Labor Code: business trips, payment

How are employee travel days paid: from average earnings or is the salary simply issued? As Art. 167 of the Labor Code of the Russian Federation, when an employee is sent on a trip, he is guaranteed the preservation of his job and average earnings (clause 9 of Regulation No. 749 of October 13, 2008), as well as reimbursement of expenses. Therefore, during his stay on a business trip, he should be paid such earnings.

Payment for business trips is usually made on payday. Accounting calculates the average amount that an employee could receive at his place of employment, and then issues it along with an advance or monthly payment.

What is average earnings

Average earnings (AE) is the average amount of wages, other payments and remunerations paid by the employer to the employee in the billing period.

The procedure for calculating SZ is indicated in Art. 139 of the Labor Code of the Russian Federation and Government Decree No. 922 of December 24, 2007. Under any labor regime, the calculation of such wages for an employee is made based on the salary actually accrued to him and the time actually worked by him for the 12 calendar months preceding the period during which the average salary is retained for the worker . Average daily earnings are determined by the formula:

The average salary for a business trip is calculated using a simple formula: the average daily salary is multiplied by the number of days worked away from the main location:

Calculation example

Let's give an example: engineer Semyon Nikolaevich Petrov receives a monthly salary of 30,000 rubles. His annual income is 360,000. The average number of working days is 191 days per year. The business trip lasted 4 working days. The average daily income of an employee in this case: 360,000 / 191 = 1884 rubles. For the trip, Semyon Nikolaevich will receive 1884 × 4 = 7536 rubles.

Since all the days were work days, he will not lose anything in income.

Also, in addition to working hours, the head of the enterprise must pay the employee’s expenses during a business trip (for example, the cost of travel tickets, renting a hotel room, meals). Payment for travel allowances is made only if the employee has supporting documents confirming the expenses.

Additional payment before salary for business trips order

- everything about the procedure for calculating additional earnings;

- about additional payments for benefits;

- on the procedure for additional payment up to average earnings;

- on the formation of an additional payment up to average earnings in 1C.

There are cases when, when an employee is transferred to a lower-paid job or in other similar cases, there is a need for additional payment up to average earnings. Legislatively, the right to additional payments is enshrined in the following documents: in articles 75 (in the event of a change in the owner of property), 102 (work in a flexible schedule), 155 (failure to comply with labor standards) of the Labor Code of the Russian Federation.

Regular basic accruals are assigned to employees when they are transferred to a job with reduced earnings. They are calculated taking into account tariff rates. New monthly, hourly or daily rates may also be specified. Basic accruals are also assigned for piecework earnings with the input of actual output, in some cases, at reduced prices.

As for the period of transfer of additional accrual, the preservation of the employee’s average earnings is valid for the entire period of work. Additional charges are designated as “additional payments up to average earnings.”

The procedure for calculating average earnings

Article 139 of the Labor Code establishes the procedure for calculating the average salary of an employee. The article says that when calculating average earnings, it is necessary to take into account all types of payments, and their source does not matter - costs of current activities, net profit, other expenses.

https://youtu.be/GbLVxT8_xK4

The average salary can be determined based on the time actually worked by the employee and accrued wages for the last working year. A calendar month means the period from the 1st to the 30th (or 31st) day of the corresponding month, inclusive. In February, accordingly, the month is considered to be the period from the 1st to the 28th (29th) day.

Thus, to determine the average salary of an employee it is necessary:

- Calculate the billing period and the number of days in it taken into account when determining average earnings;

- Calculate the amount of payments for the billing period

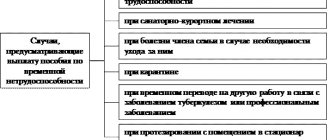

An employee who has received temporary disability status or a pregnant woman is entitled to benefits. Benefits are calculated based on the employee’s average earnings for two calendar years - that is, the period preceding the occurrence of an insured event - illness, pregnancy.

In this case, you should pay attention to some features of the formation of additional payments up to average earnings. According to Part 3.2 of Art. 14 of the Law of December 29.

2006 N 255-FZ, the total income of an employee for the year cannot be higher than the amount of the maximum base for insurance contributions to the Social Insurance Fund.

Therefore, actual earnings may be significantly lower than if they were calculated only on the basis of the amount of earnings of the working person.

In order to compensate for the reduction in wages, the employer can establish an additional payment up to the average salary on sick leave. This additional payment, naturally, does not come from the Social Insurance Fund.

Setting an additional payment up to average earnings must be supported by relevant documents. The procedure for additional payment and registration is as follows:

- Making additions and changes directly to the employment contract.

- Drawing up a local regulatory act (LNA).

Since the requirements to make additional payments to employees are not specified in the legislation, the management of the organization can independently decide which of the employees will be paid additional payments (to the entire work team or selectively) and what will be the procedure for calculating additional payments to staff.

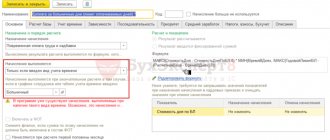

In 1C ZUP 3.0 (8.3), it is possible to accrue an additional payment to an employee up to average earnings.

When using a special tool in 1C 8.3 (8.2) ZUP, the required additional payment is calculated to the employee when calculating wages. In 1C ZUP 3.0 it is possible to form an additional payment in the form of a planned additional payment up to the average income.

In 1C ZUP 2.5 (8.2), it is possible to calculate an additional payment up to average earnings in the form of a one-time accrual; it can be generated through the “Payment according to average earnings” form. In this case, it will be necessary to make preliminary calculations - calculate the salary for the month, then enter an additional payment up to the average earnings, and return to calculating wages and recalculate personal income tax.

Unfortunately, additional payment cannot be assigned as planned. Every month it is necessary to generate a new document “Payment based on average earnings.”

In the 1C ZUP 3.0 program you can find a special document “ Order for additional payment up to average earnings .” The employee's full name and additional payment period must be entered into the form. This is enough for further use of the document.

In 1C ZUP 3.0, an employee’s basic pay is calculated and an additional payment up to average earnings is automatically calculated when calculating wages.

Attached files

- Regulations on remuneration (sample).doc

- Order on additional payment to employees whose salary is less than the established subsistence level in Crimea (sample).doc

- Regulations on remuneration (form).doc

- Order on additional payment to employees whose salary is less than the established subsistence level in Crimea (form).doc

- Professional standard for teachers 2020, approved by the Government of the Russian Federation 16319

- Individual labor disputes in 2020 2067

- Hourly wage 1818

- Liability for non-payment of wages 1430

- Get demo access

- or subscribe immediately

To download this and other expert materials from the site, sign up for trial access

.

Source: https://www.krepkoeradi.ru/obschee/74737-doplata-do-oklada-pri-komandirovkah-prikaz.html

Operating period for calculation

What period of work should be taken into account when calculating SZ for a business trip?

The calculation is based on the previous 12 months and the salary paid during this period. It is important to remember that only working days are taken into account, not calendar days.

If a worker is sent to a task in the first month of work at an enterprise, then his SZ will be calculated for the period from the first working day in the company to the first day of the trip (clause 7 of the Regulations, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922).

The calculation includes payments provided for by the current wage system.

Excluded days

The period for calculating working days for determining SZ does not include:

- vacation days;

- days of illness confirmed by a certificate of incapacity for work;

- weekends and holidays;

- time of maternity leave;

- downtime due to the fault of the employer;

- vacation “at your own expense”;

- time of previous business trips;

- additional paid days to care for children with disabilities.

Calculation of SZ without taking into account the above periods is called with excluded days.

Calculation example for excluded days

This example considers the calculation of travel allowances with excluded days, which were the days of regular annual leave.

The business trip lasts from July 1 to July 3, 2020, 3 working days. To calculate, you need to take the amount of payments from 07/01/2018 to 06/30/2019. Monthly salary is 15,000 rubles:

- for the period from 07/01/2018 to 03/31/2019, the employee was accrued 135,000 rubles;

- From April 1 to April 30, the employee was on vacation, vacation pay amounted to 15,358 rubles. 36 kopecks;

- from May 1 to June 30 he received 30,000 rubles;

- the total amount of payments for 12 months will be 180,358 rubles. 36 kopecks

Actual salary received:

- RUB 180,358 36 kopecks – 15,358 rub. 36 kopecks = 165,000 rubles.

Since vacation time is not included in the calculation. For the period from 07/01/2018 to 06/30/2019, according to the production calendar, there are 247 working days. 22 of them occurred during vacation. There is no need to take them into account. All other days were worked in full by the employee. SZ will be calculated as follows:

- 165,000 / 225 working days = 733.33;

- 733.33 × 3 working days of business trip = 2199.99 rubles.

Calculation of travel allowances: cheat sheet for an accountant

The billing period is 12 calendar months preceding the month the business trip began, or less if the employee has worked for the company for less than a year.

To calculate travel allowances, only working days are taken into account, and not calendar days, as for calculating vacation pay.

Sick leave, vacations, including without pay, business trips, downtime, etc. are excluded from the calculation period (see Article 139 of the Labor Code of the Russian Federation and clause 5 of the Regulations on the specifics of the procedure for calculating the average salary of the Permanent Government of the Russian Federation of December 24, 2007 No. 922).

Example:

Petrova A.A. has been working since 02/10/2006, on 02/25/2014 she was sent on a business trip for 5 days. There are a total of 247 working days in the billing period (from February 2013 to January 2014). There were excluded periods: in August the sick leave period accounted for 8 working days, and in September the annual paid leave period accounted for 14 working days.

Then 247 – 8 – 14 = 225 days actually worked.

Here and below, calculations in the examples are given rounded to two decimal places.

https://youtu.be/7B9PxbpQai0

Fill out and submit the DAM through Extern: import the data of all employees into section 3 in one click, use filters and mass operations. Free for 3 months.

Register

Determining earnings for the billing period

The calculation of average earnings includes all payments that are provided for by the remuneration system, except for sick leave, vacation pay, financial assistance and other social payments (see 2 and 3 of the Regulations on the specifics of the procedure for calculating the average salary of the Russian Federation Government of December 24, 2007 No. 922 ). For details of the accounting for various bonuses, see paragraph 15 there.

If before or during an employee’s business trip there was an increase in salaries (tariff rates) for the organization (division) as a whole, it is necessary to index the average earnings to calculate travel allowances (see clause 16 of the Regulations on the specifics of the procedure for calculating the average salary of the Permanent Government of the Russian Federation dated December 24 .2007 No. 922).

We calculate the average daily earnings and the amount of travel allowances

We divide earnings for the billing period by the number of days actually worked in the billing period. Then we multiply the resulting number by the number of days spent on a business trip. Business trips are subject to personal income tax.

Additional payment before salary

If the payment for travel allowances based on average earnings is significantly less than the salary that the employee would have received if he had not been sent on a business trip, an additional payment can be made up to the actual earnings.

If such an additional payment is provided for by an employment or collective agreement or a local regulatory act, the tax base for income tax can be reduced by it (see paragraph 25 of Article 255 of the Tax Code of the Russian Federation and letter of the Ministry of Finance dated December 3, 2010 No. 03-03-06/1/ 756 and dated September 14, 2010 No. 03-03-06/2/164).

However, you should always calculate travel allowances based on average earnings, and then compare them with the salary, so as not to worsen the situation of the employee if it is more profitable for him to receive average earnings.

Weekend business trip

If the days of a business trip coincide with days when the employee has a scheduled weekend, and he did not work on these days, payment is made not according to average earnings, but according to the rules for payment on a day off. If the employee was not involved in work on these days, then they are not paid.

And if an employee was involved in work on a business trip on a day off or was on the road, the average earnings for such days are not saved. Weekends are paid at least double or single, but with the right to “take off” the day off afterwards (see Art.

153 and 106 of the Labor Code of the Russian Federation).

When calculating double pay, you need to focus on the employee’s remuneration system used (see letters from the Ministry of Finance dated December 25, 2013 No. 14-2-337 and dated September 5, 2013 No. 14-2/3044898-4415).

Prepare and submit a zero calculation for insurance premiums through Extern. 3 months free.

Register

Calculation of daily allowances

For each day of being on a business trip, including weekends and non-working holidays, as well as for days on the road, including during a forced stopover, the employee is paid daily allowances (Clause 1. Regulations on the specifics of sending employees on business trips, approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749).

The employee does not have to report on daily allowance (see letters from the Ministry of Finance dated November 24, 2009 No. 03-03-06/1/770, dated April 1, 2010 No. 03-03-06/1/206).

The amount of daily allowance is established by the organization and enshrined in a collective agreement or local regulation (Article 168 of the Labor Code of the Russian Federation). Expenses for the payment of daily allowances are taken into account when taxing profits without restrictions.

Payment of daily allowances is exempt from personal income tax within the framework of the following standards: 700 rubles for each day of a business trip within the country and 2,500 rubles outside the country.

See also other cheat sheets for accountants:

- Calculation of average earnings

- Accrual of vacation pay

- Accrual of maternity benefits

Source: https://kontur.ru/articles/2244

Payment for a business trip on a day off

Average earnings during a business trip are paid for working days, according to the organization’s schedule. Even if the business trip is long, only daily allowances are paid for days off. Average earnings in this case are not expected. After all, the employee does not work on weekends, but rests (clause 9 of the Business Travel Regulations).

There is an exception to this rule. If an employee nevertheless worked on a weekend or a holiday while on a business trip or was on the road, then during this time he must be paid as for work on a weekend. The Labor Code of the Russian Federation provides for two methods of payment for work on weekends and holidays:

- at a single rate of tariff if the employee takes an additional day off (time off);

- double the amount if the employee does not take time off.

An employee goes on a business trip: how to calculate payments

Travel expenses include various benefits. These are, in particular, daily allowances, compensation for the employee’s travel expenses to the place of business trip and back, for paying for a hotel, for medical insurance if, for example, the employee travels abroad. Let's understand the intricacies of calculating and taxing travel expenses.

The procedure for calculating travel allowances is regulated by the Regulations on the specifics of sending employees on business trips (hereinafter referred to as the Regulations), approved by Decree of the Government of the Russian Federation of October 13, 2008 N 749. The Regulations came into force on October 25, 2008.

Let us recall that before this date, all employers, when sending an employee on a business trip, were guided by Instruction of the Ministry of Finance of the USSR, the State Committee for Labor of the USSR and the All-Russian Central Council of Trade Unions dated 04/07/1988 N 62 “On business trips within the USSR” (hereinafter referred to as Instruction N 62), which, in accordance with Art. 423 of the Labor Code of the Russian Federation was applied to the extent that does not contradict the Labor Code of the Russian Federation. This Instruction has not been canceled even now.

Duration of the trip

Previously, the travel period was limited to 40 days, not counting travel time. Now there is no such restriction. According to clause 4 of the Regulations, the duration of the business trip is determined by the employer, taking into account the volume, complexity and other features of the official assignment.

As a result, the problem of paying for business trips lasting more than 40 days was resolved. After all, previously, exceeding this period was qualified as a transfer to another job (Article 72.1 of the Labor Code of the Russian Federation) with all the ensuing tax consequences (see, for example, Letter of the Ministry of Finance of Russia dated March 28, 2008 N 03-03-06/2/30).

At the same time, the abolition of the maximum period of business travel does not mean that workers can now be sent on business trips forever. After all, fulfilling an official assignment (this is how a business trip is defined by Article 166 of the Labor Code of the Russian Federation) does not imply permanent work at the place of business trip. This may include inspection, control, acceptance of work, etc. Consequently, the duration of the business trip is determined by the fulfillment of such an order.

If an employee performs permanent work functions at the place of business trip, this should indeed be considered as a transfer to another job.

Let us note that the restrictions named in the Decree of the Government of the Russian Federation of February 17, 2007 N 97 “On establishing cases of labor activity by a foreign citizen or a stateless person...” remain in force.

Thus, foreigners temporarily staying in Russia can be sent on a business trip, but for no more than 10 calendar days during the entire period of validity of the work permit. For temporarily residing foreigners, the total period of business trips cannot exceed 40 calendar days within 12 calendar months.

Documenting

The documents that should be drawn up during business trips remain the same: travel certificate, job assignment, employer’s decision (order), advance report, report on work performed.

Clause 8 of the Regulations obliges the Ministry of Health and Social Development of Russia to determine the procedure and forms for recording workers leaving the sending organization and arriving at the organization to which they are sent. Until this moment, the forms of logs of arrival (departure) for a business trip, approved as Appendices to Instruction No. 62, are used.

According to clause 15 of the Regulations, an employee is sent on a business trip outside the territory of the Russian Federation by order of the employer without issuing a travel certificate. However, when sending an employee to CIS countries that have concluded intergovernmental agreements with each other, on the basis of which border authorities do not make notes on crossing the State Border in entry and exit documents, a travel certificate must still be issued. It is in it that the party receiving our employee must, as before, mark his arrival and departure.

Reimbursement

The list of expenses reimbursed to an employee during business trips abroad, in accordance with clause 23 of the Regulations, includes the following expenses: for a foreign passport, visas and other travel documents; for mandatory consular, airport fees, fees for the right of entry or transit of vehicles; for compulsory health insurance; for other obligatory payments and fees.

Including compulsory medical insurance in the specified list will help employers convince the tax authorities of the legality of accounting for such expenses as part of travel expenses, which reduce the tax base for income tax (clause 12, clause 1, article 264 of the Tax Code of the Russian Federation).

Previously, tax authorities were against this, pointing out that the said norm of the Tax Code of the Russian Federation does not provide for this (see Letters of the Ministry of Finance of Russia dated May 10, 2006 N 03-03-04/2/138, Federal Tax Service of Russia for Moscow dated May 19, 2006 N 20 -12/ [email protected] ). Therefore, taxpayers had to seek justice in the courts (see Resolution of the Federal Antimonopoly Service of the West Siberian District dated April 17, 2006 N F04-10064/2005(20874-A27-37)).

It's okay to get sick

A previously ill business traveler, in accordance with clause 16 of Instruction No. 62, was reimbursed for the costs of renting living quarters (except for cases of hospitalization) and was paid daily allowances for the entire time until he, for health reasons, was unable to begin carrying out the assignment or return to his place of permanent residence. (but not more than two months).

Now this restriction has been lifted. An employee who falls ill on a business trip will not be deprived of daily allowance and will not be forced to pay for accommodation at his own expense during the entire period of illness (clause 25 of the Regulations).

Daily allowance for one-day business trips

If an employee has the opportunity to return daily from a business trip to the territory of the Russian Federation, daily allowances, as before, are not paid to him (clause 11 of the Regulations).

If, nevertheless, a local regulatory act or a collective agreement provides for the payment of daily allowances for such business trips, the amount thereof cannot be classified as expenses for profit tax purposes (Letter of the Federal Tax Service of Russia for Moscow dated February 10, 2006 N 20-12/11312).

However, the Federal Antimonopoly Service of the Volga-Vyatka District, in Resolution No. A28-1084/2007-3/29 dated August 16, 2007, indicated that such payments can still reduce the income tax base, but then UST should be charged on them. And from the point of view of personal income tax payment, the specified daily allowances are the employee’s taxable income.

Those sent on one-day business trips abroad are luckier. According to clause 20 of the Regulations, they will be paid daily allowances in the amount of 50% of the norm for such expenses, determined by the collective agreement or local regulations for business trips abroad.

Pay on weekends or weekdays?

Remuneration for the work of a posted worker if he is involved in work on weekends or non-working holidays is made in accordance with the labor legislation of the Russian Federation (clause 5 of the Regulations). In this situation, the general rules of Art. 153 of the Labor Code of the Russian Federation, which oblige the employer to pay for work on such days in no less than double the tariff rate (salary) or (at the request of the employee) in a single amount with the provision of another day of rest.

Thus, a unified rule for remuneration for work of posted employees on weekends and holidays has been formulated.

On the one hand, this resolved the problem, which was considered by the Supreme Court of the Russian Federation in the Decision of June 20, 2002 N GKPI2002-663. The fact is that, according to paragraph 8 of Instruction No. 62, in cases where, by order of the administration, an employee went on a business trip on a day off, he should have been given another day of rest upon his return. However, the possibility of double payment for such a day was not provided.

After all, during the employee’s stay on a business trip on the basis of Art. 167 of the Labor Code of the Russian Federation, the average earnings are preserved, and the Regulations on average earnings do not provide for the average earnings to be paid to the employee in double the amount.

The Supreme Court of the Russian Federation then clarified that going on a business trip on a day off, at the request of the employee, can be paid in accordance with Art. 153 of the Labor Code of the Russian Federation as work on a day off at double the rate.

Now this possibility is directly enshrined in the Regulations: the employer must automatically calculate a double tariff rate for a posted worker for a day off. The employer can refuse it only at the request of the employee, giving him another day of rest. In this case, the day of completion of the task or departure (arrival), which falls on a weekend, will be calculated based on average earnings.

On the other hand, the Regulations do not contain a direct indication of what is considered a day off for a posted worker - a day off according to his usual schedule or a day off according to the schedule of the place of business trip (previously, Instruction No. 62 established the second option). It seems that it would be logical to continue to adhere to this rule, since the Instruction has not been canceled.

Let us also recall that, in the opinion of the Supreme Court of the Russian Federation, set out in the Determination of August 27, 2002 N KAS02-441, such a conclusion directly follows from the provisions of Art. 189 of the Labor Code of the Russian Federation on labor discipline (an employee must obey the rules of conduct defined in the organization where he performs his job duties).

Of course, this may result in some problems with holiday pay. For all working days according to the main work schedule, the employee retains his average earnings (clause 9 of the Regulations; such a norm was previously in clause 9 of the Instructions).

Let's assume that the schedules at the place of main work and at the place of business trip do not coincide. How to pay a posted employee to work on a working day, which is a day off at the place of main work? In our opinion, in this situation you should pay double the rate, and you no longer need to save the average earnings for that day.

If the day off according to the schedule of the business trip is a working day at the place of main work, then such a day, it seems, should be paid in the amount of average earnings.

The rule should also be applied regarding double payment for the day of departure on a business trip and the day of return from it, if these days fall on a day off according to the organization’s work schedule.

Average daily earnings for business trips are calculated by dividing the amount of wages actually accrued for days worked in the billing period, including bonuses and remunerations taken into account, by the number of days actually worked during this period.

Example. An employee receiving a salary of 10,000 rubles. per month, spent all 16 working days of January 2009 on a business trip.

From August 1 to August 28, 2008, he was on vacation. The rest of the time in 2008, he worked on a 5-day workweek schedule.

Earnings included in the calculation are 110,476.19 rubles. ((RUB 10,000 x 11 months) + (RUB 10,000 : 21 days x 1 day)).

During the billing period from January to December 2008, 230 working days were worked (i.e. 250 normal days minus 20 working days missed on vacation).

Average earnings during the business trip will be 7,685.30 rubles. The loss in earnings if the employee were at work in January is 2,314.70 rubles. (10,000 - 7685.30).

Sometimes the employer is ready to provide the employee with an additional payment up to his usual earnings. But how to do that?

The Ministry of Finance of Russia in Letter dated September 26, 2008 N 03-03-06/1/548 stated that if additional payments to employees who were on a business trip of a production nature are provided for in a local regulatory act, then the costs of calculating such payments can be taken into account as expenses for wages for profit tax purposes. In addition, the amount of this additional payment is subject to UST taxation and personal income tax is withheld from it.

At the same time, this method of restoring justice creates additional accounting problems. It turns out that you must first calculate the average earnings, then calculate the regular salary. And if your current earnings are higher, you should make an additional payment. We must also remember that this additional payment should not be included in the average earnings of the following months.

Some organizations do it easier. If the Russian Ministry of Finance is not against such an additional payment, then why calculate it at all? After all, in this case, you can immediately accrue current earnings, having previously noted this time in the timesheet as time spent on a business trip. The taxation of both average earnings during a business trip and the additional payment to current earnings is absolutely the same, so there is no point in allocating this additional payment separately.

The only difficulty for the organization is that sometimes the average earnings still turn out to be more than the current month’s earnings. The risk zone for the organization is April, July, September, October and December - months in which the number of working days exceeds the monthly average. Well, it is still easier to make double calculations in five months out of twelve.

However, even if this is not done, then, as practice has shown, during tax audits, inspectors, as a rule, do not delve into the details of calculating average earnings. After all, this calculation is a complex matter and ultimately does not reveal large amounts of violations.

However, there is another way to solve this problem. The employer has the right to declare an employee who frequently travels on business trips to be a person with a traveling nature of work. In this case, such a trip will not be considered a business trip for him (Article 166 of the Labor Code of the Russian Federation), therefore, for the days of the trip, the employee should be paid the usual salary, and not the average earnings.

Article 168.1 of the Labor Code of the Russian Federation requires the employer to compensate employees whose permanent work is carried out on the road or has a traveling nature, as well as employees working in the field or participating in work of an expeditionary nature associated with business trips:

— travel expenses;

- expenses for renting residential premises;

— additional expenses associated with living outside the place of permanent residence (daily allowance, field allowance);

- other expenses incurred by employees with the permission or knowledge of the employer.

The amount and procedure for reimbursement of these expenses and the list of works, professions, positions of these employees are established by a collective agreement, employment contract, agreements, and local regulations.

The Ministry of Finance of Russia, in Letter dated 01.06.2007 N 03-03-06/1/358, announced that the employer’s expenses associated with compensation for the traveling nature of work can be included in labor costs taken into account when determining the tax base for income tax. Previously, by Letter dated 08/21/2006 N 03-05-02-04/130, the financial department clarified that these expenses are not subject to UST. Personal income tax is not withheld from them in accordance with clause 3 of Art. 217 of the Tax Code of the Russian Federation (Letter of the Ministry of Finance of Russia dated August 29, 2006 N 03-05-01-04/252).

There is another advantage for people with a traveling nature of work. The increasing coefficient when calculating average earnings is not always used, and if it is used, not all amounts are indexed. Payment of current earnings during the traveling nature of the work automatically eliminates this problem.

Those wishing to expand the list of persons with a traveling nature of work should be warned about the following. In accordance with Art. 57 of the Labor Code of the Russian Federation, a condition on the nature of the work is necessarily included in the employment contract.

And issuing a travel certificate in this case is not superfluous. After all, marks about the time the employee was at the place where he performed the task will document his presence there.

Travel allowance when working part-time

Workers who are sent on business trips while working part-time are, oddly enough, a big winner.

Firstly, the calculation of an employee’s average earnings to pay for a business trip, regardless of his work schedule in accordance with clause 4 of the Regulations on Average Earnings, is made based on the wages actually accrued to him and the time he actually worked. That is, only working days are included in the calculation.

Secondly, remuneration for a posted worker if he is involved in work on weekends or non-working holidays, as follows from clause 5 of the Regulations, is made in accordance with the labor legislation of the Russian Federation. That is, the application of the general rules of Art. 153 of the Labor Code of the Russian Federation, which oblige the employer to pay for work on such days in no less than double the tariff rate (salary) or (at the request of the employee) in a single amount with the provision of another day of rest.

So, if an employee of an organization with a work schedule of Monday, Wednesday, Friday is sent on a business trip from Monday to Friday, his average earnings will be calculated for three days, and two days (Tuesday and Thursday) will be paid in double the amount of his salary for these days.

Additional payment up to average earnings

It happens that the salary calculated using the algorithm presented above is lower than the actual salary that the employee would have received if he had not been sent on a trip. The organization has the right to establish other methods of remuneration for an employee on a business trip. For example, it can be established that if the calculated average earnings turn out to be less than the salary, then the employee is paid additionally to the usual level of remuneration. This procedure must be reflected in local regulations. Then the cost of additional payment to the salary can be taken into account as part of the company’s expenses.

When establishing a different procedure for calculating payment for time spent on a business trip, you must remember that the Labor Code of the Russian Federation prohibits employers from worsening the position of the employee (Articles 8 and 9 of the Labor Code of the Russian Federation). After calculating remuneration for a business trip, the accountant will have to compare the result obtained with the value of the SZ, calculated according to the rules established in the Labor Code of the Russian Federation. After all, a situation may arise when the amount calculated according to the internal procedure turns out to be less than the SZ determined according to the rules described above.

In this case, the employee should be compensated for the difference between the average earnings due during the business trip according to the rules of the Labor Code of the Russian Federation, and the remuneration determined in accordance with the internal procedure for paying for business trips. It is necessary to stipulate this clause in an employment (collective) agreement or other local act, for example, in the Regulations on the remuneration of employees of the organization.

Order for additional payment up to actual salary during a business trip

In accordance with Art.

129 of the Labor Code of the Russian Federation, wages (employee remuneration) - remuneration for work depending on the qualifications of the employee, complexity, quantity, quality and conditions of the work performed, as well as compensation payments (additional payments and allowances of a compensatory nature, including for work in conditions that deviate from from normal, work in special climatic conditions and in areas exposed to radioactive contamination, and other compensation payments) and incentive payments (additional payments and incentive allowances, bonuses and other incentive payments). Based on Art. 132 of the Labor Code of the Russian Federation, the salary of each employee depends on his qualifications, the complexity of the work performed, the quantity and quality of labor expended and is not limited to the maximum amount. In Part 1 of Art.

From this article you will learn:

- employer's responsibilities during business trips;

- the procedure for additional payment to salary during a business trip;

- registration of additional payment before salary during business trips.

Often, employees who regularly go on business trips end up receiving a salary, including travel allowances, that is lower than the established monthly salary. When calculating average earnings, only the time actually worked is taken into account (Part 3 of Article 139

Labor Code of the Russian Federation), therefore some amounts and certain periods are excluded from it.

This results in the average salary being lower than the actual earnings or salary of the employee on a business trip. In this situation, the employer can reimburse the lost difference and issue an additional payment up to the employee’s salary.

Supplement to salary for business trips

The Labor Code of the Russian Federation orders that the average earnings be paid in addition to the salary according to the staffing schedule when the employee is on a business trip (number of days, start and end dates), and include the additional payment in the taxpayer’s expenses for taxation of profits under Art. 255 Tax Code of the Russian Federation. We recommend

What other travel allowances are due to an employee?

In addition to average earnings, the employer must reimburse the employee’s travel and accommodation expenses at the business trip location. Reimbursement of expenses is made on the basis of provided supporting documents:

- air and train tickets;

- taxi receipts (when traveling from the airport to your destination, for example);

- receipts for the purchase of fuels and lubricants (if the employee, in agreement with the employer, travels by personal transport);

- hotel accounts;

- lease agreements for other types of housing.

Also, for each day of a business trip, the employer is required to pay daily allowance. The amount of daily allowance is determined by the commercial organization independently. Their size must be approved in a local regulatory act (order of the manager, regulations on business trips).

Supplements up to the amount of salary for travel and vacation pay

Important

The Labor Code of the Russian Federation, additional conditions that do not worsen the employee’s position in comparison with established labor legislation and other regulatory legal acts, collective agreements, agreements, local regulations, can be provided directly in the employment contract. For example, an employment contract may include provisions to clarify, in relation to the working conditions of a given employee, the rights and obligations of the employee and the employer established by labor legislation.

On the legality of recognizing in tax accounting an allowance up to the official salary paid to an employee on a business trip in accordance with the employment contract concluded with him, such conclusions are given in the Letter of the Federal Tax Service of Russia for Moscow dated 02/04/2008 N 20-12/009705. Now let’s consider the question of whether it is possible to accept these payments as expenses. So according to Art.

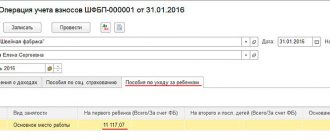

Accounting for travel allowances

Accounting for settlements with seconded employees is kept on account 71 “Settlements with accountable persons” (Chart of Accounts, approved by Order of the Ministry of Finance dated October 31, 2000 No. 94n).

Documented travel expenses are taken into account as part of the current period's expenses in expense accounts. Postings for recording travel expenses

| Contents of operation | Debit | Credit |

| An advance was issued for a business trip | 71 | 50, 51 |

| Business trip expenses are included in expenses | 25, 26, 44 | 71 |

| Unspent accountable amounts were returned | 50, 51 | 71 |

What taxes do you need to pay on business trip payments?

Average earnings paid during a business trip are subject to personal income tax and insurance contributions in the same way as regular wages. But on reimbursed expenses for travel and accommodation, neither personal income tax nor insurance premiums are paid.

A special taxation procedure has been established for daily allowances. Thus, daily allowances within the limits of the standards are not subject to personal income tax or insurance contributions. The standards are established by paragraph 3 of Article 217 of the Tax Code of the Russian Federation:

- 700 rubles - for each day of a business trip in Russia;

- 2500 rubles - for each day of a business trip abroad.

Amounts of daily allowance in excess of the standards are subject to personal income tax and insurance premiums.

In order to recognize the payment of travel allowances as expenses taken into account when calculating income tax, it is necessary that they be justified and documented. If you have all the documents confirming payment for travel and accommodation, and the daily allowance is established in the LNA, then there are no obstacles to recognizing tax expenses.