Line 1230 of the balance sheet (230, 240): decoding, principles of structure of line codes

Each line of the balance sheet has a code that allows you to identify the data contained in it. The main consumers of these codes are statistical and regulatory authorities, which can carry out analytical work on them.

Currently the codes are 4 digits long. For example, line 1230 of the balance sheet , former line 240, contains accounts receivable in the breakdown. This line shows the amount of debt that its partners, counterparties and other persons interacting with it have to the company in a certain period of time.

Line 230 also belonged to this category and reflected debts that could be repaid in no earlier than 12 months.

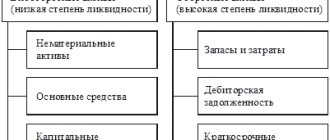

The balance sheet line codes contain very specific information:

- The first digit is that it belongs specifically to the balance sheet and not to another document.

- The second digit indicates belonging to a specific section of the asset.

- The third number shows the place of this asset in the liquid ranking. The higher the liquidity, the higher the number.

- The fourth digit is required for line detail. Thus, the requirements contained in PBU 4/99 are met.

Using a similar principle, we will selectively describe which codes correspond to the strings and provide a brief explanation of them. We will separately indicate in the table the new and old codes, since the balance must be drawn up for 3 years, and 2 years ago the previous code values were still in effect.

Balance filling sequence

All lines that should be on the balance sheet are given in its standard form. If there is no data to fill out a line, put a dash (clause 11 of PBU 4/99). So, most organizations will have dashes in lines 1110 - 1140, 1160, 1320 - 1360, 1430, 1450.

In line 1150 “Fixed assets”, indicate the residual value of the fixed assets, i.e. the difference between the balance on accounts 01 and 02. In the same line, include unfinished construction - the balance on account 08-3.

In line 1170, indicate the cost of long-term financial investments. These are shares and shares in the management capital of other organizations, as well as bills and loans with a maturity date after December 31, 2018.

Line 1190 “Other non-current assets” is usually left blank. It reflects assets not named in the standard balance sheet. For example, the cost of materials intended for construction (Appendix to the Letter of the Ministry of Finance dated January 29, 2014 N 07-04-18/01).

Calculation of line 1210 “Inventories”: add up the balance of the inventory accounts - 10, 41, 43, 45 and costs - 20, 44. Reduce this amount by the credit balance of accounts 14 and 42. Also in this line include costs from account 97, which will be written off within a year, for example for voluntary health insurance.

Calculation of line 1230 “Accounts receivable”: add up the debit balance of all subaccounts for accounts 60, 62, 68, 69, 70, 71, 73, 75, 76, reduce the result by the credit balance for account 63.

In line 1240, indicate the cost of short-term financial investments. These are notes and loans that will be repaid in 2020. Do not include the value of cash equivalents here—show them along with cash on line 1250.

Line 1260 “Other current assets” is usually left blank. It reflects assets that are not named in the standard balance sheet, for example, the debit balance on account 94.

Transfer the balance of account 84 to line 1370 “Retained earnings”. If it is a debit, show the loss in parentheses on line 1370.

In line 1520 “Accounts payable” show the total credit balance of all subaccounts for accounts 60, 62, 68, 69, 70, 71, 73, 76 and subaccounts 75-2.

In line 1530 “Deferred income”, indicate the amount of credit balances of accounts 98 and 86.

The indicator in line 1540 “Estimated liabilities” is equal to the credit balance of account 96. As a rule, the balance of the reserve for vacation pay is reflected here.

On line 1600, show the total value of all assets. And in line 1700 - the total amount of all liabilities. When calculating, we subtract the data in brackets. Lines 1600 and 1700 should be equal.

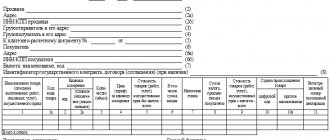

The interpretation of individual balance sheet indicators can be given in the same lines as the indicators themselves. For example, in line 1150, separately show the cost of the OS used in production. The machine-readable balance sheet form recommended by the Federal Tax Service has separate sheets for interpretation. It is not necessary to fill them out.

Lines 1100 (190), 1150 (120), 1160, 1170 (140), 1180, 1190

Line 1100 contains information about the full amount of non-current assets of the enterprise. Before the order was changed, this was line 190. The next 6 lines are elements that add up to the value of this line.

Line 1150 of the balance sheet with a transcript corresponds to the previous line 120. Data on the enterprise’s fixed assets available at the time of the report is entered into it.

Line 1160 reflects information about the amount of material assets available at the enterprise, as well as investments that generate income. All data is recorded on account 03.

Line 1170, former 140, contains data on the enterprise’s investments if they are made for more than 12 months. Accounting is maintained by the debit of accounts 58 and 55, the subaccount is called “Deposits”.

Line 1180 contains the allocated tax assets. The balance of account 09 is indicated here. Line 1190 includes all non-current assets that were not mentioned above.

Net assets on balance sheet (line)

Related publications

Net assets are the sum of the total lines 1100 and 1200 in the balance sheet, reduced by lines 1400 and 1500. The indicator is used to assess the stability of the financial condition and characterizes the real level of the business’s own funds after settlements of all obligations and debts. Let's consider how to determine the value of the NAV according to the accounting statements of an enterprise.

Lines 1210 (210), 1220 (220), 1240 (250), 1250, 1260 and 1200 (290)

The previous line 210 corresponds to the current line 1210 of the balance sheet; the accounting department enters data on the remaining inventories into it.

Line 1220 of the balance sheet in the previous version is line 220. It should contain data on VAT, which was issued by the supplier, but was not accepted for deduction until the report was drawn up. This is essentially the debit balance of account 19.

Line 1240 of the balance sheet with a breakdown was previously line 250. It reflects investments whose maturity does not reach a year.

Line 1250 is the company’s monetary assets in national and foreign currencies, as well as other resources. This refers to accounts 50, 51, 52 and 55.

Line 1260 contains all other assets that did not find a place in the above section lines.

Line 1200 in the previous version of the form was line 290 of the balance sheet. The final results for section 2 are reflected here.

Which lines to look at the balance sheet currency

The currently valid balance sheet form was approved by Order of the Ministry of Finance “On Forms of Accounting Reports” dated July 2, 2010 No. 66n (as amended on April 19, 2019). According to Appendix 4 to this order, the balance sheet currency in the balance sheet is shown in the lines with the name “Balance” and the encoding:

- 1600 is the balance sheet currency for assets;

- 1700 is the balance sheet currency for liabilities.

Line 1600 represents the sum of the total data for the sections “Non-current assets” and “Current assets”. Line 1700 is the same total for the sections “Capital and reserves”, “Long-term liabilities” and “Short-term liabilities”.

For details of the listed sections of the balance sheet, see the material “Balance Sheet (Assets and Liabilities, Sections, Types).”

You can get detailed instructions for filling out line 1600 of the balance sheet or any other line of any form of financial statements that interests you in ConsultantPlus:

Get trial access to K+ for free and go to the Accounting Guide.

Thus, changes in each section of the balance sheet lead to a change in the balance sheet currency. What could such a change indicate?

Lines 1510 (610), 1520 (620), 1530, 1540, 1550 and 1500 with decryption

In the previous edition of the form, line 1510 of the balance sheet with a breakdown was line 610 of the balance sheet. It contains information about short-term borrowed funds (accounts 66 and 67).

Line 1520 of the balance sheet with decoding before 2020 was line 620. It reflects short-term debt to partners, staff, etc. Line 1530 contains account balance 98.

Line 1540 is liabilities reflected on the credit of account 96, the maturity of which is less than 12 months.

Line 1550 is all other obligations that are not reflected in the previous lines.

Line 1500 contains the final result for section 4.

What accounting data is used. when filling out line 1300 “Capital and reserves”

commercial organizations - small businesses are not entitled to use simplified methods of accounting if they are microfinance organizations or their financial statements are subject to mandatory audit (clause 1, 4, part 5, article 6 of Law No. 402-FZ).

The procedure for filling out this line by small businesses does not differ from the generally established procedure for filling out line 1410 “Borrowed funds” section. IV Balance Sheet, the form of which is given in Appendix No. 1 to Order of the Ministry of Finance of Russia No. 66n.

For information about what obligations of the organization are taken into account as part of borrowed funds, how their value is determined and what accounting data is used when filling out line 1410 “Borrowed funds”, see section. 3.1.4.1 “Line 1410 “Borrowed funds”.

For an example of filling out line 1410 “Borrowed funds”, see section. 3.1.4.1.4.

3.6.1.9. Line “Other long-term liabilities”

On this line, small business organizations reflect all long-term liabilities existing as of the reporting date (with the exception of those reflected on line 1410 of long-term borrowed liabilities). Long-term obligations are understood as obligations whose maturity exceeds 12 months after the reporting date (clause 19 of PBU 4/99).

Attention!

Small business organizations (with the exception of issuers of publicly offered securities) have the right not to apply the Accounting Regulations “Estimated Liabilities, Contingent Liabilities and Contingent Assets” (PBU 8/2010) and the Accounting Regulations “Accounting for Income Tax Calculations of Organizations” » PBU 18/02. If an organization uses this right, then estimated liabilities and deferred tax liabilities are not recognized in its accounting.

From November 16, 2014, commercial organizations - small businesses are not entitled to use simplified methods of accounting if they are microfinance organizations or their financial statements are subject to mandatory audit (clause 1, 4, part 5, article 6 of Law No. 402 -FZ).

Date added: 2016-03-15; ;

If net assets are less than authorized capital

If your company's net assets have become less than its authorized capital, then you are obliged to reduce the authorized capital to the level of net assets and register such a decrease in the Unified State Register of Legal Entities (clause 4 of article 90 of the Civil Code of the Russian Federation, clause 3 of article 20 of the Law of 02/08/98 N 14 -FZ). That is, at least after drawing up the annual financial statements, you need to compare the authorized capital and net assets.

In addition, the following rule applies. If an LLC decides to pay dividends to participants, but as a result of accrual of dividends, the value of net assets becomes less than required, then dividends cannot be accrued in the planned amount. It is necessary to reduce the profit distributed on dividends to an amount at which the above ratio will be satisfied.

At the same time, no liability has been established for violation of the requirement for the ratio of authorized capital and net assets.

Net assets of a joint stock company

Net assets in the balance sheet of the joint-stock company, line 3600 section. 3 statements of changes in capital are calculated according to the formula used by LLCs and enterprises of other forms of ownership. Joint-stock companies calculate the NAV before paying dividends to shareholders, when a shareholder leaves the business, to determine the ratio between the authorized capital and the amount of net assets, in the case of purchasing placed shares or when repurchasing shares owned by the company.

What is a comparative analytical balance sheet of net assets?

A similar analysis is carried out to study the dynamics of changes in the financial condition of the enterprise. At the same time, absolute and specific ratios are calculated at the beginning/end of the reporting period for individual indicators and the overall picture of the state of affairs in the organization is determined. The calculations use various indicators, formulas and coefficients. For example, the method for determining the value of own working capital (SOC):

SOS = Own sources (section 4 of the balance sheet) – Non-current assets (section 1 of the balance sheet).

Conclusion - to find out where the net assets are on the balance sheet, it is necessary to calculate the amount of the company's own funds, not encumbered with liabilities. The cost is determined in monetary terms as of the latest reporting date based on accounting data.

Line 1300 balance

How to calculate: formula for calculating net assets

The calculation of net assets is regulated by the Ministry of Finance of the Russian Federation through Order No. 84n dated August 28, 2014, which defines the concept of net assets - the formula. Its enforcement applies to the following types of organizational and legal forms of enterprises:

- public and non-public joint stock companies;

- LLC - limited liability company;

- SUE and MUP;

- production and housing savings cooperatives;

- business partnerships.

How to calculate net assets on the balance sheet is defined in Order No. 84n.

To calculate the NA, you can use the difference between their cost and liabilities:

Let's decipher the main terms of this formula:

- VAO - non-current (JSC);

- OJSC - current JSC;

- ZU - debts of the founders to the institution for filling shares in the management company;

- ZBA - debt from the repurchase of own securities (shares);

- DO - long-term liabilities;

- KO - short-term liabilities;

- DBP is the profitability expected in future periods.

The formula for net assets on the balance sheet is as follows:

The value of net assets in the balance sheet, line 3600, is entered after its calculation in the “Report on Changes in Capital”, form according to OKUD 0710003.

All settlement procedures must be carried out in writing and certified by the accounting department, on a separate form developed by the enterprise independently and enshrined in the accounting policy.

Capital and reserves in a simplified balance sheet

Preparing financial statements of small businesses in a simplified version makes the work of an accountant easier, but requires the user to understand what information is contained in each line of the reporting forms.

For example, capital and reserves in a simplified balance sheet are information about all types of equity capital of the company reduced to one figure. It is located in the third section of the balance under code 1300.

Let's figure out which accounts the accountant operates when filling out line 1300 of the simplified balance sheet, which accumulates all types of capital of the company.

So, line 1300 of the balance sheet in a simplified format contains data on the company’s own sources of financing the activities of the enterprise:

- Authorized capital (account 80), i.e. the initial amount of equity capital invested by the founders in the formation of the company’s assets;

- Reserve capital (account 82), formed from retained earnings to cover the company's losses;

- Additional capital (account 83), formed during the additional valuation of the company’s fixed assets;

- Retained earnings or uncovered losses (account 84), as a result of production activities.

Thus, several types of sources are combined in one balance line. The presence of capital is always indicated by the credit of the corresponding account, and line 1300 combines the credit balances of these accounts. Losses incurred by the company during the reporting period are reflected in debit and reduce the positive credit balance of profit at the beginning of the year (if there was one).

Since all of these liabilities are recorded in line 1300 without detailed differentiation, the accountant creates analytical accounting registers for each type of source.

As a rule, the company’s accounting policies prescribe algorithms for creating reserves if there is a need for them (or an obligation, as in the event of a doubtful debt of a counterparty).

And although reserves are formed from the company’s net profit, they, being derivatives of available capital, can be spent only for the purposes for which they were formed.

Using the example of a manufacturing company, let's look at how this information is formed in the balance sheet.

Example

Igrushka LLC, specializing in the production of toys, began operating in October 2020. The authorized capital of the company is 300,000 rubles. represented by its own office space with an initial cost of 250,000 rubles. and inventories in the warehouse in the amount of 50,000 rubles.

The company rents a production workshop (rental cost 40,000 rubles per month). The accounting policy provides for the creation of a reserve fund to cover unforeseen debts and losses in the amount of 300,000 rubles.

annual deductions of 5% of net profit up to the established level.

Operations performed in 2020:

Production and general expenses amounted to RUB 914,000; including:

Purchase of materials – 600,000 rubles.

Salary – 150,000 rubles.

Insurance premiums – 40,000 rubles.

Depreciation of the premises - 4,000 rubles.

Workshop rent – 120,000 rubles.

Products were sold for the amount of RUB 2,600,000.

At the end of the year, a profit before tax was received in the amount of RUB 1,686,000. (2,600,000 – 600,000 – 150,000 – 40,000 – 4000 – 120,000).

Taxes paid - 200,000 rubles.

The company's net profit amounted to 1,486,000 rubles. (1686000 – 200000).

From these funds a reserve fund was formed in the amount of 74,300 rubles. (5% x 1,486,000), which, as stated in the accounting policy, can only be spent when losses or unexpected costs occur. The company will spend the rest of the profit (undistributed) according to the decisions made next year.

The accountant recorded transactions, incl. with these wiring:

| D/t | K/t | Sum | |

| Formation of the management company - at the expense of the management company, PF and funds are accepted onto the balance sheet | 0110 | 8080 | 250 00050000 |

| For the 4th quarter: | |||

| – materials purchased and paid for | 10 | 60 | 600 000 |

| – written off as production costs: | |||

| Materials | 20 | 10 | 600 000 |

| OS wear and tear | 20 | 02 | 4000 |

| Workshop rental | 20 | 97 | 120 000 |

| Salary | 20 | 70 | 150 000 |

| Deductions | 20 | 69 | 40 000 |

| The product was produced, its cost was written off 914,000 rubles. | 43 | 20 | 914 000 |

| Products sold | 90/1 | 43 | 2 600 000 |

| Taxes accrued and paid | 9068 | 6851 | 200 000200 000 |

| Closing successful accounts | 99 | 90/1 | 1 486 000 |

| Retained earnings for the reporting period | 84 | 99 | 1 486 000 |

| Formation of a reserve for unforeseen situations | 82 | 84 | 74 300 |

Next, the records are grouped in the balance sheet to display account balances. OSV of Igrushka LLC for the 4th quarter is as follows:

| Opening account balance | Revolutions | end of year balance | |

| D/t | K/t | D/t | K/t |

| 01 | 250 000 | 250 000 | |

| 02 | 4000 | 4000 | |

| 10 | 650 000 | 600 000 | 50 000 |

| 20 | 914 000 | 914 000 | |

| 43 | 914 000 | 914 000 | |

| 51 | 2 600 000 | 1 100 000 | 1 500 000 |

| 60 | 600 000 | 600 000 | |

| 68 | 200 000 | 200 000 | |

| 69 | 40 000 | 40 000 | |

| 70 | 150 000 | 150 000 | |

| 80 | 300 000 | 300 000 | |

| 82 | 74 300 | 74 300 | |

| 84 | 74 300 | 1 486 000 | 1 411 700 |

| 90/1 | 2 600 000 | 2 600 000 | |

| 97 | 120 000 | 120 000 | |

| 99 | 1 486 000 | 1 486 000 |

Credit balances on accounts reflecting sources:

- Account 80 – 300,000 rub.

- Account 82 – 74,300 rub.

- Account 84 – 1,411,700 rub.

These amounts are recorded in the analytical accounting registers separately, and in line 1300 of the balance sheet they are reflected summed up in one figure - 1,786,000 rubles. (300,000 + 74,300 + 1,411,700).

Source: https://spmag.ru/articles/kapital-i-rezervy-v-uproshchennom-balanse