In what cases should I fill it out?

The transfer and acceptance certificate OS-1 is drawn up when the need arises to transfer an object classified as a fixed asset of an enterprise for the use of another organization (sale, exchange, leasing) or to put it into operation.

Fixed assets are objects whose useful life in the course of the economic activity of the enterprise lasts more than 12 months, as well as plots of land, equipment, inventory, vehicles, livestock, and computer equipment.

Acceptance of buildings and structures is documented in the standard form of act OS-1a. For other single objects, the unified OS-1 form is used. For groups of objects - form OS-1b.

Construction projects can be classified as fixed assets only after completion of construction work or acquisition of a finished building.

We also recommend reading:

- construction of fixed assets by contract;

- creating an operating system in an economic way.

The transfer and acceptance certificate is used in accounting, which fully reflects information about the fixed asset.

For example, when purchasing material assets that need to be put on the company’s balance sheet as fixed assets, the transfer act serves as the basis for the fact of write-off by the seller, and for the buyer to reflect the acquisition in accounting.

Sample of filling out the unified form OS-1

In order to practice filling out the act, you should first download it. The form with an example of how to fill it out is presented below.

Let's consider the procedure for filling out the unified form OS-1, consisting of three pages.

First page:

- Signs of approval of the document by the heads of the organizations of the sender and recipient, indicating dates, positions and signatures, sealed. In this case, it is allowed not to put a stamp on the document when drawing up the act (letter of the Ministry of Finance of Russia dated 08/06/2015 No. 03-01-10/45390), if the enterprise officially refused it (Federal Law dated 04/06/2015 No. 82-FZ). If new equipment is purchased or manufactured in-house, then approval of the act by the deliverer is not required.

- Information about the organization receiving the equipment.

- Data about the donor is filled in only if fixed assets are transferred only from this organization.

- Information for accounting, including the basis for drawing up the act, for example, the purchase and sale agreement, its number and date, the date of acceptance of the fixed asset on the balance sheet, the account according to the accounting chart of accounts, the code according to the All-Russian Classifier of Fixed Assets (OKOF).

- Number and date of drawing up the act.

- Data about the fixed asset, including name, model, manufacturer, location at the time of transfer, reference data (if necessary). Numbers of depreciation group, inventory and factory. Number and date of state registration of rights to real estate (if any), indicating the number and date.

https://youtu.be/0Xg85V11M6Q

How many copies do you need?

When transferring previously used property to a new owner, 2 copies of the act are drawn up (1 for each party). The document is drawn up by the previous owner of the OS object.

Each copy of the acceptance certificate is subject to approval by the directors of both companies; proper technical documentation for the OS is attached to the certificate (registration certificate, construction plan, operating instructions).

Important! When registering the acceptance of new property, 1 act is drawn up for the receiving party.

If one of the parties to the transaction is a budgetary institution, there should be 3 copies of the document. Another package of documents is drawn up for the Federal Property Management Agency.

Signatures are affixed not only by commission members, but also by directors of state enterprises. The clause on state registration of rights is filled out only when transferring real estate.

Additional data in the product acceptance certificate

In some cases, it becomes necessary to indicate information about the payment made for the delivered products or when it will occur. Payment can be made both before and after the transfer of products. It is possible to attach a specification to the document.

You can draw up a product acceptance certificate for each item or for a specific batch of goods. This issue requires agreement with the counterparty.

When a long-term contract with multiple deliveries is in effect, each transfer of products must be confirmed by an act. Upon receipt of the last batch of products, it is advisable to draw up an additional act indicating fulfilled obligations.

© BBF.RU

Basic rules of formation

The act of acceptance and transfer of fixed assets relates to primary accounting documentation.

The requirements for the mandatory completion of the unified form OS-1 have been abolished since 2013; enterprises have the right to draw up an act in any form.

Often, companies use the approved form. It contains the most necessary information about the property being transferred; there is no need to come up with anything additional.

If there are no claims on the part of the receiving organization, then this must be recorded in the primary document. Their presence is indicated in the document with particular precision.

Filling out the first page of the unified form

The first page contains information about the enterprise object, its supplier and recipient.

At the top of the sheet there is space for approval of the document by both parties to the transaction, indicating the positions of the managers and the date of signing the acceptance certificate.

Then information about the recipient is recorded: the full name of the company, legal address, information about the company’s current account opened with a credit institution.

The transmitting party records similar information about itself in the following lines of the OS-1 form.

Important! The basis for drawing up an act in form OS-1 is a contract (purchase and sale, supply, donation, leasing) or an order from the manager. The form must indicate the date of its preparation and number (on the right side of the document).

Below are 2 more dates: acceptance and write-off from accounting. The accounting account and property number (inventory, factory, depreciation) are also recorded here.

Next, enter the serial number of the act, the day it was drawn up, the name of the transferred fixed asset, the location of the property, and the manufacturer of the object.

The rest of the information is entered as needed (participants in shared ownership, foreign currency).

Sample of filling out the first page of the OS-1 form:

Preparing the second sheet

The second page of the OS acceptance and transfer certificate is the cost and operational information of the object on the day of acceptance and transfer.

The sheet consists of three tables.

The first table includes basic information about the property being transferred:

- year of issue,

- day of putting the fixed asset into operation;

- date of repair performed,

- real time of using an OS object,

- useful life,

- amount of wear and tear on the OS,

- residual and contractual value of the object.

If the value of the object in the acceptance certificate by the seller is indicated different from the contract value, the amount from the contract is taken for accounting.

The lines are filled in by the selling organization only for used fixed assets. When purchasing OS from individuals or through retail chains, the table is not filled out.

The second table of the OS-1 form records data on the acceptance of fixed assets for accounting:

- initial cost,

- period of use of the object,

- depreciation method.

The table is filled in by the recipient of fixed assets.

The third table of the act contains data on the individual, special characteristics of the property. For example, the presence and quantity of precious metals in the object.

An example of filling out the second sheet of the OS-1 act:

Third page design

The third page of the unified form OS-1 is the conclusion of the commission and the signatures of the parties to the transaction.

The date of the commission and its results are recorded in the acceptance certificate. If there are additional attachments to the form (expert opinion), they are marked as a separate item.

At the end, the act of acceptance of the fixed asset is signed by all members of the commission, the heads of both companies and their chief accountants.

The commission must include at least 3 employees approved by order of the head of the company.

As a result of the form, accountants make the following notes:

- the transferring party reflects the disposal of the object, reflected in the inventory card (when transferring between owners),

- the receiving party notes the opening of an inventory card for the property or making a corresponding entry in the inventory book OS-6b.

When putting property into operation under a leasing agreement, a corresponding note is made in the transfer and acceptance certificate.

The agreement stipulates the fact of transferring the object to the lessee for balance.

Sample design of the third sheet of OS-1:

How to draw up an ideal act of acceptance and transfer of fixed assets

Why is this document important: The act of acceptance and transfer of a fixed asset accompanies transactions such as purchase and sale, exchange, donation, lease. On the date of drawing up the document, the former owner writes off the property from the balance sheet, and the new owner takes it into account.

What is often mistaken: If the property was purchased in a store or from a citizen, you do not need to fill out information about the donating organization in the act

08/02/2012 "Glavbukh" magazine

When and how it is necessary to draw up an act

An act of acceptance and transfer of fixed assets in form No. OS-1 is drawn up in cases where it is necessary to include the received property in the composition of fixed assets and put it into operation. Or vice versa - when such an object drops out. Such an act is not suitable only for transactions in which the subject is a building or structure.

As a general rule, during a sale and purchase, the transfer and acceptance act is drawn up after ownership of the fixed asset has transferred from the seller to the buyer. The act signed by the parties will mean that the supplier must write off the property from the balance sheet, and the buyer must accept it onto the balance sheet.

If an organization purchased a fixed asset from a supplier who accounted for it as a fixed asset, the act in Form No. OS-1 must be completed by both parties to the transaction. The supplier fills out the act in two copies, one of which remains with him and serves as the basis for writing off the sold object in accounting. At the same time, the seller does not fill out section 2 “Information about the fixed asset as of the date of acceptance for accounting” in his copy of the act.

The supplier transfers the second copy of the document to the buyer. Based on this, the receipt of fixed assets will be reflected. Section 2 of the act is filled out by the accountant of the purchasing company. Both copies of the act must be signed by both the supplier and the buyer.

However, the accountant of the purchasing company will need to draw up an additional report. After all, in order to take the received property into account, you need to reflect your data in the act, for example, the date of registration of the fixed asset or depreciation group, inventory number. And in the act received from the supplier, these sections are already filled out.

Carefully!

Even after receiving a copy of act No. OS-1 from the former owner of the fixed asset, you must additionally draw up your own act in the same form. It will reflect your data on the object.

The basis for drawing up your internal act will be Form No. OS-1 received from the seller and the technical documentation attached to the fixed asset (for example, passport, user manual).

Please note: if a company acquires property for resale, such an object is not taken into account as part of fixed assets, but is a commodity (clause 4 of PBU 6/01, clause 2 of PBU 5/01). Based on the act, the purchasing organization will be able to accept the acquired property for accounting as goods. That is, you do not need to draw up your own act additionally.

The opposite situation: the purchased asset was listed as a commodity in the seller’s accounts. Let's say the property was purchased through a retail store. In this case, the accountant of the purchasing organization draws up an act in form No. OS-1 independently, from scratch. In this case, the supplier’s details, which are provided at the beginning of the act, as well as the sections “Information on the condition of the fixed asset object on the date of transfer” and “Passed over” are not filled out. It is necessary to indicate only the release date and, if the object is immediately put into operation, also the commissioning date, which will coincide with the day the act was signed. The act is drawn up on the basis of shipping documents (for example, a bill of lading issued by a store) and technical documentation attached to the fixed asset (passport, user manual).

Let us note one more case when the accountant of the purchasing organization draws up an act in form No. OS-1 independently. This is a situation where property is purchased from an individual. After all, ordinary citizens should not draw up such documents, since for them property is not the main asset.

What must be in the act

Regardless of what transaction results in the disposal or receipt of a fixed asset, the following columns must always be completed in the act:

- number and date of drawing up the act;

- full name of the fixed asset according to the technical documentation;

- name of the manufacturer;

- place of acceptance of the fixed asset;

- factory and assigned inventory numbers of the fixed asset;

- depreciation group number and useful life of the fixed asset;

- information about the content of precious metals and stones;

- other characteristics of the fixed asset.

They draw up an act based on the technical documentation for the facility. And also, if the transferring party’s property was a fixed asset, according to its accounting data.

Important detail

The act in form No. OS-1 must contain the conclusion of the commission on the acceptance and transfer of property.

In addition, the act must contain the conclusion of the commission. Each party to the transaction has its own commission. It must include at least two people. The composition of the commission must be approved by the head of the organization by issuing an order.

Example: Drawing up an act in form No. OS-1 when purchasing a fixed asset through a retail chain

On February 15, 2010, ZAO Zavod purchased through a trading company a new metalworking machine (2009) at a price of 118,000 rubles, including VAT - 18,000 rubles. On the same day, the director issued order No. 56 on putting the facility into operation. In order to do this and first include the received equipment as part of fixed assets, a commission was created on the basis of another order of the director dated February 15, 2010 No. 57.

On the same day, February 15, the accountant of ZAO Zavod drew up an act in form No. OS-1.

On the first page, wherever data of the donating organization is required, dashes were added. In the “Recipient Organization” column, the accountant indicated ZAO Zavod, its address, telephone number, and bank details. The basis for drawing up the act is order No. 56 dated February 15, 2010.

The accountant indicated the date of acceptance for accounting the same as the date of drawing up the act, that is, February 15. The depreciation group number was determined according to the Classification of fixed assets - third. Next, I put down the inventory number that was assigned to the machine, as well as its serial number, taken from the technical passport. In the column “Location of the object at the time of acceptance and transfer,” the accountant entered the workshop of ZAO Zavod.

The second page of the act, filled out by the accountant, is presented on page 77. Further down in the act, on the third page, the conclusions of the commission are written down, each member of the commission signed. At the very end of the document, in the “Passed” section, the accountant added dashes. And the technical director accepted the fixed asset from the seller, so he indicated his data in the appropriate section. Below are the details of the craftsman to whom the machine was transferred for safekeeping. He also signed. In addition, the chief accountant put his signature.

A table will help you avoid mistakes when filling out the main columns in the document.

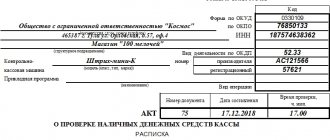

Instructions for filling out the transfer and acceptance certificate in form No. OS-1

| Name of column or section | Recommendations for filling |

| Date of acceptance for accounting | The date of inclusion of the object in the composition of own fixed assets is indicated. For the recipient organization, this is the date of drawing up the act itself |

| Date of write-off from accounting | The transferring party indicates here the date that coincides with the date of drawing up the act. The recipient company will put a dash in its act |

| Inventory number | This number is assigned to an object by the commission upon its admission to the organization, and subsequently, as a rule, the number does not change. An item of fixed assets received by an organization under a lease agreement can be accounted for by the lessee using the inventory number assigned by the lessor |

| Factory number | This number can be viewed: - on the main asset itself; — in the technical data sheet of the equipment; - in the act of acceptance and transfer (for example, when leased from another organization); - in the inventory card for recording a fixed asset, if the movement of a fixed asset occurs within the enterprise |

| Location of the object at the time of transfer | Here they write the name of the organization or its structural unit where the fixed asset is located at the time of drawing up the act |

| Participants in shared ownership | This information section is filled out when the fixed asset belongs to several owners. In this case, all participants in shared ownership and their shares are indicated. Then all information in the act is entered in proportion to the company’s share in the common property |

| Foreign currency | Fill in if the cost of fixed assets is expressed in foreign currency. Then write the type of currency and its amount at the Bank of Russia exchange rate. It must be taken on the date of acceptance of the fixed asset for accounting (clause 6 of PBU 3/2006) |

| Section 1 “Information on the condition of the fixed asset item on the date of transfer” | It only needs to be filled out if the object being transferred has already been used previously. Then all information about the property is indicated by the transferring party. If the recipient organization purchased a fixed asset from a citizen or through a wholesale or retail trade network, it does not need to fill out this section |

| Actual service life (years, months) | This refers to the total period of actual use of the acquired fixed asset from all its former owners from the moment the object was first put into operation. Filled out based on the data provided by the transmitting party |

| Residual value | For the organization that receives the property, this cost will be the initial value |

| Purchase cost (negotiable cost) | To be completed by the transferring party if the value of the fixed asset under the purchase and sale agreement differs from the residual value. Then the recipient organization, when accepting such an object for accounting at its original cost, will accept the contractual |

| Section 2 “Information about the object of fixed assets as of the date of acceptance for accounting” | This section is completed only by the recipient of the fixed asset. |

| Initial cost as of the date of acceptance for accounting | If the fixed asset was previously used, the residual or contract value is indicated. If a new fixed asset is purchased - the cost under the sales contract or the cost of acquisition (taking into account the costs of delivery, assembly, etc.) |

| Useful life | If the property has already been used and depreciated, using the straight-line method, the depreciation rate is determined based on its useful life, reduced by the number of months of operation by the previous owners. In the absence of documents confirming the service life, the buyer establishes the useful life according to the Classification. And if the former owners operated the object longer than the established period of use - independently, taking into account the technical requirements. With the non-linear method, the depreciation rate does not depend on the specific useful life, but on the depreciation group to which the object was assigned |

Post:

Comments

KKZ-2005

April 25, 2013 at 9:46 am

What does the commission display in the output?