Starting with release 2.0.37, the 1C:Accounting 8 program has automated the process of creating reserves for doubtful debts in accordance with clause 70 of the “Regulations on accounting and financial reporting in the Russian Federation” (approved by Order of the Ministry of Finance dated July 29, 1998 No. 34n, as amended by Order of the Ministry of Finance of the Russian Federation dated December 24, 2010 No. 186n) and Article 266 of the Tax Code of the Russian Federation. According to paragraph 1 of clause 70 of the “Accounting Regulations”, all organizations are required to keep records of reserves for doubtful debts.

In the accounting settings settings on the “Settlements with counterparties” tab, you can set the payment period, from which the program will count down the debt period. If the contract with any buyer specifies a different payment period, then directly in the contract with this counterparty you can specify a different period, starting from which the debt will be considered overdue. These settings apply to all organizations for which records are maintained in the infobase. But these settings take effect only if the flag for the need to account for provisions for doubtful debts for accounting and/or tax accounting is set in the accounting policy on the “Settlements with counterparties” tab.

If the organization applies PBU 18/02 and reserves are recorded only in accounting (or only in tax accounting), then permanent differences will arise. If reserves are accrued in both accounting and tax accounting, then in this case it will not always be possible to avoid differences. Because for the purposes of calculating income tax, the costs of creating reserves should not exceed 10% of the revenue of the current tax period; for accounting there is no such limitation.

If the duration of the debt (the number of days after shipment plus the number of days from the accounting parameters or the counterparty agreement) exceeds 45 calendar days, then when the month is closed with the routine operation “Calculation of reserves for doubtful debts”, a reserve will be added in the amount of 50% of the amount of the balance on the debit of the accounts 62 and 76.06. If the period exceeds 90 days, then the reserve will be 100%. Moreover, for non-ruble debt, if necessary, a reserve can be created manually.

If all or part of the debt has been repaid by the counterparty, then at the close of the month other income will be recognized in the form of restored reserves.

You can check how the reserves were calculated in the program using the help calculation “Reserve for doubtful debts”, which can be used for both accounting and tax accounting purposes, by clicking the “Settings” button by selecting the required data display mode

Let's look at what transactions are needed to account for reserves and what documents in the 1C: Enterprise Accounting program they are generated by:

Provision for doubtful debts

Dt 91.02 (other non-operating income (expenses) Kt 63 (Counterparties, Agreements, Payment documents)

The posting is generated automatically at the end of the month by the regulatory document “Calculation of reserves for doubtful debts”.

The reserve is created for each counterparty agreement. The program analyzes the debit balance of accounts 62 and 76.06, expanded according to settlement documents. Moreover, if under one agreement with a counterparty there is an advance, and under another agreement with the same counterparty there is a debt exceeding 45 days, then the reserve will be accrued. If the amount of the reserve in accounting differs from tax accounting, the permanent difference will be automatically taken into account.

If you kept records of reserves even before the update to release 2.0.37, then in this case, in account 63, the amounts of reserves were allocated without breakdown by settlement documents (i.e., by sales documents).

Therefore, after updating from previous releases, you need to create a new accounting policy, starting from the month of update, in which you need to set automatic accounting of reserves. Next, you need to distribute the total amount of reserves to a specific sales document; to do this, you need to enter the document “Operation (accounting and tax accounting).” Kt 63 indicating the sub-account “Documents of settlements with the counterparty” Dt 63 without indicating this sub-account.

Reserve restoration

Dt 63 (Counterparties, Agreements, Settlement Documents) Kt 91.01 “Other non-operating income (expenses)”

The posting is generated automatically at the end of the month by the regulatory document “Calculation of reserves for doubtful debts”.

If the counterparty has repaid part of its debt, then it is necessary to reduce the amount of the created reserve in the paid part of the debt.

Carrying forward the reserve to the next year

Dt 63 (Counterparties, Agreements, Settlement Documents) Kt 91.01 “Other non-operating income (expenses)”

Dt 91.02 “Other non-operating income (expenses)” Kt 63 (Counterparties, Agreements, Payment documents)

The posting is generated automatically at the end of the year by the regulatory document “Calculation of reserves for doubtful debts”.

If by the end of the year following the year in which the reserve for doubtful debts was created, the reserve was not used, then for accounting purposes the unspent amounts of the reserve created last year are added to the financial result (clause 70 of the Regulations on Accounting and Reporting).

In this case, immediately after adding the reserve to the financial result, it is necessary to re-create a reserve for doubtful debts (letter of the Ministry of Finance of the Russian Federation dated July 12, 2004 No. 03-03-05/3/55). This applies only to accounting, in tax accounting there will be a permanent difference.

At the close of the first month of the reporting year, the amount of the newly created reserve for the purpose of calculating income tax is adjusted to the amount of the balance of the reserve of the previous tax period:

- if the amount of the reserve newly created based on the results of the inventory is greater than the amount of the balance of the reserve of the previous reporting (tax) period, then the difference is included in non-operating expenses in the current reporting tax period;

- if the amount of the newly created reserve for tax accounting purposes (no more than 10% of the revenue of the current tax period) is less than the amount of the balance of the reserve of the previous tax period, then the difference is included in non-operating income.

Write-off of accounts receivable from the reserve for one reason or another

Dt 63 (Counterparties, Agreements, Settlement Documents) Kt 62 (76.06) (Counterparties, Agreements, Settlement Documents)

Write-off is carried out using the “Debt Adjustment” document with the type of operation “Debt Write-off”.

Accounting for reserves for doubtful debts in the 1C: Accounting 8 program

The document can be filled out automatically by clicking the “Fill” button on the “Accounts Receivable” tab. On the “Settlement Accounts” tab, indicate write-off account 63 and fill in the corresponding sub-accounts.

In the event that the amount of debt written off from the accounting reserve does not coincide with tax accounting, it will be necessary to adjust the write-off amount in the postings.

To do this, as a result of posting the “Debt Adjustment” document, you need to set the “Manual adjustment” flag in the tax accounting entry Dt 63 Kt 62.01 to set the amount covered by the reserve, and assign the debit balance to permanent differences, and the credit balance to temporary differences.

In order for the program to correctly calculate income tax, the condition BU=NU+PR+VR must be met.

The balance of debt not covered by the reserve in tax accounting should be written off to account 91.02 “Write-off of accounts receivable (payable). Accordingly, a negative permanent difference will arise for the debit, and a negative temporary difference for the credit.

In addition, written-off debt for which the statute of limitations has expired (more than three years have passed since the debt arose) must be listed for another five years as a debit in off-balance sheet account 007 “Debt of insolvent debtors written off at a loss.”

If the debtor makes payment within five years, the proceeds will be reflected in the credit of account 007, and the payment should be reflected in accounting and tax accounting:

Dt 50 (51) Kt 91.02 “Other non-operating income (expenses)”

If payment is not received within five years, then account 007 is closed with an “Accounting (Tax) Accounting Operation” for the entire amount of the debt.

Account 63 “Provisions for doubtful debts” is intended to summarize information about reserves for doubtful debts created in the organization.

Tax legislation establishes the possibility for Russian companies to form reserves for doubtful debts. To organize accounting of these sources of financing, an account was approved in the chart of accounts.

Account 63 write-off from the reserve if tax accounting is not created

Example.

The features of creating a reserve for doubtful debts in accounting and tax accounting differ significantly, since these types of accounting have different purposes. Let's compare the rules specific to accounting and tax accounting regarding the reserve.

- Mandatory creation. In accounting, such a reserve is required, since it is required by paragraph. 1 clause 7 of the Accounting Regulations. If an organization uses the accrual method for tax accounting, then the accountant himself decides whether to create such a reserve for tax accounting or not (this right is reflected in clause 3 of Article 266 of the Tax Code of the Russian Federation).

- Characteristics of deductions. Accounting defines reserve contributions as “other expenses,” and for tax accounting they must be taken into account among non-operating expenses.

- Interpretation of the doubtfulness of debt. For accounting purposes, any debt that is not repaid on time or in full is eligible for compensation as a reserve, but for tax purposes, only late payment for goods, services, and work can be recognized as such.

- Determination of the amount of deductions. For accounting, the priority of establishing the size remains with the accountant (taking into account the characteristics of the debt), and for tax accounting the sizes are clearly defined by the Tax Code of the Russian Federation.

- The total size of the reserve fund. In accounting it is not limited, and in tax accounting it cannot be more than one tenth of revenue.

It is not necessary to reflect doubtful debts and provisions for them in tax accounting. But if the accounting department deems it necessary to do this, this right is ensured and regulated by Art. 266 Tax Code of the Russian Federation.

For tax purposes, the definition of doubtful and bad debt is no different from accounting purposes. We discussed the difference in detail above. The procedure for creating and changing the reserve for the following debts differs:

- if the debt period exceeds 3 months, then the amount of the reserve will be fully equivalent to the amount of the debt;

- if the debt payment is overdue for a period of 45 to 90 days, only half of the amount can be deposited into the reserve;

- Before the debt is 45 days overdue, changes to the reserve are not permitted.

For each doubtful debt, analytical records must be constantly maintained for a prompt response in the event of a change in the financial situation of the debtor.

NOTE! In tax accounting, the reserve for doubtful debts can be used exclusively to cover losses on written-off bad debts.

Account 63 in accounting

63 entitled “Provisions for doubtful debts”.

Doubtful debt is the debt of counterparties that is not repaid within the terms established by the contract and is not provided with the necessary financial guarantees. The fundamental factor influencing the creation of a fund in a company is the presence of a receivable debt that is questionable for collection.

Attention! Federal Tax Service employees establish the need to periodically conduct an inventory of receivables in order to timely detect insolvent debtors.

In a situation where an audit reveals a counterparty’s debt that is doubtful for collection, the manager must issue an order to create a fund that will become financial ballast in the event of the partner’s financial insolvency.

Account 63 in accounting is passive; accordingly, the increase in the value of the resource is made by crediting this account. The debit of this account is used when the funds of the created fund are used to cover the uncollectible debts of counterparties.

Postings to account 63 with an example of accounting with ONA accrual

The most typical entries for account 63 - Provision for doubtful debts:

| Debit | Credit | Contents of operation |

| 91.2 | 63 | A decision was made to create a reserve for doubtful debts |

| 63 | 60, 62, 76, 58.3 | The bad debt of the supplier / buyer / other debtor / borrower is written off from the reserve |

| 63 | 91.1 | The reserve amount has been restored |

An example of accounting with the accrual of IT

Conditions:

Subscribe to our newsletter

Read us on Yandex.Zen Read us on Telegram

On 06/03/2017, the seller shipped a consignment of goods in accordance with the supply agreement in the amount of 158,000 rubles. Payment from the buyer must be received within 25 days after shipment. On July 3, 2017, partial payment was received in the amount of RUB 65,000. By the end of the year, the remaining debt had not been repaid.

Calculations:

158,000 × 20% = 31,600 - IT when creating a reserve

65,000 × 20% = 13,000 - SHE to be restored with partial payment

| Debit | Credit | Sum | Contents of operation |

| 91.2 | 63 | 158 000 | The creation of a reserve for doubtful debts is reflected |

| 09 | 68.2 | 31 600 | SHE is taken into account |

| 51 | 62 | 65 000 | Partial payment received |

| 63 | 91.1 | 65 000 | Part of the reserve has been restored |

| 68.2 | 09 | 13 000 | Part of ONA restored |

The procedure for forming a reserve

First of all, the legality of the formation of the fund must be supported by the results of an inventory of the state of receivables. All nuances in which the state has established the company’s independence must be reflected in its accounting policies.

Due to the fact that there is no mandatory requirement to create a source of security for debts that are unlikely to be collected in tax accounting, unlike accounting, each company has the right to decide to create such a resource and thereby reduce the amount of income tax.

Attention! The management of the organization must take the most responsible approach to the formation of a fund to cover the debts of debtors, since Federal Tax Service employees carefully check all aspects of the activities of Russian companies that reduce the amount of income tax payable to the budget.

Typical operations with examples

In practice, several standard operations are carried out on this account; let’s look at them.

- Dt 92-1 Kt 63. We are talking about the formation of a reserve for doubtful debt obligations. The main supporting document is the accounting policy of the organization.

- Dt 63 Kt 91-1. This entry states that there was a reduction in the amount of the reserve by the amount of debt that was repaid. To confirm this operation, a special accounting statement is used.

- Dt 63 Kt 62. Write-off of bad receivables by using the capabilities of the reserve fund. For confirmation, a special extract from the Unified State Register of Legal Entities is used. This transaction must be recorded for the correct amount to avoid confusion and erroneous information in the documents.

- Dt 91-2 Kt 63. It is assumed that the amount of the reserve for doubtful debts was formed due to the division of other expenses.

- Dt 63 Kt 76-2. This entry implies that the reserve amount was written off in connection with the satisfaction of the claim.

Thus, account 63 plays an important role in the entire accounting activity and accounting process. It is important to strictly observe the norms and features of its accounting in order to maintain the high quality of the enterprise’s activities.

Transfer to next year

Art. 266 of the Tax Code of the Russian Federation determines that reserve amounts that are not fully used during the tax period can be carried forward to the next year. Moreover, if a new source is created in the organization, then its amount should be adjusted to the amount of the source already existing in the company for covering doubtful debts of debtors.

It is reasonable to do this if there is no likelihood of the counterparty repaying the debt in the near future. If the partner nevertheless receives a signal about an improvement in financial condition and the imminent repayment of the debt, the amount of the reserve should be restored and included in other income.

Accounting procedure

In the accounting reporting documentation, the resulting receivables should be shown minus the reserve that was formed on it. Information about the reserve must be disclosed in the explanations. In this situation, there are several key scenarios:

- restoration in the process of debt repayment (in this case, the amount is included in other income and reflected in account 91);

- restoration due to lack of payment from the buyer based on the results of the annual period that follows the time the reserve was created;

- use, i.e. write-off from the reserve for bad debts of the accounts receivable plan.

In reporting, doubtful debts can be reflected on lines 1230 or 2350 of the balance sheet.

Basic accounting entries for using account 63

- Based on the results of the inventory, the company has formed a fund to cover debts with a low probability of collection:

- The counterparty's debt, which was previously unlikely to be collected, became uncollectible and was written off from the available fund:

- The claim submitted to the counterparty for violations in the fulfillment of contractual obligations was written off using the funds of the created source of debt coverage:

- The unspent amount of the reserve is classified as other income of the organization:

Victor Stepanov, 2017-04-02

Main subaccounts

In the practice of entrepreneurship, one has to be both in the role of a lender and in the role of a borrower.

In the first case, situations occur when partners, for one reason or another, do not repay the debt on time or do not fulfill their financial obligations at all.

However, such financial situations must still be reliably reflected in the organization's accounting and financial records. A special reserve is created for this purpose.

Let's consider the principles of forming this type of reserve, methods of accounting for it, accounting entries accompanying this process, as well as the nuances of write-off.

For a reliable financial reflection of an organization’s receivables in accounting documents, a so-called reserve for doubtful debts is created. To define this concept, you first need to understand what doubtful debts are.

Accounts receivable to a company are considered doubtful if they are unlikely to be repaid in full, as evidenced by the following factors:

- violation by a partner of deadlines for paying off debt;

- obtaining information about serious financial difficulties of the debtor partner;

- absence of any additional guarantees (collateral, deposit, surety, bank guarantee, retention of any property of the counterparty, etc.)

FOR YOUR INFORMATION! Debt reflected in the debit of any accounting accounts, including 60, 62, 72, as well as issued as a loan under subaccount 58-3, may become doubtful.

Doubtful debts are identified based on the results of the inventory of current accounts:

- on loans;

- for goods and/or services sold;

- payment for work performed;

- in some cases - for advances issued to suppliers.

In order to correctly reflect this type of debt on the balance sheet, a special type of reserve is created, which is intended to serve as an estimate for accounting. This means that the amount of debt must be reflected in the balance sheet by subtracting from it the funds allocated to the reserve. The content of expenses or income must necessarily display:

- creation of such a reserve;

- its increase;

- reduction of funds.

NOTE! The reserve created for doubtful debts is included in the expenses that are deducted for taxation, therefore, it is financially beneficial for organizations from the point of view of tax accounting to form and take into account the reserve.

The chart of accounts provides for the right of business entities to open subaccounts to the account. 63. Tax law provides for the company’s ability to maintain analytical accounting for each individual source of financing. Thus, the number of open sub-accounts for the account will coincide with the number of doubtful debtors of the organization.

- Based on the results of the inventory, the company has formed a fund to cover debts with a low probability of collection:

- The counterparty's debt, which was previously unlikely to be collected, became uncollectible and was written off from the available fund:

- The claim submitted to the counterparty for violations in the fulfillment of contractual obligations was written off using the funds of the created source of debt coverage:

- The unspent amount of the reserve is classified as other income of the organization:

Victor Stepanov, 2017-04-02

Let's consider what accounting entries on account 63 should be used to record transactions with the fund created to cover the debts of debtors.

- By decision of the manager, a reserve is formed in the company to cover debts that are unlikely to be collected:

- The amount of the created reserve was written off to cover the buyer’s doubtful debt:

- The amount of the reserve is offset against the debt of other debtors:

- Based on the accounting certificate at the end of the reporting period, the unspent amount of the reserve was taken into account as part of the company’s other income:

| Debit | Credit | Contents of operation |

| 91.2 | 63 | A decision was made to create a reserve for doubtful debts |

| 63 | 60, 62, 76, 58.3 | The bad debt of the supplier / buyer / other debtor / borrower is written off from the reserve |

| 63 | 91.1 | The reserve amount has been restored |

Accounting entries

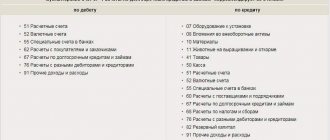

Typical postings for 76 special accounts will be:

- Dt 01 Kt 76 Write-off of acquired fixed assets to accounts payable;

- Dt 51 Kt 76 Receipt of money from suppliers to current accounts;

- Dt 10 Kt 76 Write-off of consumables in accounts payable;

- Dt 76 Kt 20 Reducing the number of unfinished fixed assets at the expense of debtors;

- Dt 76 Kt 50 Making cash payments to creditors through the organization's cash desk.

Important! Postings on the 76th accounting account are divided into various types, including insurance of property and valuables, insurance of persons and employees, reflection of settlements of claims, accounting of dividends received, etc. This helps to structure the data even better.

Analysis of balance sheet special account 76 can be carried out using its card or using SALT

Thus, account 76 in accounting is a register that displays generalized data on settlement transactions with debtors and creditors that do not belong to groups in special accounts 60-75. Account 76AB is used to receive claims and insurance amounts for debit/credit debts. Its analytics are carried out similarly to other accounting accounts based on SALT and special analytical account cards.