Before you start working with inventory (working clothes), they must be credited to the appropriate accounts (to the account “10/I/S” - for inventory, or to the account “10/СО/С” - for workwear). To account for material assets in operation, the off-balance sheet account “MTs - Material assets in operation” is used, with connected analysts for employees and inventory items.

To account for inventory and workwear, the following operations of the DCU journal are used: 1. Transfer of the MBP into operation; 2. Transfer of IBP from one employee to another; 3. Return of the MBP from service; 4. Decommissioning of the MBP from operation.

Transferring the MBP into operation

At this step, the equipment/working clothing transferred for operation is indicated.

We create the operation “Transfer of MBP into operation”. In the header of the invoice we indicate the employee to whom we are transferring the inventory/working clothes for operation and the warehouse from which we are transferring them, as well as the write-off account if the inventory/workwear will be written off immediately upon transfer for operation:

In the details of the invoice for each inventory (working clothes) transferred into operation, we indicate whether this equipment/workwear will be written off from service immediately upon transfer into operation (to the debit of the write-off account specified in the header (for example, 20/PROCH) and to the debit of the "MC" account ") or not. To do this, use the “Write off?” field. in the invoice detail, which can take one of two values “No” or “Yes”.

After the equipment/working clothing has been released from the warehouse, from that moment it is considered to be in use.

Transfer of IBP from one employee to another

At this step, the inventory/working clothing transferred for use from one employee to another is indicated.

We create the operation “Transfer of IBP from one employee to another.” In the header of the invoice, in the “From” field, we indicate the employee from whom we are transferring the equipment/working clothes, and in the “To” field, we indicate the employee to whom we are transferring the equipment/workwear. In the details of the invoice we indicate the transferred equipment/working clothes:

Returning the MBP from service

At this step, inventory and workwear returned to the warehouse from use are indicated.

We create the operation “Return of the MBP from service”. In the header of the invoice, in the “From employee” field, indicate the employee from whom we receive the returned equipment/working clothes. In the “To warehouse” field, indicate the warehouse to which the inventory/working clothing is returned.

Off-balance sheet account MC 04 - what is it and how to use it?

In the details of the invoice we indicate the returned equipment/working clothes:

(If equipment/working clothing was written off immediately upon transfer to operation, then there is no need to return this equipment/working clothing).

Decommissioning of MBP from service

We create the operation “Decommissioning of MBP from operation”. In the header of the invoice we indicate the write-off account and the employee whose equipment/workwear being written off is in use:

In the details of the invoice, if equipment/working clothing is written off as scrap, then in the field “Received scrap for the amount” we indicate the amount of scrap received, otherwise we leave this field blank. Based on the amount of scrap received, the scrap capitalization table of the MB-8 form is filled out.

If in the operation “Transfer of the IBP into operation” this inventory (working clothes) has already been written off from operation, then in this case the inventory/work clothes will be written off only from the credit of the off-balance sheet account “MC”, otherwise the write-off will be carried out to the write-off account specified in the invoice header .

Home — Articles

Results

The off-balance sheet account MTs.04 is used by users of the accounting program “1C: Accounting” to account for the inventory and household supplies transferred into operation. Inventory receipts are debited from this account, and disposals are credited to this account. Analytics is carried out in quantitative terms, by item items and financially responsible persons.

Quite often we are asked how to take into account material assets worth up to 40 thousand rubles? According to paragraph 5 of PBU 6/01 “Accounting for fixed assets”, they can be reflected as part of inventories. Of course, it is much more profitable to include the cost of such inventory items in expenses at a time rather than accrue depreciation. But some nomenclature items are quite valuable assets. For example, office and household appliances often fall into this category: laptops, printers, TVs, refrigerators, etc. Just write them off as ordinary materials, “you can’t raise your hand.” I would like to take into account this property in the context of financially responsible persons and control its availability. How to organize such accounting in the 1C: Enterprise Accounting 8 edition 3.0 program?

First of all, we reflect the receipt of inventory items.

We create a document with the type “Goods (invoice)”, specify 10.09 as the accounting account

If your document does not have columns for selecting accounting accounts, then you need to slightly change the program settings. I talked about this in detail in the article Why are accounting accounts not visible in documents in 1C 8? After the receipt is made, the following movements are generated in the accounting accounts.

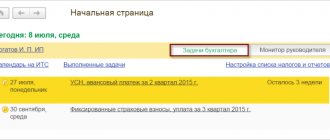

Then it is necessary to transfer the inventory items into operation and write off their cost as expenses. But first you need to make sure that the necessary functionality is enabled in the program. Go to the “Main” tab.

In the “Inventory” section, check the “Workwear and special equipment” box.

Then close the form, go to the “Warehouse” tab and select the “Transfer of materials for operation” item.

Fill out the “Inventory and Household Supplies” tab.

What should be indicated in the “Method of reporting expenses” column? Here you select an element of the directory of the same name, containing information about the cost account and subaccounts to which you want to write off the cost of inventory items. You can select an existing method or add a new one.

We post the document and see the following movements in the accounting accounts.

Simultaneously with the inclusion of the cost of inventory items in the cost structure, this item is placed in the off-balance sheet account “MC.04”, where records are kept in the context of financially responsible persons. At any time, you can create a balance sheet using this account and see the materials in use.

When there is a need to finally write off inventory items, for example, due to breakdown or physical wear and tear, you need to use the document “Write-off of materials from service.”

In this case, a reverse posting will be generated to the account “MC.04”.

Each organization that has inventory in its warehouses regularly conducts inventory. In this case, deviations in the quantity of a particular item may be revealed, both upward and downward. The inventory document in , on the basis of which the data on the quantity of goods is subsequently adjusted, will allow the actual values to be brought into line with those specified in the information base.

The inventory logic is the same for all versions of 1C:

- surplus goods must be capitalized;

missing items must be written off.

The first stage of reflecting inventory results in 1C is to create and fill out a document of the same name, which contains information about existing deviations in the warehouse. Next, the goods are written off or capitalized based on the deviations found.

There is no accounting - there is responsibility

To begin with, the accountant is most interested in liability for failure to keep records.

For violation of accounting rules, an organization may be held liable under Art. 120 of the Tax Code of the Russian Federation, and its officials (which include an accountant) - under Art. 15.11 Code of Administrative Offences. However, the last article is not applicable in this case, since it provides punishment only for distortion of reporting items.

To reflect the data of off-balance sheet accounts in the balance sheet (Form No. 1), a section is provided “Certificate of the availability of values accounted for in off-balance sheet accounts.” These data are also reflected in the Appendix to the balance sheet (Form No. 5). But you need to keep in mind that these forms are not mandatory, but recommended for use. An organization may use other forms. The main thing is that they contain all the data provided for by PBU 4/99. And according to this PBU, the data reflected in off-balance sheet accounts is disclosed in the notes to the balance sheet. However, what these explanations should look like is not directly established by the Regulations. Therefore, you can reflect data on off-balance sheet accounts in the explanatory note to the balance sheet.

In this case, there simply will not be any separate lines of reporting items for off-balance sheet accounts, which means that it is impossible to punish for their distortion.

But to bring the organization to justice under Art. 120 of the Tax Code of the Russian Federation for a gross violation of accounting rules is possible, since such violations include the systematic failure to reflect transactions on accounting accounts. And off-balance sheet accounts are also accounting accounts, since they are provided for in the Chart of Accounts. If an organization does not take into account at least two transactions, it will be fined 5,000 rubles. And some courts agree with this position.

But, as practice shows, tax authorities, when conducting an audit, are very fond of fining organizations under Art. 120 Tax Code of the Russian Federation. If you don’t keep off-balance sheet accounting, you’ll be fined for it; if you do, they’ll find something else. At the same time, the failure to reflect any data on off-balance sheet accounts does not affect the calculation of taxes. Therefore, an increased fine of 15,000 rubles. (for the offenses specified in paragraph 1 of Article 120 of the Tax Code of the Russian Federation, if they were committed during more than one tax period) can always be avoided. Since in this situation it is not clear which tax period should be taken into account.

Moreover, if an organization does not have data on the value of off-balance sheet assets (for example, the value of leased property) or on the amount of off-balance sheet liabilities and for this reason it did not reflect the information on the balance sheet, the courts refuse to collect a fine from the tax authorities under Art. 120 Tax Code of the Russian Federation.

So do we need off-balance sheet accounting?

As we see, there is virtually no responsibility. Nevertheless, it is better to keep off-balance sheet accounting, since in many cases its absence will lead to the fact that interested users will not have a complete picture of the financial condition of the organization.

That is why auditors always pay attention to the absence of such accounting, although this leads to modification of the conclusion only in extreme cases.

From authoritative sources

Efremova Anna Alekseevna, Deputy General Director of CJSC AKG RBS

“In practice, the attitude towards off-balance sheet accounting is much calmer than towards system entries, that is, towards entries in balance sheet accounts. If an accountant “forgot” to reflect the acceptance of fixed assets for accounting or the recognition of revenue, this is considered a gross error. However, everyone has encountered the fact that the accounting does not reflect intangible assets received by the organization for use, raw materials received for processing on a toll basis, or goods accepted for safekeeping. The lack of accounting for such transactions is often considered by accountants as a minor defect, and very often auditors’ complaints about the lack of relevant information in the statements are perceived almost as nit-picking that has no practical meaning.

In fact, this is not true at all.

How to write off an operating system if a shortage is discovered during an inventory?

If, during the inventory of the OS, a shortage of an OS object or its damage was discovered in the accounting accounts, the following is written:

- Reflection of starting price

- Reflection of depreciation

- Write-off of disappeared OS from the depreciated price

- Writing off the amount of the shortfall to the debt of the culprit (if such a person is identified)

- Writing off the amount of the shortfall as other expenses in a situation where the culprits are unknown

Postings:

| Dt | CT | The essence of the operation | Sum | Primary document |

| 01. | 01.01 | Starting price reflected | 450 | Inventory report |

| 02.01 | 01. | Depreciation reflected | 120 | |

| 01. | The amount shown after depreciation | 330 | ||

| 73.02/76.49 | The price of the shortage/damage is reflected as the debt of the culprit | 330 | ||

| 91.01 | The price of shortage/damage is reflected among other expenses | 330 |

Transfer of materials into operation

The focus of accounting solely on taxation purposes often becomes the reason for ignoring off-balance sheet accounting, since it is not related to the formation of tax bases.

However, if you go beyond expecting fines from a tax audit, then everything will fall into place.

Let me give you an example. If the issued pledges and guarantees significantly exceed the value of not only net assets, but also the value of the balance sheet currency, then only an unqualified or unscrupulous auditor can ignore the risk of violating the principle of business continuity of the organization.

Indeed, in the event of demands for repayment of obligations, the organization does not have the opportunity to satisfy them. This fact must be reflected in the auditor's report. And our experience shows that often only after receiving an audit report with such a reservation, organizations begin to evaluate negative factors that could lead to a reduction in activities or liquidation of the organization.

Another common situation. Often, information about leased properties is not included in accounting due to the fact that the cost of the leased property is not agreed upon by the parties.

However, the absence of such information in financial (accounting) statements does not give users of these statements a complete picture of the company’s property status. For example, often, judging by the reports, production does not need production equipment at all, trade does not need warehouse space, and management does not need an office. Such information about the organization cannot in any way be considered reliable, and the auditor, if the volume of leased assets not reflected in the reporting is significant, is obliged to include a corresponding clause in the auditor’s report.

To properly account for the organization, it is necessary to agree on the value of the leased objects in the contract with the lessor, and if this is not possible (lessors often shy away from providing such information) - to independently estimate their value. Such a non-contractual assessment will still be a lesser distortion of the data than their complete absence.”

So, it is better to keep off-balance sheet accounting. Moreover, it is not difficult to do this - it is carried out according to a simple scheme without using the double entry method. Is it difficult, for example, to reflect the cost of a rented office on account 001?

It is also convenient to use off-balance sheet accounting to monitor assets or liabilities that have already been written off from balance sheet accounts. For example, for low-value objects, the cost of which is written off as expenses upon commissioning.

The Chart of Accounts does not provide for off-balance sheet accounts to account for these assets. But you can use an open account yourself (for example, in the working chart of accounts it can be called account 012 “Assets with a useful life of more than 12 months and a value of less than 20,000 rubles”).

Of course, it is possible to control the movement of low-value objects without using off-balance sheet accounting. But why invent something when there is a ready-made version of such accounting.

* * *

As we see, off-balance sheet accounting is undeservedly deprived of the attention of accountants.

If users of your reporting need complete information and you do not want problems with the tax authorities, off-balance sheet accounting is necessary.

Selling goods from an off-balance account

IHow can you sell from an off-balance sheet account?! He swears at selling goods...what can I do?!

Get your work in order using the 1C configuration “IT Department Management 8”

ATTENTION!

If you have lost the message input window, press

Ctrl-F5

or

Ctrl-R

or the Refresh button in your browser.

The thread has been archived. Adding messages is not possible.

But you can create a new thread and they will definitely answer you!

Every hour there are more than 2000

people on the Magic Forum.

Filling out an inventory document in 1C: Accounting

For this operation, a separate item is provided in the program interface in the “Warehouse” section:

When you go to the section, a list of previously completed inventories opens, but we need to create a new document. This is done as standard by clicking the “Create” button:

Please pay attention to filling out the fields in the document header:

- a date must be set. The balances will be filled exactly on this date;

You can generate a document by warehouse or by responsible person. When choosing the first method, the balances of the specified warehouse will be filled. In the second option, balances will be generated for all warehouses that are assigned to this responsible person.

Let's analyze the inventory of the warehouse. The document needs to be filled out; this is done automatically when you select a filling method from the drop-down menu of the “Fill” button:

A table will be generated with all the goods that are listed in the specified warehouse in 1C:

The table shows the item, its actual and accounting quantities. The document can be recorded and printed to be sent to the warehouse for direct inventory. A printable form is provided for this:

The form is filled out by warehouse employees, after which the actual data is entered into the corresponding column of the table:

The program itself calculates the deviation: shortages are indicated in red with a “-” sign, and surpluses are indicated in black. After filling out the column, the document is recorded and posted. Based on it, you can print out the necessary paper forms:

Inventory in 1C:Accounting itself does not write off or capitalize; separate documents are provided for these operations.

How to take property on balance

Advice from an Expert - Legal Adviser

Photo on the topic Fixed asset is the property of the organization, which serves as a means of generating profit and also has a useful life of more than a year. An organization can acquire these assets in various ways: under a purchase and sale agreement, free of charge, in the form of a contribution to the authorized capital, and also under an exchange agreement. The accountant must charge property taxes on a monthly basis, as well as submit quarterly reports to the Federal Tax Service, but for this it is necessary to accept fixed assets on the balance sheet. Just follow these simple step-by-step tips and you will be on the right track in resolving your legal issues.

How to put fixed assets on the balance sheet - registration of fixed assets, etc... 01/02/2012

Requirements for intangible assets

In order for property to be classified as intangible assets, it must meet a number of criteria:

- have properties that are inherent in fixed assets (operation for at least a year in order to make a profit, the ability to isolate an object and determine its market value);

- have no physical form.

Equally important is the existence of rights to property - the company must, if necessary, confirm this right with relevant documents.

Based on the above, the following objects can be classified as intangible assets:

- literary, musical and other works;

- all kinds of inventions and prototypes;

- computer software;

- trademarks and service marks;

- Database;

- other objects listed in the list of PBU 14/2007.

Business reputation is also part of the intangible assets. It is defined as the difference between the purchase price and the book value of the company, which means it can be either positive or negative.

The following cannot be classified as intangible assets:

- unregistered intangible assets, utility models and patents;

- scientific work for which the results are negative, unfinished or improperly prepared;

- financial objects, the purpose of acquisition of which is to obtain profit from transfer to third parties for use.

A quick step-by-step legal guide

So, let's look at the actions that need to be taken.

Step - 1 First of all, determine which group of fixed assets the received property belongs to. There are several main categories: buildings, structures, machines, equipment, transport, tools and others. Depending on the category you choose, subaccounts are opened for account 01. Next, move on to the next step of the recommendation.

Step - 2 After this, capitalize the receipt of fixed assets. Depending on the method of receipt, correspondence accounts are drawn up, but, one way or another, initially the property is accounted for in account 08 “Investments in non-current assets”, to which the necessary sub-account is opened, for example, if this is a receipt, then select the sub-account “Acquisition of fixed assets”. Next, move on to the next step of the recommendation.

How to account for fixed assets in an organization - receipt of fixed assets, ... 01/03/2012

Step - 3 To determine the credit account, determine the source of income. If the property was received through a contribution to the authorized capital, make an entry: D08 “Investments in non-current assets” K75 “Settlements with founders” subaccount “Settlements on contributions to the authorized (share) capital”. Next, move on to the next step of the recommendation.

Step - 4 If fixed assets were received under an exchange agreement, reflect this in this way: D62 “Settlements with buyers and customers” K91 “Other income and expenses” - property was received under an exchange agreement; D08 “Investments in non-current assets” K60 “Settlements with suppliers and contractors” - receipt of property under an exchange agreement is capitalized. Next, move on to the next step of the recommendation.

How to introduce fixed assets of an enterprise - commissioning of fixed assets ... 03/19/2012

Step - 5 In the case when the property was received free of charge, make an entry: D01 “Fixed assets” K91 “Other income and expenses” or 98 “Deferred income” - the property is accepted for accounting. Next, move on to the next step of the recommendation.

Step - 6 When the fixed asset was received from the supplier, it is necessary to reflect this in this way: D08 “Investments in non-current assets” K60 “Settlements with suppliers and contractors” - the value of the property was accrued to the supplier; D01 “Fixed asset” K08 “Investments in non-current assets” - the fixed asset was put into operation. Next, move on to the next step of the recommendation.

Step - 7 After this, put the property into operation. To do this, issue an order and an act of acceptance and transfer of fixed assets (form No. OS-1). Also assign an inventory number to the object. But keep in mind that if the main asset consists of several parts, which at the same time have different useful lives, then the numbers will be different. Be sure to specify the procedure for determining this number in the accounting policy. The code is used to mechanize the accounting of fixed assets.

Additional information and useful advice from a legal consultant

Do not forget to charge depreciation of fixed assets monthly and reflect the amount of depreciation on account 02.

How to reflect lease in accounting - registration of lease of fixed assets... 01/03/2012

We hope the answer to the question - How to take property onto the balance sheet - contains legal information useful to you. Good luck to you! To find the answer to your question, use the form - Site Search.

Key tags: Jurisprudence

| Enya | |

| Russell's teapot | The answer is storage? |

| butterbean | nightmare |

| Lohmatiy | What does selling from an off-balance account mean??? O_o |

| Enya | It is necessary to sell the written-off cash register...it hangs on an off-balance sheet account.. |

| supremum | (0) Only to another off-balance sheet account. Or add it to your balance sheet. (4) if it is written off, then it no longer exists. |

| butterbean | (4) cast to 41 and push through |

| Lohmatiy | If it has already been written off, then it cannot be sold. It was necessary to make the document Transfer of OS, not Decommissioning of OS. |

| zak555 | (7) exactly, exactly? |

| Enya | (6) Sorry for the probably stupid question... how can I transfer... a document or ?! |

| butterbean | (9) yes, it is possible by manual operation, it is possible by posting |

| Lohmatiy | (9) We are probably talking about Adjusting register entries... |

| zbv | (9) do you want to sell at 0 cost or what? |

| Enya | (10)…correspondence between zabal and balance accounts is prohibited.. (12)..well why..for the cost..as an ordinary product... |

| butterbean | (13) uh, you need to write off the off-balance sheet with one entry, and at 41 you need to add another |