Accounting and reporting

Home articles Accounting and reporting

10/04/2019 print

Changes in accounting and taxation in 2020 will force many accountants to make adjustments to their work. In addition to the traditional changes that we face every year - an increase in the minimum wage in 2020, an increase in the maximum base for calculating insurance premiums in 2020, changes in the maximum and minimum amounts of sick leave and benefits in 2020 - changes have been made to reporting forms and deadlines for submitting some important ones for accountant reports. In particular, from 2020, the report in form 2-NDFL and 6-NDFL will have to be submitted a month earlier than the usual deadline for all accountants. The reporting submission date has been postponed by a month, now you need to report before March 1, 2020. And not as it was before before April 1st.

In general, there are quite a lot of changes. We have collected all the changes in accounting and taxation in 2020 in a special table so that you can quickly and conveniently navigate which changes are important to you, which of them need to be studied in detail, and which of them can be skipped.

As new changes appear, we will update the table, and by the end of the year we will publish for you the final complete table with changes in accounting and taxes for 2020 and explanations of what exactly has changed. Follow the publications on our website and you will definitely not miss anything..

You can download the table with Changes in Accounting and Taxes in 2020 by clicking the “download” button.

Accounting and reporting

Accounting reporting forms for 2020 have been changed. Accounting reporting for 2020 must be submitted using new forms. The header parts of all reporting forms have been modified. A new line has appeared where you need to mark the mandatory audit. The Federal Tax Service recommended machine-readable forms of financial statements: for those who report in a general manner - KND form 0710099 for those who report using simplified forms - KND form 0710096C reporting for 2020 Order of the Ministry of Finance of Russia dated April 19, 2019 No. 61n New rules for reflecting temporary and permanent differences Temporary and permanent differences, net profit must be calculated and reflected in the financial results statement in a new way. Mandatory - from the reporting for 2020. Voluntary - from reporting for 2020. PBU 18/02, taking into account the latest changes. Order of the Ministry of Finance dated November 20, 2018 No. 236n Order of the Ministry of Finance dated April 19, 2019 No. 61n The financial statements must reflect information about the cessation of the use of long-term assets for sale. Long-term assets for sale must be taken into account separately as part of current assets. If the company ceases to use long-term assets for sale, this fact must be reflected in the financial statements as part of information about discontinued operations. Long-term assets for sale include:- fixed assets and other non-current assets that the organization does not use because it decided to sell, except for financial investments;

- material assets for sale that remain from retiring non-current assets or that were removed during repairs, modernization, reconstruction.

Federal Law No. 325-FZ of September 29, 2019 It is not necessary to print and sign financial statements on paper. Reports prepared in electronic form are equated to reports prepared and signed on paper. Previously, it was believed that reporting was compiled and approved only after it was printed on paper and signed by the director. Now the director decides for himself: to sign the paper version of the reporting for him or to certify the electronic version with an electronic signature. From the reporting for 2020, Federal Law of November 28, 2018 No. 444-FZ

New law - new rules

The most important regulatory document, or “Bible” for an accountant, is Federal Law No. 402-FZ “On Accounting”. From January 2020, the law will be in force in a new version. Officials have made significant changes that cannot be ignored in their work.

The key goal of amending Law 402-FZ is to eliminate the differences between accounting rules in the commercial sector and the public sector. In simple words, legislators are trying to bring the legislative framework to such a form that it can be used by both the accountant of a budgetary organization and the chief accountant of a commercial company. This is currently not possible. True, the accounting innovations of 2019 will not greatly improve the current state of affairs, there is still a lot to improve, but there are already visible results.

Please note that in order to bring the accounting of the public sector to general standards, officials have defined a program for the implementation of federal accounting standards. Standards are orders of the Ministry of Finance that define the key rules and aspects of accounting by public sector institutions (public sector employees). The first 5 standards were introduced in 2020. In 2020, new standards come into force; more about them in a special article: “New federal accounting standards in 2020.”

So, let’s define the key changes to Law No. 402-FZ 2020:

1. The chief accountant’s requirements for the content and execution of primary documentation are now mandatory for all employees of the organization. The addition is enshrined in Article 9 of the Federal Law “Primary Documents”.

It should be taken into account that this innovation concerns not only the requirements imposed by the chief accountant, but also the requirements presented by another person responsible for maintaining accounting records in an economic entity. This could be a manager performing the functions of the chief accountant, or a third-party employee or even an organization with which an agreement has been concluded for the provision of accounting and reporting services.

Requirements may be not only for the content of the primary document, but also for its design, as well as for the methods and timing of submission for accounting and registration. These requirements of the chief accountant must be strictly followed by all employees of the organization.

2. Electronic documentation should be signed with an enhanced qualified electronic signature. Let us note that previously the provisions of Law 402-FZ contained an indication of the need to certify electronic accounting registers. In simple words, the old version of the law stated that any register must be certified by the signature of the responsible person. If the document is issued in electronic form, then it must be signed with an electronic signature and ensure its proper and secure storage.

Now officials have made changes. Their essence is this: an electronic signature must have enhanced qualified protection. Otherwise, the document or register will not be considered valid.

3. Paper reporting has been abolished. So, until 2020, all organizations had to prepare annual reports. Let us recall that previously, reporting was considered compiled only after the paper copy was signed by the head of the economic entity. Now these rules do not apply. Moreover, they should already be used when preparing financial statements for 2020.

What has changed? From 2020, a paper version of the report is not required. This means that it is enough for an organization to generate an electronic accounting record and certify it with an electronic signature. Do not forget that the electronic signature must be strengthened and qualified. There is no need to prepare a paper report.

However, if the obligations to provide reporting on paper are enshrined in other regulations, then you will have to duplicate the financial report on paper.

Additionally, we note that officials have secured the right of the Central Bank of the Russian Federation to establish separate requirements, rules and accounting standards, which will differ significantly from the current provisions of the law. Such standards will apply only to institutions and organizations subordinate to the Central Bank of Russia. The need is due to significant differences in accounting and the specifics of the activity.

Exchange of information with the Federal Tax Service

The Federal Tax Service Inspectorate will provide the reporting of the company’s partners upon its request. The company can request the financial statements of its counterparties from the Federal Tax Service Inspectorate and receive it for a fee. The electronic database, starting with reporting for 2020, will be maintained by the Federal Tax Service, and not by Rosstat, as it was before. Access to this information resource will be paid and amount to 200,000 rubles. for the annual maintenance of one workplace. From January 1, 2020, Federal Law No. 444-FZ of November 28, 2018; Decree of the Government of the Russian Federation of June 25, 2019 No. 811 Notification of separate divisions with a current account. It is necessary to report the granting or deprivation of a separate division of the authority to pay salaries only in if he has a bank account. From January 1, 2020, Federal Law No. 325-FZIFNS of September 29, 2019 will send SMS Tax inspectorates will send SMS messages to debtors on taxes, fines and penalties. To receive SMS, you must give your consent. From April 1, 2020, Federal Law No. 325-FZ of September 29, 2019, information on decisions on interim measures will be made public. Decisions on the adoption or cancellation of interim measures in the form of a ban on the alienation of property will be published on the website of the tax service. .From April 1, 2020, Federal Law of September 29, 2019 No. 325-FZNew PBU

The innovations will affect PBU 3/2006 “Accounting for assets and liabilities, the value of which is expressed in foreign currency.” The updates are enshrined in Order of the Ministry of Finance N 180n dated November 9, 2017, but they come into force only from January 1, 2019. Let's determine what will change in the PBU:

4. Cross course. Now, as before, the value of all assets and liabilities expressed in foreign currency will have to be recalculated at the established exchange rate of the Central Bank of the Russian Federation, into rubles. However, if the Central Bank has not set the official rate on the date of the operation/transaction, then the recalculation should be carried out using a special cross rate, which is calculated based on average values.

Cross rate is the calculated relationship between two currencies based on their exchange rate, which is calculated in relation to the rate of the third currency. The indicator is calculated by division and multiplication.

5. Revenue received in excess of the advance payment. This economic indicator appears if, when recalculating the amount of an advance received in foreign currency into rubles, the amount of the advance is obtained in excess. Part of this revenue received will have to be recalculated as of the reporting dates (the last day of the reporting period). As a result, the organization may incur other income or expenses.

These amounts will provoke the emergence of differences in tax and accounting, and most likely, organizations will have to reflect them taking into account PBU 18/02, unless legislators make appropriate adjustments to (Tax Code Article of the Tax Code of the Russian Federation).

6. Transactions in foreign currency. If an economic entity conducts part of its activities primarily in foreign currency, regardless of whether this occurs in Russia or abroad, and also meets the following conditions:

- this type of activity is capable of generating appropriate economic benefits and also requires certain expenses;

- the results of this activity are systematically analyzed by the responsible persons of the organization and are used when making management decisions on the redistribution of resources and evaluating results;

- For this particular type of activity, separate financial indicators can be generated, regardless of other types of activities performed -

then the organization has the right to prepare reports on such types of activities separately, moreover, according to the rules provided for reporting on types of activities carried out abroad. This part of the activity will have to be separated into a separate segment, in accordance with PBU 12/2010.

Also, changes in PBU 3/2006 affected such important areas as protection against currency risks and assets and liabilities abroad. The new interpretation of the Accounting Regulations provides exceptional rules for the translation of foreign exchange transactions.

Salary

The minimum wage has been increased. The minimum wage in 2020 has been increased to 12,130 rubles. An employee's full-time salary cannot be less than the minimum wage. The accounting department needs to check the staffing table and increase the wages of those workers who receive less to the minimum wage. From January 1, 2020, Order of the Ministry of Labor of Russia dated 08/09/2019 No. 561n New payment codes for wages have been established. In payment orders for the payment of wages, field 20 must be indicated new codes. For wages, benefits and compensation for harm, different codes are established, which must be approved by the Central Bank of Russia. A new coding is needed for bailiffs so that they can clearly establish which payments can be withheld according to writs of execution. From June 1, 2020, Subparagraph “d” of paragraph 3 of Article 1 of the Federal Law of February 21, 2019 No. 12-FZWage

Salary calculation taking into account the new minimum wage

The salary should not be less than the new minimum acceptable standards. Now the minimum wage is 12,130 rubles. This amount is equal to the subsistence minimum for an able-bodied citizen of Russia.

Using new codes when transferring wages

When placing an order, you must enter the payment type code in the “Purpose of payment” field. The Central Bank will provide different codes for wages, compensation, and benefits. Such a system will help bailiffs figure out what payments can be collected under writs of execution.

Insurance premiums

Limit value of the base for calculating insurance premiums Since 2020, the maximum value of the base for calculating insurance premiums has been increased:- the maximum base for pension contributions will be 1,292,000 rubles,

- The maximum base for contributions in case of illness and maternity will be 912,000 rubles.

Fixed assets in 2020 – major changes

It was expected that from the beginning of the year there would be significant changes in the accounting of fixed assets. But new regulations were never adopted. Therefore, the old rules continue to apply for a significant number of OS objects.

However, there are some innovations, which, for the most part, affected small businesses that carry out accounting according to a simplified scheme.

Such entities received the right to create the initial cost of the fixed assets based on the amounts of payment to suppliers and contractors installing this facility. If the OS was created in the organization itself, then its price is formed from the amounts paid to contractors and other organizations. All other amounts spent can be transferred to current expenses.

Important! An organization has the right to depreciate fixed assets using a simplified regime once a year on the last day of the year.

Also, business entities with simplified accounting schemes received the right to immediately depreciate at full price fixed assets related to inventory (they have a low price and a short service life). Such measures allow such entities to reduce the burden when calculating property taxes.

You might be interested in:

Income tax calculation: main types of transactions in 2020

In the current period of time, a new classifier of fixed assets has been adopted for use by groups for tax accounting, used to distinguish objects by depreciation groups. Individual objects were transferred from one group to another, and as a result, their depreciation rates will change.

Child benefits, sick leave

Monthly benefit for up to one and a half years. The maximum benefit amount in 2020 will be 27,984.66 rubles. The government has not yet established the minimum benefit amounts for 2020. Maximum and minimum amounts of child benefits in 2020 From January 1, 2020, the indexation resolution will be approved later. Monthly payments for the first and second child under three years of age. Payment for the first and second child is assigned to those families whose average per capita income does not exceed the limit established by law. The payment will be made by social security authorities. From 2020, the income limit for granting benefits will increase to 2 subsistence minimums, and it will be possible to receive it until children reach their third birthday. To calculate the amount of payment, you need to be guided by the regional children's minimum for the 2nd quarter of 2020. From January 1, 2020, Federal Law of August 2, 2019 No. 305-FZ Minimum and maximum amounts of sick leave payments If the calculation of average earnings turns out to be less than the calculation of the minimum wage, the employee must be paid sick leave based on from the minimum wage. From January 1, 2020, the minimum wage is 12,130 rubles. In 2020, the value of the average daily earnings for calculating the maximum sick leave payment will be no more than: (865,000 + 815,000) / 730 = 2,301.37 rubles. Maximum and minimum sick leave in 2020 From January 1, 2020Change table

| Change | As it was | What will happen in 2020 |

| Minimum wage, salary | ||

| Increasing minimum wages. Minimum wage 2019 | The minimum wage from May 1 is 11,163 rubles. | The minimum wage from January 1, 2020 is 11,280 rubles. |

| Write-off 100,000 rub. from salary | Debts up to 25,000 are written off | Debts up to 100,000 rubles will be written off through the employer |

| Taxes | ||

| Cancellation of benefits on contributions for the simplified tax system | Simplified workers in certain types of activities pay contributions at a reduced rate of 20% instead of 30% | From January 1, this benefit is canceled, the contribution rate increases to 30% |

| Increase in taxes for individual entrepreneurs | In 2020, fixed payments are : to the Pension Fund of the Russian Federation - 26,545 rubles, FFOMS - 5,840 rubles. If income exceeds 300,000 rubles, the entrepreneur pays insurance premiums in the amount of 1% of the excess amount. | From January 1, 2020, individual entrepreneurs’ contributions for themselves will increase. Contributions to the Pension Fund of the Russian Federation will amount to 29,354 rubles, and to the FFOMS - 6,884 rubles (Article 430 of the Tax Code of the Russian Federation). There will also be a 1% payment on income. |

| Cancellation of movable property tax | There is a tax on movable property | The tax on movable property has been completely abolished ; mention of this tax has been completely excluded from the Tax Code of the Russian Federation |

| Insurance contribution rate to the Pension Fund | The rate is 22% until 2020, from 2020 - 26% | The Duma adopted a law that fixed the contribution rate for all years at 22% |

| VAT increase | VAT rate - 18% | VAT rate - 20% |

| Growth of UTII | From January 1, 2020, the UTII rate was increased . The tax was increased by order of the Ministry of Economic Development 3010.2017 No. 579. This was the first increase in three years. | Approximately the same increase is expected in 2020 for UTII. The documents have not yet been approved. |

| Increasing the contribution base | To the Pension Fund - 1,021,000 rubles. To the Social Insurance Fund - 815,000 rubles. In FFMOS - no restrictions | Planned increase to the level of salary growth (at the moment the base has not been established for 2020) |

| Personnel | ||

| Raising the retirement age for workers | Retirement age for men is 60 years, for women – 55 | , employers will not formalize retirement in 2020 |

| Raising the retirement age for the self-employed | Those who do not have enough to retire receive a social pension upon reaching 65 and 60 years of age (men and women) | For officially unemployed self-employed people, the age for receiving a social pension rises to 70 and 68 years. |

| Postponement of holidays in 2020 | In 2020, the weekends have been moved according to the calendar. | For the New Year we will have 10 days of rest in a row, and for the May holidays we will rest first for 5 days, then 4 days in a row. |

| You can be fired for loss of trust | Only officials are fired for loss of trust | The Labor Code may introduce a new basis for dismissing an employee - due to loss of trust . The Ministry of Labor will consider the possibility of introducing a standard |

| Labor legislation will change in Russia | The Labor Code will change for employers . They will have to notify the employment service about the dismissal of people of pre-retirement age. At the same time, employers will receive benefits in paying contributions for older workers. | |

| Online cash registers | ||

| Product code in the receipt | No | A new item “product code” will appear in the online receipt. The code will need to be printed on the receipt if the company sells goods that are marked, for example, fur products and medicines. |

| Online cash registers | There are a number of payers who are exempt from online cash registers until 2019 | From July 1, 2020, these payers must use online cash registers. |

| Reporting | ||

| Cancellation of a declaration under the simplified tax system | The declaration is submitted by all payers of the simplified tax system - organizations and LLCs | From January 1, those who use the income object will not submit a declaration under the simplified tax system, subject to the use of online cash desks |

| Balance only in the Federal Tax Service | The balance must be submitted to the Federal Tax Service and Rosstat | Only at the Federal Tax Service |

| Tax authorities will begin to block accounts if a company does not submit payment payments on time | Inspectors do not have this right | Tax officials received the right to block employers’ accounts for failure to submit the ERSV. Being 10 days late will result in immediate blocking. The State Duma adopted such a law in the third reading. |

| New ERSV form | Firms and individual entrepreneurs fill out the ERSV using the current form, which was approved by order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/551 | In the calculation of contributions, they plan to change sections 1 and 3. Section 1. In section 1, the lines where policyholders calculated the total amount of contributions from the beginning of the period were removed. But employers will fill out a new line 005 “Payer type (code)” in section 1. There will be two types - persons paying income in the last three months of the billing period and those not paying. Appendix 1 to section 1. For simplifiers who pay contributions at the general tariff, the payer's tariff code in line 001 of Appendix 1 to section 1 will change. They will put code 01. |

Income tax

The range of objects for which an investment deduction can be claimed has been expanded. Now an investment deduction can be claimed for objects of the eighth to tenth depreciation groups (except for buildings, structures, transmission devices), and not, as before, only for objects of the third to seventh groups. This rule applies to those objects that were purchased or manufactured after January 1, 2020. From January 1, 2020, Subparagraph “e” of paragraph 10 of Article 1 of the Federal Law of July 26, 2019 No. 210-FZV, the investment tax deduction is allowed to include infrastructure costs Expenses for infrastructure can be included in the investment deduction. As part of the investment tax deduction, you can take into account the costs of creating:- objects of transport and utility infrastructure - no more than 100 percent;

- social infrastructure facilities – no more than 80 percent.

- regional operators for municipal solid waste management

- museums,

- theaters,

- libraries.

If you work for companies with the types of activities listed above, check that you meet all the conditions for applying the zero rate on profits.

From January 1, 2020, Clauses 3, 7 and 9 of Article 1, clause 4 of Article 2 of the Federal Law of July 26, 2019 No. 210-FZ Exchange differences in accounting for SEZ residents Residents of special economic zones should not take into account positive exchange differences when calculating the share of income from activities in agreement, which gives the right to apply reduced rates to SEZ residents. A new concept has appeared - first profit. After the company makes its first profit, it will have the right to apply the reduced rate for five years. The first profit is calculated as the difference between income and expenses without taking into account exchange rate differences. From January 1, 2020, Subparagraphs “a”, “b” of paragraph 8 of Article 1, Part 3 of Article 4 of the Law of July 26, 2019 No. 210-FZ The rule on how to include in non-operating income, the difference between deductions and accruals for certain excise taxes. The difference between deductions and accruals for excise taxes must be recognized in income on the day when the declaration for them is submitted. Until 2020, there was no rule established at the legal level. There were separate recommendations from the Russian Ministry of Finance, where officials allowed such income to be taken into account on the last day of the period in which the company filed an excise tax return. For example, a letter from the Ministry of Finance dated November 6, 2018 No. 03-03-10/79805, sent to the tax inspectorates by a letter from the Federal Tax Service dated December 25, 2018 No. SD-4-3/25355. From January 1, 2020, Clauses 15 and 18 of Art. 1 of Federal Law No. 255-FZ of July 30, 2019, IP up to 100,000 rubles is not depreciated. Now intellectual property with an original cost of no more than 100 thousand rubles. does not apply to depreciable property Since January 1, 2020, Federal Law No. 325-FZ of September 29, 2019 Be careful with losses. The period during which the income tax base can be reduced for losses of previous years by no more than 50% has been extended for a year. But tax authorities will be more attentive to transactions involving a change of ownership. The successor is prohibited from taking into account the losses of the predecessor. If the Federal Tax Service proves that the reorganization was carried out in order to take into account losses, you can forget about the transfer of losses. From January 1, 2020, Federal Law of September 29, 2019 No. 325-FZ Preservation of objects The useful life of a reactivated object must be extended for the period of conservation. From January 1 2020 Federal Law No. 325-FZ dated 09.29.2019 Changing the depreciation calculation method is possible once every five years Change the depreciation method only once every five years From January 1, 2020 Federal Law No. 325-FZ dated 09.29.2019 Check if payments are missing from foreign partners for dividends Payments that a foreign company makes to a Russian company that is a shareholder or participant when distributing after-tax profits are classified as dividends. And therefore, to taxable income, and you will have to pay taxes on them. From January 1, 2020, Federal Law of September 29, 2019 No. 325-FZChanges in accounting for 2020 with comments

Changes in accounting for 2020 have already affected such PBUs as 1/2008, 13/2000, 16/02, 18/02, 22/2010 and Guidelines for reflecting fixed assets. In this article we provide a detailed table for each of the above documents, as well as for general innovations in taxation.

Changes in tax and accounting in 2020 are so extensive that they have affected almost every company or individual entrepreneur. In addition to changes in PBU 1/2008, 13/2000, 16/02, 18/02, 22/2010 and the repeal of one of the norms of the Methodological Instructions for reflecting fixed assets, the adjustments affected the taxation of personal income tax, VAT, as well as “profitable”, property, transport and land taxes. At the same time, amendments were made to the Tax Code of the Russian Federation for each of the special regimes.

Mandatory reports to the tax office and the Pension Fund of the Russian Federation did not go unnoticed. Since 2020, the calculation of mandatory insurance premiums has been updated, and new forms for property and profit declarations have been approved. A new form SZV-TD has appeared as part of personalized reports in the Russian Pension Fund.

New in accounting 2020 for reporting

Fundamental innovations for submitting financial statements in 2020 are the submission of an annual report and an auditor’s report (if any). According to the new rules from the order of the Federal Tax Service dated November 13, 2020, from January 1, 2020, such documents must be submitted exclusively in electronic form - via TKS with a qualified enhanced electronic signature to your tax office.

The deadline for sending such a file is within 3 months after the end of the reporting year. Such rules are enshrined in the order of the Federal Tax Service dated November 13, 2020 No. ММВ-7-1/ [email protected]

The audit report, if required, is sent to the tax office in the form of a file:

- or together with financial statements;

- or within 10 days from the day following the day after the date of the auditor's report, subject to the deadline of December 31 of the year following the reporting year.

After this, within 1 working day, the tax office will confirm the date of sending the documents and generate a receipt, which will be sent to the reporting person. The reporting submission date will be the date indicated on the electronic acceptance receipt.

From this side, what is new in accounting in 2020 is related to the formation by the tax service of a common database. All information reflected in the annual financial statements of economic entities will be stored there. An exception to the submission of these reports in electronic form is made only for small businesses in relation to reports for 2020. More details about this are in table No. 1.

Table No. 1. New in Accounting for 2020 for Small Businesses

| Small Business Rule | Comments |

| Period for which you can submit a report on paper | Only 2020 |

| How to submit accounting reports on paper |

|

| When accounting statements are considered presented |

|

| Confirmation of submission of accounting reports | When submitting in person or with the help of a representative, you can ask for an acceptance mark |

Accounting changes in 2020 for fixed assets

Guidelines from the Order of the Ministry of Finance dated October 13, 2003 No. 91n, defining the rules for recording transactions with fixed assets, also affected changes in accounting in 2020. In accordance with them, subparagraph “b” of clause 54 of these Guidelines became invalid, which discussed the use of an increasing coefficient for depreciation in asset accounting using the reducing balance method.

When depreciating the cost of fixed assets using the reducing balance method, the annual depreciation rate is determined by the formula:

Annual depreciation rate = 1 / Useful life of the asset, years * 100%

If, as an example, a fixed asset is purchased whose expected lifespan is five years, then the annual deduction rate will be 20%.

Based on the annual depreciation rate, the annual amount of deductions is calculated using the formula:

Annual depreciation amount = Annual depreciation rate * Increasing coefficient. * Residual value of fixed assets at the beginning of the reporting year

If, as an example, with an annual rate of deductions, a legal entity decided to apply an increasing factor of 2, then deductions for the year will no longer be 20%, but 40% of the residual value of the object at the beginning of each year. Thus, if the initial cost of a fixed asset is 120,000 rubles, then in the first year you can write off 48,000 rubles as expenses through depreciation using the reducing balance method using a factor of 2. (20% x 2 x 120,000 rub.).

After determining the annual amount of depreciation, it must be divided by 12, obtaining the monthly amount of depreciation in accounting using the reducing balance method.

The formula for the annual depreciation amount assumes the use of a multiplying factor. The coefficient canceled by subparagraph “b” of paragraph 54 of these Methodological Instructions limited the cases of its application to the following 2 situations:

- for small enterprises – coefficient 2;

- for leasing fixed assets - no more than 3.

In relation to increasing coefficients when using the reducing balance method, the changes consist in the abolition of the restrictions established by the former subparagraph “b” of paragraph 54 of these Guidelines. This decision was made by the Supreme Court of the Russian Federation on January 23, 2020, No. AKPI19-899.

By the decision of the Supreme Court, the Methodological Guidelines were brought into line with the federal accounting standard PBU 6/01 for recording fixed assets. Standard PBU 6/01 takes precedence over the Methodological Guidelines for reflecting transactions on fixed assets and it does not define restrictions on accelerating depreciation using the reducing balance method. PBU 6/01 only states that the increasing coefficient should not be more than 3. Its specific value is determined by the legal entity itself.

Changes in Accounting Policies

From March 13, 2020, in accordance with the order of the Ministry of Finance dated February 7, 2020 No. 18n, the rules for the formation of their own accounting standards by holdings that prepare consolidated financial statements in accordance with IFRS and have subsidiaries are clarified.

Such companies have the right to develop their own standards, mandatory for all subsidiaries. Since August 2017, PBU 1/2008 has determined that legal entities preparing consolidated accounting statements under IFRS may not use the Russian accounting method in cases where it contradicts the requirements of IFRS. Now this permission in PBU 1/2008 is extended to independently developed accounting methods that are mandatory for subsidiaries of a holding organization.

New in bug fixes

PBU 22/2010 also clarified the rules for correcting an error discovered after the signing of the accounting report, but before submitting it to the owners of the organization. This reporting, if it was sent to users at the time the error was discovered, is also subject to correction.

However, from March 17 of this year, a re-compiled accounting report with the error eliminated is called not revised, but corrected. Previously, it was supposed to replace the original accounting report, but now it is supposed to re-present it to users after correcting the error.

The term “revised accounting” has been excluded from the accounting legislation when correcting errors. It was replaced by the term “corrected accounting”. This terminological change also applies to cases of correction:

- significant errors for the past year discovered after the presentation of the accounting report to the owners of the company, but before its approval;

- significant errors from last year that were discovered after the accounting statements were approved by the company’s owners.

Accounting 2020: new in PBU 13/2000 on state aid

The rules for reflecting in accounting transactions for the receipt and expenditure of budget funds by legal entities are determined by the federal standard PBU 13/2000 in accordance with the order of the Ministry of Finance of the Russian Federation dated October 16, 2000 No. 92n. What’s new regarding state aid in accounting for 2020 is an adjustment to the rules for reflecting state aid in accounting and reporting for 2020. Details on budget funds are in Table 2.

Table 2. New in accounting 2020 for state aid

| New | Standard PBU 13/2000 | Explanations |

| The scope of application of PBU 13/2000 has been adjusted | clause 1 | Now this regulatory document should not be used by government organizations |

| clause 3 | Accounting - new 2020: state participation in the authorized funds of state unitary enterprises and municipal unitary enterprises is not considered state aid | |

Reimbursement from the state to legal entities is not considered state aid:

| ||

| The forms of state aid have been clarified in relation to PBU 13/2000 | pp. 4, 14 | Now only subsidies from the state budget and extra-budgetary funds are considered budgetary funds |

| The concept of budget funds for capital investments has been adjusted | The receipt of non-current assets does not generate expenses. The corresponding budgetary funds are intended to finance capital costs | |

| The condition for reflecting state aid has been clarified | clause 5 | One of the grounds for reflecting state aid is the actual receipt of these funds by the company |

| Determined how to reflect government aid that has not yet been received | clause 7 | State aid that has not yet been received by the organization is reflected if 2 conditions are met:

It is in these situations that state aid should be reflected as the emergence of targeted financing and corresponding debt |

| Rules for writing off state aid have been adjusted | clause 9 | In relation to state aid for capital expenditures, the obligation to attribute previously recognized future income to other income has been abolished. The only general instruction left is to write off state aid as financial results. |

| The concept of current expenses under state aid is generalized | According to the new rules, current expenses for which budget funds are allocated are understood as inventories and other assets. Thus, the mention of labor costs, wages and other similar expenses was removed | |

| The reflection of received state aid on account of previously incurred current expenses has been adjusted | clause 10 | In this situation, upon receipt of budget amounts, it is necessary to increase the financial result without reflecting the debt on account 86 |

| The write-off of state aid received on account of capital costs already incurred has been clarified | clause 10 | Upon receipt of budget amounts, they should be written off as follows:

|

| The norm on the reflection of contingent assets and liabilities has been repealed | former clause 11 | A norm that was not in effect was abolished due to its reference to the long-canceled PBU 8/98 |

| Requirements for reflecting state aid in reporting have been adjusted | paragraph 19 | The outdated norm on reflecting information in an explanatory note has been canceled due to the lack of an explanatory note as part of the accounting reports |

| The rules for reflecting state aid in the Balance Sheet have been clarified. | clause 20 | If the materiality condition is met for the following amounts, then they are reflected as separate indicators for balance sheet items:

|

| The rules for reflecting deferred income in the Balance Sheet in connection with receiving state aid for capital expenditures have been clarified | clause 21 | These deferred income, regardless of their significance, can be reflected in the Balance Sheet in one of the following ways: — Under a separate article of Section IV “Long-term liabilities”. Then, in the Statement of Financial Results, written off deferred income forms a separate income item. — As a regulatory variable that reduces the book value of a non-current asset received through government assistance. Then the Statement of Financial Results does not reflect depreciation on such non-current items |

| The rules for reflecting deferred income in the Financial Results Statement in connection with receiving government assistance for current costs have been clarified | Such deferred income can be reflected in the income statement in one of the following ways: — A separate article, if such income is significant. In this case, current expenses are reflected in the usual manner. — Minus current expenses for which government assistance was received. In this case, offset current expenses are not reflected in the Report. | |

| There is a new requirement to reflect in reporting information on future income for state aid for capital expenditures | clause 22 | It is necessary to indicate in which way deferred income from received government assistance for capital expenditures is reflected in the Balance Sheet |

Changes to PBU 16/02 for discontinued operations

The rules for preparing accounting reports upon termination of any type of activity of a legal entity are determined by the federal standard PBU 16/02 based on the order of the Ministry of Finance dated July 2, 2002 No. 66n. With regard to this type of reporting, changes in accounting in 2020 will affect:

- clarification of the scope of application of PBU 16/02;

- clarification of the very concept of discontinued activity;

- the emergence of a new type of asset – long-term for sale;

- establishing the procedure for reflecting a new asset in the financial statements;

- updating the rules for disclosing information in reporting upon termination of a certain type of activity.

Changes in accounting according to PBU 16/02 come into force with reporting for 2020. More details about all adjustments for discontinued businesses are in Table 3.

Table 3. Changes in accounting according to PBU 16/02

| New | Norm PBU 16/02 | Explanations |

| The concept of a long-term asset for sale was introduced | new clause 10.1 | A long-term asset for sale is:

Only 1 type of non-current assets is not long-term assets for sale - financial investments |

| The scope of application of PBU 16/02 has been expanded | clause 1 | Changes in accounting in 2020 - this effect of PBU 16/02 now applies to non-profit organizations that cease to use long-term assets for sale |

| The concept of discontinued activities has been clarified | pp. 4.11 | Now information about discontinued activities:

|

| The rule on the recognition of liabilities with an uncertain amount or period of occurrence has been updated | paragraphs 8, 19, former paragraphs 13, 16 | The outdated wording has been brought into line with current legislation, which qualifies such liabilities as estimates rather than as reserves. Rules regarding provision recognition have been repealed |

| The rules for depreciation of assets upon termination of operations have been adjusted | pp. 9, 14 | Reference to other accounting regulations for the corresponding assets is excluded. Only rules enshrined directly in PBU 16/02 |

| The procedure for reflecting long-term assets for sale has been established | new clause 10.1 | Such assets:

|

| A procedure has been established for determining the value of long-term assets for sale | new clause 10.2 | Such a non-current asset or inventory must be measured at its carrying amount at the time it is reclassified as a non-current asset for sale. After this, the object is revalued according to the rules established for inventories |

| The rules for reflecting information about discontinued activities in annual reporting have been updated. | pp. 11, 20 | Currently, information about discontinued operations must be disclosed in the Notes to the Balance Sheet and the Statement of Financial Results, and not in the explanatory note |

| clause 12 | Now it is necessary to disclose in the Explanations, and not in the explanatory note, the following information:

| |

| The rules for reflecting information in consolidated accounting reports have been canceled | clause 11 | The requirement to disclose information has been lifted:

|

| The period for disclosing information about discontinued activities has been clarified | clause 15 | Disclosure ends in the period when all settlements for discontinued operations are completed (not when the relevant program is completed) |

| The rule for reflecting losses from impairment of assets has been changed | paragraph 17 | The instruction to necessarily reflect losses from asset impairment as other expenses has been removed |

| Requirements have been established for the disclosure of information on long-term assets for sale in the financial statements | new paragraph 23 | Upon termination of operations, the company is required to disclose the following information about long-term assets for sale:

|

Changes in accounting in 2020 according to PBU 18/02

Regarding changes in accounting, in Table 4 we have presented innovations in accounting for temporary and permanent differences, assets and liabilities, applied from the financial statements for 2020.

Table 4. Changes in accounting for 2020

| New | Norm PBU 18/02 | Explanation |

| Clarified the concept of temporary differences | clause 8 | But the new rules also consider temporary differences the results of operations that are not reflected in accounting, but form tax profit or loss in another period. For example, these are income, expenses or other results from revaluation in the accounting of fixed assets or intangible assets |

| The concept of temporary difference at the reporting date is defined | This is the difference between the book value of an asset or a liability, i.e. valuation taking into account regulatory clauses and valuation of that asset or liability for tax purposes | |

| A general list of possible temporary differences is provided. | item 11, former item 12 | Now the examples are the same for deductible and taxable temporary differences |

| The terms of income tax expense and income are defined and an example of calculating these indicators is given. | clause 20, appendix to PBU 18/02 | The new concept of expense or income for a profit payment means:

|

| Deferred income tax term defined | The new concept of deferred payment for profit means the total change during the reporting period of all deferred tax assets and liabilities, except for those transactions that do not form the accounting financial result | |

| The concept of current income tax has been clarified | clause 22 | Now the current profitable payment is simply the amount payable to the budget according to tax data |

| It has been clarified how to fill out the Financial Results Report | clause 24 | Indicates how to reflect:

|

| It is clarified what to indicate in the Explanations to accounting reports | paragraph 25 | The following should be indicated in the Explanations:

|

We would like to add that for participants of consolidated groups of taxpayers from accounting records for 2020, the changes affected:

- calculations of permanent and temporary differences;

- calculations of deferred tax assets;

- reflection of the current payment on profit;

- reflection of indicators in the Financial Results Report.

Changes in accounting and tax accounting in 2020 for personal income tax

Table 5 includes information on changes and innovations in relation to reporting the income of individuals and personal income tax. New reporting as part of changes in accounting and tax accounting in 2020 is information in the following forms:

- declaration on form 4-NDFL;

- calculation on form 6-NDFL;

- certificates on form 2-NDFL.

Table 5. Changes in accounting and tax accounting in 2020 for personal income tax

| Changes | Comments | Recommendations |

| Innovations in reporting | ||

| Declaration 4-NDFL has been abolished | The cancellation applies to individual entrepreneurs and private practitioners who work for the OSN | These persons no longer need to submit a report on expected income from doing business |

| The deadline for the annual report 2-NDFL has been changed | The postponement affects the reporting of tax agents who issued rewards to individuals and withheld personal income tax on these amounts | The 2-NDFL certificate must be submitted by March 1 of the year following the expiration |

| The deadline for the annual calculation of 6-NDFL has been changed | The 6-NDFL calculation must be submitted by March 1 of the year following the end of the year. | |

| The procedure for submitting reports 2-NDFL and 6-NDFL has been changed | The innovation applies to legal entities that have several divisions within the boundaries of one municipal territory | Such persons have the right to submit reports centrally:

|

To the above changes in accounting and tax accounting for 2020, shown in Table 5, it should be added that from the reporting for 2020, the 3-NDFL declaration form has changed from the order of the Federal Tax Service, dated October 3, 2020 No. ММВ-7-11/ [email protected] , which is rented out by individual entrepreneurs working on OSN, as well as ordinary individuals in cases specified in the Tax Code of the Russian Federation. Innovations in the 3-NDFL form affected appendices 2, 5, 7 and the procedure for filling out the form, including in its electronic format.

We would like to add that as of 2020, the rules for submitting a declaration on the 3-NDFL form have also been clarified. Now individuals can submit such reports through multifunctional centers (MFC). In this case, the submission date is considered to be the day the report is received by the MFC.

New notification on personal income tax

To centralize personal income tax reporting on personal income, companies will need to inform the tax office of their intention, but no later than January 1. The standard form for such a message has been approved since January 1, 2020 by order of the Federal Tax Service dated December 6, 2020 No. ММВ-7-11/ [email protected] This notification form is available for downloading using the links below:

Notification form

Completed notification

New in accounting and taxation in 2020 regarding insurance premiums

What’s new in accounting and taxation in 2020 regarding insurance premiums paid to the tax office concerns not only reporting, but also taxation rules. What’s new in reporting is the reissue of the form for calculating insurance premiums.

The new calculation form was approved by order of the Federal Tax Service dated September 18, 2019 No. ММВ-7-11/ [email protected] for reporting for the first quarter of 2020. In it, compared to the previous form, the appendices are renumbered and new indicators are added to section 1 , subsections 1.1 and 1.2, as well as Appendix 2 to section 1. In addition, the indicator of the total amount for the last 3 months of the reporting period was abolished everywhere.

According to the rules for calculating and paying contributions, as well as submitting reports on them, innovations for organizations, entrepreneurs and private practitioners are shown in Table 6.

Table 6. New in 2020 in terms of insurance premiums

| New | Comments | Recommendations |

| Innovations for legal entities | ||

| The obligation to submit payments for contributions electronically has been clarified | The maximum number of individuals for whom it is allowed to submit a paper settlement has been reduced | If the payment is submitted for 11 or more individuals, it should be sent exclusively in electronic form |

| The procedure for paying contributions for companies with divisions has been clarified | The innovation will affect only those divisions that issue rewards to individuals | But the new rules require that contributions be transferred to the location of this unit if it has its own bank account |

| The procedure for submitting payment calculations for contributions for companies with divisions has been clarified | According to the new rules, the calculation should be submitted at the location of this unit if it has its own bank account | |

| Contribution limits have increased | Since 2020, the maximum bases have increased (limit amounts of annual remuneration to individuals for calculating contributions to compulsory health insurance and compulsory social insurance for sick leave and maternity leave) | New in accounting and taxation in 2020 regarding maximum annual remuneration amounts:

|

| Innovations for individual entrepreneurs and private practitioners | ||

| Fixed contributions have increased | For 2020, individual entrepreneurs and private practitioners are required to pay contributions “for themselves” for compulsory health insurance and compulsory health insurance | Now the annual contribution amount is:

|

New personalized reporting form in 2020

The main change in accounting in 2020 for personalized reporting is the new reporting form SZV-TD. Its appearance is associated with the transition to storing data on the work activities of employees in electronic form. As part of the transition to electronic work books, the Pension Fund of the Russian Federation is forming a unified all-Russian database on labor activity, information for which will be provided by employers on SZV-TD forms.

Employers are required to send information on a personalized SZV-TD form to the Pension Fund if any of the following facts arise:

- Employment of a new employee.

- Transfer of an existing employee to another job.

- The employee’s will to choose a paper or electronic work record book.

- Dismissal of an employee.

More details about the cases and deadlines for submitting SZV-TD reports are in Table 7.

Table 7. Change in 2020 according to SZV-TD

| Situation | Deadline for submission of SZV-TD |

| First report with information as of January 1, 2020. | By February 15, 2020 |

| The occurrence of any of the reportable events during 2020 | By the 15th day after the reporting month in 2020. |

Facts emerging during 2021:

| By the 15th day after the reporting month in 2021. |

Facts emerging during 2021:

| The day after the relevant order is issued in 2021. |

Changes in personalized reporting also affected the following forms:

- ADV-1 questionnaires;

- ADV-2 statements;

- ADV-3 statements;

- inventory ADV-6-1;

- forms SZV-K.

All these forms have been updated since February 11, 2020 in accordance with the resolution of the Pension Fund Board dated September 27, 2020 No. 485p.

Property Tax Updates 2020

Starting this year, there are more properties that are subject to taxation based on their cadastral value. This category now includes not only residential buildings and premises, but also other real estate, if they are not listed in the organization’s accounting records as fixed assets.

As for the news on property reporting, they are in Table 8.

Table 8. Innovations in property tax reporting in 2020

| New | Comments | Recommendations |

| Calculation of advance payments has been eliminated | Now legal entities report only at the end of the year | The innovation applies to all companies that must report |

| Annual declaration updated | The new form from the Federal Tax Service order No. SA-7-21/ [email protected] should be submitted starting with the report for 2020. | Amendments have occurred in all sections of the declaration, and the rules for filling it out have also been changed. |

| Centralized reports allowed | Firms can centrally report on objects taxed based on the average annual value, which are under the jurisdiction of different tax authorities within the boundaries of one region. The exception is situations when regional law establishes standards for contributions to the local budget | For a centralized report, you must report this to the selected tax office before March 1 |

Changes in tax and accounting from 2020 according to the simplified tax system

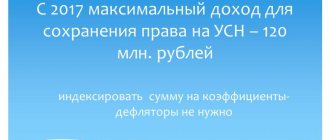

Changes in tax and accounting from 2020 according to the simplified tax system compared to 2020 consist in the resumption of the application of the deflator coefficient to the maximum amounts of income that allow you to switch to the “simplified” tax system or remain on it. For the current year, the deflator coefficient is set equal to 1, which is why the income limits are now equivalent to those specified in the Tax Code of the Russian Federation.

Changes to the simplified tax system also include permission to work on a “simplified” basis in the manufacture of excisable goods. True, not any categories, but only wine, excisable grapes, wine materials and grape must, which are produced from our own grapes.

New on UTII

As for UTII, changes in tax and accounting since 2020 affected the increase in the deflator coefficient K1 from 1.915 to 2.005. This coefficient is used when calculating the tax amount, along with the indicators of basic profitability and the size of the physical indicator - in the formula:

Let us note another important innovation – a clarification of the concept of retail trade. Now, even if certain categories of goods are sold at retail, such sales will not be considered subject to UTII. Starting this year, prohibited goods include those subject to mandatory labeling: medicines, clothing, shoes and fur products. Moreover, in the event of the sale of any of such goods, a legal entity or individual entrepreneur will lose the right to pay UTII.

Personal income tax

Personal income tax on compensation for travel to and from vacation for employees of the Far North Essentially, nothing has changed. Accountants have not previously withheld personal income tax from travel compensation for workers in the Far North on vacation and back. The only difference is that previously accountants were guided by the general norm of paragraph 3 of Article 217 of the Tax Code of the Russian Federation. And periodically there were disputes with the tax authorities. Now, compensation for travel on vacation and back within Russia for workers in the Far North and similar areas has been added to the list of non-taxable income. Personal income tax on compensation. Detailed information on this topic is available in the berator Practical Encyclopedia of Accountants. From January 1, 2020 P. 1 tbsp. 1 of the Federal Law of June 17, 2019 No. 147-FZIP no longer submit 4-NDFL Individual entrepreneurs no longer need to submit 4-NDFL about estimated income. . Now you just need to independently calculate and pay advances based on the results of the quarter, half a year and nine months. The payment deadlines have not changed: until April 25, July 25 and October 25. From January 1, 2020. 7 tbsp. 1 of the Federal Law of April 15, 2019 No. 63-FZO defines when a citizen’s income arises when his debt is forgiven or it is impossible to collect by a court decision. A citizen who has a debt to an organization earns income at the moment when the obligation to pay the debt ceases. The date of termination of the obligation may be the date of forgiveness of the debt or, for example, the date of the court decision. Previously, in 2019, income on a bad debt of a related party arose on the day the debt was written off from the organization’s balance sheet. From January 1, 2020, P. 2 tbsp. 1 of the Federal Law of July 26, 2019 No. 210-FZPurposes of updating accounting rules

In terms of accounting, Russia is still governed by rules that differ from the standards in force at the international level. Work to bring Russian and international requirements closer together is ongoing, but innovations in Russian rules are being introduced gradually. The next batch of such changes to accounting will be introduced in 2020.

Since accounting is required to reflect tax liabilities corresponding to the differences arising between accounting and tax accounting maintained for the purposes of calculating income tax, accounting directly or indirectly concerns updates in tax accounting. Therefore, we will consider, along with new accounting innovations - 2020, tax accounting changes that may be reflected in the difference between the two accounting systems.

VAT

Garbage collectors do not pay VAT. Regional operators for handling solid utility costs received a VAT benefit. The benefit can only be applied to those regional operators who will provide services at uniform tariffs established by regional authorities. The benefit will be valid for five calendar years starting from the year in which the authorities introduce uniform tariffs from January 1, 2020. Sub. “a” clause 2 of Art. 1, clause 3, art. 2 of the Law of July 26, 2019 No. 211-FZ Restoration of VAT after reorganization If a company switches to the simplified tax system or UTII, it will have to restore the VAT that it previously accepted for deduction during the period of work on OSNO. The same rule applies to any legal successor. From January 1, 2020, Federal Law No. 325-FZ of September 29, 2019 Carriers do not pay VAT. A VAT rate of 0 percent has been introduced for companies that provide services, carry out transportation work, transport not only goods, but also empty railway rolling stock or containers transported through the Russian Federation from the territory of a state that is not a member of the EAEU. From January 1, 2020, Federal Law of September 29, 2019 No. 322-FZAviation engines and civil aircraft were exempt from VAT import into Russia is exempt from VAT aircraft engines and civil aircraft. From January 1, 2020, Federal Law of September 29, 2019 No. 324-FZExplanations of the latest changes in tax accounting

By the beginning of 2020, a number of reforms had been carried out. For this reason, the legislative framework was updated and new rules were introduced for the imposition of taxes and the fulfillment of taxpayer obligations to pay fees.

According to VAT

The key change this year is the VAT increase. New categories of persons who are required to pay it:

- Firms and entrepreneurs of the Russian Federation.

- VAT agents purchasing services from foreign business structures. This applies to companies that are not registered in Russia, as persons who are required to pay taxes.

The following transactions are subject to 20% tax:

- Sale of goods and services in the Russian Federation.

- Import of property to the Russian Federation.

- Installation and construction activities.

- Metal purchase.

- Advance payment for supplied goods, services, works.

Employee vacation expenses

This type of spending is new. Accounting for expenses applies to both a specific employee and some of his relatives:

- spouse;

- individuals under 18 or 24 years of age, subject to continued education;

- children whose guardian is an employee, subject to the continuation of their education.

The Tax Code provides for expenses for:

- Flight/travel to a holiday destination within the Russian Federation and back.

- Accommodation of an employee in a medical institution located in Russia.

- Full meal plan at the vacation spot, if meals are included in the price of your stay.

- Excursions.

- Restoring the physical strength of an individual employee, undergoing rehabilitation procedures.

The nomination of the above-mentioned costs cannot exceed RUB 50,000. per person per year and no more than 6% of the amount spent on wages.

Cancellation of benefits on contributions

It is expected that contributions to compulsory health insurance (rate - 22%), compulsory social insurance (2.9%), compulsory medical insurance (5.1%) for loss of ability to work, including maternity:

- figures in the economic and financial sphere who pay PSN;

- companies that work on the simplified tax system;

- pharmacies that pay UTII.

On a note!

At the general specified rates, contributions are calculated on remuneration to individuals. In this case, the limits must be taken into account, beyond which the OSS contribution is not accrued.

Contribution limits

There are limit values for entrepreneurs that have employees and counterparties - individuals. Contributions to OSS are terminated when payments exceed the limit. The contribution to the OPS is calculated at a reduced price. The limit is increased annually, the new coefficient is approved by the government. At this stage, the following forecasts are calculated:

- within 22% for OPS – RUB 1,150,000;

- within 2.9% on OSS - 865,000 rubles.

Excise taxes

Excise tax deduction has become more accessible. Organizations that generate electricity and heat from middle distillates will be able to obtain certificates for transactions with middle distillates and claim a deduction when receiving middle distillates as fuel. The composition of technological processes for processing middle distillates has been expanded; now such processes include:- delayed coking;

- hydroconversion of heavy residues;

- obtaining carbon black by thermal or thermo-oxidative decomposition of middle distillates;

- production of bitumen by oxidation of tar.

Organizations that perform these operations when processing middle distillates will be able to apply an excise tax deduction.

From April 1, 2020 Art. 1, clause 5, art. 2 of the Federal Law of July 30, 2019 No. 255-FZ Excise tax deduction with a coefficient Organizations that generate electricity and heat from middle distillates will be able to take advantage of a deduction with a coefficient. The deduction can be applied when receiving middle distillates as fuel for combustion and energy generation. List of documents that accounting must prepare to confirm the deduction:- register of invoices (transfer and acceptance certificates) for the supply of middle distillates as fuel;

- registers for accounting for used fuel and energy supply;

- documents confirming fuel production by type of installation.

When selling middle distillates for bunkering sea vessels, the amount of deduction will need to be determined taking into account the new Vdfo coefficient. The procedure for calculating this coefficient has been established

From April 1, 2020 Sub. “b”, “c” clause 11, sub. “a” clause 12 art. 1, clause 5, art. 2 of the Federal Law of July 30, 2019 No. 255-FZA, you will no longer have to pay excise tax on dark marine fuel. Dark marine fuel has been excluded from the list of excisable goods. Any transactions with it will not be subject to excise tax. From April 1, 2020 Sub. "b" clause 4 of Art. 1, clause 5 art. 2 of the Federal Law of July 30, 2019 No. 255-FZMineral extraction tax

The calculation of the mineral extraction tax on rare metals has changed. And the list of rare metals itself has been expanded. When extracting rare metals, the mineral extraction tax must be accrued at a rate of 4.8 percent. This rate is lower than the rate in force in 2020 - 8 percent. The 4.8 percent rate applies to rare metals that form their own deposits; are associated components in ores of other minerals. When calculating the mineral extraction tax, a reduction coefficient Krm of 0.1 will apply. The coefficient can be applied within 10 years from the start of production. The list of rare metals that form their own deposits has been replenished with new items - a total of 21 items. Including cadmium, indium, tellurium and others. From January 1, 2020 P. 1–3 tbsp. 1 of the Federal Law of 02.08.2019 No. 284-FZImportant changes for accountants 2020

Let's identify other adjustments that an accountant should definitely take into account in 2020:

- An increase in the minimum wage is a key innovation in terms of wage provisions. From 01/01/2019 the minimum salary will be 11,280 rubles.

- Accounting statements will not need to be submitted to Rosstat. Only accounting reporting to the Federal Tax Service will remain mandatory.

- The employee is entitled to an additional paid day while undergoing medical examination. The day is granted once every three years.

- Sanctions have been introduced for the illegal dismissal of an employee of pre-retirement age, as well as for refusal to employ such a specialist.

Public sector accountants should take into account that the following has changed since 2020:

- the procedure for the formation and compilation of budget classification codes - Order No. 132n;

- the procedure for determining KOSGU for ongoing operations - Order No. 209n.

Organizational property tax

There is no longer any need to submit advance payment calculations. Companies no longer need to submit advance payment calculations for property taxes. Starting with reporting for 2020, companies submit only tax returns. From January 1, 2020. 20 tbsp. 1 of the Federal Law of April 15, 2019 No. 63-FZ The property tax declaration can be submitted centrally. If a company is registered with several Federal Tax Service Inspectors at the place of registration of its real estate properties and the tax base for them is determined as their average annual value, it can submit one tax return for all objects to any of the Federal Tax Service where it is registered. At your own discretion. From reporting for 2020P. 20 tbsp. 1 of the Federal Law of April 15, 2019 No. 63-FZ The list of objects of taxation by cadastral value has been expanded. According to the cadastral value, taxes will also be imposed on those objects that belong to an organization with the right of economic management. Amendments will be made to the list of real estate that is taxed at cadastral value. Instead of residential buildings and premises, which are not taken into account on the balance sheet as fixed assets, there will now be objects subject to property tax for individuals. As a result, organizations will pay tax based on cadastral value:- for residential buildings;

- apartments, rooms;

- garages and parking spaces;

- unified real estate complexes;

- unfinished construction projects;

- other buildings, structures, structures, premises.

What else has changed?

It is worth noting a number of other changes:

- Companies are forced to charge property taxes based on the average price for the year. In this case, the tax base is established only once, and during the year it is not subject to adjustment. This means that there is no need to calculate it between billing periods.

- Insurance payments for accidents were indexed (increased by 6.4%).

- Changes have been made to the dates of receipt of income for business trips. Now this is the last day of the month when the expense report was approved.

- The deflator coefficient for the simplified tax system has changed, which in 2020 is equal to 1.329.

- A change in the reduction of rates for the simplified tax system in the regions is allowed. Local authorities are given the right to reduce the rate by 1-6%.

- There have been changes in tax reporting regarding the declaration form under the simplified tax system. The new document has been in effect since April 2016.

- The minimum wage level has been adjusted to 6,204 rubles, which must be taken into account in the financial statements. This also needs to be kept in mind when assessing potential losses from sanctions.

Transport tax

Motor boats were taxed. Motor boats with an engine power of up to 5 liters were added to the list of objects of taxation with transport tax. c. From January 1, 2020 Sub. “a” clause 14 art. 1 of the Federal Law of April 15, 2019 No. 63-FZ An application procedure for the benefit has been adopted. Companies that are entitled to transport tax benefits can submit to the tax office an application for the benefit and documents confirming the right to the benefit. From January 1, 2020, Sub. “a” clause 15 of Art. 1 of Federal Law No. 63-FZ dated April 15, 2019. The submission of a transport tax return has been cancelled. As part of the reporting for 2020, companies submit a transport tax return for the last time. Starting from 2020, tax authorities will calculate the tax based on the information they have and send messages to the owners of vehicles - companies - about the payment of the tax. This practice has been applied to individuals for many years. Now it will be extended to legal entities. From the reporting for 2020 Sub. “b” clause 16, clause 17 art. 1, clause 3, art. 3 of the Federal Law of April 15, 2019 No. 63-FZ Federal Law of September 29, 2019 No. 325-FZ.Table of changes 2018 in the accounting of public sector organizations

The most significant changes in accounting have occurred in relation to public sector organizations. Since 2020, they began to apply new standards at the federal level:

| Theme of the introduced standard | Details of the order of the Russian Ministry of Finance that approved the standard |

| Conceptual framework for accounting and reporting of public sector organizations | dated December 31, 2016 No. 256n |

| Presentation of accounting reports | dated December 31, 2016 No. 260n |

| Impairment of assets | dated December 31, 2016 No. 259n |

| Fixed assets | dated 12/31/2016 No. 257n |

| Rent | dated 12/31/2016 No. 258n |

Changes have also been made to the charts of accounts used in the public sector:

| Scope of the plan | Details of the order of the Russian Ministry of Finance that approved the chart of accounts | Details of the order of the Ministry of Finance of Russia, which made the latest changes to the original order |

| Autonomous institutions | dated December 23, 2010 No. 183n | dated 12/19/2017 No. 238n |

| Budget institutions | dated December 16, 2010 No. 174n | dated November 29, 2017 No. 212n |

| Budget accounting | dated 06.12.2010 No. 162n | dated October 31, 2017 No. 172n |

| Government bodies of all levels, management of extra-budgetary state funds under the jurisdiction of the state Academy of Sciences, government agencies of all levels | dated 01.12.2010 No. 157n | dated September 27, 2017 No. 148n |

Appropriate adjustments were also made in documents explaining the accounting methodology and preparation of financial statements. There are clarifications on the application of new standards (including for the transition period) given by the responsible structures (Ministry of Finance and Treasury) in the last quarter of 2020.

Land tax

The application procedure for the benefit has been adopted. Companies that are entitled to land benefits can submit to the tax office an application for the benefit and documents confirming the right to the benefit. From January 1, 2020, para. 2 subp. "b" clause 24 art. 1 of the Federal Law of April 15, 2019 No. 63-FZ The land tax tax has been abolished. As part of the reporting for 2020, companies submit a land tax return for the last time. Tax officials will independently calculate the tax based on the information they have and send appropriate messages to payers. This practice has been applied to individuals for many years. Now it will be extended to legal entities. From reporting for 2020. 25–26 art. 1 of the Federal Law of April 15, 2019 No. 63-FZChanges in tax legislation from 01/01/2019

Tax changes will affect all payers in one way or another:

- Companies, entrepreneurs and private taxation entities;

- All those working under the general tax system or under special regimes;

- Those who make property or transport payments;

- Those submitting reports on personal income tax and other tax payments.

All important innovations are summarized in Table 1.

Table 1. Changes in tax legislation in 2019

| What will change in 2020 | Explanation of tax changes | Practical conclusions |

| VAT | ||

| The basic tax rate for VAT will increase | The base VAT rate will increase from 18% to 20%. | The change will be applied most often when shipping goods within the Russian Federation, when importing them into Russia, as well as when a company or entrepreneur performs installation and construction activities for its own needs. |

| The estimated tax rate will increase | New in tax legislation from 01/01/2019 - the estimated rate will increase from 18/118 to 20/120. | This change will be applied primarily when making payments on the basis of full/partial prepayment, when renting state or municipal facilities. |

| New types of taxpayers will emerge | New in taxation in 2020 is the need to calculate and pay VAT for legal entities and entrepreneurs on the Unified Agricultural Tax. | Starting from 2020, companies and entrepreneurs who pay the Unified Agricultural Tax must pay VAT when selling property, services, work, etc. in the Russian Federation. This tax can be deducted according to the general rules. But, subject to compliance with the limits, you can also obtain a VAT exemption. |

| The number of VAT payment agents has been reduced | When paying foreign performing companies for electronic services provided in Russia in electronic form, domestic customers will not become VAT agents. | Russian companies and individual entrepreneurs will not have to withhold VAT when paying for services to foreign companies and then transfer this tax to the budget. But if they withhold and pay VAT in 2020 according to the old rules, they will no longer be able to claim the tax as a deduction. |

| "Profit" tax | ||

| There are new expenses accepted for accounting | Another new feature in taxation in 2020 is that employers can recognize as expenses the costs of a tourist vacation for an employee and his family. | Taxable income can be reduced by an amount not exceeding RUB 50,000. per person per year. The maximum limit on vacation expenses can be no more than 6% of the wage fund. |

| Payments for the passage of heavy trucks on roads can be fully included in expenses | Payments to the Platon system no longer need to be adjusted to be included in expenses, following the rules for transport tax. | |

| The powers of regions to reduce the “profitable” tax rate are limited | Regions cannot reduce the rate for the regional part of this tax for periods from 2020 onwards. | If in any region the rate for the regional part of the tax has already been reduced as of the end of 2020, then it will be maintained, but not longer than until the end of 2022. |