Employment of foreigners in the Russian Federation has its own distinctive features. When applying for a job, they are required to provide mandatory permits. In addition, employers must report the hiring of a foreigner to the migration department of the Ministry of Internal Affairs of the Russian Federation. These are not all the features that accompany and distinguish the procedure for employing foreigners from hiring Russians. Kazakhstan has been a member of the EAEU since 01/01/2015, established by the “Treaty on the EAEU”, which was signed in Astana on 05/29/2014 (as amended on 03/15/2018). Thanks to this legal act, citizens of the EAEU member countries receive a number of privileges when finding employment in the Russian Federation. In this regard, we will further analyze in detail how to hire a citizen of Kazakhstan with a temporary residence permit in 2020.

An example of calculating contributions and personal income tax from a Kazakh monthly salary

A citizen of Kazakhstan, Sultanov Kurmet, came to Moscow and got a job at Perspektiva LLC, concluding an employment contract for a year. His monthly salary is 35,000 rubles. rub. From it it is necessary to calculate the amount of personal income tax (13%), compulsory pension insurance contributions (22%), compulsory medical insurance (5.1%), Social Insurance Fund (2.9%), Federal Tax Service (0.2%).

| What needs to be calculated | Costing | Result (RUB) |

| Personal income tax | 35,000 rub. x 13% | 4550 |

| OPS | 35,000 rub. x 22% | 7700 |

| Compulsory medical insurance | 35,000 rub. x 5.1% | 1785 |

| FSS | 35,000 rub. x 2.9% | 1015 |

| FSNS (“for injuries”) | 35,000 rub. x 0.2% | 70 |

Personal income tax of 4,550 rubles will be withheld from a Kazakh’s monthly salary. rub. In addition, the employer will have to pay contributions in the amount of RUR 10,570. rub. (7700 + 1785 + 1015 + 70). As a result, a Kazakh will receive a monthly salary of 35,000 rubles. – 4550 rub. = 30,450 rub.

https://youtu.be/c2zkXXx4ccE

Legalization of the stay of a Kazakh without a temporary residence permit on the territory of the Russian Federation

Employment of a Kazakh in the Russian Federation is impossible without registration (temporary registration). A special period of 30 days has been allocated for this.

“The registration of a Kazakh at the place of residence is carried out by the receiving party, which provides him with housing. A Kazakh who has arrived in the Russian Federation does not need to apply anywhere (the only exception is registration in an apartment/house owned by the Kazakh himself).”

According to the website of the Ministry of Foreign Affairs of Kazakhstan

The process of registering a Kazakh by his employer (this is relevant for cases when a foreigner was invited to work in the Russian Federation) is carried out according to the standard procedure that applies in Russia to all foreigners:

| No. | Procedure for registering a Kazakh | Additional Information |

| 1 | When a Kazakh arrives at the place of work, he presents to the employer a migration card filled out upon entry, along with his passport. | Migration cards and passports are not confiscated from Kazakhs |

| 2 | The tenant fills out the arrival notification form | Notification of arrival of a foreigner (form) |

| 3 | The employer submits the notification, a photocopy of the Kazakh passport and migration card to the authorized territorial department of the Ministry of Internal Affairs of the Russian Federation | There is no registration fee |

| 4 | When documents are received, the necessary marks are placed on the notification | The tear-off part of the notice, after filling out, is sent back to the employer. |

| 5 | The employer gives the tear-off part to the Kazakh | The presence of a detachable part with a Kazakh mark indicates that he is registered. |

You cannot postpone registration, as this will already be a violation, for which significant penalties are provided.

Duration of an employment contract concluded with a citizen of Kazakhstan

With citizens of Kazakhstan, as with Russian citizens, employment contracts are concluded for an indefinite period. In some cases, it is possible to conclude an employment contract for a limited period (no more than 5 years). An exhaustive list of grounds and categories of workers is contained in Art. 59 of the Labor Code of the Russian Federation.

The period for which the employment contract is concluded determines the period of stay of a citizen of Kazakhstan and his family members on the territory of Russia, if there are no other grounds for stay (for example, a temporary residence permit).

In addition, citizens of Kazakhstan are not required to leave the territory of Russia if the employment relationship is terminated early, but not earlier than 90 days from the date of arrival in Russia, if they are re-employed within 15 days.

Peculiarities of employment of a Kazakh with a temporary residence permit in Russia

RVP is a stamp in a passport or a document that is issued to a foreigner (Kazakh) once and only for 3 years, after which it cannot be renewed. A Kazakh with a temporary residence permit acquires the status of a temporarily resident foreigner in the Russian Federation. The temporary residence permit legalizes his residence in Russia for 3 years and provides him with a number of opportunities that Russians enjoy. During this time, a Kazakh with a temporary residence permit has the right to:

- move freely within the territory of the Russian Federation, travel beyond its borders and return back;

- legally live and work, but only in the subject of the Russian Federation where he received a temporary residence permit;

- receive social security;

- apply for a compulsory medical insurance policy;

- apply for a residence permit.

Having received a temporary residence permit, a Kazakh must register at his place of residence. In addition, he must have a regular income, pay taxes, comply with the laws of the Russian Federation, not commit violations and annually confirm the temporary residence permit. He cannot move without permission to another region of the Russian Federation, nor can he travel outside the Russian Federation for more than 6 months, since his temporary residence permit may be cancelled.

If you compare the temporary residence permit with temporary registration, the difference will be obvious. A temporary residence permit allows you to stay in the Russian Federation for a long period – up to 3 years. But the usual registration of a working Kazakh upon arrival in the Russian Federation gives the right to stay in the Russian Federation only for the duration of the employment contract, i.e. for a maximum of a year, and it does not provide opportunities such as temporary residence permits.

Meanwhile, in both the first and second cases, when applying for a Kazakh job, the same scheme works. Submission of documents - agreement with the employer - issuance of an order for employment - notification of the Main Directorate for Migration Affairs of the Ministry of Internal Affairs - familiarization with it to the applicant - his return to work. The only difference that occurs is the package of documents that must be submitted. Depending on the specific situation, it may differ. Let's look at the whole process in more detail using the example of employing a Kazakh with a temporary residence permit.

Contents of the Employment Agreement with a foreigner or stateless person:

Due to legal requirements, an employment contract with a foreigner or stateless person must contain:

- date of conclusion and serial number;

- details of the parties: last name, first name, patronymic (if indicated in the identity document) of the employer - an individual, address of his permanent place of residence and information about registration at the place of residence, name, number and date of issue of the identity document;

- individual identification number (business identification number);

- name of the employer - legal entity and its location, number and date of state registration of the employer - legal entity, business identification number;

- last name, first name, patronymic (if indicated in the identification document) of the employee, address of his permanent place of residence and information about registration at the place of residence, name, number, date of issue of his identification document, individual identification number;

- name of the work (labor function) of the Employee for a certain qualification, specialty, profession or position;

- place of work;

- term of the Employment contract;

- work start date;

- the duration of the probationary period, if the Employee has a condition for a probationary period in order to verify the compliance of the Employee’s qualifications with the assigned work;

- working hours and rest hours;

- size and other conditions of remuneration;

- characteristics of working conditions, guarantees and benefits if the work is difficult and (or) performed in harmful and (or) dangerous conditions;

- rights and obligations of the Employee;

- rights and obligations of the Employer;

- procedure for amending and terminating the Employment Contract;

- insurance conditions;

- liability of the parties;

- by agreement of the parties, an employment contract with a foreigner or stateless person may include other conditions that do not contradict the law. Those. The submitted Employment Agreement, which contains provisions mandatory by law, may be supplemented with provisions determined by the specifics of the Employer’s activities or other reasons. At the same time, it is important to remember that provisions of employment contracts that worsen the conditions of workers in comparison with the labor legislation of the Republic of Kazakhstan are considered invalid and are not subject to application.

Step-by-step instructions on hiring a Kazakh with temporary residence permit

Registration of a Kazakh for work in the Russian Federation is carried out using the norms of Art. 13 Federal Law of the Russian Federation No. 115 dated July 25, 2002 (as amended on December 27, 2019), as well as taking into account the provisions of the Labor Code of the Russian Federation dated December 30, 2001 (as amended on December 16, 2019). Employment is carried out in a simplified manner:

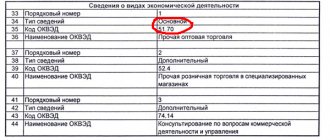

| No. | Hiring a Kazakh with temporary residence permit (step-by-step actions of the employer) | Short comments on each step |

| 1 | Interview with a potential employee, preliminary approval of the position, department where he will work | The interview procedure for foreigners is not regulated. The employer conducts it in the same way as with Russian applicants. A Kazakh has the right to apply for a job in his specialty (qualification), the presence of which he must certify with an education document he has. |

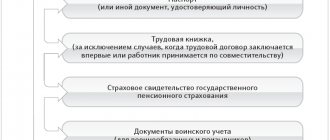

| 2 | Acceptance and consideration of documents required by the Labor Code of the Russian Federation | At a minimum:

Military registration documents, as a rule, are not presented. |

| 3 | Familiarization of the Kazakh with internal regulations, local acts, collective agreement | We are talking only about local documentation that is directly related to the work |

| 4 | Conclusion, bilateral signing of an employment contract, familiarization of the Kazakh with the job description | The employment contract must contain information about the temporary residence permit and the conditions for the provision of medical care. assistance for the period of its validity. |

| 5 | Issuing an order to hire a Kazakh, familiarizing the employee with it | Familiarization with all documents. is carried out under the personal signature of the employee with the date of familiarization. |

| 6 | Preparation of personnel documents in connection with the hiring of a new employee from Kazakhstan | An employee of the personnel department fills out: a work book, a personal card of an employed Kazakh. |

| 7 | Notification of the authorized department of the Ministry of Internal Affairs of the Russian Federation on the conclusion of an agreement with a Kazakh | The employer must do this within 3 days. Time is counted from the moment of employment (Form for notification of employment of a foreigner) |

According to Art. 97 of the Treaty, almost all Kazakh documents on education, as well as on academic degrees and titles, are recognized by the Russian side. But there are still exceptions. Citizens of Kazakhstan who plan to work as a doctor, pharmacist, teacher or lawyer are allowed to work only after the relevant educational documents have passed the recognition procedure. At the same time, Russian employers have the right:

- Require the translation of any foreign language document on education into Russian. language.

- Send a request to verify the submitted document to the educational organization that once issued it.

In all situations, when employing a Kazakh and recognizing the documents submitted by him, the norms of Russian labor legislation are applied.

Thus, having a temporary residence permit is not a prerequisite for hiring a Kazakh in the Russian Federation. He can get a job with a Russian employer without a temporary residence permit, and not only under an employment agreement, but also as a freelancer. The main thing is to follow the established order.

Nuances of registration and taxation of a citizen of Kazakhstan

- When applying for a job, a citizen of Kazakhstan must request a VHI policy (voluntary health insurance). It is needed only in order to employ a foreign citizen and conclude an employment contract with him. The obligation to require a voluntary health insurance policy is stipulated by article 327.3 of the Labor Code of the Russian Federation. (An exception will be if the employer has a paid contract for the provision of medical services with a medical organization). In the future, a working citizen of Kazakhstan will have full rights to social security, just like a Russian citizen. This is stated in paragraph 3 of Article 98 of the EAEU Treaty. This means that a citizen of Kazakhstan will be able to take out a compulsory medical insurance policy (compulsory health insurance), and the employer will fully pay his compulsory medical insurance contributions. A VHI policy will no longer be needed.

- When entering the territory of the Russian Federation, a citizen of Kazakhstan must correctly fill out the migration card and highlight Work as the purpose of the visit. This is necessary in the case when a citizen of Kazakhstan plans to stay in the Russian Federation for more than 30 days, as well as work in the Russian Federation. A citizen of Kazakhstan can stay on the territory of the Russian Federation for up to 30 days and not register for migration. A citizen of Kazakhstan needs a migration card for further registration on the territory of the Russian Federation. What does an employer need to know? A citizen of Kazakhstan can register not only with an individual (or in his own premises), but also with a legal entity-employer as a host. However, if a citizen of Kazakhstan is registered at the location of the legal entity, he is obliged to actually reside there; if this does not happen, the fine can be up to 800,000 rubles. In addition, the employer is obliged to notify FMS employees of the arrival of a citizen of Kazakhstan. The fine for violation of migration registration by the receiving party is up to 500,000 rubles for organizations and individual entrepreneurs. Thus, if the employer is not the receiving party, then it will be necessary to check whether the citizen of Kazakhstan has temporary registration.

- In accordance with paragraph 8 of Article 13 115-FZ “On the legal status of foreign citizens in the Russian Federation” dated July 25, 2002, the employer is obliged to notify the Ministry of Internal Affairs about the conclusion of an employment contract with a citizen of Kazakhstan. (Notification form) This must be done no later than 3 days from the date of conclusion of the Employment Agreement. Fines for late notification of the Ministry of Internal Affairs about the admission of a citizen of Kazakhstan can be up to 1,000,000 rubles.

- Income received by a citizen of Kazakhstan from work in the Russian Federation will be fully taxed, the same and in the same amount as for Russian citizens. As for personal income tax (personal income tax), according to Article 73 of the Treaty on the EAEU, taxation will occur at a rate of 13% from the first day of work of a citizen of Kazakhstan. However, personal income tax taxation at a rate of 13% is possible only for residents of the Russian Federation. A citizen of Kazakhstan may not be a resident. Therefore, the Ministry of Finance of the Russian Federation believes that based on the results of the tax period, it is necessary to finally determine the tax status of a citizen of Kazakhstan. And if, at the end of the tax period, it turns out that a citizen of Kazakhstan is a non-resident, then it is necessary to recalculate personal income tax at a rate of 30% (Letter of the Ministry of Finance of Russia dated May 23, 2018 N 03-04-05/34859).

All of the above conditions of this article also apply to citizens of Belarus, Armenia and Kyrgyzstan, because all of them are parties to the Treaty on the EAEU. With one exception, for citizens of Belarus it is not necessary to require a VHI policy to conclude an employment contract due to the existence of a separate agreement on equal rights between Russia and Belarus.

Do you need advice from an accountant on hiring a foreign employee, or other accounting services? Call us!

Author: Shiryaeva Natalya