When imposing taxes, legislators give relief to socially significant enterprises, industries with priority development, public projects, international agreements, etc. This is expressed in non-taxation, the use of various deductions, and a reduction in the tax rate.

Value added tax is one of the largest federal taxes. Preferential transactions on it are very diverse. However, providing tax relief does not always imply a lack of reporting. Business entities must submit a declaration if their activities include transactions not subject to VAT.

The VAT report for non-taxable transactions provides for section 7 of the declaration.

Obligation to report data in section 7

Section 7 of the report is required to be completed by all VAT payers and tax agents. In addition to revenue from non-taxable transactions, the section reflects the non-taxable goods (work, services) used and input VAT on taxable goods (work, services).

Types of non-taxable transactions

To fill out a VAT report, non-taxable transactions are divided into the following groups:

- not recognized as an object of taxation;

- not subject to taxation;

- taxed at a zero tax rate;

- carried out by tax agents;

- real estate transactions.

The list contains a complete list of transactions related to one type or another, and a list of articles of the Tax Code or other documents that exempt transactions from VAT.

Every operation has its place

The specificity of section 7 of the VAT tax return is such that each individual transaction code has its own line. By the way, you can find all the necessary transaction codes in Appendix No. 1 to the order of the Federal Tax Service approving the reporting form. Some taxpayers interpret the requirement to display each code in a separate line of the section in a peculiar way, thinking that a separate line must be filled out even for those transactions that have the same code. This is not true.

Correctly indicate in one line all amounts (columns 2, 3, 4) that have the same transaction code. Please note that this transaction code must be determined only by sale, and not by acquisition. Therefore, if an organization, when selling goods or services exempt from VAT, used goods or services purchased from counterparties using the simplified tax system or also exempt from taxation, it must display the cost of such services in column 3 of line 010.

This is important to know: Which account is reflected in 1C personal income tax?

How to fill out section 7 of the VAT return and by whom

The seventh section details each code of non-taxable transactions. If the taxpayer had several transactions subject to taxation under one code, the results for them are summed up.

Section 7 reflects sequentially in 4 columns:

- code of non-taxable transactions;

- revenue from the sale of goods and services under this code;

- the cost of goods and services not subject to VAT, included in the cost by code;

- VAT on goods and services subject to tax and included in the cost by code.

Indicators are filled in from left to right. Empty spaces are marked with a dash.

The correctness of filling out the section is certified by the signature of the taxpayer or tax agent, indicating the date of signing the declaration.

Transaction codes for VAT purposes

| Code | the name of the operation | Grounds (article, clause, subclause of the Tax Code of the Russian Federation) |

| 1 | 2 | 3 |

| 1010800 | Section I. Transactions not recognized as an object of taxation | Clause 2 of Art. 146 Tax Code of the Russian Federation |

| 1010801 | The operations specified in clause 3 of Art. 39 Tax Code of the Russian Federation | Subclause 1, clause 2, art. 146 Tax Code of the Russian Federation |

| 1010806 | Sale of land plots (shares in them) | Subclause 6, clause 2, art. 146 Tax Code of the Russian Federation |

| 1010807 | Transfer of property rights of an organization to its legal successor(s) | Subclause 7, clause 2, art. 146 Tax Code of the Russian Federation |

| 1010812 | Implementation of works (services), the place of implementation of which is not recognized as the territory of the Russian Federation | Article 148 of the Tax Code of the Russian Federation |

| 1010200 | Section II. Transactions not subject to taxation (exempt from taxation) | Article 149 of the Tax Code of the Russian Federation |

| 1010201 | Provision by the lessor of premises for rent on the territory of the Russian Federation to foreign citizens or organizations accredited in the Russian Federation | Clause 1 of Art. 149 Tax Code of the Russian Federation |

| 1010242 | Sales of coins made of precious metals (except for collectible coins) that are the currency of the Russian Federation or the currency of foreign countries | Subclause 11, clause 2, art. 149 Tax Code of the Russian Federation |

| 1010243 | Sale of shares in the authorized (share) capital of organizations, shares in mutual funds of cooperatives and mutual investment funds, securities and derivatives instruments (including forwards, futures contracts, options) | Subclause 12, clause 2, art. 149 Tax Code of the Russian Federation |

| 1010274 | Sales of scrap and waste ferrous and non-ferrous metals | Subclause 25, clause 2, art. 149 Tax Code of the Russian Federation |

| 1010276 | Carrying out banking operations by banks (except for collection) | Subclause 3, clause 3, art. 149 Tax Code of the Russian Federation |

| 1010277 | Operations for the provision of services related to the servicing of bank cards | Subclause 3.1, clause 3, art. 149 Tax Code of the Russian Federation |

| 1010278 | Operations carried out by organizations providing information and technological interaction between settlement participants, including the provision of services for collecting, processing and distributing information on transactions with bank cards to settlement participants | Subclause 4, clause 3, art. 149 Tax Code of the Russian Federation |

| 1010292 | Operations to provide loans in cash, as well as the provision of financial services to provide loans in cash | Subclause 15, clause 3, art. 149 Tax Code of the Russian Federation |

| 1010298 | Sale of residential buildings, residential premises, as well as shares in them | Subclause 22, clause 3, art. 149 Tax Code of the Russian Federation |

| 1010273 | Transfer of a share in the right to common property in an apartment building when selling apartments | Subclause 23, clause 3, art. 149 Tax Code of the Russian Federation |

| 1010275 | Transfer for advertising purposes of goods (work, services), the cost of purchasing (creating) a unit of which does not exceed 100 rubles. | Subclause 25, clause 3, art. 149 Tax Code of the Russian Federation |

| 1010258 | Operations for the assignment (acquisition) of the rights (claims) of the creditor under obligations arising from agreements for the provision of loans in cash and (or) credit agreements, as well as for the fulfillment by the borrower of obligations to the new creditor under the original agreement underlying the assignment agreement | Subclause 26, clause 3, art. 149 Tax Code of the Russian Federation |

| 1011700 | Section IV. Operations carried out by tax agents | Article 161 of the Tax Code of the Russian Federation |

| 1011711 | Sales of goods by foreign persons not registered as taxpayers, as well as sale of works and services of foreign persons not registered as taxpayers, using non-cash forms of payment | Clause 1 of Art. 161 Tax Code of the Russian Federation |

| 1011712 | Sales of works and services of foreign persons who are not registered as taxpayers, with the exception of the sale of works and services of foreign persons not registered as taxpayers, using non-cash forms of payment | Clause 1 of Art. 161 Tax Code of the Russian Federation |

| 1011703 | Services of state authorities and management bodies and local self-government bodies for the provision of lease of federal property, property of constituent entities of the Russian Federation and municipal property, including under agreements under which the lessors are a government and management body, a local government body, as well as sale (transfer) state property not assigned to state enterprises and institutions, constituting the state treasury of the Russian Federation, the treasury of a republic within the Russian Federation, the treasury of a territory, region, federal city, autonomous region, autonomous district, as well as municipal property not assigned to municipal enterprises and institutions, constituting the municipal treasury of the corresponding urban, rural settlement or other municipal entity | Clause 3 of Art. 161 Tax Code of the Russian Federation |

Thus, in column 1 of line 010 section. 7 of the declaration for banks, the sale of banking services for VAT purposes is reflected separately for the following transactions:

- banking operations;

- operations for the provision of services related to the servicing of bank cards;

- assignment of the right of claim;

- advertising services;

- sale of securities;

- sales of precious metals.

In this case, the corresponding purchase amount for the sale of these services and goods is reflected in column 3, and the amount of VAT that is not deductible is reflected in column 4.

Column 2 on line 010 reflects the amounts for each transaction code that is not subject to taxation and an operation that is not recognized as an object of taxation, in particular transactions for the sale of land plots (shares in them), the transfer of property rights of the organization to its legal successor (legal successors).

At the same time, the cost of sold (transferred) goods (work, services) that are not subject to taxation (exempt from taxation) is reflected in accordance with Art. 149 of the Tax Code of the Russian Federation, taking into account clause 2 of Art. 156 of the Tax Code of the Russian Federation. And according to the specified paragraph 2 of Art. 156 of the Tax Code of the Russian Federation are subject to taxation of transactions for the sale of services that are provided on the basis of agency agreements, commission agreements or agency agreements related to the sale of goods (work, services) that are not subject to taxation (exempt from taxation) in accordance with Art. 149 of the Tax Code of the Russian Federation.

In column 3, line 010, for each transaction code that is not subject to VAT, the cost of purchased goods (work, services) not subject to VAT is reflected, in particular:

- the cost of purchased goods (works, services), transactions for the sale of which are not subject to taxation in accordance with Art. 149 of the Tax Code of the Russian Federation. For example , insurance of bank property according to paragraphs. 7 paragraph 3 art. 149 Tax Code of the Russian Federation;

- the cost of goods (work, services) purchased from taxpayers exempt from paying tax in accordance with Art. 145 Tax Code of the Russian Federation. The right to exemption from the performance of taxpayer obligations related to the calculation and payment of tax (hereinafter referred to as exemption) is granted to organizations and individual entrepreneurs whose, over the three previous consecutive calendar months, the amount of revenue from the sale of goods (work, services) excluding tax did not exceed in total 2 million rubles;

- the cost of goods (work, services) purchased from persons who are not tax payers. For example , organizations that apply a simplified taxation system in accordance with clause 2 of Art. 346.11 Tax Code of the Russian Federation.

In column 4, line 010, for each transaction code that is not subject to taxation, the tax amounts presented when purchasing goods (work, services) or paid when importing goods into the customs territory of the Russian Federation, which are not subject to deduction in accordance with paragraphs. 2 and 5 tbsp. 170 Tax Code of the Russian Federation.

So, according to paragraphs. 1 item 2 art. 170 of the Tax Code of the Russian Federation from banks when purchasing (importing) goods (work, services), including fixed assets and intangible assets used for operations for the production and (or) sale of goods (work, services) not subject to taxation (exempt from taxation) ), tax amounts presented to the buyer when purchasing goods (work, services), including fixed assets and intangible assets, or actually paid when importing goods, including fixed assets and intangible assets, into the territory of the Russian Federation are taken into account in the cost of such goods (works, services), including fixed assets and intangible assets.

Or the bank includes in the costs accepted for deduction when calculating corporate income tax the amounts of VAT paid by it to suppliers on purchased goods (works, services), and at the same time the entire amount of tax received by it on transactions subject to taxation is subject to payment in budget (clause 5 of article 170 of the Tax Code of the Russian Federation).

Let's analyze the procedure for filling out section by the bank. 7 declaration using the following example. Let us agree that all the bank's expenses are related to its banking activities.

Example. During the period, the bank carried out a number of transactions related to its banking activities.

- An improper asset was sold - a share of a land plot previously acquired for 2.5 - 3 million rubles.

- Services provided for servicing bank cards - 1 million rubles.

- Securities purchased under repo transactions - RUB 8 million.

- Commissions paid on REPO transactions amounted to RUB 0.5 million.

- Coins made from precious materials were sold - 2 million rubles. Some of the coins were transferred from another depository vault to the bank vault - in the amount of 800 thousand rubles, resulting in VAT in the amount of 122,034 rubles. (800,000 x 18/118).

- Securities sold amounted to 5 million rubles, the cost of which, including acquisition costs, was 4 million rubles.

- Advertising products were sold at the exhibition at a price of 100 rubles. per copy (including VAT) for a total amount of 10,000 rubles. (including VAT). VAT amounted to 1525 rubles. (10,000 x 18/118).

- The right of claim under loan agreements was assigned - RUB 30 million. (the outstanding right of claim under loan agreements is RUB 25 million).

- Banking operations carried out (except for collection) - 10 million rubles.

In this case, the bank incurred the following expenses.

- A contract was concluded to insure the bank's property in the amount of 2.5 million rubles.

- For entertainment expenses, tea and cookies were purchased from Plyushka LLC, which is exempt from fulfilling the duties of a taxpayer in accordance with paragraph.

Codes by which non-taxable transactions are reflected in the declaration

Codes of non-taxable transactions for reflection in the VAT return are divided into 5 sections. Each section is assigned its own code. The last two digits specify the types of section operations.

| chapter | operations | code |

| I | not recognized as an object of taxation | 1010 800 |

| not recognized by implementation | 1010 801 | |

| privatization of state and municipal companies | 1010 803 | |

| sale of land plots (shares) | 1010 806 | |

| sale of goods abroad | 1010 811 | |

| performance of work (services) abroad | 1010 812 | |

| II | not subject to taxation | 1010 200 |

| provision of premises for rent to foreign citizens and companies | 1010 201 | |

| sale of honey goods according to the list | 1010 204 | |

| provision of honey services | 1010 211 | |

| keeping children in preschool institutions | 1010 231 | |

| archival services | 1010 234 | |

| transportation of passengers (except taxis) | 1010 235 | |

| funeral services | 1010 237 | |

| provision of residential premises for rent | 1010 239 | |

| sale of shares, shares, securities | 1010 243 | |

| warranty service | 1010 244 | |

| Bank operations | 1010 276 | |

| lawyer services | 1010 291 | |

| provision of loans | 1010 292 | |

| assignment of claims | 1010 258 | |

| III | taxed at 0% tax rate | 1010 400 |

| sale of goods under customs regime | 1010 401 | |

| IV | carried out by tax agents | 1011 700 |

| sale of goods (works, services) to foreign persons | 1011 701 | |

| rental of state and municipal property | 1011 703 | |

| V | by real estate | 1011 800 |

| real estate for own consumption | 1011 802 |

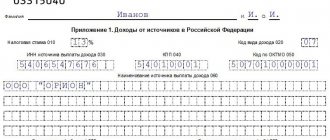

Tax return for value added tax - VAT

When reflecting in column 1 on line 010 transactions that are not subject to taxation (exempt from taxation), under the corresponding transaction codes, the taxpayer fills in the indicators in columns 2, 3 and 4 on line 010.

When reflecting in column 1 on line 010 transactions that are not recognized as an object of taxation, as well as transactions for the sale of goods (work, services), the place of sale of which is not recognized as the territory of the Russian Federation, the taxpayer fills in the indicators in column 2 on line 010 under the corresponding transaction codes. In this case, the indicators in columns 3 and 4 on line 010 are not filled in (a dash is placed in these columns).

44.3. In column 2, line 010, for each code of a transaction not subject to taxation and a transaction not recognized as an object of taxation, as well as transactions for the sale of goods (works, services), the place of sale of which is not recognized as the territory of the Russian Federation, the following are reflected:

— the cost of goods (work, services) that are not recognized as an object of taxation in accordance with paragraph 2 of Article 146 of the Code;

— the cost of goods (work, services), the place of sale of which is not recognized as the territory of the Russian Federation in accordance with Articles 147, 148 of the Code;

— the cost of goods (work, services) sold (transferred) that are not subject to taxation (exempt from taxation) in accordance with Article 149 of the Code, taking into account paragraph 2 of Article 156 of the Code.

44.4. In column 3, line 010, for each transaction code that is not subject to taxation, the cost of purchased goods (work, services) that are not taxable is reflected, namely:

- the cost of purchased goods (works, services), sales transactions of which are not subject to taxation in accordance with Article 149 of the Code;

— the cost of goods (work, services) purchased from taxpayers applying for an exemption from the taxpayer’s obligations to pay tax in accordance with Article 145 of the Code;

- the cost of goods (work, services) purchased from persons who are not tax payers.

44.5. Column 4 on line 010 for each transaction code that is not subject to taxation shall reflect the amounts of tax presented upon the acquisition of goods (work, services) or paid upon the importation of goods into the customs territory of the Russian Federation, which are not subject to deduction in accordance with paragraphs 2 and 5 of Article 170 of the Code.

44.6. Line 020 reflects the amount of payment received, partial payment for upcoming deliveries of goods (performance of work, provision of services), the duration of the production cycle of which is more than six months, according to the list determined by the Government of the Russian Federation.

44.7. In accordance with paragraph 13 of Article 167 of the Code, upon receipt of payment or partial payment by the taxpayer - manufacturer of goods (work, services), a contract with the buyer (a copy of the contract certified by the signature of the manager and chief accountant), as well as a document confirming duration of the production cycle of goods (works, services) indicating their name, production time, name of the manufacturing organization, issued to the specified taxpayer-manufacturer by the federal executive body exercising the functions of developing state policy and legal regulation in the field of industrial, military-industrial and fuel and energy complexes, signed by an authorized person and certified by the seal of this body.

What accounting data can we compare the data reflected in section 7 with?

Compliance of accounting data with section 7 of the VAT Declaration:

2 columns - credit 90 of account in terms of proceeds from non-taxable transactions;

Column 3 - debit 20, 23, 40, 41, 44 accounts regarding the formation of the cost of non-taxable operations (only used non-taxable goods, work and services are included);

Column 4 - credit 19 of account in correspondence with accounts 01, 04, 10, 20, 23, 26, 29, 44 when including input VAT in the cost of tangible and intangible assets, works, services used for non-taxable transactions.

You can highlight the amounts taken into account in section 7 by organizing analytical accounting of taxable and non-taxable transactions in the relevant accounts.

Do you need invoices?

Almost all taxpayers conducting transactions not subject to VAT know that they do not have to deal with issuing invoices. So why does Section 7 VAT exist in this case? It is filled in with invoices received as a result of transactions carried out, on which no tax is charged. The VAT return must include information from the sales book and accounting register.

Therefore, if the ongoing financial tax-free transaction is reflected in a separate accounting sub-account in sales that are not eligible for taxation, then the required amount to enter it in column 2 of section 7 is taken from the credit of the sub-account.

The law does not prohibit entrepreneurs from filling out invoices. But it is worth knowing that all invoices must go through the procedure of recording in the sales book. Such actions are not considered a violation.

Watch an interesting video about the nuances of filling out this section:

https://youtu.be/Hv_wTljgfY4

Tax consequences if Section 7 is not completed

Incorrect reflection of non-taxable transactions in section 7 of the Declaration does not bear any responsibility for taxpayers, since this information does not affect the amount of tax. But the lack of separate accounting leads to a ban on deducting input VAT or including it in expenses when calculating income tax.

Deducting tax or including it in income tax expenses without maintaining separate accounting will lead to an understatement of the tax base. This is a gross violation of the rules for accounting for taxable items. Fine: 20% of underestimated tax, not less than 40 thousand rubles.

An exception is made for taxpayers whose expenses for non-taxable transactions are less than 5% of total expenses. They can deduct all input VAT.

Also, starting from 2020, tax agents will be held liable for false information in reports. For each document with incorrect information, the fine is 500 rubles.

Who should fill out section No. 7

All tax agents and taxpayers are required to complete section 7 of the VAT return in the following cases:

- Operations are carried out that are exempt from VAT.

- The operations carried out do not relate to objects eligible for taxation.

- Processes related to the sale of services and work, the place of sale of which does not have force in the country.

- Payment for the cost of supplying goods - work, providing a number of services, the production period of which exceeds 6 months from the date of receipt of the payment amount.

Any good accountant knows how to fill out section 7 of the VAT return. But you need to start filling it out only if at least one of the operations listed above was carried out during the past quarter. If besides these there have been no other processes in recent months, then in addition to the seventh section it will be necessary to fill out the title page and 1 section.

This is important to know: Declaration of income of an individual in 2020