Controlled transactions. Notifications, eligibility criteria

We have been providing services for the preparation of notifications of controlled transactions and documentation justifying the criteria for such transactions for the Federal Tax Service for more than four years (for more information about the service and prices, see here). In this regard, we consider it necessary to draw your attention to the following main points regarding their accounting.

The law obliges taxpayers to notify the tax authorities of controlled transactions annually by May 20 (in 2020, it is necessary to notify the tax authorities of those completed in 2017).

The form (format) of the notification of controlled transactions (or, as they say, “report of controlled transactions”), as well as the procedure for filling out the form and the procedure for submitting the notification in electronic form, were approved by Order of the Federal Tax Service of Russia dated July 27, 2012 No. ММВ-7-13 /

One of the main questions for the tax authorities remains the justification of the correspondence of prices to market prices. The best solution to this issue for an organization is to have its own Methodology for accounting for controlled transactions, which contains methods of price analysis.

In accordance with the recommendations of the Ministry of Finance of the Russian Federation and the Federal Tax Service of the Russian Federation, simultaneously with the submission of the annual tax return, which reflects in a separate line the adjustment of the tax base associated with controlled transactions, it is advisable for taxpayers to send an explanatory note to the tax authority about the completion of such transactions in the reporting year.

Notifications of controlled transactions and a package of documents are prepared for each transaction (group of similar controlled transactions) and for each organization with which they were concluded in the past year.

Failure to provide documentation on controlled transactions on time may result in an adjustment to the tax base for income tax and VAT, as well as the accrual of fines and penalties.

Test yourself! A transaction is considered controlled if it meets the following criteria, that is, it is completed:

- 1) between interdependent persons;

- 2) in the field of foreign trade in goods of world exchange trade. There is a closed list of such products, which can be viewed here (table .doc, 6.05MB);

- 3) with companies registered offshore. The list of countries and territories recognized as offshore is approved by the Government of the Russian Federation and can be viewed here (table .doc, 6.07MB);

Here we consider it necessary to note that according to this criterion for classifying controlled transactions between related parties, transactions involving the resale of goods, work, or services to a related party through an intermediate acquirer performing a formal role in the chain of transactions are also equated; Loans and credits received from related parties and guarantees provided may also be classified as controlled transactions.

There are cost limits - criteria for recognizing transactions as controlled.

For paragraphs 2) and 3), transactions are considered controlled if the amount of income (received by one of the parties to the transaction) from such transactions made with one person for the corresponding calendar year exceeds 60 million rubles (clause 7 of Article 105.14 of the Tax Code of the Russian Federation).

Under paragraph 1), when the parties to the transaction are two Russian companies that are interdependent entities, the cost limit is set at 1 billion rubles. If one of the parties to the transaction uses preferential or special (STS, UTII, Unified Agricultural Tax) tax regimes, the limit is 100 million rubles.

Under paragraph 1) for controlled transactions with foreign related parties, no cost limit is established.

A separate “positive” norm – a transaction does not relate to the concept of controlled transactions when:

- interdependent persons are registered in one subject of the Russian Federation;

- interdependent entities do not have separate divisions in the territories of other constituent entities of the Russian Federation, as well as outside the Russian Federation;

- interdependent persons do not pay corporate income tax to the budgets of other constituent entities of the Russian Federation;

- interdependent persons do not have losses (including losses from previous periods carried forward to future tax periods) accepted when calculating corporate income tax;

- interdependent persons do not apply preferential or special regimes (STS, UTII, Unified Agricultural Tax)

Order service

Controlled transactions are transactions in which tax authorities can check whether the price falls within the range of market prices. Transactions in this case mean actions of citizens and legal entities aimed at establishing, changing or terminating civil rights and obligations (letter of the Ministry of Finance of Russia dated 06.06.2012 No. 03-01-18/4-70).

The concept of interdependent persons is defined by paragraph 2 of Article 105.1 of the Tax Code of the Russian Federation.

From the group of transactions between related parties, transactions were identified where all parties and beneficiaries were registered in Russia and transactions where all parties and beneficiaries were tax residents of the Russian Federation. These transactions are considered controlled if at least one of the following conditions is met.

The subject of such transactions must be goods included in the following product groups:

- oil and products made from oil

- black metals

- non-ferrous metals

- mineral fertilizers

- precious metals and gemstones

It should be noted that the court may recognize a transaction as controlled, even if it does not have these characteristics. This is possible if there are sufficient grounds to believe that this transaction is included in a group of similar transactions made for the purpose of concealing a controlled transaction.

Organizations and individuals who are parties to a transaction have the right to independently recognize themselves as interdependent entities for tax purposes if the relationship between them may affect the terms and (or) results of the transactions.

Controlled transactions 2020 - their criteria will be given below in the table - are carried out by interdependent and equivalent persons. Such transactions are subject to additional control by the Federal Tax Service, since their parties may collude and provide false information about transactions for the purpose of tax evasion. Let's consider their specifics.

Controlled transactions are those that are subject to verification by the Federal Tax Service to ensure that the participants in the relevant transactions do not intend to evade taxes (reduce them) through unjustified manipulations with prices for goods and services that are the subject of agreements. Thus, by reducing the price in the contract, the payer can reduce the tax base, and by increasing it, the payer can increase the base for calculating deductions (for example, for VAT). These actions are illegal.

In the general case, contracts between interdependent companies are considered controlled (clause 1 of Article 105.14 of the Tax Code of the Russian Federation), namely those that are determined based on the criteria established by Art. 105.14 Tax Code of the Russian Federation. It can be noted that the range of these criteria is very wide. Further in special sections of the article we will consider their essence in more detail.

A special category of controlled transactions are those carried out with the participation of firms equated to dependent ones.

Transfer pricing occurs when transactions are made between related parties. Due to the state of interdependence, such companies can set prices that differ from market prices (i.e., those that are set between independent companies). In this article we will look at which transactions are recognized as controlled in 2020 and what points it is important to pay attention to for organizations entering into such transactions.

A transaction between related parties is considered controlled if at least one of the following criteria is present:

- The amount of income from such transactions for the corresponding calendar year exceeds 1 billion rubles. Please note that this provision refers to the amount of income from transactions with one person for a calendar year;

- At least one of the parties to the transaction applies special tax regimes: Unified Agricultural Tax or UTII, and at least one party to the transaction does not apply these special tax regimes. Transactions are considered controlled in 2020 if the income from such transactions for a calendar year exceeds 100 million rubles;

- One of the parties to the transaction is a taxpayer of the mineral extraction tax, calculated at a tax rate established as a percentage, provided that the subject of the transaction is an extracted mineral that is subject to taxation corresponding to the mineral extraction tax;

- At least one of the parties to the transaction is exempt from corporate income tax obligations or applies a tax rate of 0 percent, but the other party is not;

- At least one of the parties to the transaction is a participant in a regional investment project that applies a reduced income tax rate to the subject’s budget, or a 0% rate to the federal budget

- At least one of the parties to the transaction applies during the tax period an investment tax deduction for corporate income tax, provided for in Article 286.1 of the Tax Code of the Russian Federation.

For the above transactions (clauses 3 - 6), a threshold amount of income at which transactions are recognized as controlled has been established in the amount of 60 million rubles.

In addition, foreign economic controlled transactions should be highlighted separately, i.e. controlled transactions with a non-resident of the Russian Federation (foreign organization). Foreign economic transactions are considered controlled regardless of the amount of income from such transactions for the corresponding calendar year

All people engaged in business activities are faced with the need to look for “loopholes” in order to reduce tax amounts. Agreements of a financial nature that are concluded between counterparties are no exception in this case. Representatives of the tax authorities are well aware of this. It is for this reason that they have adopted certain criteria that allow for control.

Controlled transactions are necessary to ensure that the entrepreneur cannot avoid paying taxes in the amount that has been determined. If there is an agreement between the participants, the amount of taxes, through special reduction methods, will not be transferred to the state budget in its entirety.

Article 105.14 of the Tax Code of the Russian Federation classifies the following transactions as controlled:

| Conditions for recognizing a transaction as controlled | Annual turnover limit (RUB million) |

Transactions between related partiesThe concept of interdependent persons is defined by paragraph 2 of Article 105.1 of the Tax Code of the Russian Federation. From the group of transactions between related parties, transactions were identified where all parties and beneficiaries were registered in Russia and transactions where all parties and beneficiaries were tax residents of the Russian Federation. These transactions are considered controlled if at least one of the following conditions is met. | |

| The amount of income from these transactions (the sum of transaction prices) for a calendar year exceeds the limit amount | 1 000 |

| One of the parties to the transaction is the payer of the mineral extraction tax at an interest rate, and the subject of the transaction must be the extracted mineral resource, which is recognized as subject to the mineral extraction tax for the specified party. | 60 |

| Among the parties to the transaction there are payers of unified agricultural tax or UTII and persons who do not pay these taxes. | 100 |

| At least one of the parties to the transaction is exempt from paying income tax, or applies a tax rate of 0% in accordance with paragraph 5.1 of Article 284 of the Tax Code of the Russian Federation. One of the other parties to the transaction must be a person who is not exempt from income tax and does not apply the specified rate. | 60 |

| At least one of the parties to the transaction is a resident of a special economic zone (SEZ), which has special income tax benefits. The other party to the transaction must not be a resident of such a SEZ. | 60 |

| At least one of the parties to the transaction applies during the tax period an investment tax deduction for corporate income tax, provided for in Article 286.1 of the Tax Code of the Russian Federation. | 60 |

| At least one of the parties to the transaction is a corporate research center specified in the Federal Law “On Innovation”, which applies VAT exemption in accordance with Article 145.1 of the Tax Code of the Russian Federation. | 60 |

| At least one of the parties to the transaction is a participant in a regional investment project that applies a zero or reduced tax rate for corporate income tax. | 60 |

| One of the parties to the transaction is a taxpayer in accordance with paragraph 1 of Article 275.2 of the Tax Code of the Russian Federation and takes into account income (expenses) on such a transaction when determining the tax base for income tax, and any other party to the transaction is not the same taxpayer or does not take into account income (expenses) on such transaction when determining the tax base for income tax. | 60 |

| Foreign trade transactions between interdependent persons in accordance with the general rule of paragraph 1 of Article 105.14 of the Tax Code of the Russian Federation, regardless of what goods are their subject. | 0 |

Transactions equivalent to transactions between related parties | |

| Transactions in the field of foreign trade in goods of world exchange trade. The subject of such transactions must be goods included in the following product groups:

| 60 |

| Transactions in which one of the parties is a person whose place of registration, or place of residence, or place of tax residence is an offshore zone from the list of the Ministry of Finance of the Russian Federation. | 60 |

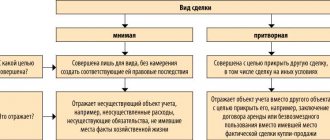

| A set of transactions for the sale of goods (works, services) made with the participation of formal intermediaries. Such transactions are concluded with the participation of a significant number of persons (intermediaries) who are not interdependent, but do not perform any additional functions other than organizing the sale of goods (work, services) by one person to another person recognized as interdependent with this person, do not bear risks, do not use assets. | 0 |

It should be noted that the court may recognize a transaction as controlled, even if it does not have these characteristics. This is possible if there are sufficient grounds to believe that this transaction is included in a group of similar transactions made for the purpose of concealing a controlled transaction.

Organizations and individuals who are parties to a transaction have the right to independently recognize themselves as interdependent entities for tax purposes if the relationship between them may affect the terms and (or) results of the transactions.

Expand description

Criteria for grounds

Controlled transactions are necessary to ensure that the entrepreneur cannot avoid paying taxes in the amount that has been determined. If there is an agreement between the participants, the amount of taxes, through special reduction methods, will not be transferred to the state budget in its entirety.

To do this, during the conclusion process, the participant will reflect incorrect data regarding the cost of goods or services. By specifying a fictitious value, all parties to the agreement can reduce the actual amount of money required to pay taxes.

Depending on the chosen taxation system, it may be overpriced . Such an action may result in an increase in the base, which is then used to carry out the deduction. In all cases, price changes can negatively affect the amount of taxes. This is also illegal. Let us note that despite the fact that entrepreneurs regularly enter into transactions, not all of them are of interest to representatives of the Federal Tax Service.

The criteria for controlled transactions are appropriate in situations where contracts are regularly concluded between enterprises that are dependent on each other. All situations that meet this criterion are described in Article 105.14 of the Tax Code of the Russian Federation. They may differ from each other in their spectrum of action. At the same time, it is worth saying that these criteria also include those transactions where firms are interdependent with each other .

Controlled for tax purposes are:

- Those that were carried out between persons who are interdependent among themselves.

- Transactions (one or more) that have become controlled due to their equating to transactions of entities dependent on each other.

- Those that were recognized in court as controlled.

The table of controlled transactions is as follows:

| Controlled transactions | Maximum cash turnover (per year) | |

| Agreements of foreign economic nature | Between persons who are dependent on each other | No limit |

| Conducted with exchange traded goods | 60 million rubles | |

| With offshore residents, in accordance with the list proposed by the Ministry of Finance of the Russian Federation | 60 million rubles | |

| Treaties held in the Russian Federation | Transactions between related parties | 1 billion rubles (starting from 2020) |

| Transactions between related parties, if the party: | ||

| Was exempt from income taxes or uses a “zero” rate | 60 million rubles | |

| A resident who has benefits established for income tax | 60 million rubles | |

| MET payer | 59 million rubles | |

| Uses a special tax regime | 100 million rubles |

Notification of controlled transactions: form

The Controlled Transaction Notice includes a traditional cover page and three sections, with the first section including two subsections lettered A and B.

Subsections 1A and 1B need to reflect information about the transaction and its subject. Sections 2 and 3 will tell you about the participants in the transaction.

Subsection 1A is filled out separately for each completed transaction or a set of similar transactions. Part of this section is very similar to a questionnaire, in which you need to select the correct statement and enter the required code. The codes are indicated directly in the notification.

Subsection 1B is an addition and decoding of information from subsection 1A. Here the reporting person indicates the name of the goods/works, contract details, country of origin and value of the subject of the transaction, etc.

The number of sheets of subsection 1B must match the number of transactions noted in subsection 1A. That is, if the taxpayer compiled four sheets of subsection 1B, then four transactions must be reflected in subsection 1A.

Sections 2 and 3 contain registration data about the persons with whom transactions are concluded. The only difference is that in section 2 the participants are legal entities, and in section 3 the participants are individuals.

Full instructions for filling out the notification are in the Order of the Federal Tax Service dated July 27, 2012 No. ММВ-7-13/ [email protected]

For controlled transactions that took place in 2020, a notification must be submitted to the Federal Tax Service by May 20, 2018. Since the reporting deadline falls on Sunday, the taxpayer has the right to send the document until May 21, 2018 inclusive.

A report on related parties or a notification on completed controlled transactions is included in the list of mandatory reporting submitted to the Federal Tax Service if such transactions took place in the reporting year. Let's consider the features of its design and delivery.

Transactions requiring reporting in 2020

notification, its form, procedure and deadlines for delivery

Such a notification is submitted by organizations and individual entrepreneurs who had controlled transactions in the reporting year (clause 1 of article 105.16, article 105.14 of the Tax Code of the Russian Federation).

Note that controlled transactions are certain transactions between related parties and transactions equivalent to transactions between related parties (Article 105.14 of the Tax Code of the Russian Federation). Such transactions, in particular, include transactions for which the annual amount of income exceeds 60 million rubles. and at the same time, two conditions are met simultaneously (clause 4, clause 2, clause 3, article 105.14 of the Tax Code of the Russian Federation):

- the place of registration/residence/residence of all parties to the transaction is the territory of the Russian Federation;

- one of the parties to the transaction is a profit tax payer, and the other is not.

Notification of controlled transactions is submitted to the Federal Tax Service (Clause 2 of Article 105.16 of the Tax Code of the Russian Federation):

- at the location of the organization;

- at the place of residence of the individual entrepreneur.

The notification must be submitted no later than May 20 of the year following the reporting year (Clause 2 of Article 105.16 of the Tax Code of the Russian Federation).

If the deadline for submitting a notification about controlled transactions is violated, the organization/individual entrepreneur faces a fine of 5,000 rubles. (Article 129.4 of the Tax Code of the Russian Federation). By the way, the same fine will apply if an organization/individual entrepreneur submits a notification with false information.

The notice consists of:

- title page;

- Section 1A “Information on a controlled transaction (group of similar transactions)”;

- Section 1B “Information about the subject of the transaction (groups of similar transactions)”;

- Section 2 “Information about the organization - a participant in a controlled transaction (group of similar transactions)”;

- Section 3 “Information about an individual participant in a controlled transaction (group of similar transactions).”

You will find a sample of filling out the notification in our consultation. There you can read about the main points of the procedure for filling out the notification.

Submitting a report

The notification to the Federal Tax Service must be submitted by the 20th day of the 5th month of the year following the reporting year. For this year, notification must be provided no later than May 20, 2018 .

If the document is submitted before the tax authorities have identified errors, the taxpayer is automatically exempt from penalties for providing information that is inaccurate.

Documents of this type can be requested by the tax service no earlier than June 1 of the year following the calendar year and, accordingly, in which the controlled contracts were concluded. As part of the review, the request for transaction documentation may last up to three years .

Exemption from sanctions is possible only if the payer provides the Federal Tax Service with documents that justify why the level of market value for goods (services) was reduced. Please note that in this case, the taxpayer is given 30 days to provide the documentation requested by the Federal Tax Service.

Documents for download (free)

- Notice of controlled transactions

Thus, in order to avoid problems for business owners, it is recommended to first take care of justifying market prices . The fact is that the process of preparing such documents most often takes from 3 to 6 weeks . In this case, the time for preparing documentation is seriously affected by the number, as well as the complexity of transactions that were carried out during the entire period of work.

The process of reporting controlled transactions is not the easiest and requires business owners to study the issue in detail. If it is not studied, then when submitting reports to the Federal Tax Service, there is a high probability that problems will arise.

It should be noted that in order to prevent such situations, it is recommended to employ an accountant with experience in the company or enterprise, who knows tax legislation, studies all the innovations, and also, due to his professional skills, knows how to solve most of the problems arising with the Federal tax service.

The definition of controlled transactions is presented in this video.

https://youtu.be/L0ClMJLbAY8

Share with friends on social networks

Telegram

Deadline for notification of controlled transactions

Notification of controlled transactions is submitted no later than May 20 of the year following the reporting year (Clause 2 of Article 105.16 of the Tax Code of the Russian Federation). If this day is a weekend, the due date is postponed to the next working day.

June 1 of the year following the calendar year in which controlled transactions were carried out is the date from which the tax authorities have the right to request documentation regarding a specific transaction or a group of similar transactions (clause 3 of Article 105.15 of the Tax Code of the Russian Federation).

Controlled transactions can be divided into two groups: transactions between related parties and transactions equivalent to them (Article 105.14 of the Tax Code of the Russian Federation). In some cases, transactions that meet the criteria on the basis of which they are recognized as controlled will not be classified as such.

For example, transactions between interdependent persons - agricultural producers who have not switched to paying the Unified Agricultural Tax, cannot be qualified as controlled on the basis of paragraphs. 3 and 4 paragraphs 2 art. 105.14 of the Tax Code of the Russian Federation (which, however, does not exclude the recognition of such transactions as controlled if there are other grounds provided for in this article).

Taxpayers who carry out controlled transactions in a calendar year are required to notify the tax authority about this. Information about controlled transactions is indicated by the taxpayer in a special notice. It is submitted to the tax authority at the taxpayer’s location (place of residence) no later than May 20 of the year following the calendar year in which controlled transactions were carried out (clause 2 of Article 105.16 of the Tax Code of the Russian Federation). The largest taxpayers submit a notification to the tax authority at the place of registration as such.

The indicated notification may be submitted to the tax authority (clause 2 of Article 105.16 of the Tax Code of the Russian Federation):

- according to the approved form on paper;

- according to established formats in electronic form.

The form and procedure for filling out the notification are approved by Order of the Federal Tax Service of Russia dated July 27, 2012 No. ММВ-7-13/

Notification of controlled transactions must be submitted by all parties to the transaction.

If the notification is not submitted within the legally prescribed period, then the sanction provided for in Art. 129.4 of the Tax Code of the Russian Federation, in the form of a fine in the amount of 5,000 rubles. Let us add that the amount of this fine does not depend on the number of controlled transactions specified in the notification.

The same fine awaits the taxpayer if he submits a notification in a timely manner, but reflects incomplete or unreliable information about controlled transactions.

At the same time, tax legislation provides the taxpayer with a chance to independently correct mistakes. Thus, if he discovers incomplete information, inaccuracies or errors in the initial notification of a controlled transaction, he has the right to send a new (clarified) notification (paragraph 4, paragraph 2, article 105.16 of the Tax Code of the Russian Federation). At the same time, para.

| Notice of Controlled Transactions for 2020 | until May 21, 2020 |

| Notice of Controlled Transactions for 2020 | until May 20, 2020 |

Criteria for recognizing transactions of related parties as controlled for tax purposes

The characteristics of controlled entities include transactions of interdependent persons that contain special conditions from Art. 105.14 Tax Code of the Russian Federation.

First of all, all participants and beneficiaries in a transaction between related parties must be registered or have tax residence in the Russian Federation. Further, the law establishes 2 types of requirements according to which a transaction can be classified as controlled:

- Compliance with the amount of profit specified in the law for the calendar year (hereinafter referred to as the amount of profit). For interdependent persons, this amount is over 1 billion rubles.

- Participation in a transaction of a person who is obliged to pay or is exempt from paying a certain type of tax depending on the specifics of his activity.

What kind of reporting is established for controlled transactions (“1C” and unified forms)

Currently, the Federal Tax Service of Russia has developed a draft order to amend the form and procedure for filling out the notification of controlled transactions (project ID 02/08/04-17/00063938). The new form of notification of controlled transactions will be applied to transactions completed starting from January 1, 2020 (Letter of the Federal Tax Service of Russia dated March 22, 2018 N ED-4-13 / [email protected] ).

Thus, in order to report on controlled transactions for 2017, you must use the previously valid form (KND 1110025), approved by Order of the Federal Tax Service of Russia dated July 27, 2012 No. ММВ-7-13 / [email protected] The Order also approves the format of the report in electronic form and the procedure filling out the form.

| Subjects of transactions | What kind of transaction can be considered for controllability? | Criteria for classifying a transaction as controlled | Sources of law that collectively establish the procedure for classifying transactions as controlled |

| Interdependent persons who are residents of the Russian Federation | Any transactions between such persons, if the amount of income on them for the year exceeds 1 billion rubles. and one of the conditions specified in the following column is met |

| Art. 105.1 Tax Code of the Russian Federation; subp. 1 item 2 art. 105.14 Tax Code of the Russian Federation; clause 3 art. 105.14 Tax Code of the Russian Federation |

| Art. 105.1 Tax Code of the Russian Federation; subp. 2 p. 2 art. 105.14 Tax Code of the Russian Federation; clause 3 art. 105.14 Tax Code of the Russian Federation | ||

| Art. 105.1 Tax Code of the Russian Federation; subp. 3 p. 2 art. 105.14 Tax Code of the Russian Federation; clause 3 art. 105.14 Tax Code of the Russian Federation | ||

| Art. 105.1 Tax Code of the Russian Federation; subp. 4 p. 2 tbsp. 105.14 Tax Code of the Russian Federation; clause 3 art. 105.14 Tax Code of the Russian Federation | ||

| Art. 105.1 Tax Code of the Russian Federation; subp. 6 paragraph 2 art. 105.14 Tax Code of the Russian Federation; clause 3 art. 105.14 Tax Code of the Russian Federation; Art. 275.2 Tax Code of the Russian Federation | ||

| Art. 105.1 Tax Code of the Russian Federation; subp. 8 paragraph 2 art. 105.14 Tax Code of the Russian Federation; clause 3 art. 105.14 Tax Code of the Russian Federation | ||

| Art. 105.1 Tax Code of the Russian Federation; subp. 9 paragraph 2 art. 105.14 Tax Code of the Russian Federation clause 3 art. 105.14 Tax Code of the Russian Federation | ||

| Art. 105.1 Tax Code of the Russian Federation; subp. 10 paragraph 2 art. 105.14 Tax Code of the Russian Federation clause 3 art. 105.14 Tax Code of the Russian Federation | ||

| Any persons in transactions equivalent to transactions between related parties | Transactions involving intermediaries | Transactions are considered controlled if:

| Clause 1 Art. 105.14 Tax Code of the Russian Federation; subp. 1 clause 1 art. 105.14 Tax Code of the Russian Federation |

| Transactions with global exchange trade goods | Transactions are considered controlled if:

| Clause 3 Art. 105.14 Tax Code of the Russian Federation; sub. 2 p. 1 art. 105.14 Tax Code of the Russian Federation; clause 5 art. 105.14 Tax Code of the Russian Federation; clause 7 art. 105.14 Tax Code of the Russian Federation; letters of the Ministry of Finance of the Russian Federation dated 02.19.2019 No. 03-12-11/1/10545, dated 03.19.2018 No. 03-12-11/1/16985, dated 10.03.2012 No. 03-01-18/7-135, dated 04.09 .2015 No. 03-01-11/51070 | |

| Transactions between persons, one of whom is registered or operates in a country from the list approved by Order of the Ministry of Finance of the Russian Federation dated November 13, 2007 No. 108n | Transactions are considered controlled if their turnover exceeds 60 million rubles. in year | Art. 105.1 Tax Code of the Russian Federation; clause 3 art. 105.14 Tax Code of the Russian Federation; subp. 3 p. 1 art. 105.14 Tax Code of the Russian Federation; clause 7 art. 105.14 Tax Code of the Russian Federation | |

| Any persons who are interdependent (equated to interdependent) with a person who is not a tax resident of the Russian Federation | Any transactions between persons who are recognized as interdependent in accordance with Art. 105.1 of the Tax Code of the Russian Federation or equated to interdependent ones in accordance with paragraph 1 of Art. 105.14 Tax Code of the Russian Federation | Transactions are considered controlled if their turnover exceeds 60 million rubles. in year | Clause 1 Art. 105.14 Tax Code of the Russian Federation; clause 3 art. 105.14 Tax Code of the Russian Federation; letters of the Ministry of Finance of the Russian Federation dated October 3, 2012 No. 03-01-18/7-135, dated September 4, 2015 No. 03-01-11/51070 Letter of the Federal Tax Service dated August 17, 2017 No. ZN-4-17/ [email protected] |

The transactions specified in clause 4 of Art. 105.14 of the Tax Code of the Russian Federation, in particular:

- between participants of one consolidated group of taxpayers;

An exception is transactions with extracted mineral resources, taxed at a percentage rate, as well as transactions for which income (expenses) are taken into account when calculating the tax base for the tax on additional income from hydrocarbon production.

- between persons who simultaneously:

- registered in one subject of the Russian Federation;

- do not have OP in other constituent entities of the Russian Federation, outside the Russian Federation;

- do not pay income tax to the budgets of other constituent entities of the Russian Federation;

- there are no conditions for recognizing transactions as controlled according to the criteria established by sub. 2-6 p. 2 tbsp. 105.14 Tax Code of the Russian Federation;

- have no losses (including losses from previous periods carried forward to future periods);

- for the provision of sureties (guarantees), if all parties are non-banking Russian organizations;

- for the provision of interest-free loans between interdependent persons - residents of the Russian Federation, etc.

Having considered what criteria have been established for controlled transactions in 2020, we will study such an aspect of the relationship between taxpayers and the Federal Tax Service as reporting on relevant contracts.

Currently, the Federal Tax Service of Russia has developed a draft order to amend the form and procedure for filling out the notification of controlled transactions (project ID 02/08/04-17/00063938). The new form of notification of controlled transactions will be applied to transactions completed starting from January 1, 2020 (Letter of the Federal Tax Service of Russia dated March 22, 2018 N ED-4-13/).

Thus, in order to report on controlled transactions for 2017, it is necessary to use the previously valid form (KND 1110025), approved by order of the Federal Tax Service of Russia dated July 27, 2012 No. ММВ-7-13/. The order also approves the format of the report in electronic form and the procedure for filling out the form.

Table. Criteria for controlled transactions 2020 and 2020

| Nature of the controlled transaction | Signs indicating a controlled transaction | Transaction amount to recognize it as controlled |

| Participants in the transaction are interdependent persons and residents of the Russian Federation (Clause 2 of Article 105.14 of the Tax Code of the Russian Federation) | Sum of transaction prices for the year | The total income from transactions is at least 1 billion rubles. |

| One of the parties to the transaction is on UTII or Unified Agricultural Tax, while the other party applies a tax regime different from those indicated | The total income from transactions is at least 60 million rubles. | |

| One of the parties to the transaction applies a 0% income tax rate or is completely exempt from paying it | The total income from transactions is at least 100 million rubles. | |

| One of the parties to the transaction is a resident of a SEZ or a participant in a SEZ that has income tax benefits. In this case, the second party to the transaction should not be a participant in the specified zones | The total income from transactions is at least 60 million rubles. | |

| One of the parties to the transaction has a license to use a subsoil plot on the territory of which there is a new offshore hydrocarbon deposit, or this party to the transaction is the operator of such a deposit and calculates the income tax in accordance with Art. 275.2 Tax Code of the Russian Federation. It is important that the second party to the transaction is not involved in these circumstances or, being the operator of the field described above, does not take into account income (expenses) from this activity when calculating income tax | The total income from transactions is at least 60 million rubles. | |

| One of the parties to the transaction is a participant in a regional investment project, whose income tax rates are distributed as follows: 0% to the federal budget and a reduced rate to the budget of the constituent entity of the Russian Federation. In this case, the second participant in the transaction can also be a participant in the investment project under the same conditions | The total income from transactions is at least 60 million rubles. | |

| One or both parties to the transaction are research corporate companies that are exempt from VAT | The total income from transactions is at least 60 million rubles. | |

| One or both parties to the transaction apply an investment deduction for income tax (Article 286.1 of the Tax Code of the Russian Federation) | The total income from transactions is at least 60 million rubles. | |

| Transaction involving intermediaries - non-related parties | The intermediary is engaged only in the resale of goods | The income from the transaction does not matter |

| The intermediary resells goods and does not bear any risks and does not use its own assets | ||

| Contract in the field of foreign trade in goods of global exchange trade | As a result of the transaction, they sell: oil and oil products, mineral fertilizers, non-ferrous or ferrous metals, precious stones and metals | |

| Foreign economic transaction between related parties | All transactions that meet the characteristics | The income from the transaction does not matter |

How to fill out the Notice of Controlled Transactions?

The Notification of Controlled Transactions form contains 4 sections, which are not required for all companies. The table below provides a brief description of the sections and their purpose.

| Section name | Who fills it out |

| Title page | All companies |

| Section 1A. Information about a controlled transaction (group of similar transactions) | All companies |

| Section 1B. Information about the subject of the transaction (groups of similar transactions) | All companies |

| Section 2. Information about the organization - a participant in a controlled transaction (group of similar transactions) | Companies that conducted controlled transactions with organizations |

| Section 3. Information about an individual participant in a controlled transaction (group of similar transactions) | Companies that conducted controlled transactions with individuals |

Generate a notification about controlled transactions in 1C, upload it to the SBIS Electronic Reporting program and send it to the tax office!

IMPORTANT! Letter of the Federal Tax Service of Russia dated March 22, 2018 N ED-4-13/ [email protected] states that in the notification of controlled transactions for 2020 it is necessary to use the OKVED2 and OKPD2 classifiers.

When reflecting information based on the OKPD2 classifier (clause 043 of Section 1B of the Notification), the first six digits of the code (without dots) should be indicated in accordance with the type of product. For example, unalloyed steel in ingots or other primary forms (code 24.10.21.110) should be indicated as follows: 241021.

If the code indicated on the basis of the OKPD2 classifier has less than six characters, the free spaces to the right of the code value are filled with the value “0” (zero) without separation by dots in accordance with the class, subclass, group and subgroup of products. For example, basic iron and steel products (code 24.10.1) are required to be designated as follows: 241010.

How is the amount of income from a transaction calculated?

According to paragraph 9 of Art. 105.14 of the Tax Code of the Russian Federation, the amount of income from transactions for a calendar year is determined by adding the amounts of income received from such transactions with one person (related parties) for the calendar year, taking into account the procedure for recognizing income established by Chapter. 25 Tax Code of the Russian Federation. Below we will talk about individual types of income.

Loan income

A loan agreement has been concluded between interdependent organizations. Is it necessary to take into account income from this transaction in order to recognize it as controlled? If so, what will be recognized as income: the accrued amount of interest or the amount of the loan received and the accrued amount of interest (This question, in particular, was asked in the Letter of the Ministry of Finance of Russia dated May 23, 2012 N 03-01-18/4-67)? To answer this question you need to refer to Chap. 25 Tax Code of the Russian Federation. In accordance with the rules established by this chapter, when determining the tax base for corporate income tax, income in the form of interest received, including under loan agreements, credit and other debt obligations, recognized as non-operating income (clause 6 of Article 250 of the Tax Code of the Russian Federation) is taken into account ), and income in the form of funds or other property received under credit or loan agreements (other similar funds or other property, regardless of the method of registration of borrowings, including securities under debt obligations), as well as funds or other property received to repay such borrowings (clause 10, clause 1, article 251 of the Tax Code of the Russian Federation). Thus, when determining for the purposes of Art. 105.14 of the Tax Code of the Russian Federation, the amount of income from transactions for a calendar year takes into account income in the form of interest received under a loan agreement. In this case, income in the form of funds or other property received under a loan agreement, as well as funds or other property received to repay such borrowings, are not taken into account when calculating the specified amount.

About intermediary transactions

Taxpayers have especially many questions regarding the procedure for recognizing transactions as controlled, as well as calculating the amounts of income from transactions, when carrying out intermediary operations. This is not surprising, since various situations may arise during the implementation of such transactions.

We have already mentioned one of them above. Let us recall this model once again: if the agent is not an interdependent person with the principal and enters into a transaction on his own behalf with a person who is not interdependent, but is interdependent with the principal, then this transaction will be considered controlled on the basis of paragraphs. 1 clause 1 art. 105.14 Tax Code of the Russian Federation. In relation to this transaction, notifications to the tax authority will have to be sent by the principal and the third party, indicating the entire amount of income from the transaction (Letter of the Federal Tax Service of Russia dated October 26, 2012 N OA-4-13/18182).

A completely different situation arises in cases where the agent is an interdependent person with the principal or with a third party. In the first case (the agent is interdependent with the principal and enters into a transaction with a person who is not interdependent both in relation to him and in relation to the principal), the notification to the agent and the principal reflects the transaction made between the agent and the principal. What will be the income in this case?

For the answer, let us turn again to Chap. 25 Tax Code of the Russian Federation. According to paragraphs. 9 clause 1 art. 251 of the Tax Code of the Russian Federation, when determining the tax base, income in the form of property (including cash) received by a commission agent, agent and (or) other attorney in connection with the fulfillment of obligations under a commission agreement, agency agreement or other similar agreement, as well as for compensation expenses incurred by the commission agent, agent and (or) other attorney for the principal, principal and (or) other principal, if such expenses are not subject to inclusion in the expenses of the commission agent, agent and (or) other attorney in accordance with the terms of the concluded agreements. The indicated income does not include commission, agency or other similar remuneration. Based on this norm, the agent’s income under the transaction will be the agency fee paid by the principal to the agent. A similar conclusion was made, by the way, in the above Letter (dated October 26, 2012 N OA-4-13/18182). In another Letter, the tax authorities expressed, however, a different opinion (Letter of the Federal Tax Service of Russia dated 02/06/2013 N OA-4-13/1706): for the purpose of recognizing a transaction between an agent and a principal as controlled, it is necessary to take into account both the agent’s income in the form of agency fees and income of the principal arising as a result of the execution of the agency agreement. At the same time, regulatory authorities propose to take into account the provisions of civil legislation regarding the regulation of relations between the principal and the agent (commission agent and principal). In particular, according to paragraph 1 of Art. 996, art. 1011 of the Civil Code of the Russian Federation, relations between the named persons in terms of transactions for remuneration do not lead to the transfer of ownership of goods, results of work performed, or provision of paid services. The transfer of ownership occurs only in relation to the services provided for which a commission, agency or other similar remuneration is paid. Thus, when determining the amount criterion in order to recognize transactions through an agent (commission agent) as controlled, one should take into account the moment of transfer of ownership of goods (work, services), guided by the provisions of Chapter. 25 of the Tax Code of the Russian Federation regarding the procedure for recognizing income (Letter of the Ministry of Finance of Russia dated January 25, 2013 N 03-01-18/1-15).

The Letter of the Federal Tax Service of Russia dated 02/06/2013 N OA-4-13/1706 also notes that for the purpose of recognizing a controlled transaction between a third party (for example, the final buyer of goods) and the agent company, it is necessary to take into account the income to be transferred by the agent to the principal on the basis of the agency agreement. As a result of these transactions, the third party incurs expenses, due to which such transactions are subject to Section. VI of the Tax Code of the Russian Federation on the basis of clause 13 of Art. 105.3 Tax Code of the Russian Federation.

Interdependent companies under the Tax Code of the Russian Federation

For the purpose of determining the controllability of transactions, firms that meet the criteria specified in paragraph 1 of Art. 105.14 Tax Code of the Russian Federation. Contracts with their participation are considered by the Federal Tax Service as controlled if:

- “unnecessary” intermediaries are involved in their signing;

- at least 1 party does not have the status of a tax resident of the Russian Federation;

- the amount of turnover on transactions for the year exceeds the established limit (income limits for each category of taxpayers are given in the table below)

The following transactions are considered transactions between related parties:

- A set of transactions for the sale of goods (works, services) made with the participation of formal intermediaries. Such transactions are concluded with the participation of a significant number of persons (intermediaries) who are not interdependent, but do not perform any additional functions other than organizing the sale of goods (work, services) by one person to another person recognized as interdependent with this person, do not bear risks, do not use assets.

- Transactions in the field of foreign trade in goods of world exchange trade (provided that the goods are included in the following groups: oil and goods made from oil; ferrous metals; non-ferrous metals; mineral fertilizers; precious metals and precious stones). Such transactions are considered controlled if the amount of income from transactions made with one person for the corresponding calendar year exceeds 60 million rubles.

- Transactions, one of the parties to which is a person who is a resident of the state, included in the list of states and territories approved by the Ministry of Finance of Russia in accordance with paragraph 1 of paragraph 3 of Article 284 of the Tax Code of the Russian Federation (i.e. is offshore).

Below is a table summarizing the criteria for controlled transactions in 2020.

Exempt from income tax or applies a 0% rate

For the purpose of determining the controllability of transactions, dependent companies include those that meet the criteria of the first paragraph of Article 105.14 of the Tax Code of the Russian Federation.

It is worth noting that contracts that were concluded with their participation are considered by the Federal Tax Service as controlled if the situations meet the following parameters:

- There are no “unnecessary” persons when signing.

- One of the parties does not have the status of “Tax resident of the Russian Federation”.

- The turnover for one year in accordance with the contract exceeds the mark of 60 million rubles.

Subjects of controlled type transactions may be related to each other or equivalent to the following:

- Tax residents and non-residents of the Russian Federation.

- Domestic companies.

- Foreign companies.

It should be noted that not only those who are interdependent, but also other persons who have given tax representatives a reason to pay attention to them can come under the control of the Federal Tax Service.

For example, a common situation is when a company unreasonably reduces the cost of a contract. Let us note that the judicial authorities are not very loyal to inspections by the Federal Tax Service of independent persons.

Which persons are considered interdependent?

The Tax Code states: if the specifics of the relationship between persons may influence the conditions and (or) results of transactions carried out by these persons, and (or) the economic results of the activities of these persons or the activities of the persons they represent, these persons are recognized as interdependent for tax purposes.

To recognize the mutual dependence of persons, the influence that may be exerted due to the participation of one person in the capital of other persons in accordance with an agreement concluded between them or in the presence of another ability of one person to determine the decisions made by other persons is taken into account. In this case, such influence is taken into account regardless of whether it can be exerted by one person directly and independently or jointly with his interdependent persons.

In accordance with paragraph 2 of Art. 105.1 of the Tax Code of the Russian Federation the following are recognized as interdependent persons:

- organizations if one of them directly and (or) indirectly participates in another and the share of such participation is more than 25%;

- an individual and an organization if such an individual directly and (or) indirectly participates in such an organization and the share of such participation is more than 25%;

- organizations if the same person directly and (or) indirectly participates in these organizations and the share of such participation in each organization is more than 25%;

- an organization and a person who has the authority to appoint (elect) the sole executive body of this organization or to appoint (elect) at least 50% of the composition of the collegial executive body or board of directors (supervisory board) of this organization;

- organizations whose sole executive bodies or at least 50% of the composition of the collegial executive body or board of directors (supervisory board) of which are appointed or elected by decision of the same person;

- organizations in which more than 50% of the collegial executive body or board of directors (supervisory board) are the same individuals;

- organization and person exercising the powers of its sole executive body;

- organizations in which the powers of the sole executive body are exercised by the same person;

- organizations and (or) individuals if the share of direct participation of each previous person in each subsequent organization is more than 50%;

- individuals in the event that one individual is subordinate to another individual due to official position;

- an individual, his spouse, parents (including adoptive parents), children (including adopted children), full and half brothers and sisters, guardian (trustee) and ward.

Some clarifications need to be made here. So, in accordance with Art. 105.2 of the Tax Code of the Russian Federation, a direct participation interest is recognized as a share of voting shares of another organization directly owned by one organization or a share directly owned by one organization in the authorized (share) capital (fund) of another organization, and if it is impossible to determine such shares - a share directly owned by one organization, proportional to the number participants in another organization.

The share of indirect participation of one organization in another is recognized as a share that is established in the following order:

1) all sequences of participation of one organization in another are determined through the direct participation of each previous organization in each subsequent organization of the corresponding sequence;

2) the shares of direct participation of each previous organization in each subsequent organization of the corresponding sequence are determined;

3) the products of the shares of direct participation of one organization in another through the participation of each previous organization in each subsequent organization of all sequences are summed up.

Example. Foreign entity A owns 75% of the shares of Company B. The latter, in turn, owns 30% of the shares of Russian trading company C. Also, Company A owns 15% of the shares of Company D, which owns 40% of the shares of Russian trading company C. In such a situation, the share indirect participation of foreign organization A in the authorized capital of Russian trading company C will be 28.5% (75 x 30 + 15 x 40). Accordingly, foreign organization A and Russian trading company C can be recognized as interdependent entities.

The rules described above also apply when determining the share of participation of an individual in an organization. It should be noted that according to paragraph 4 of Art. 105.2 of the Tax Code of the Russian Federation during the trial, additional circumstances may be taken into account when determining the share of participation of one organization in another organization or an individual in an organization.

Please note the following:

1. If the conditions and (or) results of transactions carried out by persons and (or) the economic results of their activities are influenced by one or more other persons due to their predominant position in the market or due to other similar circumstances determined by the peculiarities of the transactions performed, such influence is not a basis for recognizing persons as interdependent for tax purposes (clause 4 of article 105.1 of the Tax Code of the Russian Federation).

2. Direct and (or) indirect participation of the Russian Federation, constituent entities of the Russian Federation, municipalities in Russian organizations in itself is not a basis for recognizing such organizations as interdependent. At the same time, these organizations may be recognized as interdependent on other grounds provided for in Art. 105.1 of the Tax Code of the Russian Federation (clause 5 of Article 105.1 of the Tax Code of the Russian Federation).

3. If, in the opinion of organizations and (or) individuals, the specifics of the relationship between them may influence the conditions and (or) results of transactions they make, these organizations and (or) individuals have the right to independently recognize themselves as interdependent persons for tax purposes ( Clause 6 of Article 105.1 of the Tax Code of the Russian Federation).

4. A court may recognize persons as interdependent on other grounds (Clause 7, Article 105.1 of the Tax Code of the Russian Federation).

Controlled transactions: legislative framework

Tax control over transfer pricing is carried out at the international level and at the level of national legislation.

Among the international documents we highlight:

- Organization for Economic Co-operation and Development (OECD) Transfer Pricing guidelines for multinational corporations and tax authorities (OECD Transfer Pricing guidelines, 2010)

- OECD Declaration on BEPS (Base Erosion and Profit Shifting, 2013). The Declaration represents the OECD's action plan to combat base erosion and profit shifting. As part of the BEPS plan, it is planned to develop transfer pricing (TP) rules that will increase the transparency of transactions between companies by collecting additional information, as well as reduce costs for business.

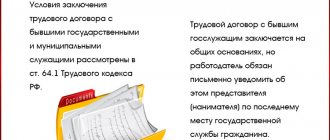

At the level of national legislation in the Russian Federation, transfer pricing issues are regulated by Section V.1 of the Tax Code of the Russian Federation “Interdependent Persons. General provisions on prices and taxation. Tax control in connection with transactions between related parties. Pricing agreement" (introduced by Federal Law dated July 18, 2011 N 227-FZ).

The provisions of this section are aimed, among other things, at preventing the transfer of tax profits outside the Russian Federation, eliminating the possibility of price manipulation in transactions between interdependent taxpayers and taxpayers applying different taxation regimes within the country. These rules replaced Art. 40 “Principles for determining the price of goods, works or services for tax purposes” and Art. 20 “Interdependent persons” of the Tax Code of the Russian Federation.

The composition of controlled transactions is regulated by Chapter 14.4 of Section VI of the Tax Code of the Russian Federation. There are two main categories of controlled transactions:

- Transactions between related parties.

- Transactions equivalent to transactions with related parties.

In addition, a transaction may be recognized as controlled by the court if it is established that it is part of a group of similar transactions completed only to create conditions under which this transaction will not meet the criteria of a controlled one.

This article will primarily focus on controlled transactions between related parties in 2020 and transactions equivalent to them.

Rules for determining the annual amount of income in controlled transactions

- When calculating, the calendar year is taken.

- Income from transactions is determined according to the rules of Chapter 25 of the Tax Code of the Russian Federation (Income Tax). In this case, income received on other grounds, outside the framework of controlled transactions, is not taken into account. For example, exchange rate differences, dividends, income classified as non-taxable for the purposes of Chapter 25 of the Tax Code of the Russian Federation.

- If the persons were interdependent for less than a full calendar year, the calculation takes into account only the income received during the period when such interdependence took place.

- Income from transactions with related parties of the EAEU countries is determined according to general rules.

- If a foreign organization registered in an offshore zone operates through a permanent representative office in the Russian Federation, income from them is determined cumulatively.

Taxation in transactions between related parties

Article 105.3 of the Tax Code of the Russian Federation determines taxation in transactions between related parties. Within the meaning of this rule, any income, profit or proceeds that could have been received by one of the persons participating in a transaction between related parties, but was not received by him, are still taken into account for tax purposes of this person. For tax purposes, prices, income, profits or proceeds received by the parties to such transactions that are not recognized as interdependent, applied in transactions between related parties, are considered to be market prices.

In this case, accounting for income, profit or revenue taxation purposes is carried out if this does not lead to a reduction in the amount of tax payable to the budget system of the Russian Federation. In accordance with the norms of the tax legislation of the Russian Federation, tax authorities, when checking controlled transactions, analyze the completeness of calculation and payment of the following types of taxes:

- income tax (NDFL);

- mineral extraction tax (MET);

- value added tax (VAT);

- corporate income tax.

If, after an audit by the tax authority, it is revealed that the taxpayer has understated the amounts of these taxes, then he cannot avoid adjusting the corresponding tax bases. When making transactions between interdependent persons in which the tax base is calculated based on prices determined in accordance with Article 105.3 of the Tax Code of the Russian Federation, in order to determine the actual price of the transaction, the tax authorities may use the methods established by Chapter 14.3 of the Tax Code of the Russian Federation. It should be noted that the tax legislation of the Russian Federation does not contain direct provisions that would oblige the taxpayer, when concluding transactions between related parties, to use the pricing methods provided for in Chapter 14.3 of the Tax Code of the Russian Federation. However, for tax purposes, income, profit or proceeds of a taxpayer from transactions between related parties are determined in accordance with the provisions of Article 105.3 of the Tax Code of the Russian Federation.

In conclusion, we note once again that all transactions between related parties are subject to mandatory verification for compliance with market prices. If transactions between related parties are made at reduced prices, then when calculating the tax, the taxpayer (participant in the transaction) must indicate the amount of income that he would have received if the transaction had been carried out at adequate market prices.

Controlled foreign companies from January 1, 2020

At the same time, it is provided that the provisions of this subparagraph do not apply to the obligation to pay taxes provided for by part two of the Tax Code of the Russian Federation, payable in relation to the profits and (or) property of controlled foreign companies; upon the sale (redemption) of securities received by the actual owner from their nominal owner, if such securities and their nominal owner are indicated in a special declaration submitted in accordance with the Federal Law “On the voluntary declaration by individuals of assets and accounts (deposits) in banks and on amendments to certain legislative acts of the Russian Federation", the taxpayer-declarant takes into account as actual expenses incurred an amount equal to the documented value of such securities according to the accounting records of the transferring party on the date of their transfer, but not higher than the market

The law on controlled foreign companies may be delayed until 2020

To recognize the Russian owner as a controlling person, the Ministry of Finance agrees to set the share of offshore ownership at 50% (as required by the business), but only for 2020. From 2020, it was proposed to reduce this threshold to 25% for one person or to 10% if the combined shares of Russian residents exceed 50%.

Finally, the Ministry of Finance proposed not to punish taxpayers for violating the rules for declaring offshore profits in 2015–2016.

It is proposed to impose sanctions (20% of the unpaid tax, but not less than 100 thousand rubles) only from 2020. However, according to a source in the Ministry of Finance, we are not talking about the date the law on CFC comes into force, but about the date of final implementation all transitional provisions of the document. The Ministry of Finance, according to him, still proposes that the government begin to apply the law in 2020.

https://youtu.be/F8G7PPbbz8Q

A representative of another department who participated in the meeting told Kommersant that

VAT 2020.

New for foreign companies providing e-commerce services in the Russian Federation

However, from January 1, 2020, such companies must pay VAT and submit reports on services for legal entities, as well as correctly draw up documents entitling the Russian buyer of services to receive a VAT deduction from the budget.

The implementation on the territory of the Russian Federation of exclusive rights to programs for electronic computers, databases, rights to use the specified results of intellectual activity on the basis of a license agreement, inventions, utility models, industrial designs, topologies of integrated circuits, trade secrets (know-how) is still are exempt from VAT [2, sub.

26 clause 2 art. 149]. This exemption will also apply to foreign organizations subject to registration in accordance with clause 4.6 of Art. 83 Tax Code of the Russian Federation. If a foreign organization provides services on the territory of the Russian Federation through an agent or agents who participate

The British Virgin Islands passed the Economic Substance Act

They are then given no more than a year to submit a compliance report to the BVI International Tax Office.

New legal entities registered or created from 1 January 2020 to carry out relevant activities are subject to the presence requirements immediately.

Such information must be provided annually.

Covered companies meet the economic substance requirement if they carry out certain primary income-generating activities in connection with their respective

The Federal Tax Service explained which controlled transactions must be reported in 2019

For interdependent Russian entities, some transactions will not be considered controlled at all if the transaction does not have special features, for example, based on the application of special regimes or on the basis of payment of income taxes, etc.

Currently, such transactions are considered controlled if the amount of income exceeds 1 billion rubles.

Transactions with foreign related parties are now considered controlled if the amount of income from such transactions for the corresponding calendar year exceeds 60 million rubles.

The Federal Tax Service clarifies that the new provisions of Article 105.14 of the Tax Code of the Russian Federation apply to controlled transactions, income and (or) expenses for which will be recognized from January 1, 2020, regardless of the date of conclusion of the relevant agreement.

Accordingly, taxpayers must report controlled transactions for 2020 using the same amount criteria.

Notifications of controlled transactions for 2020 must be sent to the tax authorities no later than May 20, 2020.

Tax on profits of foreign organizations 2019

Moreover, foreign companies that are recognized as tax residents of the Russian Federation in accordance with an international agreement on taxation issues, or those that are managed from the Russian Federation, are equated to Russian companies (clause.

5 tbsp. 246 and sub. 2, 3 p. 1 art. 246.2 of the Tax Code of the Russian Federation). Foreign companies, which within the framework of tax legislation are equated to Russian ones, are required to adhere to all the norms of Chapter.

25 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code) on the calculation and payment of income tax, like Russian tax payers. Foreign organizations that have income from sources in the Russian Federation and conduct their business activities through permanent representative offices are recognized as tax payers in the Russian Federation (clause

1st Art. 246 NK). Moreover, if such companies do not operate through official representative offices in Russia, but have income from sources in the Russian Federation, then they are subject to taxation in accordance with Art.

Verification of transactions between related parties

A decision to conduct an audit of a transaction between related parties can be made no later than two years from the date of receipt of notification of a controlled transaction or notification from the tax authority (clause 1 of Article 105.17 of the Tax Code of the Russian Federation). The form of the decision to conduct an audit of the completeness of calculation and payment of taxes in connection with a transaction between related parties was approved by Order of the Federal Tax Service of Russia dated November 26, 2012 No. ММВ-7-13/907. The period for conducting an audit of a transaction between interdependent persons begins to count from the day the head of the tax authority or his deputy makes a decision to conduct it and until the day the certificate of the audit is drawn up. It is important to note that the period subject to verification cannot exceed three calendar years preceding the year of the decision to verify transactions made by related parties.

Verification of a transaction between related parties cannot be carried out two or more times in relation to one transaction for the same calendar year. Moreover, if one of the parties to such a transaction has already had a tax audit carried out, and based on its results it was established that the terms of the controlled transaction correspond to the terms of transactions between non-related parties, then in relation to such a transaction, tax audits cannot be carried out on other participants in such a transaction. . During the audit of a transaction between related parties, the tax authority has the right to involve an expert, specialist, translator (if necessary). Carrying out a check of the correctness of the application of prices does not prevent the conduct of on-site and desk tax audits for the same period. In addition to the above, the tax authority has the right to send the taxpayer a request to submit documentation provided for in Article 105.15 of the Tax Code of the Russian Federation in relation to the transaction being audited. The tax authority's request form was approved by Order of the Federal Tax Service of Russia dated May 31, 2007 No. MM-3-06/338. The procedure for sending this request is determined by paragraphs 1, 2 and 5 of Article 93 of the Tax Code of the Russian Federation. The tax authority's requirement to provide documents when checking a transaction between related parties must be fulfilled by the person being inspected (participant in the transaction) within thirty days from the date of receipt of such a request. The documentation requested by tax authorities in relation to a specific transaction being audited between related parties, income or expenses for which, for example, were recognized in 2020, may be requested by the tax authority no earlier than December 1, 2020. The requirement to provide documents in relation to a specific transaction being audited between related parties can be directed both to the taxpayer himself and to his counterparties. In this case, the procedure for the tax authorities to request documents in relation to the transaction is established by Article 93.1 of the Tax Code of the Russian Federation.

Documents regarding a transaction are documents reflecting information about the economic activities of the audited taxpayer (participant in a controlled transaction) related to such a transaction:

- a list of persons with whom a controlled transaction was made, a description of the conditions of the controlled transaction, its pricing methods, conditions and terms for making payments under this transaction;

- information about the functions of the persons who are parties to the transaction, about the assets they use, as well as about the commercial risks they accept, which the audited taxpayer took into account when concluding a controlled transaction.

In accordance with Chapter 14.3 of the Tax Code of the Russian Federation, transaction documentation includes information about the methods used by the taxpayer for determining prices in transactions, this is:

- justification of the reasons for the choice and method of application of the method used;

- an indication of the sources of information used;

- calculation of the range of market prices for a controlled transaction with a description of the approach used to select comparable transactions;

- the amount of income received or the amount of expenses (losses) incurred as a result of a controlled transaction;

- other information specified in Article 105.15 of the Tax Code of the Russian Federation.

Verification of a transaction between related parties should not last more than six months, however, in exceptional cases, this period can be extended to twelve months by decision of the head of the tax authority or his deputy. The following may serve as grounds for the tax authority to extend the period for auditing transactions between related parties to one year:

- conducting a tax audit in relation to an organization classified as a large taxpayer (see Article 83 of the Tax Code of the Russian Federation);

- force majeure circumstances that arose at the site of the tax audit of force majeure circumstances (for example, flood, fire, etc.);

- failure by the taxpayer to submit, within the thirty-day period established by clause 6 of Article 105.17 of the Tax Code of the Russian Federation, the documents necessary for conducting a tax audit.

The decision to extend the period for conducting an audit is handed over to the taxpayer or his authorized representative in person against signature or transmitted in another way, confirming the date of its receipt by the addressee. The decision to extend the period for conducting an audit may be sent to the taxpayer by registered mail with acknowledgment of receipt within three days from the date of the decision. On the last day of the inspection, the tax authority draws up a certificate of the inspection carried out, which indicates the subject of the inspection and the timing of its implementation. A certificate of the audit of the transaction must be handed to the taxpayer being audited. If, based on the results of an audit, the tax authorities revealed a deviation of prices for controlled transactions from market prices, which resulted in an understatement of the tax base, an official of the tax authority draws up an audit report within two months from the date of drawing up the certificate of the audit. The form of the inspection report and the requirements for its preparation were approved by Order of the Federal Tax Service of Russia dated November 26, 2012 No. ММВ-7-13/907. The requirements for drawing up an inspection report are contained in paragraph 3 of Article 100 of the Tax Code of the Russian Federation. Tax authorities can check prices for transactions between related parties and as part of desk and field tax audits (see Letter of the Federal Tax Service of Russia dated September 16, 2014 No. ED-4-2 / [email protected] ). In any case, the tax authority will need to prove that the taxpayer received an unjustified tax benefit through price manipulation in transactions made by him.