In 2020, separate divisions of many enterprises can experience the beauty of communicating with tax inspectors. The fact is that from 2020, all separate divisions (including branches and representative offices) that issue payments and rewards to individuals will be required to independently calculate and pay insurance premiums, as well as submit calculations for them to the Federal Tax Service. In addition, additional responsibilities have appeared for head offices that have separate divisions (including branches and representative offices). Let's figure out what exactly has changed and how it will affect organizations.

What is a separate division: introductory information

Any Russian organization has the right to open one or more separate divisions. They may be branches and representative offices of a legal entity. At the same time, separate divisions (that is, branches and representative offices) are not legal entities and are deprived of the legal capacity inherent in legal entities. This follows from Article 55 of the Civil Code of the Russian Federation.

It is also necessary to say about the Tax Code of the Russian Federation. It follows from Article 11 of the Tax Code of the Russian Federation that a separate division must be located at an address different from the address of the main organization and have stationary jobs, that is, jobs created for a period of more than one month.

Thus, we can say that a separate division of a legal entity is a branch, representative office or stationary workplace (Article 55 of the Civil Code of the Russian Federation and Article 11 of the Tax Code of the Russian Federation).

Below in the table we will explain some of the features of the types of separate divisions.

| Branch | Representation | Stationary workplace |

| The branch carries out all or part of the functions of the main organization. Performs representative functions. | The representative office represents and protects the interests of the main organization. | The employee carries out his labor activity at the workplace. |

| The branch can conduct commercial activities. | The representative office cannot conduct commercial activities. | Cannot conduct commercial activities. Only labor relations. |

| Information about the branch must be contained in the Unified State Register of Legal Entities. | Information about the representative office must be contained in the Unified State Register of Legal Entities | Information is not included in the Unified State Register of Legal Entities. |

Insurance deductions in the Russian Federation

Currently, in the Russian Federation, the insurance system operates as follows: payments are deducted from the payer’s salary on a monthly basis. The funds, in turn, transfer funds in the amount established by law when the payer experiences an insured event:

- retirement (PFR starts paying pension benefits);

- illness, pregnancy (FSS transfers funds according to sick leave).

The insurance system distinguishes the following types of contributions: pension (insurance and savings), medical, compulsory social insurance in case of temporary disability and in connection with maternity, industrial accidents and occupational diseases.

The insurance system distinguishes the following types of contributions: pension (insurance and savings), medical, compulsory social insurance in case of temporary disability and in connection with maternity, industrial accidents and occupational diseases.

The deadlines for paying insurance premiums in 2020 remain the same, they are detailed in the table below. The main payers are budgetary organizations that calculate and pay salaries to employees.

Until the end of 2020, such payments were sent directly to the Pension Fund and Social Insurance Fund and were regulated by 212-FZ. Since January of this year, the system has changed. Now the money is transferred to the regional Federal Tax Service within the established deadlines for payment of insurance premiums (with the exception of “injuries”, which remained under the control of the FSS), and the regulating legal act is now the Tax Code of the Russian Federation, in particular, Chapter 34.

Registration of separate divisions with the Federal Tax Service

If a separate division is a branch or representative office and information about it is indicated in the charter and in the Unified State Register of Legal Entities, then at the location of this unit the organization will be registered with the Federal Tax Service automatically based on information from the Unified State Register of Legal Entities (clause 3 of Article 83 of the Tax Code of the Russian Federation).

If a separate division is not a branch or a representative office, but a workplace, then within a month from the date of its creation the organization itself must register with the Federal Tax Service at the location of such a division (clause 3, clause 2, article 23, clause 4 Article 83 of the Tax Code of the Russian Federation). To do this, you need to submit to the Federal Tax Service at the location of the organization itself a message about the creation of a separate division in form No. S-09-3-1. These rules have been in effect in the past and will continue to apply in 2020. However, from 2020, organizations with separate divisions will have new responsibilities.

Key points on insurance premiums for separate divisions

The rules for calculating insurance premiums for compulsory health insurance, compulsory medical insurance and compulsory social insurance are regulated by Ch. 34 of the Tax Code of the Russian Federation, and contributions “for injuries” - by Federal Law of July 24, 1998 No. 125-FZ. There are no differences in the calculation of insurance premiums for the parent organization and a separate division, that is, in the second case they are determined according to the same scheme as in the first case.

If separate divisions independently calculate payments and other remunerations in favor of individuals, then they must calculate and submit reports on insurance premiums at their immediate location. In this case, it makes no difference what kind of insurance premiums are meant - in the Federal Tax Service or the Social Insurance Fund. In any case, reporting is submitted at the actual location of the separate unit. At the same time, the territorial branch of the Social Insurance Fund determines the division’s occupational risk class depending on the type of economic activity in order to establish the amount of the insurance rate for contributions “for injuries.”

The obligation to calculate insurance premiums and report for a separate division arises from the parent organization in the event that the “separate division” does not pay payments to individuals and is not registered with the Social Insurance Fund.

New responsibilities of parent organizations from 2017

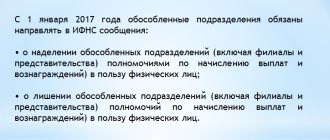

Since 2020, parent organizations are required to notify the Federal Tax Service Inspectorate at their location that their separate divisions (including branches and representative offices) in 2020 (subclause 7, clause 3.4, article 23 of the Tax Code of the Russian Federation):

- received the right to accrue payments and rewards to individuals;

- lost the authority to accrue payments and rewards to individuals.

The Tax Code of the Russian Federation allows one month for notification to the tax authority to the parent organizations from the date of vesting (or deprivation) of the “separateness” with the specified powers or their loss.

Please note: the new obligation to send these messages has been introduced only in relation to those separate divisions to which the corresponding powers have been transferred or taken away from them after January 1, 2020. There is no need to transmit messages to the Federal Tax Service regarding separate divisions (branches, representative offices) that accrued payments and rewards before 2017. This is provided for in paragraph 2 of Article 5 of the Federal Law of July 3, 2016 No. 243-FZ.

Where to pay fees and submit reports on individual units: special cases

Both of the above documents (Tax Code of the Russian Federation and Law 125-FZ) introduce a special rule for structural units located outside the borders of the Russian Federation. The legal entity submits reports on them and pays fees at the location of the parent structure (clause 14 of article 431 of the Tax Code of the Russian Federation, clause 14 of article 22.1 of law 125-FZ).

The largest taxpayers, guided by paragraph 3 of Art. 80 of the Tax Code of the Russian Federation, which requires all their tax reporting to be submitted at the place of registration as the largest, it should be borne in mind that this requirement is not related to reports on insurance premiums. Therefore, this kind of reporting will have to be submitted by the largest taxpayers in the same way as all other policyholders: in the locations of the legal entity itself and its separate structures (letters of the Ministry of Finance of Russia dated 02/28/2017 No. 03-15-06/11252, dated 02/03/2017 No. 03- 15-06/5796, dated 01/30/2017 No. 03-15-06/4424).

Since 2020, it has become possible to pay contributions independently. Read more about this in the article “Insurance premiums can also be paid for third parties.”

How parent organizations can fulfill their new responsibility

After January 1, 2020, the parent organization has the right to transmit to the Federal Tax Service a message about vesting a separate division (including a branch or representative office) with the authority to calculate payments and remunerations in favor of individuals (or about the deprivation of such authorities) (clause 7 of Article 23 of the Tax Code of the Russian Federation):

- by mail;

- in electronic form via telecommunication channels;

- through the taxpayer’s personal account.

The Federal Tax Service is obliged to approve the procedure for transmitting such messages to the Federal Tax Service in electronic form and the forms of “paper” messages. This is provided for in paragraphs 3 and 4 of paragraph 7 of Article 23 of the Tax Code of the Russian Federation.

A separate division is vested with the authority to accrue payments and rewards to individuals from the date of issuance of the relevant order or instruction of the parent organization.

The form of notification of a Russian organization - payer of insurance premiums about vesting a separate division (including a branch, representative office) with powers (about deprivation of powers) to accrue payments and rewards in favor of individuals was approved by Order of the Federal Tax Service of January 10, 2020 No. ММВ-7-14/4 .

Payment of insurance premiums by separate divisions

Published 10/07/2019 22:35 Author: Administrator “To pay or not to pay – that is the question?” – it is often this dilemma that an accountant faces when getting acquainted with clause 11 of Art. 431 of the Tax Code of the Russian Federation, according to which the payment of insurance premiums and the submission of calculations for insurance premiums are made by organizations at their location and at the location of separate divisions that make payments and other remuneration in favor of individuals. Let's look into this issue together; not everything is as simple as it seems at first glance.

Until 01/01/2017, in accordance with Part 11 of Art. 15 of Law No. 212-FZ, separate divisions independently paid insurance premiums and submitted the necessary reports only if they:

1) made accruals in favor of individuals,

2) were allocated to a separate balance sheet,

3) had bank accounts.

These three conditions had to be fulfilled simultaneously. If the separate division did not have at least one of the above characteristics, then the responsibility for paying insurance premiums and submitting reports fell on the shoulders of the parent organization. This is evidenced by letters from the Ministry of Health and Social Development of Russia dated 03/09/2010 No. 492-19, FSS of Russia dated 05/05/2010 No. 02-03-09/08-894p.

Since January 1, 2017, the situation has changed dramatically. Now the procedure for calculating and paying insurance premiums by organizations is regulated by Art. 431 of the Tax Code of the Russian Federation, according to which it is necessary to transfer insurance premiums and submit reports to the tax authority at the location of the separate division while simultaneously meeting the following conditions (clauses 11, 14 of Article 431 of the Tax Code of the Russian Federation):

1) the unit is located in the Russian Federation;

2) the division calculates and pays remuneration to individuals.

The allocation of a separate division to a separate balance sheet and the presence of its own current account in the bank, as was previously the case, now does not play any role.

To avoid penalties, it is important to notify the tax authorities in a timely manner about granting a separate division the authority to make payments in favor of individuals, or about depriving it of such authority (clause 7, clause 3.4, article 23 of the Tax Code of the Russian Federation). To do this, the parent organization must submit a message to the inspectorate at its location (Form according to KND 1112536), the sample and procedure for filling it out are approved by Order of the Federal Tax Service of Russia dated January 10, 2017 No. ММВ-7-14 / [email protected] This document is submitted within a month from the date of vesting (or deprivation) of the unit with the corresponding powers, either on paper or in electronic form via telecommunication channels.

This message is not in the 1C: Accounting program (rev. 3.0), but it can be downloaded for free from the website of the Federal Tax Service of Russia, filled out and uploaded into the program for further sending to the Federal Tax Service.

Let's consider the procedure for filling out such a message. It's quite simple. On the first page you must enter the TIN, KPP of the organization, code of the head tax office, name of the organization, OGRN, number of separate divisions. In the “Reports” field, you must select one of two values:

1 – on granting powers to accrue payments and rewards in favor of individuals;

2 – on deprivation of such powers.

On the second page of the message, you must indicate information about the separate division (branch or representative office): the separate checkpoint assigned to it, the date of vesting of powers, the full name of the separate division and registration address.

I would also like to emphasize that if in your organization several separate divisions at once are vested with the authority to make payments in favor of employees (or are deprived of them), then you can generate one message by filling out several pages in it.

Author of the article: Irina Plotnikova

Did you like the article? Subscribe to the newsletter for new materials

Our training courses and webinars

Reviews from our clients

Add a comment

JComments