balance on DT account 75 is subtracted from the indicator on line 1600.

- From the value obtained in step 3, the result of the calculations from the second point is subtracted.

This calculation algorithm is more complex, but it gives more accurate results.

SK = line 1300 f. No. 1.

If the company is interested in using the calculation of net assets, then equity capital in the balance sheet is not just a single value from page 1300, but a full-fledged calculation with several variables in its composition. Let's look at how this calculation is done in the next section.

SC = Act.calc. – Obligatory settlement,

Actual calculation - assets accepted for calculation - all assets of the company minus the debt of the founders for contributions to the authorized capital;

Oblig.calc. - liabilities accepted for calculation - all liabilities minus future income (the amount of state aid and gratuitously received property).

The equity formula for the balance sheet, according to the order of the Ministry of Finance, uses balance sheet lines 1400, 1500, 1600.

In addition, information is collected separately on the debts of company participants on contributions to the authorized capital, accumulated by the entry Dt 75 Kt 80.

The corresponding deferred income on the account loan is also highlighted. 98.

The sequence of steps taken to implement the financial department method is as follows:

- Receive the amount line 1400 and 1500 - the total amount of obligations;

- Reduce the result by credit balances on the account. 98 related to state aid and gratuitous receipts;

- Reduce the figure on line 1600 by the amount of the debit balance on account 75;

- Subtract from the value obtained in step 3 the value obtained in step 2.

Based on the above, we present equity capital according to the lines of the balance sheet in the form

SK = (line 1600 – ZU) – ((line 1400 line 1500) – DBP),

ZU - debt of the founders;

DBP - deferred income.

Own capital = Balance sheet currency - Liabilities of the enterprise

SK = A – Vol.

Read us on Yandex.Zen

Yandex.Zen

Next, let's find out where equity is located on the balance sheet. The forms of the balance sheet, as well as the report on financial results and other generally accepted forms of accounting are approved by Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n. According to Appendix 1 to this order, the company’s equity capital is reflected in the balance sheet under code 1300 and consists of indicators on lines 1310–1370.

Thus, we have determined that “Equity” is line 1300 of the balance sheet, i.e., the total amount for section III of the liability side of the balance sheet “Capital and Reserves”.

The authorized capital can be increased or decreased by the decision of the founders with mandatory registration in the company’s statutory documents. The founders of a business entity make their contributions in cash, property, intangible assets, etc.

Own shares purchased from shareholders (page 1320) reduce the authorized capital. This line is filled out by JSC and LLC, indicating the amount in parentheses.

Page 1340 “Revaluation of non-current assets” reflects the results of the revaluation of fixed assets and intangible assets. This line is also included in equity.

Additional capital (p. 1350) is also part of the equity capital and, in addition, the property of the founders of the legal entity, not divided into shares. Additional capital reflects an increase in the value of property as a result of the revaluation of fixed assets and construction in progress. Also, additional capital is formed from property and/or cash received free of charge, and from the receipt of share premium.

Reserve capital (p. 1360) is created to minimize risks. Hence the name - reserve, i.e. it is a reserve just in case. Reserve funds are created voluntarily and are formed in the manner established by the constituent documents or accounting policies of the company, depending on the organizational and legal form of its ownership.

Retained earnings from previous years and the reporting year (line 1370) are also included in the legal entity’s own capital (uncovered loss, in turn, reduces equity capital). These parts of capital are formed in accordance with legislation, constituent documents and accounting policies.

In the educational literature there are various algorithms for calculating the value of own working capital, among which the most often used indicator is the difference between the value of current assets and short-term liabilities.

JUICE = TA – TO,

SOK - own working capital;

TA - current assets (line 1200 of the balance sheet);

TO - current liabilities (line 1520 of the balance sheet).

SK = (SKng SKkg) / 2,

SK - the size of the annual equity capital;

SKng - the amount of equity capital (line 1300 of the balance sheet) at the beginning of the year;

SKkg - the amount of equity capital at the end of the year.

The total of a company's assets minus its total liabilities is equity on the balance sheet. Often the concept of equity is used on a par with the concept of net assets. International Financial Reporting Standards refer to equity as net assets (paragraphs 4.20–4.23 of the Conceptual Framework for Financial Reporting).

Net assets = Page 1600 – Debt of the founders as part of line 1230

Page 1530 – Page 1400 – Page 1500.

The formula for calculating net assets is established by law - by order of the Ministry of Finance dated August 28, 2014 No. 84n. According to this order, accounting items recorded on off-balance sheet accounts are not taken into account when determining the value of net assets.

The amount of net assets must always be greater than the authorized capital of the company. In this case, the company's activities are considered successful. The higher the net assets, the more profitable the company is. Accordingly, a negative net asset value indicates the insolvency of the company and/or its debts.

At the end of each year, joint stock companies and limited liability companies compare the amount of net assets with the authorized capital. You can increase net assets by increasing the authorized, reserve or additional capital. It is also possible to revaluate fixed assets and intangible assets according to the rules set forth in PBU 6/01 “Accounting for fixed assets” (order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n) and PBU 14/2007 “Accounting for intangible assets” (order of the Ministry of Finance of Russia dated December 27, 2007 No. 153n) respectively.

Equity assessment is a very important financial and analytical process. If the company has no debt to creditors, then the value of its assets will be equal to its equity capital.

Now you know how to calculate equity from the balance sheet.

Accounting statements of non-profit organizations in 2020

> > January 29, 2020 Are the financial statements of non-profit organizations presented in full or simplified form in 2020?

Who has the opportunity to simplify accounting and, accordingly, reporting? The answer to this is given by clause 4 of Art. 6 of Law No. 402-FZ.

What reporting forms must a non-profit organization submit? What changes have the accounting reporting forms undergone in 2020? You will find answers to these and other questions in our article. The main difference between a non-profit organization and a for-profit organization is its fundamental purpose. The goal of a commercial company is to extract the maximum possible amount of profit.

Non-profit organizations do not pursue the goal of making a profit.

This is reflected in Art. 50 Civil Code of the Russian Federation. In their activities, they must first of all be guided by the Civil Code of the Russian Federation and the Law “On Non-Profit Organizations” dated January 12, 1996 No. 7-FZ. As in commercial structures, the types of activities of a non-profit organization are fixed in its constituent documentation. The activities carried out by such an organization must correspond to the purpose of its creation and operation.

Non-profit organizations are founded for the state to implement its functions in the social sphere, education, medicine, and culture. They also conduct religious, charitable and other activities.

Non-profit organizations can also be created in the form of associations of citizens and legal entities to solve common problems. Non-profit organizations can also engage in entrepreneurial activities that generate income.

For example, educational institutions may provide additional paid services.

But such activities should not contradict the main purpose of the organization. It must also be stated in the constituent documents, for example in the charter. Accounting for income received from the results of such activities is carried out separately from the main one.

Legislation may establish certain restrictions on its conduct by certain types of non-profit organizations. Financial support for non-profits

KND 0710096 simplified financial statements, download

Small businesses are allowed to maintain simplified accounting.

And they can submit financial statements using simplified forms.

From this article you will find out who can take the KND 0710096. And you can download a blank form and an example of filling it out. Simplified accounting reporting was introduced specifically for small businesses.

In KND 0710096, indicators are presented in groups without deciphering the articles. Therefore, it is easier to compose it, but you need to take into account important nuances.

We have prepared a sample of filling out KND 0710096 to make it easier for you to understand everything. Simplified reporting includes three forms:

- Simplified balance sheet,

- Simplified income statement,

- A simplified report on the intended use of funds (submitted by non-profit organizations).

Small businesses are guided by the following rules:

- The reports reflect aggregated indicators by group; breakdowns by item are not provided,

- The appendices provide only the most important information, without which a real assessment of the company's financial condition is impossible.

At the same time, small businesses are not prohibited from submitting financial statements in full forms.

The use of KND 0710096 is a right, not an obligation, of the entities listed in Part 4 of Article 6 of the law of December 6, 2011. No. 402-FZ:

- Small businesses,

- Non-profit companies

- Residents of Skolkovo.

Read on the topic: The same legal norm lists organizations that cannot report under KND 0710096:

- Companies that are required to undergo an audit are

- Political parties,

- Housing and credit cooperatives,

- Microfinance organizations,

- Non-commercial foreign agents.

- State companies,

- Notary and bar associations,

- Bar associations and bureaus, legal consultations,

The simplified accounting reporting forms KND 0710096 were approved by order of the Ministry of Finance dated July 2, 2010.

Who uses simplified forms

Keeping records and filling out reports by companies is regulated by the accounting law of December 6, 2011 No. 402-FZ. In paragraph 4 of Art. 6 of this law lists who can use simplified forms. These include:

- small and micro enterprises;

- NPO;

- companies participating in the Skolkovo project.

In addition, in paragraph 5 of Art. 6 of Law No. 402-FZ indicates who is deprived of the opportunity to use simplified forms. In particular, the full version of accounting reports is filled out by companies that are required to submit an audit report, as well as companies engaged in certain activities (for example, housing cooperatives, legal consultations, law associations, etc.).

Sample annual reporting 0710096 for 2020

> >

- for information about length of service and data on the presence of employees - in the law “On individual (personalized) accounting...” dated 04/01/1996 No. 27-FZ (clauses 2 and 2.2 of article 11);

- for environmental collection - in Decree of the Government of the Russian Federation dated October 8, 2015 No. 1073 (clause 1).

- for payments for negative impact - in the Law “On Environmental Protection” dated January 10, 2002 No. 7-FZ (clause 5 of Article 16.4);

Tax Code of the Russian Federation (clause

7 tbsp. 6.1), as well as Rosstat’s order No. 220 dated March 31, 2014 (clause 7 of the appendix) provide for the possibility of postponing the deadline indicated as the deadline for submitting reports to a later day if its last date coincided with a weekend. The other documents above do not provide for a similar possibility of shifting dates for reports.

targeted use of finances;

- applications submitted along with mandatory reporting.

Private entrepreneurs do not have to submit such reports, while for small businesses it is possible to submit reports in a simplified version, including reporting information on financial results without details, as well as indicating in the annexes only those data that will allow assessing the financial position of the company, as well as evaluate its financial performance.

If the information needed to complete the above applications is not available, you can only fill out statements on the balance sheet and financial results. KND form 0710099: A current example of filling out a declaration can be downloaded for free from the Internet today or viewed online.

Form KND 0710096 is one of the simplified accounting reporting forms recommended by the Federal Tax Service of the Russian Federation. This type of reporting includes forms of a balance sheet, a statement of financial results and the intended use of funds. In accordance with Federal Law 402, financial statements are a series of documents that include data on the financial and property indicators of organizations and enterprises, reflecting receipts, income, and data on financial results for a certain reporting period.

Accounting financial statements of small businesses 2020. Form according to KND 0710096 (form)

→ → Current as of: April 18, 2020

In we talked about how small businesses can conduct simplified accounting. We will tell you about the composition and deadlines for submitting financial statements for 2017-2018 by small businesses in our material.

Small enterprises have the right not only to conduct simplified accounting, but also to prepare financial statements using a simplified system. Simplified reporting involves the preparation of a simplified balance sheet, a simplified statement of financial results, and for non-profit organizations - a simplified report on the intended use of funds. Small enterprises may not prepare other forms of financial statements at all if they consider that information in other forms will not be significant for assessing the financial position of the small enterprise or its financial results ().

At the same time, when preparing simplified financial statements in 2020, small businesses are guided by the following approach:

- the balance sheet, financial performance report, and report on the intended use of funds include indicators only for groups of items (without detailing the indicators for items);

- in the appendices to the balance sheet, financial results report, and report on the intended use of funds, only the most important information is provided, without knowledge of which it is impossible to assess the financial position of the organization or the financial results of its activities.

At the same time, the right to use simplified accounting does not deprive small businesses of choice: they can conduct accounting like “large” ones and also prepare annual reports.

Simplified forms of the balance sheet, statement of financial results, report on the intended use of funds for small enterprises 2017-2018 have been approved.

We will provide it with the “Code” column in Excel format.

When submitting simplified reporting in

Changes coming into force in 2020

Certain clauses of the Appendix to Order No. 61n become effective only in 2020. For the form of simplified financial statements (KND 0710096) for 2020, they are optional. But, if the company wants, it can take into account the new provisions when filling out documents for last year. They concern codes for the financial results report (Appendix No. 4 to the order):

- removed encodings 2421, 2430, 2450;

- when reflecting income tax, code 2410 is indicated in the report line, and for other income taxes the value of line 2411 is assigned;

- entered the value 2412 – “Deferred income tax”;

- a new code 2530 has been added - tax on profits from transactions not included in net profit.

Legislators also changed the wording of paragraph 9 of the note to the report on earmarked funds.

The updated coding becomes mandatory for 2020 reports.