Acceptance of escheated property into municipal ownership

The generally accepted procedure for inheriting housing, shares, land, as well as other property and their accounting is largely determined by what kind of property is recognized as escheat. This procedure is regulated by Federal Law No. 233 of July 23, 2013.

In practice, cases prevail when housing or land left without a legal heir goes to the treasury. In this case, the subject is the municipality of the locality (its authorized representative), which is in charge of the disputed real estate.

In 2021, the transfer of property can take place no earlier than 6 months from the date of the judicial opening of the inheritance. The procedure for inheritance by a municipal entity of land or other property recognized as escheat differs significantly from the usual inheritance of citizens:

- upon completion of the trial or entry into ownership through a notary, the housing inherited by the state goes through the registration procedure and becomes part of the housing stock intended for social needs;

- If movable property is recognized as escheat, then it becomes the state property not of the municipality, but of the state. Then it is sold, and the proceeds go to the budget accounts of the municipality.

A critically important feature of inheritance of escheat property is that it passes to the state only by law. When there is a will, such an inheritance cannot in any way be recognized as escheat and transferred to the treasury.

If there are no impeding circumstances, then the entity entering into the inheritance, for example, a municipal entity, turns to a notary to recognize ownership rights. In this case, the municipality must provide evidence that the object of transfer is escheat.

But, as practice shows, the municipality usually goes to court through a proxy. This is done so that the property is simultaneously recognized as escheat and transferred to the municipal treasury.

According to Russian legislation, the property of a testator whose successors have not appeared within the established period and have not declared their rights may become escheat. The inheritance mass is completely given into the possession of state or municipal bodies, and all assets, movable and immovable objects are transferred to them.

In the article we will analyze in detail the concept of “escheat property”, find out who can become its heir and find out what is the procedure for registering it as municipal property.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please contact the online consultant form on the right or call 8

It's fast and free!

When an inheritance is assigned escheat status, the state receives full right to dispose of it. The Civil Code of the Russian Federation establishes that potential claimants to the inheritance estate have exactly 6 months from the time of the death of the testator.

Delaying the deadline will lead to difficulties. You will have to get what you are owed by law through the courts. Rights to property benefits can be restored within three years.

The restoration procedure involves not only a trial, but also the presentation of the necessary documents and certificates that will prove the successor’s right of ownership of the objects in question. The heir draws up an explanatory statement confirming a valid reason for the delay.

If the legal process proves the rights of the heir in accordance with the established procedure, either the property or a sum of money equivalent to its market value is returned to the owner.

The inheritance estate, which is not claimed by the legal owners, can be transferred:

- into state ownership;

- into the possession of the municipality.

If an ownerless object can be further used for industrial purposes, it becomes the property of the federal apparatus. Residential types of real estate, movable property, financial balances, etc. are transferred to the ownership of municipalities. The structure of the transition is regulated by the state, the inheritance completely becomes the property of the Russian Federation.

Property is recognized as escheat provided that there are no claims from relatives and descendants of the testator. This often happens when there is a will that is not claimed by the heirs for a long time.

There are not many precedents in judicial practice due to the rule of seven lines, which involves government agencies searching for heirs from all seven lines.

Despite the framework established by law, cases of the return of material wealth to the relatives of the deceased are sometimes considered even a decade after the incident. The three-year restriction comes into force only after notification to the applicant. It may be delayed indefinitely due to various circumstances. These include long-term absence from the territory of the Russian Federation or incapacity of citizens.

To assign the status of state property to property, a statement of claim is filed with the judicial authorities. The plaintiff is the municipality, region, local government and state. The procedure for recognizing property as escheat is regulated by law.

We suggest you read: The order of grandchildren when inheriting property

Important! In judicial practice, there are often cases of neighbors notifying the relevant authorities about empty property. The absence of the owners of the property can be detected during various inspections by representatives of tax services or creditors.

If the notification is confirmed and government services establish that the owner does not have the property, a corresponding application is filed with the local government authorities.

Legally competent persons begin the procedure for assigning escheat status to property, which is carried out by local government, the state apparatus or other constituent entities of the Russian Federation. An application can only be submitted if there are no successors and after the expiration of a six-month period.

A statement of claim for assigning escheat status to property is filed by an authorized official. The document is sent to the real estate cadastral registration authorities for federal registration, entry into Rosreestr and technical inventory.

Only those persons who appear in civil law have the right to act as plaintiffs. The application is sent to the subordinate court for further consideration.

The plaintiff must indicate the legislative entity that establishes the assignment of escheat status to the property. The application is accompanied by a package of mandatory documents to prove and justify the decision.

Important! The basis for going to court can also be the illegal disposal of real estate by persons who took possession of the property illegally. For example, “heirs” who do not have evidence of kinship with the deceased.

Before registering escheated property as municipal property, the administration or higher authorities look for potential successors to the inheritance.

The media, print media, official news sources and other ways of informing the population about the imminent transfer of real estate to state power are involved. If no heirs are identified, the property is subject to transfer into the ownership of municipal structures.

Conclusion

We figured out how to recognize property as escheat. All property in the absence of a successor is subject to transfer to the state and municipality. You can challenge a court decision within three years, but in some cases the deadlines are extended. When applying for the right to dispose of real estate, you will need evidence of relationship with the deceased.

As a rule, after the death of a person, his property and monetary savings remain, which are inherited by the legal successors appointed by him in the will or determined by law. If no one has declared their right to the inheritance or part of it, escheat property is formed. Such inheritance is provided for in Art. 1151 Civil Code of the Russian Federation. We will tell you what the procedure is for registering escheated property as municipal property.

The property of the testator may become escheated in the following cases:

- absence of legal successors by will or law;

- the heirs are declared unworthy by a court decision;

- the heirs have lost the right to property by a court decision;

- successors refused the inheritance without indicating the persons to whom their right passes;

- all legal successors renounced the inheritance.

The state cannot refuse escheat property. It automatically becomes an heir if there are no legal successors. The transfer of the testator's property to the municipality or state is carried out as is - with encumbrances and debts.

Absolutely any property of the testator can become escheatable property. Not only real estate, a car or other property with special registration can have this status. The state will also receive personal belongings, furniture, securities, business, etc.

An exception will be assets and liabilities directly related to the person of the testator. For example, these are alimony and copyright.

The transition of property objects to the status of escheat is possible only if there are no other applicants for the inheritance among individuals. For example, this can happen if none of the potential heirs of any line have filed an application with the notary who is in charge of the inheritance case.

If in the future an heir appears from among individuals, he will be able to restore his rights. However, it is necessary to comply with the time limits provided for by law. The statute of limitations for inheritance cases is three years from the moment the successor learned about the existence of an inheritance and his rights to it.

Officially, property is recognized as escheated when ownership of it is transferred to the state or municipality with registration with the Rosreestr authorities. The process of selling real estate, securities and other objects of inheritance does not have a detailed explanation in regulations. Subjects of the federation have the right to establish their own procedures and regulations regarding the management and sale of escheated property.

What is escheat property and how to return it?

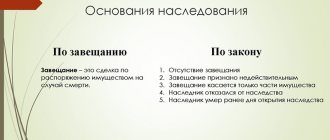

Inheritance of material assets occurs on the basis of a will or in the order of legal priority. When transferring property in order of priority, all heirs are divided into groups according to the degree of relationship. If there are no heirs, if candidates refuse property, if all applicants are recognized as unworthy heirs, the state becomes the recipient of the benefits. The state cannot refuse inherited benefits - such property in the Civil Code is called escheat property.

Article 1151 of the Civil Code of the Russian Federation provides that property in full may be transferred to the state if there are sufficient grounds for this. This applies to material assets and debt obligations that remain after the death of the testator.

If part of the property is accepted by the heirs, the remaining share of material wealth becomes the property of the state.

Grounds for transferring property to the state:

- potential recipients of property died before accepting the inheritance;

- recognition of candidates as unworthy (committing a crime against the heir, deprivation of kinship);

- refusal of heirs to accept property;

- during the six months of enforcement proceedings, none of the candidates expressed a desire to receive an inheritance (the desire to formalize an inheritance is confirmed by a handwritten application from the heir to receive the property).

Principles of retention of escheatable property:

- the state or municipality becomes the owner of the values;

- the decision to recognize objects as escheat is made only after the expiration of 6 months allotted for inheritance;

- absence of strict deadlines for the acquisition of property rights to property by the municipality or the state.

The legislation does not limit the period for acceptance of escheated property by the state. But this applies only to maximum periods, since the minimum time is limited by the action of enforcement proceedings, when the main heirs of the deceased person can assert their claims to the property:

- 6 months – the total period of inheritance;

- 9 months – inheritance by right of transmission.

Article 1117 of the Civil Code provides a list of circumstances under which a candidate for property is recognized as an unworthy heir. A person loses property rights, regardless of the presence of a will.

Grounds for recognizing an heir as unworthy:

- the heir committed illegal actions directed against the life/health of the testator;

- committing illegal actions in order to obtain a larger share of property than required by law;

- deprivation of kinship;

- a relative who evaded his obligations to support the deceased testator.

If the property has already been received, then the unworthy heir is obliged to return the received property in full.

An example of refusal to receive an inheritance by an unworthy heir: Citizen S. died, leaving behind a three-room apartment in the center of the capital. The testator drew up a will, but the relatives indicated in the administrative document died before the testator. The executor involved in the case did not find other relatives of the deceased citizen S. The apartment was transferred to the municipality and was sold.

After 7 years, citizen O., the father of the deceased, went to court. The man requested that the inheritance period be restored because he was in prison and could not claim his rights earlier. The court granted the claim. Citizen O. turned to the notary with a demand to return the inherited property. The executor was re-involved in the case, who found a document confirming that 10 years ago the man was deprived of parental rights in relation to his son. Receipt of escheatable property was denied.

We invite you to familiarize yourself with: Common shared ownership under the legislation of the Russian Federation

In practice, there are cases when the heirs of a deceased person learn about their rights a considerable time after the completion of the inheritance procedure. It happens that such values have long passed into the possession of the state. But this does not mean that a person cannot protect his property rights.

Considering that the period of inheritance has already passed, a person needs to prepare a statement of claim in court with a request to restore the period of inheritance of property. The claim is prepared taking into account the following requirements:

- It is mandatory to indicate the reasons why the inheritance period was missed;

- the petition is submitted to the court located at the address where the inherited property is located;

- consideration of the claim takes place in the form of writ proceedings;

- The approximate time frame for making a decision on an application is up to 1.5 months.

This is also important to know: Who is the first-line heir?

Ekaterina DerzhavinaAssistance in drawing up statements of claim and other legal documents The statute of limitations for such disputes is 3 years. It begins to count from the day when the heir learned (or could have learned) about the death of the testator.

After receiving a court decision to restore the inheritance period, the interested person with the document approaches a notary located in the region of the deceased testator’s last residence permit. He additionally prepares documents confirming inheritance rights to valuables.

The actual implementation of enforcement proceedings to receive an inheritance. The notary will tell you what documents are needed and advise the person on how to go through the procedure correctly.

Lawyer. 12 years of experience. Specialization: family and inheritance law. If, at the time of receiving the escheated property back, it turns out that the state/municipality has already sold the values, the state will compensate the cost of the inheritance to the person in monetary terms.

Arbitrage practice

Usually, when a claim is filed by an heir who has missed the deadlines established by law, the court willingly accommodates such a plaintiff. The main thing is to document the following facts:

- family relationship with the deceased person;

- no obstacles to inheritance;

- confirmation of compelling reasons for missing the established inheritance period.

Once potential heirs have not asserted their claims to the property, the municipality/state becomes involved. The procedure for acquiring property rights by the budget includes the following steps:

- the notary who opened the enforcement proceedings, after 6 months, is obliged to take measures aimed at preserving the inherited property (an inventory is prepared, a decision is made to seize the property);

- the notary prepares a certificate recognizing the property as escheated, which it forwards to the territorial department of the Federal Tax Service;

- the tax service accepts property from the notary, accepting the authority to protect the property;

- property valuation;

- drawing up an act of acceptance and transfer of material assets;

- commencement of the property sale procedure;

- transferring the profit received from the sale to the municipal/state budget fund.

This is also important to know: Heirs of the second stage

Anyone can buy escheated property, except employees of the Federal Tax Service. Information about property sales appears in the following sources:

- municipality website;

- local news newspaper;

- Federal Tax Service website.

The court refused to restore my mother's inheritance term. Her father's apartment was taken over by the state and put up for sale. Can we buy it? Can we privatize this housing for free, like a low-income family? You can buy an apartment on a general basis. It will not be possible to privatize real estate, since privatization is only available after living in a municipal apartment for a long time.

I was refused to restore the term of inheritance of my grandmother's house. When and how can I make a claim on a property? You can make a claim on a purchase at any time. Even before the appearance of information about real estate in the media. To do this, you need to contact the Federal Tax Service with an application.

The escheat apartment is being sold for 2,000,000 rubles. I want to buy it, but I don’t have that amount of money. Can I reduce the price? Is it possible to use social benefits to purchase such real estate? It is unlikely that it will be possible to reduce the price. As a rule, the price is already set below the market price. But you can use maternity capital, tax deductions or social assistance to purchase property. It is allowed to take out a mortgage for the purchase of escheatable real estate.

How is escheat property inherited?

Acceptance of escheat property is not a right, but an obligation of the state. Heirs may refuse what is due by law or will if there are high registration costs or if the deceased has debts that must be transferred to legal successors.

In accordance with Art. 1157 of the Civil Code of the Russian Federation, the state does not have the right to refuse escheated property and, by default, is obliged to accept the entire inherited mass, including encumbrances.

Considering that applicants from one of the 8 lines of inheritance can legally acquire the property of the deceased, the state is conditionally the 9th line.

Legislative regulation

What does the law say about inheritance and accounting for escheated property? The transfer of the inheritance of a deceased person to the treasury is regulated by Art. 1151 of the Civil Code of the Russian Federation (last edition dated August 3, 2018). According to this article, such transfer is made in the following cases:

- no heirs;

- all existing claimants to the inheritance are removed by court decision;

- none of the eligible citizens accepts the inheritance. That is, no one wrote the application for registration properly within the time limits specified by law;

- the heirs wrote notarized waivers. Moreover, the refusal of inheritance must be formalized without indicating the persons to whom the rights are transferred.

The procedure for inheriting escheated property

How does the transfer of ownership to the state occur?

Since abandonment of such property is impossible, it is not necessary to express the will of the state authorities, nor to write a corresponding statement. The Ministry of Finance's instructions presuppose the following procedure for inheritance and accounting of escheated property:

- The authorized notary sends a notification to the Tax Inspectorate about the acceptance of the inheritance into state ownership , and first describes it in the presence of two witnesses.

- The Federal Tax Service evaluates escheated property on the date of opening of the inheritance . It must do this within 5 days after receiving the notification from the notary. In this case, the notary's expenses for storing the property are deducted from the value of the property.

- Tax authorities transfer property in favor of state heirs.

There are two types of escheat property: movable and immovable . It depends on its type which government structure will act as the heir to the property.

The local committee for the management of municipal property (property) is usually responsible for the acceptance and registration of escheated property. Real estate by law becomes the property of settlements and cities of federal significance.

If we are not talking about real estate, then such property becomes the property of the Russian Federation. Thus, monetary savings are credited to the account of the federal treasury, religious objects (icons, etc.) are transferred to the church, jewelry - to the State Reserve, cultural and historical values - to the Russian Academy of Sciences.

It is also possible to register and sell property at auction. However, it is prohibited for government employees to purchase it. After the transactions are completed, the money received is credited to the regional or federal budget.

Is it possible for citizens to challenge the recognition of the property of a deceased relative as escheat?

The statute of limitations does not apply to inheritance of escheated property. There are no clear instructions in the legislation, but by analogy, definitely, the possible deadline for recognizing an inheritance as escheat occurs 6 months after the opening of the inheritance, when the time for filing applications from the heirs expires.

After six months, a representative of local authorities can begin processing a certificate of inheritance. In fact, government agencies usually take ownership of abandoned property after a few years.

Legal practice shows that inheritance is often recognized as escheated unlawfully. It happens that relatives from all eight lines of inheritance simply do not find out in time about the death of the testator. Or valid reasons prevent them from filing inheritance documents on time. What to do in this case in 2019:

- submit an application to the court to extend or restore the period for accepting the inheritance. This claim must be filed at the place where the inheritance was opened;

- file a claim against the Federal Property Management Agency. Such a claim must be filed at the location of the property. The application must contain a demand for the return of material assets recognized as escheat property. If they have already been sold, for example, sold at auction, the heir can receive appropriate monetary compensation for this claim.

The procedure for recognizing property as escheat is not fully regulated by law. Often the court takes the side of the declared heirs. It is this fact that forces municipal authorities to delay the timing of entering into such an inheritance.