Can they lay claim to each other's heritage?

Brothers and sisters, in accordance with the law, can claim inheritance. This is determined by Section 5 of the Civil Code of the Russian Federation. They have this right in the absence of people who are closer in law:

- spouses;

- children;

- parents.

The second order of inheritance provided for by law is a will. This is stated in Articles 1118 and 1141 of the Civil Code.

We talked about the order of inheritance according to the law in this material.

A will is a priority in determining legal successors. If a brother or sister is indicated in it, they will inherit the bequeathed assets in the order that the applicant himself provided.

A brother or sister will be obligatory heirs if they were dependent on a deceased relative. Then they are entitled to a share, no matter what the queue is and how many people claim the inheritance.

According to Article 71 of the Family Code of the Russian Federation, if parents are deprived of their corresponding rights, this will not affect the right of a sister or brother to receive an inheritance. Parents who have lost their rights lose this right.

What are the heirs according to the law?

According to Art. 1143 of the Civil Code of the Russian Federation, sisters and brothers, as well as grandparents, are the second line of inheritance. Thus, they can inherit the inheritance either if they are indicated in the will, or if there are no heirs in the first circle. The completeness of the relationship does not matter.

Do not confuse half-siblings with half-siblings. The latter are not related by blood and are connected exclusively through the family relationships of their parents. They do not act as heirs for each other unless they were adopted by a person who remarried their parent.

As for cousins and brothers, they are the sixth line of inheritance.

How are shares in the inheritance distributed according to law and will?

Let's look at an example. A deceased relative executed a testamentary disposition for a bank account. The depositor has the right to include his nephew in the will and formalize a testamentary disposition in the bank, that is, bequeath his account to him.

Example. Citizen A.B. died in a car accident a week after the death of his sister A.L., who had neither a spouse, nor children, nor living parents. Three children A.B. received not only the bequeathed property of their deceased father, but also divided among themselves in equal shares the property that was due to their father after the death of his sister A.L.

The order of inheritance by nephews is determined in Articles 1142 - 1145 of the Civil Code of the Russian Federation, which limits the circle of heirs to the following orders:

- first - with the inclusion in this group of children, spouses, mother and father of the deceased;

- the second - with full and half brothers or sisters, grandparents (on both family lines);

- the third - the uncle and aunt of the testator;

- sixth - more distant relatives, with the degree of relationship calculated by the number of births between the testator and the candidate.

Nephews are not directly listed among the heir groups listed. But part 2 of Art. 1143 of the Civil Code of the Russian Federation reserves for them the right of inheritance by representation - as persons representing the interests of their parents. Therefore, children of brothers and sisters are considered second-order heirs.

Whether a nephew is an heir by law is stipulated in the Civil Code of the Russian Federation. In accordance with Art. 1142 – 1148, there are 8 inheritance queues. Representatives of each of them are grouped by degree of relationship. The lower the serial number in the queue, the closer the relative.

Nephews enter into inheritance in the second line by right of representation if there are no applicants belonging to the higher first line.

Entry procedure:

- According to the law, children are the first to inherit, including adopted children born after the death of the testator; husband and parents. Grandchildren can inherit by right of representation for their parents (children of the deceased).

- The second to inherit are full and half brothers, sisters, grandfathers, grandmothers. If they are not alive, then by right of representation the children of the brothers and sisters receive the property and acquired assets.

- In their absence, members of the subsequent third line become applicants.

What is the right of representation? This is an opportunity for descendants to receive a share of the inherited property according to the law. It arises if a relative, a representative of the queue, who would have been a contender for the benefits of the deceased, died before him or with him. Then his descendants inherit by right of representation.

Example. Citizen S. has no relatives except his brother, his wife, daughter and brother’s son. S.'s brother died. Later, S. himself died. Since he had no heirs of the 1st stage, and his brother died, his nephews inherited his property for his deceased father. S.'s brother's wife cannot lay claim to S.'s values.

When can they claim to receive property and when not?

There are a number of cases when brothers and sisters can receive an inheritance:

- The presence of a will, according to which they have the right of first inheritance.

- Absence of persons who are heirs of the first stage, incl. if they refused the inheritance themselves, died or were considered unworthy.

- Being dependent on the testator. Being a dependent for a year, a person receives the same rights to inheritance as persons in the first priority.

The basis for receiving an inheritance for a sister or brother is hereditary transmission if they are the heirs of a person called to inherit after the death of the testator, if he did not carry out the succession.

At the same time, there are a number of cases when, even under the conditions noted above, a sister or brother cannot claim an inheritance if they are recognized as unworthy.

The heir may be declared unworthy in court on the basis of a claim filed by an interested party.

This is possible under the following conditions:

- The successor did not fulfill his obligations to pay alimony for the maintenance of the testator, if any.

- A person committed a crime or other act that violates the law against the testator, his heirs or the last will with selfish motives.

Can a half-sister claim inheritance?

» Required documents May 26, 2021

Am I entitled to an inheritance from my stepsister?

My father got married in 1962, she had a daughter and he had me, we grew up together in the same family, I was not adopted like my sister, when privatization began, we were both married and lived separately from our parents, my father had one even before that a marriage from which he had 2 children. And so I found out not long ago, it turns out that my half-sister, somewhere around 20 years ago, persuaded them to draw up a deed of gift for her, due to the fact that besides me he has 2 children from his first marriage and so that they would not get anything and supposedly she then will write half of it to me. But naturally she doesn't do this. She does not have her own children, but her husband has a daughter from his first marriage who lives with her mother. And now that I have learned about all this, I would like to know whether I have the right to inherit after her as her half-sister? What if she doesn't write a will? And can I somehow protest all this due to the fact that my inheritance rights to inheritance after my own father were violated?

October 19, 2021, 15:56 Marina, Moscow

Lawyers' answers (4)

Veliky Novgorod

Marina, hello. As I understand it, your parents gave the apartment to your half-sister. Therefore, there is no question of violating your inheritance rights here. Your father and stepmother were free to dispose of the apartment as they wished. Unfortunately, 20 years have passed and nothing can be disputed. After the death of a sister, the first-line heirs will be the parents, children (her, not her ex-husband), and spouse (with whom she is married at the time of death). If there are no heirs of the first stage, heirs of the second stage will inherit, and so on. Sisters and brothers are classified in the second line of inheritance, but this must be a blood relationship (that is, at least they had only a father or only a mother in common). Unfortunately, you are not one of them. Therefore, you need to talk to your sister about drawing up a will in your favor.

19 October 2021, 16:05

Have a question for a lawyer?

She does not have her own children, but her husband has a daughter from his first marriage who lives with her mother. Marina

Please clarify, does your stepsister have a husband? If there is, then the spouse should inherit, since he is the heir in the first place.

19 October 2021, 16:06

And now that I have learned about all this, I would like to know whether I have the right to inherit after her as her half-sister? Marina

In fact, you are not relatives and you will not have rights to inheritance.

Also, you are not step-relatives

CIVIL CODE Article 1143. Heirs of the second stage 1. If there are no heirs of the first stage, the heirs of the second stage by law are the full and half brothers and sisters of the testator, his grandparents on both the father's and mother's sides. And can I somehow protest all this due to the fact that my inheritance rights to inheritance after my own father were violated? Marina

Marina, the deadline for challenging the deed of gift has passed, alas, it will be impossible to do anything

19 October 2021, 16:08

You won’t be able to challenge the donation, and the deadlines have all expired, after all, 20 years have passed.

You cannot inherit from your half-sister, because... neither you nor she were adopted and are not considered blood relatives

Article 1147. Inheritance by adopted children and adoptive parents 1. When inheriting by law, the adopted child and his offspring, on the one hand, and the adoptive parent and his relatives, on the other, are equated to relatives by origin (blood relatives).

and besides the fact that she has a spouse (heir of the 1st line) and a stepdaughter (heir of the 7th line), half-brothers and sisters are not included by the Civil Code in any of the lines of inheritance.

19 October 2021, 16:10

Looking for an answer? It's easier to ask a lawyer!

to our lawyers - it’s much faster than looking for a solution.

- About Us

- Contacts

- Services

- Why us?

- Advantages

- Scheme of work

- Reviews

- Other questions for inheritance lawyers:

- Legal advice on inheritance issues. Guardianship and inheritance rights

- Legal advice regarding inheritance. Renting a store by inheritance

- Legal advice on inheritance in Moscow. Is it possible to sell a share in an apartment to a third party?

- Will contest lawyer. Invalidation of a will

- Lawyer for division of inheritance. What is inherited?

- Consultation with a lawyer on inheritance in Mytishchi. Weapons as an inheritance

- Legal advice on inheritance. Mandatory part of the inheritance

- Legal advice on inheritance online for free. Can I donate my share of the inheritance?

- Consultation regarding inheritance. How can distant relatives receive an inheritance?

- Legal services for registration of inheritance. Does a wife have rights to the property of her deceased husband?

- Consultations on inheritance. Moving into an apartment received by inheritance

- Online inheritance consultation free of charge. Do the father's debts pass on after his death?

- Question about the inheritance of an apartment. Son's rights to an apartment

- about inheritance for free. Appeal against the actions of the state registration chamber

- Controversial issues regarding inheritance. Refutation of refusal of inheritance

Our experienced inheritance lawyers advise you 24 hours a day, 7 days a week, helping you resolve your most complex issues Get free legal advice now

You can ask your questions to a probate lawyer, get free legal advice on inheritance or make an appointment with a probate lawyer by phone in Moscow and the Moscow region, in St. Petersburg and the Leningrad region

Can my stepbrother claim the inheritance?

Question from B.S. (Moscow): Hello. I have a brother, a half-brother, he left for Belarus 19 years ago, all these years he has never appeared. My sister and I looked after our parents all this time, until their death. After they died, my sister privatized their apartment, but she died soon after. The sister was not married and had no children. After her death, I began to register the inheritance for myself and suddenly my half-brother suddenly appeared and also filled out an application at the notary for a share of my sister’s inheritance, but he never entered into the inheritance, and besides, he returned to his home without leaving an address. What should I do with the apartment now, since I can’t sell my share without his consent? Does the brother have rights to a share of the inheritance? Answer: If your sister did not have direct heirs: children, husband, parents, after her death, brothers and sisters, both blood and step, can claim the inheritance. Based on this, you and your brother have the same rights to inheritance. You will be able to sell part of the apartment, but you must notify your brother in writing about its sale. You should contact that notary, he should have some contact information for your brother.

WE PERFORM THE FOLLOWING TASKS DAILY:

Sister claims inheritance

Sister claims inheritance

1-room apartment. 2) dacha (which is privatized only for her husband). 3) car. 4) vegetable storage + savings left in the savings book. Please tell me what percentage of this property will legally go to me and my daughter. Thank you!/08/02/2013 Part 3 of the Civil Code of the Russian Federation establishes the grounds for inheritance: inheritance is carried out by will and by law, inheritance by law takes place when and since it is not changed by the will, as well as in other cases established by this Code (Art.

Lost sister claims Prince's inheritance

Can a sister claim her brother's inheritance and vice versa?

Is it possible to identify more or less similar ones from them? For the law, it is quite possible. Order of inheritance according to law The law has defined gradations of family relationships - from the closest to the least close. And he lined up the line of heirs. According to this order... Parents and children inherit first, as well as husband or wife - the closest relatives. The second are brothers and sisters, recognized as close as grandparents. So, heirs of the second stage - brothers and sisters - can inherit only if the heirs of the first stage are absent, deprived of inheritance or refused to inherit.

Cousin died, no direct heirs

The heirs of the second stage according to the law are the full and half-siblings of the testator, his grandparents on both the father's and mother's sides. Children of the testator's full and half-siblings (nephews and nieces of the testator) inherit by right of representation. You, as a cousin, are the heir of the third line. ST. 1144 Civil Code of the Russian Federation Article 1144.

Claim inheritance

49 of the RF IC), and in relation to children born in the period from October 1, 1968 to March 1, 1996 - in the presence of evidence confirming at least one of the circumstances listed in Art. 48 KoBS RSFSR. [/quote]I’ll explain to you, dear Karina

that there are two independent grounds for filing an application to the court to establish a legally significant fact. The first of them is the establishment of the fact of paternity on the basis of Article 49 of the RF IC, when the father may not have recognized himself as such, and the second is the establishment of the fact of recognition of paternity, when the father recognized himself as such (Art.

Sister claims inheritance

Thank you in advance! 08 July 2014, 12:20 Olga, City not specified Answers from lawyers (4) unfortunately you do not have such rights. The daughter belongs to the heir of the first line, you to the second. The first priority also includes the parents of the deceased. And the fact that his daughter did not communicate with him does not mean anything.

Mom's sister claims inheritance

No one, neither her sister nor her brother, had any complaints.

After 6, everything had to be restored through the courts. In court, both the sister and the brother abandoned this apartment and the inheritance went completely to the mother, she gave it to herself. Today my sister shows up and demands my father’s documents and says, I’ll try to prove that I’m also his daughter and have the right to an apartment. What can she do? All these years she came and demanded money for this - something like 350,000 rubles.

Free consultation with a lawyer on wills and inheritance

After all, if you make one wrong action or even miss the deadline for submitting documents for one day, you risk not receiving what is due to you by law. It often happens that when the issue of inheritance arises, relations between relatives claiming it sharply deteriorate. And often in such cases the matter comes to court. To avoid such a situation, we recommend that you seek advice from our lawyers, who will explain to you your rights and obligations and help you determine the optimal course of action with other heirs. If you want to make a will, but don’t know where to start and how to formalize everything correctly, our experienced lawyers will also help you.

Can a brother claim an inheritance after the death of a brother who was married?

As far as is clear from your question, the deceased person has a spouse who is the heir of the first stage. Therefore, the brother will not be called to the inheritance. Munasipova Nina Viktorovna (11/19/2014 at 00:16:23) No, she can’t. In this case, the brother’s heirs will be his wife, children and parents (if any) in accordance with Article 1142 of the Civil Code. Article 1142 of the Civil Code.

My half-sister is claiming a share of my mother's inheritance

Draft contract for the provision of services

my stepsister claims a share of my mother's inheritance

No. 123135. October 20, 2009 at 1:22 am

Hello, Bokarev Alexander.

So, in order. Your mother and her father, since they were married, had common joint property that was acquired during the marriage. In this common joint property, both your mother and her father had equal shares (that is, 1/2 each). Since her father died earlier, there is inheritance by law (if he did not make a will). Your mother and half-sister (if the father did not have more other children and if his parents were not alive) were the heirs of the first turn - this means that they divided 1/2 of his property in half, that is, both your mother and half-sister have 1/4 of the half-sister's father's share.

But your mother also has her 1/2. Thus, the total share of your mother’s property is 1/2 + 1/4 = 3/4. That is, your mother has a share of 3/4 of the entire property after the death of her half-sister's father. Now, after the death of your mother, you enter into inheritance according to the law as the heir of the 1st stage (if there was no will). If at the time of death your mother had no other children besides you, and also if she did not have living parents (that is, your grandparents) at the time of death, then you are the only heir and will be the owner of 3/4 of the entire property .

Your half-sister is not your mother's heir and cannot claim any share of the property.

This arrangement applies if there were no wills, and since you didn’t say anything about this, I understand that there were no wills.

Best regards, Ivan Vladimirovich.

Sincerely, Ivan Vladimirovich ShiganovGeneral Director of Legal Dispute LLCLegal services for business and citizensTel. 7 (911) 787-33-49E-mail: Briefly

Sincerely, Ivan Vladimirovich Shiganov General Director of Legal Dispute LLC Legal services for business and citizens Tel. 7 (911) 787-33-49… Completely

Ask an additional question

Did the answer help? — + 0 —

Private legal practice

No. 123167. October 20, 2009 at 9:57 am

Alexander, good day to you.

Let me start with the fact that your mother and her father, since they were married, had common joint property acquired during marriage. In this common joint property, both your mother and her father had equal shares (that is, 50/50). Since her father died earlier, then there is inheritance by law (if he did not make a will, but as I understand there was no will). Your mother and half-sister, provided that your father had no more other children and your grandfather and grandmother had already passed away, were the heirs of the first line. Each of them was entitled to 1/2 of their father's share.

But your mother also had her 1/2 share in the common property of the spouses, which in terms of calculation means that your mother had a share of 3/4 of the total property after the death of her half-sister's father. And after the death of your mother, you enter into inheritance according to the law as the heir of the first turn.

It is worth noting that if there was a will, or your half-sister was adopted, and in addition your grandparents are alive, then the position changes a little.

If there was no adoption, and there are no grandparents, then everything is fine - you are the only heir. If at least one circumstance occurs, then you will have to share. The same is true in the case of a will.

It does not follow from your story that there was a will, or that the factors that I spoke about took place.

If they exist, then excuse me - you will have to divide the inheritance.

Sincerely, Chernenko D.M.

Call if anything happens

For any questions call

Ask an additional question

Did the answer help? — + 0 —

Still have questions? Ask our experts! Get legal advice

Or call the hotline numbers:

+7 Moscow and Moscow time. region Leningrad

Who is second in inheritance according to the law?

Second line of heirs by law

Relatives of a loved one inherit property after his death.

If there is no will, you can enter into an inheritance legally.

The Civil Code of the Russian Federation has determined the rules for entering into inheritance.

In accordance with the law, the distribution of property and non-property assets begins with direct first-degree relatives.

These include:

Read about those on the waiting list for the second round in this issue.

Who belongs to the second stage?

Who are the heirs of the second stage?

If within six months none of the immediate relatives have begun the procedure for entering into an inheritance and no one is left alive, the property is divided between the second-order heirs.

What situations might happen if there are no priority applicants?

There were no children, parents or one of the spouses left alive, or they never existed.

Representatives of the first stage are alive and well, but they voluntarily decided to refuse the inheritance. This also happens.

Article 1143 of the Civil Code of the Russian Federation limits the range of priority. The second ones who can claim the inheritance are:

- Full and half-siblings

- Grandparents (parents of the father and mother of the deceased).

Subtleties of kinship in the distribution of inheritance

Children born from one mother and one father are considered full-blooded relatives. To clearly understand the issues of approving an inheritance, let’s look at half-brothers, half-brothers and half-siblings.

Which of them are part-born or half-relative, who is entitled and who is not entitled to inherit from the second-stage applicants.

Half-siblings (half-siblings) have a single common parent. Either the father or the mother is not their own.

- Half-siblings have the same father, but different mothers

- Half-sisters and brothers have the same mother, but different fathers.

Half-siblings do not have common parents. They are not related by blood. These are children of parents from previous marriages. When there are no common parents (that is, each parent has their own children), brothers and sisters are considered step-brothers.

Half-siblings and half-brothers are often confused. Let's explain with an example:

Why do you need to understand family ties before entering into an inheritance?

Even if half-brothers and sisters have legally married parents, they have nothing to do with the second line of heirs. For stepbrothers and sisters, the law does not provide for inheritance. But in addition to siblings, half- and half-brothers and sisters (half-siblings) may well be eligible for it.

The situation is simpler with the testator’s own grandparents. The parents of the father and mother of the deceased may become claimants to the property. It doesn’t matter whose side they are from: mother or father. While adopted grandparents are excluded from applicants for inheritance.

If at the time of death the sister or brother of the deceased is not alive, then by right of representation, nephews and nieces can become heirs of the second stage

Evidence of relationship with the deceased testator

Evidence of relationship with the deceased testator

The easiest way is to present to the notary the documents of relationship that you have on hand. Often second-degree relatives do not have supporting documents.

Missing evidence of kinship involvement can be confirmed through the registry office.

If the civil registry office does not satisfy the request, the relatives apply to the court with a request to recognize the fact of relationship on legal grounds.

Plausible facts may include testimony from other relatives, acquaintances, neighbors, family friends, correspondence, etc.

After the trial, a decision is made and given to the notary. Consider the situation:

A lonely woman dies. She leaves behind a half-sister. She notifies the notary of her intention to enter into an inheritance. How can a notary confirm that she is a relative of the deceased?

In addition to personal documents, connecting evidence is required. In this situation, the documents in the most common situation are:

The difficulty is that none of the second-degree relatives have such documents. If the sisters got married and divorced more than once, the mother changed her last name - the ends can only be found in court with the involvement of witnesses.

The archive department of the registry office will not always give a positive answer. Due to the remoteness of events, documents may not have been preserved even in government institutions

Distribution of inheritance among second-degree relatives

Distribution of inheritance among second-degree relatives

The property of a deceased relative is divided among the second-degree heirs in equal shares.

Organizational arrangements are handled by the notary office.

When relatives cannot reach a common agreement on the division of property, they enter into a written agreement on the division of property after issuing a certificate of inheritance.

The priority right to the heir's indivisible property is enjoyed by the relative who used it before the opening of the inheritance.

It is prohibited to enter into an agreement on the division of real estate before receiving an inheritance. There is no ban on moving items.

The established procedure will be specified in the inheritance certificate. Heirs have the right to make changes in the use of a loved one’s belongings after his death, but with the general consent of other relatives. There is no need to have an agreement on the division of real estate certified by a notary

Read about the procedure for entering into an inheritance in the article “Inheritance without a will”

Grandchildren - granddaughters, nephews - nieces and inheritance

Grandchildren - granddaughters, nephews - nieces and inheritance

If at the time of death the sister or brother of the deceased is not alive, then by right of representation, nephews and grandchildren can become second-order heirs.

Let's say there is a representative of the first line of inheritance. Before the opening of the inheritance, he died suddenly.

By right of representation, his share is inherited by his descendants only in the event of his death.

The right of representation of the second priority is respected, as in the distribution of the inheritance of the first priority from all representatives.

The right of representation: transfer of rights to inheritance to other relatives, read the article “Principles of division of inheritance between heirs of the first priority”.

Grandchildren and nephews will not be able to receive an inheritance if the deceased was deprived of the right to inheritance during his lifetime.

Second priority: rights of heirs

Second priority: rights of heirs

What rights do second-order heirs have?

If the queue has reached, there are no first-line applicants, the basic right is the opportunity to enter into an inheritance.

It is not prohibited to dispose at your own discretion of things that a deceased relative used during his lifetime.

In addition, heirs can:

- In favor of other relatives, renounce the property, subject to renunciation of the entire part of the inheritance

- If the other heirs agree, if the relative lived in the apartment of the deceased and has no other housing, pay the other heirs monetary compensation and receive the apartment at their disposal

- Insist on reimbursement of monetary costs associated with the treatment and burial of the deceased

- By agreement with other heirs of the second priority, divide the due inheritance at your own discretion or, at least, invite the other party to listen to the opinion of one of the heirs.

For example, the testator’s sister, brother and grandfather have the opportunity to enter into an agreement with each other notarized. Grandfather inherits a dacha, brother a car, sister a house.

The agreement must determine in writing whether second-degree relatives will pay compensation among themselves. If a monetary issue arises, it is indicated to whom the amount will be compensated and in what quantity

Responsibilities for debts and responsibility for accepted inheritance

Responsibilities for debts and responsibility for accepted inheritance

A sore subject: the debts of the testator. The most common case: remaining debts from outstanding loans and borrowings.

Debt obligations are paid by the heirs of a deceased relative under Article 1175 of the Civil Code.

The point is that death is not a reason to forget about the debts of the testator.

When a creditor becomes aware that the relatives of a deceased debtor have entered into an inheritance, within three years the lender, bank, and collector have every reason to file a claim to collect debts.

The heirs are liable for the obligations of the deceased testator. If the debt is higher than the value of the entire inheritance, it is covered only by the value of the entire property. The remaining financial obligations should be written off automatically

From judicial practice

My brother inherits an apartment worth 7 million rubles. In the statement of claim, the bank demands the return of the debt of the deceased testator in the amount of 9 million rubles. According to the law, the brother must pay an amount of no more than seven million rubles.

The statute of limitations when creditors can apply for debt repayment to the heirs is no more than three years from the beginning of the period of non-payment of the deceased testator.

The courts unequivocally refuse plaintiffs’ applications for debt repayment under loan obligations if, along with the conclusion of the contract, an insurance clause was included. The defendant in this case is not the heir, but the insurance company.

Summary

The second line of heirs enters into the inheritance if there are no close contenders in the main line. The nephews of the deceased and grandchildren have a shared inheritance only by right of representation. Inheritance practice is multifaceted; an experienced lawyer will provide effective assistance in a specific situation.

About the author All articles

In 1996 he graduated from the Moscow State Law Academy with a degree in Jurisprudence, Candidate of Legal Sciences (2000). Since 2000, she has specialized in controversial issues related to inheritance and donation.

How to register an inheritance

How to make a will?

Heirs of the first stage

Is it possible to challenge a will?

Availability of enforcement proceedings

Donating an apartment between close relatives: an alternative to inheritance?

Certificate of inheritance: what kind of document is it and when is it issued?

Land donation agreement: tips for registration

We draw up a deed of gift for an apartment with the involvement of a specialist

Donating an apartment: how to draw up an agreement and avoid litigation?

Most frequently asked questions:

What is the secrecy of a will?

Sources: pravoved.ru, www.consultinga.net, likvidaciya-ooo-balashiha.ru, svem.ru, vsenaslednikam.ru

Next:

No comments yet!

Share your opinion

You might be interested in

Sale of a share in an apartment received by inheritance taxation

How long after entering into an inheritance can you sell an apartment after

How to write a letter to a notary about entering into an inheritance

Is it possible to disinherit compulsory heirs?

Popular

Within what period is a notary required to issue a certificate of right to inheritance (Read 119)

How to inherit a car if there are several heirs (Read 109)

Benefits for disabled people when accepting an inheritance (Read 74)

Kirpichnikov inherited a residential building that required major renovation (Read 55)

Step-by-step instructions on how to take possession of property after death without a will

There is an established procedure for entering into inheritance.

General algorithm of actions

To enter into an inheritance, you must adhere to the following order:

- Prepare the necessary documents.

- Submit an application to a notary.

- Appraise the property.

- Pay the state fee.

- Visit the notary again.

- Obtain a certificate of inheritance.

- Register the property.

State duty and deadlines

It is necessary to enter into inheritance rights within six months after the death of a brother or sister. If the death is established by the court, the period will be counted from the date indicated in the court decision or from the moment it enters into force.

As for expenses, the heirs must pay for the assessment of the property they receive. This is an important point, as it will determine the amount of all costs. The cost of the appraisal will depend on the property being appraised and the specific organization. Thus, an apartment appraisal will cost on average 3,000 rubles, a car – 2,000-5,000 rubles.

Also paid:

- State duty. It is 0.3% of the value of the inherited property, but not more than 100,000 rubles. If a person cannot prove the existence of a family connection, he will have to pay 0.6%.

- Notarial services. The amount will depend on the region. Taking into account the family connection, it does not change. When a notary leaves the office, the rate will increase 1.5 times (Article 333.25 of the Tax Code of the Russian Federation).

- Registration of property rights. Registration of an apartment costs 2,000 rubles, and in order to register the land for running a personal subsidiary, you need to pay 350 rubles.

If you need proof of the fact that you are dependent on the testator, you need to go to court. Since the hearing of the case will take place as part of a special proceeding, the fee will be 300 rubles. (Article 333.19 of the Tax Code of the Russian Federation).

Documentation

The list of required papers will be determined by the type of property you inherited. Basic documents include the following:

- identification document of the applicant;

- death certificate of the testator (if the court declared him dead, the original procedural document is additionally attached);

- documents confirming relationship with the deceased;

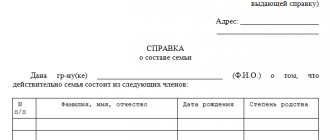

- certificate from the place of residence of the deceased;

- title documents for property;

- technical documentation for real estate;

- extract from the Unified State Register of Real Estate;

- confirmation of payment of state duty;

- property valuation report.

When opening an inheritance case at the request of another heir, most likely, a smaller package of documents will be required. A more detailed list should be checked with a notary.

Drawing up an application

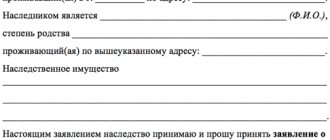

The application is written in accordance with a specific form. It indicates the notary you contacted, notes the name and place of residence of the applicant, the date of death of the testator, his full name, the composition of the inheritance and the place where it is located, as well as the amount of the assessment.

At the end, you must write down that you accept the specified inheritance and ask for a certificate to be issued for it. Also, if available, the application indicates the heirs of the first priority and under the will. At the end there is a date and signature of the applicant. The notary can provide a sample application or draw it up himself.

We have other materials about the ladder of kinship in inheritance. Read articles about the third priority according to the law, about the order of nephews and grandchildren.