Sick leave calculator

Using the sick leave calculator in 2020, you will be able to correctly determine the amount of sick leave benefits that must be paid to the employee who submitted the sick leave certificate.

The sick leave calculator calculates the amount of benefits depending on the reason for which the sick leave was issued: illness of the employee himself, caring for a sick family member or child, etc.

Start calculating benefits: Sick leave calculator on the FSS website

Sick leave payment

The employer undertakes to instruct the accountant to pay benefits within 10 days from the moment the employee submits sick leave for registration. Funds are transferred to the employee on the next salary payment date.

https://youtu.be/qjV8k-YP0jo

Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

- Moscow and the Region

- St. Petersburg and region

- Regions - 8 (800) 222-69-48

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

Labor law

https://youtu.be/8AQqAwc34CY

Calculation of sick leave for temporary disability

To determine the amount of this benefit, first you need to calculate the amount of the average daily earnings of the employee who submitted sick leave (Part 3 of Article 14 of the Federal Law of December 29, 2006 N 255-FZ):

Let us recall that the amount of earnings for the billing period refers to payments to the employee, from which contributions to VNiM were calculated, for the two calendar years preceding the onset of temporary disability (Part 1, Article 14 of the Federal Law of December 29, 2006 N 255-FZ). That is, the calculation period for payment of sick leave benefits in 2020 includes payments made to the employee in 2018-2019. It is important to remember the maximum amount of earnings required to calculate benefits in 2020:

- 815,000 rub. (contribution base limit - 2018);

- 865,000 rub. (contribution base limit 2019).

Also, do not forget that if the average employee’s earnings per each full month of the billing period is less than the minimum wage (Part 1.1, Article 14 of the Federal Law of December 29, 2006 N 255-FZ), then the amount of the employee’s earnings for the billing period is taken equal to 24 minimum wages.

Having determined the amount of average daily earnings, you need to calculate the amount of daily benefits, which depends on the employee’s length of service (Part 1, Article 7 of Federal Law No. 255-FZ of December 29, 2006):

Now you can proceed directly to calculating the amount of temporary disability benefits:

For what purpose and who can track the status of the BL on the fund portal?

You can check the temporary disability certificate on the Foundation’s website by logging into your personal account. To do this, you will need to know the SNILS number of the insured person or the BL number. The Fund’s web portal provides access to the personal account and operations therein to three categories of users:

- To the insured person - an employee of the enterprise.

- Insured - a person who hires workers and makes payments to Social Security: a legal entity or an entrepreneur.

- Persons who have access to medical and social expertise.

Note. Each category of users has a separate entrance to their Personal Account, which is determined by its status.

Insured persons can check information for the following purposes:

- checking the status of the BC;

- viewing benefit accrual;

- printout of the calculation certificate.

In addition, the insured has the opportunity to view all his BL and benefits for them.

An employer may need to check the status of a temporary disability certificate to ensure the validity of the document, as well as to certify the correctness of the data on payments that were transferred to the Social Insurance Fund.

Deadline for applying for sick leave benefits

The legislation establishes a deadline for employees to apply for benefits (Part 1, Article 12 of the Federal Law of December 29, 2006 N 255-FZ):

| Type of benefit | Application deadline |

| Temporary disability benefit | Six months from the date:

|

Documents for reimbursement from the budget

They are described in detail in Order of the Ministry of Health dated December 4, 2009 N 951n. This:

- a statement from which the name and address of the policyholder, his registration number, and the amount of funds needed to pay the insurance coverage will be visible;

- for compensation for benefits paid after January 1, 2020, a certificate of calculation of accrued and paid insurance premiums (instead of Form 4-FSS, which no longer contains such information), indicating all the data required by Order of the Ministry of Labor of Russia dated October 28, 2016 N 585n . Additionally, you must provide a breakdown of insurance costs;

- documents confirming the occurrence of an insured event, in our case – sick leave.

You will have to submit the papers in person, since electronic document management with the Social Insurance Fund has not yet been properly established. The FSS gateway is currently operating for sending sick leave only in those regions that are participating in the “Direct Payments” pilot project. It is possible that the number of users will increase after the introduction of electronic temporary disability certificates begins.

Refund application form

Calculation certificate form

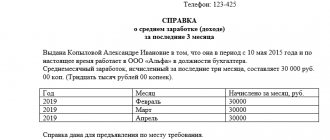

Initial data for calculating the amount of sick leave

Let's start with how the employer calculates disability benefits. To do this, he asks the employee for a properly issued sick leave.

In case of incapacity for work due to illness or injury of an employee, the first three days of illness are paid by the employer, and the subsequent days by the Social Insurance Fund. If we are talking about caring for a sick family member, quarantine, prosthetics, after-care in a sanatorium-resort organization, then all days are paid for by the Social Insurance Fund.

To calculate the amount of benefits based on a certificate of incapacity for work, you need to know certain indicators; we will dwell on each of them.

1. Insurance experience or the number of years of work of an employee (Federal Law dated December 29, 2006 No. 255-FZ).

Insurance experience is the periods of work of an employee under an employment contract, periods of military, state or other service (RF Law of February 12, 1993 No. 4468-1), as well as other activities during which the employee was insured against accidents and accidents (full list of such activities listed in the order of the Ministry of Health and Social Development dated 02/06/2007 No. 91).

Important! The employee’s length of service determines the amount of the benefit, therefore it includes only those periods that are confirmed by documents (work book or, in the absence of one, a certificate from the previous place of work, as well as an employment contract).

Whole years and months are counted in the insurance period in the following order. First, the number of complete years and months is determined. Then the remaining days are summed up, converted into months, months are converted into years. Then the total number of years is determined.

By determining the number of years of insurance experience, you can set the percentage of payment for sick leave. Here it is important to take into account the cause of the disease (see Article 7 255-FZ). If the reason is illness or injury, then the benefit amount is equal to:

60% of average daily earnings - with up to 5 years of experience;

80% of average daily earnings - with work experience from 5 to 8 years;

100% of average daily earnings - with work experience of 8 years or more.

When caring for a child or other family member, payment is not due for all days of sick leave. How many days are paid when caring for a patient, see the table.

| Who is being cared for | Paid sick days | |

| for an individual case | in a year | |

| Child under 7 years old | no restrictions | 60-90 (clause 1, clause 5, article 6 255-FZ) |

| Child from 7 years old to 15 years old | 15 | 45 |

| Child over 15 years old and other family members | 7 | 30 |

| Disabled child under 18 years old | no restrictions | 120 |

| Any child with cancer or HIV-infected | no restrictions | no restrictions |

2. The billing period or time for which the employee’s income is considered.

In Art. 14 255-FZ establishes a calculation period for establishing the amount of hospital payments - two calendar years preceding the year in which the period of incapacity begins.

If an employee falls ill immediately after employment, the pay period is calculated according to the general rules, and the payment is determined based on the average daily earnings received at the previous job. If there is no information about income from your previous place of work, the calculation is made according to the minimum wage established in 2020.

3. Earnings for the billing period or all employee income from which contributions to VNiM were calculated.

Amounts from which contributions have not been paid are excluded from the calculation. These include financial assistance up to 4,000 rubles, compensation, government benefits, etc. (for a complete list, see Article 422 of the Tax Code of the Russian Federation).

4. Average daily earnings of the employee.

In 2020, to determine sick leave payments, an employee’s average daily earnings are calculated using the formula:

average daily earnings = average earnings for the billing period / 730 days.

This formula is used to determine sick pay for all employees, including part-time/weekly workers, as well as those for whom cumulative work time records are kept (clause 16 of the Government of the Russian Federation of June 15, 2007 No. 375).

5. Benefit limitation or lower and upper payment threshold.

Limits are set for average daily earnings. Thus, the minimum benefit amount is determined by the current minimum wage - in 2019 this amount is equal to 370.85 rubles. (11280 x 24 / 730). If the employee did not work full time, then the average daily earnings are calculated in proportion to the length of working time.

When calculating the maximum benefit amount, the income limits for which insurance premiums are calculated are taken into account:

755,000 rub. in 2020;

815,000 rub. in 2020.

Hence the maximum benefit amount is 2,150.68 rubles. ((755,000 + 815,000) / 730) from one employer.

If an employee worked for several employers during the year and each employer separately calculated the amount of benefits based on maximum payments, the total amount of sick leave may exceed the limit.

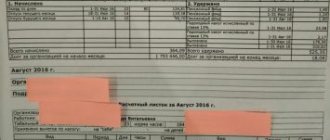

6. The total amount of payment for sick leave.

This indicator is calculated using the formula:

disability benefit = daily allowance x number of sick days,

where daily benefit = average daily earnings x percentage of benefits based on the insurance period.

In the case of caring for a sick child, the amount of the benefit also depends on whether the treatment is on an outpatient or inpatient basis.

In what cases is a certificate of temporary incapacity for work issued?

Only licensed medical institutions can issue a certificate of incapacity for work, if they have the appropriate permit for this type of activity.

However, it is issued strictly in certain cases:

- illness, injury, poisoning and other conditions leading to temporary disability;

- the need to care for a sick family member (children, elderly parents, etc.);

- for the period of holiday under the BiR;

- for the period of prosthetics in specialized institutions;

- during quarantine;

- for the period of follow-up treatment in a sanatorium (after treatment in a hospital).

A person’s desire alone is not enough to obtain a certificate of temporary incapacity for work.

An employee of a medical institution must ensure that there are circumstances justifying the need to issue it.

Rules for filling out

A certificate of incapacity for work is a document of strict accountability; both employees of the medical institution and the employer must approach its completion responsibly.

It is allowed to enter information into the sick leave manually or typewritten (on a computer).

The latter option is usually used only by medical institutions and is significantly more difficult for employers.

When filling out a sick leave form manually, you should not use a ballpoint pen.

You also cannot use colored (including blue) ink. You can only use a fountain pen, gel pen or capillary pen. The ink color must be black.

All data on the certificate of incapacity for work must be entered in the appropriate columns in capital block Russian letters.

When filling 1 letter must be placed in 1 cell. It should not go beyond the boundaries of the cell or even touch them. You should be careful and attentive when filling out the document.

Employees of a medical institution cannot correct any data on a sick leave certificate.

They need to try to avoid any mistakes. If they were admitted, then a corrected copy of the document must be issued.

The employer can correct errors, but only in the part of the form intended for him to fill out.

If errors are detected in the part that is filled with honey. the institution will have to request a corrected duplicate of the sick leave.

When making corrections, the employer must cross out the erroneous data and write the correct version on the back of the certificate of incapacity for work.

On the part of the medical institution, the sick leave must be signed by the attending physician and stamped (round or triangular).

On the employer's part, the manager and chief accountant must sign the sheet. The seal is affixed by the organization (IP) only if available.

Online calculator for calculation

To simplify the procedure for calculating benefits based on sick leave, a service has been created on the Social Insurance Fund website that allows you to do this online.

It is called the “Disability Benefit Calculator” and is available in the open part of the site or through the personal account of the recipient of social services.

Let's look at what steps you need to perform to carry out the calculation yourself using an online benefit calculator:

| Go to the official website of the FSS | and go to the menu using the link “Benefit calculator” |

| Provide basic information about sick leave | period, type of disability, treatment regimen |

| Set settlement conditions | length of service, regional coefficient, number of hours of work when combined, earnings for the last 2 years, presence of violations of the regime, minimum wage if necessary |

| Click the button | "Calculation" |

The system will automatically determine the average daily earnings and compare it with the minimum wage value indicated on the screen, take into account the rules for calculating sick leave depending on the type of disability, and make a calculation.

As a result, information will be displayed on the number of days the employee missed due to illness, pregnancy or other causes of disability, as well as the amount of benefits.

Moreover, both the total amount of the due payment and the amount of benefits from the funds of the Social Insurance Fund and the employer will be shown.

What affects the payment amount?

For every employee who was forced to go on sick leave, the amount of benefits is of great importance. After all, this is the amount that will be given to him for missed days instead of salary.

In general, the amount of benefits is influenced by 3 factors:

| Insurance experience | This is the length of time when a person worked or was engaged in other activities and contributions to the Social Insurance Fund were made for him. Determined on the basis of the work book and other supporting documents. As a general rule, an employee will receive 100% for more than 8 years of experience, 80% for 5-8 years of experience, 60% for up to 5 years of experience. For less than six months of experience, sick leave must be calculated based on the minimum wage as of the date of opening the certificate of incapacity for work. |

| Average daily earnings | It is calculated based on the amount of income for the last 2 years. In this case, the number of days per period is assumed to be 730, regardless of the actual value. It must be compared with the average daily earnings according to the minimum wage on the date of opening of sick leave. The largest of the values is taken into account |

| Duration of illness | The period of incapacity for work can be easily determined by simply carefully studying the certificate of incapacity for work. |

It is also worth noting that the following factors may affect the amount of benefits:

| Presence of regime violations | If the attending physician puts a note on the sick leave form about the patient’s violation of the established regime (leaving the hospital, late attendance for an appointment, etc.), then starting from the date of the violation, the benefit will be calculated based on the minimum wage |

| Type of disability | If sick leave was issued to care for a child undergoing outpatient treatment, then according to the general rules only the first 10 days will be paid for it. The remaining days will be paid based on 50% of average earnings, regardless of length of service |

Child care will only be paid for a limited number of days during the calendar year. Under normal conditions, this is 60 days per year.

For the remaining days, a certificate of incapacity for work will also be issued, but no one will pay for them, i.e., they will essentially come at the expense of the employee himself.

What formula is used to calculate

To calculate the amount of sick leave payments, the main thing is to correctly calculate all the initial data.

Only in this case can we talk about minimizing the likelihood of errors in calculations.

There is a special formula based on which you can easily calculate the amount of the benefit yourself:

Benefit amount = amount of income for the 2 previous calendar years: 730 x number of sick days x percentage of payment depending on length of service.

Knowing all the necessary parameters, it is easy to calculate the amount of the benefit yourself.

But in more complex cases, for example, when violating the regime or calculating sick leave for child care, it is better to check yourself using the online calculator on the FSS website.

It is constantly updated taking into account the latest changes in legislation and allows you to quickly find errors made in the calculations.

Instructions for using the online sick leave calculator

So, how to use information from the employee’s sick leave and personal card to calculate benefits using an online calculator?

Go through three stages in sequence:

- Enter the period of illness from the certificate of incapacity for work and select the cause of the illness (the code of the cause of incapacity for work is indicated on the sick leave certificate).

- Enter the employee's monthly income amounts for the two previous years and, if necessary, check the "Regional Coefficient" and/or "Part-Time" checkboxes to calculate average daily earnings.

- You will receive a table for calculating sick leave payments, taking into account the employee’s length of service and breaking down the benefit amount into two parts: the first, which is paid by the employer, and the second, which is transferred by the Social Insurance Fund.

Please note: the calculator contains hints hidden under the question marks next to the fields to be filled out. Hints contain links to articles of regulations and help to perform the calculation correctly.

Key Features

After studying the account data of the insured person, you should proceed to a description of the functionality provided by the FSS personal electronic account. It is advisable to consider the most important of them in detail.

Journal of benefits and payments

The function of viewing this type of journal opens after going to the section of the main menu of the FSS LC “Benefits and Payments”. This will allow you to display a document whose data can be grouped using a special filter according to several criteria:

- ELN number;

- date of issue of the document;

- request status, which must be selected from the drop-down list.

To obtain information about the details of calculating a specific benefit or social payment, you need to activate the context menu by clicking the left mouse button, and then follow the link to the “Benefit Calculation” tab. After this, a detailed calculation certificate is displayed on the screen.

Electronic sick leave

The functionality of the personal account of the Internet service in question allows you to obtain both generalized information about the personal health insurance issued to the user, and data on each of the sick leaves. In the first case, to display information on the computer screen, you should go to the “Certificates of Incapacity for Work” section.

To obtain detailed information on one of them or a group of electronic sick leave, you can use the filter located at the top of the table that opens, or left-click on the number of a specific electronic certificate of incapacity for work.

Rehabilitation programs

Gaining access to rehabilitation programs is carried out by launching the main menu item with the same name. The list displayed on the screen contains all the programs that are suitable for the insured person. They are located in three contributions - individual, programs for victims and conclusions of specialists from the medical commission.

Social PIN

Viewing the data of the so-called PIN or personal information navigator occurs by launching the corresponding context menu item. After this, a graph containing the following information is displayed on the screen:

- status of completed request or undeclared need;

- plans for the next event to replace technical means of rehabilitation (TSR products);

- the current date, displayed in blue;

- the expiration date of the IPRA, highlighted in red.

Spa treatment

Launching the main menu item of the same name provides access to view and study data on sanitary resort treatment. They represent a list of user requests for CCL services with a display of their status. To make it easier to search for an application of interest to the insured person, a filter is placed on the page, which includes several criteria, including: the number or status of the application, the nature of the treatment, the name of the sanatorium and the date of filing the application or treatment.

Compensation for accidents and occupational diseases

A special section of the menu is provided to provide the user with information about compensation received or available for receipt for accidents and occupational diseases. To make working in your personal account more comfortable, a filter has been developed that allows you to find the compensation you are interested in based on one or more criteria, for example, the type and category of the insured event, the type of injury or disease, the date of the incident and its status.

Birth certificates

A separate section of the FSS personal account is allocated to generic certificates registered in the system and issued to the user. After going to the corresponding menu item, a table opens with a list of all similar documents issued for the recipient of insurance services. They are sorted by any column name.

Requests to the Social Security Fund

The procedure for submitting an official request to the FSS is launched in two ways. The first involves activating the “+Create” menu section and going to the “Submit a request to the Fund” subsection, and the second opens the necessary form by selecting the “Requests to the Fund” item from the username context menu, which is located in the upper right corner of the main page of the Personal Account.

In the latter case, a table opens with already created and sent requests, also containing their status. To submit a new request, the corresponding service “+ New request” located at the top left is activated.

You can pay sick leave to an employee only

if he presented a certificate of incapacity for work. Such a sheet is issued by a medical organization (part 5 of article 13 of the Law of December 29, 2006 No. 255-FZ and clause 1 of the Procedure approved by order of the Ministry of Health and Social Development of Russia of June 29, 2011 No. 624n).

It is important that the sick leave form is filled out correctly initially. Firstly, it must be written out on a valid form - the form was approved by order of the Ministry of Health and Social Development of Russia dated April 26, 2011 No. 347n. And secondly, the data on the certificate of incapacity for work must be reflected in accordance with the established requirements. If you pay benefits based on an incorrectly completed ballot, the Russian Federal Social Insurance Fund may not compensate for such expenses.

Along with the usual paper sick leave certificates, electronic ones operate - all clinics that have an electronic signature can issue them.

The payment procedure is established by parts 1–2 of Article 9 of the Law of December 29, 2006 No. 255-FZ. For all periods of release from work with or without salary, do not pay sick leave benefits to employees. For example, for the day of his participation in a court hearing as a juror, as well as for days falling on leave at his own expense or parental leave.

Pay for sick leave received during annual leave only if it was issued due to illness (injury) of the employee himself.

Sick leave benefits are also not paid for the period when the employee:

- was suspended from work without payment of salary (the reasons for such suspension are specified in Article 76 of the Labor Code of the Russian Federation);

- was taken into custody (administrative arrest);

- underwent a forensic medical examination;

- was on downtime (the exception is the case when the illness occurred before the downtime period and continued during the downtime period);

- intentionally caused harm to his health or attempted suicide;

- lost his ability to work as a result of a crime he intentionally committed.

What is a sick leave certificate?

If an employee violates the regime prescribed by the attending physician, then from the date of violation, the benefit is calculated from the minimum wage (clause 1, part 2, article 8 of Law No. 255-FZ). The doctor will indicate the date of the violation on the sick note (clause 58 of the Procedure, approved by order of the Ministry of Health and Social Development dated June 29, 2011 No. 624n). If an employee falls ill due to alcohol, drug or toxic intoxication, then the benefit for the entire period of illness is calculated from the minimum wage (clause 2, part 2, article 8 of Law No. 255-FZ).

The employee was sick from December 25, 2020 to January 11, 2020. On December 29, he violated the regime. The doctor made a note about this on the certificate of incapacity for work. The employee's work experience is 9 years. Earnings for 2017 and 2020 - 580,000 rubles.

The benefit for the period from December 25 to December 28 must be calculated based on 100% of average earnings. It will be 3,178.08 rubles. (RUB 580,000: 730 days × 4 days).

For the period from December 29 to December 31, benefits must be calculated based on the 2020 minimum wage - 11,163 rubles. It will be 1,101.01 rubles. (RUB 11,163 × 24 months: 730 days x 3 days).

For the period from January 1 to January 11, the benefit must be calculated from the new minimum wage - 11,280 rubles. The payment will be 4,079.34 rubles. (RUB 11,280 × 24 months: 730 days × 11 days).

The total amount of the benefit is 8,358.43 rubles. (3,178.08 1,101.01 4,079.34).

There is no concept of a maximum (maximum) amount of daily or monthly benefits in the current legislation. “Why not”? – another accountant will be surprised. “Yes, yes.”