A CEO without an employment contract or salary is a common situation in small, growing companies. Let's figure out whether such a situation is acceptable, whether it complies with legal standards and how to properly register a manager.

Let's start with the question: can a CEO work without salary? It all depends on the status of the employee. For example, if this is an experienced and qualified manager brought into the business from outside, then you will have to pay in any case. It is unlikely that a top manager will agree to work as a volunteer.

Another question: can a director not receive a salary if he is a founder? Maybe. But he may receive it. The situation is relevant for a weak business that is just gaining momentum, when the entrepreneur is trying to get promoted. Additional costs in the form of your own salary are unprincipled and irrational.

Should I enter into an employment contract with myself?

To conclude an employment contract, two people are needed: the employee and the employer. If both are represented by the same person, then this is no longer a contract.

Article 273 of the Labor Code directly states that the chapter on labor relations with managers does not apply to the sole founders who manage their company themselves. In this situation, the founder appoints himself as a director by his decision (letters of Rostrud dated 03/06/2013 No. 177-6-1, Ministry of Finance dated 03/15/16 No. 03-11-11/14234, dated 02/19/2015 No. 03-11-06/2/ 7790).

There are many court decisions that briefly mention employment contracts that the sole founder concluded with himself. That is, in practice, these agreements are widespread, which is what tax officials advocate for.

Controllers from the funds even tried to fine companies for failure to submit employment contracts and orders for inspection - 200 rubles each. for each document not submitted. But the courts consider the fines to be unlawful, since the companies, in principle, do not have these documents, which means they cannot be fined (Resolution of the AS of the West Siberian District dated March 10, 2017 No. A27-594/2016).

The only founder and director in one person

The only founder and director in one person is a typical picture for a small business. Moreover, bringing a startup to profit often requires the manager to invest a year or even more of work and money into its development without receiving anything in return.

In such a situation, paying the director a salary is a luxury that not everyone can afford. The luxury of paying insurance premiums from your salary, maintaining personnel records and submitting a huge amount of “salary” reporting.

Meanwhile, in an already established business, you want something fundamentally different - social guarantees (sick leave, vacations), the formation of pension savings, a monthly salary. These are the benefits of an employment contract.

Is it necessary to conclude an employment contract and pay wages if your company has the only founder and director in one person? Unfortunately, there is no single official answer to this question. And if you came here for an exact “yes or no,” then I will immediately disappoint you.

Meanwhile, there are also advantages - using the situation in a way that is beneficial to you. And in both cases, guided by legal norms.

Employment contract with the sole founder

All official sources who are called upon to clarify controversial issues - Rostrud, the Ministry of Finance, extra-budgetary funds, the courts - like capricious young ladies, put forward opposing points of view. Moreover, with references to legislation. That does not prevent them from changing their position to the opposite one after some time.

By the way, letters from Rostrud and the Ministry of Finance are not normative legal acts; they contain only explanations and opinions and cannot have legal force.

Above, we have already briefly outlined the reasons why an employment contract with a single founder can be beneficial, we repeat:

- — the opportunity to receive monthly income from the business, regardless of whether there is profit;

- — social guarantees (payment of vacations and various benefits);

- — formation of pension insurance length of service for calculating pensions.

Examples of opinions of officials against concluding an employment contract: letters of Rostrud dated 03/06/2013 No. 177-6-1, dated 12/28/2006 No. 2262-6-1, letter of the Ministry of Finance dated 02/19/2015 No. 03-11-06/2/7790 , letter of the Ministry of Health and Social Development dated August 18, 2009 No. 22-2-3199. Here are their arguments:

- If the only founder and director are one person, then the employment contract will have two identical signatures ; it is concluded with oneself, which is impossible.

In paragraph 3 of Art. 182 of the Civil Code of the Russian Federation states that an agreement signed by the same person on both sides has no legal force. But the provisions of this article do not apply to labor relations; this is civil law.

- Article 273 of the Labor Code from Chapter 43 (labor relations with the manager) states that the provisions of this chapter do not apply to managers who are the only participants (founders) of their organizations.

As you can see, the statements are very controversial.

Is the director's employment contract with himself or with the company?

What arguments can you give in your favor if you are the only founder and director in one person and want to conclude an employment contract?

- The parties to the employment contract are different - the director as an individual and the organization as a legal entity. It is known that a legal entity has its own legal capacity and acts in legal relations on its own behalf, and not on behalf of its founders. Therefore, an employment contract between the director “with himself” is possible.

- Chapter 43 of the Labor Code, which officials refer to, describes the relationship with the manager, who is not the founder. The Labor Code itself does not prohibit concluding an employment contract with a single founder . And even in Article 11, among the persons to whom labor legislation does not apply, the founding director is not named.

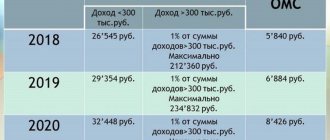

Insurance legislation indirectly confirms the possibility of concluding an employment contract with a single founder . So, for example, in paragraph 1 of Article 7 of Law No. 167-FZ of December 15, 2001 “On compulsory pension insurance in the Russian Federation” we will find that the insured persons are “those working under an employment contract, including heads of organizations who are the only participants (founders)".

Similar provisions are in laws No. 326-FZ of November 29, 2010 (health insurance) and No. 255-FZ of December 29, 2006 (social insurance).

Order for director - sole founder

Labor relations with the general director are formalized in accordance with all the rules of labor legislation, with the conclusion of an employment contract. If there is only one founder, then the agreement can be concluded for an indefinite period.

The text of the agreement states that this employee “is assigned the duties of the general director on the basis of the decision of the founder (participant) No. ..... dated .....”.

Those. first you need to sign the decision of the sole participant of the company. The decision will say: “I assign the duties of the general director to myself.”

Based on the decision, an order is issued to the director - the sole founder, which says approximately the following: I, full name, begin to perform duties as the general director of LLC "..." from (date). Grounds: decision of the sole participant of the company No.... dated...

The requirement to issue an employment order is contained in Art. 68 Labor Code of the Russian Federation. The entry for employment is made according to the general rules established by the Rules for maintaining and storing work books (approved by Decree of the Government of the Russian Federation of April 16, 2003 N 225), as well as the Instructions for filling out work books, approved. Resolution of the Ministry of Labor of the Russian Federation dated October 10, 2003 No. 69.

The signed order for the performance of duties will be an order for employment. Based on the concluded employment contract and order, an entry is made in the work book.

Entry into the work book is done as follows:

- — in column 3: Appointed to the position of General Director

- — in column 4: order details

If you plan to enter into an employment contract not only with the director, but also to hire other employees, then this article will help you .

Salary of the director - the sole founder

The employment contract will provide for the payment of wages to the director. Its size must be economically justified (Article 273 of the Tax Code - expenses are economically justified and documented).

Please note that the salary of the director - the sole founder - can only be paid upon concluding an employment contract . If it is not there, then the tax authorities will not recognize it as an expense.

The explanation is simple - among the expenses that cannot be taken into account when calculating the tax base for profits, the Tax Code indicates any remuneration to managers, except under an employment contract (clause 21 of Article 270 of the Tax Code of the Russian Federation).

The director's salary is paid according to the same rules as other employees, there are no differences. Personal income tax is also withheld and insurance premiums are charged.

The only founder and director in one person without an employment contract

There is also the opposite situation, when the founder does not want to enter into an employment contract, but performs management functions. Since we have refuted the arguments of the Ministry of Finance and Rostrud, we will not refer to their conclusions and justifications. Let's go from the other side - from the position of civil legislation.

Article 53 of the Civil Code, art. 32, 33, 40 of the Law “On LLC” indicate that the director is the sole executive body of the company and carries out the current management of the LLC’s activities.

There is no connection here with the presence or absence of an employment contract and payment of wages. From the moment the sole founder, by his decision, assumes the functions of the sole executive body, he receives management powers.

Thus, the only founder who wants to manage his organization himself has the right to either conclude an employment contract or do without it.

SZV-M for founding director

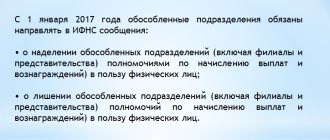

All employers are required to submit a report to the Pension Fund of Russia in the form SZV-M. This must be done no later than the 15th day of the month following the reporting month. Until March 2020, according to the official position of the Pension Fund, SZV-M was not necessary to apply for the founding director with whom an employment contract was not concluded and who does not receive a salary. This was explained by the fact that such persons were not recognized as employees, and therefore as insured persons.

However, the Pension Fund of Russia has changed its position since March 2020. Now SZV-M is submitted to the founding director in any case , regardless of:

- — the presence or absence of an employment contract concluded with him;

- - the presence or absence of wage payments to him;

- — the organization conducts business activities or stops them.

A SZV-STAZH report is also submitted to the founder.

Officials explain their demand by the fact that Article 16 of the Labor Code states that even without a concluded employment contract, in this case, an employment relationship arises with the employee due to his actual admission to employment.

On this topic you can read: letters of the Pension Fund of the Russian Federation No. LCH-08-24/5721 dated 03/29/18, 17-4/10/B-1846 dated 03/16/18.

Moreover, regional branches for reinsurance require inclusion in SZV-M not only of the founder in the singular, but also of all founders, if there are several of them.

Is the founding director included in the DAM?

The Calculation of Insurance Contributions (DAC) form in Section 3 includes personalized information about the amounts of wages accrued to each employee.

Therefore, if an employment contract is concluded with the founding director and he is paid a salary, then clearly such an individual and payments to him must be reflected in section 3.

However, according to the latest position of officials (letter of the Ministry of Finance dated June 18, 2018 No. 03-15-05/41578, letter of the Federal Tax Service No. GD-4-11 / [email protected] dated April 2, 2018), Section 3 of the DAM should include information about the director - the sole founder , even if an employment contract has not been concluded with him and he does not receive wages. In this case, subsection 3.2 will have zero indicators.

Officials explain this by saying that despite the lack of payments, such a person does not cease to be insured. And it is insured because there is still an employment relationship, even without an employment contract.

In this article, we deliberately examined not only the problem of concluding or not concluding an employment contract, but also reporting. Because in the same situation the same organs say completely different things. Fantastic! There cannot be an employment contract in principle, but at the same time there is one. As well as the obligation to submit reports.

No matter how you do it, you will still be wrong! Therefore, there is only one conclusion - do what suits you best - by concluding or not concluding an employment contract. But in the reports the only founder and director must be one person.

If you don’t have time to spend time on accounting routine, if you have more important tasks in your business, then write on the Contacts page or online chat, we will be happy to help you. In the comments you can ask questions about the content of the article if you have any.

The Ministry of Finance is on your side

Speaking about the sole founder, the Ministry of Finance did not give him the right to choose: to conclude or not to conclude an employment contract with himself.

If the head of the organization is its only founder, that is, one of the parties to the employment contract is absent, then the employment contract cannot be concluded (letter of the Ministry of Finance dated March 15, 2016 No. 03-11-11/14234).

The head of an organization, who is its sole founder, cannot calculate and pay his own salary (letter of the Ministry of Finance dated February 19, 2015 No. 03-11-06/2/7790).

The financial department is talking specifically about the impossibility of paying oneself a salary, and not about the fact that the founder has the right not to do so. Other letters contain the same categorical statements (letter of the Ministry of Finance dated October 17, 2014 No. 03-11-11/52558). We did not find any more recent letters with a different position. Therefore, the demands of tax officials contradict the opinion of their superiors. The courts also talk about the impossibility of concluding an employment contract (resolution of the Twentieth AAS dated June 30, 2017 No. A23-7189/2016).

How to appoint a general

Having figured out whether the founder and director in one person can not accrue salaries, we will determine what to do if earnings still need to be accrued. For example, the general director decided to refuse charity and assign himself a reward for backbreaking work. In this case, it is necessary to issue a similar order for appointment to the position. The procedure for remuneration of the general director can be established at a general meeting of LLC participants. The decision of the founding council may be to conclude an employment contract with the general director; then an order of appointment or an order to take office is issued.

For information on how to draw up these administrative documents, read the article “Sample order for the appointment of a general director.”

Are there agreements with other employers?

Often, the sole founder of a company continues to work in another organization under an employment contract until his own company gains momentum. In this situation, he will not physically have enough time to work under an employment contract in his company.

And the company does not need its director to work a strictly specified number of hours per day, which are established for part-time workers. For example, 30 minutes during the day may be enough to meet with a potential supplier. So the situation turns out that the director performs his leadership functions, but at the same time does not even earn his potential salary.

Refusing your salary is your right

The Supreme Court considered an interesting case. The company had two directors with whom employment contracts were concluded. But these managers filed an application with a request not to accrue or pay their salaries. In this regard, the company did not keep track of their working hours and did not pay personal income tax or insurance premiums. The tax authorities filed claims, assessed additional personal income tax and wage contributions, which were determined by calculation based on the minimum wage.

However, the appellate court decided that the employee has the right to voluntarily refuse to receive wages. The main thing is that the legal rights and interests of other participants are not violated, and that these workers are not influenced in order to limit their rights (Resolution of the Eighteenth AAS dated July 4, 2016 No. A34-8837/2015).

The Supreme Court upheld this decision. He clarified that controllers do not have the right to determine the base for contributions by calculation. It includes only accrued payments. If wages have not been accrued, then insurance premiums are not calculated (Decision of the Supreme Court dated February 17, 2017 No. 309-KG16-20570).

In general, violations of labor legislation should be dealt with by the labor inspectorate, not the tax office.

Such arguments will not work in relation to an ordinary employee; the court is unlikely to believe in a voluntary refusal of salary. But the sole founder already has enough incentives to work for his company. No one can accuse him of forcing himself to sign an unfavorable clause.

However, keep in mind that some courts consider the refusal of even the sole founder to pay a salary illegal, not to mention other employees. And they support inspectors who charge additional insurance premiums based on the minimum wage (Resolution of the Sixteenth AAS dated August 15, 2016 No. A25-2189/2015).

Courts for contract

Against the background described above, the judiciary is simply a model of stability. All cases available for study, which consider the question of whether it is necessary to conclude an employment contract with the director-owner, contain the same conclusion: yes, an employment contract must be concluded with such a manager (see, for example, the resolutions of the FAS Western Siberian District dated November 9, 2010 No. A45-6721/2010 and Far Eastern District dated October 19, 2010 No. F03-6886/2010).

And in the Determination of the Supreme Court of the Russian Federation dated February 28, 2014 No. 41-KG13-37, it is noted that if the relationship between an organization and its leader, who is the only participant (founder) of this organization and the owner of its property, is formalized by an employment contract, the general provisions apply to the specified leader Labor Code. This conclusion was made based on the provisions of Art. 11, 16, 17, 19 Labor Code of the Russian Federation.

Submit reports to the Pension Fund

The Pension Fund considers that the only founder who manages the company himself without salary is considered an insured person. Therefore, in relation to it, the organization is obliged to submit reports on individual (personalized) accounting, including in the form SZV-M and SZV-STAZH.

The fund's arguments are as follows. The appointment of a person to the position of director is formalized by the decision of the sole founder. On its basis, he performs his labor functions.

This means that labor relations with the director as an employee arise not from the employment contract, but from the decision of the sole participant, but they still exist. And since the director is in an employment relationship, it means he belongs to the working insured person.

Can a director work without salary?

Important! There are several ways to prevent a director from paying wages. However, they cannot be called safe, since each option carries certain risks.

| Methods | Description |

| Payment for time worked | If the director works part-time, then his salary will be less, but insurance premiums and personal income tax will also need to be withheld from his salary. |

| Payment of dividends instead of salary | The payment of dividends every month can be regarded by regulatory authorities as a salary, which means that the company will charge insurance premiums and taxes. |

| Taking a vacation at your own expense | If the director is on vacation, then he does not have to perform his duties, including signing documents. |

| Application for waiver of salary | During the inspection, inspectors will consider that there was an employment relationship, but there was no salary. Therefore, taxes and contributions will be charged on the minimum wage. |

| Conclusion of an agreement for free services | The director may advise the organization on legal matters. |

No activity - no salary

If no one else works for a company with a single founder, it enters into rare one-time deals, and the revenue is small, then we can say that permanent operations have not yet been established. In this situation, it is not profitable for the founder to set his own salary, since his efforts do not bring results.

But the lack of constant activity can be taken advantage of only if the turnover really tends to zero. In practice, this argument will not work in a situation where the director received money on account, purchased materials, entered into supply contracts, purchased and delivered goods, and the company’s revenue for the year exceeded 1 million rubles.

Comments

- 10/19/2014 Lyudmila Nazarova

I believe that a TD with the general director of an LLC can be concluded provided that the TD on behalf of the employer is signed, for example, by his deputy on the basis of a power of attorney issued by the LLC, i.e. the general director delegates to him his rights to conclude technical documentation and contracts with suppliers. If the TD is not concluded with the general director (sole founder), then she will not be able to receive maternity benefits (b/l) and child care benefits. The organization's income is not enough to pay dividends to the CEO.

- 10/20/2014 Oleg Poputarovsky, Partner at GSL Law & Consulting, Lawyer

***The organization’s income is not enough to pay dividends to the CEO. Probably, the salary was meant, and not dividends, which the Director cannot receive by definition. Issues of salary payment are regulated by the Labor Code and Labor Code, and not by the amount of economic earnings. There is, for example, the concept of a minimum salary provided for by law. The budget may not be indifferent to this from the point of view of the revenue received and its distribution by the same Director. Even if it (the salary) is small... Since no one has canceled taxes on the salary. Therefore, you should not abuse this factor (non-accrual of salary) too much...

Add a comment

Rating

25 13 38

It is undesirable for the company to be unprofitable

The main difference between dividends and wages is that dividends can only be calculated based on the results of the year when distributing profits (Clause 1, Article 43 of the Tax Code), and the salary is set when signing an employment contract (Article 57 of the Labor Code).

In an uncertain environment, a founder cannot predict how much his start-up company will earn. Perhaps she will receive losses, and then the owner will not earn anything at all. And the salary will only aggravate the negative results of the company’s work, which will affect its financial situation, and therefore the ability to get a loan.

Bring the company's development forecasts with you to the commission. Prove that the probability of losses at the initial stage is high, and profitability is expected only in the second or third years of work. Such forecasts will help strengthen the founder's position.

Don't replace your salary with dividends

Insisting on the right not to pay himself a salary, the director must be sure that he has completed all the formalities when paying dividends. Thus, in one of the disputes, the sole founder paid himself dividends monthly, although the LLC has the right to distribute profits no more than once a quarter (Clause 1, Article 28 of the Federal Law of 02/08/1998 No. 14-FZ).

Taking into account the fact that at the end of the year the company's profit was less than the amount paid to the founder, it was recognized as wages and additional insurance premiums were added. The court supported the claims of the tax authorities (resolution of the Volga District Administrative District dated May 30, 2016 No. A55-8232/2015).

The company's charter must state the founder's right to distribute profits once every quarter or half a year. Without this condition, he will receive dividends only at the end of the year. At the time of distribution of profits, the company's participants must fully pay the authorized capital.

The company must not have any signs of bankruptcy, and the value of its net assets must not be less than its authorized capital. In your accounting software, payments should be called “dividends,” not “salaries.”

Where does the director get the money?

The situation is especially risky when the sole founder does not pay himself not only a salary, but also dividends. Then the tax authorities will accuse him of cashing out, withdrawing shadow wages and evading personal income tax.

It is important to explain how the director lives if he does not need a salary. For example, he may receive a salary from another company, dividends from another company. Perhaps he sold the property and lives on the proceeds. He had bank deposits, which he began to spend. All these amounts must be confirmed by documents.

Why not paying a director's salary is risky

So, the director insisted, and the accountant agreed not to accrue or pay his salary.

In this case, when checking, the Federal Tax Service will definitely ask you for an explanation of why the director of the company does not receive a salary. It’s one thing if a director works in two organizations at the same time: in one he receives a salary, and in the other he does not. In this case, the probability of “unsubscribing” from the inspectors is quite high. How to justify the lack of salary for a director who has only one place of work?

In this case, nothing prevents controllers from charging additional insurance premiums to the company using the calculation method - based on the level of the minimum wage in the region. And, of course, personal income tax, penalties and fines for non-payment.