Why was the new form introduced?

From 01/01/2020, a company with several separate divisions can choose one Federal Tax Service Inspectorate, which will control the calculation and payment of tax on them. You can report and transfer payments:

- at the address of the parent organization, or

- at the place of registration of one of the “isolations”.

In this case, it is necessary that all divisions of the company specified in the notice of selection of the tax authority for personal income tax are located in the territory of one municipality.

The type of structural unit is not important.

We optimize the payment of income tax in the presence of an OP

If you have several OPs open in one subject of the Russian Federation and through each of them you pay income tax to the regional budget, starting next year you can optimize this process.

| Video (click to play). |

In order to pay income tax from 2020 through the responsible division in a specific region, the tax authorities must be notified about this no later than December 30, 2016. Moreover, it is better to use the notification forms recommended by the Federal Tax Service.

Income tax payable to the federal budget must always be paid at the location of the organization's head office (SOE)—for the organization as a whole. Also, at the location of the head unit, it is necessary to pay income tax to the regional budget in the part attributable to this state enterprise, paragraphs. 1, 2 tbsp. 288 Tax Code of the Russian Federation; Letter of the Ministry of Finance dated 02/01/2016 No. 03-07-11/4411.

When an organization has several separate divisions in one constituent entity of the Russian Federation, it can simplify income tax reporting and payment. You can select a responsible separate division through which tax will be paid to the regional budget for all OPs located in this subject.

If your OPs are located in different subjects of the Russian Federation, then in each of them you need to select its own responsible unit (if there are several of them in the subject).

SITUATION 1. In one region there are only separate units. The organization itself (head office) is in another region. In this case, you can arbitrarily select one or another OP as responsible.

SITUATION 2. Both regular OPs and the head unit are located in the region.

In this case, those responsible need to choose the head unit. If in other regions there are no OPs at all, then the head unit will be able to submit one declaration, reporting for all OPs. And you can also pay the regional part of the income tax in one amount. Letters of the Ministry of Finance dated November 25, 2011 No. 03-03-06/1/781, dated July 9, 2012 No. 03-03-06/1/333.

However, the parent unit does not automatically become responsible. He must be appointed as such, and the tax authorities must be notified of this in a timely manner.

Please note: in such a situation, you cannot select a separate division as responsible, which will report and pay regional income tax for the parent division. The Tax Code does not provide for this, paragraph 2 of Art. 288 Tax Code of the Russian Federation; Letter of the Ministry of Finance dated March 12, 2009 No. 03-03-06/1/130.

An organization can also inform in any form about its decision to pay tax centrally.

To pay tax through a responsible OP you need to:

- reflect the centralized method of paying income tax in the accounting policy for tax purposes, Art. 313 Tax Code of the Russian Federation; Letter from the Federal Tax Service for Moscow dated August 17, 2012 No. 16-15/. Please note: the taxpayer organization as a whole is switching to the new tax payment procedure. And according to the inspectors, this tax payment procedure should apply to all of its separate divisions. This means, in particular, that it is impossible in one subject of the Russian Federation to pay regional income tax separately for each OP, and in another subject - centrally through the responsible OP Letter of the Federal Tax Service dated March 25, 2009 No. 3-2-10/8; Ministry of Finance dated July 10, 2008 No. 03-03-06/2/74;

- select a responsible separate unit. Through it, the organization will submit profitable declarations and pay tax to the regional budget (including advance payments on it) par. 2 p. 2 art. 288 Tax Code of the Russian Federation;

- no later than December 30, 2020, notify the tax authorities with which the divisions are registered, including the head office, of your decision to switch to a centralized method of payment from 2020, paragraph. 2 p. 2 art. 288 Tax Code of the Russian Federation.

The Tax Code does not provide for any strict forms for notifying tax authorities about your chosen responsible OP. However, the tax service approved the recommended forms Letter of the Federal Tax Service dated December 30, 2008 No. ШС-6-3/986:

- Notice No. 1 (about payment of income tax through the OP);

- Notice No. 2 (on refusal to pay income tax through the OP).

Therefore, it is easier to use the forms recommended by the Federal Tax Service. Our diagram will help you figure out which inspection and what to submit.

How the new order is regulated

Article 2 of Federal Law No. 325-FZ of September 29, 2019 introduced amendments to the Tax Code of the Russian Federation, which will come into force on January 1, 2020. In particular, a new wording has appeared in paragraph 7 of Art. 226 of the Tax Code of the Russian Federation and paragraph 2 of Art. 230 of the Tax Code of the Russian Federation, allowing the choice of a single Federal Tax Service. That is, organizations were allowed to combine the payment of personal income tax across several structural divisions at once, thereby simplifying the procedure for tax accounting.

Previously, companies reported for the parent organization and each division, submitting reports to the Federal Tax Service for all places of registration. Please note that the company is not obliged to use the new rules. Amendments to the Tax Code of the Russian Federation allow a company to independently decide whether it will use a simplified procedure in its work or not.

Who is eligible for the benefit?

The list of citizens entitled to exemption from property tax on one of the real estate objects is defined in the legislation - in Article 407 of the Tax Code of the Russian Federation. This includes:

- military personnel;

- war veterans and members of their families;

- persons with disabilities;

- pensioners;

- "Chernobyl";

- as well as those people whose area of each real estate property does not exceed 50 sq.m. etc.

A complete list of beneficiaries can be found in the above article of the Tax Code of Russia.

This is important to know: Pros and cons of direct management of an apartment building in 2020

Form of notification of choice of tax authority

To declare a perfect choice, the company submits a special form - KND 1150097 “Notification of the choice of a tax authority” approved by Order of the Federal Tax Service of Russia dated December 6, 2019 No. ММВ-7-11 / [email protected]

In general, the rules for filling out the form are the same as for most reports and declarations:

- filling can be done by typewriting or handwriting;

- for the handwritten version, black, purple or blue ink is used;

- text fields are filled in capital block letters;

- when typing a document on a computer, the Courier New font with a height of 16-18 is selected;

- errors cannot be corrected using correction fluid or other similar means;

- a dash is placed in empty cells;

- All pages are numbered in order.

The form is printed on only one side of the sheet. Fastening sheets, leading to their damage, is not allowed.

For example, below we post a sample of filling out a notice of choice of a tax authority.

The notice consists of two sheets - the title page and sheet “A”.

The title indicates the TIN, KPP, name of the company, code of the Federal Tax Service to which the notification is submitted, as well as the reason for its submission.

Sheet “A” contains a list of checkpoints of divisions that will report to the selected tax authority.

The notification can be submitted on paper (appearing in person at the Federal Tax Service or by mail), as well as electronically.

When should the form be submitted?

A notification about the selection of a tax authority for a separate division is submitted to the tax authorities no later than January 1 of the tax period. Since this day falls on the New Year holiday, the deadline is moved to the first working day after the New Year holidays: in 2020 it is January 9 (Thursday).

At the same time, on December 27, 2019, the Federal Tax Service posted on its official website ]]>clarification]]> that firms that have chosen a new personal income tax accounting procedure in 2020 have the right to submit documents before January 31, 2020. But the amounts must be transferred according to the location of the planned control body already from 01/01/2020. Or later the taxpayer has the right to clarify his payments by submitting an appropriate application.

Where is the document submitted?

In paragraph 2 of Art. 230 of the Tax Code of the Russian Federation states that the tax agent must notify each of the inspectorates with which the company’s divisions are registered. That is, they are notified:

- Inspectorate of the Federal Tax Service “separate offices”, in which the payment of personal income tax and the submission of tax reports are stopped,

- inspection to which funds and reporting will be sent.

At the same time, the Federal Tax Service of the Russian Federation in its letter dated December 16, 2019 No. BS-4-11/ [email protected] reports that only one notification about the selected division is submitted - to the selected Federal Tax Service Inspectorate of the separate division, where payments will be transferred and reports will be submitted. Further notification of the departments indicated on sheet “A” occurs automatically.

During the tax period, you cannot choose another inspection instead of the one stated in the notification. Except in cases where the number of company divisions in the municipality becomes larger or smaller, or the procedure for providing information or paying taxes changes.

Thus, from 2020, the company itself chooses whether it will report and transfer personal income tax in the same manner, or declare a transition to a single Federal Tax Service for divisions located within the boundaries of one municipality.

Personal income tax when opening a separate division

In accordance with paragraph 1 of Art. 288 of the Tax Code of the Russian Federation, taxpayers - Russian organizations that have separate divisions, calculate and pay advance payments to the federal budget at their location without distributing these amounts among separate divisions. And the payment of advance payments to be credited to the revenue side of the budgets of the constituent entities of the Russian Federation is made by taxpayers - Russian organizations at the location of the organization, as well as at the location of each of its separate divisions.

This is the general rule for paying income tax on separate divisions. But how exactly to apply it when opening and liquidating divisions: when to transfer the first payment and the last one, taking into account the distribution, and how to fill out declarations correctly? Let's figure it out.

https://www.youtube.com/watch?v=ytcopyrightru

The rules for determining the amount of monthly advance payments are fixed in clause 2 of Art. 286 of the Tax Code of the Russian Federation and are “tied” to the amount of the quarterly advance payment for the previous period, which in turn is determined on the basis of profit calculated on an accrual basis from the beginning of the year. It turns out that monthly advance payments of a newly created separate division can be calculated only after the end of the reporting period in which this division was created.

Therefore, the obligation to pay monthly advance payments at the location of the new unit arises for the organization only from the month following the reporting period in which the OP appeared. For example, if a division was created in July, August or September (i.e. in the 3rd quarter), then you will need to start transferring advance payments to its location from the 1st month of the 4th quarter, i.e. from October. This must be done before October 28 (clause 1 of Article 287 of the Tax Code of the Russian Federation).

At the same time, you need to remember that the calculation of advance payments is recorded in Appendix No. 5 to sheet 02 of the income tax return (approved by order of the Federal Tax Service of Russia dated October 19, 2016 No. ММВ-7-3 / [email protected] ). This means the following. In order to start paying advance payments from the first month of the quarter following the quarter in which the OP was created, you must fill out the corresponding annex in the declaration based on the results of the quarter in which the unit was created.

If we continue our example, then, when reporting for 9 months of 2017, the organization will have to include in the income tax return Appendix No. 5 to sheet 02, in which line 030 will reflect the tax base for the organization as a whole, and lines 040 and 050 will determine the share of the tax base attributable to a separate division (parent organization), and on lines 120 and 121 will indicate the amount of monthly advance payments to be transferred in the fourth and first quarters.

The situation is different with the payment of advance payments from taxpayers for whom the reporting period is a month, two months, three months, and so on until the end of the calendar year (paragraph 2, paragraph 2, article 285 of the Tax Code of the Russian Federation). Since they calculate the advance payment based on the actual profit received, then the tax with distribution must be paid from the month in which the unit was created (letter from the Ministry of Finance of Russia dated 22.02.

06 No. 03-03-04/1/137). If a division of such an organization was created in September, then the advance payment for September will need to be distributed between the budgets of the constituent entities of the Russian Federation. Accordingly, it is necessary to calculate advance payments in the situation under consideration in Appendix No. 5 to sheet 02 of the income tax return submitted as part of the return for the same period (January–September in our example).

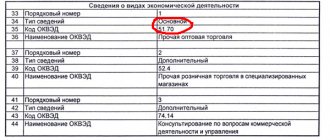

In conclusion, let us remind you what date must be indicated for the purpose indicated above. The date of creation of a separate division is taken from the corresponding field in the section “Information about a separate division”, which is in the form of a message about the creation of a separate division (form No. S-09-3-1, approved by order of the Federal Tax Service of Russia dated 06/09/11 No. ММВ-7- 6/ [email protected] ).

The procedure for making an advance payment when closing a unit is established directly in Article 288 of the Tax Code of the Russian Federation. Paragraph 8 of clause 2 of this article states: tax payment is carried out in the generally established manner, starting from the reporting (tax) period following the reporting (tax) period in which the separate division was liquidated.

As we already mentioned, the essence of monthly advance payments is that they are calculated on the basis of the previous quarter and are counted towards the advance payment for the current quarter. If the division was closed during the quarter, then it will no longer be possible to calculate the amount of the advance payment of income tax payable to the budget of the region where the liquidated division was located based on the results of the reporting period in which it was closed. After all, such a division worked for an incomplete reporting period, and it is impossible to determine the share of profit for this quarter attributable to it.

https://www.youtube.com/watch?v=ytpressru

Therefore, the payment of monthly advance payments at the location of the unit must be stopped immediately after its closure. Moreover, monthly payments paid for the quarter in which the OP was liquidated will be considered overpaid (see letters from the Ministry of Finance of Russia dated 08.10.06 No. 03-03-04/1/624 and dated 02.24.

The issue of submitting declarations at the location of closed units is resolved in a similar way. This obligation terminates in the reporting period in which the tax authority notified the taxpayer of the deregistration of the organization at the location of the liquidated division (letter of the Ministry of Finance of Russia dated 03.05.

07 No. 03-03-06/2/43). This means this. If an organization receives a notice of deregistration of a separate division (form No. 1-5-Accounting, approved by order of the Federal Tax Service of Russia dated 08/11/11 No. YAK-7-6 / [email protected] ) before the obligation to submit a declaration for that reporting ( tax) period in which the decision to liquidate was made, then the declaration for this period is no longer submitted to the tax authority at the location of the liquidated OP (see also letter of the Federal Tax Service for Moscow dated April 13, 2010 No. 16-15/038587).

According to the rules of paragraph 7 of Art. 226 of the Tax Code of the Russian Federation, Russian companies with separate divisions must transfer the personal income tax withheld from employees of such divisions to the location of the OP. Similar rules are established in paragraph 2 of Art. 230 of the Tax Code of the Russian Federation regarding personal income tax reporting: 2-NDFL certificates and 6-NDFL calculations. How to correctly follow these rules when creating a unit during the year?

To answer this question, you need to refer to the provisions of Art. 55 of the Tax Code of the Russian Federation, which states how to determine the duration of the tax period if a company is created during the year. Tax agents for personal income tax purposes must apply the following rule: if an organization was created during a calendar year, the first tax period for it is the period from the date of creation of the organization until the end of this calendar year (clause 3.5 of Article 55 of the Tax Code of the Russian Federation).

Let's apply this rule to a separate division (by the way, the tax authorities themselves do this - see letters from the Federal Tax Service of Russia dated 03/02/16 No. BS-4-11/ [email protected] and dated 03/28/11 No. KE-4-3/4817) . We will get the following output. The organization must draw up a separate 6-NDFL and submit it to the inspectorate at the location of the new OP, starting from the submission period in which the unit was created.

At the same time, the calculation indicates the corresponding indicators in relation to the employees of this separate division as of the reporting date (March 31, June 30, September 30, December 31), determined on an accrual basis from the moment the EP was formed. Information will be provided in the same manner in Form No. 2-NDFL.

In other words, in our example with a division created in September, the first calculation of 6-NDFL, which must be submitted at the location of the OP, will be a calculation for 9 months. It will contain data on the income of an employee of the unit from the date of its creation to September 30 inclusive. 2-NDFL certificates submitted at the location of the OP will be filled out similarly: they will indicate information about income from the date of creation to December 31 inclusive.

We have already partially touched on the issue of personal income tax reporting for a closed OP: “How to close a separate division: we draw up documents, fire employees, notify regulatory authorities.” Let's talk about these rules in more detail. In the event of termination of activity through a separate division during the year, the tax period for this division will be considered the period from the start date of the tax period to the date of liquidation (closure) of the enterprise (by analogy with clause 3.5 of Article 55 of the Tax Code of the Russian Federation).

In this regard, the tax authorities insist: before the completion of the liquidation (closing) of an OP, the organization must submit a calculation in accordance with Form 6-NDFL and a 2-NDFL certificate in relation to the employees of this division to the tax authority at the place of registration of the liquidated (closed) OP for the last tax period. That is, for the period of time from the beginning of the year until the day of completion of the liquidation (closure) of the unit (letter of the Federal Tax Service of Russia dated 02.03.

16 No. BS-4-11 / [email protected] ).However, such an obligation of the organization is not directly established in the Tax Code. Therefore, it is impossible to attract a tax agent for failure to provide this information at the very moment of closing a division. This means that if these reporting forms for a closed division were not submitted before it was deregistered, they will need to be submitted to the inspectorate at the location of the parent organization within the generally established time frame.

Unfortunately, the legislation also bypasses the procedure for filling out reporting forms for a separate division if they are provided after the closure of the enterprise (which is why the Federal Tax Service insists on submitting them before the moment of liquidation). In our opinion, the calculation of 6-NDFL, which is submitted to the inspectorate at the location of the parent organization after the closure of the OP, should be prepared as follows.

https://www.youtube.com/watch?v=https:tv.youtube.com

In the calculation line “Submitted to the tax authority (code)” you need to indicate the code of the inspection to which the calculation is actually submitted, in the line “OKTMO Code” - the OKTMO code at the location of the liquidated separate division, and in the line “KPP” - the KPP of the liquidated division . These conclusions follow from the rules for filling out these fields, specified in paragraph 2.

2 procedures for filling out the 6-NDFL calculation (approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected] ). The calculation indicates accruals in favor of employees of the unit from January 1 to the date of closure of the unit, and in section 2 - from the beginning of the reporting period until the date of closure of the unit. In this case, it is not necessary to submit updated calculations for the parent organization.