Procedure for submitting the 4-FSS report

Form 4-FSS is submitted quarterly by all employers using hired labor. Since 2020, due to a change in the insurance premium administrator, this report now contains only information on accident insurance premiums. The report form submitted in 2020 and the procedure for filling it out were approved by Order No. 381 of the Federal Social Insurance Fund of the Russian Federation dated September 26, 2016.

The main regulatory act regulating the procedure for calculating and paying contributions for injury insurance is the Law “On Insurance against Industrial Accidents and Occupational Diseases” dated July 24, 1998 No. 125-FZ.

Legislators have provided 2 deadlines for submitting the calculation (clause 1, article 24 of law No. 125-FZ):

- before the 20th day of the month following the reporting quarter - to submit the report on paper;

- until the 25th of the same month - to submit an electronic version of the calculation.

However, the right to choose the sending option is granted only to small companies with an average number of employees up to 25 people inclusive. If an organization employs more than 25 employees, then files can only be submitted electronically. Failure to comply with the reporting method will result in a fine of 200 rubles. (Clause 2, Article 26.30 of Law No. 125-FZ).

Upon receipt of the calculation, the FSS authorities must send the policyholder a receipt confirming receipt of the report or a negative inspection report describing the errors.

For information on how to correctly submit 4-FSS, read our material “ Updated rules for filing 4-FSS.”

Code of type of reorganization or liquidation

When there is a process of termination of the activity of an economic entity, the creation of one/several companies or other changes related to legal succession, the corresponding code is indicated in a single calculation of insurance premiums. Its possible values are specified in Appendix No. 2 of the procedure for filling out the calculation:

If there are no actions related to reorganization or liquidation, a dash is placed in the appropriate field.

What to do if I receive a negative inspection report?

If, based on the results of the inspection, the FSS body sent a negative report, the payment is considered not submitted. It is necessary to correct all errors indicated in the document and send the report again. The date of submission of the calculation is the date when the file passed all stages of verification and was accepted by the fund.

If the file is accepted after the 25th, the FSS will charge a fine, which will be calculated as 5% of the amount of assessed contributions for injuries for the reporting period, but not less than 1,000 rubles. and no more than 30% of the specified amount (Clause 1, Article 26.30 of Law No. 125-FZ).

Let's look at the most common error codes in the protocol and how to correct them.

Working conditions class code

The indicator under consideration affects the amount of insurance premiums. Additional rates are provided for employees who work in difficult or hazardous conditions. When making a single calculation, in the “Working conditions class code” box of Subsection 1.3.2, enter the number 1 if the hazard subclass is 4. And codes 2, 3, 4 and 5 correspond to subclasses 3.4, 3.3, 3.2 and 3.1.

EXAMPLE

compiles calculations of insurance premiums for the first half of 2020. When entering data about K.V. Kuznetsov, who works as an electric welder, must enter the number 4 in the “Class of working conditions” field in Subsection 1.3.2.

Common protocol errors and how to resolve them

A complete list of error codes and their interpretation can be found on the FSS website and below in our article.

- The most common error code in the FSS Form 4 verification protocol is error 508, which means that the file format is incorrect and the calculation has not passed format-logical control.

Its main reasons:

- When filling out a report in the 1C program, only part of the data is uploaded;

- The program for generating the report has not been updated.

In this case, the report can be filled out on the official FSS website portal.fss.ru (tab “Form 4-FSS”), and then download the correct file and send it through your telecom operator.

Sending is also available from the portal of the fund itself, but before this you need to register on the site and request a digital signature key. You need to take these steps in advance so as not to miss the deadline for submitting the calculation.

- Error code 503 in the FSS report means that the file name specified is incorrect and does not match the XSD schema.

According to Appendix 1 to the FSS order “On the implementation of secure exchange of documents in electronic form...” dated 02/12/2010 No. 19, the file name should look like this:

<policyholder number>_<accounting year>_<reporting quarter>. xml.

For example, 1234567891_2019_12.xml.

In this case, the policyholder number is a 10-digit digital designation of the payer’s registration number. It must correspond to the registration documents. The accounting year is written in YYYY format, for example 2020. The reporting quarter must contain 2 digits: for the 1st quarter it is designated 03, for 6 months. — 06, 9 months. - 09, years - 12.

To fix error 503, you need to rename the file or generate the file in the program and upload it again.

- Error 598 in the FSS report means that the provided file contains a TIN that does not match the registration number of the policyholder.

The reason may be the erroneous entry of information into the database by the special communications operator through whom the calculation is signed and sent, as well as an error by the accountant.

To resolve discrepancies, you must check the Taxpayer Identification Number and Registration Number on the cover page of the form. If no errors are identified, you should contact a representative of the operator’s company and check the data in their database.

Keep in mind that the courts do not consider an error in the policyholder's registration number to be a sufficient reason for not accepting a settlement. Read more about this in the material “An error in the registration number is not a reason for a fine for failure to submit 4-FSS .

Other details can be found in our material “4-FSS Errors: Reading the Failure Protocol.”

Code of the tax authority to which the report was submitted

Depending on the territorial location, tax inspectorates are assigned an individual number. You can find it out on the official website of the Federal Tax Service of Russia, from accounting reference books, or take the first four digits of the TIN.

The table shows values for some regions:

| Region of Russia | IFTS/MIFNS code |

| Moscow | 77— |

| Moscow region | 50— |

| Saint Petersburg | 78— |

| Tyumen region | 72— |

| Novosibirsk region | 54— |

| Amur region | 28— |

Where: “–” is the serial number of the tax authority in the region.

What do other error codes mean?

| No. | Error code | Meaning | Possible reasons | Elimination procedure |

| 1 | 10 | Unable to decrypt file | Invalid or expired certificate | Check the validity period of the digital signature certificate and its validity |

| 2 | 11 | It is impossible to verify the digital signature | 1. Certificate error. 2. The file is signed twice. 3. The file encryption algorithm is broken | 1. Contact a special operator and fix the certificate error. 2. Re-sign the file and send. 3. Sign the file first and then encrypt it |

| 3 | 13 | Absence of the policyholder's registration number in the certificate | An error made by a special operator when issuing a certificate | Contact the special operator representative and reissue the certificate |

| 4 | 14 | Lack of FSS department code in the certificate | See paragraph 3 | See paragraph 3 |

| 5 | 15 | Encryption error | System crash while transferring file | Resend the file |

| 6 | 16 | Incorrect format of policyholder registration number in the certificate | The number of characters of the registration number is less than or more than 10 | Reissue certificate |

| 7 | 17 | Incorrect format of the FSS unit code in the certificate | Number of code characters more or less 4 | Reissue certificate |

| 8 | 18 | The file is encrypted with an incorrect digital signature key | 1. An incorrect FSS authorized person certificate was selected. 2. Expired certificate selected | 1. Sign and encrypt the file using a valid certificate from an authorized person of the FSS. 2. Download a new certificate from the FSS website and install it in the certificate store |

| 9 | 19 | The file is not signed or encrypted | Re-sign, encrypt and send the file | |

| 10 | 20 | Unknown file format | File name does not match XD schema | Regenerate the xml file (see procedure for error 503) |

| 11 | 41 | The certificate issuer is not trusted | 1. The special operator’s certificate does not comply with the Law “On Electronic Signatures” dated April 6, 2011 No. 63-FZ. 2. The special operator’s certificate has been revoked or expired | Contact the special operator company, having first checked the validity of the root certificate in the cross-certification table |

| 12 | 42 | Error verifying certificate | Resend calculation | |

| 13 | 43 | The policyholder's certificate has been revoked | The digital signature of the certificate is invalid | Reissue certificate |

| 14 | 44 | The certificate revocation list (hereinafter referred to as CRL) of the certificate issuer is expired or not found | Certification center SOS error | Contact a representative of the telecom operator company |

| 15 | 45 | The certificate is damaged | Resend payment | |

| 16 | 46 | The insurance certificate is expired | Reissue certificate | |

| 17 | 50 | The organization's TIN is not included in the certificate | Error creating certificate | Reissue certificate |

| 18 | 504 | The certificate contains the wrong FSS division | See paragraph 17 | See paragraph 17 |

| 19 | 505 | Incorrect file name | File format does not match XD schema | Regenerate the file in xml format |

| 20 | 506 | Identical tax codes in section 2 of the report | Error filling out the form | Correct an error in the report, upload and send |

| 21 | 507 | xml file missing | Calculation file not loaded into the system | Upload file, sign, encrypt and send |

| 22 | 509 | The file contains a period that differs from the period in its name | Error when filling out the calculation | Regenerate the file and send it to the FSS |

| 23 | 511 | Error reading file | The file is empty or not in xml format | Regenerate the file and send |

| 24 | 512 | The reporting year in the file differs from the year in its name | Error when filling out the calculation | Correct the error, generate and send the file |

| 25 | 513 | The file contains a registration number that is different from the number in the file name | See paragraph 24 | See paragraph 24 |

| 26 | 514 | The policyholder's registration number on file is different from the number on the certificate | 1. Error when filling out the calculation. 2. Error when issuing a certificate | 1. Correct the error, generate the file and resend it. 2. Contact the certification authority and reissue the certificate |

| 27 | 515 | The registration number in the file name is different from the number in the report | See paragraph 24 | See paragraph 24 |

| 28 | 516 | The separate department code in the file name differs from the code in the file | See paragraph 24 | See paragraph 24 |

| 29 | 517 | File size is too large | The file must be no larger than 655 kilobytes | Generate a new calculation file |

| 30 | 518 | The file is zero size | The file is zero size | Generate a new file |

| 31 | 519 | The TIN in the certificate differs from the TIN in the calculation file | See paragraph 26 | See paragraph 26 |

| 32 | 520 | OGRN in the file differs from OGRN in the certificate | See paragraph 26 | See paragraph 26 |

| 33 | 550 | The certificate is not qualified | The certificate is not qualified | Contact the special operator company and reissue the certificate |

| 34 | 599 | The policyholder's data has not yet been entered into the FSS database | The report will be processed upon entry into the FSS database | |

How to decipher the negative protocol for SZV-STAZH, see here.

Location code

The field for this code is located on the title page to the right of the Federal Tax Service code. It is indicated depending on the territorial location of the enterprise and its legal status. The values can be as follows:

EXAMPLE

Let's assume that Guru LLC is located in Russia - in Tomsk. Then in the field in question they put the number 214, and the Federal Tax Service code is 7017:

Results

In 2020, all employers are required to provide quarterly calculations to 4-FSS regarding contributions for injuries within the established time frame. If the form is filled out incorrectly, upon verification, a negative report will be sent to the policyholder. In this case, the report will be considered not accepted until the identified errors are eliminated. If the corrective report is accepted later than the established deadlines, the policyholder will be subject to penalties.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

What codes to use for document types?

The single calculation also includes a code that informs about the type of document identifying the insured. The designation used also depends on the presence of Russian citizenship and the status of the employee. Full information is presented below (Appendix No. 6 to the order of the Federal Tax Service No. ММВ-7-11/551):

These codes indicate:

- in information about an individual without individual entrepreneur status;

- in personal data about the insured (page 140 of Section 3).

EXAMPLE

In the personalized accounting information, the company reflected information about employee N.V. Maneev on the basis of a temporary identity card issued to a citizen of the Russian Federation. In such a situation, in line 140 you must specify code “14”:

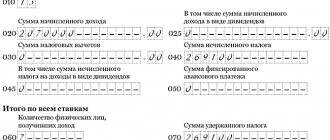

Error 508 in the FSS report

1571 All legal entities and individual entrepreneurs that employ hired employees must send a report to the social insurance department once every 3 months according to f.

Consequently, deadlines are missed. The company is held accountable. A fine of 200 rubles is imposed.

4-FSS. This report records information about accrued and paid contributions. These contributions are paid in order to create a reserve for payments for illnesses and injuries caused by production factors. If errors are found in the report, it will not be accepted. The electronic document is sent back with the mark “Error 508”.

The specifics of submitting a report are established by Federal Law No. 125 “On Insurance” dated July 24, 1998. The regulations state that reports must be sent electronically if it is an individual entrepreneur or legal entity with more than 25 employees.

If the staff size is less than 25 employees, you can send a report in paper form. The following reporting deadlines have been approved:

- For institutions submitting an electronic report – until the 25th.

- For commercial firms supplying paper reports - on the 20th day of the month following the reporting quarter.

When creating a report, the accountant must carefully check the document for any defects.

If the FSS identifies errors, the document will be sent back.

The accountant also receives a notification with a list of shortcomings. All errors must be corrected in a timely manner. Otherwise, fines will be imposed on the company.

The report may not pass verification due to errors.

In this case, the FSS sends a negative protocol to the company.

If the organization received this protocol, the report is considered not submitted.

Error 508 when sending the register to the Social Insurance Fund for sick leave

— — These deadlines do not shift if the accountant made a mistake and had to send the file again.

No liability is accepted for a "508" error. However, liability is imposed if the reporting deadline is missed.

Let's consider the forms of punishment for missing deadlines:

- Reporting is submitted in paper format. A fine of 5% of contributions paid for 3 months is imposed. This amount cannot be less than 1,000 rubles. But it cannot exceed 1/3 of the insurance premium.

- Reporting is submitted in electronic format. The fine is 200 rubles.

The person will be held accountable even if the deadline is missed by one day.

The accountant creates reports and submits them in electronic format.

An error “508” was detected in the document, as a result of which the file was sent back.

The accountant quickly corrects all shortcomings and submits the corrected document. It is successfully verified by the 20th and goes to the FSS. In this case, making a mistake does not entail any penalties.

Let's look at another example. Previously sent reports were returned due to error “508”. The accountant corrects all the shortcomings and submits the file on the 19th. However, the document passes all stages of verification only on the 21st.

A file is considered submitted only when it goes through the full review cycle.