Home / Labor Law / Employment / Part-time and part-time work

Back

Published: 05/09/2017

Reading time: 8 min

0

832

Registration of labor relations with an employee who performs other work in his spare time - part-time - involves the nuances described in articles 282-288 (Chapter 44) of the Labor Code of the Russian Federation .

One of the main rules that must be observed for a job to be part-time is the amount of working time - it should not exceed four hours a day (Article 284).

The exception is those days on which the employee is completely free at his main job (weekends, vacation periods) - in this case he can work full time. But during the accounting period, the duration of work as a part-time worker cannot exceed half of the standard working hours provided for this category of workers. For example, if an employee working a full shift has 160 working hours per month, then for a part-time worker this number should not exceed 80 hours.

When calculating the remuneration of a part-time worker, you should also take into account some features.

- Time worked

- Vacation payments

- Business trips

- Sick leave and maternity leave

- Compensation upon dismissal

Dear readers! To solve your problem, call hotline 8 or ask a question on the website. It's free.

Ask a Question

Terms of payment for part-time workers: we rely on the employment contract

The principle of remuneration for a part-time worker is established by the employment contract.

Payment for actually completed volumes

If the terms of the contract concluded between the employer and the part-time worker establish standardized tasks, then at the end of the reporting month, the volume completed by the employee is confirmed by a Certificate of Work Completed, on the basis of which the part-time worker’s wages are calculated.

The basis for calculating payment for actually completed volumes of work is the cost of a unit of product (service, work), which is calculated using the formula:

Roe = Tchs / Nv/h, where:

- Roe – the price of the paid unit;

- Tchs – tariff rate for the work performed;

- Nv/h – production rate per hour, shift;

Payment for work performed in this case will be calculated according to the following formula:

OT = Some x Sep, where:

- OT – remuneration for work performed;

- Cap – the number of paid units of production;

- Sep – cost per unit of production.

Example

A. Ivanova was hired as a part-time real estate agent. The conclusion of 1 contract is estimated at 3,000 rubles. Based on the results of a month of work, Ivanova concluded 4 agreements for the sale of apartments. Accordingly, the part-time salary will be 12,000 rubles. (3000 rub. x 4 d.). Do not forget that personal income tax must be withheld from wages. Ivanov will receive 10,440 rubles. (12,000 – (12,000 x 13%).

Payment for actual time worked

As another option by which payment can be made for part-time work, the Labor Code of the Russian Federation provides for payment for the time actually worked by the part-time worker in the reporting period.

This form of payment is the most common among employers, but it is this form that, given the frequent changes in the legislative framework, requires special attention.

The main calculation aspect in this option, based on which part-time payments are made, is determined by the Labor Code of the Russian Federation, which determines the actual unit of time worked - an hour. The cost of working hours is calculated using the following formula:

Sch = Oshr / NVmnch, where:

- Сч – calculation of the cost of an hour of work;

- Oshr - the amount of the official salary of a part-time worker according to the staffing table;

- NVmnch is the time standard established by the Ministry of Labor for the billing period.

In this case, wages will be calculated according to the following formula:

OT = Sch x FCturv, where:

- OT – remuneration for the time actually worked by the part-time worker;

- Сч – cost of an hour of work;

- FCHturv - hours actually worked, indicated in the time sheet.

The basis for indicating the number of hours worked by a part-time worker in the calculation is solely the indicators of the working time sheet.

Example

Ivanova works at her main job from 7.00 to 16.00. She works part-time as a cleaner from 17.00 to 19.00 every weekday. The official salary of a cleaner is 16,000 rubles.

Let’s calculate Ivanova’s part-time salary based on the 21 working days worked in December 2020.

16,000 rub. / 21 days / 8 hours = 95.24 rubles. (cost of an hour of work).

95.24 rub. x 2 hours x 21 days = 4000 rub. (Ivanova’s part-time salary). Ivanova will receive 3,480 rubles. (4000 – (4000 x 13%).

Example of part-time remuneration

Chechevitsyn K.N. works as an economist and combines duties in the same organization as a secretary in the planning department. The salary of an economist according to the staffing table is 25,000 rubles, a secretary - 10,000 rubles.

Every month, subject to compliance with discipline and internal rules, as well as timely completion of duties, employees are paid a bonus of 30% of the salary. The number of hours per week is 40. In April 2014, Chechevitsyn worked 176 hours in his main position, and 88 hours in a part-time position. Chechevitsyn’s salary is calculated as follows:

- Position of economist: salary - 25,000 rubles; bonus - 7500 rub. (RUB 25,000 x 30%).

- Total for the position of accountant - 32,500 rubles. (25,000 rub. + 7,500 rub.).

Secretary position:

- Salary - 5000 rub. (10000/(176 h/2)).

- Prize - 1500 rubles. (5000 rub. x 30%).

- Total for the position of secretary - 6,500 rubles. (5000 rub. + 1500 rub.).

Total for two positions - 39,000 rubles. (32500 rub. + 6500 rub.).

Part-time payment The Labor Code of the Russian Federation dictates temporary standards

According to the norms of current legislative acts, the principle of summarized recording of working time is a priori applied to part-time workers. This is due to the fact that the Law (Article 284 of the Labor Code of the Russian Federation) allows a part-time worker to work the standard time:

- in basic operating mode with a work schedule of 4 hours 5 days a week;

- with a work schedule of 1 working day, lasting 4 hours, and 2 full working days (8 hours each), provided that on these two working days the part-time worker is released (on vacation, a day off) from his main job.

However, no matter what the work schedule is chosen and established, the number of hours worked by a part-time worker should not exceed half of the standard working time established by the Ministry of Labor for the reporting period; accordingly, the payment for part-time work, when applying the principle “for proportionally worked time”, will be equal to ½ official salary.

Combination features

Extra labor is just as privileged as regular labor. Thus, a person who combines two positions has the right to bonuses, annual leave, sick leave and other benefits at each of the jobs.

According to the Labor Code of the Russian Federation, when combining professions, a main workplace and an additional one must be allocated. This is determined by the location where the work book is stored. The organization in which this document is located will be considered the main workplace of the individual.

When calculating benefits, subsidies and other payments, both basic and additional income for combining positions must be taken into account. Remuneration is made on an official basis, that is, on the basis of an agreement concluded between the manager and the subordinate. Therefore, each organization retains personnel records with a mention of the fact that the individual holds multiple positions.

By the way, the concept we are considering should be distinguished from the so-called substitution. In this case, we are talking about performing the duties of an absent member of the enterprise, and not on the terms of additional work, but instead of one’s main job. In such a development of events, the person who agreed to replace him is paid a separate salary in accordance with this position.

Legislative guarantees for part-time workers

For persons who, along with their main activities, carry out part-time work, wages, regardless of the format of part-time work (external, internal), should be considered on equal terms with full-time employees - they are subject to all established types of additional payments, incentives, incentive payments (unless otherwise established by the terms of the Employment Contract).

It should be remembered that in regions where special allowances and regional coefficients are established, they are also necessarily added to the wages of part-time workers.

Combination of positions: payment

An employee's salary when combined is a controversial issue. On the one hand, the legislation of the Russian Federation does not have specific numbers that it must comply with. The amount of earnings is determined based on the company’s policy, as well as its financial situation. At the same time, the Labor Code states that payment for additional hours should not be lower than the minimum wage established by law. But this is also a double-edged sword. Since part-time work in an additional position is characterized by a reduced schedule, the manager can assign a company employee a salary below the official minimum.

Also, the earnings of an individual depend on the conditions on the basis of which the combination of professions (positions) was formalized. Piecework payment depends directly on the amount of work performed. For example, for a craftsman this could be the number of parts produced. As for time wages, they are calculated based on the period of working time. The more hours an employee spent performing his direct duties, the higher his income will be. Sometimes a manager sets certain standards for the volume of work for his subordinates. In this case, the employee’s salary does not depend on the time spent. The decisive factor is the fact of fulfillment or non-fulfillment of the work norm. For them, the manager determines the amount of monetary payment.

What bonuses does an employee receive for overtime combining professions (positions)? Payment in this case may be supported by bonuses or an additional interest rate.

Features of calculating surcharges in various cases

Payment for combined holidays and weekends is calculated in accordance with Article 153 of the Labor Code. If an employee went to work on a holiday in a combined profession and worked within the working hours, on this day the work will be paid double if the payment is calculated at daily and hourly rates. This is possible with a shift or daily work schedule. If work is paid based on salary, for work on a holiday the employee receives an amount corresponding to part of the salary for one day of work. It is calculated by dividing the salary by the number of working days in the corresponding month.

If the enterprise accepts piecework wages, when calculating wages for combining positions, the quantity of products produced by the employee during additional activities is taken into account.

The procedure for calculating wages for part-time workers

In cases where a part-time employee is registered under an employment contract for a position with a time-based form of remuneration, the basis for calculating his salary will be the time sheet.

The accountant responsible for accruing funds is required to check the actual number of hours worked by a staff unit, absence from work on holidays, duration of sick leave and other nuances. After this, the recorded working hours are multiplied by the tariff rate indicator and the final figure to be accrued is obtained.

Pay for part-time workers at 0.5 rates and pay for part-time workers at 0.3 rates - how to apply

Part-time wages are often found in enterprises that use a shift work schedule and more. This is legally permitted - in Art. 285 of the Labor Code of the Russian Federation clearly states that part-time workers are paid on the basis of a certain amount of time worked, production volume or other basis.

Therefore, in the case where a part-time worker is signed under an employment contract, which provides for time-based wages and sets the duration of work at 30% or 50% of the normal working day, the part-time worker will be paid 0.3 or 0.5 times the rate.

Payment of benefits to a part-time employee.

In accordance with Art. 287 of the Labor Code of the Russian Federation, part-time workers have the right to receive all guarantees and compensation provided for by current legislation, collective agreements and local regulations of institutions.

If necessary, a part-time worker is entitled to benefits for temporary disability and in connection with maternity, which are assigned and paid in accordance with the generally established procedure. So, paragraph 2 of Art. 13 of Federal Law No. 255-FZ[2] determines that if the insured person is employed by several policyholders at the time of the insured event and was employed by the same policyholders in the two previous calendar years, then he is assigned and paid:

| Photo: www.ru.123rf.com |

- benefits for temporary disability, pregnancy and childbirth - by policyholders for all places of work (service, other activities);

- monthly child care benefit - the insured for one place of work (service, other activity) at the choice of the insured person.

These benefits are calculated based on average earnings, determined in accordance with Art. 14 of this law.

Please note that, by virtue of Part 2 of Art. 13, part 1 art. 14 of Federal Law No. 255-FZ, to calculate the average earnings of part-time workers, earnings are taken into account only at the place of work where the benefit will be assigned. In this case, the average earnings during part-time work with another employer are not taken into account if temporary disability benefits are paid for all places of work.

The basis for payment of temporary disability benefits is a temporary disability certificate for each place of work. By virtue of clause 4 of Order No. 624n[3], if a citizen at the time of temporary disability, maternity leave is employed by several employers and in the two previous calendar years before the issuance of sick leave was employed by the same employers, he is issued several certificates of incapacity for work for each place of work.

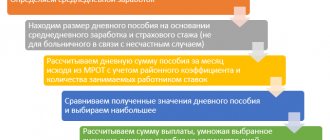

To calculate benefits, the payment of which is carried out at the expense of the Social Insurance Fund, you must remember the following:

- the calculation period is two years preceding the year of the onset of temporary disability (clause 1, part 2, article 1.3, part 1, article 14 of Federal Law No. 255-FZ);

- the average earnings include payments in favor of the insured person, for which insurance premiums are calculated in accordance with Federal Law No. 212-FZ[4] (clause 6, part 1, article 1.2, part 2, article 14 of Federal Law No. 255-FZ );

- the number of calendar days into which average earnings are divided is 730 (Part 3, Article 14 of Federal Law No. 255-FZ).

Average earnings are taken into account for each calendar year in an amount not exceeding the maximum base for calculating insurance contributions to the Social Insurance Fund established on the basis of Federal Law No. 212-FZ for the corresponding calendar year. Moreover, if the appointment and payment of benefits to the insured person are carried out by several insurers, then the average earnings, on the basis of which the benefits are calculated, are taken into account for each calendar year in an amount not exceeding the maximum amount when calculating benefits for each of these insurers (Part 3.2 of Article 14 Federal Law No. 255-FZ).

The size of the maximum base, taking into account indexation for 2014, is 624,000 rubles. (Resolution of the Government of the Russian Federation dated November 30, 2013 No. 1101), and for 2013 - 568,000 rubles. (Resolution of the Government of the Russian Federation dated December 10, 2012 No. 1276).

Example 2.

Let’s assume that external part-time worker L.A. Petrova, working as a cleaner in a budgetary educational institution, fell ill in September 2020. A certificate of incapacity for work was issued for five days. Her average earnings for the billing period (from January 1, 2013 to December 31, 2014) amounted to 110,000 rubles. Insurance experience – 10 years. Payment for sick leave is carried out according to activity code 2 “Income-generating activities”. Benefits are paid for all places of work without submitting certificates from other employers. Benefits are issued through the cash desk.

We will calculate the amount of temporary disability benefits.

The average earnings for calculating temporary disability benefits cannot be less than the minimum wage (Part 1.1, Article 14 of Federal Law No. 255-FZ). Therefore, if the insured person had no earnings during the billing period or the average earnings calculated for these periods, calculated for a full calendar month, are lower than the minimum wage established by federal law on the day the insured event occurred, then the average earnings for calculating benefits are taken equal to the minimum wage provided for by federal law on day of occurrence of the insured event.

From January 1, 2020, the minimum wage is 5,965 rubles.

The average daily earnings in this case will be 150.68 rubles. (RUB 110,000 / 730 cal days).

Let's determine the amount of average daily earnings based on the minimum wage. It will be 196.11 rubles. (RUB 5,965 x 24 months / 730 cal days).

The amount of temporary disability benefits will be equal to 980.55 rubles. (RUB 196.11 x 5 cal days). At the expense of the Social Insurance Fund, 392.22 rubles were accrued, at the expense of the employer - 588.33 rubles.

In the accounting records of the institution, in accordance with Instruction No. 174n[5], the following entries were made:

| Contents of operation | Debit | Credit | Amount, rub. |

| Temporary disability benefits accrued at the expense of the employer | 2 109 60 211 | 2 302 11 730 | 588,33 |

| Temporary disability benefits accrued at the expense of the Social Insurance Fund | 2 303 02 830 | 2 302 13 730 | 392,22 |

| Personal income tax withheld from the amount of accrued benefits (RUB 588.33 x 13%) (RUB 392.22 x 13%) | 2 302 11 830 2 302 13 830 | 2 303 01 730 2 303 01 730 | 76 51 |

| The amount of temporary disability benefits to the employee was issued from the cash register | 2 302 11 830 2 302 13 830 | 2 201 34 610 2 201 34 610 | 512,33 341,22 |

What is included in compensation payments upon dismissal of a part-time worker?

In the event of termination of employment, the employee must receive:

- the amount of unpaid wages for the entire period after the last payment;

- for the remaining days of unused vacation - monetary compensation.

If an employee is fired due to a reduction in the number or staff of employees, in the event of liquidation of the enterprise or its declaration of bankruptcy, the part-time worker, along with other employees, will receive severance pay in the amount of the average monthly salary, and if he does not find a job within two months, a monetary benefit will be paid more and during this period.