The possibility of combination is provided for in Art. 60.2 Labor Code of the Russian Federation. The law allows citizens to perform additional work for one employer, in addition to the main one, for another employee who has gone on vacation, maternity leave, in case of staff shortages, and in other cases. The combination is always formalized and is subject to mandatory payment, regardless of the category of the employee.

| When combining is prohibited (possible restrictions) | How is the deadline for completing combined work determined? | Conditions for performing combined work |

| The prohibition applies: · when the employee does not have the proper qualifications; · if we are talking about a minor employee; · when working in harmful (dangerous) conditions; · if you need to get a special permit to work | The duration of the combination can vary: from a week to several years. The period may not be limited by any date. In each specific case, it is established separately depending on the circumstances predetermining the combination, and is prescribed in all documents accompanying the registration procedure | You should know that the combination: · as defined by Art. 60.2 of the Labor Code of the Russian Federation, possible only with the written consent of the employee; · always paid extra; · involves performing work during working hours; Does not relieve you from your main job |

Important! Employees, managers, and specialists can “combine positions.” The concept of “combination of professions” is applied to blue-collar professions.

It is noteworthy that several employees are allowed to hold one position. In general, the following combination options are allowed:

- Replacing a temporarily absent employee (during his illness, maternity leave, etc.).

- For work similar to the main one (for example, a cleaner is tasked with cleaning other areas).

- For various positions, professions (for example, a driver performs the duties of a courier).

An assignment of any type of additional work can be issued both during employment and after it. In the latter case, an additional agreement is concluded. The Ministry of Labor of the Russian Federation reminds us of this (letter No. 14-1/10/1-4013 dated 09/02/2013).

If the performance of additional work was initially specified in the employment contract, then there is no further need to obtain consent from the employee for the combination.

Deputy Ministry of Labor and Social Protection L. Yu. Eltsova.

You should know that the employer should not record the combination either in the work time sheet or in the employee’s work book.

Labor legislation on combining positions (professions) and payment for it

The legal framework regulating these issues is represented by the relevant articles of the Labor Code of the Russian Federation.

| Norms of the Labor Code of the Russian Federation | Application area | Explanations |

| Art. 60.2 | Regulations regarding combination | The general procedure for assigning other additional work, its content, duration, volumes is presented. |

| Art. 57 | On the issue of drawing up an employment agreement | The contents of the employment agreement are described in detail, i.e. what must be indicated when drawing it up |

| Art. 72 | On changing the terms of the standard employment contract | This rule underlies the conclusion of an additional agreement for the combination |

| Art. 151 | Payment for combined work | The article obliges the employer to pay extra to the employee for part-time work and stipulates the procedure for determining the amount of payment. |

You should also take into account the explanations of the concepts presented in Art. 129 of the Labor Code of the Russian Federation (salary, rate, salary).

The concept of “Combining positions”

We can talk about the concept of “combining positions” if a person performs the duties of an absent person during his working hours. If he has to work overtime, then in this case we are talking about payment for hours outside working hours.

The main provisions for regulating the labor duties of employees are contained in the Labor Code of the Russian Federation. We list the rules regarding combining positions.

| Art. 60.2 Labor Code of the Russian Federation | The employee must confirm his consent in writing. |

| Art. 151 Labor Code of the Russian Federation | Mandatory payment is required for additional work. It is established by agreement of the parties. |

There are no restrictions on combining positions. But there is a circle of privileged citizens whom it is better not to burden with additional work. These include:

- minor children;

- disabled people;

- mothers with children under 3 years of age.

If the employer nevertheless decides to involve these persons in additional work, then it is necessary to obtain written consent from them and document everything.

Some nuances of registration: fixing the deadline, payment, combined work responsibilities

The assignment of additional paid work to an employee is subject to mandatory registration. All agreements reached between him and the employer must be recorded and signed.

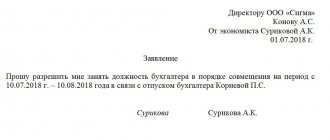

The main documents that appear during registration are: an application (written consent) of the employee, an offer from the employer to perform another, new job, an additional agreement, an order to combine positions. They are used depending on the design method.

There are no standard forms for these documents. Typically, for these purposes, forms are used that are developed by the organization independently.

When developing and compiling these forms, general requirements are taken into account. Therefore, the text part must include information about the combined position, the deadline for completing additional work, and the amount of payment for it. The additional agreement usually specifies the basis for the combination, the employee’s new job responsibilities, and the start and end dates of additional work (if a specific deadline is set for them).

An example is the following samples of an employee’s application and an employer’s order (document forms are provided).

The employee has the right to indicate his combination payment option in the application. Thus, in the proposed form, the applicant asks the employer to set him an additional payment depending on the applicable tariff for the quantity of products produced. The employer, in turn, assigns a specific final amount of additional payment in the order.

How to pay for combined work: general norms and internal regulations of the organization

The legislation does not contain clearly defined amounts, norms, or restrictions on payment for combinations. The size, procedure, and conditions of additional payment are determined by reaching an agreement between the employer and the employee, taking into account the requirements of the local documents on the remuneration system applied in the organization.

For the most part, organizations independently establish the procedure and conditions for such additional payments. Further, the decisions made are consolidated in the appropriate local documents. The additional payment for combination is established taking into account a number of significant factors. These include, for example, the volume, content of work, and the amount of salary (rate) for additional work.

The employer and employee have the right to independently agree on the amount of additional payment, which is fixed upon registration. It is optimal to assign an additional payment in proportion to the main income (or for additional work). The surcharge itself is included in the salary and deducted to the employee in accordance with the salary payment rules in force in the organization.

Important! The amount of additional payment cannot be greater than the rate (salary) for the combined position.

Payment procedure for combining positions

The main standard regulating payment when combining positions is Art. 151 Labor Code of the Russian Federation. However, this article does not provide specific information on payment for such activities, but only gives approval for independent determination of the amount of additional payment by agreement of the parties to the agreement. The text of the standard also contains a recommendation to take into account the nature of the work and the volume of tasks performed for the combined position. There are also no extreme minimum or maximum restrictions on the issue of payment for combinations. However, an indirect meaning of the maximum possible funds to be issued can be the planned money to pay for such work of a particular enterprise.

Payment for combination is subject to personal income tax and corresponding insurance premiums. Also, this category is taken into account in the amount of average earnings, sick leave, and employment and economic benefits.

The law does not provide for additional days of rest for part-time work. However, part-time payment affects the final vacation amounts issued to the employee, since it is included in the base for calculating his average earnings.

Also, controversial situations often arise when the amount of money earned in a combined position does not reach the minimum wage. Many employers often make the mistake of summing up both wages of a subordinate, which are used as a starting point in determining whether the subject’s total income has reached the minimum value. However, this is not correct. Additional payment up to the minimum wage to external part-time workers or internal employees should be made upon failure to achieve the minimum value with income only from the combined position.

Amount of payment for combined work

The amount of the surcharge must go through mandatory bilateral agreement. For your information, after this the employer has no right to change it or reduce it unilaterally, without the employee.

| Acceptable types of surcharge | Regional (other) coefficients for additional payment | Examples of additional payments as a percentage of basic earnings |

| Types of surcharges apply: percentage of salary (rate); fixed payment (specific amount per month); using the current tariff depending on the volume (number) of products produced | All coefficients (northern, regional), other percentage bonuses that are due to the employee are taken into account in the additional payment for combination (in particular, for the regions of the Far North, the norms of Article 315 and Article 316 of the Labor Code of the Russian Federation apply) | As a percentage, the additional payment may look like this: 0.5 or 0.7 salary, as well as 50% or 70% of the salary, etc. |

It should be noted that an employee may not be paid extra for a combination of jobs if he violated labor discipline or performed poorly (did not perform) the work assigned to him.

When do they stop paying extra for combinations?

Payments that are assigned and deducted to an employee upon combination are retained, as a rule, for the entire period specified in the additional agreement (or employment contract). This does not exclude circumstances in which early termination of the additional agreement occurs on the own initiative of one of the parties. Summarizing the above, the following reasons for the termination of additional payment should be noted:

- expiration of the additional agreement on combination;

- return to work of the main employee;

- hiring a new employee for a combined position;

- employee refusal to combine;

- a decision to release an employee from additional work made by the employer.

In the last two situations, the initiator of termination notifies the other party to the agreement in advance of his decision. After this, the cancellation of the surcharge is processed in accordance with the established procedure.

Common mistakes when registering a combination

Mistake 1. You should correctly understand what “combination” and “part-time work” are. These are different concepts. The difference between them is clearly defined by Art. 60.2 and art. 60.1 of the Labor Code of the Russian Federation, respectively.

Part-time work is other paid additional work that the employer entrusts to his employee working for him under an employment contract. Combination is possible only at the place of permanent work and during working hours.

Part-time work is another paid job that a specific person performs exclusively in his free time from regular work with a second, different employer (external part-time job) or in his own organization (internal part-time job).

If, with a part-time job, the second salary is paid in full, then with a combination job, only an additional payment, which is part of the main salary.

Error 2. An employee who is offered to combine work has the right to refuse this. He will not be fired for this, since combining positions or professions is not an obligation, but only his right, which he can use. This rule applies equally to workers and employees.

The refusal of the combination is formalized by the employee (“refusenik”) in writing and transmitted to the employer in advance, at least 3 days in advance.

Disciplinary measures are not taken against an employee who does not agree to perform additional work (combined).

Online inspection. rf.

Error 3. Additional payment for combination work is income, part of the employee’s basic earnings. Therefore, it is subject to general mandatory contributions and income tax.

Cancellation of additional payments for combining positions

The reasons for an employee to stop performing additional job duties assigned to him or her may be:

- Expiration of the period of time established by agreement of the parties;

- Hiring a key employee for an open vacant position;

- A person’s desire to give up such part-time work;

- The employer no longer has a need to perform such work.

How to remove the additional payment for combining positions in these cases? The cancellation process is quite simple:

- If the deadline expires, there is no need to notify the employee about this, nor should an additional order be issued.

- In all other cases, the issuance of a corresponding order from the lessor will be required.

When one of the parties initiates the termination of such labor relations, it is obliged to notify the other entity of its intention at least 3 days in advance.

Sample order for removal of additional payment for combining positions

The Labor Code of the Russian Federation does not establish a specific form of order to terminate the employment relationship of internal part-time workers and withdraw established additional payments from them. Therefore, when placing an order, you need to display the following information:

- Date and serial number of the document;

- Employer's name;

- Reason for canceling the combination;

- The day from which a person is released from bearing additional responsibilities and termination of payments;

- Manager's signature;

- Link to review the order of the interested party.

From the above it follows that when a subordinate performs a certain type of activity that is not included in his main functions, additional earnings are expected to be accrued. These funds are provided by the director in the manner established by legal acts.

Answers to frequently asked questions

Question No. 1: The employer assigned his employee to perform one more duties (new job). The parties reached certain agreements, but there was no formalization. Can an employee, under these circumstances, demand payment for combining?

Maybe, and by all available legal means. But if the case goes to court, then the person in question will need to prove that he actually combined work, provide documentary evidence, etc. In the absence of any evidence, it will be very difficult for the employee to achieve a positive decision.

Question No. 2: Are there additional days off for combined work? And are they paid?

No. The Labor Code of the Russian Federation does not provide for additional rest in such cases. But when calculating vacation pay for the main paid vacation, an additional payment for combined work is included in the calculation base.

Legal regulation

Internal combination and combination - a play on words or a fundamental difference in essence? The Labor Code defines part-time work in Article 60.1, and the combination of positions and professions in Article 60.2.

Based on the definition, it does not imply additional time spent on the performance of official duties or a proportional part, in contrast to part-time work, creating a number of differences according to the criteria presented in the table:

| Options | Combination of professions | Internal part-time job |

| Time to complete | Additional duties are performed in parallel with the main ones without time expenditure | Work at the end of a work shift or on a day off according to a schedule, using part of the interval of time free from main work |

| Registration of relations | To document it, the employee writes a statement and draws up an additional agreement | Part-time work at one enterprise is formalized by drawing up a second employment contract |

| Imposed restrictions | Not provided, since there is no increase in working hours | Prohibited for minors, persons engaged in work in hazardous conditions and requiring increased reaction speed (drivers) |

| Reward | Remuneration for combining positions is made on the basis of a concluded additional agreement and has no maximum limit on the amount | Part-time pay is calculated based on the staffing table and cannot exceed 50% of the established tariff rate or official salary |

How is combined positions paid according to the Labor Code? The payment procedure is regulated by Article 151, according to which additional payment for combining positions is made in the event of fulfillment of obligations not provided for in the employment contract and job description. The minimum amount must be established individually in an agreement or in a collective agreement.

The Labor Code of the Russian Federation does not limit the maximum size, but prohibits the performance of additional duties without additional payment. Based on the wording, we can designate a fork from one penny to an outrageous level. Part-time work is paid on the basis of Article 285 in proportion to the time worked, and in the context of Article 284, which prohibits working more than half the time, sets a limit of 50%.