What types of accounting accounts are there?

4 September 2020 lazareva Views:

The accounting account is intended to summarize information about the organization’s property and liabilities. Each account is designed to reflect information about a specific type of property or liability. You can read more about what an account is and why you need it in this article.

There are a total of 99 accounts, the description of which is given in the Chart of Accounts. All 99 accounts are divided into active, passive and active-passive. Read below about the distinctive features of these accounts.

https://youtu.be/-Nci9W8mlyM

Accounting account 58

One of the types of assets of an organization are financial investments, which include, in particular, state and municipal securities, securities of other organizations (including bonds, bills), contributions to the authorized capital of other organizations, interest-bearing loans provided to other organizations , deposits, receivables acquired on the basis of assignment of the right of claim (clause 3 of PBU 19/02).

The chart of accounts and the Instructions for its use to summarize information on the availability and movement of an organization’s financial investments is account 58 “Financial investments” (Order of the Ministry of Finance dated October 31, 2000 No. 94n). 58 accounting account is an active synthetic account, the debit of which reflects the receipt (increase in value) of financial investments, and the credit reflects their disposal (decrease in value). Analytical accounting on account 58 is carried out by type of financial investments and objects in which these investments were made (for example, by borrowing organizations).

In addition, in analytical accounting, financial investments should be divided into short-term and long-term.

Also, financial investments within the group of interrelated organizations for which consolidated financial statements are prepared should be taken into account separately on account 58 (Order of the Ministry of Finance dated October 31, 2000 No. 94n).

Subaccounts to account 58

An organization can open, in particular, the following sub-accounts to account 58:

| Name of subaccount to account 58 | What is taken into account |

| 58-1 “Units and shares” | Investments in shares of joint-stock companies, authorized (share) capitals of other organizations, etc. |

| 58-2 “Debt securities” | Investments in public and private debt securities (bonds, bills, etc.) |

| 58-3 “Loans provided” | Cash and other loans provided to legal entities and individuals |

| 58-4 “Deposits under a simple partnership agreement” | Contributions to common property under a simple partnership agreement |

Typical transactions for account 58

Let us present in the table some typical accounting entries for account 58 (Order of the Ministry of Finance dated October 31, 2000 No. 94n):

ACTIVE AND PASSIVE ACCOUNTS

All accounting accounts can be divided into active and passive. The first of them are intended for accounting for assets, the second for accounting for liabilities.

You should learn to determine whether an account is active or passive; this will help you make entries correctly.

Signs of active accounts:

- an increase in an asset is recorded as a debit, a decrease as a credit;

- the balance is always debit.

Example: count. 10 “Materials” - materials are received as a debit and written off as a credit.

Account characteristics

To correctly reflect business transactions on account 73, you need to understand its structure. So what exactly is 73 count: active or passive? The account takes into account settlements with personnel, which can reflect both funds and sources of the organization. Due to this characteristic, the account is active-passive with a one-sided debit balance and shows signs of an active account.

The initial debit balance means that the employee owes money to the organization. The value can be found in the balance sheet of the last reporting month in the group of items “Accounts receivable”.

What types of accounting accounts are there?

The final balance on account 10 shows how much materials are left in the warehouse at the end of the month; this number cannot be negative, so it will always be in debit.

Other examples of active accounts:

- 50 "Cashier";

- 51 “Current account”;

- 01 “Fixed assets”;

- 04 “Intangible assets”, etc.

Signs of passive accounts:

- a decrease in liability is recorded in debit, and an increase in liability in credit;

- The balance at the end of the month is always in credit.

Example: account 66 “Settlements for short-term loans” is intended to account for loans taken for a period of less than 1 year. Receipt of a loan (increase in liability) is reflected in the loan, repayment of the loan (decrease in liability) is reflected in the debit.

Other examples of passive accounts:

- 02 “Depreciation of fixed assets”;

- 05 “Amortization of intangible assets”;

- 42 “Trade margin”;

- 67 “Settlements for long-term loans and borrowings”;

- 70 “Settlements with personnel for wages”;

- 77 “Deferred tax liabilities”;

- 80 “Authorized capital”;

- 98 “Deferred income”.

Postings to subaccount 73.1

73 account may have several sub-accounts, the use of which is regulated by the accounting policy of the organization.

Conventionally, we assume that the company uses subaccount 73.1 to account for settlements with employees for loans provided to them. Account assignments using subaccount 73.1

| Dt | CT | Characteristics of a business transaction |

| 73.1 | 50 | The employee was given a loan from the cash register to purchase livestock |

| 73.1 | 51 | A loan for building a house was transferred from the current account to the employee's account |

| 73.1 | 10 | The employee was provided with a loan in the form of construction materials |

| 73.1 | 91 | Interest is accrued on the loan amount for use |

| 50 | 73.1 | The organization's cash desk received the amount to repay the loan debt |

| 51 | 73.1 | Funds to pay for the loan were transferred to the company's bank account |

| 70 | 73.1 | The loan amount and interest are deducted from the employee's salary. |

| 91.2 | 73.1 | The amount of unrepaid debt is written off as expenses of the organization |

As can be seen from the table, the organization has the right to withhold the amount of debt from the employee’s salary. If the retained funds are still not enough to repay the loan amount, the balance is written off to the financial result (account 91.2).

Main entries for account 73 “Settlements with personnel for other operations”

| Contents of operation | Document | Corresponding account numbers |

| Debit | Credit | |

| 1. Uniforms were issued to employees on an installment plan | workwear registration card | |

| 2. The amount of losses from the marriage is attributed to the guilty parties | manager's order | |

| 3. Revenue from sales of products (works, services) by employees of the enterprise is reflected | invoice | 90-1 |

| 4. A loan was paid from the cash register to an employee of the enterprise | account cash warrant | |

| 5. The same for non-cash payments | payment order | 51, 52 |

| 6. Cash documents were issued to employees | Ledger | 50-3 |

| 7. The amounts for voluntary insurance of the organization’s employees are reflected | calculation, statement | 76-1 |

| 8. Amounts of unreasonable expenses of accountable funds are attributed to the accountable persons | manager's order | |

| 9. The employee’s debt, which is hopeless for collection, is written off as a loss. | manager's order | 91-2 |

| 10. Repayment of the loan by the enterprise employee is reflected | cash receipt order | |

| 11. According to the calculation, the share of costs is included in the amount of material damage charged to the guilty party | calculation | 23,25,26 |

| 12. The amounts subject to withholding from the guilty persons are reflected | manager's order | |

| 13. The amounts of shortfalls are written off if the court refuses to collect them | the court's decision | |

| 14. Repayment of debt on bank loans at the expense of employees | manager's order | 66, 67 |

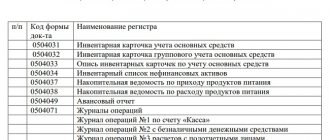

Table 13

Main entries for account 76 “Settlements with various debtors and creditors”

| Contents of operation | Document | Corresponding account numbers | |

| Debit | Credit | ||

| 1. The acquisition of material assets from other organizations is reflected | Invoice | ||

| 2. The cost of third-party services is reflected | Certificate of completion | 20,23,25, | |

| 3. The VAT amount is reflected | Invoice | ||

| 4. The cost of marriage correction services is reflected | Act | ||

| 5. Goods arrived from different organizations | Invoice | ||

| 6. Funds received from debtors to repay debt | Bank statement, payment order | 51,52 | |

| 7. Accounts payable repaid | Bank statement, payment order | 50,51,52, | |

| 8. Amounts paid from bank loans are reflected | Bank statement | 66,67 | |

| 9. The cost of transport services of third-party organizations related to the sale of products is reflected. | Consignment note | ||

| 10. Calculations for the claim to the supplier are reflected | 76-2 | ||

| 11. Deposited wages reflected | Payslip | 76-4 | |

| 12. Dividends to be received are reflected | Calculation | 76-3 | 91-1 |

Table 14

Main entries for account 70 “Settlements with personnel for wages”

| No. | Contents of business transactions | Corresponding accounts |

| Debit | Credit | |

| 1. | Accrued wages to employees of the main production | |

| 2. | Accrued wages to employees of auxiliary production | |

| 3. | Accrued wages for workers involved in production maintenance | |

| 4. | Accrued wages to the management personnel of the organization | |

| 5. | Payments were accrued to employees involved in correcting defects | |

| 6. | Accrued wages to employees of service industries and farms | |

| 7. | Accrued wages to employees engaged in trading activities or operations for the sale of finished products | |

| 8. | Wages paid to employees from the cash register | |

| 9. | Salary transferred from current account | |

| 10. | Personal income tax withheld from employee wages | 68-3 |

| 11. | The debt of employees for vouchers received at the expense of the social insurance fund is reflected | 69-1 |

| 12. | Before the deadline for submitting the advance report, the amounts paid to the employee are offset against wages. | |

| 13. | The amount of material damage is withheld from the employee’s salary | 73-2 |

| 14. | Benefits accrued to employees using social insurance funds (for example, temporary disability benefits) | 69-1 |

| 15. | Dividends accrued to founders (participants) who are employees of the organization | |

| 16. | Accrued vacation amounts and annual remuneration for long service from previously created reserves |

Table 15

Main entries for account 01 “Fixed Assets”

| No. | Contents of business transactions | Corresponding accounts | |

| Debit | Credit | ||

| Receipt of fixed assets | |||

| 1. | The cost of the acquired fixed asset is reflected according to the supplier’s settlement documents (excluding VAT) | 08-4 | |

| 2. | The amount of VAT on the cost of an asset is reflected | 19-1 | |

| 3. | Payment has been made to the supplier for the fixed asset (including VAT) | ||

| 4. | The fixed asset is accepted for accounting at its original cost (in the amount of actual costs) | 08-4 | |

| 5. | The amount of VAT paid on the registered asset has been submitted for deduction. | 68-1 | 19-1 |

| 6. | The cost of the fixed asset item received as a contribution to the authorized capital is reflected (in monetary value agreed upon by the founders of the organization) | 08-4 | 75-1 |

| 7. | The received fixed asset item was accepted for accounting at its original cost. | 08-4 | |

| Depreciation calculation | |||

| 8. | Depreciation has been accrued on fixed assets used in the construction of the facility using economic methods. | 08-3 | |

| 9. | Depreciation has been accrued on an asset used in production (when performing work, providing services) | 20,23,25, 26,29 | |

| 10. | Depreciation has been calculated on a fixed asset leased out | ||

| Write-off of fixed assets | |||

| 11. | The initial cost of an asset was written off upon its liquidation | 01-2 | 01-1 |

| 12. |

Analytical accounting on account 73

To organize accounting of settlements with employees for transactions not related to wages and accountable amounts, synthetic account 73 is used. Depending on the type of settlement, first-level subaccounts are opened.

For example, an organization might use:

- 73.1 – to reflect settlements on loans provided to employees;

- 73.2 – for accounting for amounts of material damage.

As a loan, the organization provides the employee with an amount for building a house, renting a home and for other property needs.

Material damage is calculated depending on the type of liability. Full compensation of costs involves repayment of the entire amount of damage, partial compensation - withholding an amount not exceeding the employee’s average monthly earnings.

For each employee of the organization, it is necessary to open a second-level sub-account for better accounting and systematization of data.

Posting account 69

Account 73 “Settlements with personnel for other operations”

Account 73 “Settlements with personnel for other operations” is intended to summarize information on all types of settlements with employees of the organization, except for settlements for wages and settlements with accountable persons.

Sub-accounts can be opened to account 73 “Settlements with personnel for other operations”:

73-1 “Settlements for loans provided”;

73-2 “Calculations for compensation for material damage”, etc.

Subaccount 73-1 “Settlements for loans provided” reflects settlements with employees of the organization for loans provided to them (for example, for individual and cooperative housing construction, the acquisition or construction of garden houses and the improvement of garden plots, starting a household, etc.).

The debit of account 73 “Settlements with personnel for other operations” reflects the amount of the loan provided to an employee of the organization in correspondence with account 50 “Cash” or 51 “Cash accounts”.

For the amount of payments received from the borrower-employee, account 73 “Settlements with personnel for other operations” is credited in correspondence with accounts 50 “Cash”, 51 “Settlement accounts”, 70 “Settlements with personnel for wages” (depending on the accepted payment procedure).

Subaccount 73-2 “Calculations for compensation for material damage” takes into account calculations for compensation for material damage caused by an employee of the organization as a result of shortages and thefts of monetary and inventory items, defects, as well as compensation for other types of damage.

In the debit of account 73 “Settlements with personnel for other operations,” the amounts to be recovered from the guilty parties are included in the credit of accounts 94 “Shortages and losses from damage to valuables” and 98 “Deferred income” (for missing inventory items), 28 “Defects in production” (for losses from defective products), etc.

In the credit of account 73 “Settlements with personnel for other operations”, entries are made in correspondence with the accounts: cash accounting - for the amounts of payments made; 70 “Settlements with personnel for wages” - for the amount of deductions from wages; 94 “Shortages and losses from damage to valuables” - for the amount of written off shortfalls in case of refusal to recover due to the unfoundedness of the claim.

Analytical accounting for account 73 “Settlements with personnel for other operations” is maintained for each employee of the organization.

Account 73 “Settlements with personnel for other operations” corresponds with the accounts:

| by debit | on loan |

| 23 Ancillary production 28 Defects in production 29 Servicing production and farms 50 Cash 51 Current accounts 52 Currency accounts 57 Transfers in transit 62 Settlements with buyers and customers 69 Settlements for social insurance and security 71 Settlements with accountable persons 76 Settlements with various debtors and creditors 79 On-farm settlements 81 Own shares (shares) 84 Retained earnings (uncovered loss) 91 Other income and expenses 94 Shortages and losses from damage to valuables 98 Deferred income 99 Profits and losses | 41 Goods 50 Cash register 51 Current accounts 52 Currency accounts 70 Settlements with personnel for wages 76 Settlements with various debtors and creditors 91 Other income and expenses 94 Shortages and losses from damage to valuables 99 Profits and losses |

Account description 73.03 Settlements for other transactions

Account 73.03 Settlements for other operations is used to reflect settlements with personnel for other operations. Transactions reflected in the account include atypical payments and accruals in favor of employees, as well as other deductions from employee salaries.

Accounting account 58: postings and definition

Account 58 in the financial statements is designated by the balance line “Financial investments” and shows the conduct of operations with the movement of investments (investments) of a controlled enterprise in securities (hereinafter referred to as securities), shares and bonds of other organizations, fixed capital of enterprises, and especially the cost of loans that were provided other companies.

Financial investments are considered to be an active line of the enterprise's balance sheet . In order to register investments in the asset line, an organization must fulfill a number of conditions :

- Transactions completed in accordance with all requirements with documents that can confirm the right to the opportunity to invest assets, as well as receive income from them in the form of cash.

- The ability of the organization to assume a certain group of risks;

- The ability of an enterprise to obtain economic benefit (i.e., the amount of interest, dividends, increase in value).

Accordingly, in simple words it can be explained that the financial investment section shows the participation of a certain enterprise in the financial transactions of another business entity.

The legislative framework

The legality of all financial transactions carried out by a business entity is regulated by government regulations, orders, recommendations and guidelines on accounting. The balance sheet line “Financial investments” is legally provided for:

- Regulations on accounting audit PBU 19/02, in connection with Order of the Ministry of Finance of the Russian Federation No. 126 dated December 10, 2002 (amended in 2010).

- Federal project on accounting (402-FZ).

- Civil Code of the Russian Federation (both parts).

- Tax Code.

For accurate and legal financial investment, the organization must take into account all the necessary standards provided for in the bills. Regulatory regulation in this system consists of several levels .

The highest is the Decree of the President of the Russian Federation, and the lowest are the instructions and regulations of the enterprise itself in accordance with the industry focus and the amount of profit received.

Typical correspondence for debit and credit

Analytical analysis is carried out based on the standard plan of the organization . To provide a complete picture of the financial position of the enterprise, the analysis reflects short-term and long-term cash deposits. Financial investments correspond with the following accounts of the enterprise's balance sheet.

In relation to debit:

- 50 – Treasury;

- 51 – Nominal accounts;

- 52 – Monetary account standards;

- 75 – Settlement with the founders of the enterprise;

- 76 – Payments to debtors and creditors;

- 80 – Property fund of the enterprise;

- 91 – Other income and expenses;

- 98 - Revenue of the future periods.

In relation to the loan:

- 51 – Current accounts;

- 52 – Monetary account standards;

- 76 – Payments to debtors and creditors;

- 80 – Property fund of the enterprise;

- 90 - Revenue from sales;

- 91 – Other income and expenses;

- 99 - P & L.

Business transactions and subaccounts

A typical opening of sub-accounts for account 58 is:

- 58-1: Units and shares;

- 58-2: Debt Central Banks;

- 58-3: Loans granted;

- 58-4: Deposits under a simple partnership agreement.

If the price of securities upon their acquisition compensates for the nominal value, then a certain entry . The debit reflects the total income from investments in the Central Bank, and the credit reflects the difference in amounts between settlements with debtors and creditors and investments.

Loans are reflected in the security of bills of exchange, so this stage of postings takes place separately . Funds that are transferred for use to third parties are reflected in debit, and when these funds are returned, an entry is made in the reverse order.

The operation of issuing a deposit to an individual or legal entity is carried out on a debit basis; accordingly, when it is reimbursed under the agreement back, a reverse entry is made in the balance sheet. Directly depending on what operation is carried out, score 58 is reflected either as active or passive.

Record keeping that provides complete visibility of short-term and long-term assets is called analytics . An excess of the exchange rate over the nominal value is an agio , a decrease is a disaggio . The excess is not recorded in the balance sheet, and the decrease is reflected in account 59, which shows the Central Bank's depreciation reserves.

An enterprise's participation in other firms is reflected on the balance sheet as value for investment and transfer . Often such activity is expressed by purchasing shares of other companies. Such investments are reflected in the balance sheet line “Financial investments within the purchase price” .

The concept of the current rate in asset items reflects the price at which shares and bonds can be fixed at the moment. The exchange rate often fluctuates, so numerous revaluations . Here you should take into account the shares at their actual price, but if the current exchange rate decreases, the amount of the difference should be written off as a loss.

The amount of the actual cost of the securities is shown in subaccount 58-1 and is calculated by the amount of funds invested in shares and bonds. There is no correspondence between capital and the Central Bank , so carrying out an inventory becomes more complicated.

The face value price is included in the asset according to these indicators. It is much more convenient to carry out an inventory, since the amount and the nominal balance are equal . The only drawback in such an operation is the discrepancy between the actual and nominal prices .

Subaccount 58-1 displays shares and shares, essentially indicating the ability of the head of an enterprise under his control to invest in the authorized capital of a commercial company, i.e. buy their shares. At the legislative level, such a procedure can be carried out if:

- Transfer of funds for the purchase of securities of a given company.

- Transfer of tangible and intangible assets.

- Contribution of monetary value to the capital of a third-party organization.

When conducting such operations on the company's balance sheet, the subaccount undergoes a reformation of its characteristics. These procedures may be called:

- Material accounts that are transferred to another company.

- Accounts for reflecting cash investments are determined by the Chart of Accounts and the ability of the responsible persons to provide liquidity of securities.

- A current account involves the transfer and receipt of capital from one enterprise to another.

Reflection methods

Based on PBU 19/02, financial investments in the balance sheet are reflected in long-term and short-term storage. Information on storing loans is located in section 5 .

The report fully reflects the movement of the cash fund to receive interest and dividends from the investment procedure, as well as the allocation of cash to pay interest on purchased securities. Details of the accrual of dividends and interest are displayed in the income statement .

Methods for reflecting investments in accounting are determined by the assessment and analysis of cash investments upon disposal by type and method of analysis of economic activity.

Posting examples

To accurately make financial entries, you should take into account all factors of production and industry of the enterprise, as well as the actual and nominal value of the securities.

To carry out the transaction of purchasing shares, the following entries :

- Dt 58-1 Kt 76 (Acquisition of securities);

- Dt 91-2 Kt 76 (Accounting for the amount of commission in other expenses);

- Dt 76 Kt 51 (Calculation of the value of shares taking into account the intermediary commission).

To carry out a securities revaluation operation: Dt 51-1 Kt 91-1 (Revaluation of shares according to market value).

To conduct a sale of securities:

- Dt 58-1 Kt 76 (Value expression of shares under the agreement);

- Dt 76 Kt 51 (Accrual of share value);

- Dt 91 Kt 59 (Determination of reserve);

- Dt 91 Kt 58-1 (Book value of securities);

- Dt 62 Kt 91 (Cost of shares in the agreement);

- Dt 59 Kt 91 (Increase in share price due to reserve);

- Dt 51 Kt 62 (Credits of funds for sold shares);

- Dt 91 Kt 99 (Profit from sales).

When assessed, investments are recorded at their original cost . This cost depends on the order of acquisition of investments and receipts. The initial value of securities may change during the process of their revaluation and may differ from the amount of the initial deposit.

Fulfilling the requirements of the regulatory framework, the assessment of financial investments can be made upon their disposal. Adhering to the procedure for conducting an accounting audit, there are several ways to reflect financial contributions by type, such as deposits in shares and bonds, investments in the authorized capital of a third-party organization, investments under a partnership agreement, loans and advances provided to other companies.

, an inventory of account 58 must be carried out within the time period established by him . The result of the inventory is reflected in writing in financial accounting and accounting audit.