Features of calculating average daily earnings upon dismissal

Since the amount of payments for performing work duties may vary, the Government of the Russian Federation has developed regulations for determining average earnings. Resolution No. 922 of December 24, 2007 states that the average salary is calculated in all situations that are provided for by the labor legislation of the Russian Federation. In particular, this happens in connection with a reduction in the company's workforce, during the liquidation of an enterprise, or when a specialist is dismissed.

In this case, average earnings can be calculated for a certain period of time. Depending on the time period, average daily earnings (ADE) or average monthly earnings (AME) are calculated. In this article, we calculate the average daily earnings, and to determine the average monthly indicator, you need to divide the salary for the year by 12.

Basic rules for calculating SDZ:

- Regardless of what operating mode is in effect at the enterprise, the calculation takes into account wages for the year, that is, for the 12 months preceding the moment the payment is calculated. In this case, only the actual time worked and the actual accrued salary are taken. A calendar month is defined as the period from the 1st to the last day of the month.

- The following are subject to exclusion from the billing period, as well as from the accrued salary: cases of continued earnings; cases of disability, maternity leave; downtime due to the fault of the enterprise (for independent reasons); periods of strikes; unpaid holidays; paid additional days provided for the purpose of caring for disabled children; periods of release from work duties with full or partial retention of earnings.

- If the billing period is not fully worked out, the actual earnings for the time worked are taken into account.

- The use of SDZ is allowed when calculating vacation pay, and the average daily earnings are also taken when calculating compensation for unused vacations.

- The formula for calculating SDZ takes the average monthly number of days equal to 29.3.

- When calculating the amount of earnings, you should take into account all types of remuneration to staff for performing work duties according to the organization’s SOT (remuneration system). The source of the salary does not matter.

Calculation of wages for an incomplete month with a salary

What payments are taken into account when calculating SDZ:

- Accrued salaries to staff according to approved salaries (rates) for time worked.

- Accrued wages for piece workers at accepted rates.

- Earnings given in kind.

- Earnings accrued in the form of commissions or percentages of sales revenue.

- Cash remuneration for employees filling government positions.

- Salary accrued to municipal employees.

- Media employee fees.

- Earnings for teachers of educational institutions for hours of teaching, regardless of the accrual period.

- Earnings calculated at the end of the year.

- All types of additional payments and allowances - for length of service, professional skills, combination, class, knowledge of foreign languages, work with state secrets, management, increase in volumes, etc.

- All types of payments related to the characteristics of working conditions, including increasing coefficients for wages due to overtime, hard work, employment in dangerous (harmful) conditions, night shifts, work on holidays and weekends.

- Additional remuneration for the work of class teachers and teaching staff.

- Bonuses and other remunerations to personnel for the performance of labor duties approved by the LNA of the enterprise.

- Other types of payments in accordance with the payment procedure adopted by the employer.

What payments are not taken into account when calculating SDZ:

- Social benefits - various benefits, including sick leave.

- One-time payments – financial assistance, etc.

- Some compensation payments are payment for rest, travel, food, accommodation, utilities, health care, use of personal transport, etc.

Three times the average monthly earnings calculation when personal income tax is reduced

Online cash register: who can take the time to buy a cash register Individual business representatives may not use online cash register until 07/01/2019. However, for the application of this deferment there are a number of conditions (tax regime, type of activity, presence/absence of employees).

So who has the right to work without a cash register until the middle of next year? <... A bank’s refusal to carry out a transaction can be appealed. The Bank of Russia has developed requirements for an application that a bank client (organization, individual entrepreneur, individual) can send to an interdepartmental commission in the event that the bank refuses to make a payment or enter into a bank account (deposit) agreement. <...

Home → Accounting consultations → Average salary Current as of: January 18, 2020 In what cases may an accountant be tasked with calculating the average monthly salary? It turns out that in several.

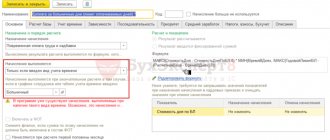

Formula for calculating average daily earnings

The unified regulations for determining the amount of average earnings are approved by the provisions of Stat. 139 of the Labor Code, which states that in all situations provided for, general rules are used. In this case, the calculation formula includes indicators of estimated time, number of days and total income.

The exact calculation algorithm depends on how much the specialist actually worked in the billing period. Separately, Resolution No. 922 provides a procedure for those situations where an employee has not completed the entire pay period. Or it didn't work at all. Mathematical formulas for calculating SDZ are given below.

Determination of average earnings if the billing period is fully worked out

SDZ = Employee's total salary for 12 months. / 12 / 29.3.

In this case, all types of remuneration listed above are included in the total income; and the average of 29.3 is constant and can only be changed at the federal level. After the SDZ value has been determined, it is necessary to multiply the resulting value with the number of days due. For example, in the process of calculating average daily earnings, when calculating compensation to a resigning specialist for days of unused vacation, the number of days of unused annual leave is taken.

Determination of average earnings if the billing period is partially worked out

SDZ = Total employee salary for the period (calculated) / (29.3 x Number of fully worked months) + Number of days in an incompletely worked month.

The main attention in this formula must be paid to the number of calendar days per hour worked. As can be seen from the formula, if a specialist has worked entire months, then their number is immediately multiplied with an average of 29.3. And for the month(s) that are partially worked, you only need to take calendar days of “presence.” If there are several such months, you need to calculate the days for each month separately, and then sum the values.

Determining the number of days in an incompletely produced month

BH = 29.3 / NHKD x NHKD, where:

BH is the number of calendar days of presence in an incompletely worked month,

CHKD – the number of days according to the calendar in such a month,

PPKD - the number of calendar days present that fall on the actually worked time in an incomplete month.

Over the past three months, how and why to count

A certificate of average earnings for 3 months is required according to Resolution of the Ministry of Labor No. 62 of 08/12/2003 in the following situations:

- to calculate the amount of unemployment benefits;

- to calculate the scholarship for the duration of training in retraining or advanced training courses.

Average earnings are calculated for 3 full calendar months before the month of dismissal or the month of training.

It should be borne in mind that when determining this value, it is not necessary to include the employee’s days of absence due to illness, days of downtime, or time paid for caring for disabled children . If, after all deductions for the accepted 3-month period, the salary turns out to be zero, then another full 3 months are taken for calculations.

An example of calculating compensation for unused vacation upon dismissal

Let's assume that an employee joined the company in 2020. The number of unused days is 28 days. In January 2020, the specialist quits. The calculation period is the time from 01/01/17 to 12/31/17. During this period, the employee received the following types of remuneration:

- Salary (total) – 420,000 rubles.

- Payment for overtime work on holidays – 18,000 rubles.

- Additional payment for official combination of positions - 37,000 rubles.

- Sickness benefit – 8200 rubles.

- Material assistance – 4000 rub.

- Vacation pay for 2020 – 34,000 rubles.

The total salary includes the following payments = 420,000 + 18,000 + 37,000 = 475,000 rubles. Consequently, benefits, vacation pay, and financial assistance are subject to exclusion. Next, we determine the billing period.

Sick days account for 5 days. from 04/10/17 to 04/14/17, for vacation - 28 days. from 02/01/17 to 02/28/17. To calculate days in the working period, the formula for calculating SDZ for an incompletely worked out calculation period will be used.

RP = 29.3 x 10 months. + (29.3 / 30 days x 25 days) + 0 days = 317.4 days.

After the billing period has been calculated, we will determine the amount of compensation for unused vacation. The employee is entitled to pay 28 days, since he did not fully use the rest over the past year.

SDZ = 475,000 rub. / 317.4 days = 1496.53 rub.

Compensation = 1496.53 rubles. x 28 days = 41902.84 rub.

Before issuing the amount “in hand” through cash payments or non-cash transfers, personal income tax must be withheld.

Personal income tax = 41,902.84 rubles. x 13% = 5447 rub.

Amount "in hand" = 41902.84 rubles. – 5447 rub. = 36455.84 rub.

Average monthly salary according to the Labor Code of the Russian Federation

Therefore, Bespalov is entitled to:

- severance pay;

- average earnings for the period of employment.

Bespalov's severance pay was paid on the day of his dismissal - January 12, 2020. To determine severance pay, the calculation period is the time from January 1 to December 31, 2014. Bespalov’s earnings for this period amounted to 240,000 rubles. (RUB 20,000/month × 12 months). During the pay period he worked 247 days. Bespalov's average daily earnings were: 240,000 rubles. : 247 days = 971.66 rub./day.

Info

In the first month after dismissal (from January 13 to February 12, 2015) there are 23 working days. The severance pay was: 23 days. × 971.66 rub./day = 22,348.18 rub.

Attention

The day after his dismissal, Bespalov registered with the employment service. During the first month after his dismissal (from January 13 to February 12, 2020), Bespalov was unable to find a job.

How to take into account the premium when calculating SDZ

In sub. “n” clause 2 of Resolution No. 922 states that bonuses must be taken into account when calculating SDZ. However, not all types of such remunerations are subject to full inclusion in total income when determining average earnings per day, but only those provided for by the SOT in the organization. How to correctly account for such amounts? You should focus on the provisions of clause 15. In particular, it says here that:

- Monthly bonuses - should be taken into account only in terms of actually accrued amounts, but no more than one type of payment for each indicator per month of the current billing period.

- Bonuses for a temporary period of more than 1 month. – are also taken in calculations if they relate to the required billing period. It is imperative to comply with the condition that the bonus accrual period does not exceed the estimated period. In this case, the entire premium amount is taken. If there is an excess, only the amount that relates directly to the billing period is taken into account.

- Annual premium – the entire premium is taken into account, regardless of the accrual period. In this case, the calculation includes both amounts for previous years and for the current year, and other types of bonus payments.

How to calculate average monthly earnings, i.e. average earnings per month

If, for example, your organization is forced to reduce the number of personnel (clause 2 of Article 81 of the Labor Code of the Russian Federation), then you must pay severance pay to each dismissed employee at least in the amount of the average monthly salary (Article 178 of the Labor Code of the Russian Federation). How to calculate the average monthly salary in this case? You can use the formula:

That is, the first action of the formula determines the employee’s average daily earnings, and the second action directly determines the amount of payment for the month.

In other materials on our website you can find more detailed information on how to calculate average monthly earnings when reducing the number of employees.

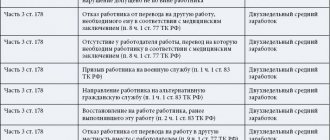

How to calculate the average monthly salary of a specialist upon dismissal

The amount of average monthly earnings is important when a trade union is terminated due to the liquidation of an enterprise or staff reduction. In accordance with stat. 178 such employees are entitled to severance pay for two, and in some cases, 3 months. How to calculate the amount of such a salary?

As when determining average earnings per day, it is necessary to be guided by the provisions of the stat. 139 TK. This means that any calculation of average data involves calculating the total income accrued to the specialist in fact and the production time for the previous 12 months. The formula looks like this:

SMZ = Total salary / 12 months.

Sometimes an employee needs a certificate from social security authorities to confirm their income level. In this situation, you usually need to draw up a document indicating the specialist’s income for 3 or 6 months. To determine the indicator, the total salary for the period is taken and divided by the number of months.

Main characteristics

The average amount of money that an employer pays an employee as compensation for his work is often calculated over a monthly period, but sometimes daily wage calculations are required.

Average earnings per day is the total amount of the employee’s salary for the entire pay period, divided by the number of days during which the individual performed his or her job duties.

It should be noted that in accordance with article number 139, which is contained in the Labor Code of the Russian Federation, the following rules have been adopted:

The calculation of the average salary of employees per day, necessary for the purpose of paying for vacation days, as well as for calculating some monetary compensation due to individuals who did not take advantage of the opportunity given to them to go on vacation, is taken into account for a period of 12 calendar months.

To find out the exact figure for average earnings per working day, you should simply divide the total salary for the period of the last 365 calendar days by 12 (the number of months in a year), and then divide the resulting figure by another 29.3 (the number that determines the average number of calendar days per month).- The average daily salary, intended for payment of funds to an employee during vacation, allocated to him on working days, as well as for payment for vacation days that the employee did not take, is calculated by dividing the total amount of his salary by the number of days that the individual worked.

In this case, the number of days must be calculated for a six-day weekly work schedule.

The exact amount of the average salary may be required upon dismissal that occurs at the mutual request of the employee and the employer, if in this case the employment contract provides for certain funds for the employee.

The amount of compensation that is due to a resigning individual must first be agreed upon between the parties and recorded in the document.

Calculation of the average salary per day is also necessary so that the employee can receive payment for his work upon dismissal for a period of less than one month (for example, for 16 shifts actually worked), as well as compensation for unused vacation, which must be paid without fail upon dismissal by agreement of the parties (Article 127 of the Labor Code).

IMPORTANT INFORMATION! In a number of cases established by Russian legislation, upon termination of an employment contract by agreement of the parties, employees are entitled to severance pay. However, to determine its size, it is necessary to calculate the average earnings per working day.

Now let's move on to considering the concept of average monthly earnings, that is, a certain amount of money, which is calculated by dividing the total income of an individual for the year by 12 months.

Such income, on the basis of which the average monthly earnings are calculated, includes not only wages, but also some allowance, additional payments to military personnel, as well as material resources received as a certain remuneration and some other income.

An example of calculating average monthly earnings

Based on the order of the head of the store, the store seller is being reduced from 03/01/18. Let's calculate the amount of benefits equal to the amount of the SMZ. The billing period will include the months from 03/01/17 to 02/28/18. During this time, the employee received a salary of only 342,000 rubles, and a birthday bonus of 2,000 rubles. The calculation looks like this:

- Total income = 342,000 rubles, birthday payment is not taken into account.

- Billing period – 12 months.

- SDZ = 342,000 rub. / 12 / 29.3 = 972.69 rub.

- SMZ or benefit for March = 972.69 rubles. x 31 days = 3015.33 rub. Thus, to determine earnings for a month, you first need to calculate the indicator per day, and only then multiply the resulting value with the number of days to be paid.

Conclusion - in this article we figured out how to calculate the average daily earnings for the purpose of calculating compensation or other payments to a resigning employee. The basic rules were approved in Resolution No. 922 of December 24, 2007. The components of the formula are considered to be indicators of total income for the period, the number of days actually worked and the number of days to be paid.