Understanding the concepts

The legal capacity of minors is limited by law to a certain extent, which affects the process of registering the transfer of real estate as a gift and the further disposal of the apartment.

So, from the point of view of the law, children under 18 years of age are divided into three categories:

- minors, that is, under 14 years of age;

- minors from 14 to 18 years old;

- emancipated, recognized as legally competent after 16 years of age.

In turn, a donation, by virtue of Article 572 of the Civil Code of the Russian Federation, represents the transfer of an object or real estate from the donor to the donee, with all the rights of the owner, implying not only possession, but also disposal, as well as use. At the same time, given that donation is based on the principle of gratuitousness, inclusion in the agreement of donating an apartment to a minor a condition regarding payment or provision of services in the future is not allowed.

Features of drawing up a contract

The main feature of a gift agreement in the presence of registered persons is the reduced value of the property, the reason for this is unnecessary red tape with the registration of third parties, you will need to spend additional time, nerves and money. They can be written out in several ways, which depend on how the persons who do not have property rights to the property are configured.

How much will you have to spend?

Although a donation is a gratuitous transfer of ownership, the recipient will still need to pay a state fee. State registration of real estate is a paid operation. The fee is 1 thousand rubles; in addition, you can reissue the certificate by paying a fee of 200 rubles.

Reference! Having received an apartment as a gift, you will need to pay income tax in the amount of 13% of the cost. Specified in the certificate from the BTI.

What is the time frame for the procedure?

To properly complete all actions, you will need to first prepare all certificates and documents. After that, you go to the notary and if everything is in order, you go to Rosreestr, it will take at least a month to complete the transaction in full.

The procedure for donating real estate if a child is registered in it

If children under the age of 14 are registered in the apartment, then to remove them from registration, either the permission of the board of trustees or a court decision will be required. This is the case if the child does not have property rights to the property. Otherwise, he will need to be provided with a place to live.

Features of donating an apartment to a minor child

By virtue of Article 28 of the Civil Code of the Russian Federation, young children do not have legal capacity, therefore they cannot independently carry out any transactions related to the transfer of ownership of real estate. Instead, their legal representatives, who, within the framework of Article 64 of the RF IC, are parents (adoptive parents, guardians), guard their interests. If the apartment is transferred to a child under 14 years of age under a gift agreement, his presence during the transaction, as well as a signature in the agreement, is not required.

Minor citizens from 14 to 18 years of age, in accordance with Article 26 of the Civil Code of the Russian Federation, have limited legal capacity and can only participate in small transactions. Therefore, the conclusion of a gift agreement is again carried out with the child’s legal representatives, but at the same time the minor already has the right to put his signature on the document.

Important! It is unacceptable for one parent to sign a gift agreement, who will act as both the donor and the legal representative of the child in one person. In such a situation, the signature of the minor or the other parent will be required.

Children who have undergone the emancipation procedure in court acquire full legal capacity and have the right to manage both their own income and personal property. Therefore, in such a rare situation, the apartment donation agreement will be drawn up only between two parties, an emancipated teenager and the donor, without the participation of parents.

The partial legal capacity of minors is not an obstacle to acquiring ownership rights to an apartment, but it is a certain limitation. So the child can use the apartment and live in it, but he has no right to dispose of it in full without the permission of the parents. In such a situation, the residential premises are under a certain encumbrance, which is automatically removed only when the owner reaches the age of majority.

Donating an apartment to grandchildren

Having residential premises in their property, grandparents, for a number of reasons, do not want to leave this property to their children, but want to pass it on to their grandchildren. In turn, when registering transactions with real estate, which is an apartment or its share (Articles 15 - 16 of the Housing Code of the Russian Federation, Article 130 of the Civil Code of the Russian Federation), it is necessary to remember that the transfer of ownership is subject to the state registration procedure .

When making this transaction, the following features must be taken into account:

- Mandatory simple written form of the contract.

- Indication of the mandatory characteristics of the property, or in other words, the address of its location, number of rooms, area, floor, cadastral or conditional number. If we are talking about donating a share, then it is necessary to indicate its specific size.

- a reference to the donor’s title documents for the transferred property is also necessary

- In the special terms of the contract must include information about the persons who retain the right to further residence and use of the residential premises (this could also be about the donor himself), about the presence or absence of any encumbrances, restrictions, arrests on the residential premises; the cost of the apartment (mainly inventory value), a link to the state registration of ownership of the donee.

- The deed of gift may indicate the degree of relationship between the donor and the recipient.

- an act of acceptance and transfer of the apartment can be drawn up as an annex to the agreement (it is not mandatory, but indicates the execution of the agreement by the parties, it is important when concluding a consensual deed of gift).

- The rights and obligations of the parties to the transaction are the same as when making a donation of any other property.

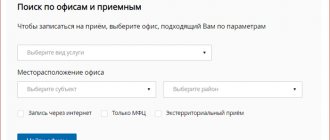

The state registration procedure is an important stage when completing a gift transaction, since it is after it that the grandson (granddaughter) becomes the legal owner of the apartment. It is carried out in accordance with the Federal Law of July 21, 1997 No. 122-FZ “On state registration of rights to real estate and transactions with it.” To complete it, it is necessary not only to prepare the gift agreement itself, but also to submit documents such as:

- passports of the parties to the transaction (if they act through representatives, then documents confirming their authority);

- receipt of payment of the state duty for the transfer of ownership ( 2000 rubles - clause 22, clause 1, article 333.33 of the Tax Code of the Russian Federation - Tax Code of the Russian Federation);

- relevant statement;

- three copies of the gift agreement;

- title documents for the apartment from the donor;

- an extract from the house register or a certificate from the passport office about the presence/absence of residents in the given residential premises;

- technical documentation for the apartment issued by the BTI (not always required);

- notarized consent of the second spouse (if the donor is married and the apartment being donated is joint property);

- consent of the guardianship and trusteeship authorities (if minors and/or incompetent persons live in the residential premises, and this transaction may affect their legal rights).

Important

In addition, the parties to the transaction or their representatives must appear in person at the registration authority with originals and copies of the above documents.

Procedure for drawing up a contract

Pursuant to paragraph 3 of Article 574 of the Civil Code of the Russian Federation, a gift agreement involving the transfer of ownership of real estate is subject to mandatory state registration. Therefore, this document must be prepared only in writing.

The procedure for donating residential premises to a minor child involves the following actions:

- collection of a package of documents, which includes not only standard information about the property and identity of the parties, but also information about other representatives, in the absence of parents;

- drawing up a preliminary agreement, which is due to the need for a legal assessment of the conditions for the transfer of real estate;

- signing a document;

- state registration of transfer of ownership rights.

Since the document is drawn up exclusively in writing and is subject to registration, it is impossible to do without the help of a lawyer.

Donating real estate to a close relative

- property is donated free of charge;

- property is transferred without conditions;

- the donor must have full legal capacity at the time of the transaction;

- the parties must understand the legal consequences of the transaction;

- the donor should not be under pressure (physical or psychological pressure);

- property documents must be originals;

- the object of the donation must be the private property of the donor;

- an object in joint ownership is donated with the consent of the spouse (other owners);

- third parties should not claim rights to the object;

- the object should not be under an encumbrance (pledge, arrest, mortgage).

Gift tax: who pays, taxation under a gift agreement in 2021

If the donor decided to make a gift to someone other than a close relative, then even when transferring the share, a tax debt will arise. In such a situation, the rate will be the same as for the sale of isolated housing - 13%. For example, the subject of the deed of gift is half of the apartment. The beneficiary will be assessed a tax in the amount of 50% of the total assessed value of the entire premises.

Letters from the Ministry of Finance of the Russian Federation indicate that when donating real estate, parties not included in the category of close relatives are required to be guided by the information specified in the gift agreement. But, there is one caveat. All this becomes possible only if the value specified in the gift fully corresponds to the real market value of the object.

Required documents

A donation agreement involves not only the transfer of ownership of residential premises to another person, but also the procedure for state re-registration. Therefore, information that confirms the legality of the transaction is attached to the deed of gift.

The donation agreement must be accompanied by:

- donor's identity card;

- child metric;

- documents on the identity of legal representatives, if the donor is not a close relative;

- parental permission for the child’s personal participation in the transaction;

- permission of the spouse to make a gift if the apartment was purchased during marriage;

- permission to draw up a gift agreement from other owners of an apartment in shared ownership;

- certificate of ownership of residential premises, including technical documentation;

- an extract from the house register on the registration of persons in the apartment;

- inventory value of the apartment for tax calculation.

For state registration of the transfer of ownership rights in Rosreestr you will need:

- gift agreement in 3 copies;

- statement;

- the above package of documents;

- receipt of payment of state duty.

Is it necessary to notarize a gift deed?

By virtue of Article 574 of the Civil Code of the Russian Federation, a gift agreement is drawn up only in writing, but the law does not contain a requirement for mandatory certification of the document by a notary. At the same time, not all donors have the necessary knowledge in drawing up documents of this type, therefore, in order to respect the rights of a minor, it is recommended to draw up the document with the help of a lawyer or a notary.

If it is intended to donate a share of an apartment to a minor in pursuance of clause 1 of Article 42 of Federal Law No. 218, notarization of the deed of gift is required.

Important! In pursuance of Part 3 of Article 35 of the RF IC, the spouse’s permission to donate an apartment acquired during marriage requires mandatory registration through a notary.

Drawing up a gift agreement for a grandson or granddaughter in 2021

The process of making a gift in 2021 is still regulated by Chapter 32 of the Civil Code of the Russian Federation and is understood as a gratuitous and irrevocable transfer of property by the donor in favor of the donee (according to the standards established in Article 572 of the Civil Code of the Russian Federation).

Today, almost any person can act as a donor, except for those listed in Article 575 of the Civil Code (for example, incapacitated or minor citizens). However, these persons can also act as recipients in such transactions.

At the same time, according to our surveys and based on the rich practice of the site’s specialists, in most cases deeds of gift are concluded between close relatives, the category of which, according to Article 14 of the Family Code of the Russian Federation, includes:

- Spouses;

- children;

- parents;

- brothers and sisters (including half-siblings);

- grandchildren;

- as well as grandparents.

Based on the norms established in the RF IC, we can recognize the fact that a gift agreement between grandparents and their grandchildren refers to transactions concluded by close relatives, which, in itself, automatically entails certain consequences of the agreement.

ARTICLE RECOMMENDED FOR YOU:

Pretentious gift agreement - legal advice

The legislator has defined a list of requirements relating to such transactions. It includes:

- A certain subject composition of the gift transaction . It is worth noting the fact that if the grandson is a minor, his legal representative (parent or specialist from the guardianship authorities) must participate in the transaction.

- Compliance with the form established for such agreements . We remind you that the gift agreement, according to the current legislation of the Russian Federation as of 2021, can be concluded between the parties either orally or in simple written form. At the same time, notarization of the agreement today is still not mandatory. However, in certain situations, the list of which can be found in Article 574 of the Civil Code of the Russian Federation, a deed of gift must be concluded exclusively in writing!

- The presence of a sign that the transaction is gratuitous . Since donation is a completely gratuitous transaction, it is recommended that the content of the contract indicate the donor’s desire to reduce his own property, thereby increasing the property of the donee without any counterclaims to the latter. If such conditions exist, the donation will be declared invalid (according to Articles 167 and 170 of the Civil Code of the Russian Federation).

- A list of the main properties and characteristics of the donated item that would distinguish it from similar ones.

We also remind you that the parties to the agreement have the right to terminate the deed of gift unilaterally. Thus, according to the norms described in Article 573 of the Civil Code of the Russian Federation, the recipient has the right to refuse to accept the gift, and, based on Articles 577-578 of the same legislative act, the donor may refuse to fulfill the agreement.

Expert opinion

Oleg Ustinov

Practicing lawyer, author of the website “Legal Ambulance”, one of the co-founders of the “Our Future” foundation.

A deed of gift between grandparents and grandchildren can be real (the transfer of the object of the gift is carried out upon concluding an agreement) or consensual (the so-called contract of promise of a gift in the future), when the donor promises to transfer the gift into the ownership of the donee within the period established in the contents of the gift agreement.

Thus, when drawing up a gift agreement, the parties are required to include the following clauses, without which the transaction can be classified by the legislator as void and invalid:

- Name of the transaction (for example, a donation agreement for a car, apartment, house);

- place of conclusion of the agreement and date;

- important information about the parties to the donation, as well as their real details;

- object of the transaction;

- characteristics and unique properties of the donated item;

- obligations, as well as rights of the donor and the donee;

- a list of special conditions (for example, a list of grounds for changing or terminating the contract);

- degree of relationship between the parties (helps save time when determining exemption from personal income tax);

- signatures.

How to give an apartment to your grandchildren in 2021

Very often, having owned residential property, grandparents, for certain reasons, want to transfer it into the ownership not of their children, but into the ownership of a grandson or granddaughter.

First of all, when drawing up transactions the subject of which are real estate objects (the category of which includes, according to Articles 15 and 16 of the Housing Code of the Russian Federation and Article 130 of the Civil Code, private houses and apartments), it is necessary to take into account that such deeds of gift require mandatory state registration of the right property of the new owner.

ARTICLE RECOMMENDED FOR YOU:

State registration of a gift agreement in Rosreestr

In addition, when deciding to transfer an apartment in this way, it is worth considering the following important features of the transaction:

- The donation must be formalized in simple written form. This is a mandatory condition established by the legislator.

- The contents of the deed of gift must list the characteristics of the housing that would distinguish it from similar real estate properties (information from the technical and cadastral passports, floor, area, number of rooms, address, etc.). In the event that we are talking about a gratuitous donation of a share, its size must be indicated.

- The text of the agreement must include a link to title documentation confirming the donor’s ownership of the apartment.

- It is recommended to indicate the degree of relationship of the parties in the deed of gift. This will make the 2021 gift tax exemption process much easier.

- Also, experienced lawyers of the website “Legal Aid” recommend that the special terms of the gift agreement be specified in the deed (any restrictions or encumbrances, the donor’s right to live in the apartment donated to him, etc.).

- The text of the main document should indicate the actual value of the property at the time of the transaction.

- To the main deed of gift, the parties can draw up an act of acceptance and transfer, which reflects the execution of the agreement (this document is not mandatory).

The next no less important stage, without which the gift will be declared invalid, is the state registration of the property rights of the grandson or granddaughter. It is after receiving the appropriate certificate that the donee is considered the legal owner of the apartment.

The registration procedure is regulated by Federal Law No. 122, which was adopted on July 21, 1997 (“On state registration of rights...”). To implement this, the parties to the donation of real estate need to draw up an apartment donation agreement, and then provide it to Rosreestr employees along with the following documents:

- passports of the donor and donee, as well as their legal representatives, if any are involved in the transaction;

- a receipt for successful payment of the state fee for registering the transfer of ownership, the amount of which for 2021 is 2,000 Russian rubles (according to subparagraph 22 of paragraph 1 of article 333.33 of the Tax Code of the Russian Federation);

- statement;

- deed of gift in 3 copies;

- all available title documents for the donated apartment;

- all technical documentation for the living space (passport, BTI certificates, etc.);

- an extract from the house register stating that the housing transferred under the donation agreement is/is not lived in by citizens other than the owner;

- notarized consent to the transaction of the second spouse, if the donated apartment is part of the property acquired jointly during the marriage;

- written consent of employees of the guardianship and trusteeship authorities, if the donated living space is inhabited by incapacitated or minor persons whose rights may be violated as a result of the transaction.

Additional terms of the agreement

By virtue of Article 572 of the Civil Code of the Russian Federation, the gift agreement is based on gratuitousness, as a result of which the donor does not have the right to include in the document any conditions that imply the receipt of profit in the future. But the former owner can still stipulate some guarantees for himself, in particular, the return of the apartment in the event of the death of the former donor.

Important! In pursuance of Article 572 of the Civil Code of the Russian Federation, the condition on the transfer of an apartment as a gift after the death of the donor is void.

A sample agreement for donating an apartment to a minor as amended in 2020 can be found here.

Giving to minor grandchildren in 2021

Gifting property by grandparents to their grandchildren is quite common today in our country. At the same time, the legislator does not limit the type and type of property benefits. Simply put, a grandson or granddaughter can receive everything through a deed of gift - from a teddy bear to real estate and large sums of money.

ARTICLE RECOMMENDED FOR YOU:

Gift deed after the death of the donor

As we already mentioned at the beginning of the article, drawing up a gratuitous donation agreement can become difficult only if the role of the donee is a minor. The reason for the complexity lies in the fact that in this situation, consent to accept the gift is actually obtained not from the recipient, but from his legal representative, whose role in 2021 can be, according to paragraph 12, paragraph 5 of the Criminal Procedure Code of the Russian Federation, as well as 64 articles of the Family Code of the Russian Federation:

- parents;

- trustees;

- adoptive parents;

- guardians.

For this reason, the parties to the donation must indicate not only the details of the grandson/granddaughter himself, but also include in the content of the agreement information about his representative, specifying that this person is participating instead of a minor or incapacitated citizen.

How will taxation change for real estate transactions?

Order an extract from the Unified State Register of Real Estate . With this document you can find out the history of the owners of the apartment, as well as all current owners. In addition, you will understand whether there are any encumbrances on the property.

Personal income tax on the sale of an apartment received under a gift agreement in 2021

There are no exceptions based on age or other criteria. Pensioners, people with disabilities, and orphans must pay the apartment donation tax on an equal basis with everyone else. And for children who are not yet 18 years old, the fee will be returned to the state by their parents, guardians or trustees.

- sisters, brothers (both full and not full-blood);

- granddaughters, grandchildren;

- grandparents;

- children (including adopted children);

- parents (father, mother);

- spouses (husband, wife).

If they are related, the extent of the relationship will be decisive in determining whether the gift is taxable. However, for the taxation of a donated apartment, other points should also be taken into account, which are always taken into account when establishing the fact and amount of the corresponding obligations.

Apartment donation transaction: legal features

- the gratuitous nature of the transfer of rights to property to another person;

- the property of the donee increases;

- the donor's property decreases;

- the voluntary nature of the participation of both parties in the gift transaction (the transfer of an object as a gift is carried out by the donor solely of his own will, and the recipient has the right, at his personal request, to accept this gift or refuse it);

- the irrevocable nature of the transfer of ownership of the object of donation, which cannot be taken back by the donor from the recipient, unless otherwise provided by the legislation in force in the Russian Federation.

- cadastral: established in the process of state assessment, applied to real estate;

- market: determined by experts, in relation to real estate is equal to cadastral;

- contractual: determined by the parties under the gift agreement (hereinafter referred to as the DD) independently.

Is it possible to be exempt from tax if the gift occurs between cohabitants?

It's always nice to receive gifts, especially if it's an apartment or a house. The only problem is that such gifts are of great interest to the tax service - after all, income received in the form of donated real estate is subject to personal income tax (clause 18.1 of Article 217 of the Tax Code of the Russian Federation).

Who must pay tax when donating real estate and how much?

The rules for calculating tax on donated real estate cannot be called simple: they have recently undergone a number of changes, so now there are more nuances. Let's look at the main ones, taking into account the latest clarifications from the Federal Tax Service.

Is gift tax subject to tax and who must pay the tax? Citizens are required to declare all their income, including items received as a result of legal transactions. Therefore, the obligation to pay tax payments falls on the recipient, since he has income in the form of received property.

You may like => Is it possible to use the child deduction in two organizations

The gift agreement is signed by both parties. Civil legislation provides that it can be drawn up in the form of a simple written agreement, or in the form of a notarial agreement. The form of the documents is chosen by the parties. In the future, when the deed of gift is signed, it will need to be registered with the registration authority - Rosreestr.

Terms of a transaction

The above-mentioned persons pay tax payments on a general basis, despite existing family ties. Pensioners do not have benefits when donating. Only if he is one of the close family members, then the benefit applies. To confirm the relationship between the parties, it is necessary to have an appropriate document, according to which the chain of relationship can be established.

Legally, the law provides for a situation where a child aged 14 to 18 years can donate an apartment that belongs to him. But in practice this is almost impossible to achieve. Art. 54 Federal Law No. 218 of 2015 provides that trustees or parents of a child donor must obtain permission to make a gift from the guardianship department at their place of registration. Specialists from the guardianship department will most likely give a written refusal to such an application, since as a result the child’s financial situation will worsen. With this refusal, parents must go to court to have it declared illegal. But as of 2021, there is no positive judicial practice in such cases. That is, the parents will be refused in court.