What is salary

All issues related to labor relations are regulated by the Labor Code of the Russian Federation. Section VI of the same name is responsible for payment and standardization of labor. In Art. 129 of the Labor Code of the Russian Federation provides a definition of salary, which can be divided into three parts and presented in the form of the following diagram:

As you can see, the legislation does not directly define what the variable part of wages is. Let us analyze the scheme in more detail and answer the question of which of it relates to the variable part of wages.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

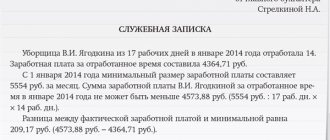

Remuneration for labor is understood as a fixed payment - salary, which is prescribed in the employment contract with the employee and can be changed only with his written consent. In addition, the salary cannot be less than the legally established minimum wage at full rate.

Compensation payments refer to payments guaranteed by the state to certain individuals or individuals working under certain conditions. These could be bonuses for work in the Far North, in territories exposed to radioactive contamination, etc.

Neither the first nor the second option can relate to the variable part, since they are quite strictly regulated either by the state or by relations with the employee.

Thus, the last component of the salary remains - incentive payments. This is the variable part of wages, and we will examine what exactly this refers to further.

Subscribe to our newsletter

Read us on Yandex.Zen Read us on Telegram

Not accrual of the variable part of the salary 100 rubles.

Good afternoon, Arviy. If your employment contract states that this variable part is established in accordance with the Regulations on Remuneration and Labor Incentives, then this provision must be present and employees must be familiarized with it upon signature.

The variable part is just a broader concept than the premium. This includes a bonus and other stimulating additional payments and allowances. In principle, payment of incentive payments is made at the discretion of the employer; the Labor Code of the Russian Federation does not indicate that such payments are mandatory.

The variable part may not be accrued to you, especially since the Employment Agreement does not stipulate that the variable part must be paid every month. But if there is a reference to the Regulations on Remuneration and Incentives in the employment contract, then the employer must have such a document. But in any case, the payment of variable payments is the employer’s right, not an obligation.

As for the employer’s demand to resign and threats, these are definitely illegal actions. If they continue to threaten you with dismissal, you can file a complaint with the prosecutor’s office.

One more thing - you are not required to work on Saturdays and Sundays if these are your days off. This is possible only with the consent of the employee (except for some exceptions) for work on such days, double pay or single pay and time off are due. Article 159 of the Labor Code of the Russian Federation states:

Work on a weekend or a non-working holiday is paid at least double the amount:

for piece workers - no less than double piece rates;

employees whose work is paid at daily and hourly tariff rates - in the amount of at least double the daily or hourly tariff rate;

for employees receiving a salary (official salary) - in the amount of at least a single daily or hourly rate (part of the salary (official salary) for a day or hour of work) in excess of the salary (official salary), if work on a day off or a non-working holiday was carried out within monthly standard working time, and in an amount of at least double the daily or hourly rate (part of the salary (official salary) for a day or hour of work) in excess of the salary (official salary), if the work was performed in excess of the monthly standard working time.

Specific amounts of payment for work on a day off or a non-working holiday may be established by a collective agreement, a local regulatory act adopted taking into account the opinion of the representative body of employees, or an employment contract.

At the request of an employee who worked on a day off or a non-working holiday, he may be given another day of rest. In this case, work on a weekend or a non-working holiday is paid in a single amount, and a day of rest is not subject to payment.

Remuneration for work on weekends and non-working holidays of creative workers of the media, cinematography organizations, television and video crews, theaters, theatrical and concert organizations, circuses and other persons involved in the creation and (or) performance (exhibition) of works, in accordance with lists of jobs, professions, positions of these workers, approved by the Government of the Russian Federation, taking into account the opinion of the Russian Tripartite Commission for the Regulation of Social and Labor Relations, can be determined on the basis of a collective agreement, a local regulatory act, or an employment contract.

That is, if you are deprived of a bonus specifically for not going to work on your days off, this is unlawful, since wages are due for working on weekends, and not the payment of a bonus; the payment of a bonus in this case is a secondary matter. Therefore, if you continue to be forced to work on weekends, then this is unlawful; in this case, you can file a complaint with the prosecutor’s office or the labor inspectorate.

Conclusion: they can be deprived of the variable part, but not on the basis of not going to work on weekends; wages on weekends are paid in double amount or in single amount with the provision of time off. An employee has the right to refuse to work on a day off, except for a number of exceptional cases, which are specified in Art. 113 Labor Code of the Russian Federation.

Contact a lawyer

| Mayorenko Margarita Sergeevna, Nizhny Novgorod | |

| Email: | [email protected] |

| ICQ: | 668196121 |

The variable part of the salary is incentive payments

Incentive payments - the variable part of the salary - include:

- Bonuses paid to employees.

Here we should make a reservation that the conditions for paying bonuses vary. If the payment is specified in an employment or collective agreement and is paid in a fixed amount or as a fixed percentage of the salary, and its payment is tied to a specific recurring event, for example, it is issued quarterly, then such a bonus should be classified more as a fixed payment. If the bonus is tied to the results of work, to any single events, for example, to exceeding the sales plan or to concluding a profitable large contract, then such a bonus can be safely attributed to the variable part of the salary. It should be approved by order of the manager and signed by all employees receiving the bonus.

- Various compensations not specified by law: transportation costs, mobile communications, food, visits to a fitness club, payment for any professional courses, etc.

- A separate line should be taken of the VHI policy, which is also very often offered by employers.

Legal regulation

FZ-90 made significant amendments to Art. 129 of the Labor Code. As a result, wages and salaries are now used by the legislator as synonyms.

According to the official definition, wages are remuneration for work, which indicates a remunerative legal relationship between employer and employee. At the same time, wages indicate precisely the labor format of the relationship and distinguishes it from the civil law format (in the latter case, wages are not paid, but we are talking about the price of the contract).

Wages are established by agreement of the parties and are fixed in the employment contract (based on Article 135 of the Labor Code). But when determining the size of the salary, the employer should take into account the minimum wage established by the state, below which it is not allowed to fall.

The legal basis of wages, its form, terms and payment procedure are determined by the Labor Code. The essential features of wages, taking into account the provisions of the Labor Code governing them, are the following:

- Timely payment of wages is the employer’s responsibility under Art. 22, 56 Labor Code.

- Wages are paid to the employee for individual work on a systematic basis.

- Wages for an employee performing a certain labor function (in particular, work in a position or profession) is one of the main rights of the employee under Art. 21 Labor Code.

- The amount of wages in terms of the maximum value is not limited in any way and is determined on the basis of current official salaries or tariff rates.

Wages mean a certain amount of money, but it is also possible to pay part of it in kind by agreement with the employee in the amount of no more than 20% of total earnings.

The amount of an employee’s salary is influenced by a number of factors: his level of education, qualifications, work experience, length of service, rank, duration of the shift assigned to him, geographical working conditions, etc.

Wages are responsible for a number of important economic functions, including economic reproduction, stimulating workers to work, regulating the labor market, etc.

What does the average monthly salary consist of?

From time to time it happens that in order to provide an employee with information or make payments that comply with the law, the manager resorts to tricks. Most often, she only takes into account one salary, and additional payments are left aside . Of course, such actions do not occur in accordance with the law.

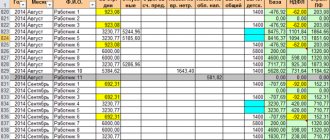

Regulations for calculating average monthly wages are prescribed in the Labor Code of the Russian Federation (Article 139) . Therefore, when an employer calculates the average monthly salary, he needs to take into account:

A month is its duration according to the calendar (from the first to the thirty-first day, except February).

It is advisable to give an example in the following circumstances: the worker performed his job duties for the entire last twelve months, without missing work days or taking sick leave. He wants to take advantage of his vacation. In this case, payments are determined simply: Average monthly salary = payments for the year/12.

Benefits, vacation pay and travel allowances: included or not

The basic salary includes additional payment for the time the employee is on a business trip, as well as annual paid leave, in accordance with Chapter 19 of the Labor Code. The salary does not include compensation for travel expenses, such as hotel payments, travel costs, meals, etc. Vacation pay is paid based on average earnings for continuous work during the 12 calendar months preceding the month the vacation starts.

According to Article 129 of the Labor Code of the Russian Federation, payments not related to wages, for example, from extra-budgetary funds, which include various types of benefits, including disability benefits, maternity benefits, are not included in the calculation of wages.

Structure according to the Labor Code of the Russian Federation

There have been some changes in legislation (No. 90-FZ), in particular in Article 129 of the Labor Code of the Russian Federation, and remuneration is currently synonymous with wages.

Wages (employee remuneration) are remuneration for work, which depends on its qualifications, quality and complexity.

Compensation charges are also included in the concept of wages, including for work in difficult conditions, as well as payments motivating work (additional payments and bonuses).

This structure consists of the following parts (see diagram):

- basic (main) part;

- compensation payments;

- incentive payments.

The base part is determined from the basic payment system for the work.

Its amount cannot be less than the minimum wage.

The basic part represents the basis of the salary and its size is not affected by the number of sales, income received and other nuances. The basic salary is determined for the actual period of time worked, or for the results of work performed according to official salaries.

When a manager displays the basic part of the salary, he must keep in mind the following data:

- an employee’s salary can be determined based on his qualifications, volume of work and complexity of production tasks;

- no discrimination should be allowed when determining the terms of payment for work;

- payment must correspond to the work performed.

Compensatory payments . and incentives represent a variable share of salary . and it, in turn, depends on the conditions and guarantees of accruals for work from a particular manager. These payments do not depend on remuneration for actual time worked or actual tasks completed.

Compensation payments are characterized by a method of local regulation. This applies to the greatest extent to incentive payments when basic rules are established by law. The legislation defines a list of compensation payments, and the manager must pay them:

- for performing tasks under certain circumstances (working in difficult conditions, with hazardous substances, in areas with a specific climate);

- for performing work in areas where radioactive contamination has occurred;

- for work under circumstances that are not considered normal (performing additional tasks due to the absence of another worker, working at night or overtime, as well as work on holidays and weekends).

The amount of compensation payments is determined based on agreements and collective agreements . The amount of these payments cannot be less than those established by law. Along with this, the legislation determines a higher payment for work for those citizens who work on a rotational basis or in the Far North.

Based on this, the main task of compensation payments is considered to be the reimbursement of excessive labor costs of an employee, which depend on the work schedule and conditions for completing tasks. Compensation payments are made as an increase to official salaries and tariff rates.

Incentive payments are considered to be a variable component of the salary, and it depends on the basic income, on the specific result of the employee’s work, and so on.

Incentive payments, as well as the bonus part, are not subject to regulation by law.

the manager’s right to make such payments . It is necessary to make a note that if motivating payments are provided for in the remuneration regime, then the manager must implement them, and the employee can demand them if he fulfills the work plan.

It can be concluded that incentive payments fall under the characteristics of financial payments for the performance of specific work tasks.

Incentive payments are needed so that employees have an incentive to achieve those results . for which the calculation of the basic salary is not enough, as well as encouraging the desire of workers to improve their skills and minimize staff turnover.

Incentive payments are assigned in the following cases:

- for professionalism;

- excellent qualifications;

- years of production at the enterprise;

- knowledge of foreign languages.

It should be noted that to motivate employees to work, enterprises have a bonus system . Bonuses are paid as a reward for the quality performance of an employee’s work. The bonus system is divided into two parts:

- Rewards that are included in payment for work.

The employee is entitled to this remuneration, and this means that the manager must make this payment if the employee fulfills specific plans for which the bonus is due . Under other circumstances, an employee cannot ask for a bonus.

- Incentives that are not specified in the salary plan.

Such payments are made in a lump sum at the request of the manager. Incentives are not paid every month, but are carried out based on specific achievements of the employee . In this circumstance, the manager is not obliged to make such payments, but they can be made at his request.