Home / Real estate

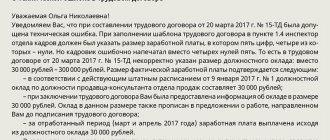

Back

Published: 05/27/2020

Reading time: 4 min

1

670

Working in the real estate market, I often come across such concepts as sham transactions. I want to warn you that they are not as harmless as they seem at first glance.

- Definition of a sham transaction and legal regulation

- Components of a cover transaction

- Hidden deal

Dear readers! To solve your problem, call hotline 8 or ask a question on the website. It's free.

Ask a Question

The concept and content of an imaginary transaction

A striking example of this is the alienation of property under the guise of sale or donation in order to avoid its confiscation. In fact, the owner of the property does not intend to give up the property he owns. On the contrary, he wants to keep it, avoiding illegal confiscation.

When determining the nature of the agreement, it is usually established whether there was a real transfer of property. Confirmation of this, for example, if we are talking about an apartment, will be receipts for payment of utilities, taxes (on whose behalf the payments were made), who is registered in it, who is making the repairs.

If an agreement is concluded between legal entities, then the coincidence of their addresses and the names of the founders may indicate its imaginary nature.

What you should pay attention to when determining the nature of the contract and what speaks in favor of the fact that it is imaginary:

- the parties to the agreement, in order to be on the safe side and give it a legal appearance, often have it certified by a notary, although by law it could be limited to a simple written form;

- the actions of both parties are aimed at completing an imaginary transaction: none of them wants or is interested in its reality. For example, a purchase and sale is formalized between close relatives (parents and son). In this case, the apartment actually remains with the seller, and the amount of the loan taken from the bank for the purchase of housing, or maternity capital, is with the buyer and spent by him for other purposes.

https://youtu.be/ZXgl9bR_gzM

Sham transaction and civil law

The definition of a sham transaction is given in paragraph 2 of Article 170 of the Civil Code of the Russian Federation. According to this norm, a sham transaction is a transaction that was concluded with the aim of covering up another transaction, including a transaction on different terms. From this definition of a sham transaction, two integral components of a sham transaction can be identified:

- a covering agreement is a pretend agreement that is made only for show;

- covered transaction – i.e. in fact, the agreement that the parties would like to completely hide from all other persons, including inspectors. This is an actual illegal interaction between the parties (for example, the sale of a larger batch of goods than was specified in the covering agreement to evade tax consequences and the need to charge taxes).

Note that the covered transaction may or may not be valid. When a covered transaction has nothing illegal in its basis, the rules governing this type of transaction are applied to it. If the covert transaction is illegal, then, like the sham transaction, it is declared invalid.

A sham transaction reflects an accounting item instead of another accounting item in order to cover it up. For example, concluding a lease agreement instead of a purchase and sale transaction.

The concept of a sham deal

The formalized sham transaction is intended to hide another agreement. The parties enter into a legal relationship, but this is not the relationship referred to in the agreement. Most often, citizens do not even consider the document they signed to be illegal. Here are examples of sham transactions:

- execution of two sales contracts instead of exchanging residential premises (to obtain a tax deduction);

- execution of a gift agreement, although in fact a purchase and sale took place. For example, so that only the donee is legally the owner of the home, and his wife cannot lay claim to it;

- registration of sale and purchase instead of donation: the donee does not want to pay income tax on the value of the property received as a gift;

- sale of a car under the guise of issuing a power of attorney for its management and disposal (in order to avoid the costs of registering the sale and purchase and insurance);

- registration of purchase and sale indicating the undervalued value of the item.

They may be declared invalid by a court decision at the request of an interested person. But at the same time, the real deal - the one they tried to disguise - remains in force. For example, if the plaintiff in court can prove the fact of transfer of money when donating an apartment, then the donation will be canceled and the purchase and sale will be legalized.

Recognition of a transaction as feigned in part of one of the parties: how to recognize a transaction as feigned

By default, a party to an agreement is the person indicated as such in the text of the agreement itself and, as a rule, who signed it. But sometimes it happens that one person is indicated as a party to the contract, but in fact another person is a party to it, performing all the actions necessary for its conclusion and execution. The legal consequences of concluding such an agreement are not defined by law, but in many cases there are attempts to recognize such agreements as sham. How correct and promising this method of protecting the rights and interests of the person who actually concluded and executed the contract was was discussed on the Ukrainian Law portal.

Position 1. An agreement concluded by a person other than a party to it is a sham as far as that party is concerned, because:

– textually the norm of Art. 235 of the Civil Code was formulated narrower than its full content, which means there is a need for a broad interpretation. The mention in the text of the norm of those same parties is due to the fact that when formulating the norm, the legislator imagined the most common situations (when the discrepancies between the real and feigned content of transactions are not related to the identity of the parties who made them);

– for the rule of law, it is equally unacceptable for both situations when persons enter into a purchase and sale agreement between themselves, but pass it off as a gift, and situations when conditional Ivanov and Petrov enter into an agreement with each other, but pretend that the agreement was concluded between Ivanov and Sidorov;

– the law should regulate real relations, and not those in which there is only the appearance of their existence. This is precisely the idea contained in Articles 234 and 235 of the Civil Code. This idea determines the purpose of the rules - to prevent the creation of legal consequences for those relations that actually did not take place, but to create legal consequences for the real relations of the parties;

– the widespread practice of courts on “recognizing a contract as invalid in part of one of the parties”, in essence, is the application of the rule on sham transactions;

- in these cases, the parties to the transaction had only one transaction - between themselves. They brought in a third person to pretend. This person was not actually a party to the transaction;

– the contract may be feigned in some part. If that part of the contract that the parties actually had in mind does not contradict the law, then the consequences of the contract actually concluded by the parties will simply apply;

– by a resolution dated January 16, 2012, the Supreme Court of Ukraine refused to review the decision of the Supreme Court of Ukraine, which upheld the decision of the appellate court to recognize the agreement for the sale and purchase of an apartment as fraudulent from the moment of its conclusion in terms of the buyer and recognizing the plaintiff as the buyer under this agreement.

Position 2. The contract cannot be considered sham in part by one of the parties. But it may be invalidated because:

– according to the Plenum of the Armed Forces of Ukraine, part 2 of Art. 58 of the Civil Code of the Ukrainian SSR (analogous to the current Article 235 of the Civil Code) must be understood in such a way that the participants (subjects) of a sham and hidden transaction (the one that the parties had in mind) can only be the same, and not third parties;

– if the court recognizes the transaction as sham, this will only mean that the legal relations between the parties should be regulated by the norms of the transaction that was hidden. For example, if it is established that instead of a gift agreement, the parties entered into a purchase and sale agreement, this means that the legal relationship between the parties should be governed by the rules of the purchase and sale agreement;

– in such cases, the two parties actually agreed on the rights and obligations of the third party;

– a contract cannot be valid if one of the parties has no will;

– the introduction of conditions into a contract that do not reflect the actual will and expression of the parties is unlawful, and therefore such a contract should be declared invalid;

– The Supreme Court of Ukraine, by a ruling dated 10/05/2011, and the Supreme Court of Ukraine, by rulings dated 06/27/2012, 11/14/2012 and 04/24/2013, overturned the decisions of lower courts to recognize contracts as sham in part of one of the parties.

Opinion of the project lawyers: Recognizing an agreement concluded by a dummy as a sham is associated with a number of difficulties caused by the existing approach in legislation to determining the essence of a sham agreement and the legal consequences of its conclusion. According to Art. 235 of the Civil Code, only a transaction that is made by its parties to cover up another transaction that was actually completed is feigned.

That is, in order to recognize a transaction as sham, it must have a content defect: the formally recorded rights and obligations of the parties to such a transaction do not correspond to the rights and obligations that the parties actually agreed upon. The legislator does not classify transactions made with the cover of the true party and, thus, having a subjective defect, as feigned, and therefore the grounds for an expanded interpretation of the provisions of Art. 235 Civil Code are missing.

As the courts (primarily the Supreme Court of Ukraine) note in the decisions set out in Position 2, as well as in many other decisions on this issue, in a sham transaction, both parties consciously, for a specific purpose, document one transaction, but in fact there are established between them other legal relations. Therefore, to recognize a transaction as sham, it is necessary that both parties to the contract act consciously to achieve some personal benefit; their actions must be aimed at achieving other legal consequences and conceal the different will of the parties to the contract. The intention of one party to enter into a sham agreement is not enough.

Accordingly, it is impossible to recognize a transaction as sham if the parties do not have a goal to hide their true will, but only have a goal to hide one of the parties to this transaction.

In addition, the courts rightly draw attention to the fact that Art. 235 of the Civil Code does not provide for the possibility of applying other legal consequences, except for the extension of the rules governing a sham transaction to the legal relations of the parties. Therefore, even if we assume that an agreement concluded with concealment of its real party is a sham transaction, it is not possible to recognize it as invalid, including in terms of the subject.

In this regard, it may be more correct in such situations to file claims not to recognize the transaction as feigned and/or invalid in part of the parties, but to transfer the rights and obligations of a party to the agreement from the person who formally concluded the transaction to the person who actually established the appropriate legal relations.

True, it is relatively easy to transfer to the true person the rights of the creditor received by the figurehead in the corresponding obligation. The legal basis for presenting such demands may be clause 4, part 1, art. 512 of the Civil Code, which provides for the possibility of replacing the creditor in an obligation as a result of the fulfillment of the debtor’s obligation by a third party.

For example, if the real buyer of an item proves that it was he who, using his own personal funds, fulfilled the obligations of the front person to pay the cost of this thing, then he will be able to obtain the rights of a creditor in the obligation to sell and, accordingly, demand the return of the corresponding amount from the front person. This is if we interpret the provisions of clause 4, part 1, art. 512 of the Civil Code is limited, extending them only to a separate obligation arising from a purchase and sale agreement. If we approach its interpretation more broadly, then all the rights of the buyer, including the right to receive the purchased item in ownership, must pass to the person who actually fulfilled the obligations instead of the debtor.

However, this method of protecting the rights of the true party to the contract is not yet popular in practice, and therefore requires additional testing in practice.

CONCLUSION:

Attempts to recognize contracts concluded by dummies as feigned and therefore invalid in part of one of the parties are met with rejection by the cassation courts. After all, the legislation defines completely different grounds for recognizing contracts as feigned and completely different consequences of such recognition. Therefore, persons who have actually entered into relevant agreements should look for other ways to protect their rights. One of these methods may be claims for the transfer to a person who is actually a party to the contract of the rights of the corresponding party to the contract. The basis for such requirements will be the fact that it was this person who fulfilled all the obligations assigned to the nominal debtor under this agreement.

What risks do the parties to the agreement bear?

Any violation of the law by any party to the contract calls into question the possibility of subsequent protection of its interests. Thus, by covering the sale of a car with a power of attorney, the actual buyer is at great risk. He will save money when he gets the car, but then he may lose it completely. After all, by issuing a power of attorney, the seller continues to remain the owner of the car, and probably, after the expiration of the power of attorney, will not want to issue a new one. Moreover, he can cancel it at any time.

If the contract specifies a lower price for housing, the buyer also runs a risk. If the transaction is declared invalid by the court, then only the amount specified in the contract will be returned to him.

Going to court

The statute of limitations for filing claims to invalidate transactions due to their illegal nature is set at three years. Interested persons whose interests have been violated can file such a claim. But at the same time, the plaintiff will have to make a lot of efforts to prove the transaction is fictitious. This is especially true for sham transactions. After all, when they are completed, a change in ownership or transfer of the subject of the transaction actually occurs. For example, a company purchases materials at a reduced price. In fact, it covers their gratuitous transfer, and donation between commercial legal entities is prohibited.

If the transaction is proven to be fraudulent, the buyer returns the goods or brings the agreement into compliance with the contract with the subsequent payment of due taxes. Transactions between legal entities are easier to analyze: the purchase price can be determined from the documents. It is much more difficult to do this in relations between citizens.

Sometimes the desire to save money when completing an agreement or pay less taxes turns against one of its participants and leads to the loss of a larger amount. Only if the parties comply with all the requirements of the law does it protect their interests.

How to properly challenge a sham gift agreement in 2020

So, due to its initial insignificance, a feigned deed of gift, according to Article 166 of the Civil Code of the Russian Federation, is considered invalid from the moment the transaction is concluded, which determines the consequences and the possibility of challenging them.

Simply put, these transactions can be challenged without a court decision. However, if the proof of such a transaction is provided for by the legislator, the interested party will have, in accordance with Article 56 of the Code of Civil Procedure, to present undeniable evidence and grounds for recognizing the transaction as void.

The procedure for recognizing a gift agreement as feigned

Let us immediately note that the recognition of a gift agreement as feigned, with the subsequent application to its parties of the consequences of invalidity, today, as a rule, is carried out only through legal proceedings in court . At the same time, the recognition procedure consists of 6 stages:

- Obtaining legal advice . We hasten to warn you that judicial practice regarding proof of the sham of contracts is quite ambiguous. Thus, proper evidence will require the plaintiff to have the appropriate experience and legal analysis to support his or her claims. Therefore, we highly recommend that you get a free consultation from our lawyers , after which you will be able to determine the right direction of action and will definitely get a positive result!

- Collection of necessary documents and evidence . Since the burden of proving the sham of the gift transaction falls on the plaintiff, it is he who is obliged to prepare a package of documents to substantiate his position. Such papers can be any documentary evidence proving the fact of compensation for the transaction. It is worth noting that in 2020, this evidence can be not only documentary (Chapter 6 of the Code of Civil Procedure). Also, do not forget to collect the standard documents that are specified in Article 132 of the Code of Civil Procedure.

- Payment of the state-established duty . Before filing a statement of claim, the plaintiff should take care of paying the state fee by attaching a receipt of successful payment, in accordance with Article 132 of the Code of Civil Procedure, to the statement of claim. Since the invalidation of a gift agreement is of a non-property nature, in 2020 the state duty is 300 Russian rubles (information from Article 333.19 of the Tax Code of the Russian Federation) for ordinary citizens and 6,000 Russian rubles for commercial organizations. If the fee is not paid or the specified receipt is missing, in accordance with Article 136 of the Code of Civil Procedure, the court sets a new deadline for submitting documents.

- Drawing up a claim and submitting an application to the judicial authorities . In the statement of claim being drawn up, the plaintiff must describe in as much detail as possible the circumstances and facts of the feigned donation, listing all legal grounds and supporting them with appropriate references to the violated legislative norms, expressing his own requirements, in accordance with the norms set out in Articles 167 and 170 of the Civil Code of the Russian Federation. A statement of claim, in accordance with Article 28 of the Code of Civil Procedure, must be filed with the court at the location of the defendant or his place of residence.

- Consideration of the case in court . As part of the judicial consideration of the claim, as we wrote above, the interested party will have to not only indicate his position, but also try to prove the deed of gift is feigned. At the same time, if the need arises, this person has the right to apply for the involvement of other persons (for example, specialists or witnesses). Remember that the final court decision depends on the completeness of the evidence base!

- Execution of a court decision . If the stated requirements are satisfied and the gift agreement is recognized as fraudulent, the stage of execution of the court decision will begin, which can be implemented in one of two ways - forced or voluntary. For example, if the culprit tries to avoid execution of the court decision, the plaintiff will have to initiate legal proceedings, within the framework of which the defendant will be dealt with (monitoring the execution of the court decision) by bailiffs.

What documents are needed to file a claim for recognition of a deed of gift?

In order for an interested person to file a claim to challenge a feigned deed of gift, he needs to collect the following documents, the list of which is indicated in Article 132 of the Code of Civil Procedure:

- A copy of the citizen's passport;

- receipt of successful payment of the established state duty;

- a copy of the statement of claim;

- copies of papers that are evidence of the plaintiff’s case (letters, certificates, expert opinions, receipts, etc.);

- copies of the disputed deed of gift;

- notarized power of attorney (only if his legal representative acts instead of the plaintiff in court).

It is worth noting that the number of copies of the gift agreement, the claim, as well as the collected documentary evidence depends on the number of participants in the trial. Also, in some cases, the list presented above may be expanded with additional documents.

Consequences of recognizing a gift deed as feigned in 2020

According to the norms established in paragraph 2 of Article 167 of the Civil Code of the Russian Federation, if a transaction is recognized as fraudulent, the generally accepted consequence of invalidity will be applied to it, that is, the return of property benefits received as a result of the conclusion of a deed of gift.

Moreover, since the pretense of a gift is, as a rule, recognized due to the lack of gratuitousness of the transaction, the donor will be obliged to return the counter-representation that was given to him in exchange for the gift.

Important : It is worth noting that the consequences of mutual return may apply not only to property benefits and rights. So, according to the information set out in Article 167 of the Civil Code of the Russian Federation, it also applies to services, work performed, duties, etc. In this case, the donor will be obliged to pay these return claims in full.

Also, it is necessary to understand that the rules of mutual return in 2020 will be applied only in cases where other special consequences of the invalidity of the deed of gift cannot be established or the application of such special consequences is not possible. We remind you that, according to paragraph 2 of Article 170 of the Civil Code of the Russian Federation, in relation to a sham gift agreement, the legislator requires compliance with the rules governing the sham transaction. You can learn more about this from this video:

Simply put, when declaring a deed of gift to be feigned, if the essence and content of the transaction covered by the gift complies with the established standards, the court can force the donor and the donee to enter into a real transaction or recognize it as legal.

Of course, all this will, first of all, depend on the content of the statement of claim, the plaintiff’s requirements and his interests. In the event that a covered gift transaction is considered invalid, general consequences will be applied to it.

Afterword and recommendations

As you can see, recognizing a gift agreement as feigned in 2020 is a rather complicated legal procedure that requires experience in the legal field. Therefore, we recommend that you definitely contact our lawyers and get a free online consultation! Save your nerves, time and money! We work for you 24/7!

Previous

Gift Parties to a gift agreement: rights, obligations, prohibitions

Next

Gift deedReal gift deed - what do you need to know about the transaction?