Teaching staff in schools and kindergartens: what is tariffication for them?

Remuneration for representatives of the teaching sector depends on the following factors:

- qualification;

- experience;

- educational qualification;

- teaching load, and so on.

The tariff system is developed in each institution in such a way as to comply with the standards in force for a particular industry.

The main components of remuneration for labor are official salaries or rates, compensation and incentive payments.

In the case of the public sector, tariffing becomes a mandatory procedure. It is carried out in schools and in relation to other educational institutions. But there are exceptions. For example, it is not provided for kindergartens. The administration of these institutions can independently make decisions regarding how labor will be paid.

The following components are installed separately:

- Basic rates.

- Calculation procedure.

- Payment of bonuses.

- Allowances for work intensity.

- Rewards for holding events.

All rules are prescribed in detail by internal regulatory documents.

Tariffing of employees

As a general rule, at the first stage the head of the organization approves a permanent body - the tariff commission. Its composition should include the direct head of the organization and be its chairman, as well as personnel and accounting workers, an economist, and representatives of the trade union.

Practical situation

How to choose wages and write them down in the contract. Five formulations for different situations

The answer was prepared jointly with the editors of the magazine “Personnel Business”

Answered by Andrey BEREZHNOV, Ph.D. Sc., lawyer at Balashova Legal Consultants, associate professor of the Department of Labor Law, Faculty of Law, Moscow State University named after M.V. Lomonosov (Moscow)

When an employee produces products according to a standard and its quality and quantity can be assessed, this is used as the basis for remuneration. Piece payment encourages employees to perform their work efficiently and on time, and not to depend on the results of the team. Piece payment is being introduced in production areas.

What determines the amount of remuneration? The employer multiplies the quantity of quality products produced by an employee over a certain period by the cost of a unit of production. This ultimately determines the amount of wages. The more products an employee creates, the higher the salary...

Next, the created commission determines the size of workers’ salaries, as well as increasing coefficients and various incentive and compensation payments and records this in the tariff lists.

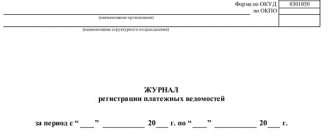

As a rule, tariff lists are compiled, like the staffing table, at the end or beginning of each year, or when wage conditions change.

Separately, it is worth considering the issue of compiling tariff lists for teaching staff. By order of the head of the educational institution, a person responsible for tariff setting is appointed; as a rule, this function is assumed by the chief accountant. The list is compiled before the start of the school year.

The total workload of teachers must correspond to the training hours, plan and programs established by the federal educational standard. The procedure for the formation of remuneration for teaching staff, as well as increasing coefficients and additional payments, is developed in accordance with the order of the Ministry of Education and Science of the Russian Federation dated December 22, 2014 No. 1601, the regulations on remuneration of a specific educational institution, collective and labor agreements.

Teaching staff must be familiarized with the established teaching load upon signature. During the academic year, when curricula and programs change, the head of the organization has the right to make changes to the tariff list of teaching staff.

Read tips on how to work according to the tariff system of remuneration from the experts of System Personnel

- How, under a piece-rate wage system, calculate the salary of an employee who performs work at a lower rate than the one set for him;

- Is it necessary to change the employee’s rank to the qualification level specified in the professional standard? The organization has established a remuneration system at tariff rates in accordance with the ETKS categories;

- How to calculate wages using a piece-rate wage system.

School pricing rules

For school representatives, pricing is carried out every day. In the spring, a preliminary table is drawn up with figures calculated for the next year. In most institutions it starts on September 1. Then the teachers themselves are introduced to the table.

Thanks to this, each teacher receives information regarding what basic and additional courses are provided for him in the current year. The employee signs the document if he has no objections to the available data.

Salaries of public sector workers in 2020

Taking into account the variety of legislative approaches to determining the wages of employees working in budgetary organizations of various formats (payment according to the unified technical system, according to salaries determined by resolutions of the Cabinet of Ministers, decisions of local governments, industry orders), we will consider changes in determining the size of salaries for each of these formats and determine what calculations should be made in connection with the establishment of the minimum wage at the level of 3200 UAH.

In this section of the publication, we will consider the conditions for remuneration of workers, determined by order of the Ministry of Labor of Ukraine dated 02.10.96 No. 77 (hereinafter referred to as order No. 77), in 2020. According to clause 1 of Order No. 77, the monthly salaries (tariff rates) specified in Appendices 1-3 to this order change in proportion to the increase in the official salary (tariff rate) of an employee of the 1st tariff category, the amount of which is determined in Note 1 of Appendix 1 to Decree No. 1298. That is, the calculated value for determining salaries for this order is such an indicator as the official salary of the 1st t. December 2020, when the official salary indicator was set at UAH 1,335. (Resolution of the Cabinet of Ministers of Ukraine dated November 23, 2016 No. 840) by a coefficient that was determined as 1335 UAH. : 1185 UAH. After that - in January 2020 by the coefficient. which is determined by 1600 UAH. : 1335 UAH. For example, the salary of a janitor in December 2020 should have been set at 1,634 UAH [1,450 UAH (1,335 UAH: 1,185 UAH)], and in January 2020 it should have been [1,958 UAH (1,600 UAH: 1,335 UAH.) )] Such calculations should be made for all categories of employees whose payment is regulated by Order No. 77. However, in the column “Official salary (UAH)” of the staffing table in accordance with paragraph. third paragraph 1 of Order No. 77, employee salaries must be determined at a level no less than the minimum wage, for 2020 it is set at 3200 UAH. Other components of the salary (allowances, additional payments) must be calculated taking into account the salary of 3200 UAH. Note that in this case we cannot change the approaches taking into account the norms of clause 3 of Section II. "Final and transitional provisions" of Law No. 1774 of such reasons. Firstly, the rule regarding the non-application of the minimum wage in 2020 as a calculated value for determining official salaries (the first sentence of the specified paragraph of Law No. 1774) has no relation to the procedure for determining the wages of workers whose wage conditions are regulated by Order No. 77. In it, the calculated value, what we talked about above is the statutory salary indicator for an employee of 1 t.g. Secondly, we have no reason to use the norm according to which, before changes are made to the laws of Ukraine regarding the non-use of the minimum wage as a calculated value, it is applied in the amount of 1600 UAH. (second sentence of the said paragraph of Law No. 1774). After all, Order No. 77 does not have the status of law.

Interesting: Accounting tests when applying for a job

Commission for tariffing teachers

This is a collegial body that operates on the territory of any educational institution on a mandatory basis. Orders of the heads of organizations regulate the creation of commissions or changes in composition when necessary.

The Commission acts based on any internal act:

- tariff rules;

- work regulations;

- commission regulations.

Most often, commissions include an accountant and a representative of trade union organizations. Associations allow the presence of one of the deputy directors as a leader.

Decisions are made by a majority vote, simple or qualified. Therefore, you should not assemble commissions with too many members. With the secretary and chairman of the commission, up to 5-7 people are enough.

Annual tariff work is not the only responsibility of the commission members; they also include adjusting tariff lists. If necessary, information is conveyed to teachers, and individual provisions are agreed upon with them.

Organization of remuneration for public sector employees

By Decree of the Government of the Russian Federation No. 785 “On differentiation in levels of remuneration for public sector workers” based on ETC, 18-bit ETC was introduced in 1993 as a regulatory document regulating wages in the range of 1-10.07. According to the terms of remuneration in accordance with the ETC, employees are rated as follows:

Remuneration for employees of institutions, organizations and enterprises financed by the budget, with the exception of employees of government bodies, is carried out on the basis of the Unified Tariff Schedule (ETC), which is a scale of tariffs and remuneration for all categories of employees in public sector sectors, including workers, employees - technical performers, specialists and managers. Each professional qualification group of workers occupies a corresponding rank in the ETC, and only the complexity of the work performed (job responsibilities) and the qualifications of the worker are taken into account.

Interesting: Committee on Property and Land Relations

Tariffication of teachers: features of the procedure

The convening of the tariff commission is relevant after the completion of the development of the curriculum for the near future. The following information is used to calculate labor compensation:

- Load data.

- Qualification indicators.

- Salaries with bonuses.

- Director's orders.

All this information is entered into a special table, which is called the tariff list. The commission determines the base salary for each teacher individually. There are several important factors for referral, including the category of student, minimum salary and qualification level.

Additional payments for having a certain level of training are established based on personal information regarding each employee. Additional payment for length of service is calculated separately.

Possibilities

Application solution “1C: Medicine.

Salaries and personnel of a budgetary institution" was developed on the basis of the standard configuration "1C: Salaries and personnel of a budgetary institution 8" and is intended to automate the calculation of wages, maintaining personnel records and generating tariff lists of employees in state (municipal) healthcare institutions. Based on the results of the annual competition “Best Medical Information System 2012”

software product “1C: Medicine. Salaries and personnel of a budgetary institution" was awarded a 1st degree Diploma as the best medical information system in the nomination "Systems for automating administrative and financial and economic functions...".

Program “1C: Medicine. Salary and personnel of a budgetary institution" provides the opportunity to:

- the personnel service of a medical institution: register all changes in the staffing table with a specialized order with the ability to display printed forms;

- control whether employees have certificates, permits to work with narcotic drugs, qualification categories and additional payments for them. Timely monitor the need to renew certificates;

- reduce labor costs for preparing regulatory forms for regulatory organizations (drug control authorities, certification commissions, etc.);

- automatically calculate an employee’s length of service based on his work history;

- automate work with a large volume of printed documents (it is also possible to use your own printed form templates).

- generate reporting by personnel categories;

- use, if necessary, the methodology for calculating wages by professional qualification groups and levels automatically;

Functionality of the product “1C: Medicine. Salaries and personnel of a budgetary institution" includes all blocks of the solution "1C: Salaries and personnel of a budgetary institution 8" and blocks reflecting the medical specifics of the product:

- calculation of remuneration for additional work within the framework of an employment contract;

- methods of remuneration for professional qualification levels and groups;

- tariffication;

- interaction with the Federal Register of Medical and Pharmaceutical Workers;

- other additional features.

Calculation of remuneration for additional work within the framework of an employment contract

Medical institutions use the most expanded accounting of payments for additional work within the framework of an employment contract without transferring the employee to another position or to another department. The configuration implements the main types of payments for additional work:

- part-time work – additional work outside of one’s position, paid as a percentage of one’s salary;

- increase in the volume of work - additional work for one’s position, paid as a percentage of one’s salary;

- Substitution is additional work paid from the salary of the replaced employee.

They are appointed or canceled by a specialized order.

The mechanism for working with this block gives the user the opportunity to draw up various payment schemes in advance for the period of additional work, in order to fill out an order assigning payments for additional work based on these schemes.

The ability to record time worked has been expanded: in the time sheet you can record the actual time worked for each order for additional work.

Methods of remuneration for professional qualification levels and groups

A new remuneration system for employees of federal budgetary institutions, which include medical and pharmaceutical workers, was introduced on December 1, 2008 by Decree of the Government of the Russian Federation of August 5, 2008 N 583.

The configuration implements a methodology for calculating wages by professional qualification levels and groups. It has become possible to flexibly configure the criteria for assigning employee positions to professional qualification groups with corresponding salaries. Added the ability to calculate employee salaries by their professional group. An employee can be assigned to a qualification level based on a combination of indicators:

- job title,

- subdivision,

- intra-position category,

- discharge.

Accounting for professional qualification levels and groups

This system involves constructing an employee remuneration scheme based on his belonging to a particular professional qualification level and group. The mechanism of professional qualification levels and groups is designed to solve the following problems:

- Determining the affiliation of medical institution personnel to professional levels based on positions held and other indicators (divisions, categories, categories,...);

- Automatic calculation of employee salaries based on their membership in a particular professional level;

- Generating analytical reporting.

The program implements the provisions of the following regulatory documents introducing a new system of remuneration for employees of federal budgetary healthcare institutions:

- Order of the Ministry of Health and Social Development of Russia No. 526 of 08/06/2007 (On approval of professional qualification groups for positions of medical and pharmaceutical workers);

- Order of the Ministry of Health and Social Development of the Russian Federation No. 463n dated August 28, 2008 (On the introduction of a new system of remuneration for employees of federal budgetary scientific institutions that have clinical units subordinate to the Ministry of Health and Social Development of the Russian Federation (as amended by Order of the Ministry of Health and Social Development of the Russian Federation dated December 19, 2008 N 741n));

- Order of the Ministry of Health and Social Development of Russia No. 247n dated May 29, 2008 (On approval of professional qualification groups for industry-wide positions of managers, specialists and employees);

- Order of the Ministry of Health and Social Development of Russia No. 248 of May 29, 2008 (On approval of professional qualification groups of general industry professions of workers);

- Order of the FMBA of Russia No. 305 dated 09/03/2008 (“On the introduction of a new system of remuneration for employees of federal budgetary institutions subordinate to the FMBA of Russia”);

The program implements the following mechanisms for recording professional qualification levels and groups:

- flexible adjustment of criteria for assigning vacancies and employees to professional qualification levels;

- setting salary indicators and coefficients for qualification groups, levels, level elements and storing the history of changes in indicators;

- calculation of employee salary according to professional qualification levels. Automatic tracking of changes in professional qualification levels of employees, displaying changes when calculating wages.

Tariffication

Mechanisms for constructing tariff reporting in the program are implemented according to two fundamental concepts:

- Regulated tariff reporting.

- Customizable tariff reporting.

The construction of regulated reporting is implemented on the basis of regulatory orders:

- Order of the FMBA of the Russian Federation dated 09/04/2008 No. 310 “On tariffs for employees of federal budgetary healthcare and social protection institutions subordinate to the FMBA of Russia.”

- Order of the FMBA of the Russian Federation dated November 11, 2009 No. 749 “On approval of the Temporary Procedure for the Tariffication of Employees of Federal Budgetary Institutions of Health Care and Social Protection of the FMBA of Russia.”

Customizable tariff reporting is presented:

- The “Tarification (Universal Form)” report - the report provides the ability to change the visualization of the tariff reporting form, expand the tariff reporting forms with additional user columns (including those calculated using formulas), and use additional grouping and selection parameters when building tariff reporting.

- Mechanisms of customizable tariffication - customizable tariffication allows you to prepare data for generating tariff reporting.

Tariff lists are built on the basis of information accumulated in the system, which relates to personal information about employees or information about the staffing table. The staffing table is supplemented with details about the category of personnel, the group of work with chemical weapons, the percentage increase for harmfulness, and increasing coefficients for drivers. Mechanisms have been developed for the formation of tariff lists:

- recording the qualification categories of employees;

- dividing employees of organizations and vacancies into personnel categories, with the ability to indicate the appropriate reporting tariff form for each of the personnel categories;

- formation of the composition of the tariff commission.

In addition to the tariff reporting itself, the configuration has the ability to build a generalized analytical report “Summary tariff data”.

In order to prepare tariff lists by healthcare institutions, the program maintains:

- accounting of employees\vacancies of the organization by personnel categories;

- recording the qualification categories of employees, maintaining additional payments for the presence of qualification categories;

- accounting of groups working with chemical weapons;

- formation of the composition of the tariff commission;

- generation of tariff reporting according to the forms regulated by orders of the FMBA of the Russian Federation dated 09/04/2008 No. 310, FMBA of the Russian Federation dated 11/11/2009 No. 749, as well as on custom forms accepted in healthcare institutions.

Interaction with the Federal Register of Medical and Pharmaceutical Workers

The subsystem for maintaining the Federal Register of Medical and Pharmaceutical Workers of the information and analytical system of the Ministry of Health and Social Development of Russia is designed to collect, store and process accounting data for medical personnel of the constituent entities of the Russian Federation, as well as monitoring and control of the distribution and movements of medical personnel. The program has developed functionality that allows you to organize the downloading of regulated information in register format.

"1C: Medicine. Salaries and personnel of a budgetary institution" allows for information exchange with the Federal Register of Medical and Pharmaceutical Workers in the following volume:

- loading register dictionaries;

- initial filling of configuration directories based on register dictionaries;

- the ability to configure correspondence between configuration elements and register dictionary elements;

- the ability to upload information about the organization’s staffing table and personal information of employees in register format.

To support data exchange with the Federal Register of Medical and Pharmaceutical Workers, the program implements:

- an expanded form of storing information about the history of employees’ work activities (with the possibility of exchange with standard structures) in a register format;

- an expanded form of storing information about the education of employees (with the possibility of exchange with standard structures) in a register format.

Other additional features

- Access to narcotic drugs In accordance with the Federal Law of the Russian Federation of January 8, 1998 N 3-FZ “On Narcotic Drugs and Psychotropic Substances,” a legal entity may carry out activities related to the circulation of narcotic drugs and psychotropic substances in the presence of certain permitting documents. For an employee of a medical institution to work with narcotic substances, it is necessary to obtain a conclusion from the authorities controlling the circulation of narcotic drugs and psychotropic substances. The applied solution for these purposes provides the following objects: the document “Request to drug control authorities” (according to Appendix 1 to the Administrative Regulations (clauses 6.1.4, 8.1 and 12.1.1), approved by Order of the Federal Drug Control Service of Russia dated June 21, 2010 N 243);

- document “Response of the drug control authority.”

It is also possible to view in the form of a report information about whether employees have access or are denied access to NSPV.

- order to change full name - changes last name, first name and patronymic in registers and names of directories;

- create and store a list of certificates for which you need to keep specialized records;

Data protection

In accordance with the requirements of the legislation of the Russian Federation, the secure software package (hereinafter referred to as ZPK) “1C:Enterprise, version 8.2z” was certified.

, issued by FSTEC of Russia, it is confirmed that the protected software package (ZPK) “1C:Enterprise, version 8.2z” is a general-purpose software with built-in means of protecting information from unauthorized access to information that does not contain information constituting a state secret, and meets the requirements governing documents:

- “Computer facilities. Protection against unauthorized access to information. Indicators of security against unauthorized access to information" (State Technical Commission of Russia, 1992) - according to security class 5;

- "Protection against unauthorized access to information. Part 1. Information security software. Classification according to the level of control of the absence of undeclared capabilities” (State Technical Commission of Russia, 1999) - according to the 4th level of control.

Clause 12 of Order No. 21 of the FSTEC of Russia provides for the use in information systems of personal data (ISPDn), certified according to security requirements, of information security means of at least 5 security class (to ensure 1-3 levels of security) and not lower than 6 security class (to ensure 4 security level). Thus, the certificate confirms that the ZPK “1C:Enterprise, version 8.2z” can be used to create ISPD of any security level, for example, those created on the basis of “1C:Medicine” configurations. Salaries and personnel of a budgetary institution", "1C: Medicine. Hospital pharmacy"

What happens next?

If teachers take on additional activities, they cannot do without so-called incentive payments. Separate incentives are also developed for certain achievements of students. Allowances related to the following areas are used:

- high academic performance of students;

- prizes in competitions and olympiads for students;

- additional lessons for students at home;

- checking work completed in writing;

- electives and clubs;

- cool guide.

For dangerous working conditions and living in certain climatic zones, employees of educational institutions are entitled to additional payments and compensation.

How to make tariffs for teaching staff?

Answer to the question:

Remuneration for teachers of organizations carrying out educational activities in additional general education programs in the field of arts, teachers of additional education is established based on the tariffed teaching load.

According to clause 2.8.1 of Appendix 1 to the order of the Ministry of Education and Science of Russia dated December 22, 2014 No. 1601, teachers of organizations carrying out educational activities in additional general education programs in the field of arts, teachers of additional education, a standard of hours of educational (teaching) work is established at 18 hours per week for wage rate.

Approval of tariff lists and their changes

When the commission finishes drawing up the document, it is handed over to the manager for further approval. The director checks the information presented, independently or with the participation of accountants or other specialists.

The commission finalizes the draft list if the other party has any comments. If everything is correct, then the project is approved.

The algorithm for changing the document is in many ways similar to how it was approved for the first time. First, they convene a commission and check all the figures. Sent to the manager for approval.

One of the innovations for the educational system of the Russian Federation is the so-called target indicators. Previously, the possibilities for creating additional material incentives for teachers were very limited. Now the Government has made significant changes to the current system.

A whole list of works has been developed related to increasing remuneration for teachers.

Remuneration of public sector employees

According to Decree of the Government of the Russian Federation No. 785, highly qualified workers employed in important and responsible jobs can be set tariff rates and salaries based on 9 - 12 categories of the unified labor force according to the lists approved by the ministries and departments of the Russian Federation and the Ministry of Labor and Social Development of the Russian Federation. This norm of Government Decree No. 785 is interpreted not as the possibility of tariffing the corresponding professions of workers with 9 - 12 categories, but only as the possibility of their payment at the rates of these categories, and payment that is not necessarily of a permanent nature. The use of 9 - 12 categories is provided only in cases where the complexity of the work performed by workers exceeds the complexity of the work classified by the ETKS as 6 - 8 categories, and if this category is the highest for this profession.

Interesting: How much can bailiffs deduct from wages based on a writ of execution?

In first place in importance among the factors influencing the efficiency of the use of labor is the wage system. It is wages, and often only wages, that are the reason that brings a worker to his workplace. Therefore, the importance of this problem cannot be overestimated.

Features of tariffs for preschool institutions

The procedure for developing a document in this case remains standard. The preliminary tables provide general information regarding the clock. Then they draw up a final version, which contains a detailed schedule for each employee.

Strict requirements for the development of tariff tables have not yet been created. In the header of the document is the full name of the educational institution, mandatory details such as address. The year during which the document remains valid is indicated separately.

We compile tariff lists of general education institutions

For our part, we will add that if an institution is serviced by a centralized accounting department, the tariff list is agreed upon with the trade union committee, signed only by the director of this institution and then submitted for approval to a higher management body.

Similarly, starting from 09/01/2005, in accordance with paragraphs “b” and “c”, paragraph 2, paragraph 4 of Order No. 557, an increase to the official salary (wage rates) is established for honorary and sports titles. , and the official salary is not increased, as provided for in paragraph 24 of Instruction No. 102.

Basic standards for wage tariffication

The basic tariffication of wages for a professional qualification group is the minimum salary, the wage rate of an employee of a budgetary institution carrying out professional activities in the profession of a worker or an employee position, excluding compensation , incentives and social payments.

Mandatory for application on the territory of Ukraine, taking into account tariffication systems , are the wage standards established by the Tariff Commission of Ukraine and state laws of Ukraine.

20 Aug 2020 glavurist 295

Share this post

- Related Posts

- How to calculate transport tax in 2020

- Regional Maternity Capital in the Volgograd Region in 2019

- Who can receive free housing from the state

- What Documents Are Needed to Obtain a Tax Deduction on Mortgage Interest

Article 143 of the Labor Code of the Russian Federation. Tariff systems of remuneration

The Constitution guarantees payment for any work.

But the amount of remuneration depends on the qualifications, abilities of the specialist, as well as the complexity of the work duties assigned to him. Salaries for employees are calculated according to the tariff system of payment for work described in Art. 143 of the Labor Code of the Russian Federation.

Legislators call the remuneration system all the standards that legislators have approved with the aim of differentiating salaries for different groups of employees. Such differentiation depends on the intensity and complexity of work duties, the level of comfort in the workplace, and the climate.

Article 143 of the Labor Code of the Russian Federation identifies the following elements of this system:

- tariff rates;

- salaries of positions;

- tariff schedule;

- tariff coefficients.

All of the above elements provide a good system for increasing labor efficiency.

Tariff schedule

In simple terms, a tariff schedule is a regular table in which the values accepted for tariff coefficients used by the company for tariff categories are entered.

These coefficients show the ratio of the tariff rates of work to the most simple in terms of qualifications work. This ratio in labor legislation is called the range of the tariff scale.

The coefficient for the first digit is equal to one. It denotes types of work that require minimal professional skills. More complex types of work are assigned higher category values and tariff rates.

There are several types of tariff schedules:

- uniform - in this case, the inter-category difference in tariff coefficients is the same;

- progressive - the inter-bit difference increases when moving to a higher value of digits;

- regressive - the inter-bit difference decreases when moving to a higher value of digits;

- mixed - in this case there is an increase, and then a decrease in the inter-bit difference.

To calculate each tariff rate, a certain coefficient must be multiplied by the first category tariff rate. The sixth category is considered the most common. There are special types of work for which seven- and eight-bit rates are assigned.

The tariff schedule establishes a confirmed material basis for advanced training of specialists.

The organization has the right to develop its own tariff schedules, which have up to 18 categories:

- with the help of the first 8, payments are made for workers;

- 3–10 are intended for calculating compensation to employees;

- 4–14 are used to remunerate specialists;

- 15–18 are used for the purpose of calculating labor compensation for managers.

Payment to persons with the first category should not be less than the minimum wage accepted in the country.

Tariff and qualification category

Article 143 of the Labor Code defines the concept of “tariff category” as a value that allows us to indicate the complexity of an employee’s work duties. The number of such categories depends on the level of complexity, as well as the variety of work performed in the organization. For each category, according to the Labor Code of the Russian Federation, it is necessary to establish a tariff rate, that is, the amount of wages.

But the professional level of a hired specialist is determined by another value - the qualification category.

If work is performed by a team, then its rank is determined in one of two ways:

- an average category is established, which is calculated by the sum of elements for all types of work;

- a differentiated element is established for each type of work.

When assigning a rank, the following factors are taken into account:

- the complexity of the work performed by the specialist;

- the qualification level of the employee himself.

The qualification element for a novice specialist who has recently graduated from an educational institution is assigned by the qualification commission of this institution. When assigning a rank in this case, the theoretical and professional levels of training, as well as the results of passed professional exams, are taken into account.

The assignment of ranks to specialists who already have work experience is carried out by workshop or general plant qualification commissions. Their composition is approved by the management of the enterprise.

During the exam at which the rank is established, the specialist must:

- provide answers to the questions set out in the “Must Know” section;

- perform basic types of work;

- demonstrate good knowledge of work instructions, technical operating rules, equipment care instructions, technological charts, as well as rules relating to labor protection.

Based on the results of the qualification commission, the employee is assigned a rank. The established qualification category is documented. Information about him is also indicated in the work book.

It is worth noting that the rank received by an employee at the enterprise is valid only for him. If a specialist decides to change his place of work, then at another enterprise a decision may be made to re-assign the qualification category.

Tariffication of works

Tariffing of work allows you to determine the category of a certain type of work based on the qualification characteristics that are set out in the Unified Tariff and Qualification Directory (hereinafter referred to as UTKS). This directory is used to rate workers who work in industries, industries and jobs mentioned in its structure.

But the ETKS standards do not apply to work that is regulated by special provisions. Such work, for example, includes service in the Ministry of Emergency Situations and work in locomotive crews.

The tariffication procedure involves equating a certain work with similar works described in the reference book.

Some time ago, ETKS standards were mandatory. Now they are of a recommendatory nature.

Establishment of wage systems

It is the responsibility of the management of the organization to pay its subordinates on time. For this purpose, wage conditions are being developed. This procedure requires the following steps:

- determination of tariff rates;

- determining salary levels for positions;

- differentiation of all salaries and rates by groups, grades and positions.

The tariff rate is the amount of monetary compensation. Labor legislation identifies the following types:

- hourly rates;

- daily rates;

- monthly rates.

The most popular is the hourly tariff rate. The daily rate is calculated based on the hourly rate and the accepted length of the working day. When calculating the monthly rate, the average value of the standard duration of the calendar month in hours is used.

The amount of wages is determined by the qualifications of the employee, as well as the complexity of the job duties.

To carry out payroll calculations, you need to take into account the underlying basis. This concept refers to the tariff rate adopted for the first category. Its value is prescribed in the collective agreement of the organization.

The tariff rate for first-class specialists is the salary of a first-class worker who works with a normal level of intensity in a comfortable working environment. The wage must be equal to or exceed the minimum wage established in the state.

The concept of “official salary” in domestic legislation indicates a stable amount of monetary payment for the work of a hired specialist for one calendar month. The amount of wages paid depends on the position in which the employee works.

When it comes to people holding managerial positions, employees or ordinary specialists, a salary chart may be drawn up for them to reflect the tariff conditions of payment for them. In it, all monthly salaries are grouped by position. To establish a system of remuneration for work performed at the inter-district level, regional coefficients are used.

In general, the tariff system has certain advantages:

- motivating employees to improve their skills;

- provides the opportunity to effectively manage the company’s personnel;

- the responsibility and complexity of the work performed is taken into account.

The tariff system also has its drawbacks. Among them, it is worth highlighting a poor assessment of the quality of the work performed, as well as a focus on normal working conditions.

Source: https://ZnatokTruda.ru/trudovoj-kodeks/statya-143/