If an inheritance is opened and the property is distributed according to the law, close relatives usually receive the property. Among them are brothers and sisters. You need to follow the sequence. The order of inheritance after the death of a brother or sister is determined by Chapter 63 of the Civil Code of the Russian Federation. Additionally, the presence of a will is taken into account. If there is one, the standard features of property distribution may change. The presence of other heirs, the presence of a documented and well-executed will of the deceased owner of the property affects who will receive the inheritance after the death of a brother or sister.

Can a brother or sister claim an inheritance?

Property is distributed by law or by will (Articles 1118 and 1141 of the Civil Code of the Russian Federation. If the deceased owner has documented his will in the will, his wishes will be taken into account. A citizen has the right to name any person as his heir. Then the presence of family ties is not taken into account. They are important if property is distributed according to the law. The process is regulated by Chapter 63 of the Civil Code of the Russian Federation. Inheritance is received in order of priority. Initially, the closest people claim the property. These are:

- mother and father;

- children (natural or adopted);

- husband or wife.

If there are no 1st line relatives, the right to receive property passes to representatives of the 2nd line.

It follows from the provisions of Section 5 of the Civil Code of the Russian Federation that brothers and sisters can claim inheritance. They receive property both by law and by will. Brothers and sisters are heirs of the 2nd stage. To obtain property, the law requires a blood relationship. This means that brothers and sisters can be full and half-blooded. This fact does not affect the specifics of inheritance. But half-brothers and sisters who do not have common parents do not receive property if there is no mention in the will.

Can a sister legally claim her brother's inheritance?

A sister can claim her brother's inheritance through legal inheritance. Section 5 of the Civil Code establishes general provisions for succession that guarantee the rights of relatives (including distant ones) to inheritance. You will receive the right to the property of a deceased brother if he did not have closer relatives - wife, children, parents.

Information for your attention! The law of the Russian Federation provides for two methods of inheritance - law and will. Such possibilities are mentioned in Art. 1118 and 1141 Civil Code. The will has priority when determining the circle of recipients. A citizen has the right to dispose of property at his own discretion.

And the question of whether the sister, whose interests the brother has provided for in the will, has the right, disappears by itself. She will be able to inherit money bequeathed to her, immovable/movable objects to the extent provided by the testator.

Question: “If I am the only heir under a will, but my brother has children and a spouse, can I inherit the bequeathed property in full?”

Answer: To give the correct answer, you need to clarify some nuances. Namely, you need to find out whether the spouse of the deceased person is able to work and what age his children are. Minor age, disability, incapacity for work due to age are grounds for allocating a compulsory inheritance share to the applicant.

Obligatory heirs can claim 50% of the share guaranteed to them as part of legal inheritance (if it were their turn to be called). The share due to them will be allocated regardless of the wishes of the manager. If a wife lays claim to her husband’s share, she needs to certify the marital ties and confirm her own incapacity for work (disability, retirement age).

When do brother and sister claim each other's inheritance?

Brother and sister do not always inherit property after each other. They will receive property in the following cases:

- There are no heirs of the 1st stage, or a refusal to receive property by inheritance has been issued.

- The sister or brother was a dependent of the testator. This status will be assigned if the owner of the property provided for a relative for at least one year. In this case, the brother or sister must be recognized as disabled.

- In order of investigative transmission. The issue is regulated by Article 1156 of the Civil Code of the Russian Federation. A sister or brother will receive property if he is the heir of a person who should have received the property, but died without exercising his right. It's easiest to understand with an example. Let's say one of the two brothers passes away. The testator is survived by his mother and children. The woman also died soon before she could receive the property. The mother indicated her son as her only heir. In this case, the brother will receive a share in the property, although representatives of the 1st stage are present.

- A will has been drawn up. Any person can be indicated in the document, regardless of family ties.

Can a sister claim her brother's inheritance if he has children?

The children of a deceased citizen are heirs of the 1st stage (Article 1142 of the Civil Code of the Russian Federation). Therefore, having a child usually deprives a brother or sister of a share in the inheritance. But there are exceptions. Brothers and sisters will receive property in the following cases:

- The person was dependent on the testator. In this case, the brother or sister will be taken into account among the compulsory heirs.

- A notarized waiver of the property has been issued, or there are no heirs of the 1st stage. In this case, the brothers and sisters will receive a share on a common basis. They are recognized as heirs of the 2nd stage (Article 1143 of the Civil Code of the Russian Federation).

- A sister or brother is the heir of a person who had the right to a share, but did not have time to accept it (Article 1156 of the Civil Code of the Russian Federation).

- A will has been drawn up. The testator has the right to name any persons, regardless of relationship. But if there are heirs of the 1st priority, there will be a need to allocate a mandatory share (Article 1149 of the Civil Code of the Russian Federation).

When can a sister claim her brother's inheritance?

It is impossible to answer such a question unequivocally. The fact is that, regardless of the degree of relationship, the right of inheritance can be influenced by the factor of the will, obligatory share and many others. Therefore, such a question can only be considered in the totality of circumstances.

A sister can become an heir to the property of a deceased brother in several cases:

- If the brother left a will in the name of his sister, where he indicated her share or as the sole heir. If, in addition to the sister, other persons and shares are not determined, then the shares of all heirs will be the same. This method of inheritance is the most problem-free, since if there is a will, it is enough to bring it to a notary, present the applicant’s passport to the notary and, after a period of 6 months from the date of death of the relative, receive a certificate of the right to inherit;

- If the heirs of the previous line (in inheritance by law) refused the will or were recognized by the court as unworthy heirs. In this case, the turn of inheritance will pass to the sister or brother of the deceased;

- The category of disabled dependents is considered as a separate category of heirs. If a brother or sister was dependent on the deceased for more than one year, then they receive the right to claim a share in the inheritance on an equal basis with the heirs of the current line. If property is inherited under a will, then the right to an obligatory share in the inheritance arises, regardless of the existence and contents of the will. The share will be calculated according to the rules of priority. The presence of relatives who would inherit the property if there were no will is checked and the share of each is calculated taking into account the calculation and the obligatory share. The received share is awarded to the dependent. And the rest of the property is distributed according to the will.

What rights does an adopted child have to inheritance?

How to challenge an inheritance, read here.

How to open an inheritance case with a notary, read the link:

IMPORTANT!

If the heir has discovered that he has the right to inheritance, he must submit an application to the notary at the place of conduct of the inheritance case no later than six months after the death of the testator. If this deadline is missed, it will be possible to enter into an inheritance only through the court.

The law recognizes as dependents only those persons who were supported by the deceased and cannot support themselves independently. As a rule, such persons include people with disabilities, incapacitated persons, and persons incapacitated by age.

Sister's rights to brother's inheritance

The issue of inheritance by law is regulated by Chapter 63 of the Civil Code of the Russian Federation. The sisters are mentioned in Article 1143 of the Civil Code of the Russian Federation. It is dedicated to the heirs of the 2nd stage. The statute states that persons in this category will receive property if there are no children, spouses or parents of the testator. Sisters can be siblings or step-sisters. However, there must be a blood relationship. Stepsisters do not receive property if they do not have at least one common parent with the testator.

The question arises about the procedure for obtaining property if a sister was adopted by her brother’s parents. An explanation is given in Article 1147 of the Civil Code of the Russian Federation. It states that the adopted person and the adoptive parent are recognized as blood relatives. A person takes part in the inheritance procedure on a general basis.

Right to inheritance after the death of a sister

The entry into the right to inherit a sister after her death occurs on the basis of the rules established by the fifth section of the Civil Code of the Russian Federation.

There are two methods of inheritance defined by law:

- inheritance based on a will (defined in Article 1118 of the Civil Code);

- inheritance by law (defined in Article 1141 of the Civil Code).

Based on the method of inheritance, the list of citizens who have grounds to claim the property left after the death of their sister can vary greatly. Therefore, it is worth dwelling on this in more detail and considering all the nuances that arise.

In the will left behind, the sister, after passing away, determines the circle of legal successors who will own the remaining inheritance, that is, property, securities and savings, as well as financial obligations.

Based on Articles 1116 and 1119 of the Civil Code, in this case, heirs can be any citizens, regardless of family ties, as well as legal entities, organizations and even government agencies. In this case, everything is left to the testator and is limited only by his will.

In the absence of a will or if it is declared invalid by the court, as well as in the case of incomplete coverage of all inherited property by the will, the right to inheritance on the basis of Article 1141 of the Civil Code is received by the heirs by law.

These citizens are classified by law into 8 groups - queues. Each of which is formed based on the degree of relationship, that is, the number of generations between the deceased and the heir.

Representatives of each line have the right to inheritance inherited from a deceased sister, but only in the absence of relatives of the previous line. First in line to receive an inheritance, Article 1142 of the Civil Code defines the children of the deceased, as well as her parents and spouse.

In the absence of the above persons, the right of inheritance, on the basis of Article 1143 of the Civil Code, passes to the relatives, as well as half-sisters and brothers of the deceased and her grandparents.

In the absence of these relatives, Article 1144 of the Civil Code transfers the right to the uncles and aunts of the deceased. If they are also absent, then Article 1145 of the Civil Code transfers the right of inheritance to representatives of subsequent orders.

Existing disabled dependents of the deceased belong to a special category of heirs, based on Article 1148 of the Civil Code, who receive their share in any case, regardless of the method of inheritance.

Brother's rights to sister's inheritance

A brother, like a sister, inherits secondarily (Article 1143 of the Civil Code of the Russian Federation). The exception is when a will has been made. The specifics of the distribution of property within its framework are regulated by Chapter 62 of the Civil Code of the Russian Federation. In the document, the testator confirms his will and records who will receive which object. You can deviate from the standard order.

In accordance with the provisions of Article 1143 of the Civil Code of the Russian Federation, the brother will receive the sister’s inheritance if her husband, parents and children abandoned the property. A similar rule applies if there are no representatives of the 1st line. Additionally, the brother may be recognized as a dependent. Such persons inherit taking into account the provisions of Article 1148 of the Civil Code of the Russian Federation. The brother will be assigned the appropriate status if he is disabled and lived with her before the death of his sister. Dependents inherit equally with other persons who are called to inherit.

Inheritance rights of first and second cousins

Cousins inherit in the order of representation (Article 1146 of the Civil Code of the Russian Federation). They will receive property if their parents, who had the right to inheritance, died at the same time as the testator or before his death. However, there are exceptions. The corresponding right does not arise for persons if the heir whom they represent was deprived of inheritance by the testator (Article 1119 of the Civil Code of the Russian Federation).

Second cousins do not legally inherit. They can only receive property if there is a will or the person is a disabled dependent.

Heirs after the death of uncle and aunt

The nephews and nieces of the deceased can inherit by law and by will, drawn up in the form provided for by the current legislation of the Russian Federation. In this case, inheritance is allowed on several grounds (by law and by will).

In law

General rules regarding inheritance by law are defined in Art. 1141 of the Civil Code of the Russian Federation, namely:

- receipt of inheritance by persons entitled to it as heirs by law is possible only in the order of priority determined by this Code;

- representatives of the second and subsequent orders may be called to inherit when there are no representatives of the first and subsequent orders, or all of them have refused the inheritance;

- recognition by the court of a person as an unworthy heir, in accordance with Art. 1117 of the Civil Code of the Russian Federation, deprives him of the right to inheritance, which passes to other citizens of this queue or representatives of subsequent queues;

- deprivation of a citizen of inheritance by order of the testator serves as the reason for the transfer of his rights to the inheritance to other heirs of this or subsequent orders.

Nephews and nephews of the deceased are not included in one of the lines of succession. But, according to Art. 1143 of the Civil Code of the Russian Federation, they, by right of representation, receive a share in the inheritance in the event of the death of their father or mother - the testator's brother or sister, entering into the inheritance together with representatives of the second line of inheritance by law.

Article 1146 of the Civil Code of the Russian Federation defines general provisions regarding inheritance by right of representation:

- If the death of the testator's brother or sister occurred at the same time as him or before the opening of the inheritance, his share in the inheritance passes to his nephews.

- The share received by right of representation is divided in equal parts among the nephews of the testator.

- If an heir is legally deprived of his rights to inheritance due to being declared unworthy (Article 1117 of the Civil Code of the Russian Federation), his descendants cannot inherit the property of the deceased by right of representation.

- If an heir is legally deprived of the rights to inheritance in connection with the corresponding order left in the will (clause 1 of Article 1119 of the Civil Code of the Russian Federation), his descendants cannot inherit the property of the deceased by right of representation.

Nephews can also inherit on other grounds. If there are several grounds, inheritance occurs separately for each of them, with the citizen receiving the share due to him.

USEFUL INFORMATION: Acceptance of inheritance - terms and methods, reservations and conditions, refusal

According to Art. 1148 of the Civil Code of the Russian Federation, the nephew of the deceased may receive a share in the inheritance as a disabled dependent. Paragraph 2 of this article clarifies the conditions necessary for this:

- the nephew must be disabled on the day of opening of the inheritance;

- during the last year (or more) before the death of his uncle, the nephew was fully supported by him;

- at least a year before the death of the testator, his nephew had to live with him.

Despite the fact that the nephew is a blood relative of the testator, he is not among the persons entitled to inheritance in the order of priority determined by Articles 1145 of the Civil Code of the Russian Federation. For this reason, the very fact of his living with the deceased becomes significant.

By will

From Art. 1118 of the Civil Code of the Russian Federation it follows that a will is the only way to leave dispositions regarding property in the event of one’s own death. You can complete the document only if you are fully capable. However, it must be signed personally. Making a will through trustees is not legal. It is impossible to leave the order of several citizens in a document.

The rights that the testator receives are defined in Art. 1119 of this Code. It includes the following items:

- citizens have the right to bequeath any property, including that which does not yet belong to them;

- the will can indicate any persons, even those who are not heirs at law;

- the testator has the opportunity to independently determine the size of the shares of the heirs;

- the document may contain orders regarding the inherited property and the conditions for its acceptance by the heirs;

- the testator may not disclose the information contained in the document executed in a form convenient for him.

The testator has the right to draw up several wills, indicating in each of them specific property or certain heirs. The document may contain only orders - in particular, on depriving nephews of rights to inheritance.

It is allowed to sub-appoint an heir - a person to whom the heir's share will pass if the latter refuses it or does not accept it for other reasons (Article 1121 of the Civil Code of the Russian Federation).

Freedom of testament is limited by the current legislation of the Russian Federation, including the right to an obligatory share in the inheritance (Article 1149 of the Civil Code of the Russian Federation). This right cannot be transferred to him by inheritance or by right of representation from anyone.

The actual and formal method of accepting an inheritance

In accordance with the provisions of Article 1153 of the Civil Code of the Russian Federation, actual or formal acceptance of the inheritance of a sister or brother is possible. In the first case, applicants apply to a notary or other authorized person to obtain a certificate. First, the citizen collects a package of documents and then writes a statement. It confirms that the person wants to accept the inheritance. You can contact a notary in person, send documents by mail, or delegate authority to an intermediary. In the latter case, the heir’s signature must be certified by a notary or another person who can perform similar actions. Additionally, a power of attorney is issued. It must provide for the authority to accept inheritance. If a legal representative is acting on behalf of the heir, there is no need to issue a power of attorney.

The alternative is to actually accept the brother or sister's inheritance. This is possible if the heir:

- actually owned or managed the property, paid expenses for its maintenance;

- paid the debts of the testator;

- protected property from attacks and claims of third parties;

- managed and used the property.

The actual acceptance of the inheritance must be confirmed. For this purpose, papers may be provided demonstrating payment for the maintenance of the facility, etc. It is acceptable to provide receipts for payment of utilities and taxes. You can present the car's title, a contract for repair work, and the testator's passbook. If there are no papers, you can bring in witnesses. If a dispute arises, the issue of actual inheritance is resolved in the manner of claim proceedings (clause 36 of the Resolution of the Plenum of the Armed Forces of the Russian Federation No. 9 of May 29, 2012).

Does cohabitation affect inheritance?

As a general rule, the fact that a brother and sister live together does not affect the specifics of inheritance. Exceptions are situations when actual acceptance is performed, or a dependent person. In order for a person to be assigned this status, he must live with the deceased relative for at least a year before his death. The dependent has the right to receive property together with the heirs of the 1st stage.

Actual entry into inheritance will help if the deadline for contacting the authorized body has been missed and there are no valid reasons. By confirming ownership of the property, a person will be able to register ownership of the object.

How is a brother's or sister's inheritance divided?

Article 1141 of the Civil Code of the Russian Federation states that heirs of one line receive property in equal shares. A similar rule applies if brothers and sisters take part in the division. The distribution of property is carried out by a notary. He accepts applications from all persons claiming the inheritance, checks the documentation, and then issues a certificate. Shares can be changed with the voluntary consent of all participants in the procedure. Disputes that arise are resolved peacefully or in court.

The testator has the right to distribute his property during his lifetime. To do this, a will is drawn up. However, part of the property can be seized and transferred to the obligatory share. It is provided taking into account Article 1149 of the Civil Code of the Russian Federation. The obligatory share is allocated to the following persons:

- minors or disabled children;

- disabled parents or spouses;

- disabled dependents.

The above-mentioned persons receive part of the property even if they are not mentioned in the will. In this case, the share of the brother and sister, which appears in the documented will of the testator, will be slightly reduced. Initially, property is separated from that part of the property that was not distributed by the testator. Only after this the shares of the heirs, which the deceased reflected in the will, are reduced.

How is the inheritance divided after the death of a sister?

The division of the inheritance remaining after the death of the sister is made depending on the method of inheritance, the presence of a completed will, and the category of inherited property. For example, when entering into an inheritance by law, the shares between the heirs, based on the requirements of paragraph 2 of Article 1141 of the Civil Code, are distributed equally, with the exception of persons claiming inherited property in accordance with Article 1146 of the Civil Code, that is, by right of representation.

This happens if the heir died before the opening of the inheritance or at the same time as the testator. These heirs receive the share of the property that was due to their deceased relative.

Don't discount other nuances, for example:

- if there is a will, the shares due to each heir will be exactly the same as they are stated in the document, while if several heirs became the owners of one indivisible property by will, then it is, on the basis of paragraph 2 of Article 1122 of the Civil Code, bequeathed in shares. Of course, division of such property is impossible. Therefore, the method of division is determined based on the purpose of the bequest. Very often, courts are involved for this purpose;

- if the will does not specify the shares of the heirs or the inherited property is not distributed among them, then paragraph 1 of Article 1122 of the Civil Code prescribes the division of the entire inheritance mass equally. If part of the inheritance is not covered by a will, then this part is also divided into all heirs by law in equal shares;

- if the deceased has obligatory heirs, the list of which is determined by paragraph 1 of Article 1149 of the Civil Code, the property is divided according to separate rules determined by the same article of the Civil Code. These persons must receive half of the property that would have been distributed to them if the division had been carried out according to law. Moreover, in this case, whether they are written in the will or not plays absolutely no role. The obligatory part of the inheritance is first allocated from the inheritance mass that is not specified in the will. And only in the case when this property is not enough, the remaining part is taken from the inheritance included in the last will of the deceased. It is clear that because of this, the size of the due share of the remaining heirs decreases;

- Article 1165 of the Civil Code allows for the division of inheritance transferred into common shared ownership from a deceased sister by mutual agreement drawn up in writing;

- When inheriting property or a thing that cannot be divided, Article 1168 of the Civil Code allows for the presence of heirs who have a priority right to receive this inheritance, which he has the right to receive by compensating for the cost of the shares of the remaining applicants. This right belongs to the person who, together with the deceased, used this property or thing, for example, lived together in an apartment.

USEFUL INFORMATION: Entering into inheritance after 6 months

Can a sister claim her brother's inheritance?

In what order are brothers and sisters the heirs? Read here.

Registration deadlines

Brothers and sisters are required to accept the inheritance within 6 months from the date of its opening (Article 1154 of the Civil Code of the Russian Federation). The transfer is calculated from the moment of death of the testator. In practice, the exact date has not been established. In this case, the inheritance is opened on the day of the expected death. However, the period of inheritance is calculated from the entry into force of a court decision declaring a citizen dead.

Brothers and sisters are not heirs of the 1st stage. They receive the property after the children, spouses or parents of the deceased have refused to receive the property. In this case, you must contact a notary within 3 months from the moment the relevant right arises.

If the deadline is missed, it can be restored (Article 1155 of the Civil Code of the Russian Federation). The easiest way to do this is if all other heirs agree to this. They must document their decision. Then the person turns to the notary. He redistributes property. A previously issued certificate is invalidated. The specialist’s decision can only be challenged in court.

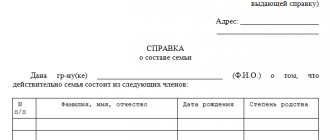

Required documents

Article 1153 of the Civil Code of the Russian Federation states that acceptance of an inheritance is carried out on the basis of an application. Additionally, the heir is obliged to confirm the identity and provide the specialist with a list of property that was in the property of the deceased relative. To do this, the brother or sister provides:

- death certificate of the testator;

- documents confirming relationship;

- an extract from the house register or personal account;

- real estate documents;

- papers for a car.

If a will was executed, it is also included in the list. The list of other papers remains the same.

Applications for accepting an inheritance and issuing a certificate of inheritance can be found here.

Applications for accepting an inheritance and issuing a certificate of the right to inheritance under a will can be found here.

Inheritance after the death of a sister without a will

When carrying out inheritance after a sister or brother according to the law, you must comply with the provisions of Chapter 63 of the Civil Code of the Russian Federation. The following steps must be performed:

- Determine the place of opening of the inheritance. The timing coincides with the moment of death of a relative or a court decision declaring a person dead. The place of discovery becomes the last place of residence of the deceased. Often it coincides with registration.

- Collect documents and contact a notary. You will need a death certificate, a certificate from the last place of residence, papers demonstrating family ties, confirming the list of property owned.

- Apply. You need to contact a notary office located at the place where the inheritance was opened. Here you will need to fill out an application. The form contains information about the deceased relative, information about the heir, the degree of relationship and a list of property. Be sure to include a date and signature.

- Conduct a property assessment and pay state fees. Its size is regulated by Article 333.24 of the Tax Code of the Russian Federation. The duty amount ranges from 0.3% to 0.6% depending on the proximity of the relationship.

- Wait until the deadline is completed and receive a certificate of inheritance. Based on the document, a brother or sister can transfer the inherited property to themselves.

Registration of inheritance after the death of a brother

Civil legislation determines a certain procedure for registering an inheritance, in general. The law does not differentiate or define different procedures for registering an inheritance, depending on how exactly the inheritance was received.

From these rules it follows that:

- To receive an inheritance, it must be documented;

- You can only accept the entire share due as an inheritance. It is impossible to accept only part of your share. In this case, all reasons for accepting a share of the inheritance are taken into account;

- You can refuse an inheritance;

- The inherited share belongs to the heir from the moment the inheritance is opened, regardless of when the heir actually receives his share;

- Acceptance of an inheritance can also be expressed in its actual acceptance. These are those cases when the documents were not properly executed, but the heirs actually assumed their rights. They pay taxes on property, protect it, use it for its intended purpose, and so on.

What is the formal method of accepting an inheritance?

The formal method of acceptance means the method of entering into inheritance rights, in compliance with all legal requirements for the preparation of documents. Such registration begins with the submission of an application for inheritance to a notary. The application is submitted to the notary who has the right to conduct a specific inheritance case.

The application can be submitted either in person or by mail. If the application is submitted in person, the signature will need to be affixed in the personal presence of a notary. If the application is sent by mail, you will have to have your signature certified by the nearest notary and only then send the application.

Also, such an application on behalf of and on behalf of the heir can be submitted by a representative. But at the same time, the heir must issue a notarized power of attorney, which will directly indicate the powers of the representative to represent the heir in the inheritance matter. A copy of the power of attorney will be attached to the inheritance file and will be stored there according to the rules for storing inheritance files.

What is actual acceptance of inheritance?

By the actual acceptance of an inheritance, the law understands the actual actions to take possession of the property that remains after the death of the owner.

The law includes such actions:

- Actual ownership and management of property;

- Protecting property, preserving it, caring;

- Carrying out repair work at your own expense;

- Payment of debts of the deceased (if any);

- Other aspects of the actual transfer of property to the heir.

USEFUL INFORMATION: Exclusion of unworthy heirs from inheritance

In other words, until someone proves otherwise in court, no one will be able to prevent the actual heirs who have entered into the inheritance from receiving the inheritance.

Based on the actual acceptance of the inheritance, the heir can receive documents on the right to inheritance

It is important to bring the notary evidence of the actual acceptance of the inheritance. Otherwise, the notary may refuse

Of course, the law does not oblige the actual heir to receive a document on the right to inheritance. But this paper will be required if the heir decides to re-register the property in his name. The cadastre authorities will not transfer the property to the new owner without a document from a notary, even if the heir provides evidence of actual inheritance.

Inheritance after the death of a brother without a will

If you need to formalize an inheritance after the death of a brother, the same rules apply as in the case of a sister. The issue is regulated by Chapter 63 of the Civil Code of the Russian Federation. The citizen will have to:

- Prepare a package of documents and draw up an application for acceptance of inheritance.

- Contact a notary at your brother’s last place of residence. Here the inheritance will be opened. The application must be submitted to a state notary office.

- Conduct a property assessment and then pay a state fee of 0.3-0.6%.

- Wait until the inheritance period ends.

- Obtain a certificate confirming the acceptance of the property and obligations of the testator.

- Re-register the property in your name by contacting Rosreestr and other authorized bodies.

How to accept an inheritance after the death of a brother

Each interested successor must go through the process of accepting the estate. To do this, the heir has a choice of two methods - notarization and actual succession.

At the notary

In general, the most preferable option is to register the inheritance with a notary. This method involves the performance of legally significant actions and requires compliance with the established procedure. And as a result, the heir consolidates his status at the official level, which is necessary for the full use and disposal of the inherited property.

Order and procedure

Instructions for the heir:

- First, you need to go to a notary who operates in the territory covering the last registered place of residence of the deceased. This must be done no later than six months after the death of the brother. Otherwise, the right to receive his property will be transferred to other heirs.

- An application is submitted to the notary to perform a legally significant action in relation to the property of the testator. On its basis, the authorized person opens an inheritance case and informs the applicant about the list of necessary documents, the cost of services and the timing of their provision.

- The applicant prepares the necessary documents, pays state fees and legal and technical services, and submits papers to the notary. At this stage, the testator’s sister, who was his dependent, will have to go to court to establish this circumstance (if she has not done so earlier).

- After checking the received documents and clarifying significant information, the notary registers the acceptance of inheritance rights and notifies the applicant of the date of issue of the corresponding certificate. As a rule, the document must be received by the successor after six months from the date of death of the testator, but in some cases the period may be delayed. This can happen when registering an inheritance received by way of transmission, while awaiting the birth of a successor conceived during the life of the testator, or when the property of the deceased was not accepted on time by the priority heir.

Statement

The application for acceptance of inheritance must contain the following information:

- Name and place of residence of the sister;

- Full name and place of work of the notary;

- Full name and date of death of the testator;

- composition and brief characteristics of the inheritance being drawn up;

- grounds for the succession of the sister, an indication of the remaining equal heirs;

- date of application to the notary.

Documentation

To register an inheritance, the testator's sister must submit the following papers to the notary:

- Brother's death certificate.

- Refusal of inheritance or death certificate of other successors.

- Certificate of deregistration of the deceased at the last place of residence.

- Applicant's identity card.

- A document confirming the right to receive an inheritance (own and brother’s birth certificate, court decision establishing the fact of dependency, will).

- Power of attorney if the application is submitted by a voluntary representative of the sister.

- A document indicating the powers of the legal representative (parent, guardian or trustee).

- Legal acts for inherited property.

- Act of estimated value of inheritance.

- Receipts for payment of services.

Expenses

For registration of inheritance rights, the sister will have to pay:

- state duty - 100 rubles. for certifying the signature on the application and 0.3% of the estimated value of the inheritance for obtaining a certificate of title;

- services of a legal and technical nature - for the issuance of a certificate, division of property, determination of shares and other notarial actions, payment is charged according to the tariff established by the notary chamber of each subject of the Russian Federation.

State duty is not paid by minors, incapacitated persons and heirs of living space on which they lived before the death of its previous owner and continue to live thereafter.

Actually

This method of acquiring an object of inheritance is simple and convenient, because the successor does not need to waste time visiting a notary, collecting documents and contacting official institutions. He simply begins to exercise his inheritance rights and fulfill his duties, namely:

- pays bills for maintenance of inherited property;

- uses, manages and protects property (including through authorized representatives);

- repays the debts of the deceased;

- receives the funds due to the testator.

However, in practice, it is rarely possible to completely avoid the unwanted registration procedure. The fact is that in order to use a vehicle, it must be registered with the MREO; real estate cannot be sold or donated without officially recorded ownership of it; without a certificate of title for a bank deposit, it will not be issued to the heir. And state registration and obtaining a certificate of inheritance rights is impossible without contacting a notary.

And then the actual heir will still have to resort to the services of a notary, but only after the trial, where he will establish the fact of acceptance of the inheritance.

Inheritance after the death of a brother or sister under a will

If there is a will, the inheritance is drawn up taking into account the provisions of Chapter 62 of the Civil Code of the Russian Federation. The process is somewhat different from legally acquiring the property of a deceased relative. Registration of a brother or sister is carried out according to the following scheme:

- They are looking for a will. The testator can announce its existence or execute the document secretly. In the second situation, one of the copies of the paper is stored in the notary's office. Therefore, the search takes place across the database. To begin the procedure, you must contact a notary, present the death certificate of the testator and a document confirming the relationship. Based on the documents, a search for the will will be carried out. If it is found, the applicant will be informed where the documented will of the testator is kept.

- An inheritance is opened. It is necessary to contact a specialist at the last place of residence of the deceased citizen and begin the process. You must present a completed application, death certificate and will. Additionally, property papers will be required.

- Documents are checked. The process is performed by the notary who accepted the application for inheritance. He checks the passport data with the information reflected in the will and checks the authenticity of the document.

- They await the completion of the inheritance period and accept property and obligations. You will have to pay a state fee of 0.3-0.6% of the amount.

- Obtain a certificate of inheritance and re-register it as property. Sometimes, before this, it may be necessary to fulfill debt obligations and transfer part of the property to the obligatory heirs by law.

Who has the right to inheritance after the death of a brother?

The property that was owned by a brother or sister during their lifetime is inherited on a general basis. The law does not provide any advantages in relation to a brother or sister. In this case, inheritance will also be carried out either by will or in accordance with the provisions of the law.

The right to inheritance is received only by those persons who, according to the law, will be entitled to it.

We consider it necessary to consider several of the most common cases of inheritance of property:

- If a deceased brother or sister left a will before their death, then the inheritance will be made in favor of only those persons who are mentioned in the will and only in the order specified in the will. If the will does not indicate to whom how much inheritance is due, then it will be distributed equally among all heirs under the will;

- Any individual or legal entity can act as heirs under a will. The state can also act as an heir. Thus, only the owner of the property has the right to choose an heir under a will. A separate topic will be consideration of issues with a mandatory share in the inheritance;

- If a will has not been drawn up or a will drawn up earlier does not cover the entire inheritance mass (including that acquired after the will was drawn up), then that part of the property that is bequeathed to specific persons will be transferred to them, and that part that is not stipulated by the will , will be inherited according to the general rules prescribed by law. If there is an obligatory share in the inheritance, then first of all it will be allocated from the property that is not stipulated by the will;

- All possible heirs are divided by law into eight lines. Depending on the degree, the chance of receiving an inheritance increases. The lines of heirs are separated depending on the number of births that separate the heir from the testator. Each subsequent line of heirs, which allows brothers and sisters to inherit property, receives this right only if there are no heirs of the previous line or they refused the inheritance. Moreover, if among the heirs of the previous line there is at least one who did not refuse the inheritance, he inherits the entire inheritance mass. In this case, the next line of heirs is not called upon to inherit at all;

- Children of the deceased, spouses, parents, brothers and sisters have the greatest chance of receiving an inheritance. All other relatives belong to more distant lines of heirs;

- A separate topic of conversation about the rules of inheritance is the situation with the presence of disabled dependents who were supported by the deceased for at least one year before death. This category of heirs receives the right to an obligatory share in the inheritance on an equal basis with the summoned line of heirs. At the same time, a will cannot deprive them of their obligatory share in the inheritance.

The cost of registering the inheritance of a brother or sister

Entering into the inheritance of a brother or sister requires a number of costs. First of all, the state fee is paid. Its size is regulated by Article 333.24 of the Tax Code of the Russian Federation. Brothers and sisters pay 0.3% of the value of the objects. Other categories of persons provide 0.6%. There are additional costs. An independent assessment will be required. Its value depends on the type of property and its quantity. On average you will have to spend from 5,000 rubles. There is no inheritance tax. The exception is income from works of art, literary work, rewards for innovation, inventions, and patents. They are charged deductions to the state in the amount of 13%. There is no difference in tariffs between entering into an inheritance by law or by will. If a person engages a lawyer, his services are paid separately.

How to enter into an inheritance after the death of a sister

Entering into inheritance is a common procedure. The algorithm is almost the same for all options. However, remember that the heirs receive not only rights to property and finances, but also the obligations of the testator, including financial ones, for example, unpaid loans.

These financial obligations remaining from the testator must be repaid regardless of whether the heir knew about it or not.

The main stages of inheritance:

- opening a inheritance case in a notary office;

- distribution of hereditary mass;

- entry into inheritance;

- documentary registration of inherited property.

The period allowed by law for registration and entry into inheritance is six months. It is calculated from the moment the sister passes away or from the day she is declared dead by the court. The entry into inheritance will be significantly influenced by the presence or absence of a will of the deceased.

Opening an inheritance case with a notary

For any option for opening an inheritance, the first step is always standard - visiting a notary and drawing up a corresponding application in his presence. If you have a will, contact the notary who executed it. If there is no will and the inheritance case has not yet been opened, go to a notary office located in the area where the deceased relative lives.

Have with you:

- personal passport;

- death certificate of a relative;

- document on deregistration;

- a document confirming the last place of residence of the deceased.

Be sure to obtain a document confirming your relationship with the deceased. This paper will give you the opportunity to claim your rights to the inheritance left behind. For this document, use, for example, a birth certificate in which common parents are registered, as well as any other papers that can confirm the fact and degree of relationship.

There are no restrictions on evidence. It is important that after studying them, the notary can establish a family connection.

If there is no right to inheritance or there are no family ties, when visiting a notary to open an inheritance case, take your passport with you so that the initiator of opening the inheritance case is indicated.

When registering an inheritance, as a rule, a number of serious difficulties arise with the collection and execution of documents. To make this process easier, use the services of companies working in this field. Experienced lawyers will significantly save time and effort. Moreover, many consultations are given free of charge.

Having distributed the property between the applicants by will or by law, proceed to the procedure for entering into an inheritance, after which the heirs become the full owners of the received property.

To complete it, pay a state fee, the amount of which directly depends on the degree of relationship, namely:

- priority heirs pay a state duty in the amount of 0.3% of the market value of the inherited property;

- other applicants - 0.6%, but not more than a million rubles.

Although, in order to objectively assess the value of the inheritance, contact specialized organizations licensed to provide property valuation services or legal advice.

Without a receipt for payment of the state fee, the notary will not issue documents confirming the fact of inheritance. This will allow you to accept the inheritance in full and begin to use it.

Is it possible to refuse the inheritance of a brother or sister?

When entering into an inheritance, brothers and sisters receive not only part of the testator’s property, but also his debts. Therefore, obtaining property is not always profitable. The law allows you to refuse inheritance. Such a right is enshrined in Article 1157 of the Civil Code of the Russian Federation. You can issue a refusal in favor of another person or without his instructions. The procedure can be carried out during the entire period specified for accepting the inheritance. It applies even if the person has already submitted an application. However, you need to remember that the decision cannot be changed later. If a minor or incompetent citizen wants to issue a refusal, the procedure is carried out only with the permission of the guardianship authorities. A sister or brother who does not want to receive the property and possible debts of the brother and sister will have to:

- Submit an application. The specifics of drafting the paper are not fixed by law. You will need to provide information about yourself, the decision you made, and your signature.

- Prepare a package of documents. You need an identity card, a death certificate, papers confirming the right to inheritance.

- Contact the notary office where the inheritance has been opened. The procedure takes place in the state office that serves the last place of residence of the testator.

- Submit a package of documents. The notary will communicate the consequences of the decision and make sure that the applicant truly understands them. If the refusal is conscious, the documents will be accepted.

How to inherit after the death of a brother or sister

Does the sister (brother) have the right to the inheritance of the sister (brother)? The procedure for entering into inheritance is determined by Art. 1153 of the Civil Code of the Russian Federation. It distinguishes 2 methods: formal and factual.

The first involves registration with a notary. To do this, the brother or sister must contact a notary office no later than 6 months after the death of the relative. Otherwise, the inheritance is transferred to the next person in line.

It is important to fill out an application for acceptance of property or issuance of a certificate of the right of a sister/brother to the inheritance of a brother/sister (clause 1 of Article 1153 of the Civil Code of the Russian Federation). It is submitted when visiting a notary, by registered mail with notification, or through an authorized representative who has a formalized power of attorney.

Attention! When sent by mail, the applicant's signature is notarized.

Based on the application, the notary opens an inheritance case, notifying the applicant about the cost of services, required documents, and deadlines for registration. The heir provides the following documents:

- death certificate of brother (sister);

- documents confirming the absence of other heirs of the first and second order (certificate of their death, recognition of them as unworthy, etc.);

- a certificate of discharge of a deceased relative from registration at the place of residence;

- documents confirming the identity of the heir and his relationship or being a dependent of the deceased;

- title documents for inherited property;

- property valuation act;

- receipt of payment of state duty;

- a document confirming the authority of the representative, if any.

Relatives who were dependent on the deceased will have to go to court to establish the fact and period of dependency.

The application is submitted to the notary's office at the place of residence of the deceased relative or at the location of the property (real estate). The statement states:

- information (full name, place of residence) about the applicant and the testator indicating the date of death;

- grounds for entering into inheritance;

- composition and nature of the property;

- date of application.

When registering an inheritance, a state fee of 100 rubles is charged. for certification of the applicant’s signature and 0.3% of the estimated value of the inherited property (established according to the appraisal report). Notarial, legal and technical services are paid additionally at established rates. Minor heirs and persons who lived with the testator before his death are exempt from state duty.

The actual method of inheritance

Can a sister (brother) enter into an inheritance after the death of a brother (sister) without documentation? The law (clause 2 of Article 1153 of the Civil Code of the Russian Federation) provides for the actual possession of property. It is established when the heir actually takes ownership of the property, namely:

- fully owns, i.e. uses and manages the property at its own discretion;

- provides protection from any attacks;

- maintains it in proper condition at its own expense;

- fulfills all obligations of the brother (sister) and pays his debts.

With such entry into an inheritance, no paperwork, a visit to a notary, or payment of state fees are required. However, this method has several serious drawbacks. The heir will not be able to register at the place of residence (if he did not previously live with the deceased) without registering ownership of the property.

Problems arise when using movable property: a vehicle cannot be re-registered or sold without proper registration of ownership. You cannot use a relative’s bank account. There is a possibility that a relative of the first or second line of inheritance will appear and restore his rights through the court.

Distribution of inheritance

Inherited property is divided according to the will of the testator or in equivalent shares upon inheritance by law. At the same time, Art. 1165 of the Civil Code of the Russian Federation provides for division on the basis of a concluded agreement between the heirs, when the shares may change. Most often this happens in relation to property that was jointly owned by the deceased and one of the heirs.

Reference. Can a sister claim her brother's inheritance if he has children? Yes, if they and other priority claimants renounce their share, if the sister is named in the will or was dependent on the brother for at least a year before his death.

Article 1168 of the Civil Code of the Russian Federation allows for the establishment of a heir's preemptive right to indivisible property, but subject to legal monetary or other material compensation to the remaining heirs for their shares.

Nuances

It is impossible to waive only the debts of the testator and at the same time accept the property. A person either agrees to be an heir and be responsible for the obligations of a sister or brother, and also receives part of his property, or decides not to enter into an inheritance.

The amount of obligations cannot exceed the value of the property received. So, if a brother or sister had an outstanding loan, the bank will not be able to demand an amount in excess of the share that the citizen received.

It is not necessary to complete an application to relinquish property. It is enough not to contact a notary for six months. When the period ends, the specialist will distribute the property between the persons who filed applications to inherit the brother or sister. Subsequently, restoring the right to receive property is extremely problematic.

How to refuse an inheritance in favor of a sister or brother

At the legislative level, it is possible for heirs to renounce their right to inherited property, including renunciation in favor of other persons (Article 1157 of the Civil Code of the Russian Federation).

This can be done within the period established by Art. 1154 Civil Code. Sometimes a refusal of inheritance is formalized after the successor has accepted it formally or in fact.

If the successor decides to renounce the inheritance in favor of a relative, he will need to draw up a statement of refusal and submit it to the notary at the place where the inheritance was opened (clause 1 of Article 1159 of the Civil Code). If an inheritance case is opened for this estate in another notary office, you need to write a statement of refusal and submit it to the specialist who opened the specified case.

ATTENTION! View the completed sample application for renunciation of inheritance:

Please note! You can refuse an inheritance in favor of a relative if the conditions listed in Art. 1158 GK:

- The relative in whose favor the successor wants to renounce must have the right to inherit the property of the deceased by law, in accordance with a will, by right of representation or by hereditary transmission. It is impossible to refuse an inheritance in favor of other persons;

- The will should not state that the relative is deprived of inheritance. It is also impossible to transfer the right to inheritance to a relative who is recognized as an unworthy heir;

- You can refuse a share that is not obligatory. The fact is that only certain persons can receive a mandatory share in the inherited property. It will not be possible to give up your obligatory share in favor of someone else;

- If a legal successor who wants to renounce his share in favor of a relative has sub-designated heirs, he will not be able to perform these actions. If there are such persons, the refusal will be unlawful;

- No conditions or stipulations are allowed in the renunciation of inheritance;

- It will not be possible to refuse part of the due share in the inheritance. Such actions are possible only if a successor is called for several reasons simultaneously. He may refuse one or more of them.