Average headcount in DAM 1

The tariff code in RSV 1 2020 is especially important for those companies that enjoy benefits.

For example, for an HOA with OKVED 70.32, the tariff will be 07. It is in DAM 1 that these codes are indicated, and the choice of benefit directly depends on the type of activity. A reduced tariff is allowed if revenue under the OKVED code with preferential taxation is at least 70% of the company’s total turnover. The Russian Tax Service has completed the formation of a unified form for reporting on insurance contributions made. You will need to submit a new report to the Federal Tax Service. The report for 2020 has also not been canceled. For the 4th quarter 16 it is necessary to report to the Pension Fund. The report submission date is February 2020 and for RSV 1 on paper.

The main document defining the procedure for calculating and paying insurance contributions to social, medical and pension insurance funds, as well as the procedure for submitting reports, is the Federal Law of July 24, 2009 N 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation , Federal Compulsory Health Insurance Fund and territorial compulsory health insurance funds.” 2010-2014 are transitional years and for certain categories of taxpayers during this period, reduced insurance premium rates are applied.

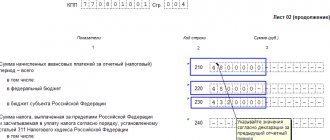

When filling out the RSV-1 Calculation, the following is taken into account: Only one indicator is entered in each line and the corresponding columns. If there are no indicators provided for in the Calculation, a dash is placed in the line and the corresponding column. All values of monetary indicators are reflected in rubles. Indicator values of less than 50 kopecks are discarded, and indicator values of 50 kopecks or more are rounded to the nearest ruble. Rounding to whole rubles the base for calculating insurance premiums, as well as the calculated amounts of insurance premiums and other indicators that have a monetary value, which are indicated in the Calculation, is carried out after summing up all individual accounting data as a whole for the payer of insurance premiums.

Which organizations must indicate code “213” in the 6-NDFL report?

The Federal Tax Service order No. MM-3-06/308 dated May 16, 2007 (as amended on September 28, 2018) lists the criteria according to which an organization can be classified as a large taxpayer. The main criterion is the company’s annual income, which is:

- from 10 billion rubles up to 35 billion rubles — for the largest taxpayers at the regional level;

- over 35 billion rubles. – for federal largest taxpayers.

Non-profit organizations can also be recognized as the largest taxpayer. “Special regimes” do not belong to the category of the largest payers.

It should be noted that organizations that do not meet the established criteria may also fall into this category. This happens if the tax service makes an appropriate decision in relation to certain entities.

Report to the Pension Fund of the Russian Federation in form RSV-1 in 2019

- Organizations are required to provide updated data before mandatory reporting (after the first day of the fourth month following the reporting month). In this case, parts 2.5 and 6 are not included in the additional form.

- If there is an overpayment, then the values of lines 150, 100, 140 and 130 are checked:

- the indicator from column 5 of line 150 must be equal to the sum of the values in columns 3 and 4 (of the same line).

- The use of codes has been clarified:

- “CHILDREN” means that a person is on parental leave for one and a half years;

- if the child is already 1.5 years old, but not three years old, then the code “DLCHILDREN” is entered;

- "CHILDREN" is used to refer to carer's leave granted to: a carer;

- grandmother or grandfather;

- another relative (not a parent).

- “NEOPL” is used to identify periods of leave without pay or forced downtime due to the fault of the worker;

- the period of advanced training is coded with the sign “QUALIFICATION”;

- if a citizen is involved in the performance of state or public duties, then “SOCIETY” is indicated;

- donor days are shown as "SDKROV";

- standstill associated with suspension from work is coded with the sign “SUSPENDED”.

- On paper you need to prepare two copies:

- one remains in the fund;

- the second is marked with receipt;

- The electronic version has the following features:

- mandatory for organizations employing more than 25 people;

- must be certified by an electronic digital signature.

Important: if the number of employees of an enterprise exceeds 25 people, then it is allowed not to submit a calculation on paper.

12.6. Line 351 indicates the date and number of the entry in the register of insurance premium payers - Russian organizations and individual entrepreneurs producing, publishing (broadcasting) and (or) publishing mass media (except for mass media specializing in messages and materials advertising and (or) erotic nature), based on the received extract from the register, sent by the authorized federal executive body in accordance with Decree of the Government of the Russian Federation dated March 5, 2011 No. 150 “On the procedure for confirming the authority of payers of insurance contributions to state extra-budgetary funds for production, publication (broadcast) and (or) publication of mass media, as well as maintaining a register of specified payers of insurance premiums and transferring it to the authorities monitoring the payment of insurance premiums" (Collected Legislation of the Russian Federation, 2011, No. 11, Art. 1529; No. 51, Art. 7537).

6.5. Line 140 “Paid from the beginning of the billing period” reflects the amounts of insurance premiums paid from the beginning of the billing period on an accrual basis until the end of the reporting period, and are calculated as the sum of the values of line 140 of the Calculation for the previous reporting period of the calendar year (including payments specified in line 145) and lines 144 for the last three months of the reporting period.

Rules for filling out section 2

In 2020, the order in which information is displayed in section 2 of the declaration has not changed. According to clause 36 of the procedure for filling out a VAT tax return, section 2 is completed by the tax agent for each of the counterparties, which is:

- a foreign person is a non-taxpayer,

- a foreign person registered with the tax authority in accordance with clause 4.6 of Art. 83 of the Tax Code of the Russian Federation and providing services to individuals in electronic form,

- lessor from among municipal and government agencies,

- seller of state property.

Moreover, the information cannot be spread over several pages in the context of various contracts for one counterparty.

It will be useful to read the article “Who is the VAT payer?” .

When selling confiscated property, ownerless property, etc., information is also reflected by the tax agent on one page of the 2nd section. But tax agents-shipowners who did not manage to register the vessel within 45 days fill out this section for each vessel.

How to fill out a VAT return for scrap metal buyers who are also tax agents, see here.

The 2nd section contains information on the amount of VAT payable according to the information of the tax agent in the context of counterparties with the allocation of KBK. At the top of the form of the 2nd section, the tax agent codes (KPP and TIN), as well as the serial number of the page, must be indicated.

How to correctly fill out the RSV-2 PFR form for peasant farms

- The data on line 100 about the debt balance must be identical in all columns to the indicators on page 150 of the form filled out for the previous period. Column 4 on page 100 cannot be equal to zero. Putting a dash in this field is a violation associated with incorrect calculation

- Line 110 in columns 3 and 6 should be equal to columns 7 and 8 of the final part of the second section, respectively. In this case, columns 4 and 5 should not be filled out at all.

- Line 120 reflects the amounts of adjustments based on the results of PFR audits. The amounts of errors and distortions found by the accountant independently are also included here.

- If an overpayment was shown in column 4 of page 150 for the previous year, then column 3 of page 100 of the reporting year should be identical to the sum of columns 3 and 4 of page 150 for the current period. For example, for 2014, column 4 of page 150 contained the amount of excess payment. The responsible person must enter the required balance in column 3 of page 100 of the 2020 form.

One of such documents is the calculation of accrued and paid contributions to the Pension Fund of the Russian Federation and the Federal Compulsory Medical Insurance Fund, compiled according to the RSV-2 form. The report is a form filled out in the prescribed manner, containing information about the enterprise, calculation of contributions to the Pension Fund of the Russian Federation and transfers to the Federal Compulsory Medical Insurance Fund. Certified by the signature of the head and the seal of the organization.

Line by line instructions for filling

In line 010, the checkpoint of the division of a foreign entity that is registered for tax purposes in Russia is filled in. Lines 020–030 contain the data (name and TIN, if available) of foreign entities - tax evaders, lessors from among state and municipal authorities and sellers of state property. In line 040 the KBK is entered, 050 is the OKTMO code of the tax agent submitting the report. The amount of tax payable is reflected in line 060 and the transaction code in line 070.

According to clause 37.8 of the Procedure for filling out the declaration, the amount of VAT payable is determined taking into account indicators for shipment (080) and receipt of partial or full advance payment (090) by tax agents, which are (clauses 4–5 of Article 161 of the Tax Code of the Russian Federation):

- intermediaries selling goods, works or services (except for services in electronic form) from foreign sellers in the Russian Federation;

- sellers of confiscated property by court decision, as well as sellers of ownerless valuables and treasures.

In this case, the amount of tax payable, displayed in line 060, will be calculated using the formula: line 080 + line 090 – line 100.

Why do you need a code at the place of registration for UTII 2018?

When transferring the entire activity or its individual areas to imputation, the taxpayer must submit a declaration to the territorial division of the Federal Tax Service Inspectorate. This obligation applies to both legal entities and entrepreneurs, subject to the use of the designated special regime. If an entity simultaneously works on several tax systems, it will be necessary to prepare separate reports. The list of forms varies depending on the modes.

The current imputation declaration form for 2020 was approved by the Federal Tax Service in Order No. ММВ-7-3 / [email protected] dated 07/04/14. Here is the form of the document, as well as the procedure for its preparation with a breakdown of the requirements into sheets and sections. When a declaration is filled out, the code at the location (registration) is entered in accordance with the values in Appendix 3 of the Order. The information is indicated in a special column on the title of the report. At the same time, data is entered into other lines according to the current order.

Note! Since coding of indicators is necessary to simplify the reporting processing procedure, all imputed taxpayers without exception are required to fill out these lines. Error-free entry of values will not only help tax authorities quickly post data, but will also protect companies from providing incorrect information.

Usn: simplified taxation system - all about the “simplified”

- 1 Why do you need a code at the place of registration for UTII 2018

- 2 How to enter the code at the place of registration for UTII in the declaration in 2018

- 2.1 Values of accounting codes (places of presentation) for the UTII declaration:

- 3 What is the location (accounting) code in 6-NDFL

- 4 How to fill in the 6-NDFL code at the location (accounting)

- 4.1 Values of presentation place codes for f. 6-NDFL:

- 5 RSV – code at location (accounting)

- 6 Declaration according to the simplified tax system - code at the location (accounting)

- 7 How to find out the code at the location (accounting)?

Why do you need a code at the place of registration for UTII 2020 When transferring the entire activity or its individual areas to imputation, the taxpayer must submit a declaration to the territorial division of the Federal Tax Service Inspectorate.

How to enter the code at the place of registration for UTII in the declaration in 2020

In order to correctly report to the tax authority, the code at the location (accounting) is indicated in the appropriate line. The indicator is entered in digital format according to Appendix 3 and filled out from left to right. Entering dashes, indicating zeros or missing data in cells is not allowed. Why?

First of all, for the reason that any imputed taxpayer is required to first register with the Federal Tax Service. And it doesn’t matter what legal status we are talking about - a legal entity or an individual entrepreneur. To transfer your activity to UTII, you must first submit an application to the tax office. And only after obtaining the appropriate permission, the use of this special regime is allowed. Since imputation reporting is submitted at the place of business, indicator values have been developed to clarify the responsible control body.

UTII - tax calculation in 2020, example

Values of accounting codes (places of presentation) for the UTII declaration:

- 120 – indicated by those entrepreneurs who submit a declaration to the tax authorities at their address of residence.

- 214 – code 214 at the location (registration) is intended to be indicated by Russian legal entities that are not recognized as major taxpayers.

- 215 - intended for successor companies that are not recognized by the largest taxpayers.

- 245 – indicated by foreign companies when submitting a declaration to the address of conducting the imputed activity through a representative office (permanent).

- 310 – indicated by Russian companies when submitting a declaration at the address of the imputed activity.

- 320 – code at the place of registration 320 in UTII, or more precisely in the declaration of imputation, is used in the case of submitting a report to the address of conducting activities in a special regime.

- 331 – indicated by foreign companies when submitting a declaration to the address of conducting the imputed activity through a branch of such a business entity.

Note! The imputed accounting code at the location for an LLC and an individual entrepreneur will differ. After all, registration of individual entrepreneurs is carried out with reference to the address of his residence (120) or the place of actual conduct of the imputed business (320). At the same time, the accounting of legal entities will depend on whether it is a Russian or foreign company; whether the enterprise is considered the largest taxpayer, and whether reorganization procedures have been carried out.

Who needs to know this meaning

When filling out tax returns and insurance calculations, it is important to indicate this information correctly. Therefore, the registration code at the location for an LLC is necessary and important information that you need to know.

The registration code at the location for individual entrepreneurs is also important, since entrepreneurs submit reports to the tax service. Even individuals who are not entrepreneurs indicate its value, for example, when filling out calculations for insurance premiums.

Thus, you should know the required combination of numbers:

- legal entities of any form of ownership;

- IP;

- individuals who are not individual entrepreneurs, if they provide reporting.

How to fill in the 6-NDFL code at the location (accounting)

Entering the value of the required territorial code is carried out by the tax agent on the title f. 6-NDFL. The indicator is in digital format and consists of three characters. Data is indicated from left to right. Let's take a closer look at how this detail is filled out.

Values of presentation place codes for f. 6-NDFL:

- 120 – used by entrepreneurs for tax registration at their residence address.

- 124 – applied by heads/members of peasant farms during tax registration at their residence address.

- 125 – indicated by lawyers during tax registration at their residence address.

- 126 – used by notaries for tax registration at their residence address.

- 213 – used by legal entities for tax accounting in the status of the largest taxpayer.

- 214 - in 6-NDFL, the location code 214 is indicated by ordinary companies, not the largest.

- 215 - intended to be indicated by successors (not the largest) to provide the form at their location.

- 216 – for contribution by legal successors recognized as the largest.

- 220 – is affixed by Russian OPs when filing 6-NDFL at the location of such units.

- 320 – indicated by the individual entrepreneur when submitting the form to the business address. For example, when presenting data on personnel engaged in imputed activities.

- 335 – is intended for foreign OPs to indicate when submitting the form to the address of such units.

Note! Until March 25, 2020, for ordinary enterprises, the indicator at the location of accounting with code 212 was in effect. After this date, the value was replaced by code 214.

What code to put and why

Code at the place of registration, which serves as a taxpayer identifier in the Federal Tax Service database by category, and answers the following questions:

Any taxpayer submitting reporting information to the Federal Tax Service in the form of a declaration or calculation (legal entity, individual, entrepreneur) is required to use this code.

Attention! The location (accounting) code is given for use in ready-made form for each legally approved form. Independent compilation and use of codes is prohibited.

Note that the analogue of the latter in the VAT return will be code 116. The coding for this tax is the most complex and extensive, it consists of 17 codes and takes into account many nuances accompanying personal income tax calculations.

The smallest number of codes contains transport tax - 3. Fiscal authorities are interested in the location of the vehicle, the location of the largest taxpayer or his legal successor and the coding corresponding to these economic facts.

The codes are recorded in detail in the regulatory documents of the tax service, a list of which is given below.

Attention! The largest tax payers this year include organizations that paid taxes to the federal treasury in the amount of 1 billion rubles. or more. For communications organizations and transport workers, this figure is lower – 0.3 billion rubles. Income and assets according to reports – from 20 billion rubles. In this sense, enterprises of the defense complex have their own characteristics.

RSV – code at location (accounting)

The current form for a single calculation of insurance premiums was approved by the Federal Tax Service in Order No. ММВ-7-11 / [email protected] dated 10.10.16. Code indicators are contained in Appendix 4 to Appendix 2, which defines the procedure for drawing up the ERSV. The current values for 2020 are as follows:

- 112 – when submitting data at the address of residence by an individual, not an individual entrepreneur.

- 120 – when submitting a report as an individual entrepreneur at his residence address.

- 121 – when submitting information by a lawyer who has his own law office at his residence address.

- 122 – when submitting a report by a private notary at his residence address.

- 124 – when submitting a calculation by the head/members of a peasant farm at their residence address.

- 214 – used by ordinary Russian companies when submitting a report to their address.

- 217 – intended for successors of domestic companies.

- 222 – used by the OP of Russian companies when submitting a report to the address of such divisions.

- 335 – used by the OP of foreign companies when submitting a report to the location of such divisions.

- 350 – used by international structures when submitting calculations to the tax registration address of such organizations.

Income tax

The codes for the places for submitting a tax return for corporate income tax are given in Appendix No. 1 to the Procedure approved by Order of the Federal Tax Service dated October 19, 2016 No. ММВ-7-3/:

| Code | Name |

| 213 | |

| 214 | |

| 215 | |

| 216 | |

| 218 | At the place of registration of the responsible participant of the consolidated group of taxpayers |

| 220 | |

| 223 | At the location (registration) of the Russian organization when submitting a declaration for a closed separate division |

| 225 | At the place of registration of the organization that has received the status of a participant in the project for the implementation of research, development and commercialization of their results in accordance with the Federal Law “On Innovation” |

| 226 | At the place of registration of the organization carrying out educational and (or) medical activities |

| 228 | At the place of registration of the organization participating in the regional investment project |

| 229 | At the place of registration of a non-profit organization submitting a tax return only for the tax period |

| 231 | At the location of the tax agent - organization |

| 234 | At the place of registration of the theatre, museum, library, concert organization, which are budgetary institutions |

| 235 | At the place of registration of the tax agent presenting information on income paid to individuals |

| 236 | At the place of registration of the organization providing social services to citizens |

| 237 | At the place of registration of the organization that has received the status of resident of the territory of rapid socio-economic development |

| 238 | At the location (registration) of the organization recognized as the controlling person of the foreign company |