A very specific account 09 “Deferred tax assets” (DTA) occupies line 1180 in the first asset section of the balance sheet. 09 account in the balance sheet occurs if the recognition of income/expenses does not coincide in the accounting and tax accounting of the company. The amounts on it reflect the company's obligations to pay taxes that will arise in the future, but actually arise at the moment due to different approaches to assessing income, costs, liabilities, and asset accounting methods used by the organization. The calculation of OTA amounts is carried out on the income statement using the liability tracking method.

Account 77 in accounting: Deferred tax liabilities

Account 77 of accounting is a passive account “Deferred tax liabilities”, collects information on the presence and movement of deferred tax liabilities. Using standard postings and practical examples, we will consider the specifics of using account 77 in accounting.

How deferred tax liabilities arise

Deferred tax liabilities arise when permanent or temporary differences arise as a result of different procedures for recognizing income and expenses (profit/loss) in accounting and tax accounting.

Deferred tax liabilities are accounted for in an amount equal to the product of taxable temporary differences and the income tax rate at the reporting date.

Taxable temporary differences in the formation of taxable profit/loss form deferred income tax, which should increase the amount of income tax in subsequent reporting periods when paid to the budget.

Let's look at an example of how deferred tax liabilities are formed.

Let's say from January 2020. JSC "Zern" commissioned new equipment. Its cost was 240,000 rubles, its useful life was four years.

The procedure for recognizing expenses in accounting and tax accounting is as follows:

Get 267 video lessons on 1C for free:

- Accounting - linear depreciation method, that is, for February = 5,000 rubles, the residual value as of March 1 was 235,000 rubles.

- Tax accounting is a non-linear depreciation method, that is, for February = 10,000 rubles, the residual value as of March 1 was 230,000 rubles.

- Therefore, the taxable temporary difference is RUB 5,000.

Account 77 in accounting

Account 77 “Deferred tax liabilities” of accounting is passive. On the credit side of the account, deferred tax is reflected, which reduces the conditional income/expense of the reporting period, and on the debit side, the decrease/full repayment of deferred tax liabilities is reflected for the accrual of income tax in the same reporting period.

Analytical accounting for account 77 is carried out according to the types of assets/liabilities for which a taxable temporary difference occurred.

Postings to account 77 “Deferred tax liabilities”

Correspondence 77 accounts and entries for accounting for deferred tax liabilities are shown in the table below:

| Dt | CT | Wiring Description | A document base |

| 68 | 77 | Deferred tax reflection | Accounting certificate, Advance payment, Declaration |

| 77 | 68 | Reduction/full repayment of deferred tax reflected | Accounting certificate, Tax registers, Bank statement |

| 99 | 77 | Deferred tax liability written off | Accounting certificate, Tax registers |

Examples of transactions and postings on account 77

Let's look at an example:

- In the second quarter of 2020, Polor LLC (cash method) shipped goods to Vex LLC in the amount of 370,000 rubles, excluding VAT, and received payment of 210,000 rubles, excluding VAT.

- In the third quarter of 2020, the buyer fully repaid its debt to Polor LLC.

- In July of the same year, Polor LLC sold the machine, the accrued depreciation on which amounted to 46,000 rubles in accounting, and 52,000 rubles in tax accounting.

Let's do the calculation:

- income in the accounting records of Polor LLC will be recognized in the amount of 370,000 rubles, and in the tax accounting - in the amount of 210,000 rubles;

- taxable temporary difference – RUB 160,000.

The deferred tax liability for account 77 is reflected in the following entries:

| Dt | CT | Transaction amount, rub. | Wiring Description | A document base |

| 51 | 62 | 210 000 | Partial payment from Veks LLC is reflected | Bank statement |

| 62 | 90.01 | 370 000 | Reflected sales revenue | Packing list |

| 68.04.2 | 77 | 32 000 | Reflection of the increase in tax liability for the 2nd quarter of 2020 | Accounting certificate, Advance payment, Declaration |

| 51 | 62 NVR | 160 000 | Reflected payment from LLC "Vex" | Bank statement |

| 77 | 68.04.2 | 32 000 | Deferred tax liability settled | Accounting certificate, Tax registers, Bank statement |

| 77 | 99 | 1 200 | Reflection of the write-off of the amount of deferred tax liability (machine) | Accounting certificate, Tax registers |

Source: https://BuhSpravka46.ru/buhgalterskiy-plan-schetov/schet-77-v-buhgalterskom-uchete-otlozhennyie-nalogovyie-obyazatelstva.html

Accounting account 77 “Deferred tax liabilities”

Accounting account 77 is one of the most difficult accounts for an accounting employee; it is called “Deferred tax liabilities” (DTL). In the article we will look at how IT appears, what transactions exist in account 77, as well as who may not use this account and how to avoid accrual of deferred liabilities.

The image for this article was purchased from Shutterstock.

How IT appears

Accounting account 77 was created to consolidate information about the presence, as well as the movement of deferred liabilities. It is included in the accounting records of companies that pay income tax.

The procedure for accounting for IT is described and legally regulated by PBU 18/02 “Accounting for calculations of corporate income tax”, and the rules for using account 77 itself are regulated by the chart of accounts. IT appears due to the fact that the method of calculating a company’s income and its expenses differs in accounting and tax accounting. This is where permanent or temporary differences arise.

Permanent differences are not taken into account in calculating the amount payable for tax, which is why they have that name. The reasons for their occurrence:

- non-deductible expenses for property acquired free of charge;

- transfer to subsequent periods of a loss that cannot be taken into account due to the fact that the statute of limitations has expired.

Temporary differences subject to tax, due to which IT appears, occur in the following situations:

- acceptance for accounting of revenue received in carrying out the main activity during the period specified for the report, as well as income from interest using the accrual method for accounting and the cash method for taxation;

- the difference in methods for calculating depreciation in the accounting and tax accounting of an organization;

- different ways of recording interest paid on credits (loans), in tax and accounting.

In addition to those listed, depending on the specifics of the organization, other similar differences may appear.

How account 77 is formed in accounting

You can calculate IT using the formula:

IT = HBP × C,

where: TVR is a temporary difference subject to tax;

C is the current tax rate on profit.

At the end of the billing period, NVRs create deferred amounts for payment. It is worth increasing the tax value on them for further payments.

Let's look at how account 77 is formed in accounting. A credit reflects deferred tax, leading to a decrease in deemed income or expenses in the quarter in which reporting is submitted, and a debit reflects the repayment of obligations by accrual for subsequent payment of tax for the same period. The account for deferred tax liabilities is a passive account.

Analytical accounting for account 77 is carried out by type of assets and liabilities.

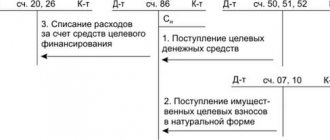

Account 77 – Deferred tax liabilities – is involved in the following transactions:

- Dt 68 Kt 77 - accrual of deferred tax is recorded;

- Dt 77 Kt 68 - full or partial repayment of IT;

- Dt 77 Kt 99 - IT was written off upon disposal of the asset (object) for which the mentioned obligation was accrued.

Example of IT calculation

The accounting policy of Romashka LLC stipulates that OS will be recognized as an asset for accounting worth more than 30,000 rubles, and for tax accounting - more than 100,000 rubles. In January 2020, Romashka LLC put into operation equipment worth 50,000 rubles. without VAT. For accounting, this is an OS with an SPI of 24 months.

Depreciation will be:

50,000 rub. / 24 months = 2,083.33 rub. per month.

In tax accounting, the cost of equipment will be completely written off as expenses. In January 2020, a taxable difference is formed - 50,000 rubles. Let's calculate IT provided that the tax rate is 20%:

50,000 × 20% = 10,000 rub.

Throughout the entire SPI OS, we repay it every month in the amount of:

2083.33 rub. × 20% = 416.67 rub.

Postings:

- Dt 01 Kt 08 in the amount of 50,000 rubles. — the equipment has been accepted for registration;

- Dt 68 Kt 77 in the amount of 10,000 rubles. — accrual of IT.

From February 2020 to January 2021, monthly postings are made:

- Dt 20 Kt 02 in the amount of 2,083.33 rubles. — depreciation calculation;

- Dt 77 Kt 68 in the amount of 416.67 rubles. - repayment of IT.

Reflection of account 77 in the balance sheet

When preparing the balance sheet, IT is recorded on line 1420 of the liability in the “Long-term liabilities” section. PBU 18/02 gives a choice of how to reflect the balance in this line.

There are 2 options:

- Full display. The balance of account 77 is recorded on line 1420 as a liability, and the balance of account 09 “Deferred tax assets” on line 1180, respectively, as an asset, in the “Non-current assets” section.

- Abridged version. With this method, the credit balance of account 77 must be reduced by the debit balance of account 09.

It is important to note that the deferred asset will not be an overpayment of income tax; they go separately from each other. Failure to understand this fact may result in fines and penalties.

Accounting features related to account 77

PBU 18/02 also provides for a situation where the income tax rate undergoes changes. Then all IT is subject to recalculation. Since the filing of corrective accounting reports is not provided for by law, the result of the calculations must be reflected in the balance sheet, which the organization submits in the year following the reporting year.

Organizations that are given the opportunity not to work with PBU 18/02 and not to keep records on account 77:

- those who are not required to pay income tax and apply special regimes;

- related to small business;

- non-profit organizations and legal entities participating in the Skolkovo project.

The decision that PBU 18/02 will not be used must be reflected in the accounting policy of the enterprise.

***

If the organization is not one of those who may not apply PBU 18/02, then it is worth simplifying record keeping. It can be concluded that in order to avoid the emergence of non-return accounts, and, accordingly, IT accounting, it is necessary to bring tax accounting as close as possible.

Companies that use the accrual method of tax accounting have this opportunity. To minimize discrepancies between tax and accounting in an organization, it is recommended to reflect in the accounting policy the key points regarding the calculation of depreciation and recognition of fixed assets.

If you still have to count 77, it is worth studying this PBU.

***

Even more interesting and useful information here: https://nsovetnik.ru/

Source: https://zen.yandex.ru/media/id/5b1135b9256d5c490fc0d476/5bb24de209eb0100aaf60f96

Definition and causes

Account 09 in the accounting system is active and collects information on ONA. The debit account is for the accumulation of amounts, and the credit account is for writing them off.

So, deferred tax assets are the total differences in income taxes that appear when there are differences in accounting and tax information. Deviations according to information in accounting and accounting records are called deductible temporary differences (DTD), that is, they exist only for a certain period.

In simple terms, account 09 forms a share of income tax, which is transferred to subsequent periods. That is, the company postpones, temporarily postpones the fulfillment of the obligation to pay taxes to the budget.

During the year, account 09 accumulates the amounts for each transaction separately. Merger is not allowed. At the end of the period, the generated result must be transferred to the balance sheet in line 1180 of the non-current assets section (clause 23 of the PBU).

Due to the difference in requirements for accounting for expenses and income in accounting and tax accounting, the same business transactions can generate completely different results.

ONA are formed if, at the request of accounting, expenses are accepted at a time at the time of a business transaction, and in the accounting system they are distributed over subsequent periods. Also, a factor in the occurrence of a balance on the debit of account 09 is the situation with the benefit accepted into the tax base in the NU, but not generated in the accounting account.

Based on the totality of the company’s profits and costs, the amount of the non-profitable income, called conditional, is determined in accounting, and the current amount in the accounting system. It is the base calculated in NU that is the basis for calculating obligations to be paid to the state budget.

Here are several typical situations that affect the formation of SNA:

- The amount of tax transferred to the budget exceeds the accrual amount.

- A reserve for vacation pay has been created in the accounting department.

- Different methods of calculating depreciation.

- The procedure for accepting commercial and administrative expenses in accounting and financial institutions.

- Loss upon sale of a fixed asset.

These situations lead to the conditional return amount being lower than the current one. Accordingly, the amount of tax also turns out to be different in terms of accounting and NU. Such differences are deferred tax assets.

The decision to maintain IT accounting is made by each organization independently and is enshrined in the accounting policy.

Account balance 09 loss of the current period what does it mean

The amount entered into the debit of account 09 is calculated according to the first formula indicated above - the product of the difference in income (or expenses) by the rate (20% in 2020).

) The credit records the amount to be reduced (repaid) of the asset indicated in the debit, received upon subsequent recognition of income in accounting or expenses in taxation. The amount contributed to the credit of account 09 is determined by the second formula.

At the same time, the tax asset reflected for a specific transaction in debit 09 is gradually fully repaid.

If the object, upon receipt of which a deferred asset was formed, is disposed of, then the ONA for it, recorded in debit 09, should be written off to debit 99 of the account intended for recording the financial result. Analytics on the account is carried out for each operation or transaction in relation to which it arose.

Account 09 in accounting: deferred tax assets. example and wiring

Posting for accrual of deferred tax asset Based on the results of the 3rd quarter of 2020, 3 batches of materials (spare parts for electrical equipment) were delivered to the warehouse of Marker JSC for a total amount of 484,300 rubles, VAT 73,876 rubles. Payment for spare parts was made partially - in the amount of 232,500 rubles, VAT 35,466 rubles.

To reflect the amounts of IT in accounting, the accountant of Marker JSC made the following calculations:

- Accounting expenses - 410,424 rubles. (484,300 rubles - 73,876 rubles).

- Tax accounting expenses - 197,034 rubles. (RUB 232,500 - RUB 35,466).

- Deductible temporary difference - 213,390 rubles. (RUB 410,424 - RUB 197,034).

Based on the above calculations, the following entries were made in the accounting of JSC Marker: Dr Kt Description Amount Document 10 60 Spare parts were received at the warehouse of JSC Marker (484,300 rubles - 73,876 rubles) 410,424 rubles.

What does the debit balance of account 09 mean at the end of the year?

Attention The procedure for recording transactions on account 09 is established by PBU 18/02 and is relevant for all income tax payers, except for credit and municipal institutions (clause 1 of PBU 18/02).

Small businesses, as well as non-profit organizations reporting on simplified financial statements, are given the opportunity to refuse to apply PBU 18/02 (clause 2 of PBU). They are required to record their choice in the accounting policy.

Read more about drawing up an accounting policy in the section “How to draw up an organization’s accounting policy.”

When posting Debit 09 Credit 09 is used Posting Dt 09 Kt 09 is needed for taxpayers using automated accounting systems to close debit balances in the “Current period loss” subaccount of account 09 at the end of the year. Example Miralux LLC purchased office equipment worth RUB 120,000 at the beginning of 2015.

Definition of account 09 accounting

Future expenses. The directory is filled out as follows:

- Name – Loss of the year (the name can be arbitrary).

- Type of BBP – Other

- Method of recognition of expenses - In a special order (the accountant will independently decide when and how much of the loss of previous periods will be used to reduce the tax base of the current tax period)

- Amount – (amount of loss for Appendix 4 to Sheet No. 2 of the Declaration)

- The start of the write-off is January 1 of the year following the year in which the loss was incurred (based on this date, Appendix 4 to Sheet No. 02 of the Declaration determines the year of the loss: the year the write-off began minus 1).

If an organization uses PBU 18/02, it is necessary not to forget to also make an entry in the debit of account 97.11 according to the type of accounting BP (temporary differences) for the amount of loss with a minus sign. There are no carry forward losses in accounting.

Carry forward of losses

The accounting policy of the enterprise notes that in accounting, depreciation of fixed assets is written off using the reducing balance method, and in tax accounting - in a straight-line manner. When calculating income tax (PIT), the company uses PBU 18/02.

At the end of 2020, accrued depreciation on office equipment was:

- in accounting - 40,000 rubles;

- at the tax office - 20,000 rubles.

As a result, a VVR was formed in the amount of 20,000 rubles. (40,000 (used) – 20,000 (used)). The amount of IT at the end of the year was 4,000 rubles. (GVR × NNP rate = 20,000 rubles.

× 20%). The reflection of IT in accounting was recorded by the following posting: Dt 09 (loss of the current period) Kt 68 (calculation of income tax) - 4,000 rubles. To simplify the example, we will agree that no more operations were carried out by Miralux LLC in 2020.

Stavanalite

On the last day of each period, a double entry was made to repay the deferred asset:

- For the first quarter – 450,000 * 20% = 90,000 rub.;

- In 6 months – (800,000 – 450,000) * 20% = 70,000 rub.

Source: https://juristufa.ru/2018/04/19/saldo-po-schetu-09-ubytok-tekushhego-perioda-chto-znachit/

How to close

If at the end of the tax period there is a balance in the debit of account 09, and the current amount of tax payable is zero, then the balance can be closed only in the next period

.

The book value of IT is revised when periodic reporting is prepared and is reduced if there is no possibility of applying a deduction in taxable profit.

Deferred tax asset is an effective tool for applying PBU 18/02 on the way to improving financial policy standards. The calculated deferred income tax in accounting and regulated reporting allows you to completely prevent the occurrence of deviations in the recognition of income and expenses

.

This instruction provides additional information on this account.

What to do with balances on accounts 09 and 77 when combining modes

Tax changes: what to keep in mind? How to competently get rid of temporary assets and liabilities? What to do with balances on accounts 09 and 77 when combining modes?

Question: An organization applying OSN and using PBU 18/02 from 01/01/2018.

switched to UTII in terms of retail sales to the population. OSN is used for the sale of medicines to medical institutions. What to do with the balances on accounts 09 and 77, if in 2020, with a combination of regimes, ONO and ONA will be, but as a percentage, in proportion to income.

For example, account 77 takes into account the depreciation of equipment that is used for OSN and UTII.

Answer:

According to the rule established in paragraph 7 of Article 346.26 of the Tax Code of the Russian Federation, when combining the payment of UTII with the general regime, taxpayers are required to keep separate records of property, liabilities and business transactions in accordance with the accounting policies of the organization.

Therefore, if an organization simultaneously conducts activities subject to the general taxation regime and activities subject to UTII, the calculations of deferred tax assets and liabilities become more complicated. To determine the final financial result, as a rule, separate sub-accounts are opened.

https://youtu.be/wYz00Cxgrvk

At the time of transition to UTII, the organization, as a rule, remains unwritten off deductible temporary differences (DTD) and taxable temporary differences (TDT), as well as the amounts of deferred tax asset (DTA) and deferred tax liability (DTL), listed respectively in accounts 09 and 77.

The balances of accounts 09 and 77 should be attributed to account 84 “Retained earnings (uncovered loss).”

Debit 84 Credit 09 (deferred tax asset written off).

Debit 77 Credit 84 (the balance of deferred tax liabilities is written off).

In the annual balance sheet for the previous year, the amounts of deferred tax assets and deferred tax liabilities will not change. And the opening balance sheet will change for the next year. In addition, the “Retained earnings (uncovered loss)” indicator will also change in the opening balance sheet.

Rationale

Tax changes: what you need to remember

As of December 31, 2008, in the accounting records of the enterprise, the balance on the debit of account 09 “Deferred tax assets” is 100,000 rubles, and the balance on the credit of account 77 “Deferred tax liabilities” is 200,000 rubles.

Because income tax rates have changed, the balances in these accounts must be reduced on January 1, 2009. The differences must be attributed to account 84 “Retained earnings (uncovered loss)” (clauses 14 and 15 of PBU 18/02).

The recalculation should be reflected in the following entries:

Debit 84 Credit 09*

– 16,666.67 rub. (RUB 100,000 – (RUB 100,000 x 20%: 24%)) – reflects the recalculation of deferred tax assets;

Debit 77 Credit 84

– 33,333.33 rub. (RUB 200,000 – (RUB 200,000 x 20%: 24%)) – reflects the recalculation of deferred tax liabilities.

In the balance sheet (form No. 1) for the first quarter of 2009 and in the following reporting periods, the opening balance must be adjusted. On line 145 you must indicate the amount of 83,333 rubles. (100,000 – 16,666.67). On line 515 you must indicate the amount of 166,667 rubles. (200,000 – 33,333.33).

On line 470 it is necessary to indicate the amount of retained earnings increased by 16,667 rubles. (33,333.33 – 16,666.67).

How to competently get rid of temporary assets and liabilities

The accountant of a small enterprise applied PBU 18/02. And at some point, I legally decided to refuse this responsibility. How to correctly write off temporary tax assets and liabilities? This was the question asked by visitors to the forum on the website of the Glavbukh magazine.

Accountant question

Since the beginning of 2008, the organization has applied PBU 18/02 “Accounting for calculations of corporate income tax.” They did this voluntarily, since the company is a small enterprise. Now the accountant has decided to abandon accounting for differences. How to close accounts now? Can small businesses really forget about PBU 18/02?

What was recommended on the forum

Forum participants advised writing off the differences to account 84 “Retained earnings (uncovered loss).” That is, make the same transactions that companies made due to the reduction in the profit tax rate from 24 to 20 percent this year. These accounting entries must be made at the beginning of the year.

Editorial advice

Indeed, small enterprises may not apply PBU 18/02. This is directly stated in paragraph 2 of this PBU. But they can apply it; this is a voluntary matter of the company itself. In this case, information about deferred tax assets and liabilities is reflected in special accounts 09 and 77.

If a small company first applied this PBU and then abandoned it, the balances on accounts 09 and 77 should be attributed to account 84 “Retained earnings (uncovered loss).” That is, the advice of the forum participants is absolutely correct. The accounting entries themselves will look like this:*

Debit 84 Credit 09

–

deferred tax assets are written off;

Debit 77 Credit 84

–

the balance of deferred tax liabilities is written off.

At what point should such records be made? There is a nuance here. In your case, you can ignore the norms of PBU 18/02 only from the beginning of the year.

The fact is that the refusal to take into account permanent and temporary tax assets and liabilities must be enshrined in the accounting policy for accounting purposes. This follows from paragraph 9 of PBU 1/2008 “Accounting policies of the organization.” And changes made to the accounting policy come into force only from the beginning of the year.

True, PBU 1/2008, in principle, allows changes to be taken into account already in the current year. But only, for example, in the event of a change of activity or reorganization. That is, with a significant change in business conditions.

In this case, nothing changes. After all, the accountant voluntarily applied PBU 18/02, and now he simply decided to abandon it. Therefore, the entries we have given must be made in the so-called inter-reporting period.

In other words, in the annual balance sheet for last year, the amounts of deferred tax assets (line 145) and deferred tax liabilities (line 515) will not change. And the opening balance sheet will change for the next year. In addition, in the opening balance of the balance sheet, the indicator of line 470 “Retained earnings (uncovered loss)” will also change.

Smena LLC, being a small enterprise, voluntarily applied PBU 18/02 in 2008. From January 1, 2009, the company's management decided to abandon the use of this PBU.

As of the beginning of the year, the accumulated amount of deferred tax assets in the accounting of Smena LLC amounted to 312,000 rubles. (line 145 of the balance sheet), and the amount of deferred tax liabilities is 432,000 rubles. (line 515 of the balance sheet).

The indicator of retained earnings (line 470 of the balance sheet) is 1,213,500 rubles. It is these figures that should be reflected in the company’s balance sheet for 2008.

Since January 1, 2009, the company no longer applies PBU 18/02; a record of this was made in the order on the organization’s accounting policy. Therefore, deferred assets and liabilities must be written off the balance sheet.

Thus, the opening balance at the beginning of the balance sheet year for the first quarter of 2009 on lines 145 and 515 will be zero. And the figure on line 470 of the balance sheet will be 1,333,500 rubles. (1,213,500 – 312,000 + 432,000).

It’s another matter if the company switched from the general regime to paying UTII during the year. After all, “imputers” do not pay income tax and, accordingly, they do not need to apply PBU 18/02. In this case, the company has the right not to apply PBU 18/02 from the month in which it began to meet the “imputation” criteria.

Confirmation of this point of view can be found in the letter of the Ministry of Finance of Russia dated January 22, 2003 No. 04-05-12/02. Paragraph 12 of this document states: “imputed” tax must be paid from the month in which the activity falling under UTII began.

This means that there is no need to charge income tax for this month.

JSC "Market" trades retail. The enterprise is not small, therefore it applied PBU 18/02.

In May 2009, part of the sales area was sold, and the store area became less than 150 square meters. m. For this type of activity, UTII has been introduced in the region. The company meets all the conditions for the use of this special regime. Therefore, from May 1, I stopped paying income tax.

At the same time, we decided to abandon the use of PBU 18/02. As of May 1, the accounts of Market CJSC included 11,200 rubles in account 09, and 8,800 rubles in account 77. Using entries dated May 1, 2009, the accountant wrote off these amounts from the balance sheet:

Debit 84 Credit 09

–

11,200 rub. – the balance of deferred tax assets is written off;

Debit 77 Credit 84

–

8800 rub.

– the balance of deferred tax liabilities is written off. It is important that the balance sheet indicators are comparable.

To do this, data at the beginning of the year should also be shown without taking into account deferred assets and liabilities. There is no need to make any corrective entries in the January accounting records. Alexander Sorokin answers,

Deputy Head of the Operational Control Department of the Federal Tax Service of Russia

“Cash payment systems should be used only in cases where the seller provides the buyer, including its employees, with a deferment or installment plan for payment for its goods, work, and services.

It is these cases, according to the Federal Tax Service, that relate to the provision and repayment of a loan to pay for goods, work, and services.

If an organization issues a cash loan, receives a repayment of such a loan, or itself receives and repays a loan, do not use the cash register. When exactly you need to punch a check, look at the recommendations.”

From the recommendation: Is it necessary to use cash register when issuing, receiving and repaying a loan?

Source: https://www.glavbukh.ru/hl/252175-kak-postupit-s-ostatkami-po-schetam-09-i-77-pri-sovmeshchenii-rejimov

Why and how to correctly use the auxiliary account “00”

First, recall that auxiliary account 00 is a service account.

It is found only in accounting programs and is intended to enter opening balances into the program. When should you enter opening balances into the program? There are only three such cases:

- the organization is new and it is necessary to enter the first accounting entries;

- the organization is already operating, but accounting is done manually (or in another automated program);

- the organization is already operating, but accounting has not been maintained and account balances are unknown (accounting needs to be restored).

In the first case, you do not need to use account 00. To enter all balances, simple correspondence on accounting accounts is used. But in other cases you will need to use correspondence with a subsidiary account.

Balance sheet account 00 “Auxiliary account” is active-passive. The basis for using this account, as for other balance sheet accounts, is the principle of double entry. That is, when entering balances on balance accounts into an automated program, a posting must be made for two accounts.

Let us formulate the basic rules for using account 00:

- if the account for which the initial balances are entered is active, then the balance on it is reflected as a debit, and the auxiliary account 00 is entered as a credit and vice versa;

- if the account for which the balances are entered is active-passive, then the balance on it can be recorded by debit or credit in correspondence with the auxiliary account 00;

- Balances must be entered as of the last date preceding the start date of accounting. For example, if you need to start work on January 1, 2014, then the opening balances should be entered as of December 31, 2013;

- account balances in correspondence with account 00 must be entered in the context of subaccounts and analytical accounts;

- Based on the results of entering initial balances, it is necessary to create a balance sheet.

The correctness of filling out the balance sheet can be checked by checking the sum of the balances for all accounts (from 01 to 99) and for the auxiliary account 00. They must be equal.

In order to correctly form account balances, it is necessary to conduct an inventory of property and liabilities as of the date of formation of the initial balances.

We evaluate the authorized capital on the basis of constituent documents and reflect the amount in account 80 “Authorized capital”. We restore the founders' contributions (cash, fixed assets, materials, etc.) on the basis of relevant documents and reflect them in accounts 01 “Fixed assets”, 50 “Cash”, 10 “Materials” and so on.

Account 00 is used only in automated accounting programs and is intended for entering initial balances into the program.

Based on bank statements and cash book data, it is possible to determine the balance of funds in banks (the opening balance in accounts 51 “Cash Accounts” and 52 “Currency Accounts”) and the organization’s cash desk (the opening balance in account 50 “Cash Office”). If an organization has several current accounts, then the balances on bank statements must be added up.

Indicators for credit and loan accounts 66 “Short-term loans and borrowings”, 67 “Long-term loans and borrowings” can be confirmed if you reconcile settlements with debtors and creditors. In this case, it is necessary to determine data both on the amount of the principal debt and on the amount of interest accrued at the end of 2013.

The balance values at the end of the day on December 31, 2013 and at the beginning of the day on January 1, 2014 are the same.

Using reconciliation reports, information about the status of settlements with counterparties is restored. For each counterparty, receivables and payables are generated (account balances 60 “Settlements with suppliers and contractors”, 62 “Settlements with buyers and customers”, 76 “Settlements with various debtors and creditors”).

Here is a list of documents with which you can determine the amount of receivables and payables:

| Types of debt | Account correspondence | Documentation | |

| DEBIT | CREDIT | ||

| For advances issued for the supply of goods | 60.02 | 00 | Payment orders for the transfer of money to sellers (suppliers), incoming invoices and acts |

| By goods sold to customers | 62.01 | 00 | Bank statements, PKOs or cash receipts indicating the receipt of money from customers, outgoing invoices and acts |

| For loans issued | 76, 73 | 76, 73 | Loan agreements in which you act as a lender, bank statements, PKOs and cash register checks indicating payment of debt and interest |

| For issued accountable amounts | 71 | 00 | Expense cash orders and advance reports |

| For goods received from suppliers | 00 | 60.01 | Payment orders for the transfer of money to sellers (suppliers), incoming invoices and acts |

| For advances received from buyers | 00 | 62.02 | Bank statements, PKOs or cash receipts indicating the receipt of money from customers, outgoing invoices and acts |

| For loans received | 00 | 66, 67 | Loan agreements, payment orders for payment of debt and interest |

| To employees regarding the payment of wages, benefits and vacation pay | 00 | 70 | Payroll and payslips, sick leaves, vacation applications |

| Before extra-budgetary funds | 00 | 69 |

Write-off of materials step-by-step instructions for accounting

Any organization acquires materials for the company’s activities not for their own sake. And the purchased valuables will not lie dead weight in the warehouse for the director to admire. They are intended for use in production, sales or administrative purposes. Therefore, purchased materials are subsequently consumed in production.

However, in the warehouse the storekeeper or warehouse manager is responsible for them, and the materials are taken into account on account 10. When the materials leave the warehouse, the situation will change: the account and the person in charge will change. In this article we will analyze the write-off of materials with step-by-step instructions for this procedure for you.

articles:

1. Accounting entries for writing off materials

2. Registration of write-off of materials

3. Write-off of materials - step-by-step instructions if not everything is consumed

4. Standards for writing off materials for production

5. Example of a write-off act

6. Methods for writing off materials for production

7. Option No. 1 – average cost

8. Option No. 2 – FIFO method

9. Option No. 3 – at the cost of each unit

So, let's go in order. If you don't have time to read a long article, watch the short video below, from which you will learn all the most important things about the topic of the article.

(if the video is not clear, there is a gear at the bottom of the video, click it and select 720p Quality)

We will look at write-offs of materials in more detail than in the video later in the article.

Accounting entries for write-off of materials

So, let's start by determining where the purchased materials can be sent. It should be noted that materials are truly ubiquitous and there are ways to, as they say, “plug a hole” in any problem area of the organization:

- - serve as the basis for the production of products

- - be an auxiliary consumable material in the production process

- — perform the function of packaging finished products

- - used for the needs of the administration in the management process

- — assist in the liquidation of decommissioned fixed assets

- - used for the construction of new fixed assets, etc.

And the accounting entries for writing off materials depend on what materials are released from the warehouse for:

Debit 20 “Main production” – Credit 10 – raw materials released for production

Debit 23 “Auxiliary production” - Credit 10 - materials were released to the repair shop

Debit 25 “General production expenses” – Credit 10 – rags and gloves were issued to the cleaner servicing the workshop

Debit 26 “General business expenses” – Credit 10 – paper for office equipment issued to the accountant

Debit 44 “Sales expenses” – Credit 10 – containers for packaging finished products were issued

Debit 91-2 “Other expenses” – Credit 10 – materials released for liquidation of fixed assets

It is also possible for a situation where it is discovered that the materials listed in the accounts are actually missing. Those. there is a shortage. For such a case, there is also an accounting entry:

Debit 94 “Shortages and losses from damage to valuables” – Credit 10 – missing materials written off

Registration of write-off of materials

Any business transaction is accompanied by the preparation of a primary accounting document, and write-off of materials is no exception. The step-by-step instructions in the next paragraph contain the study of the primary documents that accompany the write-off process.

Currently, any commercial organization has the right to independently determine the set of documents that will be used to formalize the write-off of materials, so the registration of write-off of materials may vary from organization to organization.

The main thing is that the documents used are approved as part of the accounting policy and contain all the mandatory details provided for in Article 9 of Law No. 402-FZ “On Accounting”.

Standard forms that can be used when writing off materials (approved by Resolution of the State Statistics Committee of October 30, 1997 No. 71a):

- — requirement-invoice (form No. M-11) is applied if the organization has no limits on receiving materials

- — limit-fence card (form No. M-8) is used if the organization has established limits on the write-off of materials

- — an invoice for the release of materials to the third party (form No. M-15) is applied to another separate division of the organization.

The organization can modify these forms - remove unnecessary details and add details that the organization needs.

The invoice requirement is suitable for accounting for the movement of material assets within an organization, between financially responsible persons or structural divisions.

The invoice in two copies is drawn up by the financially responsible person of the structural unit handing over material assets. One copy serves as the basis for the handing over unit to write off valuables, and the second copy serves as the basis for the receiving unit for the receipt of valuables.

Write-off of materials step-by-step instructions if not everything is consumed

Usually, when preparing these documents, it is assumed that the released materials were immediately used for their intended purpose, which means they are accompanied by the postings that we discussed above - for credit 10 of the account and debit 20, 25, 26, etc.

But this does not always happen, especially in large production. Materials transferred to the work site or workshop may not be immediately used in production. In fact, they simply “move” from one storage location to another. In addition, when dispensing materials, it is not always known what type of product they are intended for.

Therefore, those materials that are released from the warehouse but not consumed should not be taken into account as expenses of the current month, neither in accounting nor in tax accounting for income tax. What to do in this case, how to write off materials, step by step instructions below.

In such situations, the release of materials from the warehouse to the production department should be reflected as an internal movement, using a separate subaccount to account 10, for example, “Materials in the workshop.” And at the end of the month, another document is drawn up - a materials consumption act, where the direction of materials consumption will already be visible. And at this moment the materials will be written off.

Such tracking of material consumption will allow you to achieve greater reliability in accounting and correctly calculate income tax.

Please note that this applies not only to materials that go into production, but also to any property, including stationery used for administrative needs.

Materials should not be issued “in reserve”. They must be used immediately.

Therefore, a one-time operation to write off 10 calculators for an accounting department of 2 people, during an audit, will certainly raise questions as to what purpose they were required in such quantities.

Example of a write-off act

That's why:

- - or you issue and immediately write off only what is actually consumed (in this case, the requirement of an invoice is quite sufficient)

- - or you draw up an act for writing off materials (transmitting a demand invoice, and then gradually writing off acts for writing off).

If you use write-off acts, do not forget to also approve their form as part of the accounting policy.

The act usually indicates the name, and, if necessary, the item number, quantity, accounting price and amount for each item, number (code) and (or) name of the order (product, product) for the manufacture of which they were used, or number (code) and (or) the name of the costs, the quantity and amount according to consumption standards, the quantity and amount of consumption in excess of the standards and their reasons.

An example of what such an act might look like is in the picture below. I repeat, this is just an example; the type of act will very much depend on the specifics of the enterprise. Here, as a basis, I took the form of the act that is used in budgetary institutions.