Every person has heard about value added tax, because it is indicated on the receipts of any purchases. The line “price including VAT” is perceived by Russian citizens as an integral element.

When people without a financial or accounting background begin to wonder about the meaning of this check mark, they find it difficult to understand value added tax. This situation is natural, since VAT is a complex payment from all sides. Even the income tax system is being adopted more quickly.

Sales tax

Before the development of VAT, the economic systems of countries used a turnover tax - a payment similar in principles.

It was first used in Germany in 1916. The big disadvantage of the turnover tax was its cascading effect, i.e. taxation of costs at each stage of production and sale, which encouraged enterprises to develop their own materials industry for the further manufacture of final products. Such internal production was more economical than purchasing components and materials from external suppliers.

In order to get rid of the cascade effect and vertical integration of firms, the French economist and financier Maurice Loret created a completely new fiscal payment in 1954 - VAT. A special feature of the tax was the VAT offset invented by Mr. Loret, i.e. removing the tax burden from the supply chain and transferring it to subsequent buyers at the resale stages. As a result, according to Lore's theory, the final price of the product sold to consumers will be significantly lower.

Testing

As an experiment, the tax was introduced in Ivory Coast, a French colony of that period. Having received positive statistics, the French authorities 4 years later, in 1958, approved VAT on the territory of their country.

After France, the tax began to spread in European countries. In 1977, the European Economic Community adopted a directive to codify the legal regulation of VAT in all countries of the association. This directive established the presence of a value added tax in the country's economy as a mandatory condition for membership in the EEC. The tax was required to be introduced before 1988.

Modernity

Today, VAT is the main indirect tax in the world. To participate in the World Trade Organization, a state is required to introduce a tax into the economy. The same condition persists in the European Union.

Among developed countries, only the United States does not apply VAT, but continues to operate a sales tax at the retail stage.

Despite the optimal solution to the cascade issue, VAT has its drawbacks, the most important of which are the high requirements for tax reporting, its administration and the possibility of corruption on the part of the tax system, since the difficult accrual mechanism creates speculative conditions.

Russian VAT

In the USSR, VAT was not introduced; the Soviet system established a fixed turnover tax in the territory of the association in 1930, which functioned until the collapse of the Union. The Russian government, not having time to unify tax legislation into a single legal act, used a differentiated system of separate laws for each fiscal payment.

VAT came into force in Russia in 1992 under Law 2813-1. A decade later, in 2002, the second part of the Tax Code of the Russian Federation, including Chapter 21 - “Value Added Tax”, gained legal force.

What is the tax system?

The taxation system refers to the procedure for collecting taxes, that is, those monetary contributions that each person receiving income gives to the state. Taxes are paid not only by entrepreneurs, but also by ordinary citizens whose income consists only of salaries. With proper planning, the tax burden of a businessman can be lower than the income tax of an employee.

Well, since we are talking about the taxation system, we need to understand its main elements. According to Art. 17 of the Tax Code of the Russian Federation, a tax is considered established only if the taxpayers and elements of taxation are determined, namely:

- object of taxation – profit, income or other characteristic, the appearance of which creates an obligation to pay tax;

- tax base – monetary expression of the object of taxation;

- tax period – a period of time at the end of which the tax base is determined and the amount of tax payable is calculated;

- tax rate – the amount of tax charges per unit of measurement of the tax base;

- tax calculation procedure;

- procedure and deadlines for tax payment.

Today in Russia you can work under the following tax regimes (taxation systems):

- OSNO – general taxation system;

- STS is a simplified taxation system in two different versions: STS Income and STS Income minus expenses;

- UTII – single tax on imputed income;

- Unified agricultural tax - unified agricultural tax;

- Patent taxation system (only for individual entrepreneur taxation).

As you can see, there is plenty to choose from.

In our service you can prepare a notification about the transition to the simplified tax system absolutely free of charge (relevant for 2019):

Create an application for the simplified tax system for free

Note: There is another rarely used taxation system - when executing production sharing agreements , which is used in the extraction of mineral resources, but we will not consider it within the scope of this article.

Let's take a look at the main elements of Russian tax regimes. Let's take into account that several different taxes are paid on OSNO: VAT, property tax of organizations or individuals, plus individual entrepreneurs on OSNO pay income tax on individuals, and organizations pay income tax.

| Element | simplified tax system | UTII | Unified agricultural tax | PSN | BASIC |

| Object of taxation | Income (for the simplified tax system Income) or income reduced by expenses (for the simplified tax system Income minus expenses | Taxpayer's imputed income | Income reduced by expenses | Potential annual income | For income tax - profit, that is, income reduced by the amount of expenses. For personal income tax - income received by an individual. For VAT – income from the sale of goods, works, services. For property tax of organizations and individuals – real estate. |

| The tax base | The monetary expression of income (for the simplified tax system Income) or the monetary expression of income reduced by expenses (for the simplified tax system Income minus expenses) | Monetary value of imputed income | Monetary value of income reduced by expenses | Monetary value of potential annual income | For income tax - the monetary expression of profit. For personal income tax – the monetary expression of income or the value of property received in kind. For VAT – revenue from the sale of goods, works, services. For corporate property tax – the average annual value of property. For personal property tax, the inventory value of the property. |

| Taxable period | Calendar year | Quarter | Calendar year | Calendar year or period for which the patent was issued | For income tax - calendar year. For personal income tax – calendar year. For VAT – quarter. For property tax of organizations and individuals - calendar year. |

| Tax rates | by region from 1% to 6% (for the simplified tax system Income) or from 5% to 15% (for the simplified tax system Income minus expenses) | 15% of imputed income | 6% of the difference between income and expenses | 6% of potential annual income | For income tax - 20% in general, and from 0% to 30% for certain categories of payers. For personal income tax – from 13% to 30%. For VAT – 0%, 10%, 20% and calculated rates in the form of 10/110 or 20/120. For corporate property tax – up to 2.2% For personal property tax – up to 2%. |

Concept and components

VAT is the most difficult tax to calculate. However, if you understand the theory of its mechanism, the calculation will be much easier to understand, although compliance with all the subtleties of the legislation will always remain one of the key difficulties of payment.

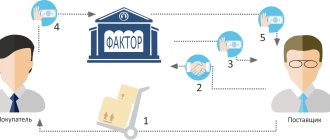

VAT, as indicated in the name, is charged on the increase in value when goods are transferred from one enterprise to another during the manufacturing and sales processes. Each link in the chain adds value to the product, including costs such as depreciation, employee wages, transportation, advertising, etc. As a result, VAT is levied on the added value of the product, since there is a constant tax offset between suppliers and buyers.

For example, I purchased materials for making wooden furniture worth 100 thousand rubles. She sold the manufactured goods for 200 thousand rubles. The proceeds are used to calculate VAT. The purchase price from is VAT deductible.

We extract 18% of the tax paid from the total cost:

100,000 * 18 / 118 = 15,250 rubles.

Output VAT - the tax that must be paid to the state treasury is equal to:

200,000 * 18 / 118 = 30,500 rubles.

After deducting the input tax, the company transfers:

30,500 - 15,250 = 15,250 rubles.

Thus, the entrepreneur has the right to reduce his tax base by the amount of VAT that was included in the cost of purchased materials. Such an offset is carried out by all links in the chain, except for the final buyer - he purchases the product with the tax included in it, this is the line “price including VAT”. In essence, VAT is levied on expenses, since it falls on direct consumers, and the organization recognized as the payer is only a tax agent - it transfers tax to the budget from consumers, ordinary citizens.

Structure

Like all Russian taxes, VAT consists of the following structural elements:

- objects;

- taxpayers;

- basis for calculation;

- rates;

- periods;

- calculation;

- deadlines and procedure for submitting reports and transferring payments to the budget.

Tax incentives are also an important component of VAT.

Who pays

Tax payers are standard individuals and legal entities:

- enterprises;

- entrepreneurs.

All VAT subjects according to the territory of activity are divided into:

- domestic payers engaged in sales within the country;

- external payers performing imports to Russia.

Those business units that have not sold goods and services of more than 2 million rubles over the next three consecutive months have the right to submit a notification to the Federal Tax Service inspection at the place of registration and receive in response an exemption from VAT payer obligations in accordance with Article 145 of the Tax Code.

The notification form was adopted by order of the Ministry of Taxes and Duties in 2002. As a result, the following categories of individual and legal entrepreneurs do not pay VAT:

- UTII payers;

- Unified Agricultural Tax payers;

- using the simplified tax system;

- using PSN;

- participating in the Skolkovo innovation project;

- not having revenue of more than 2 million rubles.

More information about payment amounts can be found in this video.

How to calculate advance payments for income tax

During the year, the accountant must calculate advance payments for income tax. There are two ways to calculate advance payments.

The first method is established for all organizations by default and provides that the reporting periods are the first quarter, half a year and nine months. Advance payments are made at the end of each reporting period. The payment amount based on the results of the first quarter is equal to the tax on profits received in the first quarter. The advance payment at the end of the half-year is equal to the tax on the profit received for the half-year, minus the advance payment for the first quarter. The amount of payment based on the results of nine months is equal to the tax on profit for nine months minus advance payments for the first quarter and half of the year.

Plus, monthly advance payments are made during each reporting period. At the end of the reporting period, the accountant withdraws the advance payment based on the results of this period (we have given the calculation rules above), and then compares it with the amount of monthly payments made within this period. If the total monthly payments are less than the final advance payment, the company must pay the difference. If there is an overpayment, the accountant will take it into account in future periods.

Monthly advance payments are calculated according to the following rules. In the first quarter, that is, January, February and March, the accountant calculates the same monthly advance payments as in October, November and December of the previous year. In the second quarter, the accountant takes tax on the profit actually received in the first quarter, and divides this figure by three. The result is the total of the monthly advance payments for April, May and June. In the third quarter, the accountant takes the tax from the actual profit for the six months, subtracts the advance payment of the first quarter, and divides the resulting figure by three. The amount of monthly advance payments for July, August and September comes out. In the fourth quarter, the accountant takes tax from the profit actually received for nine months, subtracts advance payments for six months, and divides the resulting value by three. These are advance payments for October, November and December.

The second way is based on actual profit. The company can adopt this method voluntarily. To do this, you need to notify the tax office no later than December 31 that during the next year the company will switch to calculating monthly advance payments based on the actual profit received. With this method, the reporting periods are one month, two months, three months, and so on until the end of the calendar year. The advance payment for January is equal to the tax on profits actually received in January. The advance payment for January-February is equal to the tax on profits actually received in January and February minus the advance payment for January. The advance payment for January-March is equal to the tax on profits actually received in January-March minus advance payments for January and February. And so on until December.

Companies whose sales revenue excluding VAT during the four previous quarters did not exceed an average of ten million rubles per quarter must accrue only quarterly advance payments. This rule, regardless of the amount of revenue, also applies to budgetary, non-profit and some other organizations.

Newly created organizations accrue not monthly, but quarterly advance payments until a full quarter has passed from the date of their state registration. Then the accountant must look at what the sales revenue is (excluding VAT). If it does not exceed one million rubles per month or three million rubles per quarter, the company can continue to accrue only quarterly advance payments. If the limit is exceeded, the company switches to monthly advance payments from the next month.

Types and rates

To assess VAT in Russia, percentage rates are used. Article 164 of the Code approves the following tax rates.

0%

- export of goods;

- international transportation of goods;

- transportation, reloading and transshipment of oil through pipelines;

- gas transportation through pipelines;

- supply of electricity via a unified power grid from Russia to foreign countries;

- storage and transshipment of goods at river and sea ports, the point of departure of which is foreign countries;

- a cottage for transportation of railway rolling stock;

- export of goods on river and sea types of vessels;

- sale of hydrocarbons produced in the offshore territory of Russia;

- transportation by air of goods sent to foreign territories;

- transportation of luggage and passengers to foreign countries;

- transportation of luggage and passengers to Sevastopol and the Republic of Crimea;

- sale of space goods (equipment, infrastructure);

- sale of precious stones and metals to state funds, the Bank of Russia;

- etc.

A complete and detailed list of zero rate payers is given in paragraph 1 of Article 164 of the Code.

10%

- sale of poultry and livestock, meat and meat products, dairy products and milk, eggs and egg products, vegetable oils, food fats, sugar, salt, bread and pasta, flour, grains and cereals, fish, seafood, vegetables, diabetic products, baby food;

- sale of children's goods - clothing, shoes, furniture, school supplies, etc.;

- sale of printed magazines, almanacs, bulletins and periodical newspapers, educational books;

- sale of medicinal and pharmaceutical preparations, medical devices;

- provision of services for air transportation of baggage within Russia.

18%

- all other types of sales and exports.

Exports of goods are charged at the last two rates depending on the classification of imported goods into the listed categories.

What is taxable and what is not?

The object of taxation is the basis, the reason for the emergence of tax liability.

In the case of VAT, these are four types of actions. If a person commits them, the Federal Tax Service charges him with paying tax:

- Sales (sale of goods, provision of services, performance of work, transfer of goods under compensation and novation agreements (replacement of a monetary obligation with the transfer of other property in exchange), transfer of property rights).

- Transfer of goods for one's own needs is the actual posting of goods, services or work between structural departments of an enterprise and the impossibility of reducing the income tax base by the amount of production costs of these goods.

- Construction and installation work for own needs.

- Export of goods.

Not included in VAT items:

- transfer of residential real estate and infrastructure elements to government authorities free of charge;

- transfer of property at the federal and municipal levels in the process of privatization;

- the work of government institutions, the obligation to perform which is approved by law;

- transfer of property in the form of fixed assets to public authorities on a gratuitous basis;

- sale of land and shares of land;

- transfer of property and sums of money for the formation or filling of the target capital of an NPO;

- foreign exchange transactions;

- investment contributions to the authorized capital;

- confiscation of property;

- inheritance;

- transfer of residential real estate from state and local funds to individuals;

- other actions under Articles 146 and the Code.

Taxes 2017 for dummies. A short excursion.

Much has been written and said on this topic.

That's why we offer you a short “2020 Tax Summary” to help you cover the whole picture. The state has two news for you: good and “as usual.”

The good news is that there are tax breaks.

Oil tycoons who love to change currency and sell scrap metal will be in seventh heaven:

- now they will not have to pay a 2% tax on foreign exchange transactions;

- rent rates for oil production fell by half: from 45% to 29%;

- The tax on the delivery of scrap metal has been eliminated.

As you can see, these are very useful and necessary concessions.

The news “as usual” is the essence of our entire subsequent article.

Without going into heartbreaking details, we will briefly describe the situation using current interest rates as an example:

- Excise taxes:

- The excise tax on gasoline increased by 42 €/1000 l;

- Excise taxes on fortified and sparkling wines - by 12%;

- Excise taxes on other alcohol - by 20%;

- Excise tax on tobacco products is 40%.

- Rent rate:

- for the use of radio frequencies increased (including 500 times for 4G frequencies);

- for the use of subsoil (except for mining) - by 10%;

- for special use of water - by 10%;

- for special use of forest resources - by 10%.

- Pension innovations will affect everyone under 35 years of age. Now they will contribute 2% of their salary to an individual pension account.

- The special tax regime in agriculture has been abolished by law (and not as in 2020) Subsidies from the budget will be allocated for agricultural activities, which, however, to a greater extent may not reach simple agricultural enterprises (as usual).

- Property tax. For extra square meters of real estate (more than 60 m²) in Kyiv, citizens will have to pay 1% of the minimum wage.

a little more detail on the taxation of enterprises. As you know, all enterprises can be taxed in two ways: on the general system and on the simplified one.

Here's a short diagram:

The simplified taxation system is considered more promising these days, although not everyone has the right to resort to it.

Thus, enterprises whose activities involve:

- organization and conduct of gambling;

- currency exchange;

- export, import, sale of excisable goods;

- mining, production, sale of precious metals;

- sales of minerals;

- financial intermediation;

- enterprise management activities;

- provision of postal and communication services;

- sale of art and antiques;

- organization of trades (auctions) for works of art;

- organizing and conducting tour events.

Let's look at the most interesting changes.

What's new in income tax?

Calculation

In a standard situation, the calculation uses the cost reflection of objects, for example, the cost of work or imported goods.

To calculate VAT payable, it is necessary to determine the tax from revenue, input tax, and in some cases, recovery tax.

The VAT that the tax authorities refunded to the person is subject to restoration, but circumstances have arisen that deprive him of the right to a refund; therefore, the person must return the VAT to the budget.

The final cost of goods already includes VAT - even if the business entity does not actually include its amount in the sales price, the legislator believes that the tax is included in the price. How to extract VAT from the generated cost? Multiplying the amount by 18% is not enough, since a share of the cost with the same VAT will be obtained.

For the calculation, the fraction 18/118 is used - this is how the tax included in the price is determined. This is the calculated rate that is used when:

- payment for goods from Article 164 - discounts, risk insurance, etc.;

- receiving an advance for future deliveries;

- calculation, withholding and payment of VAT by tax agents.

General formula for VAT payable:

cost of goods * 18/118

If an organization applies an input tax deduction, then:

cost of goods sold * 18/118 - cost of goods purchased * 18/118

If the price does not include VAT, then for calculation:

base * rate

Example 1

engages in the sale of book products for higher educational institutions through a retail network at a price of 100 rubles per book. 500 copies were sold during the quarter.

She has her own workshop for the production of paper for books, which are transferred to another division of the company - the printing house; during the quarter, materials worth 20 thousand rubles were transferred (excluding VAT). The object is the sale of goods and the transfer of goods for one’s own needs.

Revenue for the quarter:

100 * 500 = 50,000 rubles.

We extract VAT from the price (since it is included in the final price):

50,000 * 18 / 118 = 7627 rubles.

Cost of transmission for own consumption:

20,000 * 0.18 = 3,600 rubles.

VAT payable:

7627 + 3600 = 11,227 rubles.

Results:

- cost of sales including VAT - 50,000 rubles;

- excluding VAT - 42,373 rubles;

- transfer with VAT - 23,600 rubles;

- excluding VAT - 20,000 rubles;

- tax to the budget - 11,227 rubles.

Example 2

The company provides translation services. During the tax period, services were provided in the amount of 40,000 rubles each month excluding VAT.

Revenue for the quarter:

40,000 * 3 = 120,000 rubles excluding VAT.

VAT:

120,000 * 0.18 = 21,600 rubles.

Cost including VAT:

120,000 + 21,600 = 141,600 rubles.

How to calculate income tax

You need to determine the tax base (that is, the profit subject to tax) and multiply it by the appropriate tax rate. For profits subject to different rates, the bases are determined separately.

The tax base is calculated on an accrual basis from the beginning of the tax period, which corresponds to one calendar year. In other words, the base is determined during the period from January 1 to December 31 of the current year, then the calculation of the tax base begins from scratch.

If at the end of the year it turns out that expenses exceeded income and the company incurred losses, then the tax base is considered equal to zero. This means that the amount of income tax cannot be negative; the amount of tax must be either zero or positive.

The correctness of the calculation of the base must be confirmed by entries in the tax registers. Each enterprise develops these registers independently and consolidates them in its accounting tax policy. In practice, tax accounting registers are similar to accounting registers. Two types of accounting - tax and accounting - are needed to reflect the different rules for the formation of income and expenses that apply respectively in tax and accounting. In some cases, “tax” and “accounting” income may be the same.

Reporting

According to the latest changes in tax legislation, taxpayers report to the Federal Tax Service inspections via electronic communication channels.

In the case of VAT, businesses are required to file a return. The updated declaration form was submitted by order of the Federal Tax Service in 2014.

The new form has added sections in which you need to indicate information from the invoice journal and sales and purchase books. Such changes in the filling procedure gave tax inspectors the opportunity to verify amounts for goods and services between counterparties - buyers and sellers. This reconciliation allows you to find inconsistencies and illegal claims for deductions.

The declaration is submitted at the end of each tax period - before April 25, July 25, October 25 and January 25.

Documents for download (free)

- Value added tax declaration

- Notice of VAT exemption

- VAT invoice

Rules for filing a VAT return in the Russian Federation and Ukraine

At the end of the reporting period, each enterprise registered with the tax office submits a VAT return. For “dummies”, we note: in Russia, the reporting period is considered a quarter, and in Ukraine – a month. The quarterly reporting period is used only if the volume of taxable transactions for the last 12 months does not exceed the amount of UAH 300,000. Within twenty days following the last day of the tax period, the declaration must be submitted to the relevant authorities. Payment of contributions in Ukraine must occur within thirty days after the end of the reporting period, and in Russia - within twenty.

Filing a tax return in Ukraine can be carried out personally by the taxpayer, transmitted electronically or sent by mail as a valuable letter with mandatory notification. In Russia, as of January 1, 2014, VAT returns can only be submitted electronically via telecommunications channels. You can select an electronic document management operator on the regional websites of the Federal Tax Service. It is necessary to conclude an agreement with him, obtain crypto-protection means and an enhanced qualified electronic signature, which will be used to certify invoices and declarations.

Filling out the VAT return must be carried out in strict accordance with the form established on the date of its submission.

Tax deductions

You can reduce the VAT calculation base by the following amounts:

- VAT presented by contractors, suppliers, performers;

- VAT paid on exports for processing, temporary exports, domestic consumption;

- VAT paid on exports by members of the Customs Union.

Conditions for deduction:

- posting of goods;

- availability of an invoice.

An invoice is prepared along with other financial statements by the executor of contractual obligations. Since 2020, there have been no changes in the rules for its design and presentation.

Innovations

Since the beginning of the year, numerous changes in tax legislation, including VAT, have come into force:

- submission of explanations for errors and inconsistencies in the VAT return is carried out only in electronic form;

- for a simplified and quick VAT refund procedure, the bank guarantee period has been increased to two months;

- from July 1 of the year, users of municipal and regional subsidies are required to restore VAT;

- Internet services of foreign companies are included in the taxation.

In simple words, you can learn about VAT from this lecture.

How to register for State Services

An account on “State Services” will greatly simplify your life in general and make it easier to work with the Federal Tax Service website. Without it, you will have to go to the tax office to find out the login and password for your personal account or receive an electronic signature.

Read article →