What is account 60 used for in accounting?

The current Chart of Accounts establishes that settlements with suppliers and contractors must be carried out using account 60.

Here, transactions involving the receipt of goods, works, services from counterparties, and the amount of allocated VAT are recorded, if these companies work with VAT.

The use of account 60 involves reflecting on it advances for the next receipt of goods, as well as making payments for material assets already received or services rendered, work performed.

Attention! Thus, the information reflected on account 60 allows you to find out the status of mutual settlements with each supplier, and the balance on the account reflects either the amount of debt that the company must transfer to these companies, or the cost of goods, works and services expected to be received.

The same account reflects material assets that came to the company without documents being issued for them from suppliers, that is, uninvoiced supplies.

Systematization issues related to lending

Basic accounting questions arise in situations where the usual order of things is disrupted or controversial interpretations may arise in the assessment of an accounting event: for example, when the actual receipt of inventory items and document data do not coincide or when the work has already been accepted, but invoices for it have not yet been received. A number of such questions can be answered in detail.

Actions of an accountant in case of receipt of valuables (works, services), but no invoices for them

This situation can happen if, for example, a person holding the position of head of an organization for some reason refuses to pay for goods received or work completed and accepted (the work was carried out with defects, goods and materials do not correspond to the declared quality). If it is assumed that the goods are subject to return, of which suppliers will be notified, then the accountant makes an entry on the off-balance sheet account with debit 002: “Inventory and materials accepted for safekeeping.”

Another difficulty arises when inventory items are not returnable, but the price is unknown. If valuables are recognized as having come into ownership, then they are subject to capitalization, which presupposes the extension of material responsibility to them and assigning it to certain persons. For capitalization, it is necessary to apply the prices of contractors or suppliers to inventory items. If the accompanying documents contain these prices, then no questions arise. However, in the absence of a price, accountants often refuse to immediately capitalize inventory items, explaining this by waiting for invoices with prices.

Such a “suspended” state of inventory items can be regarded during an audit as artificial and created for selfish purposes.

There is an explanation for this interpretation. Goods not received under a plausible pretext complicate inventory and facilitate the manipulation of financial results within the company, and outside it, it allows underpayment of property taxes.

https://youtu.be/s43mWPvFBL0

To avoid suspicion, in practice it is recommended in any case to put inventory items on the receipt:

- first of all, focusing on the terms of the supply contract and the prices specified therein,

- in the second - if prices are not indicated in the contract - focusing on the prices indicated in the documents of the last similar receipt of the same goods and materials,

- thirdly, if we are talking about a new, previously unpurchased product, for expert assessment.

An expert assessment presupposes the presence of an expert or an authorized person in the organization, but this does not always happen. In such a situation, the accountant himself takes on the function of an expert, and the accountant clarifies the entries made on the basis of his assessment after receiving the documents from the supplier.

Discrepancy between the actual state and the data of the documents for incoming goods and materials and the work performed

When a discrepancy is detected between the actual quantity and/or quality of goods and materials and those characteristics provided for in the contract, the buyer must notify the seller of this discrepancy. In order for the contractor to be held liable for violations of the terms of the agreement, the buyer must do this within the time period specified by the contract or legislation. If the period is not established at the contract level, then within a reasonable time period that is determined for a particular industry in accordance with the Civil Code of the Russian Federation. It also defines the extent and forms of liability for non-compliance with certain contractual conditions (depending on the type of violation).

However, the contractor (supplier) may not admit the violation or admit it only partially, which delays the consideration of the issue. An accountant in such a situation, despite the identified discrepancy with the contract, must still credit account 60 based on the results of the presented invoice. The deficiency itself is documented in an act, after signing which the accountant makes an entry:

- by debit 76.2 “Calculations for claims”,

- under loan 60 “Settlements with suppliers and contractors”.

Account 76.2 is used to account for the financial consequences of violating the terms of an agreement with claims:

to suppliers and contractors, as well as transport organizations, if a difference is found in the invoices and the contract for the prices of goods and materials or work (services) and if arithmetic errors are discovered;

- to suppliers and transport companies if loss during transportation exceeds natural loss (compared to standard indicators);

- to suppliers of goods and materials or to those companies that process materials for the organization, if non-compliance with quality standards or technical specifications is detected,

- to suppliers (contractors) for downtime and defects, as well as on issues of fines, penalties, penalties, in amounts that are recognized by the payer himself or determined by a court decision.

In this scheme, the supplier (contractor) is still the creditor for the full amount of his invoices, and the amount of accounts payable remains the same until the creditor admits the fact of violation of the agreement and the extent of the damage. In this case, the amount that consists of the claims made is also necessarily reflected by the buyer.

If the person to whom the claim is sent does not recognize it, then the balance on account 76.2 is recorded until the court decision, after which either payment will follow or the disputed amounts will be written off at a loss.

Does acceptance of a supplier's invoice mean the occurrence of accounts payable “by default”?

Invoices that come from suppliers (contractors) are accepted by the managers of the organization, who in this case make an indicating mark with their signature for the accounting department, and the accountant (which is also implied by the accountant’s job description) is obliged to credit account 60. The account is credited for all amounts payable ( including VAT), and if partial acceptance occurs, then only for those amounts that correspond to the accepted part.

In this situation, the fact of receipt of an invoice is considered as an offer, and if management gives instructions to credit invoice 60 - that is, accepts the offer - then this automatically means the occurrence of accounts payable even before the actual receipt of goods and materials (acceptance of work). By accepting invoices, the organization also accepts the proposal of the supplier (contractor), and, therefore, the obligation to partially or fully pay them. However, this raises questions about the account that needs to be debited. Here you cannot debit the following accounts: “Materials” (10), “Goods” (41), “Completed stages...” (46), etc.

The point is not only that materials and goods have not yet arrived, and work stages have not yet been completed. The point is also that the very fact of accepting an invoice does not mean a transfer of ownership of the recipient’s goods and materials, and storekeepers working under a liability agreement cannot accept missing goods. Therefore, in such a situation, it is advisable to debit “intermediary” account 15 – “Procurement and acquisition of material assets.” “Intermediary”, because after the actual receipt of goods and materials and acceptance of work, this account is credited (closed), and accounts 10, 41, 46 and other accounts of material assets are debited.

Characteristics of account 60 “Settlements with suppliers and contractors”

Legislative norms determine that account 60 “Settlements with suppliers and contractors” is an active-passive account, which can have two balances - on the debit and credit of the account.

That is, both receivables and payables are indicated here:

- A credit balance on account 60 means that the company has unfulfilled obligations to transfer funds for previously received goods, works, and services.

- A debit balance on account 60 means that organizations that are suppliers of work, services, and material assets in relation to the company where accounting is kept have not fulfilled their obligations.

The credit of account 60 shows the receipt of material assets from supplier companies, the cost of work performed by contractors as provided for in contracts, and the cost of services provided. At the same time, the cost of goods, works, and services received under contracts may include amounts of input VAT that must be paid to suppliers.

The debit of account 60 reflects the payment under contracts within the deadlines established therein. This can be either an advance payment, which is reflected in advances paid, or payment for goods supplied. Payment can also be made using bills of exchange.

Determining the account balance depends on what the balance was at the beginning:

- If it is debit, then you need to add the debit turnover to it and subtract the credit turnover. The final balance must be reflected in debit if it is at the beginning in debit plus the debit turnover is greater than the turnover in the credit account. Otherwise, the balance must be reflected on the credit of the account.

- If the initial balance is a credit balance, then the credit turnover of the account is added to it and the debit turnover is subtracted. The same rule applies here: if the excess goes to debit, then the final balance will be debit, otherwise it is the balance on the credit of the account.

Attention! Account 60 balances are shown in different sections of the balance sheet. The debit balance must be taken into account as part of accounts receivable in the assets of the balance sheet, and the credit balance in the liabilities of the balance sheet must be included in accounts payable.

General methodology for accounting calculations

Accounting for settlements with suppliers (contractors) in its methodology is based on the rule of E. Desgrange, which states: Whoever receives is debited.

Whoever issues it gets credit.” Both debts (receivables and payables) can arise from any type of settlement between an organization and a counterparty. In this case, the main type of debt obligations are considered to be obligations with suppliers (contractors). Suppliers (contractors) are enterprises that supply goods and materials, materials, raw materials, provide services, and perform work. Calculations are made as a result of and after shipment of goods and materials or, with the consent of the recipient, simultaneously with shipment. The form of payment for supplied goods and materials and services provided is chosen by the organization independently and is specified in the agreement between the parties.

The majority of payments are made by bank transfer. Transactions with cash take place mainly when selling goods at retail to the public, when trading in small wholesale, when paying for labor, etc. Non-cash transactions occur by transferring money to the recipient’s account from the payer’s account through banking institutions.

Settlement transactions are consequences of contractual relations that reflect agreements for the supply of goods and materials, performance of work and provision of services. Depending on the customs of doing business, fixed by the contract, payments can be made on an advance payment basis (when the buyer pays for the goods before shipment), upon receipt or after the fact (when the goods or work are paid after the actual delivery). For accounting, this means that receivables or payables systematically arise. In practice, this usually raises questions of compliance with settlement and payment discipline and the specifics of accounting for accounts receivable and accounts payable.

Accounts receivable

This debt includes funds and property resources that other persons owe to the entity organization that maintains accounting records. The subject organization in this situation acts as a creditor, presenting claims to debtors, which include persons (legal entities and individuals) who owe the organization money, assets or their equivalent.

In monetary terms, such debt refers to the organization’s current assets, and its increase means the diversion of working capital. The creditor (entity organization) reflects the reduction (repayment) of this debt synchronously with the actual receipt of money from the debtor, upon acceptance of work or when offsetting mutual claims.

To create financial statements, accounts receivable are usually classified:

- For objects in connection with which debtor obligations arose.

- On timely payment of debt.

- By maturity date.

- According to the criterion of a normal operating cycle. This cycle is the period of time that passes between the acquisition of supplies necessary for the implementation of activities, on the one hand, and the receipt of funds from the sale.

Based on the last two criteria, two more types of debt can be distinguished:

- Current, which includes the amount of receivables arising in the normal operating cycle or intended to be repaid within 12 months (year) from the balance sheet date. (This also includes debt that lasts more than a year but is expected to be repaid during the normal operating cycle).

- Long-term, which violates previous conditions.

If current debt is expected to be collected one year from the balance sheet date, the combined amounts of each asset that are expected to be received both before and after 12 months (year) from the balance sheet date must be disclosed.

When current accounts receivable are related to the sale of goods, works, services, they are presented in the balance sheet as separate items (in accordance with the type of sale as part of current assets). When debt is not related to sales, its types are reflected in the balance sheet as separate items. Types not related to sales include debts on advance, budget and internal payments, as well as on accrued income.

Accounts payable

This debt includes the entity's debts to creditors: other companies, employees. The reasons for accounts payable are circumstances related, for example, to payment to suppliers (contractors) of goods and materials received from them, accepted work (services), payment of a commercial bill, transfer of property as an advance or prepayment, payment of taxes and budget contributions and other obligations.

Accounts payable includes three main groups of debts of the subject organization:

- to the budget and social funds - taxes and equivalent payments that were assessed but not paid on time,

- to the staff - wages and compensation payments,

- to suppliers (contractors) for received but not paid goods and materials, works, services and debts to the founders for the payment of dividends.

In addition to the listed calculations for debt obligations, calculations for personal and property insurance, deposited amounts and claims, and various types of income are subject to accounting. In addition, free accounting reporting is maintained with creditors and debtors belonging to a group of interrelated organizations.

Settlements with suppliers and contractors

Between suppliers (contractors) and the subject organization, economic relations (both directly and indirectly) are established by:

- concluding direct agreements (agreements, contracts),

- centralized procurement of goods and products by logistics enterprises,

- conducting transactions through wholesale intermediary companies.

https://youtu.be/-RVSxUrxrNQ

If there is at least one intermediary between enterprises, the connections are classified as indirect. But direct connections are considered more economical and, thanks to this, more progressive. They not only reduce the cost of inventory and materials, but also reduce service costs (document flow, distribution costs), and also stabilize the interaction process - deliveries become more regular, and the relationship between the recipient and suppliers is strengthened. The economic feasibility of direct supplies is especially noticeable in conditions of large-scale consumption of material resources. However, if the enterprise does not require volumes comparable to the volumes of the supplier’s transit form of shipment, then in order not to accumulate excess material assets, immediately deciding on a large purchase, it makes sense to resort to the services of intermediaries or choose a combined form.

Correlating with the criterion of “direct-indirect” connections is the division into forms of supply organization: transit and warehouse.

- The transit form involves the direct movement of products from the supplier to the recipient without reloading at intermediate warehouses of intermediaries, which speeds up delivery and reduces transportation costs. However, this form has restrictions on transit vacation standards.

- The warehouse form involves the delivery of products to the warehouses of intermediaries with their subsequent distribution to consumers. This makes it possible to order smaller volumes more often and not accumulate excess material resources. However, with this form, the costs of warehousing, storage and transportation increase.

If we compare relationships with suppliers according to the criterion of duration, then short-term forms are considered less progressive, since with long-term forms of relationships the parties have more opportunities to improve products and reduce their material intensity.

All settlement relationships with suppliers (contractors) in the accounting department of the subject organization are reflected in account 60 “Settlements with suppliers and contractors”, where all information on the described processes is summarized.

What subaccounts are used?

According to the standard working plan of accounts, sub-accounts can be opened for the account:

- Advances issued - information on settlements is shown here when the company makes preliminary transfers under concluded contracts.

- Urgent—shows settlements with suppliers whose shipment of goods and materials is not yet due for payment.

- Settlements on bills issued - used if payment for goods supplied is carried out using bills of exchange.

- Calculations for uninvoiced deliveries - shows the receipt of goods from the supplier without documents issued for delivery.

- Settlements on documents for which payment is overdue - it is very important to keep records of overdue accounts payable. Within a subaccount, subaccounts can be formed with designated periods (up to 45 days, 45-90 days, over 90 days).

You might be interested in:

Fixed assets in accounting and tax accounting, main changes in 2020

If settlements with counterparties are carried out not only in Russian rubles, but also in foreign currency, it is advisable to open separate sub-accounts for these operations:

- Settlements with suppliers and contractors in foreign currency;

- Settlements on advances issued in foreign currency.

Each company, taking into account the specifics of its activities, can open other sub-accounts to account 60 (commercial loan, etc.)

Attention! Within these subaccounts, analytical accounting can be maintained for each supplier separately. Sub-accounts can also be opened based on contracts concluded with the supplier.

Any enterprise in the process of work uses the services of third-party suppliers and contractors. The enterprise receives inventory items (raw materials, materials, spare parts, etc.) from suppliers. Contractors of an economic entity perform construction, research and repair work and provide services (supply of heat, water, gas, electricity, etc.) necessary for the implementation of the production activities of the economic entity.

Obligations for settlements with suppliers and contractors arise between organizations under transactions formalized by purchase and sale agreements, which include a supply agreement. In terms of content, these agreements must comply with the requirements formulated in Art. 455, 506 and other Civil Codes of the Russian Federation. For the formation of accounting information, information about deliveries is of particular importance: name of the product, its quantity, price, forms of payment, delivery and payment terms, transportation conditions, the moment of transfer of ownership of purchased goods, materials and other property from the seller to the buyer.

Due to the discrepancy in the timing of the parties to the contract fulfilling their obligations, depending on the terms of the contract, an economic entity may develop both payables and receivables when making payments to suppliers and contractors.

Accounts payable to suppliers and contractors are a consequence of the fulfillment of contractual obligations by organizations as a result of a transaction, upon completion of which the seller receives the right to claim payment.

Accounts receivable from suppliers and contractors are a consequence of payment for products (works, services) by the buyer and customers before the seller fulfills its obligations under the contract.

To account for settlements with suppliers and contractors, account 60 “Settlements with suppliers and contractors” is used.

It collects information about payments for:

- received inventory items;

- completed and accepted work;

- consumed services, including the provision of electricity, gas, steam, water, etc., as well as services for the delivery and processing of material assets, payment documents for which are accepted and subject to payment through the bank;

- inventory items, works and services, payments for which are made in accordance with scheduled payments;

- inventory items, works and services for which payment documents were not received from suppliers or contractors (for so-called uninvoiced deliveries), etc.

Sub-accounts can be opened to account 60 “Settlements with suppliers and contractors”: “Settlements for advances issued”, “Settlements for bills issued”, etc. The organization must determine the number of sub-accounts and their names independently and consolidate this in the accounting policy.

Analytical accounting for account 60 “Settlements with suppliers and contractors” is carried out for each submitted invoice, and in terms of settlements in the order of scheduled payments - for each supplier and contractor.

At the same time, the construction of analytical accounting should ensure the ability to obtain the necessary data on suppliers:

- on accepted and other payment documents, the payment deadline for which has not yet arrived;

- for settlement documents not paid on time;

- for uninvoiced deliveries;

- on advances issued;

- on bills issued, the payment period of which has not yet arrived;

- on overdue bills of exchange;

- on received commercial loans, etc.

All transactions related to settlements for acquired material assets, accepted work or consumed services are reflected in account 60 “Settlements with suppliers and contractors”, regardless of the time of their payment.

The formation of debt to suppliers and contractors for material assets supplied and services rendered is reflected in account 60 “Settlements with suppliers and contractors” for the loan; the amount of fulfillment of obligations to suppliers and contractors - by debit.

The basis for recording transactions on account 60 “Settlements with suppliers and contractors” are properly executed primary source documents.

The basis for accounting for accounts payable to suppliers are settlement documents (invoices, invoices) and documents evidencing the fact of the transaction (invoices, receipt orders, acceptance certificates, acts of completion of work and services, etc.).

The credit to account 60 “Settlements with suppliers and contractors” includes the amount indicated in the settlement documents, within the limits of the amounts accepted for payment (accepted).

For the amount of supplier invoices presented and accepted for payment, including VAT, the following is recorded:

Debit account 10 "Materials"

Debit account 15 “Procurement and acquisition of material assets”

Debit account 20 "Main production"

Debit account 26 “General business expenses”

Debit account 97 “Future expenses”, etc.

Debit account 19 “Value added tax on acquired assets”

Credit account 60 “Settlements with suppliers and contractors.”

If shortages are detected in incoming inventory items, discrepancies in prices stipulated by the contract, and arithmetic errors, account 60 “Settlements with suppliers and contractors” is credited for the corresponding amount in correspondence with account 76 “Settlements with various debtors and creditors”, subaccount 2 “ Claims settlements."

In the case of receipt and registration of materials (work, services) in the absence of accompanying documents from the supplier (uninvoiced deliveries), the debt to the supplier is determined based on the accounting price accepted by the organization. After receiving settlement documents for uninvoiced deliveries, their accounting price is adjusted taking into account the data specified in the received settlement documents (see topic 6).

To repay debts to suppliers and contractors, an economic entity can use cash and non-cash forms of payment, as well as non-monetary forms of payment (commodity or financial bills, under an exchange agreement, through mutual settlements, through the assignment of claims).

Economic entities independently choose forms of payment for supplied materials, products (works, services) and provide for them in contracts concluded with suppliers and contractors.

Payment for materials (products, work, services) in cash in accordance with the terms of the contract can be made either after receipt and registration of materials (work, services) - subsequent payment, or before receipt of materials (work, services) - advance payment.

When making payments in cash, the primary documents confirming settlements with suppliers and contractors are payment orders, cash receipts and debit orders, and cash receipts. When repaying accounts payable to suppliers and contractors after receipt and acceptance of materials (work, services), the amounts indicated in the payment documents are reflected in the accounting records:

Debit account 60 “Settlements with suppliers and contractors”

Credit account 50 "Cashier"

Credit account 51 “Current accounts”

Credit account 52 “Currency accounts”

Credit account 55 “Special bank accounts.”

When transferring funds to suppliers and contractors in advance on account of the upcoming delivery of materials (works, services) - in case of prepayment - accounting for prepayments (advances issued to suppliers and contractors) is carried out on account 60 "Settlements with suppliers and contractors" in a separate subaccount "Settlements for advances issued."

Accounting for advances issued is carried out separately in separate analytical accounting registers in order to obtain information about settlements with specific suppliers and monitor their status. The amounts of advances issued are transferred by payment order from current and other bank accounts.

An entry is made for the amount of advances (prepayments):

Debit account 60 “Settlements with suppliers and contractors”, subaccount “Settlements for advances issued”

Credit account 51 “Current accounts”

Credit account 52 “Currency accounts”

Credit account 55 “Special bank accounts”, etc.

The amounts of advances transferred to suppliers and contractors are recorded in the debit of account 60 “Settlements with suppliers and contractors”, subaccount “Settlements for advances issued” until the supply of inventories or the volume of work stipulated by the contract is fully completed and documented and services. For goods received and work performed, confirmed by documents, a debt arises to suppliers and contractors, which is reduced by the amount of previously issued advances, i.e., the previously issued advance is offset.

At the same time make a note:

Debit account 60 “Settlements with suppliers and contractors”

Credit account 60 “Settlements with suppliers and contractors”, subaccount “Settlements for advances issued”.

If the supplier fails to fulfill its obligations to supply prepaid materials (works, services), the advance amounts are returned by the supplier to the buyer's bank account. Such an operation is formalized by a payment order, which must indicate the basis (the number and date of the payment order according to which the receipt of the advance was recorded, as well as the number and date of the agreement).

The supplier's return of unused advance amounts is reflected in the accounting records as follows:

Debit account 51 “Current accounts”

Debit account 52 “Currency accounts”

Debit account 55 “Special bank accounts”, etc.

Credit account 60 “Settlements with suppliers and contractors”, subaccount “Settlements for advances issued”.

When making settlements with foreign suppliers for purchased imported materials (work, services), in the event of a discrepancy between the moments of occurrence and repayment of accounts payable in account 60 “Settlements with suppliers and contractors”, an exchange rate difference is formed.

Exchange differences are included in other income and expenses by entries:

Debit account 60 “Settlements with suppliers and contractors”

Credit account 91-1 “Other income - if a positive exchange rate difference occurs,

Debit account 91-2 “Other expenses”

Credit account 60 “Settlements with suppliers and contractors” - if a negative exchange rate difference occurs.

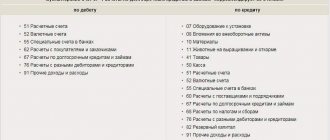

Which accounts does it correspond with?

The current instructions establish that account 60 can correspond with the following accounts:

By debit:

- With account 50 — Payment in cash.

- With account 51 – Payments are made by non-cash payment.

- With account 52 — When payments are made through a foreign currency account.

- With account 55 – special invoices are used for payment.

- From accounts 60, 62, 76 - under mutual settlement agreements.

- From account 66 - when payment is made using borrowed funds.

- With account 79 - when the parent company pays for organizing the account.

- With account 91 - overdue accounts payable are written off.

- With account 99 – debt write-off in emergency circumstances

By loan:

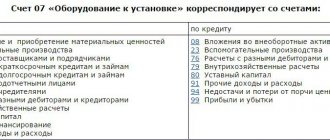

- With account 07 - purchase of equipment that requires installation.

- With account 08 — acquisition of fixed assets.

- With account 10 - purchase of materials.

- With account 15 - when the receipt of materials is recorded using this account.

- With account 19 - when allocating incoming VAT.

- With account 20,23,25,26, 29, 44 – when works and services are purchased.

- With account 41 - upon receipt of goods that will be resold in the future.

- With account 50,51,51, 55 - upon return of overpaid amounts.

- With account 60, 76, 79 - for mutual settlements.

- With account 91 – when writing off overdue accounts receivable

- With account 94 - when a shortage of supplies from suppliers is identified.

- With account 97 - when recording expenses that are subject to distribution over a certain period (for example, rent, compulsory motor liability insurance, etc.)

Questions about systematizing debit entries

The bulk of practical issues are related to the reflection of payment by bills of exchange and prepayment.

Payment by bills

The fact of shipment of products to the buyer means the sale of goods regardless of the form of payment for the shipment. There may be an exception to this logical rule due to the accounting policy of the enterprise, when for tax purposes the moment of payment for the goods is selected as the moment of sale. Then the receipt of a bill of exchange, instead of money, is not recognized as a sale and is regarded as a transformation of goods and materials into receivables. Such an interpretation can be explained by the requirements of prudence (PBU 1/98), but in this case any sales should be considered not based on the fact of shipment, but on the fact of payment.

A situation may arise where a supplier's invoice is paid by a third party's bill of exchange. In this case, the payment is considered a sale, and to reflect the bill payment in practice, a new account is created - the “Bills Issued” subaccount. It retains accounts payable to the seller (supplier), but in a larger volume, since interest is added for deferred payment.

To correctly account for interest, there are several options for choosing a debit account, each of which has its own specific advantages and disadvantages.

- Account 44 “Sales expenses” or cost accounts. The issuance of a bill of exchange here imposes an obligation to pay goods and materials at a higher price, however, interest costs relate to the entire period of validity of the bill of exchange, and not to the time of its issuance.

- Account 91.2 “Other expenses”. Here the situation is similar to the previous option, but interest expenses are not included in the cost price, which underestimates the total cost of the commodity mass.

- Account 97 “Deferred expenses”, which involves writing off interest on the bill of exchange during the period of validity of the bill of exchange. Expenses are distributed more evenly, but work is added to distribute the amounts.

- Account 41 “Goods”, which is explained by the calculative status of this account and the requirement to reflect on it the actual cost of purchased goods. In this option, the conditions for the assumption of temporary certainty and continuity of activity are met, but the accounting of transactions with goods is complicated. The increase in accounting nomenclature is especially noticeable when accounting according to the natural value scheme.

- Account 60, but only for the cost of goods and materials without interest, and interest is calculated at the end of each reporting period. In this case, there is no need to maintain the “Bills issued” subaccount, but the amount of credit debt is reduced compared to the actual one.

The choice of option depends on the accounting policy of the organization, however, when forming it, it is necessary to take into account regulations and accounting regulations.

Prepayment

The meaning of prepayment in the context of accounting comes down to the fact that until the actual provision of services or the transfer of goods and materials into the ownership of the buyer, the money already paid for them creates a receivable for the payer. Repayment of such debt will take place at the time the supplier ships the valuables and transfers ownership of them to the recipient. The peculiarity of accounting in this situation is that account 60 is first debited, and after the transfer of ownership it is credited.

Prepayment, according to the norms of the Civil Code of the Russian Federation, can be made either in full or in part. In case of partial prepayment, it is considered as an advance. In this case, both full prepayment and partial in the advance status are reflected in account 60 in the expanded form of debts: receivables - in assets, creditors - in liabilities. Therefore, both the advance and the prepayment are reflected in a separate subaccount “Advances and prepayments”, and upon receipt of goods and materials and works (services), this amount is offset against the subaccounts: Debit 60 – Credit 60 in the subaccount “Advances and prepayments”.

https://youtu.be/YYW8_wGPqpU

Balance sheet for account 60

Account 60 is active-passive, that is, it can simultaneously contain both debit and credit balances. In order to track their formation, it is advisable to keep records for each supplier.

Modern software products for accounting allow you to build registers to review calculations for the general account, for subaccounts, and also allow you to create a balance sheet for each individual supplier.

The balance sheet for account 60 is an accounting register. The law does not define a special form for this type of document, but it establishes a list of mandatory details:

- Company name, register name;

- Start and end date of the register, period of compilation;

- The value of monetary measurement;

- Signatures and names of responsible persons.

When creating a statement for account No. 60, you must adhere to the following rules:

- When generating debit turnover, all operations to repay the debt to the supplier, or prepayment for work or services are indicated there. It is also necessary to indicate here information about all payment documents - orders or cash settlement orders on the basis of which the payment was made. Also in this turnover it is necessary to show the operations of offset of claims, as well as the return of goods to the supplier.

- When forming credit turnover, all operations for the acquisition of inventory and materials from the supplier are indicated here - goods, works, non-current assets, etc. Also here you need to show all the primary documents on the basis of which the goods or services are posted - delivery notes, invoices, etc. etc. Also in this turnover you need to enter returns from prepayment suppliers for unfulfilled deliveries.

How to reflect the receipt of inventory items in accounting?

Account 60, the debit-credit of which reflects the amount of debt to suppliers or the suppliers themselves, is easy to use in accounting. Accepted - we credit, paid - debit. Everything seems to be simple. But there is a small nuance: VAT. Upon receipt of inventory items, two amounts must be allocated. One of them will include VAT, the second will not. The amount excluding VAT is reflected in the accounts of received assets. For example, materials were received in the amount of 32 thousand rubles (including VAT of 4,200 rubles). The accountant makes a posting: Dt “Materials” Ch “Settlements with suppliers” for an amount equal to 32,000 – 4,200 = 27,800 rubles. The remaining amount of VAT is allocated to the “VAT” account with the account assignment: Dt “VAT” Ct “Settlements with suppliers”. The postings are made at the same time.

If the buyer is not a VAT payer, then the total amount is not divided into parts, but is indicated in full on invoice 60. Do not forget that the amount excluding VAT must match the one indicated in the invoice issued by the supplier.

The procedure for writing off receivables and payables on account 60

According to accounting requirements, only true facts must be reflected in accounting data and reporting. If the documents show accounts payable with an expired collection period, then this rule is violated.

You might be interested in:

Account 68 in accounting - calculations of taxes and fees: characteristics, subaccounts, typical transactions

Thus, the company is obliged to write off accounts payable if the collection period established by law has passed.

In addition, a debt that can no longer be repaid is subject to removal if the counterparty has been deregistered and no longer exists as a legal entity.

The law establishes that the period during which the creditor has the right to demand its coverage is set at 3 years. In this case, it is necessary to correctly determine the beginning of this period.

When concluding a supply or service agreement, this document usually indicates the date for repayment of obligations. From the day following it, you need to start counting the statute of limitations.

However, the law provides for the deadline to be reset and counted from the beginning. This happens if the debtor acknowledges the existing debt in writing, makes partial payment, signs a reconciliation report, etc. In this situation, the limitation period must be counted first from this moment.

Attention! However, this cannot be done indefinitely. When a period of 10 years has been reached from the date of its formation, the debt must be written off unconditionally.

The debt write-off process is carried out in the following order:

- Carrying out an inventory of all payments. This procedure must be performed annually in order to compare the accounting data with the actual amounts of debt. During the inventory, it is also checked on what date the last movement on this debt occurred.

- Registration of an inventory report. There is a recommended form of the INV-17 form, but currently the company has the right to use its own forms. It is necessary to include in the act all the debts the company has, and not just the identified overdue ones. The document is drawn up in two copies, one is transferred to the accounting department, and the second remains with the commission.

- Preparation of accounting certificates. The accountant must analyze the executed act and draw up a certificate based on it. It reflects the counterparty for which there is a debt, the reason for the occurrence, the amount of the debt, as well as the day when the statute of limitations expired. Certificates of all expired debts, together with the act, are transferred to the manager for consideration and decision-making.

- Making an order. If the manager decides to write off, then he gives instructions to draw up an order to write off the debt. This document provides instructions to write off debt in accounting and tax accounting, and also appoints responsible persons. Based on the order, the accountant prepares accounting entries.

Interaction with other accounting accounts by debit

According to the principle of double entry, any business transaction must be reflected in the accounting documents in the debit of one account and the credit of another account for the same amount. In order to correctly draw up entries describing changes in the balance due to the receipt (decrease) of funds, you need to know the characteristics of each of the corresponding accounts. Answer the question: “Which count of 60 is active or passive?” is no longer difficult for readers: active-passive. An increase in liabilities will be shown in credit, and a decrease in liabilities - in debit.

What accounts does account 60 interact with? First of all, with the calculated ones: 50, 51, 55.1. They are used to pay off debts to suppliers. For example, an amount has been paid from the current account for the supply of goods. The posting will look like this: Dt 60 Kt 51. A similar account assignment is drawn up when transferring the advance payment. It is worth noting that such amounts must be accounted for in a separate subaccount. For example, Dt 60.2 Kt 51 - an advance is transferred from the current account.

In addition to money accounting accounts, debit account 60 can enter into correspondence with accounts 66, 67, 91. This happens if the debt was repaid by issuing a short-term or long-term loan (accounts 66, 67). Amounts with an expired statute of limitations are written off to 91 accounts, recognizing them as other income.

Payment for delivery upon receipt

If the contract for the supply of goods or the provision of services states that the amount billed by the supplier must be paid immediately after the goods and materials arrive at the buyer, then the accountant registers the receipt and then pays for the delivery. In this case, the following accounting entries are made:

- Dt of the asset account (08, 10, 20, 41, etc.) Ct “Settlements with suppliers” – the supplier’s invoice has been accepted.

- Dt “VAT” Ct “Settlements with suppliers” – VAT is allocated from the amount and accepted for accounting.

- Dt “Mandatory payments to the budget. VAT" Ct "VAT" - the amount of VAT is sent for deduction.

- DT “Settlements with suppliers” CT “Settlement invoice” – the invoice for the provided inventory and materials has been paid.

It often happens that the buyer and the supplier (contractor) agree on payment in advance. After funds are transferred, delivery is carried out. To do this, open a document marked “Suppliers” (account 60) and the corresponding sub-account, where information on advances issued is collected. The procedure is fixed with three entries:

- Dt “Advances issued” Ct “Current account” – advances are transferred to suppliers.

- Dt asset accounting account Kt “Settlements with suppliers” - inventory items received and accepted for accounting.

- DT “Settlements with suppliers” DT “Advances issued” – the advance issued earlier was offset.

Analytical accounting

Analytics for account 60 is carried out for all counterparties and contracts. The ending balance indicates that either the goods have been paid for but not yet received, or there is a debt to the supplier. According to analytical accounting data, information should be displayed in the following sections:

- accepted payment documents for which the payment deadline has not yet arrived;

- for documents not paid on time;

- on bills issued;

- overdue payments on bills;

- on a commercial loan received.

Synthetic accounting is carried out according to settlement documents (within the limits of acceptance amounts) based on the number of values. If upon acceptance of goods a shortage or arithmetic errors were discovered, account 60 in accounting is credited with account 76-3 “Calculations for claims” for the amount of discrepancies between the goods actually received and the amount in the documents. VAT is displayed in correspondence with DT18.

Reconciliations

Periodically, mutual settlement amounts are checked between counterparties. Based on its results, the client’s debt can be reduced or increased. Let's look at how the check (accounting) is displayed on the balance sheet. Account 60 is debited with the following accounts:

- 16 “Deviation in value”, 92 “Non-operating income and expenses”, if, based on the results of the reconciliation, the amount of debt decreases. The second adjustment option is to reverse the corresponding entry.

- For the amounts of paid advances in correspondence with the CT cash account.

- When repaying the debt, mutual claims are offset - account. 62, 76.

At the end of the month, for materials not received, the payment amount is credited to the inventory account. At the beginning of the next month, the cost of accepted raw materials is reversed. Payment amounts continue to be included in accounts receivable.