Lines 010–060 Income and expenses. Profit

On lines 010–050, indicate income and expenses on the basis of which the profit received or loss incurred is calculated. Do not record earmarked receipts and other non-taxable income here, as well as expenses associated with these incomes.

On line 010, indicate income from sales. Transfer this amount from line 040 of Appendix 1 to sheet 02. Do not include in it the income reflected in sheets 05 and 06.

To line 020, transfer the amount of non-operating income from line 100 of Appendix 1 to sheet 02.

To line 030, transfer the amount of expenses associated with production and sales from line 130 of Appendix 2 to sheet 02. Do not include in this amount the expenses reflected in sheets 05 and 06.

Transfer the amount of non-operating expenses and losses to line 040:

- from line 200 of Appendix 2 to sheet 02;

- from line 300 of Appendix 2 to sheet 02.

To line 050, transfer the amount of losses from line 360 of Appendix 3 to sheet 02. Do not include losses reflected in sheets 05 and 06 in this amount.

Calculate the total profit (loss) for line 060:

| page 060 | = | page 010 | + | page 020 | – | page 030 | – | page 040 | + | page 050 |

If the result is negative, that is, the organization suffered a loss, enter the amount with a minus on line 060.

https://youtu.be/wDWISWXTyD0

How to submit a tax return

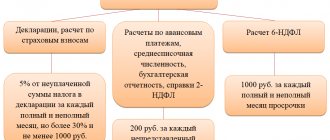

Submission of a tax return on profits is carried out in accordance with the provisions of Art. 289 Tax Code. Its current form is contained in the order of the Federal Tax Service of Russia dated September 23, 2019 N ММВ-7-3/ [email protected] The declaration, in addition to section 1 (and its mandatory subsection 1.1), includes sheets 01 (title) and 02, as well as appendices (1 and 2) to sheet 02.

Companies that pay monthly advances, calculated on the basis of actual income on an increasing basis from the beginning of the year, submit a tax return in the above composition at the end of each quarter (I, II, III) and for the year. Based on the results of intermediate months (for 1 month, for 2, 4, 5, 7, 8, 10, 11 months), declarations are provided in the following composition: sheets 01 and 02, subsection 1.1 of section 1.

Tax returns can be filed in paper form by all taxpayers, except those recognized as the largest. Such taxpayers are required to submit returns in electronic format.

Declarations are submitted before the 28th day of the month that follows the reporting period (clause 3 of Article 289 of the Tax Code of the Russian Federation). At the same time, companies paying monthly advances submit a declaration no later than the payment deadline for such payments, which is also equal to the 28th day of the month following the period based on the results of which the calculation was made (clause 1 of Article 287 of the Tax Code of the Russian Federation).

At the end of each reporting period, the amounts of advance payments paid monthly during such period are counted when making the payment of the next advance payments calculated based on the results of the reporting period. Advance payments based on the results of the reporting period are counted against the payment of income tax based on the results of the next period (Clause 1, Article 287 of the Tax Code of the Russian Federation).

Read more about calculating advances in the material “Advance payments for income tax: who pays and how to calculate?” .

Lines 100–130 Tax base

For line 100, calculate the tax base using the formula:

| page 100 | = | page 060 | – | page 070 | – | page 080 | – | page 090 | – | Page 400 appendix 2 to sheet 02 | + | page 100 sheets 05 | + | page 530 sheet 06 |

Indicate negative results with a minus sign.

On line 110, indicate losses from previous years. For more information about this, see How to take into account losses of previous years for income taxes.

On line 120, calculate the tax base for calculating tax using the formula:

| page 120 | = | page 100 | – | page 110 |

If there is a negative amount on line 100, enter zero on line 120.

Fill in line 130 if the organization applies regional benefits in the form of a reduced income tax rate. In this case, indicate separately on the line the tax base in respect of which the reduced tax rate is applied.

If the organization is engaged only in preferential activities, line 130 will be equal to line 120.

What form is the declaration used to fill out?

Line 290 is located on the second sheet, which summarizes the main results. Information is entered on this sheet based on the data indicated on other reporting pages, as well as in the appendices. Almost all companies must fill out line 290 in their income tax return, except:

- Organizations that pay advance payments every quarter, that is, these are organizations whose profits over the last four quarters amounted to less than ten million rubles, as well as those companies that operate in Russia through representative offices.

- Organizations that at the beginning of the year began to transfer advances every month. They calculate advances based on actual income received.

Line No. 290 is displayed on application sheet No. 02. It must be completed by all taxpayers who are not subject to exceptions, which include:

- organizations that use quarterly advances and meet one of the following mandatory conditions:

a) whose revenue did not exceed 15 million rubles for the final reporting period (based on the results of the annual income tax return);

b) non-profit, budgetary or branch firms of foreign companies, as well as other taxpayers listed in paragraph 3 of Article 286 of the Tax Code of Russia, who have the right to submit a profit tax report once a quarter.

- companies that pay only monthly advances based on actual profits.

Companies submitting declarations with both monthly and quarterly advances, in line No. 290 indicate the total amount of the monthly advance payment, which is payable in the quarter following the quarter of the report.

In this case, line No. 290 is filled in as follows: (click to expand)

| Report period | What is reflected in line No. 290 |

| I quarter | Data from line No. 180 (sheet No. 02) of the declaration |

| II quarter (semi-annual report) | The amount of the difference between the data in line No. 180 (sheet No. 02) of the declaration for the half year and the first quarter of the current year |

| III quarter | The amount of the difference between the data on line No. 180 (sheet No. 02) of the declaration for 9 months and the total amount for the 1st and 2nd quarters of the current year, if the indicator is greater than zero. If the sum of the difference is 0 or less, then a dash is placed |

| IV quarter (final, annual declaration) | Dash |

Lines 140–170 Tax rates

On line 140, indicate the income tax rate.

If the declaration is submitted by an organization with separate divisions, put dashes on line 140 and indicate only the federal income tax rate on line 150.

On line 150, indicate:

- federal income tax rate. For example, for a standard rate of 2 percent, enter “2–.0–”;

- or a special income tax rate, if the organization applies exactly that. This is explained by the fact that the tax calculated at special rates is completely transferred to the federal budget (clause 6 of Article 284 of the Tax Code of the Russian Federation).

On line 160, indicate the regional income tax rate. For example, for a standard rate of 18 percent, enter "18.0-."

If the organization applies regional benefits in the form of a reduced income tax rate, indicate the reduced regional tax rate on line 170.

How the data for line No. 290 is calculated

In accordance with paragraph 2 of the Tax Code of Russia, taxpayers can transfer advances on income tax quarterly or monthly. The size of the quarterly advance depends on the amount of income of the enterprise and the tax rate. The amount of the monthly advance also depends on the payment period.

For monthly advances in the first quarter of the current year, the payment amount is equal to the monthly advance paid in the 4th quarter of the year preceding the reporting year.

NAIkv = VAIVkv, where:

- NAIkv – accrued advance payment for the first quarter of the current year;

- BAIVq – advance paid for the fourth quarter of the year, the previous year of accrual.

In the second quarter, the advance is equal to one third of the amount indicated in line No. 180 of the declaration filed in the first quarter of the current year. That is, the amount of the advance for one month of the quarter.

HAIIkv = BAIkv – DIkv ÷ 3, where:

- NAIIq – accrued advance for the second quarter of the current year;

- BAIkv – advance payment for the first quarter of the current year;

- ДIкв – data from line No. 180 of the declaration for the first quarter of the current year.

In the third quarter, the advance should be equal to one third of the difference in advances for the 1st and 2nd quarters of the current year. Those. the difference between the amount of advances indicated in the semi-annual report and for the 1st quarter is subtracted and divided by 3.

HAIIIkv = VApl – VAIkv ÷ 3, where: (click to expand)

- HAIIIQ – accrued advance for the 3rd quarter of the current year;

- WApl – advance payment for the first half of the current year;

- BAIkv – advance payment for the first quarter of the current year;

In the final (annual) reporting, the amount of the advance must be equal to one third of the difference between the advances for 9 months and half a year. Those. the difference between the amount of advances indicated in the report for 9 months and the first half of the year is subtracted and divided by 3.

NAIVkv = VA9m – VApl ÷ 3, where:

- NAIVq – accrued advance for the fourth quarter of the current year;

- VA9m – advance payment for 9 months of the current year;

- WApl – advance payment for the first half of the current year.

Lines 180–200 Tax amount

On line 190, calculate the income tax paid to the federal budget using the formula:

| page 190 | = | page 120 | × | page 150 | : | 100 |

On line 200, calculate the income tax paid to the regional budget using the formula:

| page 200 | = | (page 120 – page 130) | × | page 160 | : | 100 | + | page 130 | × | page 170 | : | 100 |

If the organization has separate divisions, form the line 200 indicator taking into account the tax amounts for the divisions indicated on lines 070 of Appendix 5 to Sheet 02.

On line 180, calculate the total amount of income tax using the formula:

| page 180 | = | page 190 | + | page 200 |

General algorithm for calculating an advance payment

Based on the provisions of paragraph 2 of Art. 286 of the Tax Code of the Russian Federation, an organization needs to accrue an advance every month based on the results of the reporting period, using the tax rate and the amount of profit taken into account when paying income tax as the basis for calculation. Accounting for income and advance payments occurs on an accrual basis for the entire reporting period from the beginning of the year. The amount of monthly transfers is determined by the taxpayer throughout the entire tax period.

The methodology for calculating the advance payment of income tax differs depending on the quarter in which it is calculated and transferred from the company’s current account to the relevant budgets:

- The monthly transfer for the first quarter is equal to the same figure for the 4th quarter of the previous year:

Av1 = Av4pg,

where: Av1 - advance payment for the month of the 1st quarter;

Av4pg - monthly advance in the 4th quarter of the previous year.

To check the correctness of its application, the amount on line 180 is compared with line 290. If the calculation is carried out correctly, the data in them should match.

- During the 2nd quarter, the monthly payment amount will be equal to the value in line 180, containing the total amount of advance payments for the previous 3 months, divided by 3:

Av2 = ID1 / 3,

where: Av2 - the amount of the monthly advance payment in the 2nd quarter;

ID - the result on line 180 of the declaration for the 1st quarter.

The following condition is used for verification: Av2 > 0. In this case, the correctness of the calculation is confirmed by the relation: line 180 in the current period – line 180 in the previous quarter = line 290. When receiving the ratio Av2 ≤ 0, 0 is entered in line 290.

- For the 3rd quarter, the difference between the advance paid for the first half of the year and the 1st quarter of the current year (data from line 180 of the declaration for the corresponding periods), divided by 3, is taken as the monthly payment amount:

Av3 = (An – Av1) / 3,

where: Av3 - monthly advance payment in the 3rd quarter;

Ap - advance amount for the half-year (Av1 + Av2);

Av1 - advance amount for the 1st quarter.

To check line 290, it is compared with line 320 of the declaration. If the amount is entered correctly, they should be equal.

- In the 4th quarter, the amount of the monthly payment is determined as the difference between the advance amount for 9 months and half a year, divided by 3:

Av4 = (A9month – Ap) / 3,

where: Av4 - the amount of the monthly advance payment in the 4th quarter;

A9month - the total amount of tax accrued for payment for 9 months;

Ap is the total of the tax accrued for payment for the six months.

The control ratio according to the calculation method is identical to that used for the 2nd quarter. If Av4 > 0, then: line 180 in the reporting period – line 180 in the previous period = line 290. If Av4 ≤ 0, 0 is entered in line 290.

The advance payment is not made if the amount obtained as a result of the described calculation methods is less than or equal to 0.

The procedure for calculating the amount of monthly advance payments for income tax depends on the period for which they are calculated: quarter, half-year, 9 months or year. For a significant part of the calculations, the data reflected in the declaration for previous periods (quarters) are mandatory.

In this case, line 290 is not filled in in the annual declaration.

To calculate the amount of advance payments in the 1st quarter, information is used on line 290 of the declaration submitted to the tax office for 9 months of last year. For the next 3 months, the basis for accrual is 1/3 of the total advance amount for the previous reporting period. In subsequent quarters, the methodology is repeated; the amounts from the tax reporting for the previous quarters, divided by 3, are used as the base. Such uniformity greatly simplifies filling out line 290.

Similar articles

Lines 210–230 Advance payments

On lines 210–230, indicate the amounts of advance payments:

- on line 220 - to the federal budget;

- on line 230 - to the budget of the constituent entity of the Russian Federation.

When filling out the lines, follow clause 5.8 of the Procedure approved by Order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600.

Lines 210–230 of sheet 02 of the income tax return reflect accrued advance payments. The indicators of these lines do not depend either on the amount of actual profit (loss) at the end of the reporting period, or on the amounts of advance payments for income tax actually transferred to the budget. However, they are affected by how the organization pays income tax: monthly or quarterly.

Organizations that pay tax monthly based on the profit of the previous quarter indicate in these lines:

- the amount of advance payments on the declaration for the previous reporting period (if it is included in the current tax period);

- the amount of advance payments to be transferred no later than the 28th day of each month of the last quarter of the reporting period (IV quarter of last year (if the declaration is submitted for the 1st quarter of the current year)).

Situation: how to fill out lines 210–230 in the half-year income tax return? Starting from the second quarter, the organization switched from monthly advance payments to quarterly ones.

In lines 210–230, enter the data from lines 180–200 of the declaration for the first quarter.

In lines 210–230, organizations that transfer advance payments to the budget quarterly indicate the amount of advance payments for the previous quarter. And these are the amounts that were in lines 180–200 in the previous declaration. The exception is the declaration for the first quarter, in which these lines are not filled out. This is provided for in clause 5.8 of the Procedure approved by order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600.

Let us explain why from the declaration for the first quarter it is necessary to take data from lines 180–200, and not lines 290–310 of sheet 02 and subsection 1.2, where accrued monthly advances are usually reflected.

The fact is that based on the results of the first quarter, it is already possible to draw a conclusion: from the second quarter, an organization has the right to switch from monthly payments to quarterly payments or not. To do this, you need to estimate the volume of revenue for the previous four quarters - in the situation under consideration, for the 2nd–4th quarters of last year and for the 1st quarter of the current year. And if sales revenues do not exceed an average of 15 million rubles. for each quarter, then you no longer need to pay monthly advances. That is, in the declaration for the first quarter there is no need to fill out lines 290–310.

In the half-year declaration, when determining the amount of tax to be paid additionally (lines 270–271) or reduced (lines 280–281), it is necessary to take into account the indicators of lines 180–200 of the declaration for the first quarter (paragraph 4 of clause 5.8 of the Procedure approved by the order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600). At the same time, the amount of monthly advance payments accrued during the first quarter (lines 210–230) cannot be reflected in the half-year declaration. Even if there is an overpayment on your personal account card due to these payments based on the results of the first quarter, it can be compensated. To do this, at the end of the six months, it is enough to transfer to the budget not the entire amount reflected in lines 180–200, but the difference minus the overpayment resulting from the results of the first quarter.

Determine the balance of settlements with the budget in the half-year declaration using the formula:

| The amount of income tax to be paid additionally (reduced) based on the results of the six months | = | Tax base for half a year | × | Tax rate | – | The amount of the advance payment accrued for the 1st quarter (lines 180–200 of the declaration for the 1st quarter) |

If for some reason in the declaration for the first quarter the accountant declared monthly advance payments for the second quarter (filled out lines 290–310 of sheet 02 and subsection 1.2 in the declaration), then the tax inspectorate will expect the organization to pay them. In order for the inspector to reverse the accruals in the personal account card on time, inform him about the transition to quarterly payment of advances.

This follows from paragraphs 2–3 of Article 286 of the Tax Code of the Russian Federation and paragraph 5.8 of the Procedure approved by Order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600.

See examples of filling out a half-year income tax return when switching from monthly advance payments based on the profit for the previous quarter to quarterly transfer of advance payments, if:

- based on the results of the first quarter, the organization made a profit;

- According to the results of the first quarter, the organization suffered a loss.

Organizations that pay tax monthly based on the actual profit received or quarterly indicate on lines 210–230 the amount of advance payments on the declaration for the previous reporting period (if it is included in the current tax period). That is, the data on these lines must correspond to the indicators on lines 180–200 of the previous declaration. In the declaration for the first reporting period, lines 210–230 are not filled in.

In addition, regardless of the frequency of tax payment, on lines 210–230, indicate the amount of advance payments additionally accrued (reduced) based on the results of a desk audit of the declaration for the previous reporting period. Provided that the results of this audit are taken into account by the organization in the current reporting (tax) period.

For organizations that have separate divisions, the amount of advance payments accrued to regional budgets for the organization as a whole should be equal to the sum of the indicators in lines 080 of Appendix 5 to Sheet 02 for each separate division (for a group of separate divisions located on the territory of one subject of the Russian Federation) , as well as at the head office of the organization.

This follows from the provisions of paragraph 5.8 of the Procedure, approved by order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600.

Situation: how to fill out lines 180–210 of sheet 2 in the annual income tax return? From the fourth quarter, the organization switched from quarterly to monthly tax payments.

On line 180, indicate the total amount of income tax accrued for the year. In line 210, enter the sum of lines 180 and 290 of sheet 02 of the declaration for nine months of this year.

The organization's transition to monthly payment of tax does not affect the completion of these lines. The fact is that the income tax return only needs to reflect the accrual of tax and advance payments. Actual settlements with the budget (in particular, the order of transfer and the amount of transferred advance payments) are not shown in the declaration.

Therefore, fill out lines 180–200 in the general order:

- on line 180, indicate the total amount of income tax;

- on line 190 (200) - income tax paid to the federal (regional) budget.

This procedure is provided for in clause 5.7 of the Procedure approved by order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600.

On lines 210–230, indicate the total amount of advance payments:

- accrued for nine months. In this case, these are the amounts indicated on lines 180–200 of the declaration for nine months;

- declared for payment in the fourth quarter. These are the amounts indicated on lines 290–310 of the declaration for nine months.

Important: since from the fourth quarter the organization switched from quarterly to monthly payment of tax, in the declaration for nine months it was necessary to declare the amount of monthly advance payments for the fourth quarter. If for some reason you did not do this, fill out and submit an updated declaration nine months in advance.

This procedure follows from the provisions of paragraph 5.8 of the Procedure, approved by order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600.

If the amount of accrued advance payments exceeds the amount of tax calculated at the end of the next reporting (tax) period, the resulting overpayment of tax is reflected on lines 280–281 of sheet 02. These lines show the final balances for settlements with budgets in the form of amounts to be reduced (clause 5.10 of the procedure approved by order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600).

Similar clarifications are contained in the letter of the Federal Tax Service of Russia dated March 14, 2013 No. ED-4-3/4320.

See examples of how advance tax payments should be reflected in the income tax return if:

- The organization transfers advance payments monthly based on actual profits. During the year, the amount of taxable profit decreases;

- The organization transfers advance payments monthly based on the profit received in the previous quarter. During the year, the amount of taxable profit decreases:

- The organization makes advance payments quarterly. During the year, the amount of taxable profit decreases, but there is no loss.

Features of paying advances on profits

Tax legislation, namely, stat. 286 of the Tax Code, provides for the accrual and payment by taxpayers of advance payments on profits. The exact deadlines and rules for transferring such obligations are regulated by Stat. 287 NK.

The final tax amount is calculated based on the results of the year (calendar). And for each intermediate period (1 quarter, half a year and 9 months), the amount of advances for the next quarter is calculated. Calculations are carried out sequentially throughout the year. The final amount of tax to be paid by the company to the budget or to be reduced is calculated at the end of the year, taking into account the advances already transferred.

As a rule, all legal entities pay advance amounts every month. Moreover, such calculations are carried out in accordance with the previous declaration. The results are shown on page 290 for the current period and show how many advances the company must pay each month in the next quarter.

Line 290 is required to be filled out only by those taxpayers who pay advances every month with subsequent additional payments based on the results of the corresponding quarter. There is no need to form this line:

- Organizations that transfer advances to the budget quarterly - in accordance with clause 3 of Art. 286 of the Tax Code, such entities include: Enterprises whose quarterly revenue does not exceed 15,000,000 rubles. In this case, only the last 4 quarters are taken into account.

- Autonomous institutions, as well as budgetary ones, except for cultural organizations (libraries, museums, theaters, concert institutions).

If your company does not belong to the list of entities listed above, you will have to fill out page 290. How to do this correctly is described below.

Read: How to fill out line 041 of the income tax return in 2018

Lines 240–260 Tax outside the Russian Federation

On lines 240–260, indicate the amounts of foreign tax paid (withheld) outside Russia in the reporting period according to the rules of foreign countries. These amounts are offset against tax payments in Russia in accordance with the procedure established by Article 311 of the Tax Code of the Russian Federation.

Separately reflect the amount included in the tax payment:

- to the federal budget - on line 250;

- to the budget of a constituent entity of the Russian Federation - on line 260.

On line 240, calculate the total amount of creditable tax using the formula:

| page 240 | = | page 250 | + | page 260 |

Results

Line 290 needs to be filled out only for those income tax payers who make quarterly payments on it and also pay monthly advances during the quarter following the reporting period. When calculating the value that falls on line 290, you should proceed from the specific reporting period in which the declaration is submitted. However, most calculation indicators require data from declarations for previous periods.

The essence of accruing an advance payment is that its amount is equal to the income tax attributable to the last quarter of the reporting period.

Read about the specifics of calculating advance payments through a responsible division in the article “An example of calculating advance payments for income tax through a responsible division.”

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated September 23, 2019 No. ММВ-7-3/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Lines 270–281 Tax to be paid additionally or reduced

Using lines 270–281, calculate the amount of tax to be paid additionally or reduced.

On line 270, calculate the amount of tax to be paid additionally to the federal budget:

| page 270 | = | page 190 | – | page 220 | – | page 250 |

On line 271 - additional payment to the regional budget:

| page 271 | = | page 200 | – | page 230 | – | page 260 |

If the results are zero, put zeros on lines 270 and 271.

If you get negative amounts, put dashes on these lines and calculate the amount of tax to be reduced.

On line 280, calculate the amount of tax to be reduced to the federal budget:

| page 280 | = | page 220 | + | page 250 | – | page 190 |

On line 281 - the amount to be reduced to the regional budget:

| page 281 | = | page 230 | + | page 260 | – | page 200 |

The most common errors in filling out line 210

Accountants of large, medium and small enterprises often submit imperfect declarations. There are different shortcomings, but in this article we will consider the main errors associated with filling out line 210. However, filling out line 210 is incorrect only when other declaration indicators are incorrectly calculated.

Statistics show that often all mistakes made are related to the payment of monthly advance payments. The fact is that when establishing the size of the indicator, the calculation is carried out on the basis of two lines - the amount of monthly advance payments and the amount of accrued and paid taxes in the previous period. Accountants often forget to summarize these indicators. Also, it was previously mentioned that additionally accrued income tax, or rather advance payments, should also be taken into account in this line. If for some reason the report still contains such an error, then it is likely that the tax office will fine you for a violation in the amount of 20% of the amount intentionally unintentionally hidden. Also, based on the results of a desk audit, erroneous information on line 210 may lead to tax authorities demanding additional information, explanations in the form of an explanatory note, as well as documents confirming the amount and timeliness of payment of tax advances.

Lines 290–340 Monthly Advance Payments

Fill in lines 290–310 if the organization transfers income tax monthly based on the profit received in the previous quarter. However, do not fill out these lines in your annual declaration.

For organizations that do not have separate divisions, the advance payment to the federal budget (line 300) is calculated using the formula:

| page 300 | = | page 190 sheet 02 for the current reporting period | – | page 190 sheet 02 for the previous reporting period |

For information on the specifics of calculating tax and filling out declarations for organizations that have separate divisions, see How to pay income tax if an organization has separate divisions and How to draw up and submit an income tax return if an organization has separate divisions.

Calculate the advance payment to the regional budget on line 310 using the formula:

| page 310 | = | page 200 sheet 02 for the current reporting period | – | page 200 sheet 02 for the previous reporting period |

Calculate the total amount of monthly advance payments on line 290 using the formula:

| page 290 | = | page 300 | + | page 310 |

If the amounts are negative or equal to zero, there is no need to transfer advance payments.

Complete lines 320–340 if the organization:

- transfers income tax monthly based on the profit received in the previous quarter.

- Fill out these lines only in the declaration for nine months;

- transfers income tax monthly based on actual profit. Fill out these lines in the declaration for 11 months if the organization plans to pay tax monthly starting next year based on the profit received in the previous quarter.

For these lines, indicate the amounts of advance payments that will be paid in the first quarter of the next year:

- to the federal budget - on line 330;

- to the regional budget - on line 340.

Calculate the total amount of monthly advance payments on line 320 using the formula:

| page 320 | = | page 330 | + | page 340 |

How to calculate line 290 of income tax - formulas

The algorithm for calculating advances differs depending on the period of their payment. Here are the formulas that will be useful when filling out the declaration for the 1st quarter, half year, 9 months and year:

- Gr. 290 reports for 1 quarter. = gr. 180 declarations per 1 sq.

- Gr. 290 reports for 1st half. = gr. 180 for 1 half. – gr. 180 per 1 sq.

- Gr. 290 reports for 9 months. = gr. 180 for 9 months. – gr. 180 for 1 half.

When generating a declaration for the year (calendar), a dash is entered in line 290. In 1 sq. of the current year, advances are paid in the same way as in the 4th quarter. last year. Indicators for columns 300 and 310 are determined in a similar way. They are broken down by budget level - federal (at a rate of 3%) and regional (at a rate of 17%). The formulas are as follows:

- Gr. 300 = gr. 190 for the current period – gr. 190 for the previous period.

- Gr. 310 = gr. 200 for the current period – gr. 200 for the previous period.

It is not necessary to indicate the amount of advances if, as a result of calculations, the taxpayer obtained a negative value or “0”. Next, when actually transferring advance obligations, the total amount is divided by 3 in order to distribute payments in equal installments over the months. When it is not possible to divide the number equally, the balance is added to the last month's payment.

Remember that advances and the total amount of the company's profit obligations must be paid within the same time frames established by the Tax Code of the Russian Federation for filing reports. So, based on the results of 2020, the declaration must be submitted before March 28, 2020. For interim periods, the report must be submitted by the 28th of the next month. The document must be sent to the Federal Tax Service at the address of the legal entity and each of its separate divisions, if any.

Subsection 1.1

In Section 1, Subsection 1.1 is not filled in:

- non-profit organizations that do not have an obligation to pay income tax;

- organizations are tax agents that are not payers of income tax and submit declarations with location codes 231 or 235.

In the “OKTMO code” field, indicate the code of the territory in which the organization is registered. This code can be determined using the All-Russian Classifier, approved by order of Rosstandart dated June 14, 2013 No. 159-st, or on the website of the Federal Tax Service of Russia (indicating the inspection code).

In the cells on the right that remain empty, put dashes.

On line 030, indicate the budget classification code (BCC), by which the organization must transfer tax to the federal budget, and on line 060, indicate BCC for transferring tax to the regional budget. It is convenient to determine these codes using a lookup table.

In line 040, transfer the amount of tax to be paid additionally to the federal budget from line 270 of sheet 02.

To line 050, transfer the amount of federal tax to be reduced from line 280 of sheet 02.

In line 070, transfer the amount of tax to be paid additionally to the regional budget from line 271 of sheet 02.

In line 080, transfer the amount of regional tax to be reduced to the regional budget from line 281 of sheet 02.

When is line 290 filled in and who is required to do it?

Sheet 02 collects the final data necessary for calculating tax from other sections. Line 290 of the income tax return , which is mandatory for all taxpayers, with the exception of certain categories, is also filled out here

Those exempt from the obligation to fill out line 290 include:

- Enterprises using the quarterly method of calculating and paying advance income tax, without breaking down by month. To switch to this mode, one of the following conditions must be met:

- Average quarterly revenue for the previous 4 quarters did not exceed RUB 15 million. (from January 2020);

- the organization belongs to non-profit, budgetary, foreign, operating through branches in Russia or other categories of taxpayers provided for in paragraph 3 of Art. 286 of the Tax Code of the Russian Federation, which secures their right to use the quarterly method of calculating and paying advance income tax.

- Firms that have chosen the method of calculating the advance payment based on the actual profit received for previous periods and have applied it from the beginning of the reporting period. If a company has chosen such a method, it does not have the right to change it during the tax period.

Features of reflecting trade fees

The form, electronic format of the income tax declaration, as well as the Procedure for filling it out, approved by Order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600, do not provide for the possibility of reflecting the paid trade tax. Before making changes to these documents, the tax service recommends doing the following.

Indicate the amount of the paid trade tax on lines 240 and 260 of sheet 02 of the declaration. Do this in the same way as when reporting tax paid (withheld) abroad that is offset against income taxes. In this case, the amount of trade duty and tax paid abroad reflected in the declaration cannot exceed the amount of tax (advance payment) that is subject to credit to the regional budget (line 200 of sheet 02). That is

| Page 260 sheets 02 | <= | Page 200 sheets 02 |

In addition, when filling out line 230 of sheet 02, reduce the amount of accrued advance payments by the amount of the trade fee reflected in the tax return for the previous reporting period. That is

| Page 230 sheets 02 of the declaration for the current reporting period | = | Amount of accrued advance payments for the current reporting period | – | Page 260 sheets 02 of the declaration for the previous reporting period |

Such clarifications are contained in the letter of the Federal Tax Service of Russia dated August 12, 2015 No. GD-4-3/14174. Appendixes 1 and 2 to this letter provide examples of how trade fees should be reflected in income tax returns.

For information on how trade taxes are reflected by organizations with separate divisions, see How to prepare and submit an income tax return if an organization has separate divisions.

Line filling order

Line 290 is filled in in accordance with the advance payment calculations. That is, based on the results of the reporting period, companies must calculate the amount of the advance depending on the rate and amount of profit and enter the resulting value in line 290 of the income tax return. The amount of the prepayment, which is paid every month, must be calculated throughout the year. The amount of advances will depend on the reporting period:

- 1st quarter – the amount of the monthly advance will be the same as in the fourth quarter of the previous year. That is, line 180 of the previous year’s report should be equal to line 290 of the current year’s report.

- 2nd quarter (half year) - the amount of the monthly prepayment will be equal to one third of the amount of the advance payment calculated in line 180 for the first quarter of the current year. If the resulting value is zero or less than zero, a dash is placed in line 290.

- 3rd quarter (nine months) – the amount of the monthly advance will be equal to one third between the amounts of accrued prepayments for the six months and the first quarter of the current year. In the income tax return, line 290 should be equal to line 320.

- 4th quarter (one year) – the amount of prepayment for the month is calculated as one third of the difference between the amounts of accrued advance payments for six months and nine months of the current year. If the resulting value is less than or equal to zero, a dash is placed in line 290.

Features in the Republic of Crimea and Sevastopol

Starting from the reporting periods of 2020, organizations in Crimea and Sevastopol fill out income tax returns in the same manner as Russian organizations.

Organizations in Crimea and Sevastopol can receive the status of participants in the free economic zone. If such status exists, in sheet 02 and in appendices 1–5 to sheet 02 of the tax return, in the “Taxpayer Identification” field, code “3” must be indicated (letter of the Federal Tax Service of Russia dated March 2, 2020 No. GD-4-3/3253).

Page 1 2 3 4 5

The procedure for filling out line 210 when calculating advance payments from the actual profit of the enterprise

The principle of filling out line 210 when calculating advance payments from the organization’s actual profit is similar to the principle of indicating quarterly payments in the declaration, however, there is still a slight difference. Since profit-oriented enterprises calculate advance payments on a monthly basis, and accordingly fill out an income tax return on a monthly basis, the scheme for entering information in line 210 during the year looks like this.

| Reporting period | The procedure for entering information in line 210 |

| January | A dash is placed in the line |

| January February | The data from line 180 of the previous declaration is inserted into the line |

| January March | Information is entered from line 180 of the previous declaration (for the period January-February) |

| January - April | Indicate information transferred from the declaration January - March on line 180 |

| January – May | The amount specified in line 180 of the previous declaration is transferred |

| January June | The value of line 180 of the declaration for January - May is noted |

| January – July | Indicate data from line 180 of the declaration January - June |

| January – August | Line 180 of the declaration for the previous months of the reporting period (January - July) is transferred to the specified column |

| January – September | Information from line 180 of the declaration for January - August is transferred to line 210 |

| January – October | The data from line 180 of the previous declaration is indicated |

| January – November | The value of line 180 is transferred from the January-October declaration |

| January December | Stock 210 is filled with data from line 180 of the declaration January - November |

Other nuances of paying advances

Payers of this tax are required to submit income tax returns.

Find out detailed information about income tax payers from this material.

For the income tax return for the 2nd quarter of 2020, use the form approved by order of the Federal Tax Service of Russia dated October 19, 2016 No. ММВ-7-3/ [email protected]

When filling out the profit declaration for the 2nd quarter of 2020, you can follow the same rules that you used to fill out the declaration for the 1st quarter - there have been no significant changes in the form of the declaration and the procedure for filling it out recently.

The declaration form in force in 2020 was approved in Order of the Federal Tax Service No. ММВ-7-3 / [email protected] dated 10/19/16. It also contains a detailed procedure for entering information into the document, including lines 210-290 of the income tax. Additionally, the rules for calculating the indicator on line 290 are regulated in clause 2 of the stat. 286 NK.

- For 1 sq. – the indicator is considered equal to the value of advances that were determined by the taxpayer for the 4th quarter. last year.

- For 1 half. (2 sq.) – the indicator is defined as the accrued advance for 1 sq. current year.

- For 9 months (Q3) – the indicator is defined as the difference between the amounts of advances for the 1st half of the year and the 1st quarter. current year.

- For the year (Q4) - the indicator is defined as the difference between the amounts of advances for 9 months. and 1st half of the current year.

When calculating the value for line 290, you need to take into account the data specified in lines 180 of the declarations for the current period and the previous one. There are special formulas that help calculate the desired value quickly and without errors. We present them below.

Example

Deadlines for filing income tax returns for the 2nd quarter

The income tax return for the 2nd quarter of 2020 (or, more precisely, for half a year, since the return is filled out on an accrual basis) is submitted within the deadline specified in clause 3 of Art.

289 of the Tax Code of the Russian Federation, no later than 28 days after the end of the quarter. And taking into account the fact that the deadline for reporting falls on a non-working day, the legal period for preparing a “profitable” report in July is extended by 1 day. As a result, the last reporting day for submitting a profit declaration for the 2nd quarter of 2020 falls on July 29, 2019 (Clause 7, Article 6.1 of the Tax Code of the Russian Federation). What options for making advance payments are provided for by tax legislation, see this publication.

What does line 210 consist of?

The declarant independently calculates the payment, which is paid in advance, based on the rate prescribed for the organization. Calculated from the beginning of the reporting period to the end. This is stated in Art. clause 1 of the Tax Code. There are exceptional cases when, when receiving income that has already been accrued and paid by a group of taxpayers, this amount is not indicated in the declaration (Article 286, paragraphs 4,5 of the Tax Code)

Line 210 of the income tax return itself shows the income received by the enterprise and the contributions made to the budget. The indicators of lines 210 to 230 do not reflect the actual profit and loss of the organization. The line itself shows how the company pays tax, monthly or quarterly. If you correctly enter data into other sections, line 210 itself will not cause any difficulties when filling out. Based on the data already entered, line 210 indicators are generated.