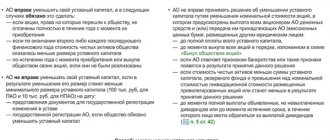

Participant exit options:

According to the law, a participant can leave an LLC of his own free will and forcibly. If a participant leaves of his own free will, he transfers his own share in the organization to another person. The primary right to purchase it is given to other LLC participants.

Voluntary withdrawal of a participant from the LLC

When a participant leaves the LLC , he must assign his share in the company to another person. First of all, the right to receive this share is given by law to people who are among the founders of the LLC.

How much it will cost is decided by the board of founders. The leaving participant himself simply writes a statement with a request to remove him from the LLC to the board of founders. This document may be delivered in person or by mail. After this, he is released from any obligations, and after selling his share, he has no rights in relation to the LLC.

The board of founders is obliged to make a decision on exit within three days and determine the cost of exit of the LLC participant. The minutes of the meeting of founders with the corresponding decision are being prepared.

Expulsion of a participant from the LLC

The law allows for the forced withdrawal of a participant provided that he committed any action that had an adverse impact on the work of the organization, or this was the result of his inaction. Moreover, this is possible only if his share in the authorized capital of the company is more than 10%.

If a peaceful resolution of the situation is impossible, the meeting of founders has the right to go to court.

Application for withdrawal of participants from the LLC

: sample can be

downloaded here

. The document is certified by a notary.

The decision of the meeting of the founders of the company or its minutes.

Form p14001

– application of the LLC with a request to make changes to the Unified State Register of Legal Entities.

Since 2108, filling out the form when an LLC participant leaves is carried out according to new rules. You can download a sample form for filling out here.

Constituent documentation of the company: Charter and extract from the Unified State Register of Legal Entities.

A certificate confirming that the LLC is registered and registered with the state.

The decision of the general meeting of founders, which appointed the general director of the company.

Accounting

Several theses regarding accounting entries and taxation in connection with the exit of the organizer of the company:

- The amount received for the share by the co-owner is his income. Therefore it is taxed.

- From January 1, 2020, the co-owner received the right to a tax deduction (Article 220 of the Tax Code of the Russian Federation).

- At the same time, the LLC still withholds, calculates and pays the tax amount on the full amount. The former co-owner is given the right to optionally claim a deduction when filing a return.

- To receive a deduction, you will need to provide documents confirming the costs of purchasing the share.

- If the deduction is less than 250 thousand rubles, then you cannot use it.

- Payment of the cost of the share portion is not an expense, but is subject to accounting under other accounting items (Settlements with previous participants in the company).

- The nominal value of the share is reflected in the subaccounts “Participant” and “Society”.

- After distributing the share among the other organizers, they have income, so they are subject to personal income tax.

- Benefits do not apply to shares acquired as a result of the vacancy of a post by one of the co-owners.

Video: how to formalize the withdrawal of a participant from an LLC?

https://youtu.be/S22JfVtCJWs

The procedure for a participant to leave an LLC: step-by-step instructions

The legal requirements, according to which the exit or withdrawal of a participant must be carried out, are prescribed in several regulations.

- Federal Law No. 14 of February 8, 1998 “On LLC”.

- Changes made to the Law on LLC Federal Law No. 312 of December 30, 2008.

- Article 94 of the Civil Code of the Russian Federation and Article 8, 26 of Federal Law No. 14.

When a participant leaves an LLC, the step-by-step instructions in 2019 include several main points.

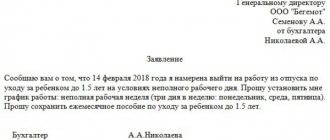

Step 1. Submission of an application by the participant to the management of the company

When an LLC participant voluntarily leaves the company, he expresses a request to remove him from the company. The law does not provide for a strict form for such an application, but it must contain the applicant’s full name, the name of the LLC, and the details of the head of the company. The basis for leaving the LLC must also be indicated and the size of the share of the person leaving the LLC.

The document must be certified by a notary: this is a mandatory legal requirement since 2020.

Step 2. Transfer of share to the company

At the moment of submitting the application and its registration in the incoming documentation of the LLC, the share is transferred to the company. It has the right within a year to decide how it will be distributed or alienated. For this purpose, a protocol on the participant’s withdrawal is drawn up.

Step 3. Calculation of the participant's share

The formula for calculation is given in Federal Law No. 14 in paragraph 6.1 of Article 23. This must be the actual value, which means part of the company’s net assets, the volume of which is determined on the basis of accounting data for the entire period of operation of the company, which passed before the participant submitted an application to leave the LLC. In addition to the amount that was contributed by the participant when creating the LLC, it also includes part of the company’s profit.

Step 4. Calculate taxes on the paid share

The share that a participant receives upon leaving the LLC is subject to personal income tax. In this case, the general rule applies: tax is charged on the entire amount of profit that is paid.

The market value of a company's fixed assets is calculated excluding tax. That is, when calculating it, it does not increase by the amount of VAT.

Step 5. State registration of changes

The LLC is required to inform the Federal Tax Service that the composition of participants has changed. This must be done no later than a month after the participant’s application to leave the organization was accepted. It is also necessary to inform about the decision made on how the company will dispose of the share.

The general director himself can submit documentation to the tax service. He also has the right to send it via the Internet, if he has an electronic signature, or by mail: in a letter with a description of the contents.

After this, the general director of the company can receive in hand or by mail the corresponding certificate in the form of an entry sheet in the Unified State Register of Legal Entities, which indicates what changes have been made to the charter

Step 6. Payment of the cost of the share upon leaving the LLC participants

It is allowed to make it in the form of a sum of money or in the form of property (with the consent of the person leaving the LLC).

If the share has not been distributed during the year, the company is obliged to repay it, reducing its authorized capital by exactly the amount at which it was valued.

The company may refuse to pay the cost of the share if the participant has not paid for it in due time. If an LLC goes through bankruptcy, the exiting member may be the last to claim its share.

He also has the right to renounce the participant’s share upon leaving the LLC and transfer it free of charge to the company.

Step 7. Notifying counterparties about changes in the LLC

If an LLC’s agreements with counterparties provide for a clause that the company must notify them of changes in the composition of its participants, this must be done in writing. Otherwise, the counterparty has the right to demand payment of a fine or make other demands.

In addition, it is imperative to inform the banks with which the company cooperates about the changes.

So, according to the law, any LLC participant has the right to leave the company. In this case, all conditions of the law must be strictly observed. The many nuances that arise in the process require special legal knowledge and experience. That is why it is advisable to turn to specialists for qualified help.

Cost of leaving the LLC

By contacting our company if you need to remove a member from an LLC, you receive a full range of services and competent legal support of the process.

Consequences of the founder's exit

When the decision about what to do next and about vacating the post of co-owner of the company has been made, the founder will need to write a statement and submit it to the board of directors or another authorized person. From this time on, the mechanism for transferring his share to the balance sheet of the company is launched.

To resign from the founders of an LLC, you need to write a statement and submit it to the board of directors.

But before we describe step by step the stages of the organizer’s exit, it is necessary to dwell in more detail on the mutual settlements between the company and its participant.

The law stipulates that the company is obliged, when one of its organizers leaves, to pay him the actual value of the share. This is a mandatory norm that does not imply the gratuitous transfer of a share, even if the participant expresses such a desire. In this case, non-payment will mean a violation of the law and will not deprive the retiring organizer of the right to subsequently claim the amount of money due through the court.

A way out in this situation may be to draw up a gift agreement, which is permitted by civil law between an individual and an organization. The agreement can be drawn up in simple written form and does not require notification of government agencies and notarization.

Payment to the organizer must be made within three months. At the same time, the company must, within a year, distribute the share of the withdrawing participant that has entered the balance sheet among the others, sell it to one of the organizers or a third party (if the organization’s charter allows this).

Payment of the share to the withdrawn organizer must be made within three months.

Example: at a general meeting, a decision was made by a majority vote to expel entrepreneur Andreev. His share in the company was 10% and, after paying its actual value, it was sold (with general consent) to one of the co-owners.

How to leave the founders of an LLC - procedure, calculations and documents

Are you the founder of an LLC, but have decided to leave the Company? The intention is completely legal, but there is a certain procedure. And to comply with it means to do everything according to the law and not attract increased attention from the tax service. Where to start the process and where to turn? We will “walk” the whole path with you and tell you in detail what steps to take.

Notice of withdrawal - we notify LLC members correctly

If you have made a decision, prepare a written statement of intention to leave the ranks of the founders. The document must clearly state the decision; you are not required to explain the reasons. Remember that the opinions of other participants do not in any way affect the process of leaving the LLC. But simultaneous withdrawal from the founders of several members of the Company or one who is the sole owner of a share in the business is not allowed.

The completed application must be submitted only in writing and can be delivered personally by the applicant or sent by mail or delivered by courier. When sending a letter, be sure to receive a document that reflects the value of the letter and contains notification of its receipt by the addressee. The application can only be accepted by officials of the LLC: the head of the executive body, the employee who is responsible for accepting correspondence, the chairman of the board of directors of the Company.

But there is another option to inform about leaving the founders. You can initiate the process directly at a formal meeting of LLC members, just as you would at closing. A decision is made and a protocol is drawn up on the withdrawal of one or more founders.

As soon as the application is officially accepted, you lose all rights to your share, which becomes the property of the enterprise. However, you are required to compensate your share in cash and register the corresponding changes in the Unified State Register of Legal Entities.

We are preparing a package of documents for submission to the Federal Tax Service

No later than 3 days from the date of receipt of the application to leave the LLC, you are required to notify the Federal Tax Service about the event.

Prepare a package of documents:

- Application on Form 14001.

- Application for resignation from the founders of the LLC (with a mark on the date of acceptance).

- Minutes of the meeting of participants, which record changes in the composition of the Society.

- Original and copy of the applicant's passport.

Don’t forget that the tax office will require notarization of your signature on form 14001. The notary must provide: OGRN and TIN certificates, director’s passport and minutes of the meeting on his appointment, form 14001, resignation letter, extract of participants (valid for no more than 1 month), stamp LLC, protocol on amendments to the composition of the founders. At this stage, you will have to spend from 1,000 to 1,500 rubles on notary services.

The documents are ready - submit them to the Federal Tax Service for registration. This can be done in person or through a proxy, by mail (a detailed list of documents is required).

We receive documents from the tax office

The legislator clearly establishes the period for registration of documents - 5 days. After this period, within 24 hours you will be given all the documents with changes to the Unified State Register of Legal Entities. You can indicate a convenient way to receive securities: in person or by mail. As soon as the certificate is in your hands, the changes come into force and must be taken into account when the LLC interacts with other persons.

Your share is payment of its cost

The LLC charter may contain information that determines during what period you are required to pay your share in cash. Usually the period is 3 months from the date of the official statement of resignation from the Company. The withdrawing participant can count on the value of his share, which is calculated proportionally from the authorized capital on the day of payment. Payments are allowed in the form of:

- Cash.

- Property, only with the consent of the former founder (written confirmation).

The share cannot be reimbursed for services!

An important nuance: if at the time of legal payment of the share the company is declared bankrupt, you must be reinstated! The right to the share is returned and the person again becomes the founder of the LLC. Reinstatement is possible no later than 6 months from the date of filing the application (that is, 3 months from the date of the expected payment).

A little about numbers

How to determine how much payment should be made? The net assets of the LLC are taken into account (information based on data as of the end of the next reporting tax period - the last month). The amount of payments is directly proportional to the initial contribution to the authorized capital. For example, the net assets of the enterprise were 100,000 rubles, the authorized capital was 20,000, and the founder’s share was 50%.

The amount of payment must be determined using the following formula: 100,000 (assets) x 10,000 (share in capital) / 20,000 (authorized capital) = 50,000. This amount must be paid to you.

Withdrawal from an LLC due to the death of the founder

If one of the founders of the company dies, all rights to his share pass to his heirs. The fact of death must be reported to the relevant authorities and changes must be made to the Unified State Register of Legal Entities within 5 days.

Heirs are required to declare their rights to the share (read about the procedure here). If such actions are not followed, the Company has the right to dispose of capital at its discretion. If the deceased has not determined in the will in which parts his share is divided between legal successors, it is distributed in equal parts among the first-line heirs. But only adults can accept such a “gift”; until the age of 18, the capital will be managed by a guardian or proxy.

Forced expulsion of the founder

This type of exit from an LLC is also possible. It can be initiated by other members of the Company who have a share in the authorized capital of 10% or higher. The reasons may be different: the participant violates the concept of the enterprise, deliberately harms the activity, through his fault profitable opportunities were lost, and interferes with the implementation of entrepreneurial activity. As practice shows, in such cases a peaceful outcome is very doubtful. You will have to go to court and prove your position.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now: Moscow and region St. Petersburg and region

All regions of the Russian Federation Consultation is free!

As you can see, it is not so difficult to formalize the withdrawal from the founders of an LLC; the main thing is to adhere to all the requirements of the law and comply with the deadlines. A problem may arise precisely when paying a share, and here it is important to obtain up-to-date information for the reporting period. If the company refuses to provide them to you, contact the tax service for help, initiate checks and audits, prove the violation of your rights.

Practice shows: you should not agree to reimbursement of a share in property equivalent. After all, the company will have to pay taxes and only after deducting this amount will return your share to you.

If one of the founders died: algorithm of actions

Business is booming, the company is gaining fame, contracts have been signed, and a bright future lies ahead. And then one of the founders suddenly dies. Such a situation may take other participants (shareholders) of the business company by surprise1. A similar problem may arise for the management of a non-profit organization. What actions should be taken in such cases to avoid negative legal consequences?

First, let's consider the situation that arises in the event of the death of one of the founders, using the example of a limited liability company that has more than one founder (participant).

Consequences for LLC

According to Federal Law No. 14-FZ dated 02/08/98 (as amended on 12/29/2015) “On Limited Liability Companies” (hereinafter referred to as the LLC Law), the constituent document of an LLC is its charter. It, among other things, must contain information about the procedure for transferring a share or part of a share in the authorized capital of the company to another person (Part 2 of Article 12 of the LLC Law).

Article 21 of the LLC Law states: the transfer of a share or part of a share in the authorized capital of a company to one or more participants of this company or to third parties is carried out on the basis of a transaction in the order of succession or on another legal basis. Shares in the authorized capital of the company pass to the heirs of citizens and to the legal successors of legal entities that were participants in the company, unless otherwise provided by the charter of the LLC.

With regard to the inheritance of a share (part of a share), the charter of the company may provide that the transfer of a share in the authorized capital to the heirs and legal successors of legal entities that were participants in the company, the transfer of a share that belonged to a liquidated legal entity, its founders (participants) who have proprietary rights to it property or rights of obligation in relation to this legal entity are permitted only with the consent of the remaining participants in the company.

The company's charter may provide for different procedures for obtaining the consent of company participants to transfer a share or part of a share in the authorized capital of the company to third parties, depending on the grounds for such a transfer.

For example, the Law on LLC and (or) the charter of the company provides for the need to obtain the consent of the company's participants to transfer a share or part of a share in the authorized capital of the company to a third party. Such consent is considered received in two cases:

all participants of the company, within 30 days or another period determined by the charter from the date of receipt of the corresponding application (offer) to the company, submitted written statements of consent to the alienation of a share or part of a share on the basis of a transaction or to the transfer of a share or part of a share to a third party by on another basis;

within the specified period, written statements of refusal to give consent to the alienation or transfer of a share or part of a share have not been submitted.

The company's charter may provide for the need to obtain the company's consent to the alienation of a share or part of a share in the authorized capital of the company to the company's participants or third parties. Such consent is considered received by the company participant alienating the share or part of the share if:

- within 30 days from the date of contacting the company or within another period determined by the charter of the company, he received the consent of the company, expressed in writing;

- the company has not received a refusal to give consent to the alienation of a share or part of a share, expressed in writing.

Thus, the company’s charter may prescribe various options for action in the current situation. Let's analyze them.

Option 1. Transfer of a share to the heirs is possible without the consent of the LLC participants

If the charter provides for the possibility of transferring a share to the heirs regardless of the opinions of other LLC participants, it is necessary to find out the coordinates of the notary who is in charge of the inheritance file of the deceased (notary at the place of residence of the deceased) and visit the notary. It is important to find out from the notary whether there is a will of the deceased; if there is no will, we find out whether there are heirs.

It is worth noting that it is not necessary to look for and visit a notary who is handling the inheritance matter. But if they contact a notary, the remaining founders will speed up the process of bringing the LLC documents into compliance and will not make illegal decisions, which the heirs can subsequently appeal.

In accordance with Art. 1173 of the Civil Code of the Russian Federation, if the inheritance includes property that requires not only protection, but also management (enterprise, share in the authorized (share) capital of a business partnership or company, securities, exclusive rights, etc.), a notary, guided by Art. . 1026 of the Civil Code of the Russian Federation, as the founder of trust management, enters into a trust management agreement for the named property. That is, before the heirs inherit the shares in the LLC, the notary who conducts the inheritance case disposes of (signs the minutes of the general meeting of participants for urgent and necessary issues regarding the economic activities of the LLC).

In the case where inheritance is carried out under a will in which an executor of the will is appointed, the rights of the founder of the trust management belong to the executor of the will.

When entering into an inheritance, the heirs must notify the company and the other participants of the LLC by mail.

After the heirs enter into the inheritance and receive a certificate of the right to inheritance, an application in form P14001 is submitted to the Federal Tax Service, as well as a certificate of the right to inheritance to register changes in the Unified State Register of Legal Entities.

If there are many heirs, the share of the deceased participant is distributed in proportion to the shares in the inheritance.

Option 2. Transfer of the share to the heirs requires the consent of the LLC participants

In a situation where the charter provides for the possibility of transferring a share in an LLC to the heirs only with the consent of the remaining participants or the company itself, the latter decide whether they want the heirs to join the company or not. The members of the company inform the company of their decision within 30 days in simple written form. If the remaining members of the company do not object to the heirs of the deceased participant joining the LLC, further actions take place as in the first option.

Let’s say that the consent of the company’s participants to transfer the share has not been received. In this case, the share passes to the company on the day following the expiration date, that is, after 30 days from the date of notification of the company about the heirs’ desire to join the LLC or another period determined by the charter of the LLC (Clause 5, Article 23 of the LLC Law) . In this case, the company is obliged to pay the heirs of the deceased company member the actual value of the share or part of the share, determined on the basis of the company’s financial statements for the last reporting period preceding the day of death of the company member, or, with their consent, give them in kind property of the same value.

The company notifies the notary and the heirs of the deceased member of its decision.

Next, the company’s participants hold an extraordinary general meeting, at which they decide to register with the Federal Tax Service changes to the constituent documents on the transfer of the deceased’s share in the LLC. Then the changes are registered in the Unified State Register of Legal Entities, for which the minutes of the extraordinary meeting of participants, a copy of the death certificate, and an application in form P14001 are submitted to the tax authority.

At the next stage, an extraordinary meeting of participants is convened, where a decision is made on the distribution of the share owned by the company according to the shares of the remaining participants.

Based on the results of the meeting, an application in form P14001 and the minutes of the general meeting of company participants are submitted to the Federal Tax Service.

Option 3. The charter does not allow the transfer of shares in the LLC to third parties

The participants of the company act according to the same scheme as in the case of lack of consent of the participants to the entry of the heirs of the deceased participant into the LLC.

Implications for Nonprofits

The situation is different with non-profit organizations (hereinafter referred to as NPOs) and their founders (participants, members).

The activities of NPOs are controlled by the Russian Ministry of Justice. Federal Law No. 7-FZ dated January 12, 1996 “On Non-Profit Organizations” (as amended on December 30, 2015, hereinafter referred to as the Law on Non-Profit Organizations) does not contain a clear procedure for actions in the event of a change of participants or the death of one of the founders.

The current legislation of the Russian Federation, regulating the activities of NPOs and, in particular, the relations between the founders, participants and the organization itself, does not indicate the possibility of their inheritance, but also does not establish a ban on their inheritance.

In paragraph 1.2 of Art. 15 of the Law on NPOs contains an exhaustive list of persons who cannot be a founder (participant, member). The persons listed in the above list, even inheriting the “share” of a deceased participant in an NPO, do not have the right to become its founder (participant, member).

Let's consider the legal situation that develops in the event of the death of the founder for the most common forms of non-profit organizations - a private institution, a foundation and an autonomous non-profit organization.

Private institution

A private institution is an NPO created by the owner (citizen or legal entity) to carry out managerial, socio-cultural or other functions of a non-profit nature, that is, a private institution has one founder. According to Art. 1112 of the Civil Code of the Russian Federation, the inheritance includes things and other property that belonged to the testator on the day the inheritance was opened, including property rights and obligations.

Accordingly, the new founder of a private institution can only be an heir who will inherit according to the same rules as in an LLC. After this, forms P13001, P14001, the charter in the new edition, a certificate of the right to inheritance, and a receipt for payment of the state duty are submitted to the Ministry of Justice of Russia. After state registration of changes, a private institution has a new founder.

Fund, ANO and other NPOs: we act taking into account the amendments

Federal Law No. 7-FZ dated January 31, 2016 “On Amendments to Certain Legislative Acts of the Russian Federation” introduced amendments to the Law on NPOs regarding inclusion and withdrawal from the founders of certain NPOs. Changes are effective from January 31, 2020.

So, in accordance with the new paragraph 3 of Art. 15 of the Law on NPOs, unless otherwise provided by federal law, founders (participants) of non-profit corporations, founders of funds and autonomous NPOs have the right to withdraw from the founders and (or) participants of these legal entities at any time without the consent of the remaining founders and (or) participants. To do this, on the basis of Federal Law No. 129-FZ dated August 8, 2001 “On State Registration of Legal Entities and Individual Entrepreneurs,” you must provide information about your withdrawal from the founders to the registration authority.

If the last or only founder and (or) participant leaves the founders and (or) participants, he is obliged, before sending information about his withdrawal, to transfer his rights as a founder and (or) participant to another person in accordance with federal law and the charter of the legal entity.

The rights and obligations of the founder (participant) of a non-profit corporation or the rights and obligations of the founder of a foundation or autonomous non-profit organization in the event of his withdrawal from the list of founders and (or) participants terminate from the date of amendments to the information about the legal entity contained in the Unified State Register of Legal Entities. A founder (participant) who has withdrawn from the founders (participants) is obliged to send a notice of this to the relevant legal entity on the day of sending information about his withdrawal from the founders (participants) to the registration authority.

The Foundation is recognized as a non-membership non-profit organization established by citizens and (or) legal entities on the basis of voluntary property contributions and pursuing social, charitable, cultural, educational or other socially beneficial goals. In the event of the death of one of the founders of the fund, the “share” of the deceased passes to the heirs. The procedure for accepting an inheritance and registering changes is the same as for private institutions.

An autonomous non-profit organization is an NPO that does not have a membership, created for the purpose of providing services in the field of education, healthcare, culture, science, law, physical culture and sports and other areas. An autonomous NPO can be created as a result of its establishment by citizens and (or) legal entities on the basis of voluntary property contributions. In cases provided for by federal laws, an autonomous NPO may be created by transforming a legal entity of a different organizational and legal form.

Property transferred to an autonomous NPO by its founders (founder) is the property of such NPO. The founders of an autonomous NPO do not retain rights to the property they transferred into the ownership of this organization. The founders are not liable for the obligations of the autonomous NPO they created, and it is not liable for the obligations of its founders.

Thus, in accordance with the already mentioned amendments to the Law on NPOs, unless otherwise provided by federal law and the charter of a legal entity, individuals and (or) legal entities have the right to join the founders (participants) of a non-profit corporation, the founders of a fund and an autonomous NPO with consent of other founders and (or) participants.

In other words, if the charter of an autonomous NPO does not prohibit the entry of new participants, the “share” of the deceased founder passes to the heirs. The heirs, in accordance with the procedure established by law (the detailed procedure is described above), enter into the inheritance, and then become part of the participants and distribute shares.

Registration of changes is carried out in the Ministry of Justice of Russia.

For your information

A certificate of the right to inheritance in case of inheritance by law is issued to the heirs at any time after six months from the date of opening of the inheritance (Article 1163 of the Civil Code of the Russian Federation).

1 Read about the algorithm of actions in the event of the death of one of the shareholders in the upcoming issues.

Urgently withdraw from the membership of participants (founders) in 2020

The urgency of leaving the membership is usually dictated by very important circumstances: you have learned that civil servants cannot be participants in commercial organizations, a conspiracy has emerged against you in order to shift all responsibility for debts onto you, the company is suffering losses and you need to get rid of it faster than others. There is simply a civil position: “I do not take part in the LLC either through actions or means, and I do not want to appear in the organization’s documents. And urgently - because time has appeared, and today.” Everyone's situation is different. But the solution is the same. It should be remembered that leaving the society can only be voluntary.

You can very quickly (in 1 hour) draw up a package of documents for leaving the company (if there are at least two participants), redistribute the share, and be in time for the notary and the tax office. If you try very quickly, you can get everything done today, today. It is important that all citizens of the LLC (exiting participant and manager), whose right to sign is required, are ready for action, and that there are original documents. If the manager is not ready to sign documents, there are options to exit without his participation.

Receiving starting documents by email will speed up the process. In addition, we can work online.

But if you are the only participant in the Company, you will not be able to urgently leave the LLC. In this case, you cannot leave the LLC at all. Then there are only two ways not to be listed as a participant (founder): liquidate the Society (this is the time) or sell your share to a third party (if you find such a citizen). There are a number of other legal solutions, but you’d better consult our lawyers about them.

Possibility of leaving the founders

An important aspect in this case is the voluntary action of the founder leaving the company. If these factors are feasible, then he can receive his share, after which all ties with the LLC will cease.

However, there are two circumstances under which the founder cannot leave the company:

- if he is the only shareholder in the authorized capital;

- in case of simultaneous withdrawal of the entire composition of the founders.

Given such factors, the company cannot exist and is subject to liquidation.

Cost of legal registration of exit from LLC

Design options are different. At least there are two of them.

① If you prepare documents in the usual (non-urgent) manner, and only with the exit of the participant, the cost will be 3,000 rubles .

② It is possible to register not only an exit, but also a redistribution of the share of the exiting participant to other participants at the same time. This will save time and money. Instead of two registration steps in MI Federal Tax Service No. 15, everything can be done in one step. The cost of preparation of all documents by lawyers will be 4500-7500 rubles . You should be aware of the costs of a notary.

We work according to the system: guaranteed results or your money back.

How to quickly leave an LLC of your own free will?

The main thing is to understand whether it is possible to leave the LLC at all. The legislation obliges each organization to stipulate in the LLC Charter the possibility or impossibility of leaving the Company. If the Articles of Association allow you to leave the LLC, this can be done. Moreover, regardless of the consent of other participants or society (manager). The share of the withdrawing participant may be transferred to the company or distributed among the remaining participants. The main thing is that the head of the organization participates in the preparation of documents for registration of changes occurring in the Unified State Register of Legal Entities.

First, you need to prepare documents (or copies) with which to come to an appointment with our lawyer. Within one hour, a package of documents for a quick exit from the LLC will be ready. Then it will be necessary to have the signature certified by a notary and send certain documents to the recipients (action plan below).

Documentation of the procedure

Since there is no approved application form for leaving the LLC , the document is drawn up in any form.

In its text it must include the following information:

- personal data about the identity of the founder (full name, residential address);

- name of the company and individual data of the head of the LLC;

- information about the size of the share that is listed in the constituent papers;

- justification for exit, based on the clause of the charter in which the founders are given the right to leave the organization;

- description of the reason for leaving the LLC.

The founder leaving the LLC may send an application for his removal from the shareholders by registered mail or via courier delivery, who are required to provide notification of its delivery. You can also come in person to hand over the application to an authorized person to verify its receipt.

How to leave if there is no contact with the director?

This is, of course, not the best option. But it is completely feasible if the LLC Charter contains a provision on the possible voluntary withdrawal of a participant. You (or your lawyer) must obtain a copy of the Charter and all amendments to it from the registration authority, and prepare an application with this document, sign it with a notary and send it to the registration authority. The exception is the situation when the participant is the only one.

If the registration authority cannot provide the Charter and all amendments to it, you will have to go to court. Our lawyers will also help with this; exclusion from the list of participants will be by court decision.

Change of LLC founder

1. Notifies the other participants of the company about the sale of his part in writing. Moreover, each member of the LLC has a preemptive right to purchase a share. 2. If the participants refuse to purchase a share, a certified waiver of the preemptive right to purchase the participant’s share is drawn up. 3. If the participant who is selling his share is legally married, then it is necessary to obtain the consent of the spouse to sell the share. The buyer will be required to provide the same documents. 4. The seller and buyer turn to the notary with a package of documents. The seller provides constituent documents that confirm his right to a share of the authorized capital of the LLC. 5. A notary certifies the sale and purchase transaction of a share. Within three days, he sends a notification to the registration authority with a request to make changes to the Unified State Register of Legal Entities.

A change of founder in an LLC can be accomplished without the involvement of specialized law firms. This process occurs at the request of the founder and by decision of the company's participants. In accordance with the norms of current legislation, there are several ways to change the composition of an LLC.

Interesting: How to make a car purchase agreement yourself

Documents for withdrawal from participants (founders) of LLC

To prepare documents on withdrawal from the membership of an LLC, you need:

- Citizen's passport (original) and TIN (a copy is possible);

- Charter of a legal entity and all amendments to it, certificate of state registration;

- Size of the share (extract from the Unified State Register of Legal Entities - can be obtained by specialists from our organization);

- Other information on the situation (to be determined by the lawyer).

! The procedure for leaving the Company (signatures) is certified by notaries using documents prepared by lawyers. The Charter and amendments to it in original copies are required!

Withdrawal upon application of the participant will take place in the following order:

- Providing copies of documents to lawyers: in person at one of the convenient offices of our center or by email

- Drawing up by a lawyer the necessary package of documents.

- Signing some documents without a notary, the other part - with a notary. Our lawyer will indicate the list of obligatory persons for notarization of signatures and the completeness of documents.

- Registration actions in MI Federal Tax Service No. 15 in St. Petersburg or in Vyborg (for companies registered in the Leningrad region).

- Sending notifications of changes to counterparties and the bank.

Payment of state duty is not required. In case of simultaneous distribution of the share of the exiting party, the minutes of the general meeting of participants are additionally submitted to the Federal Tax Service.

Change of founder and CEO at the same time in 2020

The successful completion of the simultaneous change of director and founder is associated with compliance with the specified algorithm. Even the most insignificant mistake can lead to a delay in the procedure and holding company officials accountable .

- Drawing up an application by a new participant . To do this, the joining partner must draw up an application addressed to the head of the company. In the document, he indicates the cost of the contribution, the size of the future share, as well as the method and timing of the contribution.

- Drawing up a decision or protocol on expanding the number of founders. The application is considered by the participants (including the only one). Each signature on a decision or protocol is certified by a notary. In the same document it is necessary to appoint a new manager.

- Registration of changes. Next, you need to draw up forms 14001 and 13001. The first contains information about the new founder and manager, and the second contains information about the changed authorized capital. Both statements are signed by the new manager in the presence of a notary. You will also need to print and staple a new version of the LLC charter in 2 copies and pay a state fee of 800 rubles. Documents (charter, statement, protocol or decision, form 13001 and 14001, receipt or payment order) must be submitted to the tax service no later than 3 days after the decision to change the manager is made. Registration is completed within 5 days, after which you can receive confirmation.

- Registration of the founder's exit. The participant leaving the LLC must file a statement of resignation from the company. It must be notarized. The remaining founders (participant) accept the application and instruct the accounting department to calculate the value of the share of the exiting partner. The amount is calculated based on data as of the previous reporting date.

- Registration of changes in the composition of founders. To do this, you need to fill out Form 14001, indicating information about the participant's departure. It is signed by the general director of the LLC in the presence of a notary. Next, the documents (application, form 14001, protocol or decision) are transferred to the tax service. This time you will not have to pay state duty. The registration period will be 5 days, after which you can receive ready-made documents.

Interesting: Requirements for storing documents in an organization in

Will quitting get rid of obligations? What's better?

The participants of an LLC (if we talk only about the founders, but not about the director) bear the rights and obligations specified in the Charter of such a Company. Basically, participants are liable for debts and are liable to the extent of the value of each share. For example, a participant has a share of 20%, the authorized capital is 10,000 rubles, respectively, the limit of liability is 2,000 rubles. But that's basically it. In reality, everything may be different. Legislation since 2020 has tightened liability for “culpable unlawful acts”, “inaction”, etc. In general, the responsibility of a participant is determined by many factors. For example, if there is a chapter “Major Transactions” in the Company’s Charter, the obligations of each participant further increase. We need to get to the bottom of things.

If leaving the LLC is feasible, most of the problems are usually resolved upon exit. Exceptions are those personal obligations that arose BEFORE leaving the Company.

If leaving the LLC is associated with liquidation (those who leave faster will not have to deal with liquidation actions), then this may be a solution to the problem. But everything must be done correctly so that the registration of a package of documents is not refused, and violations of the law are not proven. There are cases when the second participant who filed for withdrawal is registered in the Unified State Register of Legal Entities earlier than the first.

There is an option to transfer your share to interested parties. For example, sell it to one of the remaining participants or all those remaining in shares, and if they refuse to buy, find an interested party.

Leaving an LLC may be due to the need to urgently receive money. Then two options are possible: either to actually formalize the withdrawal from the membership and receive the actual value of the share (but, unfortunately, money cannot be quickly received without the consent of the Company), or to sell it on favorable terms to the participants or third parties (according to the rules specified in the Charter of the Company and not contrary to the law).

Features of exit in different situations

There are important points to consider when carrying out this procedure. Let's look at the most common of them.

Sole founder

It is unacceptable to remove from the LLC the only person who founded the company and is a single shareholder in the authorized capital. In order to leave the LLC, the owner of the authorized capital and receive his monetary share must declare liquidation or sell the organization to a third party.

Founding Director

If an LLC has only 2 shareholders, one of whom serves as the general director and wants to leave, then he can transfer his powers to another person after writing an application to withdraw him from the company.

This is done like this:

- The owner of a share of the authorized capital in the position of General Director submits an application for resignation in his own name.

- The next day, the remaining member submits an application for consideration and makes a decision in which the share of the retiring person is distributed among other members, and appoints a new person as general director.

- Information about changes is reflected in the approved form and, together with a package of documents, is sent to the Federal Tax Service. The applicant is the new general director.

Regular Member

An ordinary participant can leave the company only if there is a permitting indication for such actions, described in the charter of the LLC. He can also sell or donate his part, again if there is a corresponding clause in the text of the charter. If these points are missing, then the decision can be made by the board of directors.

There is nothing complicated in the procedure for leaving an LLC for founders. The only thing you need to do is to carefully draw up and fill out the documents, checking for errors. If you have doubts about your abilities, you can turn to specialists who will carry out the procedure for withdrawing the founder quickly and correctly.

The rules for selling shares in an LLC are described in the following video:

Articles on the topic

Parting with your property is sometimes as difficult as acquiring it. When a participant withdraws from the authorized capital of an LLC in 2019, there are a lot of nuances that need to be taken into account so as not to create problems for yourself and your business partners. Read about them in this article.

The exit of the founder from a limited liability company is regulated by the provisions of Article 26 of the Law “On LLC” and Article 94 of the Civil Code of the Russian Federation.

The legislation provides that:

- Withdrawal is carried out without the consent of other participants (founders). This possibility must be recorded in the company's charter. But even if this is not done, the founder has the right to be guided by federal rules of law.

- An individual or legal entity who is the sole founder can leave the LLC only as a result of the liquidation of the company.

- Unlike the sale of a share, exit from the company involves its alienation in favor of the company with further receipt of monetary compensation (payment).

Withdrawal of two participants from the LLC (out of three)

Any number of exits is possible, except for the last one. The paperwork procedure is normal, as described above. Moreover, if the participants are in different cities, this will also be possible to do, but it will take more time. We have already had situations where it was necessary to carry out a series of actions in different cities, then collect documents in one place and carry out further registration. Email and postal or courier delivery will be required. By the way, a new service has appeared from Russian Railways - delivery of postal correspondence by high-speed trains. In one city they handed over documents at the station, in another they met us. Faster than fast.

Change of the Charter, address, types of activities, etc.

Along with changes in the composition of participants, we advise you to put documents in order, update information and notify the Unified State Register of Legal Entities about such changes. In terms of cost, it will only be an additional payment, but in terms of importance and usefulness, everything will be in order, right away. If your LLC has an old-style charter, bringing the charter into compliance with the law will have to be done without fail. Supervisory authorities carefully check the actual location of the company indicated in the documents. If the address indicated in the Unified State Register of Legal Entities does not coincide with the actual one, when leaving the LLC with a simultaneous redistribution of shares, the registration authority may check the organization's address and refuse registration. Therefore, it is important and necessary to strictly follow the law and fulfill its requirements. Checks are sent to the address in 8 cases out of 10.

Change of participant and general director from LLC

Thus, a change of director and changes in the composition of the founders are made. At each stage, you need to fill out applications, reflect innovations in the Unified State Register of Legal Entities, and untrained workers can get confused in the documentation. By transferring responsibilities to RosCo consultants, you get rid of risks and can be confident in the result.

Any company may experience structural changes in its composition.

For an LLC, a situation is likely in which rotations affect both the founder and the management. It is complicated by the need to simultaneously perform many organizational actions. Changing a founder and changing a director are different procedures, but they are interconnected, and only a qualified expert can correctly build a sequence of steps.

Interesting: Can an organization give an interest-free loan to the founder?

Dividend payment

The calculation of the amount to be paid is prescribed in the Law “On LLC” in clause 6.1 of Art. 23. But this is not simple math by multiplying net assets by share size. You must first establish the size of your net assets. You can read more about this in the law. In life, everything is much more complicated. In situations where society has no money at all to pay, you can ask for property of the same value. In this case, the participant receives income, which in some cases will be taxed.

The second option is to write in the application that the participant leaving the company refuses to receive dividends. At the same time, the company will have an income in the same amount. What should an accountant do with taxation? There are a number of letters from the Ministry of Finance, and, of course, the Tax Code. For different situations, society's taxes will be different.

There are two situations when the company does not have the right to pay the value of the share in cash or in kind: if the company already shows signs of insolvency. bankruptcy, or if payment would result in these symptoms.

Guarantees and convenience for customers

Our clients have been receiving professional assistance since 2000. The services of lawyers and advocates have been certified by the St. Petersburg Certification Center “Petersburg Quality Mark”. The team of the legal center "Advekon" received a mark of quality of services.

There are several offices (metro Akademicheskaya, metro sq. Muzhestva, metro sq. A. Nevsky, metro Udelnaya, metro Frunzenskaya), the service can be ordered at any of the offices (Kalininsky, Central, Primorsky, Moskovsky district of St. Petersburg ) or online.

We serve all areas of St. Petersburg and the Leningrad region.

We work according to the system: guaranteed results or your money back.

Contact us. We are ready to help you.

Step-by-step instructions for removing a participant from the founders of an LLC in 2020

Step-by-step instructions for removing a participant from the founders of an LLC by withdrawing upon application and transferring his share to the company with subsequent distribution among the remaining participants of the company, the instructions have been updated and contain all the changes for 2020.

The withdrawal of a participant from the founders upon application, in contrast to the method with notarized registration of the purchase and sale of a share, is quick and economically profitable. A member of the company writes a statement of resignation, after which his share is transferred to the company, followed by notarization of the statement and given 5 working days to register with the tax office. Let's consider the procedure for removing founders from the LLC.

The main advantages of this method are as follows:

- Minimal financial costs for registration, notarization and registration of changes;

- No state duty for registering changes;

- Fast processing (7 working days);

- The applicant is the general director (frees the founder from the need to spend time on a notary and the tax office).

Step-by-step instructions

The very procedure for removing a founder from an LLC requires the company to follow a certain procedure, which is justified by law. The regulations contain instructions on observing time frames and making decisions on a number of certain legal issues. In addition, it is necessary to carry out measures to provide the necessary documentation to the relevant government agencies in order to make changes that have occurred in the composition of the founders.

The legal procedure established by law for leaving the founders of an LLC consists of several stages that must be followed in a certain order:

- The founder writes a statement of resignation from the LLC and has it notarized.

- Confirmation of the spouse’s consent to the applicant’s exit from the LLC is drawn up at the notary’s office if the founder leaving the organization is married.

- Then he must send the application to the founders’ society through the head of the organization or another authorized person.

- The board of directors of the LLC, which includes owners of shares of the authorized capital, decides at the meeting to satisfy the request of the retiring member. A protocol on this is drawn up at the meeting.

- Preparation and transfer of a package of title papers from the LLC to the Federal Tax Service inspection in order to make changes in registration records. Employees must re-register data in registration records for a five-day period, starting from the moment they receive documentation from the company.

- The LLC receives a certificate from the Federal Tax Service on the changes made and a new extract from the Unified State Register of Legal Entities.

- With the received new documents about the changes, you must contact the banking institutions to notify them of the change that has occurred.

- Accrual and payment of compensation for the share of the withdrawing participant within a 3-month period from the date of acceptance of the application.

The procedure and rules for conducting the process of withdrawal of a participant from the LLC are discussed in the following video:

https://youtu.be/wR8rKnqrgfo

How to remove a founder from an LLC step by step

First step: Preparing documents to register changes to the participant's output

- Statement on withdrawal of participants. A company participant leaving the founders must write a statement addressed to the general director about leaving the LLC founders. This application must reflect the size of the share of the authorized capital that will be transferred to the company and have it notarized. According to the legislation of the Russian Federation, a participant is considered to have left the Company from the moment the application is completed and notarized. An application for the withdrawal of a participant from the company is subject to mandatory notarization by a notary.

- Minutes of an extraordinary general meeting of participants or a decision on the distribution of the company's share. The main agenda in the minutes is the distribution of the share in the authorized capital of the Company owned by the Company among all participants of the Company. The share remaining after the withdrawal of a participant can be distributed among the remaining participants in proportion to their shares in the authorized capital; sold to a member of the Company or a third party, or may be retained by the Company for a year.

- Fill out the application form No. Р14001. If, when registering the withdrawal of a participant, changes affecting the constituent documents are not submitted at the same time (change of legal address, OKVED codes, name of the company), then it is necessary to use application form No. P14001. When registering changes in Form No. P14001, the state duty is not paid, and a new version of the charter is not developed. If there is a need to simultaneously carry out the changes described above, then application form No. P13001 will be required, with payment of the state fee and two copies of the new edition of the charter.

Second step: Certification of documents by a notary

Before submitting documents to the tax office, a notarization of the registration application will be required. The applicant will be the current general director of the company. The appearance of the founder leaving the company before the notary is mandatory!

Before visiting a notary, you will need to obtain a current extract from the Unified State Register of Legal Entities, no older than 10-15 days. Prepare all the documents described above, as well as take a complete set of constituent documents (certificates of state registration, registration, current charter, protocol or decision on the appointment of the general director, etc.)

The average cost of notary services is 1,700 rubles. for certification of the form, 3 100 certification of the participant’s withdrawal application. If an authorized person will submit and receive, you will need a notarized power of attorney and a copy of the right to submit and receive documents + 2,400 rubles. for a power of attorney.

Third step: Submitting documents to the tax office

It is necessary to go to the registering tax authority (in Moscow this is Federal Tax Service No. 46, which is located at the address: Moscow, Pokhodny Proezd, building 3, building 2. Tushino District), receive a coupon in the electronic queue and submit the prepared documents for registration of changes .

To register changes to the tax office you must submit:

- A copy of the statement of withdrawal of participants certified by a notary;

- Minutes of an extraordinary general meeting of participants or a decision on the distribution of the company’s share;

- Application in form No. P14001, certified by a notary.

After submitting documents for registration, we will receive a receipt confirming the acceptance of documents; after five days, according to the receipt, you must receive the finished documents.

Fourth step: Receiving ready documents

On the sixth working day, you must go to the tax authority and receive the completed documents by receipt.

You will receive a new entry sheet in the Unified State Register of Legal Entities with all registered changes.

The procedure for the founder to leave the LLC

Correct and timely execution of documents at each stage is a guarantee of successful completion of the exit from the founders of the company. In 2020, this requires going through the following stages:

- Notifying the head of the company by submitting an application;

- Preparation of necessary documents for government agencies;

- Filling out an application on form P14001 ();

- Sending a package of documents to the Federal Tax Service;

- Receiving documents on changes to the Unified State Register of Legal Entities from the tax office.

Notarized documents are submitted to the tax service:

- Completed application forms (form for individuals + form for legal entities);

- The company's decision on the distribution of shares;

- Extract from the Unified State Register of Legal Entities (term – no more than 5 calendar days);

- Company Charter;

- Manager's passport;

- A copy of the employment agreement, contract, order appointing a person as general director;

- Certificates recording the fact of registration of the company and its state registration;

A package of documents can be submitted to the tax office in person, through a special electronic form on the website, or sent by registered mail. This is done within one month from the date of withdrawal of the participant from the LLC.

IMPORTANT! Carefully check all the data in the papers: numbers, number of pages, signatures, dates

After reviewing the documents, Federal Tax Service employees enter the data into the Unified State Register of Legal Entities (USRLE). The company must then notify its partners and creditors of changes in the composition of the founders.