The problem of donation becomes relevant when the owner of real estate is looking for an opportunity to register in the legal field his will to freely transfer to any person (most often a close relative) the rights to this real estate.

But what if the owner of the property wants to make a gift during his lifetime, but with the proviso that the new owner ( the donee) has the right to accept this gift only after the death of the donor.

The desire of the property owner to formalize just such a transaction is quite understandable. Many have heard about many years of litigation in which heirs are at odds with each other in attempts to challenge the will and divide the property of the testator (deceased) against his will. To stop disagreements between relatives, property owners are trying to find a way out by donating real estate during their lifetime.

However, the Civil Code of the Russian Federation (Civil Code of the Russian Federation) limits the circle of people willing to make such gifts. The restrictions are reasonable because they significantly protect the rights of living property owners.

As Part 2 of Art. 17 of the Civil Code of the Russian Federation, a citizen receives the opportunity to participate in civil transactions ( acquire rights and perform duties ) at the time of birth and loses this opportunity at the time of death. The obligation to donate an item that the donor undertakes under the gift agreement exists exactly as long as the donor is alive.

Attention

The person who accepted the gift must have time to formalize his right only as long as the donor is alive. It is considered that real estate has been accepted as a gift only after its state registration (Part 3 of Article 574 of the Civil Code of the Russian Federation). Otherwise, you will have to prove your right to the gift in court.

It is prohibited to include in the text of the deed of gift a condition that the recipient has the right to accept the gift (in the case of real estate, to register ownership) only after the death of the one who made such a gift (Part 3 of Article 572 of the Civil Code of the Russian Federation).

Concept and parties to the gift agreement

Despite the fact that the act of donation is called an agreement, civil law does not provide for any agreements between the donor and the donee. This is a one-sided transaction , under which only the donor has obligations.

Any mutually beneficial agreements must be made according to the rules of the purchase and sale agreement or other compensated transactions. The definition of donation is given in Part 1 of Art. 572 of the Civil Code of the Russian Federation, and, based on it, we can give the following characteristics to these legal relations.

- The donor undertakes the obligation to give the donee property (part of the property) that is owned by the donor.

- The donor is prohibited from demanding payment from the recipient for transferring the gift .

- Although the donee does not assume any obligations under the deed of gift, he is a party to this agreement and must sign it. Subsequently, the recipient has the right to refuse the gift. The procedure for signing the contract itself does not oblige the recipient to any action.

Is a deed of gift contested after the death of the donor?

The question often arises: is it possible to challenge a gift agreement? The answer is yes, you can. But it is immediately necessary to make a reservation that challenging a deed of gift is a very long and complex process, especially if it is drawn up according to all the rules. In addition, the period for challenging the deed of gift is 3 years from the date of conclusion of this agreement.

It would not be superfluous to take into account the situation if the gift deed has already been concluded, but its registration has been postponed to a later date.

If during this period the donor dies, then such an agreement also has no legal force, since when submitting an application to RosReestr to register the transaction, the signatures of both persons, the donor and the donee, are required.

Below is a list of documents that are required to register a transaction.

- Passport or birth certificate of the donor, as well as the recipient.

- Donation agreement. (According to the number of persons between whom the transaction takes place. + 1 for RosReestr).

- State payment receipt fees for recognition of the transaction.

- Certificate of cadastral registration of property (passport) from the Bureau of Technical Inventory.

- Extract from the EIRC.

- Extract from home book.

- Extract from personal account.

It is important to note that, provided that minor children are registered or live in the donated property, mandatory permission from the guardianship and trusteeship authorities is required for this transaction!

Form of gift agreement

According to the general rules of civil proceedings, a gift can be made in two forms:

- by oral application (Part 1 of Article 574 of the Civil Code of the Russian Federation);

- execution of a written document (Part 2 of Article 574 of the Civil Code of the Russian Federation).

Important

A verbal order for a gift that the donee can accept only after the death of the donor is illegal. This rule applies to gifts between citizens of cars, household items (furniture, household appliances, etc.), and any movable property.

The form of the real estate gift transaction is more strict:

- Real estate can only by written agreement;

- a written deed of gift must undergo mandatory state registration (Part 3 of Article 574 of the Civil Code of the Russian Federation);

- a notarized form of certification of the transaction is not mandatory . Roughly speaking, the donor has the right to write a gift agreement by hand, and the recipient of the gift will be able to transfer the property to himself under this agreement;

- all terms of the gift agreement must be set out in accordance with Russian legislation and civil rules. That is why those wishing to make a gift are recommended to contact notaries to draw up a notarized gift agreement, since the notary will be able to draw up the correct text of the transaction. Moreover, he bears financial responsibility for errors made in the contract. The fact that the law does not indicate that a notarial form is mandatory does not exclude the right of a party to contact a notary on its own initiative.

- An agreement drawn up in violation of civil law will not pass state registration.

What is the content of a statement of claim for the cancellation of a gift agreement after the death of the donor?

This statement contains a lot of information. First of all, this is all the necessary data of the plaintiff (last name, first name and patronymic in full, address of registration with zip code, contact phone number). The same data, with the exception of the telephone number, is indicated for the gifted person. The last name, first name and patronymic, as well as the address where the donor lived, are also subject to recording in the statement of claim.

A full description of the donated property cannot be avoided. There must be a reference to the regulatory basis for challenging the deed of gift (that is, to those articles of regulatory legal acts that, in the opinion of the plaintiff, were violated). The essence of the circumstances in accordance with which the agreement on donation of property should be canceled should be set out as fully as possible. The text of the statement of claim must contain a description of all the evidence that the plaintiff intends to present to the court (during the consideration of the case, other evidence not listed in the statement of claim may also be provided).

IMPORTANT !!! The plaintiff must clearly state in the statement of claim exactly what demands he is making. We must be aware that such demands must be legal and appropriate; it will not be possible to challenge the donation simply on the basis that the donor ignored the plaintiff. In this case, going to court will be a waste of time; to cancel the donation you need compelling reasons, supported by a strong evidence base.

At the end of the statement of claim there must be a list of documents that are appendices to it. The plaintiff must put his own signature on the statement of claim.

During the consideration of the case, various examinations may be carried out, including post-mortem forensic psychiatric examinations.

Subject of the gift agreement

Property that can be donated should not be excluded from civil circulation .

Ownership rights must be registered in accordance with the norms of the legislation that was in force at the time the ownership rights arose. This is especially true for rebuilt or completed real estate properties. A property that does not comply with the documents cannot be transferred as a gift.

Additionally

The contract may contain a promise of a gift in the future .

Moreover, it is valid only if it is concluded in writing and contains a clear intention to complete the transaction. The subject of the donation must be specified in detail in the deed of gift . If we are talking about real estate, then the address, area, and title documents for the object must be included (Part 2 of Article 572 of the Civil Code of the Russian Federation).

The object of the deed of gift - what can act as a gift in 2021

The object of donation in 2021 can be any property rights or benefits that are not excluded from civil circulation!

ARTICLE RECOMMENDED FOR YOU:

Donation agreement from a legal entity to an individual

In addition, the ownership of an item donated free of charge must be registered in accordance with the laws in force at the time of the emergence of this ownership. This is especially true for real estate objects that have been completed or rebuilt, and their current plan differs from the previously approved one. Thus, real estate that does not comply with the documentation cannot act as an object of donation!

Lawyer's Note

We remind our visitors that a gift agreement can be not only real, but also consensual! Simply put, it can be in writing and contain a promise by the donor to carry out a transaction in favor of the donee in the future.

Also, do not forget that one of the fundamental norms when drawing up an agreement is a detailed indication in the content of the gift agreement of all the important characteristics and properties of the object of the gift, distinguishing it from other similar objects.

For example, if the gift is real estate, then, according to Part 2 of Article 572 of the Civil Code, the content should include:

- physical address of the object;

- its actual area (residential and non-residential);

- title documents for real estate, etc.

Is it possible to give after death?

As can be seen from a systematic analysis of civil law norms, a gift agreement, according to which the recipient accepts the gift only after the death of the donor, cannot be concluded by the parties .

In addition, the Civil Code of the Russian Federation has a direct ban on concluding such agreements (Part 3 of Article 572 of the Civil Code of the Russian Federation). According to this norm, such a gift is void.

Important

If the contract itself contains a condition that the recipient of the gift has the right to accept it (register ownership) only after the death of the giver, then such a transaction is void .

If there is no clause in the contract, but in fact the recipient did not accept the gift (did not register) during the life of the donor. After the donor has died, re-registration will be possible only after a positive completion of the legal battle to recognize the deed of gift as valid.

When dealing with a void deed of gift, you need to realize that there is no need to challenge this document in court, since in accordance with Part 1 of Art. 166 of the Civil Code of the Russian Federation, such a gift is initially void and not controversial . This is important because courts only consider disputes between citizens.

What is the procedure if the owner dies?

A deed of gift for an apartment after the death of the donor is not always recognized as valid; these issues are regulated by the Civil Code of Russia. One of these moments is considered to be when there is a note in the contract that the residential premises or land ownership will be transferred as a gift only after the death of the donor. This is not implemented and is considered illegal, as it is contrary to the laws of our country. An apartment donation agreement can only be executed while the donor is alive. This happens because the submission of documentation for the deed of gift takes place in the Russian registry and with the mandatory presence of all members participating in the procedure.

A donation after the death of the donor is considered incomplete, since the new owner has not taken possession of the property. When the rights to an apartment or land ownership have not been registered to the new owner, the donated apartment after the death of the donor is included in the inheritance, which means it is transferred to the heirs for their use.

There are times when the deceased managed to sign a gift agreement, but the transfer of ownership documentation to the new owner is not completed.

The recipient can try to establish his right to own the donated property in court, but this is very difficult; the heirs are able to challenge the transaction, since the gift agreement is declared invalid after the death of the donor.

We recommend that you read:

How to return a donated apartment back to the donor

What is a deed of gift for an apartment after the death of the donor, how does the whole procedure take place:

- A void document is a transaction that could have been completed, but for certain reasons does not have legal force. This happens when a document does not comply with the basic requirements of the legislation of our country. Article 573 of the Civil Law Code states that it is possible to issue a deed of gift for an apartment while the donor is alive.

- The gift agreement will be invalid if the donor dies, since all his property at that moment passes to the heirs.

- A deed of gift for an apartment is processed only when all members of the transaction are alive. Since the transaction itself implies the replenishment of the property of the recipient and, accordingly, a decrease in the donor’s possessions.

- When a person wants to transfer his possessions as a gift only after death, it is better to prepare a will, because a deed of gift cannot come into force after the death of the donor. Therefore, before concluding a deal, you need to think carefully about whether there is a desire to part with the property during your lifetime.

- When a person chooses whether he wants to donate an apartment or leave it in a will, responsibility for the choice remains only with the person concluding the agreement. Since the competence of lawyers includes only supporting the transaction and confirming its legality.

- People do not always understand the meaning of the donation procedure and often find themselves in a situation where they are deprived of all grounds for using their home by donating it. To prevent this from happening, you can prepare a will and use the property yourself until your death. Heirs receive the right to use the apartment only when the testator passes away.

After the death of the donor, members of his family can challenge the deed of gift for an apartment; they are also called heirs.

The fact of donation is confirmed by the re-registration of the right of use; if this does not happen, the transaction can be refuted and considered invalid.

Consequences of donation after death

Sometimes heirs are faced with situations where, after the death of a relative, it turns out that all or part of his property was donated. In such cases, the recipient of the gift provides the heirs with a gift agreement to confirm his rights.

Heirs have the right to disagree with the testator’s gift in the following cases:

- if at the time of opening of the inheritance (death) the property has not actually been donated (there is a condition in the agreement that the recipient accepts the gift only after the death of the donor);

- if in the deed of gift the donor disposed of property that did not belong to him. Most often this concerns movable property. For example, he donated furniture from his apartment, which belonged in equal shares to his wife.

Additionally

When it is established that the gift agreement is void , this is reported to the notary who is in charge of the inheritance case. In this case, the notary is obliged to be guided by the consequences of a void transaction, which are determined by Part 1 of Art. 167 of the Civil Code of the Russian Federation, that such a transaction does not entail any consequences .

If the testator left a will with the wording according to which he bequeaths to the heirs all his movable and immovable property in certain shares, the gift for a void transaction is included in the inheritance and is distributed among the heirs in those parts determined by the testator.

If a will is drawn up for specific objects of civil rights , then the heirs inherit the inheritance due to them under the will, and the property included in the inheritance as an insignificant gift is inherited according to the rules of inheritance by law.

If the testator did not leave a will , all his property, including an insignificant gift, is inherited among the heirs according to the law.

General introductory information

Every year, more and more Russians want to transfer their property or a certain part of it to their loved ones, observing all the necessary legal norms. At the same time, many of them want to transfer free of charge ownership of property only after their death, wanting to avoid problems with relatives and drawing up a will. There are no problems in cases where a person wishes to transfer property during his or her lifetime. A gift transaction is quite suitable for this.

The problem arises when the owner seeks to transfer the right to use the gift to others during his lifetime, but with the condition that ownership will pass to these persons only after his death.

Expert opinion

Oleg Ustinov

Practicing lawyer, author of the website “Legal Ambulance”, one of the co-founders of the “Our Future” foundation.

Considering the numerous legal proceedings between heirs, as well as conflicts and “schisms” within families, the above-described desire of the owners is considered quite logical. After all, in this way, it is possible to improve the quality of life for certain individuals right now, without worrying that their rights may be challenged by other heirs in the future.

Let us immediately note that, according to the current legislation of the Russian Federation, not everyone can make such gifts! At the same time, the restrictions established by the legislator are, first of all, aimed precisely at protecting the rights of living owners of property benefits.

Thus, based on the information published in Part 2 of Article 17 of the Civil Code of the Russian Federation, a citizen receives the opportunity to participate in the role of one of the parties to the deed of gift (that is, is endowed with the ability to accept and transfer things) at the moment of birth, and loses these rights and obligations at moment of death.

Thus, the obligation to transfer property, which is formed when concluding a gift agreement, can only exist during the life of the donor. Simply put, the donee must have time to re-register ownership during the life of the donor! This is especially true for gifts that require, according to Part 3 of Article 574 of the Civil Code of the Russian Federation, mandatory state registration (such, for example, include a private house or vehicle). Otherwise, the party accepting the gift will need to defend its rights to it in court.

ARTICLE RECOMMENDED FOR YOU:

How to arrange a deed of gift for an apartment or house for your son?

The situation is complicated by the fact that when drawing up a deed of gift, the parties are prohibited from introducing into it any conditions relating to the acceptance of the gift after the death of the donor (Article 572 3 of the Civil Code).

However, there is a way out of this situation. But, for this, it is necessary to understand how donation “works” from the inside.

Alternative to donation after death

An alternative is a will . In a will, everyone has the right to dispose of property at their own discretion. To exercise this right, the testator, when drawing up a will, can:

- bequeath all your property to a specific person . However, such wills are most often contested, since the testator often has heirs who have the right to claim an obligatory share in the inheritance;

- bequeath specific property to specific persons . Such wills are difficult to challenge. But the person who draws up the will must ensure that the inheritance (for example, an apartment) is properly formalized and registered with government authorities, since otherwise the heir will not have rights to the unregistered piece of real estate.

Example

The father gave his son an apartment. The contract was certified by a notary. However, the son did not have time to register the apartment in his name before his father’s death. After the death of his father, his wife, with whom he did not live together, but did not formally file a divorce, filed an application to accept the inheritance. The notary established that the apartment donated to the son under the contract has not yet been registered in the son’s name, and on the basis of Part 3 of Art. 572 of the Civil Code of the Russian Federation included the apartment as part of the inheritance. The son filed an application to the court to recognize the donation as valid. Since the son had in his hands the act of acceptance and transfer of the apartment and the title documents on it, the court recognized that in fact the son accepted the gift from the donor and the gift agreement took place. Based on a court decision, the apartment was excluded from the inheritance.

Registration of a gift agreement by an heir

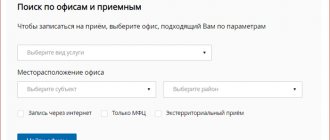

The heirs have full right to dispose of the property inherited under the will. To write a deed of gift, you need to follow the given algorithm of actions:

| Stage | What should the heir do? |

| Entry into inheritance | • Contact a notary office. • Present to the notary documents confirming the right of inheritance: - papers proving the existence of a connection between the deceased and the presumptive heir; - identification; - death certificate; - cadastral passport. |

| Registration of property rights | • Visit the notary's office again. • Provide the following documents to the specialist: - passport; — documents on the basis of which the client has the right to dispose of inherited property; - a check confirming the transfer of money towards the state duty. |

A citizen can dispose of property received under a will from the moment of registration of property rights. The process is complicated by the presence of several heirs. Each of them owns a certain share, therefore, the gift agreement is drawn up only with the consent of all co-owners.