OS accounting

Registration is carried out at the original cost, which includes direct costs for fixed assets and the amount transferred to the supplier. It is worth noting that VAT is not included in the initial cost.

For the service life, the depreciation value is calculated, which the accountant writes off every month to the appropriate account. The balance sheet of an enterprise records the amount of fixed assets minus depreciation, which is called the book value of the asset.

Useful life and entries when calculating depreciation

The useful life of a fixed asset depends on the depreciation group. Based on the useful life, depreciation is calculated in tax accounting. Therefore, it is important for an accountant to accurately select a depreciation group. There are 10 depreciation groups in total. The longest period of use of fixed assets belongs to the 10th group.

Three steps to determine useful life:

- Determine the OKOF of the acquired fixed asset.

- Find which group the selected OKOF belongs to.

- Set the useful life based on the group. Typically, a time period is specified for each group of fixed assets. For example, the third depreciation group corresponds to a useful life of 3 to 5 years inclusive. This means that the company has the right to set a useful life of 3, 4, and 5 years.

You can quickly and accurately determine the depreciation group in the reference and legal service Standard.

An interactive directory “OKOF and depreciation groups” has been created especially for accountants.

You can search for the desired OKOF in the tree, looking separately at each section of the directory. You can enter the type of fixed asset in the search bar, and the system will highlight all groups where such a name exists. If you left-click on the desired name, the depreciation group number will appear on the right.

Example of depreciation calculation.

It is important for an accountant to accurately assign a fixed asset to the required depreciation group; the correct calculation of income and property taxes depends on this. The OKOF directory will help you make the right choice!

Liquidation of OS due to expiration of the term of use

Every asset has a useful life, whether it is a building or an industrial piece of equipment. The organization can write off fixed assets later. Postings during liquidation after the end of the recommended period for operation and immediately after its onset are no different.

Characterize the write-off of an object of fixed assets by transactions carried out by an accountant. It is assumed that the amount of the asset's cost is fully transferred to current costs. This statement confirms the zero final balance on account 01 after the transaction, which does not require additional quotes for writing off balances.

Typical postings for account 02

By debit of the account

| Contents of a business transaction | Debit | Credit |

| Write-off of depreciation on fixed assets disposed of as a result of sale, liquidation, gratuitous transfer to reduce the original cost | 02 | 01 “Disposal of fixed assets” |

| Depreciation on a fixed asset item included in property intended for rental was transferred to a separate subaccount | 02 | 02 |

| Depreciation on property previously intended for rental and transferred to fixed assets was transferred to a separate subaccount | 02 | 02 |

| Depreciation on retired fixed assets intended for rental is written off to reduce its original cost | 02 | 03 |

| Depreciation of exploration assets transferred to fixed assets or intangible assets is written off as a reduction in initial cost. | 02 | 08 |

| Depreciation on fixed assets transferred to a branch allocated to a separate balance sheet was written off (posting in the accounting of the head office) | 02 | 79-1 |

| Depreciation on fixed assets transferred to the head office was written off (posting in the branch accounting) | 02 | 79-1 |

| Depreciation on fixed assets transferred to trust management was written off (in the accounting of the management founder) | 02 | 79-3 |

| Depreciation on fixed assets previously received for trust management and returned to the founder of the management was written off (on a separate balance sheet of the trust) | 02 | 79-3 |

| The amount of depreciation is reduced when the value of fixed assets decreases as a result of revaluation | 02 | 83 |

By account credit

| Contents of a business transaction | Debit | Credit |

| Depreciation has been accrued for fixed assets used in the reconstruction or modernization of other fixed assets | 08 | 02 |

| Depreciation has been calculated on fixed assets used to create intangible assets | 08 | 02 |

| Depreciation was accrued for fixed assets used during the construction of the facility for the organization’s own needs | 08-3 | 02 |

| Depreciation was calculated on fixed assets used in the main production | 20 | 02 |

| Depreciation was calculated on fixed assets used in auxiliary production | 23 | 02 |

| Depreciation has been accrued on fixed assets for general production purposes | 25 | 02 |

| Depreciation has been accrued for general purpose fixed assets | 26 | 02 |

| Depreciation was calculated on fixed assets used in service production | 29 | 02 |

| Depreciation was accrued on fixed assets intended to support the sales process | 44 | 02 |

| Depreciation has been calculated on the fixed assets of a trading organization | 44 | 02 |

| Depreciation was taken into account on fixed assets received from the head office of the organization, allocated to a separate balance sheet (posting in the branch accounting) | 79-1 | 02 |

| Depreciation on fixed assets received from a branch allocated to a separate balance sheet is taken into account (posting in the accounting of the head office) | 79-1 | 02 |

| Additional depreciation was accrued on fixed assets, the cost of which increased as a result of revaluation | 83 | 02 |

| Depreciation has been accrued on fixed assets leased (renting is not the subject of the organization’s activities) | 91-2 | 02 |

| Depreciation has been accrued on fixed assets used in the performance of work, the costs of which are taken into account as deferred expenses. | 97 | 02 |

Write-off of fixed assets - postings

Liquidation of assets due to the expiration of their useful life involves the use of the following accounting entries:

- Dt “Disposal of fixed assets” Kt 01 (subaccounts of the fixed assets type “Non-production fixed assets”, “Inventory” and others) - the amount of the original or replacement cost is written off.

- Dr. “Depreciation” Ch. “Disposal of fixed assets” – the amount of accrued depreciation on liquidated assets is written off.

- Dt “Expenses” Kt accounts of group III “Accounting and production costs” - the amount of expenses associated with the write-off of fixed assets.

- DT “Materials” CT “Revenue” - the amount of materials and waste received during the liquidation.

Reception of materials and spare parts is carried out taking into account their actual condition at market prices. If the company does not write off depreciated fixed assets, transactions are not drawn up or are carried out in accordance with the decision made on further use or sale.

Accounting for depreciation of fixed assets

Depreciation is a monetary unit of wear and tear. That is, this is part of the cost of an asset, which is included monthly in the cost of products, services, and goods.

Through depreciation, there is a gradual transfer of the value of a fixed asset, at which it is listed in accounting, to products and goods.

Ultimately, the money spent on the acquisition of operating systems is returned to the company after receiving payment from buyers and clients for the purchased values.

This process is gradual and continues throughout the entire useful life. To account for it, the accountant makes monthly entries in specially designated accounting accounts.

As long as the fixed asset is listed on the balance sheet of the enterprise, the accountant must make monthly depreciation deductions. This procedure is carried out until complete wear and tear, write-off due to unsuitability, breakdown or transfer to other persons.

The process of depreciation accumulation is suspended only in two cases:

- The OS is under conservation, provided that its duration exceeds 3 months.

- Restoration, modernization, reconstruction of an object, if this process takes more than a year.

If a decision is made to sell an object or write it off, the accountant determines the residual value of the asset. To do this, the depreciation accrued for the entire period is written off by posting to account 01, where the residual parameter is determined.

If during the operation of equipment or another object the initial cost changes due to revaluation, then depreciation accumulations are also recalculated and the necessary entries are made.

Thus, the accountant is faced with the need to reflect entries for accounting for depreciation of fixed assets in the following cases:

- making monthly depreciation payments;

- changes in accumulated deductions due to revaluation of the value of fixed assets (may either increase or decrease);

- write-off of a depreciable object as unnecessary (physical or moral wear and tear, breakdown, irreparable defects);

- disposal of fixed assets to third parties (sale, donation, contribution to the authorized capital of other enterprises).

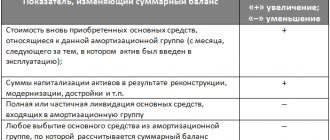

On what account are they reflected?

For the purpose of accounting for depreciation accumulations for fixed assets, account 02 is provided in the Plan:

- By debit – the amount of depreciation on written-off and retired objects is shown, as well as a decrease in savings due to the devaluation of fixed assets.

- For a loan, accrued depreciation included in the cost is collected, and an increase in accumulated deductions due to revaluation is also reflected.

On account 02 it is possible to open sub-accounts:

- 1 – deductions are shown for owned assets on the balance sheet;

- 2 – depreciation is reflected on fixed assets taken on a long-term lease and on the leased balance sheet. Accounting and depreciation of leased property.

On account 02, it is necessary to provide analytical accounting for each individual fixed asset or group of similar objects.

This will allow you to obtain the necessary information to analyze the efficiency and feasibility of using fixed assets.

Monthly double entries on account 02 when accrued

From the month immediately following the month of receipt of the fixed asset in the organization, it is necessary to calculate depreciation and write it off as expenses.

Depreciation charges are calculated on the credit of account 02 in correspondence with the debit of the enterprise's cost accounting accounts.

The choice of a corresponding account depends on the purpose and place of use of the fixed assets object, as well as on the nature of the enterprise’s activities - trading, manufacturing.

Depreciation can be written off to the following accounting accounts:

- 20, 23 – for production facilities, equipment engaged in main and auxiliary production;

- 44 – for fixed assets operated by trading companies;

- 91 – for OS leased.

Table of entries for calculating depreciation of fixed assets:

| Debit | Credit | Operation |

| 20 | 02 | Depreciation was accrued on fixed assets and equipment of production enterprises (included in the costs of main production) |

| 44 | 02 | Accrued depreciation on fixed assets of trading organizations (included in sales expenses) |

| 91 | 02 | Reflection of accrual by the lessor for fixed assets leased (accounted for as part of other expenses) |

Postings are made monthly throughout the useful life of the reporting period to which they relate. It does not matter what the financial result of the enterprise is.

The accumulation of deductions should not stop, except for long-term cases of restoration and conservation.

The amount for which an accounting entry is made is calculated using one of the established four methods.

How is it written off upon disposal?

The need to deregister a fixed asset arises for various reasons:

- Depreciation is obsolete - the equipment is outdated.

- Physical wear and tear – the service life has ended, or the object has become so worn out that it is no longer suitable for use.

- Breakdown - if its repair is not feasible for economic reasons or is not possible.

- Transfer to other parties when selling, donating, or entering into the charter capital of other companies.

- Shortages identified after inventory.

Regardless of the reason for deregistration of a fixed asset, the procedure is the same:

- A separate sub-account 11 is opened on account 01.

- The initial or replacement cost of the fixed assets is written off to the debit of the open subaccount.

- The accumulated depreciation is transferred to the credit of the open subaccount.

- The residual value is determined and written off depending on the reason for deregistration of the asset.

The transfer of depreciation charges accumulated on the date of disposal or write-off is carried out using the accounting entry: Dt 02 Kt 01-11 - the amount of accrued depreciation is written off.

When revalued

Revaluation is a procedure for recalculating the value at which fixed assets are listed on the balance sheet. This is done to match actual market prices.

The result of this process can be an additional valuation when the initial cost increases, and a markdown when it decreases.

The value indicator by which fixed assets are accounted for in the debit of account 01 changes depending on the results of the revaluation - it increases or decreases. The resulting cost will already be called replacement cost.

Depreciation accumulations on account 02 also change accordingly. Moreover, a proportional calculation is made of the amount by which accrued depreciation must be reduced or increased, depending on changes in the replacement cost of the fixed asset.

Formula for recalculating depreciation:

Formula:

Recalculated A. = Restoration article * Accumulated A. / Initial article.

Table with entries for accounting for depreciation during revaluation:

| Debit | Credit | Operation |

| 83 | 02 | The increase in depreciation when revaluing the cost of fixed assets is reflected in additional capital |

| 02 | 91/1 | The decrease in savings due to writedown is included in other income |

Example

Initial data:

On February 20, 2020, the company bought a machine; the total cost was 720,000 rubles.

The period of use for the machine is set at 6 years = 72 months.

Depreciation is calculated using the straight-line method, monthly deductions = 10,000.

On June 10, 2020, the company sells a machine for RUB 500,000.

What entries should the accountant record for the period from February to June 2020?

Solution:

Postings for depreciation charges must begin from March 1, 2020 to June inclusive.

Let's assume that the company operates under the simplified tax system and does not pay VAT.

Posting table:

| date | Sum | Operation | Debit | Credit |

| 20.02 | 720 000 | The machine was put into operation as OS | 01-1 | 08 |

| 01.03 | 10 000 | Depreciation for 1 month is included in production costs | 20 | 02 |

| 01.04 | 10 000 | Depreciation charges for 2 months of use | 20 | 02 |

| 01.05 | 10 000 | Depreciation for 3 months of operation | 20 | 02 |

| 01.06 | 10 000 | Depreciation for 4 months | 20 | 02 |

| 10.06 | 720 000 | The initial cost of a fixed asset was written off due to its sale | 01-11 | 01-1 |

| 10.06 | 40 000 | Accumulated deductions for the object are written off | 02 | 01-11 |

| 10.06 | 680 000 | The machine is for sale | 91-2 | 01-11 |

| 10.06 | 500 000 | The sales price of the machine is reflected | 62 | 91-2 |

| 180 000 | The financial result of the transaction is a loss | 99 | 91-2 |

Enterprise example

Let's consider a common situation for an organization liquidating an operating system: production equipment with an initial cost of 25,000 rubles has been written off.

Depreciation deductions have been received in full. During dismantling, workers discovered spare parts worth RUB 3,500 that were suitable for further use. Additionally, scrap metal worth RUR 1,000 was accepted. Liquidation of equipment brought the following expenses: used materials - 500 rubles, wages to workers - 1,500 rubles, social tax and insurance contributions - 500 rubles. Carrying out business transactions

| Dt | CT | Amount, r | Characteristic |

| 01.9 | 01 | 25000 | the amount of the initial cost of the asset is written off |

| 02 | 01.9 | 25000 | depreciation is written off over the entire service life |

| 10 | 91.2 | 3500 | received materials were capitalized |

| 10 | 91.1 | 1000 | scrap metal received is taken into account |

| 91.2 | 10 | 500 | the cost of materials used is written off |

| 23 91.2 | 70 23 | 1500 | wages accrued to employees of auxiliary production |

| 91.2 | 69 | 500 | the amount of social tax and contributions accrued |

The example clearly shows the write-off of the initial price and depreciation of fixed assets: postings Dt “Disposal of fixed assets” Cht “Assets” and Dt “Depreciation” Cht “Assets”. When assets that have served their full life and have managed to accumulate full depreciation value are liquidated, account 01 is completely closed with the transactions described.

Depreciation of fixed assets: entries in the table

| № | Debit | Credit | |

| Accounting entries for fixed assets under capital construction | |||

| Accrued for fixed assets used in the creation of new non-current assets and in operations to bring acquired assets to a condition suitable for further operation | |||

| Accounting entries for production fixed assets located in the main production | |||

| Accrued for fixed assets used in the production of one specific type of product (work, service) | |||

| Accounting entries for production fixed assets located in auxiliary production | |||

| Accrued for fixed assets used in the production of products (works, services) that are auxiliary (auxiliary) for the main production | |||

| Accounting entries for production fixed assets in general production use | |||

| Accrued for fixed assets used in the production of several types of products (works, services) or related to workshop facilities. These expenses can be taken into account directly on account 23 “Auxiliary production”, without first accumulating them on account 25 “General production expenses” | |||

| Accounting entries for production fixed assets in general economic use | |||

| Accrued for fixed assets attributed to fixed assets for management and general economic purposes | |||

| Accounting entries for production fixed assets located in service industries and farms | |||

| Accrued for fixed assets used in the production of products (works, services) of service industries and farms of the organization | |||

| Accounting entries for production fixed assets located in divisions of the organization engaged in sales of products | |||

| 44 subaccount “Business expenses” | Accrued based on fixed assets used in product sales | ||

| Accounting entries for fixed assets located in trading organizations | |||

| 44 subaccount “Distribution costs” | Accrued for fixed assets used in organizations engaged in trading activities | ||

| Accounting entries for fixed assets located in the social sphere | |||

| Accrued according to OS used in the social sphere. The amount of depreciation is accrued to the financial results (other expenses) of the organization | |||

| Accounting entries for fixed assets located in divisions of the organization engaged in performing work taken into account as part of deferred expenses | |||

| Accrued for fixed assets used in the development of new production facilities and other types of work taken into account as part of deferred expenses | |||

Fresh materials

- Certificate of non-admission to the apartment, sample EVERYTHING THAT CONCERNES THE COMPANY BURMISTR.RU CRM system APARTMENT.BURMISTR.RU SERVICE FOR REQUESTING EXTRACTS FROM ROSSREESTR AND CONDUCTING…

- Balance sheet of JSC Accounting (financial) statements of enterprises 39,149.84 billion rubles — JSC VTB CAPITAL 4,892.93 billion…

- Tax planning Tax planning in an organization Tax planning can significantly affect the formation of the financial results of an organization,…

- Exemption from VAT Notification of the use of the right to exemption from VAT Notification of the use of the right to exemption from VAT...

Liquidation of OS due to wear and tear

Often, production equipment becomes unusable long before the end of the service life provided for by the technical characteristics of the facility. The accountant carries out several operations: records the residual value and writes off depreciation of fixed assets. Postings are made in the prescribed manner:

- The initial price of fixed assets is credited (Dt “Disposal of fixed assets” Cht “fixed assets”).

- The depreciation cost is reflected (Dt “Depreciation of fixed assets” Cht “Disposal of fixed assets”).

- The residual value of fixed assets is written off (posting Dt “Income” Cht “Disposal of fixed assets”).

In addition to the debit balance of the account. 01, in sch. 91.1 includes other costs for liquidation of fixed assets. Materials and spare parts arrive in the same order as when written off after the end of their service life.

Reflection of depreciation in company accounting

To reflect standard transactions in accordance with the norms of Order No. 94n, the account is intended. 02, on which transactions for accumulated depreciation of fixed assets are generated. This account is passive - with depreciation on credit and write-off on debit. Accordingly, the corresponding account will depend on the area of activity of the organization and the type of asset.

Note! If the cost of an asset does not exceed 40,000 rubles, such an object can be immediately included in the inventory (inventory) and does not require depreciation as fixed assets (clause 5 of PBU 6/01).

Depreciation accrued - posting

When calculating depreciation amounts, the posting is made to the credit account. 02 in correspondence with account. 08, 44, 23, 20, 25, 26, 79, 29, 97, 91, 83. The duration of depreciation depends on the useful life of the asset. This period is established taking into account the requirements of the OS Classifier (Resolution of the Government of the Russian Federation No. 1 of 01.01.02). The amount of depreciation is affected by the chosen calculation method. When calculating depreciation, transactions can be recorded in different ways:

- Depreciation was accrued on production equipment - posting D 20 K 02.

- The amount of depreciation on auxiliary equipment has been accrued - posting D 23 K 02.

- When calculating depreciation amounts for equipment of general production or general economic importance - posting D 25 (26) K 02.

- If the fixed assets are leased, the following entry is made - the amount of accrued depreciation is credited to the account. 02, corresponding with account. 91.

Write-off of depreciation - posting

When an asset is removed from the balance sheet of an enterprise, it is necessary to write off the asset. To do this, the amount of accumulated depreciation is transferred from the debit of the account. 02 on credit account 01. As a result, the account is closed. 02. The operation is reflected as follows:

- The amount of accrued depreciation is written off - posting D 02 K 01.

Let's look at how in practice depreciation is calculated and depreciation is written off when disposing of fixed assets.

Suppose a manufacturing enterprise purchased a machine at a price of 1,400,000 rubles. The accountant assigned the object to group 3 according to the Classifier, and the SPI was set at 40 months. The depreciation calculation method is linear, the amount of monthly depreciation is 35,000 rubles. (1/40 month x RUB 1,400,000.00). In accounting, depreciation transactions are reflected as follows:

- Monthly depreciation charge - posting D 20 K 02 for RUB 35,000.00.

Let’s assume that after 3 years, that is, after 36 months, management decided to sell the machine at a price of 250,000 rubles. without VAT. The amount of depreciation accrued by this time is 1,260,000 rubles. (36 months x RUB 35,000.00). Let's reflect the operation in accounting:

Solving the problem of eliminating OS due to wear and tear

Let's consider an example: a fictitious enterprise has decided to write off a capital extension to its production premises. The replacement cost is 1,000,000 (taking into account the cost of the extension - 250,000 rubles). Depreciation amounted to 500,000 rubles, and the depreciation rate was 10%. After liquidation, the expected service life of the structure will be 4 years.

The following accounting entries must be made:

- Dt “Disposal of fixed assets” Kt “OS” – 250,000 rub. – replacement cost written off.

- Dr. “Depreciation” Dr. “Disposal of fixed assets” – (1000: 2000) × 500 = 750,000 rub. – depreciation accumulations are reflected.

- Write-off of the residual value of fixed assets - posting Dt "Revenue" Cht "OS" - 1,000,000 - 750,000 = 250,000 rubles.

The necessary amounts to be written off have been identified. The company's expenses due to wear and tear of the operating system amounted to 250,000 rubles.

Disposal of assets in case of emergencies

The characteristics of incidents that can be assessed as emergencies are regulated by statistical accounting. Accounting entries when writing off fixed assets during an emergency will depend on whether the property was insured. In this case, the amount of compensation paid by the insurance company should not exceed the amount of actual damage.

When calculating insurance compensation, the account is used. 76.1. The balance not covered by the payment is written off for emergency expenses of the organization.

Write-off of fixed assets - postings in case of emergency

Uninsured funds are subject to write-off using correspondence accounts:

- Dr. “Disposal of fixed assets” Cht. “fixed assets” - the amount of replacement or full cost of acquisition.

- Dt “Depreciation” Kt “OS” – the amount of depreciation of the liquidated object.

- DT “Expenses in case of emergency” CT “OS” – the amount of the residual value.

- Dt “Materials” Ct “Revenue” - the amount of materials suitable for use.

When using insurance, the accounting for write-off of fixed assets changes. The entries made by the accountant are recorded as follows:

- Dr. “Disposal of fixed assets” Cht. “fixed assets” - the amount of replacement or full cost of acquisition.

- Dt “Depreciation” Kt “OS” – the amount of depreciation of the liquidated object.

- Dt "Calc. for insurance" Kt "OS" - an insurance payment that is part of the amount of the residual value written off as a result of an emergency of the object.

- Dt “Materials” Ct “Revenue” - the amount of materials suitable for use.

- Dt “Expenses in case of emergency” Kt “OS” – the amount of residual value that is not covered by the insurance payment.

Disposal of fixed assets upon sale

Liquidation of property in connection with the sale consists of several business transactions:

- Reflection of the initial price (Dt “Disposal of fixed assets” Cht “fixed assets”.

- Write-off of depreciation of fixed assets (entries Dt “Depreciation” Kt “OS”).

- Recognition of proceeds from sales (Dt “Settlements with customers” Ct “Revenue”).

- VAT on the sale amount (Dt “Revenue” Ct “VAT”).

When exchanging or donating a retiring fixed asset, in addition to the above quotes, the depreciated cost is written off and the costs associated with the transfer and transportation are reflected.

Basic postings

A convenient guide to postings will tell you how to calculate depreciation using different methods of calculating it. In it you will find not only wiring, but also visual examples with detailed calculations and comments.

The directory includes four sections. Each section contains narrower topics and individual examples with wiring. The user can find the material of interest using the contents or using the search bar of the directory.

Basic entries for depreciation

| Debit | Credit |

| Depreciation of fixed assets used in production has been calculated | |

| Depreciation of fixed assets used in trade has been calculated | |

| Deferred tax liability (DTL) is reflected, which arises due to differences in tax and accounting | |

| IT is decommissioned | |

| Deferred tax asset (DTA) reflected | |

| Depreciation of leased fixed assets has been calculated | |

| Depreciation on retired fixed assets is written off |

Elena Rogacheva, expert of the reference and legal service Kontur.Normative

Liquidation due to shortage

If a shortage or damage to property is detected during an inventory, the accountant writes off fixed assets. Postings are made in the prescribed manner:

- The initial price of the OS is taken into account.

- The depreciation value is reflected.

- The difference between depreciation charges and lost fixed assets is taken into account.

- The amount of the shortfall is written off to the culprit or to the company's expenses.

To calculate material damage as an employee's receivables, accounts 73 or 76 are used. The amount minus depreciation is reflected and the subsequent write-off of the shortfall occurs in account 94. The first operation is accounted for as a debit, the amount of the shortfall is recorded as a credit.

Liquidation of fixed assets in budgetary institutions

Disposal of fixed assets in budgetary organizations occurs for the same reasons as in any commercial company. For write-offs, acts are drawn up, which are signed by the commission and approved by management. Only on their basis are entries made for writing off fixed assets in budgetary institutions: Dt 020 “Depreciation of fixed assets” Kt 010–019 “OS” and Dt 250 “Fund in fixed assets” Kt 010–019 “OS”. Used accounts 010–019 are subaccounts. 01 and are used in budgetary institutions when maintaining accounting records.

As a result of the emergency, fixed assets and postings are written off: the budget reimburses the cost of damaged property Dt 020 Kt 010–019 and Dt 250 Kt 010–019. Liquidation of fixed assets as a result of shortages occurs using the same quote, but the accountant additionally makes a second entry attributed to the guilty party. Quotes depend on the nature of the cash receipts with which the lost fixed assets were purchased:

- at the expense of the budget Dt 170.1 Kt 173.1;

- through gratuitous assistance Dt 170.1 Kt 270.3;

- through entrepreneurship Dt 170.2 Kt 401.

The arrival of materials and spare parts as a result of the liquidation of fixed assets is taken into account in the debit of accounts 063.1, 063.3, 069.1 and 069.3 and the credit of the account. 270, 241. Amounts received from the sale of assets or materials during liquidation are reflected in the account. 178.3 (Dt) and count. 270, 241 (Kt).

Maintaining OS accounting occupies an important place in the accounting department of an enterprise of any type of activity. Data on residual amounts are used when calculating property taxes. Incorrect indicators can lead to errors and administrative liability for violation of the Tax Code of the Russian Federation.

Calculation of depreciation of transactions

Open the document in your ConsultantPlus system: Transaction Guide. Purchase and sale of movable property (fixed assets that were in use). Buyer Due to the different cost criteria for recognizing property as depreciable for the purposes of accounting and tax accounting for property worth from 40,000 to 100,000 rubles. In accounting, a taxable temporary difference (TDT) and a corresponding deferred tax liability (DTL) arise. This is due to the fact that in tax accounting the cost of such property is included in material expenses in full as it is put into operation (unless a different procedure for writing off the value of property as material expenses is established in the accounting policy for profit tax purposes), and in accounting depreciation is calculated in relation to such property. The occurrence of IT is reflected in accounting as the debit of account 68 “Calculations for taxes and fees” and the credit of account 77 “Deferred tax liabilities”. The specified NVR and IT are reduced (repaid) as depreciation is calculated in accounting. The decrease (repayment) of IT is reflected by an entry in the debit of account 77 and the credit of account 68 (clauses 15, 18 PBU 18/02, Instructions for using the Chart of Accounts).

To reflect depreciation on fixed assets (fixed assets), depreciation is calculated in the enterprise's accounting; postings are made according to the norms of Order No. 94n of the Ministry of Finance dated October 31, 2000. What accounts are used in this case? Where is the accumulated amount of depreciation charges written off when objects are disposed of? Details below.