There are situations when a person is laid off, but cannot complete the remaining time due to an illness that leads to disability. The Labor Code here protects the rights of working citizens. And if a person is forced to leave for treatment, having temporarily lost his ability to work, then the employer will be obliged to provide not only benefits after dismissal, but also to accept a certificate of incapacity for work.

Roughly speaking, if, for example, a person is notified of a layoff that will take place in 60 days, and the employee takes sick leave 2 weeks before the contract is cancelled, then he will receive two benefits at once.

Sick leave after dismissal due to staff reduction: how is payment made?

The employer pays for the certificate of incapacity for work issued in connection with the illness of the employee himself. Sick leave issued when family members of a redundant employee fall ill is not subject to payment. An employee has the right to sickness benefit in the amount of 60% of average earnings, regardless of his or her total length of service.

When calculating the amount, the procedure corresponds to the conditions for paying sick leave to employees of the enterprise. To calculate benefits, the earnings received by employees in the previous 2 years are used. If the person’s total length of service is less than 6 months, payment is made based on the minimum wage.

Deadlines for presentation and payment of certificates of incapacity for work

When receiving payment, the employee and employer must comply with the documentation deadlines.

| Condition | Fixed time |

| The onset of a disease confirmed by sick leave | The opening date must not be later than 30 days after the day of reduction |

| Deadline for submitting sick leave | No later than 6 months from the date of dismissal |

| Benefit payment period | Within 10 days from the date of presentation of the document |

| Payment deadline when applying for payment to the Social Insurance Fund | Within 10 days from the date of submission of the application and sick leave |

| Deadline for receiving accrued benefits | 3 years from the date of accrual |

Violation of the deadlines for document flow entails the refusal of the Social Insurance Fund to recognize the legality of the payment of benefits.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

https://youtu.be/-hw7nfQGeeE

What the law says

According to the Labor Code of the Russian Federation, an enterprise represented by an employer is obliged to notify an employee of dismissal due to reduction 60 days in advance. If there are vacancies, then offer them to choose from. All this time, the employee continues to perform his duties and enjoy all rights, labor guarantees, including sick leave.

If the employee received sick leave at the time of layoff , then it is considered the basis for the continuation of the employment contract. It will be legal until the employee becomes able to work. The order with the date of his dismissal will be moved to the last day of his sick leave.

Another option is if an employee is dismissed due to staff reduction while he is on sick leave. According to the law, payment of disability to a former employee after payment in connection with the reduction is carried out in accordance with the general rules.

If his incapacity for work occurred from the day he ended his work for a calendar month (30 days), then the employer is obliged to accrue and pay money according to the attached document in the form of a medical bulletin.

https://youtu.be/rHCv_xpqOMA

Withholding personal income tax and paying contributions from accrued benefits

The employer has the obligation to withhold and transfer personal income tax to the budget from the amounts of accrued payments. Benefits paid in connection with illness are not considered non-taxable payments and are subject to taxation. When withholding tax, standard and other deductions are not applied due to their expiration on the day of termination of the employment contract.

Insurance premiums due for accrual from payments to employees are not accrued on the certificate of incapacity for work of a dismissed employee. The procedure applies to the entire document, regardless of the source of payment.

| ★ Best-selling book “Calculating sick leave and insurance premiums in 2018” for dummies (understand how to calculate insurance premiums in 72 hours) 3000+ books purchased |

Documentation of payment for employee illness after layoff

In connection with a person’s illness or injury, a medical institution provides a standard form of sick leave. A document issued to a person without a specific place of employment does not contain the name of the enterprise. When paying for the period of illness of a dismissed person, the employer independently enters the name of the enterprise on the list of incapacity for work. Benefits are paid subject to certain conditions being met. Read also the article: → “When sick leave is not paid. 2 examples”

| Condition | Explanations |

| A document base | Certificate of incapacity for work opened by a medical institution within 30 days after layoff |

| Additional documents | Statement from the employee, a copy of the work record book indicating that the employee was not hired during the period of incapacity for work |

| Duration and end date of sick leave | The expiration date of incapacity for work is not taken into account |

| Sick person | An employee of an enterprise dismissed due to layoffs |

| The need for prior notice to the employer | Absent |

Contacting the employer within a period exceeding 6 months leads to refusal of payment. The period can be restored if there are special circumstances. Valid reasons include missing a deadline due to insurmountable natural circumstances, moving to another area, illness lasting more than six months, or other reasons. The restoration of the period is carried out in court.

Payment nuances

When he recovers, he returns to his workplace after finishing his sick leave and already writes a letter of resignation from work. But no one can automatically fire him while he is on legal sick leave. They will wait for him until he recovers, even if the dismissal date has already arrived.

The sick leave certificate itself, if properly completed, can be submitted to the employer within six months. The employee brings the sheet to the employer, and he is obliged to submit the necessary data to the Social Insurance Fund 10 days in advance. The very fact of job loss does not in any way affect the final amount of payment, since it is determined based only on the insurance period and the average daily wage of the employee.

FZ-255 plays in favor of the laid-off employee. Payment is due if the illness overtakes the person within 30 days - the period established by law. The amount largely depends on the income level of the patient. The average daily income for the last two years is taken into account. However, you need to know that the amount of compensation will be only 60%, even if taking into account the length of service the full amount is due. Moreover, income tax will be withheld from the payment amount.

This is important to know: The deadline for transferring sick leave by the employer to the Social Insurance Fund

Payment of maternity benefits

The Labor Code of the Russian Federation prohibits layoffs of women during pregnancy. The grounds for terminating an employment contract with a pregnant employee are:

- Liquidation of an enterprise or termination of the activities of an individual entrepreneur.

- The employee’s own desire, for example, in connection with her husband’s transfer to service or work in another locality.

- Dismissal of an employee when a temporarily absent employee is hired for a position. When a permanent employee starts work, the employer must present vacant positions to the temporarily hired person who is pregnant. If the employee refuses, he is dismissed due to the termination of the contract.

After dismissal, the employee has the right to register with the employment center. When receiving sick leave for pregnancy and childbirth, payments from the employment center are terminated and resumed after the end of the period.

Payments of maternity benefits to employees during liquidation are made by the social insurance fund. Unlike other grounds for dismissal, the employee will receive benefits based on income. Average earnings are calculated based on the income received by the employee over the previous 2 years. The right to sick pay is available for 12 months from the date of registration with the employment center and recognition as unemployed.

| Grounds for dismissal | Payment of maternity benefits |

| Liquidation of an enterprise or termination of the activities of an individual entrepreneur | Payment is made by social insurance authorities |

| Personal initiative of the employee | Payment is not made, except in cases of opening a certificate for maternity leave within 30 days from the date of dismissal |

| Dismissal under the terms of a fixed-term contract due to the departure of a permanent employee | Similar to voluntary dismissal |

The employee fell ill after reading the order

If an employee’s sick leave is issued after reviewing the information about dismissal, then the employer has written consent.

In this case, there are two options:

- the person is fired within the period established and specified in the notice. But this can only be done if the employee has already provided a closed sick leave certificate,

- The employment contract with the person will be terminated after he returns to work from sick leave.

If the administration committed violations of the notification period, this must occur no later than two months before the date of reduction. If the notification is received later, then the date of dismissal must be postponed to the required period of time.

Watch the video. How to apply for sick leave?

Notice and reduction during the period of incapacity for work

If an employee falls ill at the time of the planned notice of layoff, a corresponding valuable letter with an enclosed inventory is sent by mail. The signature put by the person on the delivery notice indicates receipt of information about the upcoming staff reduction.

The occurrence of an illness or injury may prevent dismissal on the day about which the employee was notified 2 months in advance. An employee cannot be fired on the day he is absent from work due to illness, which requires postponing the date of termination of the contract. Sick leave may be opened due to a child becoming ill. Payment for sick leave opened before the day of layoff is made in full according to the total length of service.

If you were laid off during illness

So, contraction during illness is more than likely. If this happens, the person being fired should answer three questions:

- whether he has the right to preferential retention at work;

- whether he was warned in time about the termination of cooperation;

- what the director offers in return.

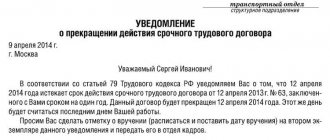

The Labor Code requires the heads of the company to notify the candidate for layoff two months before the date of severance. Often such paper is handed over directly in the office, with a personal signature. However, nowhere does it say that this must be done in person, so you can send the warning by registered mail with notification and declared value. The only important thing is the term - sixty days (Article 180 of the Labor Code).

So, if at the time of writing the letter a person is not at work due to ill health or problems with a disabled family member, the document is sent by mail, and the moment of personal familiarization will coincide with the date of delivery.

If at the time of writing the letter a person is not at work due to ill health or problems with a disabled family member, the dismissal document is sent by mail

If a person becomes ill after receiving the notice, during those same sixty days, this is also not a hindrance - the person will go to work and then he can be fired.

But that's not all. For example, they decided that the company no longer needed a specialist assistant. In exchange, the dismissed person must be offered other positions, which he can occupy due to his health and qualifications. If there are none or the person refuses, the contract is terminated.

Due to a child's illness

The same can be applied to cases when the reason for an employee’s reporting to the newsletter is not problems with his own health, but the illness of his son or daughter. In this case, all guarantees of Federal Law No. 255-FZ apply to it. That is, the entire period of absence is compensated and it is illegal to fire a person before he leaves the ballot. Even if a subordinate’s child fell ill just a couple of days before the day of the expected termination of cooperation, this date will be postponed.

What to do with pensioners

Federal Law N 90-FZ. Article 179

Many ordinary people believe that pensioners have priority during layoffs (Article 179 of the Labor Code). They are distinguished by greater experience, a greater store of knowledge, and a higher level of qualifications than their young comrades. However, this is not always the case, and often it is the young who surpass the older ones in terms of labor productivity. So here no obligations fall on the director; the final decision remains with him. It is important that a pensioner laid off on sick leave is notified of this in a timely manner and receives all due payments.

Reduction order

Payment for disability occurring after liquidation

An employee dismissed due to the liquidation of an enterprise has the right to payment for the period of incapacity from the Social Insurance Fund. During liquidation, all employees are subject to dismissal, including pregnant employees and persons with children under 3 years of age. The FSS makes the payment to the person’s account or sends the required amount by postal order to the applicant’s registered address. To receive payment, the person provides:

- A copy of your identification document.

- A certificate of incapacity for work issued within a month from the date of liquidation.

- A copy of the work book with a record of liquidation, confirming the lack of employment.

- Certificates of income for the previous 2 years. An employee who has not received a certificate of income from the enterprise’s accounting department attaches an application asking the Social Insurance Fund to send a request to the Pension Fund of the Russian Federation about the amounts received by the person.

- An application addressed to the head of the FSS department with a request for payment of benefits.

An employee has the right to receive sickness benefits even in the event of a difficult financial situation of an enterprise that is in the process of bankruptcy. An employee dismissed due to the liquidation of a bankrupt enterprise that was not removed from the register due to the end of the procedure receives payments through the Social Insurance Fund. To receive the required amount, a certificate issued by the bankruptcy trustee and a copy of the court decision on the initiation of bankruptcy proceedings for the enterprise are required.

Sick leave issued when laying off civil servants

Persons recognized as civil servants have similar rights to other employees. When an illness occurs, the organization pays benefits:

- According to a sheet opened within 30 days from the date of reduction at the rate of 60% of average earnings.

- For sick leave, which begins before the day of layoff or falls on the last day of employment, in the amount of average earnings depending on length of service.

- If the length of service is less than 6 months - based on the minimum wage.

A special procedure is provided for persons who are contract employees in the RF Ministry of Defense or the Ministry of Internal Affairs. Employees are not subject to the terms of the Labor Code of the Russian Federation or payments from the Social Insurance Fund. Payment for the period of incapacity for work is carried out according to departmental legislative acts. After layoffs, payment for sick leave is not carried out. Also, be sure to check out the example of filling out a sick leave form after layoff.

Results

While the employee being laid off is registered with the company, it is obliged to provide him with compensation for sick leave within the framework of the general scheme (as if the employee was not planned to be laid off). If at the time of the layoff date a person is on sick leave, he will continue to be on the company’s staff until he leaves sick leave.

You can familiarize yourself with other nuances of calculating compensation for sick leave in this section of our website.

Peculiarities of document flow for individual entrepreneurs

An individual entrepreneur, as an employer, has the right not to comply with notice periods and payment procedures when laying off workers. The requirements of the Labor Code of the Russian Federation are established only for legal entities. The entrepreneur independently determines the notice period and the possibility of paying severance pay. Conditions for different types of contracts can be included in labor or collective agreements or approved by orders.

A certificate of incapacity for work for an employee, opened within 30 days after the dismissal of an individual entrepreneur, is paid in accordance with the established procedure. Similarly to legal entities, the employee is required to provide sick leave, a work book and an application.