Remuneration and its fund

The right to wages in Russia is guaranteed by the Constitution of the Russian Federation and a number of federal laws (FL) on labor. Salary is the remuneration that an employee must receive regularly for his work. According to the Federal Law, it includes salary, bonuses and various remunerations and compensations, which are expressed in monetary terms.

The wage process is a kind of barter in which a person exchanges his labor for money. Based on this, he has the opportunity for the existence of both himself and the whole society. To ensure timely payment of employees at the enterprise, there is a wage fund (payroll).

Usage Analysis

This operation is directly related to the previous paragraph. Making a plan and paying wages is not everything. It is necessary to analyze how much the planned diverged from the actual.

The company has drawn up a payroll plan. This is a specific figure that was planned to be spent on paying workers. There are rare cases when the actual amount spent and the planned amount agree, and any discrepancy must be analyzed.

If the discrepancy happened in favor of the company, then a smaller payroll can be planned for the next year, but if the planned funds were not enough, then you need to understand what contributed to this. Perhaps production rates have increased, more labor was needed, or a crisis has occurred.

If this was not predicted, then it is necessary to work with the planning department or accounting department so that everything is taken into account in the future.

In large companies, we may be talking about a discrepancy between the plan and actual payments of several millions, and the task of the financial department is to make sure that there is always a source for paying salaries, despite force majeure.

Often, when analyzing, large manufacturers use not only their own data, but also data from competitors. All information necessary for this is open, so this analytics is legal and uncomplicated. And its advantage is that you can use the experience of other companies - both positive and negative.

Usage analysis is necessary for various fields. Among them:

- increasing efficiency and optimizing processes and costs;

- budget planning;

- elimination of errors that lead to costs going beyond limits.

We invite you to familiarize yourself with the Agreement on the donation of shares in a joint-stock company between individuals

The analysis itself is used for more effective economic management of the organization, since the planned budget of the entire company can be distributed more correctly. The scope of analysis is carried out by accounting employees, as well as special financial analysts, if the organization is particularly large and has a large staff.

An additional factor in using the analysis is the full implementation of all labor standards that relate to the remuneration of workers, since otherwise the enterprise may receive various sanctions for failure to comply with legal standards.

Properly planned expenses, which are included in the payroll, should not reduce the motivation of the workforce. At the same time, they will allow the enterprise to make a profit and successfully withstand market competition. Salaries and incentives for employees should always be within reasonable limits.

The amount of remuneration is calculated taking into account the determination of the prospects for economic development of production.

To form a payroll, one of the following methods is used:

- incremental - this is when, with an increase in production volumes by one percent, wages increase;

- percentage - its part is determined by the level ratio to the total volume of production;

- residual - as part of the income as part of the enterprise’s profit.

Formation of the payroll amount includes planning a reserve of funds from which money will be used if there is not enough money for all due payments for labor. Conversely, if the size of the planned budget for employee salaries exceeds the total amount of payments, then the remainder is sent to the reserve.

The effectiveness of planning the size of the payroll is determined by the balance of working hours, from which excused absences from work due to illness, vacation, etc. are excluded.

Payroll value

The wage fund is an enterprise resource that will be spent on paying the labor of all employees.

They include settlements with employees, both in money and goods, that is, in kind. The payroll includes all planned payments. This also includes “social” money. Payroll can be calculated for the day, month, year. The amount of labor costs implies the calculation of the mentioned fund. It is also an economic indicator that is used for statistical reports and analysis of enterprise activities.

In addition, payroll is one of the components of the cost of production. The payroll depends primarily on the labor market, that is, on the price of labor, on the inflation processes that occur in the state and a number of other factors. Payroll planning takes place at the enterprise itself. The only control the state has is the argument that the “price” of labor cannot be lower than the established minimum wage. This norm is laid down in the law on the minimum wage (No. 82 Federal Law of June 19, 2000). The maximum, however, has not been adopted at the state level. It is determined by the employee himself, his qualifications, position, as well as the employer. All this is confirmed by internal documents.

How to calculate payroll

The calculation depends on the availability of the necessary data, as well as the specified calculation period. For example, the annual option is needed for an annual report, and the daily option is most often used for daily payment or analysis.

Universal scheme

Annual payroll = Salary-m x Chsr-sp. x 12, where:

- ZPs-m - monthly salary indicator, that is, the total annual value divided by 12;

- Chsr-sp. — average number of personnel.

Average number refers to the number of employees each day during the month. The average payment is calculated according to the statement, and the average composition of employees according to the accounting of staff units every month. It turns out that staff units are being added and then divided by 12.

The universal scheme is more often used when it is necessary to calculate the annual preliminary consumption.

When using hourly wages, use the formula FOThour = ∑st. x RF.

RF is the number of hours worked and ∑st. the total rate for all hourly employees.

With piecework payment

Payroll of piecework wages. = (Vpl. x Tsed.) K N Pr. Vsoc., where:

- Vpl. — planned volume of goods;

- Tsed. - unit price of the product that was produced;

- K - compensation of any nature;

- N—surcharge;

- Etc. — bonuses;

- Vsots.—necessary social payments.

If necessary, additional amounts may be added as provided by law or the organization’s charter.

To calculate the annual amount, you need to know a number of quantities. Among them:

- the amount of salaries according to the statement that were paid;

- time sheet with the indicated number of hours;

- additional costs indicating their amounts in local regulatory documentation;

- number of employees by state;

- a form of security used by a company.

If we know the average monthly amount and the number of employees, we obtain SMZ × PE × 12. When multiplying the indicated amounts, the total annual fund is obtained.

If there are several groups of personnel with different forms of payment or amounts of payments, they are combined into their own categories, which are calculated in a similar way. After this procedure, the total amount is added up from the obtained values.

The monthly size is similar to the annual size, only without using the number of months. It turns out that data is needed on the number of employees, as well as the amount of all payments. The product of the indicated amounts will be the monthly amount.

If some workers work on a piece-rate basis, and some on a standard basis, then the two values are calculated independently, after which they are added together.

Since this indicator is a planned one, the average salary value for the entire organization is used to determine it. And it is calculated from the actual indicators of the previous year.

Let's take for example a small company, which last year consisted of:

- directors with a salary of 60,000 rubles;

- manager with a salary of 30,000 rubles;

- security guard with a salary of 15,000 rubles.

During the year, (60,000 30,000 15,000) × 12 = 1,260,000 rubles were spent on payments.

The amount spent on remuneration for the labor of all employees is divided by their average number of employees (ASH) for that year and by 12 months.

Since we have three employees, we will receive an average salary for the company equal to 35,000 rubles.

The average headcount should be taken at the current moment. And if the director hires another employee, the salary for the next year will be: 35,000 × 4 × 12 = 1,680,000 rubles.

But labor costs can be planned not only for a year, but also for shorter periods. Then, instead of the MSS, the number of man-hours spent should be used.

Payroll structure

The wage fund consists of: 1. The wage fund. Monetary remuneration is paid to each employee for the amount of work performed. Provided that it will not be less than required by Law No. 82-FZ. To determine this part of the payroll, there is a calculation of the wage fund. It is done at every enterprise. 2. Payment in kind. In Russia, the legislator has provided for the possibility of paying for labor with products manufactured by the company. This means that part of the employee’s salary will be given to the “merchandise”, about which information will necessarily be entered into the accounting documents of the enterprise.

Example: An enterprise sells goods of its own production at a price of 300 rubles. The employee demanded that he be given part of his salary in goods in the amount of 10 pieces. The salary is 30,000 rubles. Consequently, the employee will receive part of the salary - 3,000 rubles (300 rubles x 10 pieces) as a "merchandise". The rest - 27,000 rubles - in money.

3. Awards, bonuses. In each organization, local documents, the so-called “salary” acts, provide for various types of remuneration. They can be bonuses or allowances for length of service, for the quality of work. Example: Military personnel in the Russian Federation receive an increase in their salary (more precisely, in their salary). Thus, service from 2 to 5 years will bring income to a military man in the amount of 10% of his salary, and service to the homeland for more than 25 years will bring 40% of his salary.

4. Compensation. These include monetary remuneration for special working conditions, overtime, on holidays and others. 5. Cash costs that employees use for free. An example of such costs is when an employer provides food or accommodation for its employees at the expense of the company. Also, workers may be given free products or various types of services. 6. Expenses for the purchase of things that are given to the employee free of charge. Example: an enterprise has its own dress code and each employee receives a uniform at the expense of the employer. The production of various T-shirts, jackets and attributes of the employer’s company fits into the payroll and the necessary documents of the enterprise. 7. Expenses for all types of vacations: main, additional, educational. These also include all compensation for unused periods of legal rest. 8. Costs of medical examinations (medical examinations) - annual examination by doctors. 9. Various compensations: sick leave, payments upon closure of an enterprise, for absenteeism through no fault of the employee, upon transfer to a position with a lower salary. 10. Salaries of freelancers who are drawn up under contracts.

Calculation example

Let's give an example of calculating payroll for a service organization servicing cars.

The approved official salaries of the enterprise administration per month are:

- Chief Manager – 20,000 rubles.

- Accountant – 15,000 rub.

- Office manager – 12,000 rub.

- Supplier – 13,000 rubles.

Approved hourly rates and number of employees according to staffing schedule:

- car mechanic – 95 rubles/hour, number of workers – 6 people;

- auto electrician – 84 rubles/hour, number of workers – 6 people;

- welder – 150 rub./hour.

Bonus payments to employees are set at 10%.

20,000 15,000 12,000 13,000 = 60,000 rub.

(6*95*167 hours 6*84*167 hours 150*167 hours)*1.1 = (95,190 84,168 25,050)*1.1 = 224,849 rub.,

where 167 hours is the average number of hours per month for the year.

60,000,224,849 = 284,849 rubles.

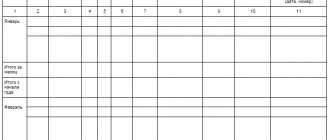

If you need to calculate the planned payroll amount for the entire organization specifically for each month of the year, then to do this we clarify the number of working hours approved by law for each month with a five-day working week and an 8-hour day. Then the exact amount of payroll for the year is calculated by summing all the values for each month.

284,849 * 12 months = 3,418,186 rubles.

Thus, the average size of the planned payroll for the year was obtained.

Expenses outside the fund

The structure of the payroll cannot include some expenses of the enterprise. This should be taken into account when the company is forming a wage fund.

Non-fund expenses consist of bonuses and payments from: other special funds;

- supplements to some benefits;

- material assistance;

- certain compensations;

- contributions for compulsory insurance;

- payment for travel packages;

- other payments from Social Insurance Fund accounts.

Example 1: A trip to health or recreation is paid for by the social insurance fund. Therefore, this amount of costs cannot be included in the wage fund.

Example 2: An employee goes on maternity leave. Although she will receive maternity benefits at her place of work, these payments are made at the expense of the Social Insurance Fund. Therefore, the amount of the benefit cannot be specified in the payroll.

Payroll planning

Due to the fact that the composition of the wage fund occupies a very significant part of the company's expenses, a very important stage in its activities is planning the wage fund. At this stage, the payroll structure (its components) and its size are determined.

Payroll planning proceeds as follows:

- To begin with, information is collected about the company, its structure, and data on the number of employees.

- Information on average earnings is collected, and the entire structure of the wage fund is analyzed.

- The staff schedule and internal documents of the enterprise regulating payroll are also taken into account. These include regulations on wages and bonuses, and other local acts.

- Then a payroll estimate is drawn up - compilation of the wage fund.

- The end result in this process will be the calculation of the fund.

Payroll planning

Remuneration for the employees of the enterprise is carried out at the expense of and within the framework of the employee wage fund (WF) of the enterprise. It is based on the wage fund. Enterprises independently plan the amount of funds intended to pay employees, choose forms and systems of remuneration, and develop a planning system.

The main goal of planning remuneration is to ensure high final production results, the direct dependence of the amount of remuneration on the volume of work and profit.

Funds allocated for wages form the wage fund (WF), which consists of the wage fund (WF) and funds paid from profits. The wage fund is included in the cost of products (work, services) and is regulated by current regulatory documents, primarily the regulation on the composition of costs included in the cost. The amount of funds allocated by the enterprise from profits depends on the results of production and economic activities.

Payroll planning includes:

payroll planning; average salary planning.

The initial data for planning the wage fund are:

manufacturing program; number of employees by category; current tariff system; labor standards; prices for products, parts; staffing; applied forms and systems of wages; labor legislation.

Determination of funds for wages occurs on the basis of the planned number and established official salaries (tariff rates), which take into account the minimum wage and the category of the employee according to a single tariff schedule.

Planning the wage fund at an enterprise can be carried out using the following methods:

according to the achieved level of the basic wage fund; based on average salary; normative; element-by-element (direct counting method).

Payroll planning based on the achieved level of the basic wage fund. This method is based on the basic wage fund (FOTbaz), the planned production growth rate (Cop), the planned reduction in headcount (Ech) and the average annual salary of one employee in the planning period (ZPsr):

Although this method has been widely used in practice, it has a major drawback: all irrational wage payments that occurred in the base year are transferred to the planned fund, therefore, it does not focus the team on the effective use of living labor.

Payroll planning based on average wages. This method is based on the planned number of employees by category (Nsp) and the planned average salary of one employee of this category (ZPS):

where ZPb is the achieved level of wages for an employee of the i-th category, rub.;

Кзп – planned growth rate of average wages of the i-th category of workers.

This method is more accurate; the complexity of its application is associated with the difficulty of justifying the planned level of wages.

Standard method of planning the wage fund.

Currently, there are two variants of the normative method: level and incremental.

With the level normative method, the payroll is determined on the basis of the planned volume of output (commodity, gross) in value (labor) terms (OP) and the planned wage standard per ruble (standard hour) of production volume (WIP):

where FOTb is the wage fund in the base period minus the relative overexpenditure;

OPb – actual production volume of the base year, rub. or standard hours;

?ZP – planned total increase in average wages in relation to the base period, %;

?PT – planned increase in labor productivity, %.

The increase in average wages (?ZP) is determined by the formula:

where Нз is the standard increase in % of average wages per one percent increase in labor productivity.

The use of this method requires stable standards.

The incremental normative method is based on the standard for the increase in payroll by one percent of the increase in production volume (? WIP):

This method, unlike the one discussed above, is characterized by a large stimulating effect and is widely used in countries with developed market economies.

Normative methods are quite actively used in domestic practice.

The element-by-element method (direct counting method) provides for a detailed calculation of each item of the planned wage fund separately by category:

,

where ZPipl is the average annual salary of one employee;

Chipl – planned number, i-th category of personnel, people;

Payroll planning for key production workers involves the allocation of basic and additional wages.

The basic wages of workers include direct wages and bonuses in accordance with the current bonus regulations.

Additional wages include various payments provided for by labor legislation.

The calculation of the direct payroll of workers is carried out separately for piece workers and time workers.

For pieceworkers, the direct wage fund is calculated using the formula:

where OPi is the volume of production of i-th products (works, services) in the planning period;

n – number of items of products (works, services);

Рсi is the total planned piece rate for each product for the enterprise (division).

The piece rate per unit of product (work, service) is the sum of piece rates for all operations of the technological process.

This wage fund can be determined on the basis of the labor intensity of the production program (T) in standard hours and the average hourly tariff rate (ASH) in rubles:

FOT=T*TSsd

where ТСi is the hourly tariff rate of the i-th category, rub.;

Chi – number of workers of the i-th category;

n – number of worker categories.

The direct wage fund of the main workers, paid according to time-based systems, is calculated based on the planned fund of time of one worker, their number and the corresponding average hourly tariff rate.

Planning the workers' compensation fund involves calculating the hourly, daily and monthly (quarterly, annual) fund.

Additional payments are accrued to the calculated direct wage fund in accordance with current legislation - bonus wage fund for workers and additional payments of a compensating nature.

All of these types of payments (direct, bonus fund and various types of additional payments) make up the hourly wage fund for workers. The planned daily fund includes the hourly wage fund, as well as various additional payments included in the composition of man-days worked (Fig. 14).

The monthly (quarterly, annual) wage fund for workers includes the entire daily fund, as well as additional payments that are not taken into account when calculating the hourly and daily funds: payment of basic and additional vacations, severance payments, compensation for unused vacation, etc. (Fig. 14).

Planning of the employee wage fund is carried out on the basis of the established monthly official salaries (DOi) of each category, the average monthly number of these employees according to the staffing table (Ni) and the number of months of work in a given period (P):

where Dn is the amount of other additional payments included in the wage fund of the i-th category of employees (work on weekends, night hours, etc.).

Payment funds for students (FOTuch) and other categories of personnel (FOTpr) are planned separately.

The wage fund for industrial production personnel (FPPP) is equal to:

The wage fund of an enterprise is calculated by adding non-industrial group employees to the payroll of industrial production personnel.

As noted earlier, in addition to the payroll, the wage fund includes payments from the consumption fund, formed from the net profit of the enterprise. The size of the consumption fund and the direction of its use are established in financial terms. Typically, part of the consumption fund is allocated to wages, and the rest is transferred to the management and used to stimulate the enterprise's employees. When planning the average salary, the average salary is established by categories of personnel. There are average hourly, average daily, average monthly (average annual) wages. Each of them is determined by dividing the corresponding planned fund by the number of hours worked, man-days, and the average number of employees.

The average salary can also be determined using the calculation and analytical method, based on individual factors:

raising the minimum wage; changes in working conditions; reduction of lost working time; increase in labor productivity; change in the shares of individual categories, etc.

For each factor, the corresponding index is calculated separately. The total influence of all factors is determined by multiplying these indices.

When planning wages, it is necessary to ensure faster growth in labor productivity compared to wage growth.

The coefficient reflecting the ratio of growth rates of labor productivity (LP) and average wages (ZPsr) is determined by the formula:

To accomplish this task, enterprises must make maximum use of all reserves for increasing labor productivity. As a result, a possible increase in wages per 1% increase in labor productivity can be determined.

The obtained planned indicators of the number of employees and the wage fund make it possible to carry out a verification calculation of the compliance of the expected data with the volume of activity in the planning period: marketable products, payroll, average number of employees, labor productivity, average salary and their ratio.

The ratio of increases in labor productivity and average wages should confirm the correct justification of the planned indicators.

Payroll calculation using the formula

The wage fund can be compiled for different periods of time. When calculating it, you should take into account all the listed components of the payroll. You also need to take into account the fact that the cost of goods or services makes up a significant part of the salary. Payroll can be calculated for any period, at least for one working day.

The most simplified calculation scheme is the following: we sum up the salaries of all existing employees of the enterprise for one month (taking into account the law on the minimum wage - Federal Law No. 82), then multiply this number by the number of months of the work period for which the payroll needs to be calculated.

Example - the quarterly payroll looks like this.

Salary * 3 = Payroll

where ZP is salary, 3 is the number of months in a quarter.

In the case of payment by the hour, the number of hours of work should be determined. Then the hourly rates of employees are summed up and multiplied by the total number of hours worked. For workers who are paid by piece, prices must be multiplied by the total volume of planned work. In the end, everything adds up. The employer also includes all bonuses, compensation, and social benefits to this number. Example: Let’s say the company’s documents stipulate: salary - ZP, bonus - P, bonus-1 - N-1, bonus-2 - N-2. Based on this, the calculation formula should look like this:

Salary + P + N-1 + N-2 = Payroll

All the formulas provided in this article are schematic, this is an example, because at each enterprise the calculation is made in more detail, depending on the components of the payroll and what internal documents exist for its activities.

Planning

How to correctly calculate the payroll so that there are no mistakes that can reduce the interest in the work of the staff? The success of work in planning for the future of all expenses for financing employees will largely depend on determining the amount of the reserve for the payment of wages and incentives.

In addition, all compensation options, additional payments, allowances, incentives, bonuses, and financial assistance that exist at the enterprise must be used in the calculations. When paying by piece, the parameters for determining the payroll amount will be the prices and the amount of planned work, the implementation of which will give the desired result.

Calculations can be carried out using different methods:

- Approximate – in connection with the planned production volume;

- A more accurate calculation option is to calculate the expected salary of each worker employed in production.

To determine the payroll, you can use the hourly wage rate and the effective balance of working hours.

Ʃphot = TCn * ChSPn * Tef, where TCn is the tariff rate (in hours, days) of the n-category worker, rub.; ChSPn is the number of workers of the n-th category, people; Teff is the working time fund according to the balance (number working hours or days).

Ʃphot =Pn * Vn, where Pn is the unit piece price for one operation or product in the volume of the production program; Vn is the volume of products of the nth type.

The annual average payroll for managers, engineers and employees is determined by the size of their salaries by multiplying the monthly earnings of each group of workers by their number and by 12 (the number of months).

Fund within a fund

Every operating organization, enterprise, and company has a wage fund. But it is also provided for by federal laws (FL) in such type of activity as charity. Creating a charitable foundation is not only helping those in need, but also a kind of business with minimal entrepreneurial activity. The difference between it and an enterprise is that profits cannot be distributed among the founders and founders.

Registration of a charitable foundation is carried out with government agencies. Documents submitted must comply with all federal laws (FL).

Registration of a charitable foundation is described in the Federal Law “On Charitable Activities and Charitable Organizations.”

The foundation, despite operating under the guise of a charity, is also subject to payments to employees for their work. At the same time, do not forget about Federal Law No. 82 and the minimum wage, because every work must be paid. Therefore, as in any other organization, planning the payroll of a charitable foundation must be at a legal level. This should be taken into account when registering a charitable foundation.

How to plan the size

To do this, it is necessary to have accurate information about the number of staff, working hours, and work schedule. When forming, you need to take into account not only the amount of wages, but also possible bonuses (based on previous periods or taking into account the necessary assumptions, class of employees, etc.). An important point is to take into account the adequacy of the size of these payments.

There is no single formula; some enterprises use a motivation system in the form of deductions of a percentage of profits, others use fixed bonuses when the plan is fulfilled, etc. In this case, the size of the planned profit and other data must be included in the calculations.

The generalized formula looks like this:

Payroll = ChRP × ZPSR + NP × K,

Where:

- NPR - the average expected number of staff of the enterprise;

- ZPSR - average salary;

- NP - allowances and bonus payments;

- K - planning time horizon (3, 6 or 12 months).