VAT on prepayment received

Upon receipt of partial payment (advance payment) for the upcoming delivery of goods subject to VAT, the seller is obliged to calculate the amount of tax (clause 2, clause 1, article 167 of the Tax Code of the Russian Federation).

In addition, no later than five calendar days from the date of receipt of the advance payment, the supplier company must:

- draw up an invoice for the advance payment in two copies;

- register the invoice in the sales book (clause 3, 17 of the Rules for maintaining the sales book);

- transfer one copy of the invoice to the buyer (clause 3 of article 168 of the Tax Code of the Russian Federation).

The tax base for VAT when receiving an advance payment from the buyer is the amount of payment received, including VAT (paragraph 2, clause 1, article 154 of the Tax Code of the Russian Federation).

The amount of tax payable to the budget is determined at the estimated rate. Her choice is determined by the VAT rate that the company intends to apply when selling goods for which an advance was received. The taxpayer currently applies a rate of 18/118 or 10/110 (clause 4 of article 164 of the Tax Code of the Russian Federation).

Sometimes, when receiving an advance payment to a company, it is not known what VAT rate will be applied to goods upon shipment: 10 or 18%. In this case, the Ministry of Finance recommends calculating VAT at the rate of 18/118 (letter of the Ministry of Finance of Russia dated March 6, 2009 No. 03-07-15/39).

If VAT is not calculated on the prepayment received, the payer may be held liable under Art. 122 of the Tax Code of the Russian Federation.

By the way, from the point of view of the Ministry of Finance, a deposit is equivalent to an advance payment (letter of the Ministry of Finance of the Russian Federation dated April 10, 2017 No. 03-07-14/21013). Therefore, according to the department, it is also necessary to pay tax on the deposit. But this position is ambiguous. Since a deposit is only a way to reduce commercial risks, it cannot be recognized as a means of payment until the conclusion of the main agreement (clause 1 of Article 380 of the Civil Code of the Russian Federation). Therefore, the need to tax the deposit amount with VAT according to the rules applicable to advances received can be challenged in court.

The invoice is issued in a single copy “for yourself”

In this case, it is advisable to use special processing Registration of invoices for advance payments (Bank and cash desk - Registration of invoices - Invoices for advance payments)

, which will automatically create invoices for all outstanding advances according to the established statement rules*.

*The procedure for issuing invoices for advances received is established in the accounting policies of organizations (), as well as in the agreement with the counterparty. By the way, we strongly advise you not to neglect the latest provision of the law and issue invoices for all advances that are not paid by the end of the day. One of our acquaintances, an accountant, has been reprinting books of purchases and sales since 2011, due to the fact that he wrote out advances that were not accounted for within 5 days.

The most important limitation of this method is that before registering advance invoices, we must be sure that:

- The sequence of settlements with customers is relevant

- Duplicate counterparties and contracts were reconciled

- All debt balances are as of 62.01

- All balances of advances are at 62.02

- At 62.02 there are no balances for which the advance should have already been closed

- In case of changes in mutual settlements in the period for which processing has already been performed Registration of invoices for advance payments

, need to restart

Let's briefly consider each of the above restrictions separately:

VAT deduction from prepayment

On the date of shipment of goods, against the advance payment received, the amount of VAT calculated on the advance payment received from the buyer can be deducted (clause 8 of Article 171, clause 6 of Article 172 of the Tax Code of the Russian Federation).

Advance VAT is deductible only in the quarter of shipment of goods. It is impossible to transfer the deduction to the next tax period (letters of the Ministry of Finance of Russia dated July 21, 2015 No. 03-07-11/41908, dated October 17, 2017 No. 03-07-11/67480). The amount of advance VAT deduction depends on the tax rate that is applied when shipping goods as an advance payment (clause 6 of Article 172 of the Tax Code of the Russian Federation).

If the cost of goods shipped, including VAT, is equal to or greater than the amount of the advance received previously, a deduction is declared in the amount of the VAT calculated earlier upon receipt of the advance (letter of the Ministry of Finance dated 05/07/2018 No. 03-07-11/30585). If the amount of the advance payment exceeds the cost of goods shipped against this advance, including VAT, then the deduction can only be claimed in the amount of VAT on the cost of shipment.

Example

Gratis LLC received an advance from the buyer in the amount of RUB 354,000. (including VAT RUB 54,000). The following month, the company shipped goods worth RUB 236,000 to the buyer. (including VAT RUB 36,000).

On the date of shipment, the company has the right to deduct VAT from a previously received advance in the amount of 36,000 rubles.

How to reflect a deduction in a purchase ledger

Registration of invoices for advances in the purchase book is carried out by buyers according to the general rule. In this case, the right to deduction arises if the invoice is received during the current quarter - no later than the 25th day of the next month. If the document is registered in the purchase book later than the specified date, then the VAT amount can be deducted in the next quarter.

Registration of accounts must be carried out as the right to deduction arises. The exceptions in this case are invoices for export transactions - they must be registered only if there is a document confirming the right to apply the zero VAT rate.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

VAT deduction in non-standard situations

In practice, the taxpayer-seller of goods can calculate the amount of VAT on the advance payment using the calculated rate of 18/118. And shipment against the advance received can be made at two rates: 10 and 18%. How much VAT should be deducted during the shipment period? And how to avoid senseless tax losses?

Example

On July 15, 2020, Gratis LLC received an advance from the buyer in the amount of RUB 236,000. Since the company did not have information on VAT rates for goods planned for shipment against the advance received, VAT of 36,000 rubles was calculated on the advance amount.

The advance amounts and VAT were reflected by Gratis LLC in the tax return for the second quarter of 2020. The tax has been paid in full to the budget.

On September 15, 2020, Gratis LLC shipped goods to the buyer. The cost of shipped goods is 236,000 rubles, including VAT 10% - 4,000 rubles, 18% - 29,288 rubles. The total amount of VAT charged to the buyer upon shipment of goods is RUB 33,288.

In the example considered, the amount of VAT calculated on the advance received exceeds the amount of VAT that can be deducted upon shipment, guided by the norm of clause 6 of Art. 172 of the Tax Code of the Russian Federation. It turns out that the taxpayer overpaid VAT when receiving an advance from the buyer, although the amount of shipment, including VAT, is equal to the amount of the advance received earlier.

The Supreme Court, in Ruling No. 310-KG18-11870 dated August 21, 2018, called the difference resulting under similar circumstances an overpaid tax. The taxpayer’s dispute with the tax authority concerned the amount of tax deduction from a previously received advance. The taxpayer deducted all advance VAT.

However, the inspector did not agree with this calculation. And he allowed us to deduct only the amount of VAT in the amount of tax calculated on the cost of shipped goods.

Consequently, the company will have to file an updated VAT return for the period in which the advance payment was received. As a result, the company will have an overpayment of taxes, which can be returned or offset according to the rules of Art. 78 Tax Code of the Russian Federation.

Registration of invoices for advance payments

Finally, when we are sure that:

- The sequence of settlements with customers is relevant

- Duplicate counterparties and contracts were reconciled

- All debt balances are as of 62.01

- All balances of advances are at 62.02

- At 62.02 there are no balances for which the advance should have already been closed

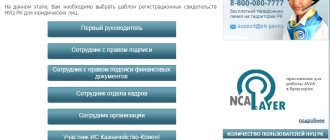

Only now we can use the automatic issuance of invoices for advances ( Sales - Maintaining a sales book - Registration of invoices for advances

).

Document Invoice

issued with the sign

For advance

registration registers the following movements in the system:

- Accounting entry Dt 76.AV Kt 68.02 for the amount of VAT on the advance

- Register entry VAT sales

– it is on the basis of the data from this register that the

Sales Book

I repeat, in case of changes in mutual settlements in the period for which processing has already been performed Registration of invoices for advance payment

, it is necessary to re-perform processing, and the program implements the ability not to renumber previously generated documents (this is important if we have already printed previously issued invoices).

Billing

The document must indicate:

- name, address, TIN of the parties to the transaction;

- number and date;

- name of goods;

- prepayment amount;

- tax rate;

- VAT amount.

In case of prepayment, the invoice must indicate the tax rate as a percentage of the base. Based on these data, VAT is then taken into account on advances received. As for the name, the invoice can indicate the name of groups of goods without a detailed explanation.

VAT deduction on advances and prepayments

In accordance with clause 12 of Article 171 of the Tax Code of the Russian Federation, taxpayers-buyers have the right to claim “input” VAT for deduction not only at the time of taking into account purchased goods (works, services), but also upon transfer of an advance payment on account of the upcoming delivery of goods ( works, services), property rights (clause 12 of article 171 of the Tax Code of the Russian Federation). However, when claiming VAT on the advance amount, you need to take into account the problems that may be encountered in practice.

In accordance with the Tax Code of the Russian Federation, the mechanism for using deductions for advance payments is as follows.

The buyer, who has transferred the prepayment to the supplier, receives from him an invoice for the amount of the prepayment (let's call it an “advance invoice”) and, on the basis of this invoice, claims VAT for deduction (registers the specified invoice in his purchase book).

Then the buyer receives from the supplier those goods (work, services, property rights) for which he previously made an advance payment. When shipping these goods (works, services, property rights), the supplier again issues an invoice to the buyer (let’s call it a “shipping invoice”), on the basis of which the buyer again claims VAT for deduction (registers the received shipping invoice in his purchase book ). And at the same time, the buyer restores for payment to the budget the amount of VAT that was declared by him for deduction when transferring the prepayment (i.e., registers in the sales book the advance invoice received from the supplier when transferring the prepayment) (subclause 3 of paragraph. 3 Article 170 of the Tax Code of the Russian Federation).