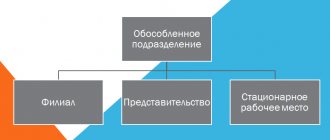

What is a separate division?

An organization that has stationary workplaces formed for a period of more than thirty days, and is located on a territory separate from the head office, has the status of a separate division.

The division belongs to the category of separate ones, regardless of whether its creation is recorded or not in the statutory documents and administrative documentation of the enterprise, and depending on the level of authority vested (2nd paragraph 11 of Article TC).

According to the Law of August 8, 1998 “On Limited Liability Companies”, the creation of an OP is possible by making a decision by counting the votes “for” and “against”. Moreover, for the verdict to come into force, the total number of those voting “against” is no more than 33%. Voting on closing an organization is carried out in the same way.

https://youtu.be/QXBj7qmzpA8

The procedure for closing a separate division

To close a separate division, you need to take the following steps:

- the manager makes a decision and issues an order to close a separate division;

- within three days from the date of issue of the order, you must submit to the Federal Tax Service a message about the closure of a separate division (subclause 3.1, clause 2, article 23 of the Tax Code of the Russian Federation);

- dismiss employees of a separate division;

Read on topic:

Dismissal of employees upon closure of a separate division

- receive a notification from the inspectorate about the closure of a separate unit;

- submit the necessary reporting for a closed section;

- carry out a reconciliation with the tax office, pay additional taxes.

What is needed to close a branch or representative office?

- A lawyer working in an organization draws up a sample document on the verdict on the liquidation of an OP.

- A decree is issued.

- The Federal Tax Service is notified of the completion of the work of a branch or representative office using form S-09-3-2, where page 1 contains information about the organization and owner, and page 2 contains information about the branch.

- Employees of the organization must be notified sixty days before the termination of the employment contract.

- Fill out form P13001. When the work of a branch or representative office is terminated, the details of the branch are written down on sheet 1 of the form, and Appendix “K” is filled out, which consists of 2 sheets. In the first sheet, for the liquidation of an activity, it is written down what type the separate division belongs to, for what reason the changes are being made and its name.

- Changes are made to the Charter and 2 copies are drawn up.

- A receipt for payment of the state duty is attached to the package of documents.

Procedure for liquidation of a separate division

Based on Art. 55 of the Civil Code of the Russian Federation, branches or representative offices located outside the territory of the main organization are considered separate divisions. They do not have their own legal entity status; in contrast to the liquidation of an entire organization, the closure of such a unit does not require the creation of liquidation commissions, although they can be established at the request of the organization’s management.

This reduces the procedure to just the following steps:

- Advance notification to employees.

- Making a decision on the liquidation of a separate division by the sole or collegial executive body of the organization and its written execution.

- Making changes to the constituent documents and paying state fees (800 rubles). If there is no information about the division in the constituent documents (charter), then no changes are required (in this case, no fee is charged).

- Deregistration of a subdivision with the territorial tax authority.

List of measures to complete the functioning of the OP.

- Carry out a vote on the issue of liquidation of the OP.

- Create an order to complete the work of the OP.

- Employees of the organization must be notified against signature sixty days before the termination of the employment contract.

- Fill out form P 14001 to notify about changed data.

- When the work of the OP is terminated, the details of the unit are indicated on the first page of the form, and Appendix “O” is filled out. The first sheet for liquidation of an activity specifies what type of separate division it is, the grounds for making the change and its name.

- The Federal Tax Service is notified of the termination of the work of the OP in the prescribed form S-09-3-2.

Both cases considered involve submitting all documentation to the Federal Tax Service. In accordance with Article 23, clause 2, subclause 3.1 of the Tax Code of the Russian Federation, completed forms R 13001 and R 14001 are provided 3 days after the decision is made to terminate the work of the branch or OP. The documentation is sent to the Federal Tax Service in paper or electronic form with digital signature.

If the organization’s statutory documents do not contain information about the OP, then Form 14001 is not filled out and the state duty is not paid.

Liquidation of a non-resident separate division

How to correctly carry out the procedure for liquidating a separate division that is located in another city, but does not have a separate balance sheet and current account?

According to paragraph 2 of Art.

11 of the Tax Code of the Russian Federation, a separate division of an organization is any division territorially isolated from it, at the location of which stationary workplaces are equipped. Recognition of a separate division of an organization as such is carried out regardless of whether its creation is reflected or not reflected in the constituent or other organizational and administrative documents of the organization, and on the powers vested in the specified division. In this case, a workplace is considered stationary if it is created for a period of more than one month. A workplace is a place where an employee must be or where he needs to arrive in connection with his work and which is directly or indirectly under the control of the employer (Article 209 of the Labor Code of the Russian Federation).

According to paragraphs. 3.1 clause 2 art. 23 of the Tax Code of the Russian Federation, an organization is obliged to report to the tax authority, respectively, at its location, about all separate divisions on the territory of the Russian Federation through which the activities of this organization are terminated (which are closed by this organization):

- within three days from the date the Russian organization makes a decision to terminate activities through a branch or representative office (closing a branch or representative office);

- within three days from the date of termination of the activities of the Russian organization through another separate division (closing of another separate division).

Clause 5 of Art. 84 of the Tax Code of the Russian Federation provides that in the event of termination of activity (closing) of a separate division (except for a branch and representative office) of a Russian organization, deregistration of the organization by the tax authority at the location of this separate division is carried out on the basis of a message received by the tax authority from the Russian organization in accordance with clause 2 Art. 23 of the Tax Code of the Russian Federation within 10 days from the date of receipt of this message (application), but not earlier than the end of the on-site tax audit of the organization, if one is carried out.

Order of the Federal Tax Service of Russia dated 06/09/2011 N ММВ-7-6/ [email protected] approved form N С-09-3-2 “Notification about separate divisions of a Russian organization on the territory of the Russian Federation, through which the activities of the organization are terminated (which are closed by the organization) " The message is submitted to the tax authority at the location of the organization (clause 2 of the information message of the Federal Tax Service of Russia dated 09/03/2010). Thus, in the case under consideration, the organization, no later than three days from the date of making a decision to close a separate division (for example, the issuance of an order (instruction) of the head, a decision of the founders or another local document) is obliged to submit a message in form N C- to the tax authority at its location. 09-3-2.

The legislation does not require the submission of any documents justifying the termination of the organization’s activities through a separate division.

In addition, in accordance with paragraph 2 of part three of Art. 28 of the Federal Law of July 24, 2009 N 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund,” organizations are required to notify in writing the body monitoring the payment of insurance premiums at their location about the closure separate divisions within one month from the date of closure of the separate division (cessation of the organization’s activities through the separate division). At the same time, the organization’s fulfillment of the obligation to report the creation or closure of a separate unit does not depend on the presence of a separate balance sheet, current account for this separate unit, as well as the accrual of payments and other remunerations in favor of individuals (letter of the Ministry of Health and Social Development of the Russian Federation dated 09.09.2010 N 2891-19).

Currently, the form of notification of the closure of a separate unit submitted to the body for control over the payment of insurance premiums at the location of the organization has not been approved, so the organization can notify the funds in any form.

Let us remind you that in accordance with Art. 3 of Law N 212-FZ, control over the correctness of calculation, completeness and timeliness of payment of insurance contributions to state extra-budgetary funds is assigned to the Pension Fund of the Russian Federation and its territorial bodies in relation to insurance contributions for compulsory pension insurance paid to the Pension Fund of the Russian Federation, and insurance contributions for compulsory medical insurance, paid to the Federal Compulsory Medical Insurance Fund, and the Social Insurance Fund of the Russian Federation and its territorial bodies in relation to insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity, paid to the Social Insurance Fund of the Russian Federation.

In accordance with Art. 6 of the Federal Law of July 24, 1998 N 125-FZ “On compulsory social insurance against accidents at work and occupational diseases”, only those separate divisions that are allocated to a separate balance sheet, have a current account and accrue payments and other payments should be registered as insurers remuneration in favor of individuals.

Consequently, if a separate division does not have a current account and is not allocated to a separate balance sheet, then the division was not obliged to register as a payer with the branch of the Social Insurance Fund of the Russian Federation at the location of the separate division and, accordingly, should not report to the branch of the Social Insurance Fund of the Russian Federation at the location of a separate unit on the closure of such a unit.

The texts of the documents mentioned in the experts’ response can be found in the GARANT legal reference system.

Dissolution of employees of a separate unit.

Compliance with the Labor Code of the Russian Federation is strictly necessary.

The legislation provides for 2 solutions:

- Upon completion of the activities of the EP in the same locality where the parent organization is located, employees are offered vacant positions in the existing organization. If there are no vacant jobs, the basis for dismissal is reduction, based on Article 81 of the Labor Code of the Russian Federation, paragraph 2. Notification of employees occurs 3 months in advance.

- If the OP is closed in the locality, there are no longer any branches of the company, then the dismissal occurs in accordance with Article 81 of the Labor Code of the Russian Federation, clause 1, part 1, due to the termination of the OP’s work. The employee must be notified sixty days in advance. In this case, the employer is not obliged to provide the employee with work in another locality.

In both cases of closing a branch, it is necessary to close all debts on wages and other payments to employees, as well as provide social benefits. guarantees

The decision to close a separate division

The order to close the OP must include:

- date of liquidation of the separate division. The deadline for submitting a notification to the tax office will begin from there;

- issues related to closure: dismissal and transfer of employees, transfer of property to the parent organization, filing reports and paying taxes.

Read on topic:

We fill out the 6-personal income tax in a closed “separate form”

Legal basis

The law gives each organization the right to organize its own structural units, which operate on the basis of internal regulations and perform a certain range of functions (Civil Code of the Russian Federation, Article 55).

Also see “What should be the order to create a separate unit in 2017.”

From the point of view of the Tax Code, a unit is territorially isolated if the workplace is organized for a period of more than 1 month. That is, permanently (Tax Code of the Russian Federation, Article 11). The constituent and internal administrative documents may not contain records of the creation of individual work positions and vesting them with appropriate powers.

The workplace as a concept is taken from the context of labor legislation. This is a place controlled by the employer where the employee must be present or must go there to perform his work - job duties. It must create conditions for the normal performance of their functions by subordinates. If there is no permanently organized workplace, then there is no “isolation”. In this case, the question of how to close a separate division does not arise in principle.

The enterprise is obliged to include in the Unified State Register of Legal Entities information about branches and representative offices, and at their location - to submit the appropriate accounting, tax and statistical reports. Failure to comply with these legal requirements will result in sanctions.

For more information about this, see “How can separate divisions pay insurance premiums and submit reports to the Federal Tax Service from 2020.”

If maintaining and servicing a remote office or a separate stationary location is ineffective and involves excessive diversion of resources, then it is advisable to carry out optimization. To the point of closing a separate division at the tax office and registering this change.

What reports must be submitted when closing a unit?

When closing a branch, you will have to conduct an inventory and, based on its results, put the property on the balance sheet of the parent organization or remove it from the balance sheet. Then the following are drawn up:

- Tax return. According to Part 3 of Art. 346.23 of the Tax Code of the Russian Federation, this is done no later than the 25th day of the month following the one in which form C-09-3-2 was submitted. The declaration is submitted at the place of registration of the separate subdivision.

- Forms 2-NDFL for each employee and other persons to whom the unit paid income for the period from the beginning of the year until liquidation (Part 2 of Article 230 of the Tax Code of the Russian Federation). Submission is made at the place of registration of the unit.

- Reporting on insurance contributions to extra-budgetary funds. In this case, the organization has 15 days to pay the remaining unpaid amounts for insurance premiums.

If the department has its own current account, it must also be closed.

Deadlines and features for submitting form C-09-3-2

Message C-09-3-2 is submitted no later than three days after the decision to close the branch was made . A copy of this decision, as well as an identification document of the manager (power of attorney for the representative) is attached to the document. We remind you that late submission of the form will result in a fine for each day of delay.

If it is not the OP, but a branch that is being liquidated, you should, among other things, attach to the message a copy of the decision to amend the charter document, form P13002 or a notice of changes to the Charter and form P14001.

After the documents have been submitted, it will take 3-5 days to receive notification of the closure of a separate unit.

Who, when and how to notify about the closure of a separate division

The management of an organization may close a separate division for various reasons, for example, the cost of renting a warehouse (office) has risen or the products are not in demand. And as soon as the decision is made, the accountant has a lot of worries: he must notify government agencies about the liquidation of the OP, pay off the employees of the unit, submit final tax returns and payments for insurance premiums, complete all settlements with the inspectorate and funds at the location of the OP.

We decided to prepare several articles on this topic, and in the first we will tell you how to inform the regulatory authorities about the liquidation of an OP.