Millions of people work in various conditions, putting their health at risk. Various situations occur at work that lead to work-related injuries.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 110-43-85 (Moscow)

+7 (812) 317-60-09 (Saint Petersburg)

8 (800) 222-69-48 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Here we describe what victims, employers, and human resources departments should do in the event of an injury.

Normative base

According to Art. 5 Federal Law No. 255-F3 dated December 29, 2006 the injured employee is eligible to receive disability benefits.

Federal Law of December 29, 2006 N 255-FZ

According to Article 184 of the Labor Code of the Russian Federation, he is compensated for treatment costs and monthly earnings.

In addition, Art. 8 and Article 9 of Federal Law No. 125-FZ of October 22, 2004 oblige the Social Insurance Fund to pay temporary disability benefits to victims in the full amount of their monthly earnings.

According to Article 229 of the Labor Code of the Russian Federation, the circumstances of the injury are investigated by a commission created by the director of the enterprise. Damage to health, and as a consequence, loss of ability to perform work functions (professional fitness), is determined during a medical and social examination.

What determines the amount of payments?

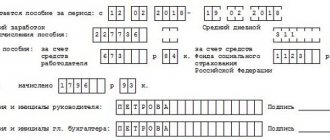

Article 7 255-FZ tells in detail how sick leave is calculated for a domestic injury and what amount of benefits the victim will ultimately receive.

We invite you to familiarize yourself with them. Are you not getting paid? We complain to the prosecutor's office about the employer!

The amount of benefits for a domestic injury mainly depends on the number of years of insurance coverage of the injured person:

- an employee who recently got a job, but has worked for less than six months recently, cannot expect to be paid more than the minimum wage prevailing in his region on the date of injury;

- a person who has worked for more than 6 months, but less than 5 years, will be paid only 60% of the average earnings for the previous two years;

- those who have worked for more than 5 years, but less than 8, will receive 80% of the average salary;

- 100% will be received by persons officially employed for more than 8 years.

Unfortunately, length of service will not matter if the former employee suffered a domestic injury after being fired. No matter how long he works throughout his life, the benefit amount will be only 60% of the average salary. But if he was injured while still employed, and provided a document about this 6 months later, then the payment will be calculated in full, the amount will depend on the length of service and the amount of income.

In addition to length of service, the final amount of benefits may also be affected by the circumstances that arise during a domestic injury, and the presence of notes about violation of the regime or state of intoxication while on sick leave. Article 8 255-FZ tells how sick leave is paid for a domestic injury, which has special doctor’s notes on the front side of the disability document.

So, if an employee, while in a hospital or on outpatient treatment, neglected the regime or did not show up for an appointment prescribed by the attending doctor, then the employer is obliged to significantly reduce the amount of benefits to the amount of the minimum wage from the date the violation began. But if the cause of a domestic injury was intoxication, no matter what type, then the payment will not exceed the minimum wage from the first day.

The presence of special doctor’s notes on sick leave will force the employer to demand from the victim a written explanation of his behavior, to assess the degree of validity of the reasons and events that led to the violation of the regime. It is safer to record a decision to reduce the amount of benefits in an order, having familiarized the employee with its contents.

The employer's right to a reduction arises already when the certificate of incapacity for work is marked with the code of a domestic injury (02), and in the period about the facts of violation of the regime, code 24 is indicated or in the “Other” field there is 34. If there is a conclusion that the employee was injured in a state of alcoholic or toxic intoxication (domestic injury code - 021), then you need to prove a direct connection between these events.

A situation may arise where the injury was not the result of drunkenness, it was simply an accompanying circumstance. Alternatively, the person received a traumatic brain injury from a heavy object falling on his head from the roof of a building, past which he was returning home, being slightly drunk. Since the illness would have occurred regardless of the fact of drinking alcohol, the benefit must be accrued in full.

The calculation of the reduced benefit is made in proportion to the number of days of sick leave, based on the fact that the minimum wage is calculated for the entire month. This means that the accrued amount for each full month of illness, from the first to the last day, will be equal to the minimum wage plus the regional coefficient. If the injury was not severe and the employee was ill for only a few days, then the minimum wage on the day the injury occurred at home must be multiplied by 24 months and divided by 730/731 calendar days, and then multiplied by the number of calendar days of illness or period of violation.

Legislation in the field of social insurance quite reliably protects workers who have suffered a domestic injury or general illness, and there are not many reasons for refusing to receive insurance payments, Article 9 255-FZ:

- If the injury occurred while on free leave, maternity leave, child care leave or suspension from work due to the fault of the employee. Only days of incapacity for work that occur during annual leave are subject to payment, but only if the illness struck the employee personally, and not minor members of his family.

- Illness during arrest, detention or forensic examination.

- A domestic injury during a period of downtime, when employees are paid 2/3 of their salary, will also not be paid as temporary disability. But, if an injury incident occurred even the day before the start of downtime, then the benefit will be assigned on a general basis.

- They will refuse to accrue if it is proven that the injury occurred as a result of self-harm or the commission of a deliberate criminal offense.

- Sick leave provided later than 6 months from the date of its closure, as well as if the former employee’s certificate of incapacity for work was opened 31 days or more after the date of dismissal, will not be accepted for payment. Even if an employee was late in providing sick leave and payment for it will no longer be received, it is still worth giving it to the employer. Indeed, according to paragraph 5 of Order 624n, such a document will help prove that the employee did not miss work, but was released from work for medical reasons.

Whatever the reason for the refusal to provide benefits, it is worth formalizing it with an order. It is better to put the documents on the basis of which such a decision was made under it. These may be certificates or expert opinions, answers from medical institutions, copies of other orders to send an employee on leave or downtime, protocols of investigative authorities, explanatory notes from the injured person himself, and testimony of witnesses.

| Links to sources | Explanation |

| Source | Federal Law “On compulsory social insurance against accidents at work and occupational diseases” dated July 24, 1998 N 125-FZ |

| Source | Federal Law “On compulsory social insurance in case of temporary disability and in connection with maternity” dated December 29, 2006 N 255-FZ |

| Source | Labor Code of the Russian Federation" dated December 30, 2001 N 197-FZ |

| Source | Decree of the Government of the Russian Federation dated June 15, 2007 N 375 (as amended on December 10, 2016) “On approval of the Regulations on the specifics of the procedure for calculating benefits for temporary disability, pregnancy and childbirth, monthly child care benefits for citizens subject to compulsory social insurance in case of temporary disability and in connection with maternity" |

| Source | Order of the Ministry of Labor of Russia dated April 30, 2013 N 182n (as amended on January 9, 2017) “On approval of the form and procedure for issuing a certificate of the amount of wages, other payments and remunerations for two calendar years...” |

| Source | Order of the Ministry of Health and Social Development of Russia dated June 29, 2011 N 624n (as amended on July 2, 2014) “On approval of the Procedure for issuing certificates of incapacity for work” |

Zinovieva Natalya Igorevna

Lawyer at the Legal Defense Board. Specializes in handling cases related to labor disputes. Defense in court, preparation of claims and other regulatory documents to regulatory authorities.

Still have questions on the topic Ask a lawyer

Definition of concepts

Let us dwell on two key concepts for our consideration. These are the concepts of industrial injury, sick leave or certificate of incapacity for work.

An industrial injury is understood as causing damage to an employee as a result of an accident that occurred at work and caused the following consequences:

- the need to transfer to another workplace;

- permanent or temporary loss of ability to work;

- death of an employee.

Ability to work is understood as a state of health that allows one to perform certain functions.

A sick leave certificate is a document confirming temporary incapacity for work and giving the right to receive benefits due to a person in cases of work-related injuries.

What injuries received at work are not considered work-related?

The difficulty lies in the fact that even with seemingly obvious factors, the commission does not always agree to connect the injury received by the employee with the specifics of his work. Thus, an injury sustained by:

- not in the workplace;

- during the working day, but at a time when the person was engaged in matters not related to work or orders from superiors;

- while going to work (no matter on foot or by car, unless otherwise stated in the employment contract);

- in other cases not specified by the laws of the Russian Federation and internal regulations.

There are many examples of such cases:

- a man was traveling to work in a minibus, but tripped and sprained his leg;

- an accounting employee took the reports to the Pension Fund, then immediately went home and broke his arm;

- during lunch break, a man went to the store and there he cut himself with a piece of a broken display case;

- bruises received in a fight during a corporate party (even if the evening was on the territory of the organization).

Injuries received outside of work are not considered work-related

However, if, for example, the employment contract stipulates compensation for lunches at a certain catering outlet and an employee who came there, for example, slipped with an overfilled tray and broke his ankle, such an injury will be considered an industrial injury.

Important! Never and under no circumstances are work-related injuries that an employee received while drunk, participating in a crime, or planning to commit suicide, recognized as industrial injuries. It does not matter where and at what time they occurred.

Also, an industrial injury should be distinguished from an occupational disease, that is, long-term, persistent damage to health received under the influence of factors related to the profession.

Possible cases

There are two types of work injuries:

- injuries due to accidents;

- occupational diseases.

Accidents include situations in which the insured person was injured at work - it is expressed in injury, disability or death of the employee.

Not only situations that arise at the organization’s location during working hours are taken into account. Industrial injuries are considered to be injuries sustained between shifts, on the way to and from work, if employees travel on the organization’s transport.

Diseases appear if a person has been under the negative influence of various factors of work activity on his health for a sufficiently long time.

Various work features and circumstances can cause certain diseases that become acute or chronic.

How and when is sick leave with code 02 (domestic injury) paid?

Note! The law regulates the period within which an employee must submit his sick leave to the employer for payment. This period is 6 months and is counted from the moment of restoration of working capacity (Part 1, Article 12 of Law No. 255-FZ).

If the specified deadline was missed, then the possibility of paying benefits is considered by the territorial body of the Social Insurance Fund, but if there are good reasons for missing the deadline (Part 3 of Article 12 of the said law). The list of such reasons is regulated by Order of the Ministry of Social Health Development dated January 31, 2007 No. 74. These include:

- the influence of force majeure circumstances;

- long-term disability of the employee (more than 6 months);

- moving;

- forced absenteeism due to termination of an employment contract or removal from work without legal grounds;

- illness or death of a close relative;

- other reasons recognized as such by the court.

Payment of benefits is made on the nearest date of payment of salaries in the organization (Part 1, Article 13 of Law No. 255-FZ).

So, we have figured out how sick leave is paid for an injury at home, and then we move on to the question of how an industrial injury is paid for on sick leave.

Actions of the victim

The behavior of the victim depends on the degree of damage received. In case of death, he will not be able to do anything. In addition, in addition to him, many actions are required to be performed by other people, especially management.

The sequence of actions is approximately this:

- Call a doctor or health worker. He records the fact of injury. If it is not recorded, then any payments are illegal.

- Contact with the management of the enterprise or structural unit, since the recording must take place in his presence.

- An act is drawn up, signed by the employer and witnesses.

- An investigation into the situation begins.

- A commission of 3 people is created. It may include representatives of the employer, trade union and those responsible for labor protection.

Extent and assessment of damage

Damage and treatment costs depend on the severity of the injury.

There are three types of injuries:

- Minor injuries. These include abrasions, scratches, and bruises. They do not pose a serious threat to health, but treatment is required without serious medical procedures, for example, a hospital.

- Moderate injuries. In this case, the body is harmed and cannot be treated without medical intervention. Usually they are treated in a hospital and given sick leave for a period of 10 days to 1 month.

- Severe injuries. They pose a threat to the life of the victim. In this case, medical assistance is required and an ambulance is often called. They are released from work for no less than a month.

The size of the lump sum payment directly depends on the severity of the injury and the number of days during which the person must recover.

It is necessary to pay the basic income in full. The amount of additional compensation depends on the certificates and various receipts provided to the employer, which indicate the cost of purchased medications, travel, rehabilitation measures, etc.

Find out from our article how to indicate sick leave on a time sheet. You can find out about extending sick leave for pregnancy and childbirth here.

Rules for applying for sick leave in case of injury at work

In order to receive the required sick leave benefit from the employer, the employee (or his relative, in the case of the patient’s serious condition) must complete a number of mandatory steps:

- After receiving a closed certificate of incapacity for work from the doctor, send it to the head of the organization, attaching a corresponding application with a request to pay for all days of illness;

- If the injured citizen is entitled to a one-time payment and additional compensation in the amount of monthly earnings, then they can also be requested in a corresponding application issued to the head of the organization;

- Within 10 days after receiving the documentation, the employer is obliged to review and check the sick leave certificate for authenticity, and then send the necessary package of documents to the Social Insurance Fund with a request to reimburse the amount of financial compensation that should be transferred to the employee who received an industrial injury;

- In the event that the period of treatment and subsequent restoration of health required a lot of expenses for expensive medications, the employee (or his representative who has an official power of attorney) can also submit an application and a corresponding supporting package of documentation to his employer with a request for reimbursement of all expenses. The decision to transfer the requested amount is made within 10 days from the receipt of the papers, financial payment is provided within 20 days.

How is sick leave paid for a work injury in 2020?

Since compensation of costs largely lies with the employer, he needs to know how sick leave is paid for a work-related injury.

Terms and Conditions

To receive the required compensation, the employee must bring a sick leave certificate and papers that prove his expenses for treatment.

To receive disability benefits, you do not need to write an application.

But in order to reimburse the costs of medicines, you must write it to the employer with a request for payment. In this case, you must attach all documents and receipts.

If the employer refuses or the payments are incomplete, you must go to the labor inspectorate and file a complaint about the illegality of the actions.

The inspectorate will conduct an inspection. An inspection does not deprive the victim of the right to self-defense. He has the right to sue the employer for compensation of expenses.

Who pays

The Social Insurance Fund provides a guarantee of full payment of average annual earnings for the entire period of treatment.

In addition to compensation for incapacity for work on sick leave, other payments are possible:

- compensation for medical rehabilitation costs;

- monthly benefit due to disability;

- Death benefit is a one-time payment.

Sick leave payments are made by the employer, and benefits are calculated by the Social Insurance Fund.

What cases are not subject to payment?

Cases that are not considered to be a work injury are not eligible for payment.

For example, the terms of an employment contract or internal regulations stipulate that an employee must have lunch at such and such a time. But, the injury occurred while he was having lunch at a different time - this will not be considered a work-related injury.

An injury will not be paid if it occurred outside of working hours and while not performing duties.

It is also worthwhile to dwell on the issues of payment for injuries received as a result of various situations on the way to work.

The injury will be considered as work-related if the person was traveling on the employer’s transport or on personal transport, which, according to the employment contract, is used for business purposes.

Work-related injuries sustained on the road include:

- injuries;

- heatstroke or frostbite;

- damage from insect bites or various animals;

- various injuries listed in paragraph 3 of Article 227 of the Labor Code of the Russian Federation.

Thus, any injuries that occur during non-working hours or that are unrelated to the performance of work functions will not be subject to payment.

Codes

An industrial injury is indicated by code 04, and an occupational disease by code 07. However, when accruing, calculating and paying, one must rely on the provisions of the mentioned Federal Law No. 255.

Maximum and minimum payout amounts

The Social Insurance Fund sets the maximum value for one-time compensation for injuries at work and monthly payments. The latter are provided to the employee until complete recovery.

Currently, the maximum one-time payment is 94,018 rubles. Accordingly, you cannot receive monthly payments in amounts greater than 72,290 rubles.

The minimum payment is equal to one minimum wage. This amount is prescribed not only for low-paid wages, but also in the event of an injury sustained by an employee who did not control his actions due to alcohol intoxication.

Calculation

The amount of disability payments is made by multiplying the amount of average daily earnings for the last two years by the number of days on sick leave.

The amount of additional payments is added to the resulting value.

Taxation

The amount of compensation received for a work injury is subject to personal income tax (NDFL).

The rate of this tax is 13%. The employer is required to remit this tax.

Examples

Let's calculate the total monthly payment amount and the amount received in hand minus tax.

Let's say Sergey Pavlovich Ivanenko worked as an engineer at a plant, receiving 25,000 rubles per month in 2020 and 22,000 rubles per month in 2015. While he was near a facility under construction, a load fell from a crane. The fragments hit the engineer. Due to severe injuries, he was forced to remain on sick leave for 60 days. That is, the annual income in 2020 was 300,000 rubles, and in 2015 it was 264,000 rubles.

Let's calculate the average salary per day:

SRZPD= (300000+264000)/730= 564000/730= 772 rubles.

The maximum amount of payments per day according to the FSS standards in 2016 was 2,576 rubles. Therefore, the maximum value does not need to be taken into account.

Let's calculate the amount of payments (SV):

SV-=SRZPD X PB, where PB is the sick leave period.

CB= 772 * 60= 23160 rubles.

To calculate the amount received minus tax, we determine the amount of personal income tax:

Personal income tax = 23160 * 0.13 = 3011.

Now let’s find out the amount of net payments, excluding taxes:

SCHV=SV-NDFL=23160-3011=20149.

Periods of incapacity for work

The length of time a person is unable to work depends on the severity of the injury, determined in each specific case, the actions of doctors and the person’s condition.

The Letter of the Federal Social Insurance Fund of the Russian Federation dated September 1, 2000 N 02-1810-5766 indicates approximate (approximate) periods of temporary disability for the most common diseases and injuries.

So, for minor injuries and bruises, say, a wound to the nose, the employee will be sent on sick leave for 7 to 10 days. But, in case of life-threatening conditions, the timing will be completely different. In particular, for a fracture of the femur you will have to be treated for 195 to 210 days.

How to properly register a personnel officer?

To avoid possible sanctions, in the event of an accident you must act as follows:

- one day from the date of the incident, report it to the FSS unit at the place of registration of the policyholder;

- in the event of a serious accident, an incident involving a group of people or a fatality, you must notify the labor safety inspectorate, the local prosecutor's office, the executive authority at the place of registration of the enterprise, as well as the trade union;

- in case of dangerous poisoning, report to the organization responsible for sanitary and epidemiological safety of the population;

- create a commission of at least 3 people that will investigate the incident: for minor injuries it will be considered for up to 3 days, for severe injuries the investigation lasts up to 15 days, all expenses are borne by the employer;

- during the investigation, the results of the inspection are recorded in Form 7, eyewitnesses and the victim are interviewed, and information is written out from the labor safety instruction logs;

- form an act of form N-1: it indicates the reasons, circumstances and labor protection violators;

- the last document is transferred to the FSS within 3 days from the date of completion of the investigation;

- the accident is recorded in a special journal.

Duration of sick leave

Order No. 624n of the Ministry of Health and Social Development of 2011 prescribes the procedure for issuing sick leave by a doctor in the event of a work-related injury sustained by an employee. This is the subject of Chapter II. Basically, sick leave for a work injury is issued for a period of no more than 15 days. It is issued only if the patient has symptoms indicating temporary loss of disability. Otherwise, the issuance of a medical document will be refused.

If, after being injured at work, an employee can independently get to the hospital, then a sick leave certificate is accordingly opened in the clinic, in the doctor’s office.

There are cases when transporting an injured person without the supervision of medical personnel is impossible or is fraught with negative consequences for the person’s health, then the doctor arrives when called to the scene of the incident and issues a sick leave.

A paramedic, unlike a doctor, can only issue sick leave for up to 10 days. If on the last day the patient’s ability to work is not restored, then the sick leave is extended. Extension is possible only by decision of the medical commission, i.e. The attending physician does not have the right to make such a decision on his own. In case of a work-related injury, the maximum period of sick leave is 12 months.

This period of one year is applicable only in extremely severe cases, when we are talking about operations, complications, serious diagnoses, when restoration of health and performance is delayed for such a long time. The general maximum period of sick leave is 10 months.

When extended, the patient must be examined at least once every 15 days: either he independently arrives at the hospital for outpatient treatment, or the doctor observes him at home when the patient’s motor activity is reduced.

As a general rule, a certificate of temporary incapacity for work is issued on the day of seeking medical help. There cannot be any correspondence examinations by a doctor. But, any rule may have exceptions, for example, if an employee was at work when injured, then sick leave can be opened the next day so that the employee’s time sheet shows a working day. This is also important when investigating an industrial accident, since one of the evidence of a person’s injury is a report card.

Days of travel to a medical facility are also added to the time of incapacity for work if it takes a long time to travel from a rural settlement to a regional center.

The sick leave certificate contains encrypted information; the reason for issuing the medical document is veiled in the code. “02” - code for an injury sustained outside of work, written on the sick leave. “04” is a code for an accident that occurred at work in 2020. When an accounting employee receives a certificate of incapacity for work with code “04,” the payment is made at the expense of the insurance company’s funds.

How can an employer hush up the matter?

An accident at work does not bode well for an employer. If violations of the rules governing labor protection are detected, different penalties are possible depending on the potential or actual consequences and their severity.

Monetary penalties are usually applied. But under the circumstances specified in the Criminal Code of the Russian Federation, the perpetrators are subject to criminal punishment.

Therefore, employers can take different steps to resolve the situation using not entirely legal methods:

- employee bribery or pressure;

- bribing or influencing witnesses;

- refusal to record an accident;

- various violations in the investigation of the incident;

- bribe to inspectorate employees.

The employer is punished even if the employee is to blame for the incident.

Therefore, in addition to the above, he can try the following:

- ask or force to sign documents on receipt of personal protective equipment;

- offer to quickly sign documents - for example, a letter of resignation, vacation, etc., time off;

- ask to receive medical care in an institution dependent on him.

All this reduces the chances of receiving sufficient insurance payments.

You will find a sample for correcting errors on a sick leave certificate by an employer in our article. Is sick leave paid during administrative leave? Information on the issue is here.

How many days of sick leave are paid 100 percent? Find out here.

Required documents

The list of original documents, without which payment of sick leave to an injured person, issued on a permanent basis with one insurer, will not occur, is small:

- Original sick leave certificate.

- Application for changing the billing period, if necessary.

Additional documents will be required if the sick employee combines several jobs:

- The original certificate of incapacity for work, issued specifically for each current policyholder, if the employee has chosen the payment system at all places of current employment.

- A copy of the sick leave, if the employee does not apply for part-time benefits, but is still obliged to confirm the validity of the reasons for his absence.

- Certificates from other places of employment about wages for the previous 2 years, if a decision has been made to receive benefits from the main employer.

If an employee who has already resigned received a domestic injury, and the date of the accident fell within 30 days, then along with the original sick leave from the previous place of work, you must also provide a work book; the absence of records in it about hiring a new job will confirm the sick person’s right to receive benefits.

Actions of the employee if the employer refuses

If the employer refuses to properly classify the accident or other violations, the employee has the legal right to appeal to the state labor inspectorate.

You need to write an application and attach documents related to the subject of the application:

- conclusions of medical commissions;

- sick leave;

- information about the incident and its consequences;

- photographs or video of the accident scene;

- witness statements;

- other evidence.

As already mentioned, in addition to contacting the labor inspectorate, an employee can go to court to protect his rights.

Drawing up an accident report

Another document required to be submitted to the accounting department with a sick leave certificate is an accident report. It is drawn up by a special commission created at the enterprise. If two or more people were injured, or a fatal accident occurred, the commission includes a labor inspector and a representative of the local government. After investigating the incident, a report is drawn up on form N-1. The document describes in detail the scene of the incident, the circumstances of the incident, and draws up a conclusion about its causes. The act determines the degree of guilt of both the employee and the employer. The legislation establishes specific deadlines for carrying out such work. The investigation must be completed within:

- 3-5 days – in cases of minor and moderate injuries;

- 10-15 days – for severe injuries.

Sometimes an employer tries to hide the fact that an employee has suffered a work injury in order to avoid liability for violating safety regulations. If an employee meets his manager halfway, he must understand that the consequences of the injury may return years later, and he will lose the opportunity to receive payments and compensation for the injury. .

Documents required to receive payment

When receiving a domestic injury, a sick leave certificate is issued by the attending physician at the place of registration of the person; no special documents are required.

https://youtu.be/U6gd_mbWzvI

To receive benefits, it is enough to submit a certificate from a medical organization, which must be stamped.

To receive benefits, you must submit a document within six months after the employee returns to work after treatment and rehabilitation.

To receive benefits in the event of a domestic injury, you must submit a number of documents:

- form form 4-FSS of the Russian Federation;

- application completed by the employer;

- a receipt that confirms the payment of the single social tax during the employee’s incapacity for work;

- copies of documents confirming the right to receive payments: certificates, sick leave. Copies of documents must be certified by a notary.

To receive sick leave benefits due to a domestic injury, the following documents are required:

- statement from the employer;

- a special statement form according to Form 4-FSS of the Russian Federation;

- a receipt confirming payment of the unified social tax during the period of officially confirmed incapacity for work of the employee;

- notarized copies of documents confirming the need for payments from the Social Insurance Fund: medical sheets, certificates.

To assign sick leave payments in connection with a work injury, the following documents will be required:

- certificate of incapacity for work indicating its cause - industrial injury (code 4);

- act N-1, information from which contains a sick leave certificate.

If you have questions, write in the comments

How is it paid?

Currently, sick leave is payable when an injury occurs, including if the person was drunk. In this case, calculations will be made on the basis of the minimum wage, length of service is not taken into account.

Attention! Payment for sick leave depends on the reasons for which the injury was received, as well as the degree of its severity. If an injured worker misses at least one day of work, he is issued sick leave.

The document can be issued for a different period, for which the Social Insurance Fund of the Russian Federation and the employer will have to make payment. It should be noted that payment is not made if the injury results in disability.

Thus, the employee is only responsible for obtaining sick leave and providing it to the employer.

The FSS explains: Did the injury turn out to be work-related? Sick leave must be completed

24.08.2015 10:33:00

What kind of injury is considered work-related? What to do if sick leave for a work-related injury is issued as a domestic injury? Consulting: Vasily Aleksandrovich Zarubin, Deputy Head of the Insurance Cases Examination Department of the Professional Risk Insurance Department of the Federal Insurance Service of the Russian Federation.

What kind of injury is considered work-related? What to do if sick leave for a work-related injury is issued as a domestic injury? A representative of the FSS talks about this.

Consulting: Vasily Aleksandrovich ZARUBIN , Deputy Head of the Insurance Cases Examination Department of the Professional Risk Insurance Department of the Federal Insurance Service of the Russian Federation.

– Vasily Aleksandrovich, can an industrial injury received by an employee on the employer’s premises at the end of the working day as a result of an accident between employees’ cars when leaving the parking lot be recognized?

- No. Injuries received by employees at the end of the working day can be classified as production-related only if the employees received them while performing work related to their job duties, or while acting in the interests of the employer (Article 3 of Law No. 125-FZ of July 24, 1998). Actions of employees that do not directly arise from their job duties are considered to be committed in the interests of the employer if they are associated, for example, with the protection of the employer’s property interests. And in the above situation, the actions of the workers were related to their personal interests.

– Can an injury sustained by an employee due to a fall on a checkpoint (slippery floor) a few minutes before the start of the working day be considered an accident at work, if the territory of the checkpoint is not the territory of the employer?

I think that the circumstances of the accident, unfortunately, do not allow it to be classified as production-related. After all, the employee was not on the employer’s premises, did not have time to begin performing his job duties and did not perform any actions before starting work established by the internal labor regulations of the organization (for example, he did not prepare his workplace).

– Is it possible to re-issue a certificate of incapacity for work, in which the cause of incapacity is indicated as a domestic injury according to the employee, if in fact an accident occurred during working hours while performing work duties?

If the injury occurred at work, the employer must arrange for the employee to be transported to a medical facility (Article 228 of the Labor Code of the Russian Federation). However, there are often situations when the victim seeks medical help on his own. In such cases, the doctor who recognized the insured as temporarily disabled establishes the cause of the incapacity, as a rule, from his words. If the cause of temporary disability has changed and the employer has conducted an investigation of the accident, drawn up and approved an act based on its results in Form N-1, the sick leave must be additionally issued. To do this, the doctor must enter a new code 04 in the “change code” cell. The employer must contact the medical institution with a copy of the act in form N-1 confirming the change in the cause of disability. After all, he is obliged to calculate the benefit correctly, and the reason for the disability may affect the amount of the benefit.

– An employee was injured at work after working hours. Can it be considered an industrial accident? Will it matter if the employee stayed late at work to complete the employer's assignment if the employer did not involve him in overtime work?

– An employee is involved in overtime work with his written consent at the initiative of the employer (Article 99 of the Labor Code of the Russian Federation). Although there are exceptions, for example, if it is necessary to prevent a disaster, an employee can be involved in work without his consent. However, there are quite frequent cases when the employer does not involve the employee in overtime work, but the employee needs to complete some of the employer’s tasks outside of his working hours, since he does not have time to complete the work during working hours.

In my opinion, in this case, the most important circumstance for qualifying an accident is the very fact that the employee performed his job duties. If an employee performed his work duties after working hours due to production needs and was injured in the process, such an accident may be classified as production-related.

– How can an employer determine the degree of guilt of an employee in an accident at work and how does this affect the payment of sick leave?

– The employer must create a commission that will investigate the accident and determine the degree of guilt of the employee in the incident (Article 229.2 of the Labor Code of the Russian Federation).

How does the payment work?

Rules and features

When calculating payments, all income received by the employee for 1 year that is related to the performance of his job duties is taken as a basis; this is not only the rate or salary, but also bonuses, replacement payments, only sick leave and vacation pay are not taken into account. It turns out that the calculated amount is equal to payments received for the actual number of days worked.

The calculation formula uses the sum of a person’s average earnings, excluding his absenteeism, compensatory leave and sick leave, which is divided by the number of days remaining after that. This average daily earnings is multiplied by the number of sick days due to the injury.

- If the situation occurred due to negligence, economy or another reason related to the employer, then compensation for losses to the victim will fall 100% on his shoulders. In addition, he will have to pay the costs of medicines, doctor’s services and rehabilitation of the employee.

- It happens that the employee himself is to blame for what happened, then receiving payments will remain in question.

How to apply for sick leave for a work injury

Actions of the parties

If an employee is injured, he must be immediately taken to the hospital (by the employer or by calling an ambulance), where, after an initial examination, a certificate must be drawn up about the nature of the injury received by the employee, its severity, etc.

The direct employer, after performing all urgent actions provided for in Article 228 of the Labor Code of the Russian Federation to eliminate dangerous consequences due to an accident (calling the Ministry of Emergency Situations, eliminating the consequences on their own, if possible, preventing further development of the situation, etc.) is obliged to perform the following actions:

- notify the authorized body of the Social Insurance Fund about the accident that has occurred

- appoint a commission to investigate the accident

- assist in the work of the commission

In the course of its activities, the commission determines whether the injury was caused by work, the degree of culpability of the parties, and the amount of payments to the victim. Among other things, the commission determines how sick leave will be paid for a work-related injury.

Features of calculating benefits in connection with an accident at work or occupational disease

Now let's look at what features an accountant needs to take into account when calculating temporary disability benefits in connection with an industrial accident or occupational disease.

Appointment and payment

The assignment and payment of benefits for temporary disability in the event of an industrial injury or occupational disease are made in the same manner as for the payment of benefits in cases not related to an occupational injury (disease) (Clause 1, Article 15 of Law No. 125-FZ and Part 2 Article 1, Article 12, 13, 15 of Law No. 255-FZ).

There is no limit on the amount of earnings

As in the case of calculating a regular temporary disability benefit, a benefit in connection with an industrial accident or occupational disease is calculated based on the employee’s earnings for the two years preceding the year of the insured event (Part 1, Article 14 of Law No. 255-FZ). However, the amount of employee earnings is not limited to the limit. The fact is that the taxable base for calculating insurance premiums in case of injury is not limited by a maximum value (unlike the taxable base for calculating insurance premiums in case of temporary disability and in connection with maternity).

Note. The maximum value of the taxable base is established for the calculation of insurance premiums in connection with temporary disability and maternity in accordance with Parts 4 and 5 of Art. 8 of the Federal Law of July 24, 2009 N 212-FZ. In 2013 it is 568,000 rubles.

And since there is no limit on the amount of assessed contributions, there is no limit on the amount of earnings for calculating this type of benefit.

Insurance experience is not taken into account

According to Art. 9 of Law N 125-FZ, temporary disability benefits due to an industrial accident or occupational disease are paid in the amount of 100% of the employee’s average earnings. In this case, the length of his insurance period does not matter.

Note. Why is length of service not taken into account? The dependence of the amount of benefits on the length of the employee’s insurance period is regulated by Art. 7 of Law No. 255-FZ. But this article is not mentioned in Part 2 of Art. 1 of Law No. 255-FZ. Consequently, its norms cannot be used as a guide when calculating benefits for temporary disability in connection with an industrial accident or occupational disease.

The benefit amount is not reduced

The amount of the benefit is not reduced, even if the doctor has noted a violation of the regime on the sick leave. Temporary disability benefits due to an industrial accident or occupational disease are paid for the entire period of temporary disability of the insured until his recovery or permanent loss of professional ability is established in the amount of 100% of his average earnings (Article 9 of Law No. 125-FZ). Reduce the amount of benefits even if there are grounds listed in Art. 8 of Law N 255-FZ, the employer does not have the right, since the mentioned article is not indicated in the list of articles established by Part 2 of Art.