Additional payment before actual earnings to the benefit, the amount of which is limited

Source: Glavbukh magazine

According to Article 183 of the Labor Code of the Russian Federation, in case of temporary disability, the employer pays the employee benefits in accordance with federal laws. The main one is Federal Law No. 255-FZ of December 29, 2006.

Calculation of average earnings for calculating temporary disability benefits, maternity benefits, and monthly child care benefits is carried out for two calendar years preceding the year of incapacity. In this case, the denominator of the calculation indicates a fixed number of days - 730.

The company pays for the employee’s sick leave for the first three days at its own expense. From the fourth day, the benefit is paid from the funds of the Federal Social Insurance Fund of Russia.

Average earnings, on the basis of which temporary disability benefits are calculated, are taken into account for each calendar year in an amount not exceeding that established on the basis of Federal Law No. 212-FZ of July 24, 2009 (hereinafter referred to as Law No. 212-FZ) for the corresponding calendar year the maximum value of the base for calculating insurance premiums to the Social Insurance Fund of Russia.

Benefits for loss of ability to work due to illness or injury are paid in the following amount:

- with more than eight years of experience - 100 percent of average earnings;

- with experience from five to eight years - 80 percent of average earnings;

- with up to five years of experience - 60 percent of average earnings.

It turns out that employees with little experience lose a lot financially. At the same time, they can be very valuable personnel for the organization.

https://youtu.be/VV4ZAaDk56k

Additional payment up to average daily earnings when calculating sick leave benefits

The additional payment is made along with sick leave and is subject to personal income tax and insurance contributions to the Pension Fund of the Russian Federation and the Federal Compulsory Medical Insurance Fund. For the simplified tax system and income tax, such an additional payment is perceived as labor costs.

You can receive the maximum possible amount of benefits if you have at least 8 years of insurance experience. Then the sick leave payment will be 100% of the average earnings. In cases where the insurance period is shorter, the benefit can be increased by assigning an additional payment. This is the employer's right. The law does not oblige him to pay the employee extra, leaving the wording for this action as “the right.”

The employer can, but is not obligated to, increase the amount of sick leave benefits!

If the employer is ready to assign an additional payment to an employee whose length of service does not allow him to receive the maximum temporary disability benefit or the average income for the billing period is higher than the base value, this must be reflected:

- in the collective labor agreement;

- in an individual employment contract.

Read about issuing sick leave for child care here.

When an employee goes on sick leave based on a clause in the employment contract, an order for additional payment is issued. The amount of the additional payment will necessarily be reflected in the company’s balance sheet as a labor expense. Accordingly, it will not be subject to income tax.

The status of additional payment for sick leave is one of the types of wages from which income tax in the amount of 13% and insurance contributions are required to be withheld.

The video explains how to calculate sick leave

Where to register the amount of additional payment before actual earnings

In order not only to donate money to a sick employee, but to take into account the additional payment for sick leave when calculating the company’s income tax, you need to follow a number of rules.

In accordance with the provisions of Article 255 of the Tax Code of the Russian Federation, labor costs include any accruals to employees in cash or in kind, incentive accruals, compensation, etc. The provisions of paragraph 25 of Article 255 of the Tax Code of the Russian Federation allow the recognition of profits and other types for tax purposes expenses incurred in favor of the employee, provided for by an employment or collective agreement. Thus, the company has the right to reflect the amounts of additional payments to employees up to the average earnings for the period of their temporary disability as part of expenses that reduce taxable profit, if such payments are provided for in an employment or collective agreement.

Consequently, if the condition for additional payment is not specified in the employment or collective agreement, then it will not be possible to take the additional payment into account when calculating income tax. This position is again confirmed in the letter of the Ministry of Finance of Russia dated April 10, 2014 No. 03-03-Р3/16325. Previously, financiers expressed it in letters dated December 27, 2012 No. 03-03-06/1/723, dated May 3, 2012 No. 03-03-06/2/47, dated October 26, 2009 No. 03-03 -06/1/691. And judges take the side of officials in this matter (resolution of the Federal Antimonopoly Service of the Moscow District dated September 21, 2012 No. A40-14994/12-99-72).

However, the employer has the opportunity to regulate such payments. If he wants to pay additional funds to all his sick employees, then this provision can be enshrined in the collective agreement. But, you must admit, this rarely happens. Much more often, an employer seeks to financially support a specific employee, rather than everyone. But this is not difficult to formalize: the provision for additional payment in this case must be written down in the employment contract.

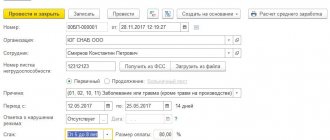

Creating an accrual “Additional payment for sick days”

General settings on the Main tab

Let's create an accrual Additional payment for sick days (limit of paid days)* , which is calculated only if the type of time tracking is entered Sick leave :

Calculation formula

Let us analyze the formula for this type of calculation using diagrams.

General formula for Additional payment for sick days and explanation of the formula for calculating the amount of additional payment for one day:

Explanation of the calculation of the number of sick days for which additional payment must be accrued:

Clarification of the calculation of the number of sick days for which additional payment must be accrued:

Decoding the calculation of the number of sick days that were already taken earlier this year and converting the values involved in the calculation into indicators for the formula:

Converting scheme indicators to calculate the number of days for which an additional payment can be accrued into indicators for the formula:

The final formula for Additional payment for sick days (limit of paid days)* is as follows:

Calculation base settings

In the accrual settings Additional payment for sick days (limit of paid days)* Base calculation tab, in the list of basic accruals, we will include the calculation type Number of days of sick leave , and Base calculation period to Current year :

Accrual time accounting settings

On the Time Accounting for the Type of time , indicate – Sick leave :

How to calculate taxes and contributions from additional payments to benefits

If we consider the additional payment before actual earnings when paying sick leave as part of the remuneration, then it should be subject to personal income tax and mandatory insurance contributions in the usual manner.

Personal income tax from the additional payment is withheld by virtue of Article 217 of the Tax Code of the Russian Federation (about the same - in letters of the Ministry of Finance of Russia dated May 6, 2009 No. 03-03-06/1/299 and dated February 12, 2009 No. 03-03-06 /1/60), and mandatory insurance premiums are calculated in accordance with Article 9 of Law No. 212-FZ. You will also have to pay mandatory insurance premiums for injuries (clause 1, article 20.1 of the Federal Law of July 24, 1998 No. 125-FZ).

The fact is that state benefits are not subject to personal income tax and contributions, with the exception of temporary disability benefits, as well as other payments and compensations assigned in accordance with current legislation. An additional payment up to average earnings in an amount exceeding the maximum benefit amount established by the Federal Social Insurance Fund of Russia cannot be considered as a state benefit.

Example A.P. Markin has been working for the company for 17 months. In May 2015, he fell ill and received sick leave for nine days. The benefit for the employee is calculated based on average earnings in the amount of 888.34 rubles. in a day. However, the actual average earnings of this specialist in 2015 were 1,099.66 rubles. in a day.

Markin has less than five years of insurance experience, so he can only count on 60 percent of his average earnings. Therefore, according to the sick leave, he should receive 4797.04 rubles. (RUB 888.34 x 9 days x 60%).

However, the employment contract with the employee states that in case of illness the company makes additional payment to him before his actual earnings. Thus, the amount of additional payment before actual earnings will be 5099.90 rubles. (RUB 1,099.66 x 9 days – RUB 4,797.04).

Mandatory insurance contributions in the amount of RUB 1,529.97 will need to be charged for the amount of the surcharge. (RUB 5099.90 x 30%). It is also necessary to withhold personal income tax in the amount of 662.99 rubles. (RUB 5099.90 x 13%).

The company corresponds to occupational risk class VII, therefore the insurance rate for insurance premiums against accidents and occupational diseases is 0.8 percent. Consequently, contributions in the amount of 40.80 rubles will have to be charged on the amount of the additional payment. (RUB 5099.90 x 0.8%).

In accounting, this will be reflected in the following entries: DEBIT 20 CREDIT 70 - 5099.90 rubles. – additional payment for sick leave has been accrued;

DEBIT 70 CREDIT 68 subaccount “Personal Income Tax Payments” – 662.99 rubles. – personal income tax withheld;

DEBIT 20 CREDIT 69 – 1529.97 rub. – mandatory insurance premiums have been charged;

DEBIT 20 CREDIT 69 subaccount “Settlements for insurance against accidents at work and occupational diseases” – 40.80 rubles. – insurance premiums are calculated for accidents at work and occupational diseases.

A. Anishchenko, auditor

Regulations on surcharge

The right to employees to receive additional payment for sick leave can be secured in a separate document, such as a provision on additional payment. It specifies who is entitled to it and under what circumstances. At the same time, reference to this provision must be made in employment contracts with employees. Essentially, this is a variation of the previous case.

Note. Payment deadlines and liability for late payments

The employer must keep in mind that in cases where the additional payment is part of the remuneration system, it cannot be paid late. Otherwise, he will have to pay interest to the employee in accordance with Art. 236 of the Labor Code - no less than 1/300 of the refinancing rate of the Central Bank of the Russian Federation for each day of delay, starting from the next day after the established payment deadline up to and including the day of actual settlement. The obligation to pay interest does not depend on the employer's fault.

Additional sick pay before actual earnings

The amount of sick leave benefits is usually less than the employee’s actual earnings. Some employers make appropriate additional payments on their own initiative. Accounting for such payments will be discussed.

The company must pay a temporary disability benefit to a sick employee, the amount of which depends on the patient’s length of insurance.

Thus, if an employee’s insurance experience is eight years or more, then he is entitled to a benefit in the amount of 100 percent of his average earnings; from five to eight years - 80 percent of his average earnings; up to five years - 60 percent of his average earnings.

An employee with less than six months of insurance experience is paid sickness benefits in an amount that should not exceed for a full calendar month the minimum wage established by federal law (clauses 1 and 6 of Article 7 of the Federal Law of December 29, 2006 N 255-FZ , hereinafter referred to as Law No. 255-FZ). From January 1, 2014, the minimum wage amount is 5,554 rubles. per month (Article 1 of the Law of June 19, 2000 N 82-FZ, as amended on December 2, 2013). Let us recall that in 2013 this figure was 5,205 rubles.

It is important to know. To pay sickness benefits, the employee must submit to the employer a certificate of incapacity for work issued by a medical institution. It must be drawn up in accordance with the requirements of the Procedure, which was approved by Order of the Ministry of Health and Social Development of Russia dated June 29, 2011 N 624n.

It is according to these rules that social insurance will calculate and, accordingly, reimburse the amount of benefits to the employer (with the exception of the first three days of illness). The FSS will not pay a penny extra from above.

At the same time, no one prohibits employers from paying for sick leave in excess of the average earnings limit, paying part of the benefits (in addition to three days, which already come from the company’s pocket) at their own expense. For example, temporary disability benefits, which must be paid without fail, can be paid by the employer up to the actual earnings of the employee.

Let's figure out how to do this correctly and what consequences await kind-hearted employers.

Accounting for surcharges in calculating average earnings

Additional payment before actual earnings or any other type of additional payment of temporary disability benefits can be accrued in the month falling within the billing period when determining average earnings for certain cases. Let's figure out whether the additional payment is included in the number of payments taken into account when calculating average earnings.

Average earnings for vacation and other cases provided for by the Labor Code. Let's turn to paragraphs. “b” clause 5 of the Regulations on the specifics of the procedure for calculating average wages, approved by Decree of the Government of the Russian Federation of December 24, 2007 N 922. It states that when calculating average earnings, time is excluded from the calculation period, as well as amounts accrued during this time, if the employee received temporary disability benefits or maternity benefits.

Consequently, the additional payment is not taken into account when calculating average earnings in cases of its preservation provided for by labor legislation.

Average earnings for benefits. According to Part 2 of Art. 14 of Law N 255-FZ, the average earnings, on the basis of which benefits for temporary disability, maternity, and monthly child care benefits are calculated, include all types of payments and other remunerations in favor of the employee, which are taken into account in the base for calculating insurance premiums in the FSS of the Russian Federation in accordance with Law N 212-FZ.

Now let's turn to clause 1 of Art. 8 of Law No. 212-FZ. It talks about what payments are included in the base for calculating insurance premiums. Among them are all payments and rewards in favor of an individual, except for the amounts specified in Art. 9 of Law No. 212-FZ. If you study the mentioned article, the additional payment is not named in it. Thus, the additional payment as a payment in favor of the employee is included in the base for calculating insurance premiums.

It would be natural to assume that on this basis it should be included in the list of payments taken into account when calculating average earnings for calculating benefits. However, time spent on sick leave is excluded when determining the number of calendar days of the billing period. This is stated in paragraphs. “b” clause 5 of the Regulations on the specifics of the procedure for calculating the average salary (approved by Decree of the Government of the Russian Federation of December 24, 2007 N 922).

Consequently, the additional payment accrued for the excluded period of incapacity for work is not taken into account in the future when calculating benefits.

Summarizing the above, we provide a table containing data on the taxation of surcharges.

Table

| Taxes, contributions, average earnings, benefits | Surcharge established | |

| labor (collective) agreement (provision referred to in the employment contract) | only by order of the director (one-time payment) | |

| Income tax | Reduces the taxable base | Does not reduce the taxable base |

| Personal income tax | Taxable | |

| Insurance premiums | ||

| Contributions in case of injury | ||

| Average earnings according to the Labor Code of the Russian Federation | Not taken into account | |

| Benefits |

I.A.Gavrikova

Senior Scientific Editor

magazine "Salary"

| How to make a vacation schedule | |

| New Year's holiday for workers |

Calculation of surcharge

To calculate the amount of the surcharge, you need to determine the amount of sickness benefit that the employer must pay without fail. In this case, one should be guided by the Regulations approved by Decree of the Government of the Russian Federation of June 15, 2007 N 375, as well as Art. 14 of Law No. 255-FZ.

The amount of mandatory benefits is usually calculated based on the employee’s average earnings. First, the amount of accruals made in his favor for the billing period is determined. Typically this is the two years preceding the year in which the temporary disability began.

Only the accruals that are taken into account when determining average earnings are added up. And these are the amounts that are included in payments and other remuneration in favor of the employee, for which insurance contributions to the Federal Social Insurance Fund of the Russian Federation are calculated in accordance with Federal Law No. 212-FZ of July 24, 2009 (hereinafter referred to as Law No. 212-FZ).

Accruals are added up separately for each year of the billing period. If this time period has not been fully worked out or there is no certificate of earnings from other employers, then the actual amount available is taken into account.

The maximum benefit limit is then determined. That is, the amounts received for each year are compared with the maximum permissible value. Namely, with the maximum value of the base for calculating insurance contributions to the Federal Social Insurance Fund of the Russian Federation. In further calculations, a smaller indicator is used.

Next, the resulting amount is divided by 730, which gives the average daily earnings. It is multiplied by the insurance period coefficient, then by the number of calendar days of incapacity.

Finally, they determine how much the employee could actually earn if he worked and was not sick. The amount of compulsory benefits is subtracted from the resulting value. The result is a surcharge.

Example 1. Cashier of Magic LLC O.V. Vasilyeva was on sick leave from November 18 to November 26, 2013.

Her insurance experience is five years and two months. Earnings for 2011 amounted to 470,000 rubles, for 2012 - 530,000 rubles. The salary is 45,000 rubles.

The employment contract provides for the employer’s obligation to pay extra in case of incapacity to actual earnings.

The accountant of Magic LLC made the following calculations.

First, he determined the average earnings to determine the benefit established by law.

Since the employee’s income for the two years preceding the time when temporary disability occurred is greater than the maximum base for calculating insurance contributions to the Federal Social Insurance Fund of the Russian Federation (in 2011 - 463,000 rubles, in 2012 - 512,000 rubles), then In the calculation, the accountant took into account the maximum possible values. As a result, the average daily earnings for calculating benefits were:

(463,000 rub. + 512,000 rub.) : 730 days. = 1335.62 rub.

The amount of temporary disability benefits is equal to:

RUB 1,335.62 x 80% x 9 days = 9616.46 rub.

The accountant then calculated the amount that O.V. Vasilyeva would have received, if she had worked these days, in the amount of:

45,000 rub. : 20 days x 9 days = 20,250 rub.

The amount of additional payment before actual earnings was:

20,250 - 9616.46 = 10,633.54 rubles.

Accounting

Additional payment before actual earnings is recognized as an expense for ordinary activities and is reflected in the debit of the account for accounting for production costs (sales expenses) in correspondence with the credit of account 70 (clause 5 of the Accounting Regulations “Organization Expenses” PBU 10/99, approved by Order of the Ministry of Finance Russia dated 05/06/1999 N 33n).

Let's look at an example of how to reflect an additional payment in accounting.

Example 2. Let’s use the data from example 1. How to reflect in accounting the amounts of temporary disability benefits and additional payments paid to N.L. Solnyshkina, if it is known that the premium rate for insurance against industrial accidents and occupational diseases at Podsolnukh LLC is 1%?

Solution. The accountant made the following entries:

Debit 20 Credit 70

- RUB 3,239.16 - additional payment to the benefit before salary has been accrued;

Debit 70 Credit 68, subaccount “Calculations for personal income tax”,

- 421 rub. (RUB 3,239.16 x 13%) - personal income tax is withheld from the additional payment amount;

Debit 20 Credit 69

- RUR 842.18 (RUB 3,239.16 x 26%) - insurance premiums are calculated from the additional payment amount;

Debit 20 Credit 69, subaccount “Settlements with the Federal Social Insurance Fund of the Russian Federation for social insurance in case of injury”,

- RUB 32.39 (RUB 3,239.16 x 1%)—insurance premiums in case of injury are calculated from the amount of the surcharge;

Debit 70 Credit 50

- 2818.16 rub. (3239.16 rubles - 421 rubles) - an additional payment was given to the employee from the cash register.

Accounting for income tax expenses

When calculating income tax, a company reduces the income received by the amount of expenses incurred. The latter also includes labor costs. These, in particular, include other types of costs that are incurred in favor of the employee and are provided for by the labor (collective) agreement (clause 25 of Article 255 of the Tax Code of the Russian Federation).

It is important to know. Expenses deducted from taxable income must be justified and documented. This is the requirement of paragraph 1 of Art. 252 of the Tax Code.

This means that the company has the right to take into account the amounts of additional payments to employees before actual earnings for the period of their temporary disability as part of expenses that reduce taxable profit. A prerequisite is that such payments must be provided for in the labor and (or) collective agreement.

A similar conclusion follows from a number of Letters issued by the Ministry of Finance of Russia: dated December 27, 2012 N 03-03-06/1/723, dated August 3, 2010 N 03-03-06/1/508, dated July 27, 2010 N 03-03-06/1/487, dated June 22, 2010 N 03-03-06/4/62, dated October 26, 2009 N 03-03-06/1/691 , dated September 14, 2009 N 03-03-06/2/169.

The situation is completely different if the regulation on remuneration and bonuses for employees in force in the organization stipulates that, by decision of the employer, on the basis of an order or instruction, employees may be given additional payments to temporary disability benefits, but neither the labor nor the collective agreement will make the above additional payments not provided. Then the company does not have the right to take into account these payments in labor costs in accordance with clause 25 of Art. 255 of the Tax Code in order to calculate income tax.

Collective agreement

Experts from the Ministry of Finance recommend providing for the possibility for employees to receive additional payments to benefits in the collective agreement. This will allow you to take this amount into account in labor costs when calculating the taxable base for income tax. In this case, the additional payment will apply to all employees. In addition, the employer will not be able to refuse to assign additional payment until changes are made to the collective agreement.

If the employer decides to fix an additional payment in a collective agreement, the wording in the document may be as follows: “Employees in the event of temporary loss of ability to work and receiving benefits in an amount less than their actual earnings are paid an additional payment up to their actual earnings at the expense of the employer.” The wording may be different depending on the type of surcharge.

Based on the provisions of the collective agreement, data from the work time sheet, confirmed by a certificate of temporary incapacity for work, the personnel department prepares a draft order for the assignment of additional payment. Then the head of the organization signs the order. The employee is familiarized with the document and transferred to the accounting department. And finally, based on the order, the accounting department calculates and pays the additional payment.

There is such a right

Not all employees have the right to receive sick leave benefits in the amount of 100% of average earnings, since the figure depends on the length of insurance coverage.

For more details, see “100% sick leave: when paid in full.”

And sometimes such benefits are calculated based on the minimum wage. Therefore, additional payment for sick leave up to average earnings comes to the aid of such personnel.

For more details, see “Minimum wage in 2020 for calculating sick leave.”

In case of temporary loss of ability to work, the employee is paid sick leave benefits, calculated on the basis of average earnings. The calculation period is taken as two years preceding the year in which the insured event occurred.

The Social Security Fund limits the value at which days of absence are paid. So, in 2020, the maximum income for the billing period is equal to:

- 670,000 rub. (for 2020) + 718,000 rub. (for 2020) = RUB 1,388,000.

- RUB 1.388 million / 730 day (number of days in 2020 + 2020) = 1901.37 rubles/day.

Amounts above these limits are not taken into account when calculating sick leave and are not paid. But the law does not prohibit the employer from making additional payments to the average salary on sick leave for the missing amount.

Remember: providing employees with such additional payment is the right, not the obligation of the employer!

How to register correctly

When an enterprise makes additional payments to employees up to the average salary on sick leave in the event of their temporary loss of ability to work, this condition must be included in local regulations, an employment or collective agreement. Since the legislation does not regulate the rules regarding this issue, the employer independently determines:

- the circle of persons who are entitled to compensation (it is not necessary to pay funds to all personnel);

- procedure for calculating the amount of funds to be paid additionally.

Calculations with the budget

If the documents are completed correctly, the additional payment up to the average salary on sick leave can be taken into account in income tax expenses as wages. This requires:

- comply with the conditions discussed above;

- issue an order on the basis of which such additional payments should be made.

Since the surcharges in question do not come from the government, they are subject to income tax. Its calculation occurs in the general manner.

For more information, see “Paying income tax on sick leave.”

Also, the employer must deduct contributions to extra-budgetary funds from the amount of the supplement up to average earnings.

EXAMPLE S. Mikhailov, who works in and is a tax resident of the Russian Federation, took out sick leave on September 26, 2016. He returned to work on October 6, 2016. The average salary of an employee over the past two years per day was 2,250 rubles. Insurance experience – 7 years. The company's collective agreement provides for additional payment for sick leave up to average earnings. What actions need to be taken?

Solution

- Since Mikhailov has 7 years of insurance experience, he is entitled to compensation in the amount of 80% of his salary.

The amount of funds allocated to him without additional payments will be: 1901.37 × 80% × 10 days = 15,210.96 rubles. - Compensation, taking into account the terms of the collective agreement, is equal to:

2250 × 10 days = 22,500 rubles. - The amount of additional payment due to him will be:

22 500 – 15 210,96 = 7289,04. - We charge tax on the amount that we provide additionally:

7289.04 × 13% = 947.6 rubles. – we withhold this amount of personal income tax from additional payment for sick leave up to average earnings.

The legislation does not regulate up to what maximum amount or period of additional payment can be made. And despite the fact that earnings can be fixed by salary, actual products produced, etc. The main thing is that the rules for calculating additional payment up to the average earnings on sick leave are specifically reflected in regulatory documents or the employment contract with the employee.

If you find an error, please select a piece of text and press Ctrl+Enter.

Payment of sick leave in 2020: percentage of length of service

The percentage of length of service has a direct impact on the amount of sick leave payment. Let's look at specific examples of how to calculate an employee's length of service and the amount of temporary disability benefits due to him in 2020.

- activities of an individual as an individual entrepreneur, private notary, detective or security guard after 01/01/2003, if social security contributions were paid during these periods, as well as periods before 01/01/2001;

- working as a lawyer after 01/01/2003, if social security contributions were paid during these periods, as well as periods before 01/01/2001;

- work on a collective farm or production cooperative after 01/01/2003, if social security contributions were paid during these periods, as well as periods before 01/01/2001;

- execution of powers of a deputy of the State Duma and the Federation Council;

- filling government positions in constituent entities of the Russian Federation, as well as municipal positions filled on a permanent basis;

- the activities of a clergyman, if social security contributions were paid during these periods;

- paid work of the convicted person in the period after November 1, 2001.

We recommend reading: Find out the debt of housing and communal services according to the Federal Tax Service Moscow region

How to calculate the surcharge?

The amount of the supplement is determined as the difference between the average earnings and sickness benefits.

The average wage is calculated by multiplying the average daily earnings by the duration of disability in days. For the calculation, all income included in the taxable base under the Unified Social Tax is taken into account. When determining the average salary per day, the calculation period is considered to be 1 year preceding the illness.

The amount of the benefit is determined depending on the length of service of the insured person. It varies from 60 to 100% of average earnings. Its maximum value is regulated by law and changes annually.

For example, a factory employee was sick for 7 calendar days in March. His monthly salary is 65,000 rubles. The billing period from February 1 of last year to February 28 of the current year has been fully worked out. Additional sick pay up to average earnings is provided for in collective and labor agreements. Work experience – 7 years.

| Index | Calculation procedure | Result |

| Average salary per day | 65000*12/365 | 2136,98 |

| Sick leave per day | 2136,98*80% | 1709,59 |

| Maximum amount of sick leave per day | 1521,00 | |

| Sick leave amount | 1521,00*7 | 10647,00 |

| Amount of surcharge | 1709,59*7 – 10647,00 | 1320,13 |

Since the maximum amount of temporary disability benefits is limited by law, the company compensates the difference of 1,320.13 rubles.

Sample order for payment of shortcomings due to the fault of the employer

No bonus or other remuneration was awarded to Petrov for January.

Payment for work on a holiday will be 3,000 rubles. (10 hours × 150 rub./hour × 2).

Payment for the remaining time worked will be 15,600 rubles. ((114 hours – 10 hours) × 150 rub./hour).

Petrov’s earnings for January 2012 will be 18,600 rubles. (RUB 15,600 + RUB 3,000).

Nina Kovyazina,

Deputy Director of the Department of Medical Education and Personnel Policy in Healthcare of the Russian Ministry of Health

- Answer: In what ways can you keep track of working hours?

- daily: used for a five- and six-day working week;

- summarized: used when production conditions do not allow employees to comply with the daily or weekly working hours established for employees, incl.

Methodology for determining average earnings per day

You can understand how to calculate the average daily earnings for sick leave if you know the calculation rules and a simple formula.

The days when the worker is undergoing treatment are indicated on the certificate of incapacity for work. The payment due during this time - the allowance - is calculated depending on the average salary. It is defined as the arithmetic average of the total earnings for the 2 years preceding the year in which illness occurred or going on maternity leave.

These 2 years are called the billing period. The average daily earnings for calculating disability benefits depend on the profit in the billing period.

Additional payment of maternity benefits

If the collective and labor agreement stipulates the employee’s opportunity to receive an additional payment up to the average salary for such benefits, then these costs can also be included in labor costs.

The procedure for determining the average salary must be reflected in the local regulations of the employer. If this is not reflected in the documents of the business entity, then the average earnings can be determined in accordance with the current regulations governing the procedure for its calculation.

The Tax Code of the Russian Federation determines that an economic agent has the right to classify expenses for additional payments to maternity benefits up to average earnings as income tax expenses.

The amounts of such additional payments are subject to income tax. Unified social tax is calculated for them. Local regulations of the tax agent in the field of labor legislation may establish an additional payment not only up to average earnings, but also up to:

- official salary. Bonuses and any allowances are not taken into account;

- actual earnings, that is, up to the salary that would have been received by the employee if he had worked for a full month;

- any fixed value that can be set the same for all employees of the enterprise, regardless of salary and job responsibilities. The amount of the additional payment depends on the employer’s financial ability to compensate for the employee’s material losses during illness.

Additional payment up to the minimum wage for part-time workers

The procedure for additional payment up to the minimum wage, including for part-time workers, deserves special attention. If the employee’s salary, as well as sick pay, does not reach the minimum wage, the employer is obliged to compensate the difference.

The Labor Code stipulates that part-time workers are paid in proportion to the time worked. Additional payment of sick leave up to the minimum wage follows the same principle. The procedure for such additional payment must be reflected in the employer’s internal regulations governing wage calculations. The provisions of these documents are brought to the attention of the employee against signature.

The additional payment is issued by order of the enterprise.

Answers to pressing questions

Question No. 1. Can an enterprise take into account in its expenses to determine the income tax base an additional payment for sick leave up to the average earnings of a citizen of another state?

Answer. An enterprise has the right to pay additional sick leave up to the average salary in accordance with the employment agreement to its employee, regardless of his citizenship. But such costs cannot be included in expenses when calculating the taxable base for income tax. If a citizen of another state is not an insured person, then he has no right to sickness benefits. Consequently, such costs are not regulated by Article 255 of the Labor Code of the Russian Federation and are not taken into account as expenses affecting the amount of taxable profit.

Question No. 2. How to calculate the amount of additional payment up to the minimum wage for an employee working part-time. For an employee, on his own initiative, working days are Monday, Tuesday, Thursday and Friday, and Wednesday, Saturday and Sunday are days off. The company has a five-day work week. In April 2017, the planned working time was 160 hours, the employee’s salary was 7,000 rubles. Actually 128 hours worked.

Answer. The employee’s salary in accordance with the number of hours worked in April 2020 is:

7000/160*128 = 5600 rubles.

The employee’s salary does not reach the minimum wage established by law as of the reporting date. Consequently, as someone who has worked the full working hours established for the employee individually, he has the right to receive an additional payment to his earnings up to the minimum wage. The additional payment will be calculated in proportion to the time of actual work:

7500/160*128 = 6000,00.

Consequently, the amount of additional payment for this employee is 400.00 rubles (6000.00-5600.00).

Question No. 3. Will the amounts of additional sick leave up to average earnings be reimbursed from the Social Insurance Fund?

Answer. According to the current legislation regulating the procedure for calculating sickness benefits, the average salary per day cannot be more than the limit determined by regulations for the reporting year. This means that only the benefit amount calculated based on this limit value, but not the actual income of the insured person, can be repaid from the Social Insurance Fund. The employer can compensate the difference at his own expense. It should be noted that the additional payment up to the employee’s actual salary is subject to taxation as income in the generally established manner for salaries.

Question No. 4. On December 25, the employee was accrued additional sick leave up to average earnings. The next day, the employee was paid for sick leave and the income tax on this amount was transferred to the budget. How to correctly reflect the accrual of surcharges in the Form 6-NDFL report?

Answer. The Income Tax Law stipulates that the amount of personal income tax on the income of an individual taxpayer must be transferred by the employer no later than the next day after the funds are issued to him. There are no exceptions to this rule for additional payments for sick leave up to average earnings. The additional payment of disability benefits paid in December up to the average salary is reflected in the 6-NDFL report for the current year as follows:

- Page 100 – 26.12 – the date of payment of the additional payment is indicated;

- Page 110 – 26.12 – the day of personal income tax withholding is reflected;

- Page 120 – December 27 – the day of payment of income tax to the budget.

Question No. 5. What taxes should be imposed on the amount of additional payment to sickness benefits up to the average, actual earnings or minimum wage?

Answer. Such additional payments, as well as disability benefits themselves, are subject to personal income tax under tax law. As with benefits, additional payments are subject to a tax rate of 13% or 30% depending on whether the taxpayer is a resident or not. Additional payments are also subject to taxation for insurance premiums, in contrast to the amount of disability benefits. In addition, for the amount of additional payment for sick leave, you need to charge contributions for injuries, but for the amount of the sick leave itself it is not necessary.

Rate the quality of the article. We want to become better for you: If you have not found the answer to your question, then you can get an answer to your question by calling the numbers ⇓ Free legal advice Moscow, Moscow region call

One-click call St. Petersburg, Leningrad region call: +7 (812) 317-60-16

Call in one click From other regions of the Russian Federation, call

One-click call

How much is the average salary for calculating sick leave in 2020?

We recommend reading: Karelia Young Family Program

All such insurance cases are regulated by the civil legislation of the Russian Federation. The law controls and guarantees appropriate payments to working citizens. Such compensation is called temporary disability benefits.

How is the minimum average daily wage calculated?

For the calculation, the minimum wage (minimum wage) established by local governments, each region has its own, is used. In this case, it is not the minimum wage for the two previous years that is taken, but the minimum wage on the date of onset of the disease.

So, if in 2020 the minimum wage in the region is 7,500 rubles, the average daily earnings will be equal to:

7500 X 24: 730 = 246.58 rubles.

This means that if an employee earned less than 7,500 x 24 = 180 thousand rubles during the pay period, then when calculating benefits, an amount equal to 246.58 rubles should be taken as the amount of the average daily payment.

The same amount of average earnings per day is taken into account if the employee did not work anywhere during the period of time preceding the onset of disability.

Note! When calculating the amount of average earnings per day, a value with several decimal places is obtained. It is not prohibited to round the resulting value to hundredths.

Federal Law Federal Law No. 255 of December 29, 2006 “On the procedure for calculating average daily earnings for calculating disability benefits” does not contain instructions regarding the rounding of decimal places of its value. Until this is stipulated by the legislator, each person making the calculation can act at his own discretion.

The calculator has the right to round to two decimal places. Experts advise rounding the results not of intermediate stages of calculations, but of the final ones. This will give a more accurate figure in the end.

If the calculation is carried out using a computer program, it automatically considers the average daily earnings as an intermediate value and does not round it up. Rounding is applied only at the final stage. This a priori makes the calculation highly accurate.

The periods for which the employee maintained his average earnings, for which the employee received temporary disability benefits, and some others are excluded from the calculation. When calculating average daily earnings, these periods should not be taken into account: for example, when calculating the amount of time worked, or when determining the amount of payments received.