Before opening the card

Before creating this accounting document, it is necessary to draw up an act of acceptance and transfer of fixed assets - it is from this that information about the object comes into the card. In addition, to fill it out, data is taken from other accompanying papers, such as, for example, technical passports of products, equipment and machinery.

The inventory card refers to the internal accounting documentation of the enterprise and information is entered into it for any actions with the property registered in it (purchase, transfer from one department to another, repair, reconstruction, modernization, write-off, etc.).

Rules for document execution

The inventory card of a fixed asset object has a unified form with code OS-6, approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 N 7.

The document is drawn up for each object separately and in a single copy, and if the cards are kept in electronic form, then there must be a copy of it on paper (it is the paper versions that contain the “live” signature of the financially responsible person). It is not necessary to certify the document with the company seal, because it refers to its internal documentation.

List of required data

Initially, it should be noted that the list of information necessary to generate a card may vary depending on the purpose.

In general, the mechanism is identical. For example, in order to create a unified form OS-6, you will need to indicate information such as:

- company name without any abbreviations;

- document numbering, including the date of formation;

- an object in combination with a characteristic, in particular - series and number, date of manufacture;

- form according to OKOF, OKUD, OKPO;

- numbering - inventory groups, inventory, production and passports;

- detailed location of the OS object;

- name of the manufacturer;

- data regarding the fixed asset for the period of registration;

- information about revaluation;

- admission information;

- making amendments to the initial cost taking into account personal income tax;

- a brief but succinct personal description.

Information may differ not only depending on the OS format, but also on its type. For example, in relation to fixed assets, not only labor reserves can be considered, but also vehicles, construction projects, and so on.

It is extremely important to clarify such a point in advance in order to eliminate the possibility of varying complexity.

Without exception, all the necessary information can be easily found from 1C, accounting and tax reporting.

Example of registration of an inventory card according to the OS-6 form

Filling out the document header

At the beginning of the document write:

- name of the company that owns the fixed asset,

- the structural unit to which the property is assigned,

- inventory card number,

- date of its preparation,

- name of the registered object.

Here, in the column on the right, the enterprise code according to OKPO (All-Russian Classifier of Enterprises and Organizations) is indicated - it is contained in the constituent papers and the code of the fixed asset object according to OKOF (All-Russian Classifier of Fixed Assets). Continuing to fill out the right column, we enter detailed information about the object:

- number of the depreciation group to which it belongs according to the accounting of the enterprise,

- passport registration number,

- serial and inventory numbers,

- date of registration of the fixed asset for accounting,

- number of the account (sub-account) through which it passes.

Below, the location of the fixed asset object is entered in the corresponding lines (indicating the department code, if such coding is used at the enterprise) and information about the manufacturer (this data can be found in the technical passport).

Filling out detail tables

The second part of the document opens sections dedicated to the registered object.

Please note: information is entered into the first section only if the property was already in use at the time of entry into the card. If it is new, you do not need to fill out this section.

The second section includes the cost of the object at the time of acceptance for accounting and its useful life.

The third section is drawn up when revaluing a fixed asset - and the price can vary both upward and downward. The difference between the original cost and after revaluation is determined as the replacement price.

The fourth section of the card contains information about all movements of recorded property. The data is entered here strictly on the basis of accompanying papers indicating the type of operation, the structural unit to which the asset belongs, the residual value and information about the responsible person.

If the fixed asset is owned by several persons, then they must be indicated under the fourth table with the percentage distribution of shares.

Filling out sections of the reverse side of the OS-6 form

The fifth section indicates all changes in the original value of the object, regardless of the actions performed with it. The type of operation, data from the supporting document, as well as the amount of expenses incurred by the organization in the process of carrying out the necessary procedures are written here.

The sixth section includes information about repair costs, with a full breakdown of each operation performed (type of repair, accompanying documentation, amount of expenses).

The seventh section contains special data about the fixed asset object, including data on the content of precious and semi-precious metals, stones and materials in its composition.

The last table of the card records structural units, elements and other features that are a distinctive feature of the property, as well as its qualitative and quantitative indicators. If there are any comments, they are entered in the last column of the table.

Finally, the document is certified by the employee responsible for maintaining inventory cards at the enterprise (his position must be indicated here and a signature must be affixed with a transcript).

Design graph

To fill out a card for an inventory item, the accountant needs to submit:

- transfer deed or invoice;

- technical certificate;

- another document that will display the action performed on the OS, for example, write-off, overhaul, acquisition, sale, etc.

When filled out, each card must receive its own number, which is placed in the corresponding line. Other columns contain information related to the OS.

So, in the card for each object you should enter:

- the date of completion, it must coincide with the date of the transfer deed;

- classifier code;

- No. of depreciation group;

- inventory number assigned to the object;

- serial number, which can be taken from the technical passport, acceptance certificate;

- the date of acceptance for accounting, which corresponds to the date of inclusion of the property in the fixed assets, it also coincides with the date of the acceptance certificate;

- date of write-off from accounting, when necessary;

- information about the location, manufacturer, series data, type (for construction), model, brand, everything that can be taken from the technical documentation.

Further, the text form contains 7 sections:

| First section | Filled in with information about the OS at the time of transfer under the transfer deed. If the company acquires new property, then the section is not filled out. |

| Second | This should include data on the initial cost of the property and the period of its use. To be completed at the time the property is registered. |

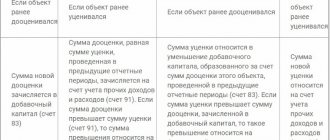

| Third | Information about revaluations, if they were carried out, i.e. the section can only be filled out while using the OS. As a result of revaluation, the value of the fixed assets is recalculated to bring it closer to the market value. After each revaluation it is necessary to enter in the section:

|

| Fourth | This section contains data on movement (receipt, internal movement between departments, write-off, disposal). |

| Fifth | The section contains information regarding operations carried out with the OS that changed its value. These may include completion, re-equipment, repair, modernization, etc. |

| Sixth | Designed to enter information about the company's costs for repairs. |

| Seventh | The individual characteristics of the OS are described here. |

After registration, the card must be signed by the responsible accountant.

Form T-13 is required to generate a time sheet. How tax calculations are carried out on the amounts of income paid to foreign organizations and taxes withheld - we will tell you here.

Form of the unified form OS-6

If document flow in an organization is carried out using unified accounting forms, then analytical accounting of fixed assets (FPE) is carried out using inventory cards according to the unified OS-6 form. Inventory card OS-6 for accounting for fixed assets (the form of which you can download on our website) and instructions for filling it out were approved by Decree of the State Statistics Committee of the Russian Federation dated January 21, 2003 No. 7.

For group accounting of fixed assets, use the unified form OS-6a “Inventory card for group accounting of fixed assets”.

Form OS-6 of the inventory card for recording fixed assets may not be filled out by organizations whose number of fixed assets is small. Such organizations, instead of inventory cards, can keep an inventory book in the OS-6b form (clause 12 of the Guidelines for the accounting of fixed assets, approved by order of the Ministry of Finance of the Russian Federation dated October 13, 2003 No. 91n (hereinafter referred to as the Guidelines for the accounting of fixed assets)).

Since 2013, the use of unified forms approved by the State Statistics Committee has become optional, so it is possible to use independently developed documents of similar content.

For information about what information should be present in a self-developed document form, read the article “Primary document: requirements for the form and the consequences of violating it .

Results

An inventory card according to the unified OS-6 form is used to record and move fixed assets within the company. But the use of unified forms is not mandatory since 2013, therefore the organization has the right to develop a card form independently, adhering to the requirements for the preparation of primary documents specified in Art. 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ.

Sources:

- Resolution of the State Statistics Committee of the Russian Federation dated January 21, 2003 N 7

- Order of the Ministry of Finance of the Russian Federation dated October 13, 2003 N 91n

- Federal Law of December 6, 2011 N 402-FZ “On Accounting”

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Inventory card OS-6: procedure for maintaining and filling out

Inventory cards are designed to record fixed assets, as well as their movement within the organization. An inventory card in the OS-6 form is opened for each fixed asset, and it is recommended to draw up such a document also for leased objects (clause 14 of the Guidelines for accounting for fixed assets).

An inventory card of fixed assets is opened on the basis of the act of acceptance and transfer of fixed assets (forms OS-1, OS-1a, OS-1b). From it, part of the information about the acquired object is transferred to the inventory card for recording fixed assets (sections 1 and 2 are filled out). Also, when filling out the card, information from accompanying documents, for example technical data sheets of manufacturers, is used.

For more details on the types of OS-1 form, see the following materials:

At the time the OS is accepted for accounting, the card reflects the following information:

- in section 1 - information about the asset as of the date of transfer: date of issue, data on the commissioning document, service life, accrued depreciation, residual value (the section is filled out for objects that were already in operation by the previous owner);

- in section 2 - the initial cost and useful life (they will be needed to calculate depreciation);

- in section 4 - information about the acceptance of the object (details of the acceptance document, department, cost of the fixed assets and the financially responsible person are indicated);

- Section 7 contains a brief individual description of the object.

The remaining sections are filled in as the OS operates. In particular, the following information is entered into the card:

- on the revaluation of fixed assets (section 3);

- movement of the object and its write-off (section 4);

- costs of reconstruction, modernization and repair (sections 5 and 6).

The card is signed by an authorized employee (usually an accountant).

A sample of filling out an inventory card for fixed assets can be found on our website.

NOTE! In the example of filling out an inventory card for accounting for fixed assets, sections relating to changes in the value of a fixed asset, its repair, individual characteristics, and the accountant’s signature are given on the 2nd page.

Inventory card form

It is allowed not to have individual inventory cards for objects of the library collection and property whose value does not exceed three thousand rubles. The forms of acts for writing off fixed assets for budgetary institutions are regulated by Order of the Ministry of Finance No. 52n (dated March 30, 2020). If eliminated:

- vehicle, then form 0504105 is used

- printed publications – 0504144

- soft (or household) equipment – 0504143

- other property (not a vehicle) – 0504104

This document is approved directly by the head of the institution. As a rule, additional approval is required from higher authorities controlling the activities.

Only after receiving a properly executed protocol and write-off act does the accountant have the right to begin entering information into the inventory card and removing fixed assets from the balance sheet.

Thus, there is no legal obligation at the legislative level to use a card for asset accounting for commercial enterprises. But maintaining this document will significantly simplify the procedure for rational ownership of property and promptly monitor the need to update existing long-term labor tools. The most complete information is provided in the OS-6 form, which the organization has the right to modify and use at its own discretion, subject to the requirement that the form contains all mandatory details. For state-supported institutions, there are specific features in accounting for fixed assets and its documentation.

Top

Write your question in the form below

Criteria for recognizing a fixed asset

In order for an asset to be recognized as a fixed asset in accounting, certain conditions must be met (PBU 6/01):

- the object must be intended for use in the production of products, performance of work, or for the management needs of the organization;

- it is expected to be used for a long time (more than a year);

- its further resale is not intended;

- the object is capable of generating economic benefits in the future.

In addition to the listed criteria, in RAS, in order to register an asset as fixed assets, it must cost less than 40,000 rubles. In tax accounting there is also a minimum cost criterion, but there it is 100,000 rubles.

Why do you need an inventory card?

The main assets include:

- building;

- structures;

- cars and equipment;

- transport;

- production and household equipment.

The accounting unit is an inventory object. An inventory accounting form is created for each object upon its receipt. It is compiled in one copy. It contains all facts of movement, revaluation, repair and other events related to the asset. It also records the facts of disposal (sale or liquidation). After disposal of the object, the accounting form must be kept for at least five years (clause 80 of the Methodological Guidelines for Accounting for Fixed Assets, Order of the Ministry of Finance of the Russian Federation dated October 13, 2003 No. 91n).

Which form to use

After the new accounting law 402-FZ comes into force, organizations have the right to independently develop forms for primary accounting documents. This rule also applies to OS inventory cards. But a unified inventory card for accounting for fixed assets can also be used (the sample filling is based on the form approved by Resolution of the State Statistics Committee of the Russian Federation dated January 21, 2003 No. 7).

Inventory card for accounting of fixed assets: sample

Rules for filling out an inventory card for recording fixed assets

An individual accounting document is created at the moment an object of fixed assets is received by the organization. This may be an acquisition for a fee, a contribution to the authorized capital, a gratuitous transfer from the founder, or another method that does not contradict the law. Primary information about the asset is entered on the basis of acts of acceptance and transfer of fixed assets, technical passports, and other accompanying documents. At the time of acceptance for registration, you must fill out:

- general section (name and inventory number of the object, its location, date of acceptance for accounting and depreciation group number);

- section 1 (issue date, date and number of the commissioning document);

- Section 2 (acquisition cost, expected useful life);

- section 7 (if the asset has any special quantitative or qualitative characteristics).

Throughout the entire period of use, it is necessary to reflect information about relocation, reconstruction, repair or modernization, revaluation (sections 3, 4, 5 and 6). Data on events that occurred with the fixed asset object during its operation are filled in on the basis of the relevant primary documents.

At the time of disposal, in Section 1 it is necessary to fill in information about the actual service life as of the date of disposal, accrued depreciation and residual value.

Step-by-step filling out the inventory card for accounting for fixed assets OS-6 - and a sample in word and excel

One of the purposes of accounting is to generate reports on fixed assets of an enterprise. Such accounting is reflected in the organization’s local documentation.

Do not forget about the various nuances of this procedure. The inventory accounting card is one of the auxiliary forms. We’ll figure out how to fill it out correctly in the article below.

The article describes typical situations. To solve your problem , write to our consultant or call for free:

+7 (499) 490-27-62 — Moscow — CALL

+7 — St. Petersburg — CALL

+8 ext.849 — Other regions — CALL

It's fast and free!

Purpose of the document

Before drawing up a property accounting form, an act of acceptance is drawn up, from which all the basic information about the received fixed asset is entered.

Download samples of the acceptance certificate:

In addition, an inventory card is filled out based on other accompanying documentation (technical passports for equipment). The issuance of a card according to the unified OS-6 form is carried out in companies where it is necessary to exercise control over the maintenance of fixed assets, their storage and movement.

As a rule, such enterprises have a significant amount of property. Inventory cards for recording fixed assets in the OS-6 form are issued for objects owned by the company, as well as those used under a lease agreement.

The main areas of use of the form are:

- simplifying the process of analyzing the state of an object,

- preparation of statistical reports.

The asset accounting card includes all information about any actions with property (purchase, repair, reconstruction, write-off, relocation). It is compiled by any enterprise for fixed assets (regardless of the company’s field of activity).

Tax inspectors check inventory cards very carefully. The presence of errors in filling them out entails quite serious sanctions.

Which form should I use?

The card has the approved unified form OS-6 (Decree of the State Statistics Committee No. 7 of January 21, 2003).

The form is filled out for each fixed asset (in one copy). When maintaining a document electronically, a copy must be present on paper.

The inventory card requires the signature of the materially responsible employee. The OS-6 form is not certified by a seal.

What you need to know

An inventory card for recording a fixed asset object, form OS 6, must be drawn up without fail at enterprises, regardless of the scope of its activity.

The procedure has its own characteristics. The actual compilation of such cards is usually carried out by an accounting employee. It is in it that accounting cards of this type are reflected.

Key issues that will need to be considered in advance include:

- necessary terms;

- purpose of the document;

- current standards.

Required terms

All important issues related to reporting of this type are reflected in the legislation. But for a correct understanding and interpretation, it is imperative to understand the terms used in it in advance.

The most common ones include:

- fixed assets;

- primary accounting documents;

- accounting and tax accounting;

- depreciation of fixed assets;

- inventory card for accounting of fixed assets.

| Under the term "fixed assets" | It refers to the means of labor directly used in the production process and used for the gradual extraction of profit. The main feature of fixed assets is that they retain their natural shape. Main purpose - for the needs of the main activity |

| Time is an important factor | The period of use of such funds should not be less than 1 year |

| "Primary accounting documents" | Documents that reflect information on any completed banking procedures. They are compiled directly at the time of a money transaction, other operation, or when another business transaction is completed. They are one of the primary evidence of their accomplishment. Certain types of documents have a format established at the legislative level. Others are compiled directly inside the document |

| "Accounting" | The process of reflection in special tables in a manner established at the legislative level. Accounting data is always checked by tax authorities |

| Tax accounting | The process of reflecting information on the basis of which the amounts of contributions to the budget are formed. It is directly related to fixed assets. Tax and accounting records can be maintained both together and separately |

| "Depreciation of fixed assets" | Gradual transfer of their value into production. This process must be reflected in the appropriate reporting. This is what the inventory card is used for. However, there are different formats of this card. A specific one is selected depending on what exactly will be taken into account - one object or a whole group of different ones at the same time. Accompanying documents are attached to the card |

Purpose of the document

The inventory card itself allows you to solve a fairly extensive list of various tasks.

The most significant:

| Simplification of the procedure for analyzing information on fixed assets | Both for the head of the enterprise, other employees, and for those conducting desk audits |

| It becomes possible to compile statistical data as quickly as possible | Related to fixed assets |

| Organizing information | — |

When conducting various types of audits, tax authorities always pay attention to inventory cards. Therefore, you should carefully read the algorithm for filling out this document.

If there are errors, a fairly serious fine may be imposed. In some cases, its value will be quite significant.

Moreover, liability is imposed not only on a legal entity, but also on an individual.

Current standards

An example of filling out an inventory card for recording fixed assets can be easily found on the Internet. It is especially important to do this in the absence of relevant experience. This way you can avoid a large number of different troubles.

The inventory card number must be unique; it is assigned directly at the enterprise.

The fundamental legal document in accordance with which fixed assets are reflected is Order of the Ministry of Finance of the Russian Federation No. 26n dated March 30, 2001 “On approval of the Accounting Regulations”, PBU 6/01.

It includes main sections:

| Chapter No. I | General provisions |

| Chapter No. II | How to assess the existing fixed assets of an enterprise |

| Chapter No. III | Performing the depreciation procedure for fixed assets |

| Chapter No. IV | The procedure for restoring all available fixed assets |

| Chapter No. V | Asset disposal process |

| Chapter No. VI | The process of disclosing information in reporting of the type under consideration |

There is an extensive list of various letters from the Ministry of Finance regulating the issue of recording fixed assets and the process of maintaining an inventory card. All instructions must be followed.

In 1C, the process of drawing up the documents indicated above is quite significantly simplified. Therefore, the optimal solution would be to use programs to automate the process of drawing up cards.

Today the following document formats are established:

- form No. OS-6a;

- form No. OS-1;

- form No. OS-1a;

- Form No. OS-1b.

Each form has its own purpose. You should familiarize yourself with all the nuances in advance. It is important to remember about the annual reform of legislation.

At the same time, the issue directly related to the reflection of fixed assets in a special inventory-type card is also touched upon.

Therefore, it is worth closely monitoring all the innovations in lawmaking. Most often, errors in reporting arise precisely because the accountant lacks up-to-date information.

Filling in upon receipt of OS

Initially, the accounting card is filled out when fixed assets are received by the enterprise.

The header of the OS-6 form contains information about:

- name of the enterprise (owner of the object);

- the structural unit to which the fixed asset is assigned;

- inventory card number;

- date of compilation and name of the recorded property.

In the column on the right side of the document, the codes are filled in: OKPO (in accordance with the constituent papers of the organization) and OKOF (according to the classifier of fixed assets).

Below in the columns are written the numbers: depreciation group of the object, passport, inventory and factory, as well as the date of registration of the fixed asset in the accounting documentation and the accounting account number.

Next, the location of the fixed asset (workshop, maintenance department, accounting department) is recorded, indicating the coding, if any.

In the next line from the technical passport of the object, information about the manufacturer's organization is entered.

Then, in the OS06 form, tables are presented for filling out information on the registered fixed asset object:

- section No. 1 - is not filled out for new property, data is entered only for fixed assets that were previously in operation;

- section No. 2 - the cost of the fixed asset is recorded on the date of acceptance for accounting, consisting of the sum of all costs, the period of its use (useful);

- Section No. 4 - information about the movements of property is entered.

The fourth section is filled out strictly in accordance with the accompanying documentation indicating the type of operation for the fixed asset.

The third section of the inventory card is filled out if the cost of the object is recalculated to match market prices. The initial cost can be either increased or decreased. The changed cost of the fixed asset is replacement value, it is recorded in column 3.

In addition, accrued depreciation is also revalued; for this purpose, a conversion rate is used. It is determined by dividing the replacement cost by the original cost, and then multiplying the result by depreciation. The coefficient is written in column 2. The first column is the date of depreciation, as a rule, this is the end of the calendar year.

For property worth less than 40 thousand rubles, depreciation is calculated as 100% of the total cost on the date of its acceptance for accounting. Objects with a cost of more than 40 thousand rubles are subject to depreciation in accordance with established standards.

If the owners of the property are several people, then they are indicated under table No. 4 indicating the percentages due to each of the owners.

On the reverse side of the unified form of inventory card OS-6, upon receipt of an item of fixed assets, section 7 is filled out if the property is characterized by special data, including the presence of precious metals and stones in its composition. Structural components, other distinctive features of the OS object, qualitative and quantitative indicators are also subject to registration here. To enter special notes into the inventory card regarding the characteristics of the property, the last column of the table is provided.

The OS-6 form is endorsed by an employee of the organization responsible for its correct preparation. Typically, these actions at an enterprise are carried out by an accounting employee.

Also on the reverse side there are sections:

- No. 5 - filled in when the initial cost of a fixed asset changes, the costs of major repairs, modernization, and liquidation are reflected, which leads to an increase in the initial cost;

- No. 6 - is intended to display information about the costs of current repairs, which do not lead to an increase in cost, but are subject to write-off to the cost of the product.

Important nuances

Features of filling out the inventory accounting form:

- When filling out information about a fixed asset at the time of its acceptance, it is necessary to enter only the cost of acceptance of this property.

- Data on the receipt, movement, and write-off of objects are recorded in chronological order. The first entry will be about the receipt of fixed assets. The documents that provide the basis for the actions taken must be indicated - acts of acceptance, transfer, and write-off.

- Information about adjustments to the starting value of property is recorded on the basis of the figures indicated in the OS-3 act.

- Repair costs are recorded only for those that do not affect the value of the property.

- Individual indicators include any information characterizing the registered object.

If the enterprise has a relatively small number of fixed assets, it is allowed to create a consolidated inventory card (inventory book). Then it is allowed not to draw up a separate document for each object.

Download a free form and sample with an example

Let's look at an example of filling out an inventory card when a truck arrives.

This object is a fixed asset, it arrives at the enterprise in a new condition, and therefore the first section in the inventory card is not filled out.

The second section of the OS-6 form indicates the initial cost, in this example it is 1 million rubles. and useful life: this car is assigned to depreciation group 4 and has an SPI of 5 years = 60 months.

At the time the vehicle is accepted for registration, it is also necessary to fill in information about the document on the basis of which the vehicle was received; the data is entered in section 4 of the OS-6 form, as well as additional information about the receipt.

The completed sample card is signed by the responsible employee - usually an accountant. As necessary, information on the fact of revaluations, repairs, and movements of the vehicle between departments will be entered into this form. The final entry is made at the time of disposal or write-off of the vehicle.

You can download the OS-6 form in Word for free using the link.

The form of the inventory card for accounting of fixed assets in excel format can be downloaded here.

Sample of filling out the registration form upon receipt of the car - download.

What a completed accounting card looks like for this example:

Sample filling OS-6

In the header of the inventory card for accounting for fixed assets, fill in the name of the company, the asset, the location of the object, the form code according to OKUD - 0306005 (do not confuse with the inventory card for accounting for non-financial assets - 0504031), code according to OKPO, OKOF, numbers (factory, inventory, etc. .), date of acceptance and write-off from accounting.

The main part of the inventory card of the OS-6 form consists of 7 sections - tables. At the time the object is accepted for registration, the following sections must be completed in the OS-6 form:

- Section 1, which contains information about the object as of the date of transfer;

- Section 2, which contains information about the object as of the date of its acceptance for accounting;

- Section 4, which contains information about the acceptance of the object;

- Section 7, which contains the characteristics of the object.

The remaining sections of the OS-6 form should be completed during the operation of the facility:

- in section 3, information about the revaluation of an asset is filled in;

- Section 4 contains information about internal movements of an object between divisions of the enterprise and its write-off;

- Section 5 contains information about changes in the original cost. Filling out this section of the OS-6 form, for example, is necessary when upgrading a facility, reconstructing or completing construction;

- Section 6 displays the costs of repairing the facility.

The completed form of the fixed assets inventory card is signed by the responsible person. If the enterprise makes a decision to dispose of a fixed asset for any reason (operating conditions were violated, an accident or emergency occurred, or for another reason), based on the write-off act, a corresponding mark is made in the inventory card in the OS-6 form. Inventory cards for objects that have been retired must be stored for a period established by the head of the company, but not less than five years.

If you are filling out the OS-6 inventory card for the first time, familiarize yourself with the filling out sample and pay attention to the procedure for filling out the OS-6 form. A sample of filling out OS-6 is given below:

OS-6 forms:

Storage

Cards registering fixed assets refer to primary documentation forms. They are subject to standard storage rules for such papers - 5 years. After its expiration, the documents are disposed of properly.

Sometimes, depending on the category of fixed asset, the duration of storage of inventory cards may be longer.

Once every few years it is necessary to carry out an inventory of inventory cards. The purpose of this event is to register accounting forms. By implementing this procedure, the safety and availability of documentation is confirmed. Registration is carried out in accordance with the data of budget accounts.

Questions that arise ↑

The process of filling out an inventory card of this type has features and nuances. The list of them is quite extensive. Preliminary familiarization will solve many problems before they arise.

The most significant questions:

- nuances in budgetary institutions;

- what is the shelf life?

- carrying out an inventory of cards.

Nuances in budgetary institutions

There are some features directly related to the process of accounting for fixed assets in budgetary organizations. First of all, you need to familiarize yourself with the list of situations when asset disposal is carried out.

The list of these includes:

- gratuitous transfer is carried out;

- written off due to complete disrepair;

- there is a shortage - the write-off is made at the expense of the persons responsible for it;

- writing off shortfalls due to natural disasters or other factors over which a person has no control.

The list of documents on the basis of which disposal is carried out includes the following acts:

| Compiled in case of write-off of fixed assets | The exception in this case is road transport. |

| Write-off of an entire group of vehicles | — |

| Separate document | Related to vehicle decommissioning |

| Write-off of various types of inventory | Economic, as well as soft |

| Writing off literature of various types | Assigned to the library or another |

A lot depends on the type of OS that will be written off. At the same time, the format of the inventory card remains completely standard.

Therefore, when entering various data through the 1C program, you can use standard algorithms. This way you can avoid all sorts of difficulties.

What is the shelf life

Inventory cards of fixed assets are primary reporting documents. Therefore, standard rules apply to them. This also applies to the duration of document storage.

The main document that reflects regulatory information on storage periods is Article No. 17 of Federal Law No. 129-FZ of November 21, 1996. You should also focus on the provisions of Article No. 361 of this law.

This regulatory document lists primary reporting documents. Their shelf life is at least 5 years. After this period of time, the documents are disposed of accordingly.

This rule also applies to asset inventory cards. In some cases, the storage duration may be longer. Everything directly depends on the type of fixed assets for which the card is drawn up (or a group of such fixed assets).