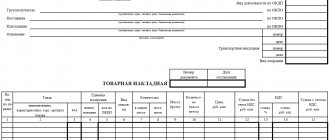

Based on a time sheet

Despite the fact that with any form of remuneration, the employer is obliged to keep records of the working time actually worked by each employee (Article 91 of the Labor Code of the Russian Federation), it is the work time sheet under the time-based wage system that is the main document on the basis of which wages are calculated .

The employer develops the form of the working time sheet independently and consolidates it in its accounting policy for accounting purposes. Form No. T-13 (approved by Resolution of the State Statistics Committee dated January 5, 2004 No. 1) can be used as a guide.

Cases of payment of wages in kind

The form of remuneration under consideration is used at enterprises whose products the employee can regularly and effectively use. For example, quite often at enterprises in the agricultural sector of the economy, in conditions of an unstable situation of the organization, it is practiced to pay part of wages in food products.

Products issued as wages must be suitable for use. As a general rule, the organization makes payments in kind in the form of consumer goods. Wages in kind are given to personnel taking into account qualifications, quality of work, number of hours worked, and can be used as an incentive measure.

For a full month - salary

With a time-based wage system, wages are calculated based on the salary. Salary is a fixed amount of remuneration for an employee for the performance of labor (official) duties of a certain complexity for a calendar month, excluding compensation, incentives and social payments (Article 129 of the Labor Code of the Russian Federation). The employer can set not a monthly salary, but an hourly rate, which is especially convenient for employees with a flexible schedule or part-time workers. We discussed the specifics of calculating earnings for hourly wages in a separate consultation.

Legal regulation

The time-based wage system has many advantages and has become widespread.

This article talks about typical ways to resolve the issue, but each case is unique. If you want to find out how to solve your particular problem, call :

- Moscow .

- Saint Petersburg .

Or on the website. It's fast and free!

According to the provisions of Art. 129 of the Labor Code, the salary includes three main elements:

- The salary itself or a certain payment for the amount of work performed.

- Compensatory payments taking into account special working conditions for carrying out labor activities.

- Additional payments of an incentive nature , the purpose of which is to reward employees for work results and increase interest in these results.

The first two components of the salary are transferred to employees without fail and are regulated by the Labor Code. In particular, in Art. 143, 144 of the Labor Code provide sources for pricing the work performed depending on their level of complexity.

According to Art. 134 of the Labor Code for state institutions provides for mandatory salary indexation. At the same time, the maximum salary of heads of budgetary institutions is limited by the average earnings of his subordinates under Art. 145 TK.

In Art. 146-149, 152-154 of the Labor Code establishes the obligation of management to transfer salaries in an increased amount when employees work under special conditions.

Whereas the payment of bonuses is not mandatory and is made at the discretion of the employer. Therefore, based on the provisions of Art. 129 and 135 of the Labor Code, the employer must independently decide whether the bonus will be included in the salary and on what conditions it will be accrued.

At the same time, the content of these documents must be agreed upon with representatives of the labor collective and communicated to employees under personal signature, in accordance with Art. 57 TK.

According to Art. 129 of the Labor Code, wages can be transferred to employees in two main forms : as piecework (based on the amount of work performed or services provided) and as time-based (taking into account the actual time worked). If there are bonuses in the wage system, the salary has a piece-bonus form or a time-bonus form.

Unlike a regular time-based system, where the salary depends only on the time actually worked, with a time-based bonus system, an employee’s income depends on additional factors: the volume of work performed and its quality.

Thus, the time-bonus wage system is a salary that is accrued for a calendar month and consists of the following parts: payment for work for the time actually worked, additional payments for special working conditions (if any occurred in the billing period) and bonuses, which are due to each employee per month.

In addition, the time-based bonus payment system has the following advantages:

- It is easy to calculate and transparent for company employees.

- It leads to improved labor organization , since the employee is interested in saving labor resources.

- It motivates the employee to take initiative , use advanced methods and technologies, and treat the equipment used with care.

Time-bonus system

The time-based bonus system of remuneration provides not only accrual for time actually worked, but also additional remuneration (bonus) for achieving certain results (for example, efficiency and quality of work). The procedure for calculating and accruing bonuses is provided for by the regulations on remuneration, regulations on bonuses, an employment contract or other document.

It is possible to combine piecework and time-based wages, when wages are calculated not only for the time actually worked, but also for specific labor results, recorded, for example, in a piecework work order.

Earnings calculation

Payroll calculation under the time-bonus system is based on the following documents:

- Time sheet , which records the number of days or hours worked in the billing period.

- Tariff schedule or staffing table , which determine the salary amount.

- Provisions in an employment and collective agreement or other local act , which describes the procedure for calculating bonuses.

Let us give an example of calculating an employee’s earnings when using a time-based bonus payment system. For example, an employee works in a company with a salary of 30 thousand rubles. There were 22 working days in the month, of which he worked 17. In the region where the employee worked, the coefficient was set at 1.3. The bonus is paid upon achievement of planned indicators in the amount of 20% of the salary.

Salary for the pay period will be calculated as follows:

- 30,000 / 22 * 17 = 23,181.82 rubles;

- taking into account the current regional coefficient, this value will be 30,136.36 rubles. (23181.82 * 1.3).;

- taking into account the fact that the employee fulfilled the plan, his bonus will be 6027.27 rubles;

- In total, at the end of the month, the employee will receive, taking into account the bonus, 36,136.63 rubles. (30136.36 + 6027.27).

Thus, a time-based bonus form of payment can be established for employees whose work is assessed by payment based on salary and the transfer of bonuses to them on a regular basis. The bonus rules in force at the enterprise should be enshrined in local regulations.

Dear readers, each case is individual. If you want to find out how to solve your particular problem, call :

Or on the website. It's fast and free!

Articles on the topic

The law provides for different types of remuneration. Let's consider what features need to be taken into account when choosing one option or another. The article contains a convenient table with remuneration systems, descriptions and examples.

Use ready-made samples from experts:

Premium remuneration systems; purpose, essence and types of awards

There are two forms of remuneration. Payment is established either depending on the time during which the enterprise used labor, or in accordance with the volume of work performed. In the first case, payment is called time-based, in the second case - piece-rate.

Premium wages are an additional payment system, which must be used in combination with any basic one - time-based or piece-rate system. According to their purpose, bonuses are divided into two groups: bonuses for the main results of economic activity and bonuses for improving certain aspects of production activity (special). Bonuses, as a rule, are targeted in nature and serve as a means of stimulating employee motivation to achieve certain goals that are significant for the organization.

Time-bonus - a wage system in which a premium in a certain percentage of the tariff rate or other measure is added to the amount of earnings at the tariff. The primary documents for recording the labor of employees with time-based payment are time sheets. The time-bonus wage system is used to improve qualitative or quantitative indicators (accident-free operation, improved product quality).

With a piece-rate bonus system, in addition to earnings at direct piece rates, a bonus is paid for fulfilling and exceeding the plan according to pre-established qualitative or quantitative indicators.

This is interesting: Diagnoses with which they are not accepted into the army

Bonuses are an integral part of the employee motivation scheme, designed to stimulate them to perform better and more efficiently. A bonus is an additional payment of a stimulating or incentive nature to the employee’s basic earnings.

Thus, bonuses can be of two types: 1. Incentive bonuses, which are provided for by the remuneration system.

According to Article 135 of the Labor Code, the employer has the right to establish various systems of bonuses, incentive payments and allowances, taking into account the opinion of the representative body of employees. These systems can also be established by collective agreement.

At the same time, the bonus remuneration system adopted by the organization must provide for the payment of bonuses to a certain circle of people based on pre-established specific indicators and bonus conditions.

2. Bonuses (encouragement) for distinguished employees outside of remuneration systems. According to Article 191 of the Labor Code, an employer can reward employees who conscientiously perform their job duties. Employees may be paid one-time bonuses: for increasing labor productivity; for many years of conscientious work; for improving product quality; for innovation in work; for flawless performance of job duties; for other achievements in work provided for by the Internal Labor Regulations and the collective agreement.

When paying one-time bonuses, the circle of bonuses is not determined in advance.

The amount of the bonus to each employee for a certain period is established in the order of the head of the organization. This takes into account: the employee’s personal contribution to the organization’s activities; the result of the work of the department in which the employee performs his job duties; the result of the organization's activities.

Concept of remuneration

Wages are the remuneration that an employee receives as a result of professional activities. Timely payment of wages in full is the responsibility of the employer. For evasion or non-compliance, a number of administrative fines and penalties are provided. Chapter 21 of the Labor Code of the Russian Federation is devoted to the standards in this area of labor relations.

There are a lot of professions, and historically, each has a certain procedure for calculating wages. For example, office employees, secretaries, accountants, and administrative workers receive salaries based on the time worked. Specialists involved in production earn money in proportion to what they do. Teachers are paid based on hours worked. There are several options. An entrepreneur has the right to choose the most optimal approach for his staff.

Even within the same organization, the types of remuneration for different employees may differ.

For example, management and administrative staff receive wages from hours worked, and workers - from manufactured products. The right choice of salary type is necessary for fair remuneration of employees, productivity growth and the success of the enterprise as a whole.

The employer has the right to choose from several payment options

Answer

The employer sets the remuneration system independently (Part 2 of Article 135 of the Labor Code of the Russian Federation). At the same time, changing the remuneration system will require changes to employment contracts with employees. An organization can change employment contracts unilaterally only if there are organizational or technological changes (Article 74 of the Labor Code of the Russian Federation).

So, in order to introduce a time-bonus wage system, you will need:

— make changes to the wage regulations or develop a new regulation. Develop Regulations on bonuses;

— make changes to employment contracts with employees (conclude additional agreements to employment contracts);

- make changes to the staffing table.

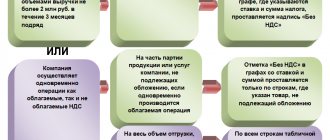

Visually, the employer’s action algorithm will look like this:

In the Regulations on remuneration it will be necessary to indicate that the organization is introducing a time-based bonus system of remuneration. All employees will need to be familiarized with this provision and signed.

The introduction of a new remuneration system will change the terms of remuneration specified in employment contracts. In this regard, it will be necessary to conclude an additional agreement to the employment contract, which will indicate the new salary amount, as well as the possibility of paying a bonus. Please note that it is not necessary to directly indicate in the text of the employment contract the size, conditions and procedure for paying bonuses. You can make a link to the Regulations on Bonuses. All employees must be familiarized with this provision and signed.

Let us note once again that all changes to the terms of the employment contract are possible only by agreement of the parties (Article 72 of the Labor Code of the Russian Federation). An employer can unilaterally change the terms of an employment contract only if there are organizational or technological changes and in compliance with the procedure established by Article 74 of the Labor Code of the Russian Federation.

Thus, employees will need to be notified at least two months before the changes are introduced. If the employee refuses to continue under the changed conditions, the employment contract is terminated on the basis of clause 7, part 1, article 77 of the Labor Code of the Russian Federation.

This is interesting: Receiving benefits for utility bills

The staffing table will also need to indicate the new salary level, as well as the amount of bonuses.

Details in the materials of the Personnel System:

1. Situation: How to make changes to an employment contract if they are caused by a change in organizational or technological working conditions in the organization

Ivan Shklovets

, Deputy Head of the Federal Service for Labor and Employment

Changes to the employment contract for reasons related to changes in organizational or technological working conditions include, for example:

- changes in equipment and production technology, for example, the introduction of new equipment, technical regulations, which led to a reduction in the employee’s workload, as well as changes in the rules for operating equipment, improvement of workplaces (appeal ruling of the Supreme Court of the Komi Republic dated December 2, 2013 No. 33-6124 /2013);

- structural reorganization of production, for example, the exclusion of any stage of the production process, the introduction of new labor regimes, changes in the remuneration system in the organization as a whole, labor standardization systems, redistribution of tasks and areas of responsibility between structural divisions;

- other changes in organizational or technological working conditions that led to a reduction in the employee’s workload.

At the same time, it is prohibited to change the employee’s job function.

This is stated in Part 1 of Article 74 of the Labor Code of the Russian Federation.

The organization is obliged to notify the employee against signature about upcoming changes related to changes in organizational or technological working conditions, as well as about the reasons that caused the need for such changes. This must be done no later than two months before the introduction of such changes. This is stated in Part 2 of Article 74 of the Labor Code of the Russian Federation. If the employee agrees with the upcoming changes, draw up an additional agreement to the employment contract (Article 72 of the Labor Code of the Russian Federation).

If an employee does not agree to work under the new conditions, then the organization is obliged to offer him another job, including a lower-ranking one with lower pay, if the organization has suitable vacancies. An employee should only be offered vacancies that are available to the employer in the given area. Job vacancies in other locations should be offered only if this is provided for in a collective agreement, labor agreement, or other agreements. This procedure is enshrined in Part 3 of Article 74 of the Labor Code of the Russian Federation.

If the employee refuses to work under the new conditions or there are no suitable vacancies in the organization, then the employment contract can be terminated:

- to reduce staff on the basis of clause 2 of part 1 of Article 81 of the Labor Code of the Russian Federation with the payment of all compensation - if we are talking about changing the working regime, namely the introduction of a partial regime (Part 6 of Article 74 of the Labor Code of the Russian Federation);

- in connection with the refusal to continue work in new conditions on the basis of clause 7 of part 1 of article 77 of the Labor Code of the Russian Federation, also with the payment of compensation - in all other cases (part 3 of article 178 of the Labor Code of the Russian Federation).

2. Situation: Is it necessary to include grades, allowances and bonuses in the staffing table?

Nina Kovyazina

, Deputy Director of the Department of Medical Education and Personnel Policy in Healthcare of the Russian Ministry of Health

Staffing form No. T-3 was approved by Decree of the State Statistics Committee of Russia dated January 5, 2004 No. 1. This form contains the columns “rank” and “addition”. Therefore, if a rank is provided for a particular position, as well as the payment of bonuses or allowances, this information must be reflected in the staffing table.

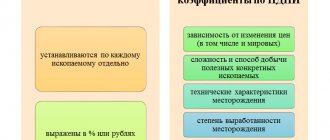

In column 3 of this form, reflect the rank of position (if any). In column 5 - salary in accordance with the remuneration system adopted in the organization. In columns 6–8 “Bonuses”, indicate incentive and compensation payments that are established by current legislation, for example, northern bonuses, bonuses for an academic degree, etc., as well as bonuses, bonuses, additional payments introduced at the discretion of the organization, for example, related to the regime or working conditions. In this case, the indicators in columns 5–8 can be expressed not only in monetary terms - in rubles, but also in other units of measurement, for example, in percentages, coefficients, etc.

This is interesting: What is needed to apply for a mortgage at Sberbank

Such rules were established by Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1.

However, from January 1, 2013, in connection with the adoption of the Law of December 6, 2011 No. 402-FZ, the use of unified forms is not mandatory for most organizations. The exception is public sector organizations. They must still use unified forms in their work without fail.

All other organizations, when drawing up organizational and administrative documents, have the right to continue to use both unified forms and to develop them independently.

Such conclusions follow from the totality of the provisions of Articles 7, 9 of the Law of December 6, 2011 No. 402-FZ. A similar opinion was expressed by employees of the Russian Ministry of Finance in a letter dated December 4, 2012 No. PZ-10/2012.

Thus, if an employer uses an independently developed form of staffing, then he can indicate grades, allowances and bonuses or not indicate them at all if they are not provided for in the organization.

With respect and wishes for comfortable work, Elena Karsetskaya,