Basic provisions

Inventory is carried out at enterprises by a special commission, the composition of which and the timing of the commission are approved by order of the manager.

Before starting the inventory, the presence of:

- inventory books, cards, inventories;

- technical documentation for the OS;

- other documents for accepted, leased, transferred or issued, written off OS.

https://www.youtube.com/watch?v=https:accounts.google.comServiceLogin

If discrepancies are found in the accounting, changes are made to the relevant documents. The inventory includes an inspection of the operating system, checking the technical condition and compliance of the remaining property with documents and accounting. When making an inventory, special inventories are used, where the names of objects, their numbers, technical and other indicators are entered.

Property that is located outside the enterprise can be inspected only before its temporary disposal or upon return. If the commission identifies operating systems that are unsuitable for use, they are entered into a special list, indicating the reason that led to the damage or malfunction.

Funds that are leased or stored are accounted for in a separate statement. If the inventory cannot be carried out within one day, then the premises where the property has not yet been inspected is sealed until the commission returns. During accounting, fixed assets are classified into groups that include inventory objects.

The latter are formed devices that include various objects or complexes of objects that together perform one function. If we are talking about the movement of fixed assets, then all items related to the inventory object are taken into account.

Each OS must be assigned an inventory number. Despite the fact that the object as a whole may consist of different items (parts), the same inventory number is marked on all of them.

| Front side | Here you need to enter:

|

| back side | Here it is indicated:

|

The cards are formed into a file cabinet, which is acceptable for large enterprises; for small enterprises with a small number of operating systems, it is enough to keep an inventory book (IR). If objects are located in different places, then it is allowed to draw up lists with the help of which their safety will be taken into account.

Who fills it out?

Filling out the form falls on the shoulders of the accountant

companies.

The inventory book form records information about fixed assets stored on the territory of the enterprise, leased and written-off fixed assets.

When an asset is deregistered (regardless of when it is sold or moved for repair work), an entry is made in the journal.

Which form should I use?

To fill out the accounting information for fixed assets in the organization, the inventory journal form OS-6b

.

It is drawn up in a single version on the basis of acts,.

The book is maintained simultaneously for each type

primary document and is actually compiled using inventory cards.

Filling out OS-6b upon receipt of OS objects

An inventory book in the OS-6b form consists of a title page and a list of information about the property

.

First sheet

Form OS-6b contains the name of the organization or division (if necessary), OKPO code.

Second page of the form

consists of a table. Information about the property accepted for accounting is entered in the rows and columns. Each fixed asset is recorded on a separate line.

Numbers and meaning of columns of the OS-6b form

:

- Serial number of the registered property.

- Name of the object registered with the company (recorded on the basis of the acceptance certificate).

- Fixed asset number (inventory).

The following columns in the OS-6b form reflect information about the acceptance of property

for registration of a small enterprise:

- Details of the act (number, date), which is the fundamental document for putting the facility into operation.

- Full date (day, month and year) of acceptance of the asset for accounting.

- The structural unit (if any) that accepted the asset.

- Last name and initials of the employee responsible for storing the fixed asset.

- The cost of the property including all costs incurred.

- The period of use of the fixed asset (useful).

Columns 4, 8-9

are filled out on the basis of a signed act of acceptance and transfer of property for subsequent use.

The initial cost consists of all expenses

enterprises incurred for the acquisition and commissioning of fixed assets (less VAT).

In the process of economic activity of the company, the use of acquired property in it, property is produced.

To reflect the results of the revaluation

To do this, you should additionally enter information about the object into the inventory summary book in columns 12 to 14:

- Date of revaluation.

- Conversion factor.

- The final cost received after the events.

Sometimes property is moved from one unit to another, written off due to moral or physical wear and tear. All of these transactions are also recorded in the inventory book.

When moving the OS is filled

10-11 and 15-18 journal columns:

- 10

— accounting for depreciation of a fixed asset (the accrued amount as of the date of disposal, movement or write-off of property); - 11

— residual value (difference between columns 8 and 10); - 15

— details of the document on the basis of which the external movement or disposal of property is carried out; - 16

— the changed location of the object within the organization, the name of the structural unit is indicated; - 17

— Full name of the employee appointed responsible for maintaining the safety of property at the new location; - 18

— the reason for disposal or write-off (for example, the number of the purchase and sale agreement).

Using the inventory book, depreciation groups are distributed according to the place of operation, or some other characteristic.

The document also takes into account leased property

. In this case, the inventory number of the object in the book indicates the one assigned by the lessor.

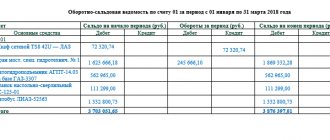

The book data is summarized monthly

and are compared with synthetic accounting data (accounting for the arrival and departure of fixed assets).

Each fixed asset object has its own inventory number. Even if the property consists of several items (parts), this number is repeated on all components of the asset.

Rented funds (under safekeeping) are accounted for in a different statement.

If the inventory of property cannot be carried out in one day, then the building where the property that has not yet been inspected is located is sealed before the commission resumes its work. Fixed assets are classified during the period of their accounting into groups that include objects.

and sample

Below we offer a standard form OS-6b and a completed example of a consolidated accounting journal for acquired assets for a small enterprise.

The inventory book of fixed assets, form OS-6b, is a journal in which all fixed assets arriving at the enterprise and further movements of these objects are recorded. The form is filled out by small businesses instead.

Small enterprises have the right to conduct simplified accounting, use simplified register forms, and submit simplified reporting. In addition to all this, small businesses may not have a separate inventory card for each incoming fixed asset item, but rather record all actions with fixed assets in one journal, called an inventory book. The form of this document is OS-6b.

Instructions for filling out the OS-6b form:

The book is a magazine with a title page.

Directions for use

Business transactions at any enterprise must be formalized on the basis of documents that can be taken for primary accounting. Primary documents (PD) become the basis for accounting. PD is understood as evidence of a business transaction (CO), which has legal force and does not need clarification.

PD must be drawn up in accordance with standard forms developed for accounting by enterprises with any form of ownership. Thus, it is necessary to take into account the presence and movement of OS using forms OS-6, 6a, 6b. The latter is acceptable for small businesses. When there is no need to fill out separate cards, you can enter everything into the IK.

The forms are drawn up in one copy and filled out on the basis of other PD intended for accounting of property - acceptance and transfer certificates, drawn up according to forms OS-1, 1a, 1b and other documents. All movements in relation to inventory objects can be displayed in the book, if there are few of them.

Rules for filling out the register

The OS-6b book consists of a title page and a tabular part, while there can be quite a lot of internal sheets.

The title page displays information about the owner of the OS, and also indicates the period for which the book was opened. Mandatory details are the position and full name of the employee responsible for maintaining the book.

Information about each OS object is entered in a separate line (and only in one). That is, a record about one object is made once, and as the situation with the object changes, new information is added to the line (up to and including deregistration of the object).

There are only 18 columns in a line. When revaluing an asset, information about this is entered into gr. 12-14, when moving - in gr. 15-17, and when deregistered (sale, write-off) - in gr. 18.

IMPORTANT! In the columns where the amount of depreciation should be indicated, information about the depreciation accrued for the entire period of operation should be displayed.

When accepting an object of fixed assets for an enterprise, it is necessary to open an inventory card for it to record all operations carried out with the object during operation. Organizations for these purposes use the OS-6 form, which can be used. Form OS-6b, called the inventory book of fixed assets, has been developed especially for small enterprises. and this form can be found at the end of the article.

We also offer filling out the inventory book, which can be used as a template.

The unified form OS-6b is different in that it contains information about all fixed assets received by a small enterprise. For example, an inventory card according to the OS-6 form is filled out for each individual object.

Design graph

To fill out a card for an inventory item, the accountant needs to submit:

- transfer deed or invoice;

- technical certificate;

- another document that will display the action performed on the OS, for example, write-off, overhaul, acquisition, sale, etc.

When filled out, each card must receive its own number, which is placed in the corresponding line. Other columns contain information related to the OS.

So, in the card for each object you should enter:

- the date of completion, it must coincide with the date of the transfer deed;

- classifier code;

- No. of depreciation group;

- inventory number assigned to the object;

- serial number, which can be taken from the technical passport, acceptance certificate;

- the date of acceptance for accounting, which corresponds to the date of inclusion of the property in the fixed assets, it also coincides with the date of the acceptance certificate;

- date of write-off from accounting, when necessary;

- information about the location, manufacturer, series data, type (for construction), model, brand, everything that can be taken from the technical documentation.

| First section | Filled in with information about the OS at the time of transfer under the transfer deed. If the company acquires new property, then the section is not filled out. |

| Second | This should include data on the initial cost of the property and the period of its use. To be completed at the time the property is registered. |

| Third | Information about revaluations, if they were carried out, i.e. the section can only be filled out while using the OS. As a result of revaluation, the value of the fixed assets is recalculated to bring it closer to the market value. After each revaluation it is necessary to enter in the section:

|

| Fourth | This section contains data on movement (receipt, internal movement between departments, write-off, disposal). |

| Fifth | The section contains information regarding operations carried out with the OS that changed its value. These may include completion, re-equipment, repair, modernization, etc. |

| Sixth | Designed to enter information about the company's costs for repairs. |

| Seventh | The individual characteristics of the OS are described here. |

https://www.youtube.com/watch?v=ytaboutru

After registration, the card must be signed by the responsible accountant.

Form T-13

required to generate a time sheet.

How tax calculations are carried out on the amounts of income paid to foreign organizations and taxes withheld - we will tell you here.

When is it issued?

For accounting of fixed assets by small enterprises.

Information about received fixed assets is entered into the book on the date the fixed asset is put into operation. This date must coincide with the date of the OS-1 act (OS-1a).

Subsequently, the following information is entered into the inventory book:

- when moving a fixed asset - on the day of drawing up the OS-2 act;

- in case of revaluation - on the day of drawing up the act on the results of the revaluation of fixed assets;

- upon disposal - on the day of drawing up the act OS-1, OS-1a (when selling fixed assets), OS-4, OS-4a (when writing off fixed assets that have become unusable).

Sample filling

Filling out the title page of form OS-6b

The name of the organization and, if necessary, the name of the department should be indicated.

You also need to write the start date for filling out the book. At the bottom of the title page, the full name and position of the materially responsible person is written and his personnel number is indicated.

Filling out a book page, form OS-6b

Each sheet of the inventory book form is divided into 18 columns, the filling of which will be discussed below:

1 - number in order.

2 – name of the fixed asset that is received, retired, written off or moved. Initially, the first entry is about the receipt of the object; data is entered on the basis of the acceptance certificate (, and OS-1b).

3 – inventory number assigned to the fixed asset object.

4-7 – information about the receipt of fixed assets (number, date and name of the document, the date when the object was accepted for accounting, the name of the department into which the fixed assets were accepted and the full name of the financially responsible person).

8 – cost of the object taking into account all costs.

9 – useful life (from the acceptance certificate);

10 – accrued depreciation (also from the act).

When carrying out revaluation, you need to fill out columns 11-14.

12 – date of revaluation.

13 – conversion factor used for revaluation.

14 – replacement cost obtained after the recalculation procedure.

All internal movements, as well as disposal and write-off of an object are reflected in columns 15 - 18.

OS-6b

(inventory book) is a register used to account for fixed assets (fixed assets) with a small number of them. Below is information on how to use this register.

Sample of filling out the inventory book for accounting of fixed assets

It is necessary to record information in the IC on the basis of transfer acts, which are drawn up according to forms OS-1, 1a, 1b for one object or group, buildings or structures. It is designed like a card.

Mandatory details of the IC are:

- Name;

- date of registration;

- name of company;

- the essence of XO;

- CO meters, these include natural, labor, monetary;

- signatures and full names of employees responsible for chemical equipment.

In addition to the basic details, additional details can be entered into the primary documents, these include, for example, the basis for carrying out the operation, the address of the organization, and the number of the document that evidences the transaction.

The main part of the IC is a tabular one, consisting of 18 lines; they are filled out for each object that the enterprise registers as an operating system.

| When receiving OS | The following information is required:

|

| When revalued | Required:

|

| When moving | Required:

|

The IK is filled out by the responsible accountant. A sample form can be found above.

Inventory cards are designed to record fixed assets, as well as their movement within the organization. An inventory card in the OS-6 form is opened for each fixed asset, and it is recommended to draw up such a document also for leased objects (clause 14 of the Guidelines for accounting for fixed assets).

An inventory card of fixed assets is opened on the basis of the act of acceptance and transfer of fixed assets (forms OS-1, OS-1a, OS-1b). From it, part of the information about the acquired object is transferred to the inventory card for recording fixed assets (sections 1 and 2 are filled out). Also, when filling out the card, information from accompanying documents, for example technical data sheets of manufacturers, is used.

At the time the OS is accepted for accounting, the card reflects the following information:

- in section 1 - information about the asset as of the date of transfer: date of issue, data on the commissioning document, service life, accrued depreciation, residual value (the section is filled out for objects that were already in operation by the previous owner);

- in section 2 - the initial cost and useful life (they will be needed to calculate depreciation);

- in section 4 - information about the acceptance of the object (details of the acceptance document, department, cost of the fixed assets and the financially responsible person are indicated);

- Section 7 contains a brief individual description of the object.

The remaining sections are filled in as the OS operates. In particular, the following information is entered into the card:

- on the revaluation of fixed assets (section 3);

- movement of the object and its write-off (section 4);

- costs of reconstruction, modernization and repair (sections 5 and 6).

The card is signed by an authorized employee (usually an accountant).

A sample of filling out an inventory card for fixed assets can be found on our website.

Inventory book OS-6b

October 11, 2020 Fixed assets

The inventory book for accounting for fixed assets, form OS-6b, is used by small enterprises and is kept in one copy. In other situations, a document of a different form is already selected. This form is filled out by an accountant using data from primary documents.

The inventory book of small enterprises stores information about the availability of a fixed asset item, and it indicates all its movements within the enterprise. The inventory book form is presented in a general form, approved by the legislation of the Russian Federation and has the form OS-6b.

| Form OS-6b form | |

You can download a completed sample of the OS-6b inventory book from the link at the end of the article.

The inventory book records acts of acceptance and transfer of fixed assets of the enterprise (and OS-1a for buildings), as well as accompanying documents (technical passports of manufacturing plants can play their role).

Objects that are not suitable for use are subject to write-off on the basis of an act on write-off of fixed assets (and a sample form OS-4 is possible, OS-4a for vehicles -). At the same time, an entry is made in the inventory book about the deregistration of the fixed asset item.

When accepting intangible assets for accounting, an accounting card in the form of intangible asset-1 is filled out.

UNIFIED FORMS OF PRIMARY ACCOUNTING DOCUMENTATION

N OS-1 “Act on the acceptance and transfer of fixed assets (except for buildings, structures)”, N OS-1a “Act on the acceptance and transfer of a building (structure)”, N OS-1b “Act on the acceptance and transfer of groups of fixed assets assets (except for buildings, structures)", N OS-2 "Invoice for the internal movement of fixed assets", N OS-3 "Acceptance and delivery of repaired, reconstructed, modernized fixed assets", N OS-4 "Act on write-off of fixed assets (except for motor vehicles)", N OS-4a "Act on write-off of motor vehicles", N OS-4b "Act on write-off of groups of fixed assets (except for motor vehicles)", N OS-6 "Inventory accounting card object of fixed assets", N OS-6a "Inventory card for group accounting of fixed assets", N OS-6b "Inventory book of accounting of fixed assets", N OS-14 "Act of acceptance (receipt) of equipment", N OS-15 “Act on acceptance and transfer of equipment for installation”, N OS-16 “Act on identified equipment defects”.

2. Distribute the unified forms of primary accounting documentation specified in paragraph 1 of this Resolution to legal entities of all forms of ownership operating on the territory of the Russian Federation (with the exception of credit organizations and budgetary institutions).

- dated 10.30.97 N 71a regarding the approval of unified forms of primary accounting documentation for accounting of fixed assets: N OS-1, N OS-3, N OS-4, N OS-4a, N OS-6, N OS-14, N OS-15, N OS-16;

- dated January 28, 2002 N 5 regarding paragraph 1.

Chairman of the State Statistics Committee of Russia V.L. SOKOLIN

Unified form N OS-1

APPROVED by Resolution of the State Statistics Committee of Russia dated January 21, 2003 N 7

| I APPROVED | I APPROVED | ||||||||||||||||

| Head of the delivering organization | Head of the recipient organization | ||||||||||||||||

| job title | signature | full name | job title | signature | full name | ||||||||||||

| "__" ____________ 20__ | |||||||||||||||||

| M.P. | M.P. | ||||||||||||||||

| Code | |||||||||||||||||

| OKUD form | |||||||||||||||||

| Recipient organization | according to OKPO | ||||||||||||||||

| Name | |||||||||||||||||

| address, telephone, fax | |||||||||||||||||

| Bank details | |||||||||||||||||

| name of the structural unit | |||||||||||||||||

| Delivering organization | according to OKPO | ||||||||||||||||

| Name | |||||||||||||||||

| address, telephone, fax | |||||||||||||||||

| Bank details | |||||||||||||||||

| name of the structural unit | |||||||||||||||||

| Basis for drawing up the act | number | ||||||||||||||||

| order, instruction, contract (indicating its type, main obligations) | date | ||||||||||||||||

| date | acceptance for accounting | ||||||||||||||||

| write-offs from accounting | |||||||||||||||||

| Account, subaccount, analytical accounting code | |||||||||||||||||

| according to OKOF | |||||||||||||||||

| Document Number | Date of preparation | ||||||||||||||||

| Number | depreciation group | ||||||||||||||||

| ACT | |||||||||||||||||

| inventory | |||||||||||||||||

| ON THE ACCEPTANCE AND TRANSFER OF FIXED ASSETS (EXCEPT BUILDINGS, STRUCTURES) | factory | ||||||||||||||||

| State registration of rights to real estate | number | ||||||||||||||||

| date | |||||||||||||||||

| Fixed asset object | |||||||||||||||||

| name, purpose, model, brand | |||||||||||||||||

| Location of the object at the time of reception and transmission | |||||||||||||||||

| Manufacturing organization | |||||||||||||||||

| Name | |||||||||||||||||

| Share in common property rights, % | |||||||||||||||||

| For reference: | 1. Participants in shared ownership | ||||||||||||||||

| 2. Foreign currency {amp}lt;*{amp}gt; | |||||||||||||||||

| Name | well | on the date | sum | ||||||||||||||

2nd page of form N OS-1

| 1. Information about the condition of the fixed asset item on the date of transfer | 2. Information about the fixed asset item as of the date of acceptance for accounting | |||||||||||

| date | Actual service life (years, months) | Useful life | Amount of accrued depreciation (wear and tear), rub. | Residual value, rub. | Purchase cost (negotiable value), rub. | Initial cost as of the date of acceptance for accounting, rub. | Useful life | Method of calculating depreciation | ||||

| release (year) | commissioning (initial) | last major overhaul | ||||||||||

| Name | norm | |||||||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 1 | 2 | 3 | 4 | |

| 3. Brief individual description of the fixed asset item | ||||||

| Object of fixed assets, fixtures, accessories | Content of precious materials (metals, stones, etc.) | |||||

| Name | quantity | name of precious materials | item number | unit | quantity | weight |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| Other characteristics | ||||||

3rd page of form N OS-1

| Transfer and acceptance commission | |||||||||||||||||||||

| Test result for “__” ___________ 20__ | |||||||||||||||||||||

| Fixed asset object technical specifications | corresponds | Finalization | required | ||||||||||||||||||

| does not match | not required | ||||||||||||||||||||

| indicate what does not correspond | indicate what is required | ||||||||||||||||||||

| Commission conclusion: | |||||||||||||||||||||

| Application. Technical documentation | |||||||||||||||||||||

| Chairman of the Commission | |||||||||||||||||||||

| job title | signature | full name | |||||||||||||||||||

| Members of the commission: | |||||||||||||||||||||

| job title | signature | full name | |||||||||||||||||||

| job title | signature | full name | |||||||||||||||||||

| Fixed asset object | |||||||||||||||||||||

| Passed | Accepted | ||||||||||||||||||||

| job title | signature | full name | job title | signature | full name | ||||||||||||||||

| "__"___________ 20__ | Personnel Number | __" ____________ 20__ | |||||||||||||||||||

| By power of attorney dated "__" ______________ 20__ | N | , | |||||||||||||||||||

| issued | |||||||||||||||||||||

| by whom, to whom (last name, first name, patronymic) | |||||||||||||||||||||

| Accepted the fixed asset object for safekeeping | |||||||||||||||||||||

| job title | signature | full name | |||||||||||||||||||

| "__" ____________ 20__ | Personnel Number | ||||||||||||||||||||

| Accounting note: In the inventory card (book) of accounting for a fixed asset item, disposal is noted | A note from the accounting department about the opening of an inventory card for accounting for a fixed asset item or an entry in the inventory book | Document Number | Date of preparation | ||||||||||||||||||

| Chief Accountant | Chief Accountant | ||||||||||||||||||||

| signature | full name | signature | full name | ||||||||||||||||||

Unified form N OS-1a

| I APPROVED | I APPROVED | ||||||||||||||||

| Head of the delivering organization | Head of the recipient organization | ||||||||||||||||

| job title | signature | full name | job title | signature | full name | ||||||||||||

| "__" ____________ 20__ | |||||||||||||||||

| M.P. | M.P. | ||||||||||||||||

| Code | |||||||||||||||||

| OKUD form | |||||||||||||||||

| Recipient organization | according to OKPO | ||||||||||||||||

| Name | |||||||||||||||||

| address, telephone, fax | |||||||||||||||||

| Bank details | |||||||||||||||||

| name of the structural unit | |||||||||||||||||

| Delivering organization | according to OKPO | ||||||||||||||||

| Name | |||||||||||||||||

| address, telephone, fax | |||||||||||||||||

| Bank details | |||||||||||||||||

| name of the structural unit | |||||||||||||||||

| Basis for drawing up the act | number | ||||||||||||||||

| order, instruction, contract (indicating its type, main obligations) | date | ||||||||||||||||

| date | acceptance for accounting | ||||||||||||||||

| write-offs from accounting | |||||||||||||||||

| Account, subaccount, analytical accounting code | |||||||||||||||||

| according to OKOF | |||||||||||||||||

| Document Number | Date of preparation | ||||||||||||||||

| Number | depreciation group | ||||||||||||||||

| ACT | |||||||||||||||||

| inventory | |||||||||||||||||

| ABOUT RECEPTION AND TRANSFER OF BUILDINGS (STRUCTURES) | factory | ||||||||||||||||

| State registration of rights to real estate | number | ||||||||||||||||

| date | |||||||||||||||||

| Fixed asset object | |||||||||||||||||

| name, purpose, model, brand | |||||||||||||||||

| Location of the object at the time of reception and transmission | |||||||||||||||||

| Organization-designer (performer of construction work) | |||||||||||||||||

| Name | |||||||||||||||||

| Share in common property rights, % | |||||||||||||||||

| For reference: | 1. Participants in shared ownership | ||||||||||||||||

| 2. Foreign currency {amp}lt;*{amp}gt; | |||||||||||||||||

| Name | well | on the date | sum | ||||||||||||||

https://www.youtube.com/watch?v=https:tv.youtube.com

2nd page of form N OS-1a

| 1. Information about the condition of the object on the date of transfer | 2. Information about the object as of the date of acceptance for accounting | ||||||||||||

| date | Actual service life (years, months) | Amount of accrued depreciation (wear and tear), rub. | Residual value, rub. | Purchase cost (negotiable value), rub. | Initial cost as of the date of acceptance for accounting, rub. | Useful life | Method of calculating depreciation | ||||||

| start of construction | completion of construction | intro for exploitation | latest reconstruction, completion, modernization | last major overhaul | |||||||||

| Name | norm | ||||||||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 1 | 2 | 3 | 4 | |

| 3. Brief individual characteristics of the object | |||||

| Content of precious and/or semi-precious materials (metals, stones, etc.) | |||||

| name of precious and/or semi-precious materials | item number | unit | quantity | weight | |

| 1 | 2 | 3 | 4 | 5 | |

| Name of structural elements and other features characterizing the object | Qualitative and quantitative characteristics | Note | ||||

| main object | attached premises, etc. | |||||

| 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| Total area, m2 | ||||||

| Number of floors | ||||||

| Total construction volume, m3 | ||||||

| including underground part, m3 | ||||||

| Area of built-in, built-in and attached premises, m2 | ||||||

| Including: | ||||||

| materials | ||||||

Surpluses of fixed assets (funds) identified during inventory, regardless of the nature and reasons for their formation, come to the balance sheet of the organization.

At the same time, the usual accounting entries are made to increase fixed assets (funds). Naturally, an object discovered as a surplus is assigned a corresponding inventory number, an inventory card is created for it, or it is entered into the inventory book of fixed assets (funds), s [p.84] In enterprises with a small number of fixed assets, object-by-object accounting can be organized in inventory book for accounting of fixed assets (form No. OS-11). Entries in the book are made according to classification groups (types) of fixed assets and their location. [p.247] Inventory books for accounting of fixed assets 84 [p.446]

By agreement with higher organizations, enterprises can organize accounting of fixed assets in the inventory books of fixed assets (form No. OS-11). Entries in the book are made in the context of classification groups (types) of fixed assets and by their location. This option is applicable for a small number of fixed assets. [p.89]

Inventory book for accounting of fixed assets (form No. OS-11) [p.164]

The books are numbered bound sheets. The advantage of books is the impossibility of replacing individual sheets for the purpose of abuse and theft. For example, to reconcile accounting and operational warehouse data and to control the safety of valuables in warehouses, a Materials Accounting Book is maintained. The organization maintains a General Ledger, a Cash Ledger, and can also use a Business Transactions Ledger, an Income and Expense Ledger, and an Inventory Ledger for Fixed Assets. The disadvantage of books is that they can only be filled out by hand. [p.74]

Books are used in cases where the list of objects taken into account is insignificant. For example, in the case when an enterprise has a small list of fixed assets, then instead of inventory cards (form No. OS-6), an inventory of inventory cards for accounting for fixed assets (form No. OS-7) and cards for recording the movement of fixed assets (form. No. OS-8) it is advisable to keep a book of fixed assets. [p.325]

Inventory cards and books of accounting of fixed assets 5 5 [p.156]

Inventory cards and fixed assets accounting book [p.115]

Inventory cards and books of accounting for fixed assets - 3 years after the liquidation of fixed assets. [p.63]

The disposal is noted in the fixed asset accounting card (book). Inventory card No. 55 is closed. [p.140]

The completed and approved write-off act is transferred to the accounting department, which notes the disposal of the object in the fixed assets accounting book (fixed assets movement card) and in the object-by-object registers of fixed assets (in the inventory list or inventory card). The inventory card for the liquidated object is removed from the file cabinet. [p.13]

The invoice for the internal movement of fixed assets is issued in two copies by the department (shop) employee - the deliverer. The first copy with the recipient's receipt is transferred to the accounting department, and the accounting department, based on the received invoice for internal movement, makes an entry in the inventory card (book) for accounting for fixed assets and transfers the inventory card to the appropriate place in the file cabinet. Based on the second copy of the invoice for the internal movement of fixed assets, the deliverer makes appropriate notes in the inventory list of fixed assets (by location, operation) about the disposal of the object. [p.161]

The form is used to formalize the acceptance and delivery of fixed assets from major repairs, reconstruction and modernization. The act, signed by an employee of the workshop (department) authorized to accept fixed assets, and a representative of the workshop (enterprise) that carried out major repairs, reconstruction and modernization, is submitted to the accounting department of the enterprise (organization), where the corresponding entries are made in the inventory cards (books) of accounting for fixed assets. funds for major repairs, reconstruction and modernization. [p.161]

The object-by-object accounting data for fixed assets at their location (operation) must be identical to the entries in the inventory cards (books) for accounting for fixed assets maintained in the main (central) accounting department. [p.164]

Analytical accounting of fixed assets is maintained in inventory cards for recording fixed assets (form No. OS-6) or in books. Inventory cards (inventory book) are filled out on the basis of the act (invoice) of acceptance and transfer of fixed assets, technical passports and other documents for the acquisition, construction, movement and write-off of fixed assets. [p.129]

Fixed asset accounting books, IBP, inventory cards. [p.135]

For account No. 02, accounting is carried out in the context of two subaccounts No. 1 Depreciation of fixed assets in terms of complete restoration and No. 2 Depreciation of fixed assets in terms of major repairs. To determine the depreciation of each specific object, they use the data available in inventory cards (fixed asset books, inventory lists) about the initial cost of the object, the time it was in operation, and depreciation rates. For example, the initial cost of an object that has been in operation for 10 years is 8,000 rubles. The annual depreciation rate for this facility is 5.2%, including 2.8% for complete restoration and 2.4% for major repairs. Depreciation of an object in terms of complete restoration [p.53]

At the enterprise, analytical accounting of fixed assets is maintained on cards opened for each inventory item, or in books according to their types, place of use and financially responsible person. In small enterprises, it is usually more convenient to record them in a book of fixed assets, which has a standard form. Entries in the book are made in the context of classification groups (types) of fixed assets and by their location. [p.85]

Synthetic accounting registers include memorial orders, turnover sheets for synthetic accounts, general ledgers, etc. Analytical accounting registers include payroll sheets for workers and employees, personal accounts, materials accounting cards, and inventory cards for fixed assets. [p.72]

Analytical accounting is an object-by-object accounting of fixed assets and is maintained on inventory cards according to f. No. OS-6. An inventory card is opened for each inventory item or for a group of similar items. Filling out inventory cards (books) is carried out on the basis of primary documentation of acceptance certificates, technical passports and other documents. They should not include all indicators of technical documentation. [p.195]

Chronological registers are used to register all documents in the order they were received, but without distribution among accounts. Chronological recording is made in special journals or registers; its purpose is to ensure control over the safety of documents received by the accounting department and the correctness of entries in them. Chronological registration is also used for making inquiries (for example, a registration journal, a cash book, a log of incoming goods, an inventory of inventory cards for accounting for fixed assets). [p.191]

In the oil supply system at large oil depots, at large oil pumping stations, it is advisable to conduct analytical accounting of fixed assets (funds) on inventory cards. At medium and small oil depots, loading points and small oil pumping stations with a small number of inventory items, it is advisable to keep analytical records of fixed assets (funds) in the inventory book for each group separately using a manual accounting option. [p.76]

Analytical accounting of fixed assets is carried out on inventory cards (books), on the front side of which the name and inventory number of the object, year of manufacture, date and number of the acceptance certificate, location, total cost, depreciation rates, cost code (for attributing depreciation amounts) are indicated. , the amount of depreciation as of the date of acceptance or revaluation of the object, the cost of major repairs, internal movement of the object and the reason for its disposal. [p.132]

Analytical accounting of fixed assets is carried out in object-by-object cards or inventory books. [p.55]

Analytical accounting of fixed assets is carried out by type of inventory items and financially responsible persons in the book of form No. K-26. The balance for each fixed asset item is displayed only as of July 1 and January 1. Form book No. K-26 has been used for several years. With mechanized accounting of fixed assets, it is advisable to conduct analytical accounting in an inventory card, which provides the same indicators for accounting for fixed assets as in the book of form No. K-26. [p.176]

ACCOUNTING FOR FIXED ASSETS is carried out by enterprises and business organizations for inventory items grouped in accordance with the standard classification of fixed assets. Entries in accounting accounts are made at the cost of fixed assets established during their revaluation as of January 1. 1960, or the amount of costs for the construction (construction) or acquisition (including costs of delivery and installation) of fixed assets put into operation after January 1. 1960 The receipt of fixed assets (putting into operation) is formalized by the act of acceptance into operation. Then, for each object, as a rule, an inventory card is filled out, indicating its name and inventory number, the date and number of the commissioning certificate, the initial cost, depreciation rates, as well as a brief technical description. characteristic. The card contains all notes about the costs of major repairs, the movement of an object within the enterprise and its disposal. In enterprises with a small number of fixed assets, an inventory book (inventory) is used for this. Receipt of fixed assets [p.457]

Fixed assets (funds) No. 13 Standard item-by-object accounting cards, inventory books, inventory lists Inventory of inventory cards for accounting of fixed assets, f. No. OS-10 [p.51]

Standard documentation assumes that analytical accounting of fixed assets is carried out centrally in the general accounting department of enterprises. At the same time, in large enterprises with a large number of fixed assets, analytical accounting is kept in inventory cards, and in enterprises with a small number of inventory items, at the discretion of the ministry and department, analytical accounting can be kept not on cards, but in inventory books. [p.102]

Each object has an inventory number, which is retained for the entire time it is in operation, in reserve or mothballed. An inventory object is the subject of analytical accounting of fixed assets. Such records are kept on inventory cards (books), containing, in addition to monetary value, depreciation rates, technical characteristics of the object. It must be emphasized that all objects of fixed assets, with the exception of structures, buildings and some others, must be under the financial responsibility of certain persons, so that there is no ownerless property and in the event of a shortage or surplus of fixed assets, it would be possible to identify the person responsible for actual condition of fixed assets. [p.67]

Analytical accounting of fixed assets is maintained for each inventory item on inventory cards, which are subject to registration in a special inventory. For a small number of objects, records are kept in the inventory book. [p.112]

The completed and approved act is transferred to the accounting department of the organization, where a note is made about the disposal of the object in the asset accounting book (fixed asset movement card), and in the registers of object-by-object accounting of fixed assets (inventory list or inventory card). At the same time, the following accounting entries are made [p.14]

Chronological registers are registers in which business transactions are recorded as they occur. This is, for example, a cash book, a log of incoming goods, an inventory of inventory cards for accounting of fixed assets. [p.59]

Accounting for fixed assets at their location or operation is carried out in the inventory list of fixed assets (Form No. OS-13). It indicates the date and number of the entry in the inventory card or inventory book, the inventory number of the object, its name, initial cost, disposal (date and document number, reason for disposal). The data on the list and inventory cards must match. [p.89]

In large cooperatives, instead of a statement for each fixed asset item, inventory cards (form No. OS-6, OS-7, OS-9, OS-10), inventory lists (form No. OS-13) or inventory accounting books can be opened (form No. OS-11), which indicate the main characteristics of fixed assets, their location, and the amount of depreciation charges. To record small business enterprises by their types, the card “(form No. MB-2) can be used. [p.108]

The form is used for manual processing of accounting documentation to record the movement of fixed assets by classification groups; it is filled out on the basis of data from inventory cards (books) of the corresponding groups (types) of fixed assets and is verified with data from statistical accounting of fixed assets. [p.164]

Based on these documents, the accounting department makes the appropriate entries in the inventory cards (books) for accounting for fixed assets, after which the technical documentation is transferred to the technical (production) or other department of the enterprise. [p.161]

Inventory cards and Zg. After the liquidation book of fixed assets accounting Art. 3 1 3 dates of fixed assets [p.211]

Checking the correctness of maintaining inventory cards, books, inventories, technical passports and other documents is carried out for each object. Transfer of data, introduction of corrections and clarifications in accordance with the new unified forms of primary accounting documentation for accounting of fixed assets (approved by Resolution of the State Statistics Committee of the Russian Federation dated October 30, 1997 No. 71a) [p.60]

Improving analytical accounting of fixed assets is associated with the use of mini and microcomputers. On the one hand, this leads to an increase in the volume of analytical information, increasing its reliability and objectivity. On the other hand, it helps eliminate the duplication of permanent information contained in various primary documents and the refusal to maintain inventory cards (books) and inventory lists in accounting, since analytical object-by-object accounting data for fixed assets is generated and stored on computer media. At the same time, computer technology ensures the prompt delivery of the necessary information to employees of the accounting department and other departments in the form of appropriate machine reports or videos displayed on display screens directly at the consumers’ workplaces. [p.140]

With the comprehensive mechanization of accounting in a tabular-punched card form, along with machinograms, only some analytical accounting registers compiled manually or on a computer can be stored (warehouse records cards, inventory cards or books of fixed assets, workwear accounting cards in operation, as well as auxiliary statements and calculations for calculating product costs). [p.73]

Inventory cards and books indicate the source of acquisition of fixed assets (through bank loans, funds from the production development fund, etc.), the start date of collecting payment for this object to the budget and the validity period of certain benefits for payment for funds. To calculate the total amount of this fee, a grouping sheet (machine diagram) is drawn up, which indicates the inventory number of the object, its name, the book value of fixed assets in the context of the places of their operation and groups of benefits for fees for funds. Object-by-object accounting of fixed assets in monetary terms and calculation of payments for fixed assets are made in amounts rounded to rubles. [p.84]

The form is used for object-by-object accounting of fixed assets of all types at industrial enterprises, construction sites and in organizations with a small number of inventory objects, where it is inappropriate to keep records of objects on separate inventory accounting cards. The book is kept in the accounting department. Records are made with the calculation of its long-term use in the context of classification groups (types) of fixed assets and at their location. [p.164]