A peasant farm (peasant farm) is an association of people (based on family ties or the nature of their activity) for the purpose of production, processing, storage, delivery and marketing of agricultural products on the principles of shared participation in joint ownership of property. Even one person can create an individual farm. Registration of a peasant farm as a legal entity is not mandatory, however, farmers on their own initiative can register as a legal entity on the basis of Art. 86.1 Civil Code of the Russian Federation. State support, the creation of favorable conditions for starting activities and tax benefits are also attractive in this type of business. How to open a peasant farm - this is what today’s article is devoted to.

What is a peasant farm?

In the Russian Federation, the concept of a peasant farm is interpreted by Federal Law No. 74-FZ “On Peasant (Farm) Farming” dated May 11, 2003 as follows:

A peasant farm is an association of citizens related by kinship and (or) property, having property in common ownership and jointly carrying out production and other economic activities (production, processing, storage, transportation and sale of agricultural products), based on their personal participation.

A farm can be created by one citizen.

A farm carries out entrepreneurial activities without forming a legal entity. The entrepreneurial activities of a farm carried out without the formation of a legal entity are subject to the rules of civil legislation that regulate the activities of legal entities that are commercial organizations, unless otherwise follows from federal law, other regulatory legal acts of the Russian Federation or the essence of legal relations.

A farm may be recognized as an agricultural producer in accordance with the legislation of the Russian Federation.

According to this law, as of April 1, 2017, 150,634 peasant farms (peasant farms) were registered in Russia. They have the following key legal features:

- the main activities of peasant farms should be aimed at the production, processing and sale of agricultural products;

- A peasant farm is not an individual entrepreneur or a legal entity, but after registration its head receives the status of an individual entrepreneur;

- the head of a peasant farm can be replaced in case of inability to fulfill his duties for 6 months or due to his voluntary refusal;

- a change in the chairman of a peasant farm does not mean his exit from the farm;

- members of peasant farms can only be persons who are related or related;

- persons who are not related to the head of the peasant farm (no more than 5 people) can be accepted as members of a peasant farm;

- members of peasant farms act on the basis of a signed agreement with all key issues of activity specified in it;

- by agreement, the products, income and property of the farm are divided into shares or belong to all members of the peasant farm;

- all transactions of a peasant farm are carried out by its head;

- The peasant farm is responsible for its obligations with all its property;

- a member of the farm may leave the peasant farm, but is obliged to bear subsidiary liability for the obligations undertaken by the farm;

- upon leaving the state of a peasant farm, its former member cannot receive a land plot for production tools, but he is paid monetary compensation proportional to his share in the common property.

https://youtu.be/T6-Dk62bcQA

Choosing a direction

Before becoming a Farmer from scratch in Russia, develop a farm business plan. Calculate how much initial capital will be required to purchase the necessary minimum to start a business from scratch.

Consult with entrepreneurs experienced in the business area in question, and also divide the implementation of the idea into stages.

Regardless of the chosen direction of farming from scratch, you will need a plot of land.

Will consider 2 options for obtaining land:

- Buy.

- To rent.

Both options have pros and cons. If a plot of land is leased, then you do not need to spend a large amount immediately. This allows available capital to be used for agricultural development. The downside is that you are limited in using the terms of the lease agreement, and there is no guarantee that after the expiration of the term the lessor will not express a desire to terminate cooperation.

The best option is to buy a plot of land before opening a farm. You will have to spend money right away, but the land becomes property, and no one can limit the entrepreneur’s desire to start farming.

The average cost of a hectare of land, for example, in the Voronezh, Tula, and Tver regions is from 20 thousand rubles. This is a realistic price even for beginners who want to open their own farming business.

Select the direction of peasant KFK, for example:

- chicken breeding;

- growing vegetables and fruits;

- rabbit and pig breeding;

- Breeding cattle;

- fish farming.

To begin with, limit yourself to growing vegetable crops, but keep in mind that the greatest profitability is achieved when organizing mixed farms, combining different types of cultivated crops and livestock, using agricultural land.

In the first stages, you can do without hired personnel, but with development you cannot do without additional workers.

Before you organize a farm from scratch, consider sources of sales for your finished products.

Possible activities

Growing:

- Cereals: wheat, sunflower, barley, oats, rye, millet, corn, buckwheat...

- Vegetables: cabbage, potatoes, carrots, tomatoes, cucumbers, pumpkin, peppers, eggplants...

- Greens: onion, garlic, dill, parsley...

- Berries and fruits: apples, strawberries, cherries, pears, plums, prunes, watermelons, melons, apricots...

- Nuts.

- Flowers.

Breeding:

- Pigs, cattle, rabbits, sheep, goats, horses...

- Poultry farming: broiler chickens, laying hens, turkeys, geese, ducks, pheasants, ostriches...

- Fish farming: carp, trout, silver carp, sturgeon, pike, carp, catfish, crayfish...

- Beekeeping.

Production from the above:

- Meat and meat products: stew, sausages, smoked meats...

- Egg production.

- Milk and dairy products.

- Canned vegetables and fruits.

- Juices, purees, jam, jam.

- Vegetable oils.

- Own bakery production.

- Flour, cereals, cereals, mixed feed, bran and other products from plant crops and animals.

Some features of registration and activities of peasant farms and individual entrepreneurs

The concepts of individual entrepreneurs and peasant farms are often closely intertwined in entrepreneurship. They are similar in many ways. Individual entrepreneurs and peasant farms begin their activities from the time of registration (without forming a legal entity), the procedure for completing which is also almost the same. Individual entrepreneurs and peasant farms are closed by submitting the relevant documents. But there are a number of fundamental differences between them.

| Comparison object | IP | peasant farm |

| Organizational and legal basis | An individual who has the right to engage in commerce | An association of citizens whose sphere of interests is exclusively related to agriculture |

| Registration | Only one person can be an individual entrepreneur by registering once; a seal must be made; for peasant farms there is no need for it | The applicant for the creation of a peasant farm is the elected head of the future farm (he also receives the status of individual entrepreneur); Tax authorities, along with other documents, must submit an agreement on the formation of a peasant farm, which is not required when registering an individual entrepreneur; the head receives a separate certificate |

| Tax regime | OSN, USN | Unified agricultural tax, OSN, simplified tax system; for the first 5 years personal income tax (rate 13%) is not calculated |

Peasant farm participants, unlike individual entrepreneurs, have the right to engage only in agricultural activities on existing plots of land. This includes production of products, their transportation, storage, and sales.

To rent or purchase a plot of land, a corresponding application is submitted, together with an agreement on the formation of a peasant farm, to the authorized territorial or local authorities. The applicant must indicate the purpose of using the land, its size, possible location, and the conditions for its provision for use.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Taxation of peasant farms

If a person creating a peasant farm wants to significantly reduce the tax burden on his farm, then he needs to decide on the choice of a special tax regime. A decision must be made upon registration of the farm or within 30 days after its creation. The head of a peasant farm is given a choice between:

- simplified taxation system (STS) - 15% of the difference between income and expenses, or 6% of income.

- single agricultural tax (UST) - 6% of the difference between income and expenses. An important condition is the presence of income from agricultural activities of more than 70% of the total amount. If by the end of the reporting period it is less than 70%, then the entire year will be recalculated according to the general regime.

The Federal Tax Service must be notified of the chosen taxation system by submitting an application for transition. If the head of the farm does not do this, then the peasant farm is automatically assigned a general taxation system (OSNO).

OSNO is a tax regime with the maximum tax burden. However, a grace period of five years is provided for peasant farms, during which, on the basis of Art. 217 of the Tax Code of the Russian Federation, personal income tax is not paid on income received. Also, one-time assistance for household improvement, development grants and subsidies from regional budgets are not subject to taxation. This leads to the conclusion that for peasant farms the general taxation system turns out to be beneficial if the farm receives a VAT exemption.

The choice of one or another taxation system must be made after consultation with a tax specialist and taking into account the profile of the activities of the organizing peasant farm.

How to correctly draw up an agreement on the creation of a peasant farm in 2019? Legal advice

The requirements for the content of the agreement on the creation of a farm are listed in the text of Art. 4 “On peasant (farm) farming.” In accordance with the provisions of this article, the following information must be indicated in the agreement:

- Date and place of drawing up the agreement;

- Full name and passport details of the head of the peasant farm;

- Full name and passport details of peasant farm members;

- The degree of relationship between these persons;

- Location of the peasant (farm) enterprise;

- Information about the rights and obligations of members of the farm;

- Information on the procedure for forming farm property;

- Information about the procedure for owning, using, disposing of this property;

- Information on the procedure for distributing received income (products);

- Other conditions that do not contradict the current legislation of the Russian Federation.

It is worth mentioning separately the rules for drawing up such an agreement:

Firstly, it must be signed by both the future head and the other persons indicated as members of the peasant farm;

Secondly, copies of documents confirming the relationship of the persons signing the agreement (marriage certificate, birth certificate, etc.) are attached to the agreement.

agreement on the creation of a farm (version current for 2020)

Note! If you have any questions or encounter any difficulties when preparing an agreement on the establishment of a peasant farm, you can always seek free legal advice from the specialists of the CenterSoveta portal. The average waiting time for a response from a lawyer is 15 minutes.

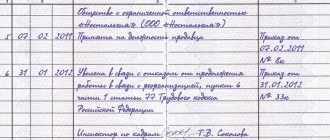

Step-by-step instructions for registering a peasant farm in the Russian Federation

To state registration of a peasant farm, you need to go through the following steps.

Selecting a Federal Tax Service branch

This is done at the place of permanent or temporary registration.

We create a package of documents

To register a peasant farm, a special application form is provided, which is in many ways similar to an application for registration of an individual entrepreneur. An application for registration of a farm is submitted using form P21002. The requirements for filling out this form are similar to the requirements for the application on form P21001. In case of personal submission of the application by the future head of the farm, there is no need to have the application certified by a notary. The form is signed in the presence of the tax inspector.

The next document for registering a peasant farm is a copy of the passport. To be checked by an employee of the Federal Tax Service, the applicant must have the original with him. If a copy of the passport is submitted by the head of the household, then it is not required to be certified by a notary.

The state fee for registering a peasant farm is paid using the same details and in the same amount as for registering an individual entrepreneur - 800 rubles. You can ask for a sample receipt to fill out at the registration authority or fill it out yourself through the Federal Tax Service service.

If in the future there will be several peasant farms, then an agreement between the members of the peasant farm must be submitted to the Federal Tax Service. The agreement must specify the powers of the head of the peasant farm, the duties and rights of members, as well as the procedure for the distribution of income.

Handing over documents

This can be done in person at the Federal Tax Service office, by mail (with declared value and description of the investment) and via the Internet. If a package of papers is submitted by power of attorney or by mail, the applicant must have a copy of the passport and form P21002 certified by a notary. If a package of documents is submitted through a proxy, a power of attorney will be required.

To submit online, use this service.

If the submitted papers are in order, then after 5 working days the farm will be registered and notified. The end of the registration procedure is the issuance of a certificate of registration of an individual entrepreneur and a USRIP registration sheet. You can receive these documents by mail or in person.

Division of peasant farm property upon termination of its activities

The ban on the division of peasant farm property (land and means of production) applies in all cases, with the exception of termination of farming.

The division of the common property of a peasant farm may take place in cases where the activities of the farm are terminated due to the withdrawal of all its members, i.e. when members of peasant farms voluntarily or by court decision liquidate their farms and cease to engage in the production of agricultural products (clause 4, clause 1).

Also, the division of the common property of a farm is possible between the heirs after the death of the last member of the peasant farm, if none of the heirs intends to run a farm.

Termination of the activities of a peasant farm, regardless of the reasons, presupposes the full repayment of all obligations of the farm to creditors. In this connection, only the property of the peasant farm, which will remain after the repayment of all debts, is subject to division between the participants of the peasant farm (Articles 61, 63 of the Civil Code of the Russian Federation).

Read more…

The Law on Peasant Farms ( ) also establishes other grounds for termination of peasant farms:

- in case of insolvency (bankruptcy) of a farm (Articles 217 - 223 of the Federal Law of October 26, 2002 No. 127-FZ “On Insolvency (Bankruptcy)”);

- in the case of creating a production cooperative or business partnership on the basis of the property of a peasant farm (Article 259 of the Civil Code of the Russian Federation).

In cases of termination of the activities of a peasant farm for the specified reasons, the division of common property between members of the peasant farm is not possible.

In the event of bankruptcy of a peasant farm, the property of the farm may be foreclosed on by creditors. Such property is included in the bankruptcy estate and is sold through auction.

In cases where a business partnership or production cooperative is created on the basis of the property of a peasant farm, the common property of the farm is not divided among the members, but becomes the property of the newly created legal entity in the form of contributions and other contributions.

The division of common property must be carried out according to the rules of the Civil Code provided for (for shared and joint property, respectively).

Upon termination of a peasant farm, the common property may be divided between its participants by agreement between them. If no agreement is reached on the method and conditions for dividing the common property - in court. The land plot, which is part of the common property of the peasant farm, is divided according to the rules established by civil and land legislation.

Read more…

The division of the land plot is carried out in accordance with Art. 11.4 of the Land Code of the Russian Federation. The plots formed as a result of the division must comply with the requirements established by the Land Code of the Russian Federation. If the corresponding land plot belongs to the category of agricultural land, then it is also necessary to take into account the rules of Art. 4 of the Law of July 24, 2002 No. 101-FZ “On the turnover of agricultural land” regarding the maximum size of land plots formed.

If a member of a peasant farm is one person - the head of the peasant farm, including in the event of all other members leaving the peasant farm, upon termination of the peasant farm, the property of the farm, including the land plot, becomes his property.

The rights of peasant farm members to real estate (land, building, structure) arising as a result of the division of the common property of the peasant farm are subject to state registration in the Unified State Register of Real Estate.

To do this, former members of the peasant farm must contact Rosreestr with a corresponding application, attaching to it an agreement on the division of property in connection with the termination of the peasant farm or a court decision that has entered into legal force.

When dividing a land plot constituting the common property of a peasant farm, simultaneously with state registration of rights, state cadastral registration of all land plots formed as a result of such division is carried out on the basis of a boundary plan prepared by a cadastral engineer (Part 2 of Article 41 of the Law on State Registration of Real Estate).

For state registration, a state fee must be paid in the amount established by the Tax Code of the Russian Federation.