Receiving a pension

Related publications

When pension grounds arise, a person independently arranges pension payments. The employer submits information about a person’s insurance experience and contributions to his account quarterly (or annually) to the Pension Fund. If the onset of pension falls within the inter-reporting period, the employee can contact the employer with a request to submit to the Pension Fund the SPV-2 form containing information about his work experience during the inter-reporting period. This is information that has not previously been transmitted to the Pension Fund, which means it may not be taken into account in the calculation of pensions.

Results

In order for the insured person to have all periods of insurance coverage counted when assigning a labor pension, when the deadline for submitting mandatory reports by the employer to the Pension Fund has not yet arrived, you should take care of drawing up the SPV-2 form. In order for this settlement document to be submitted by the policyholder to the Pension Fund of the Russian Federation, the insured person who is planning to retire must submit a corresponding application to the employer.

If you have any unresolved questions, you can find answers to them in ConsultantPlus. Full and free access to the system for 2 days.

When pension grounds arise, a person independently arranges pension payments. The employer submits information about a person’s insurance experience and contributions to his account quarterly (or annually) to the Pension Fund. If the onset of pension falls within the inter-reporting period, the employee can contact the employer with a request to submit to the Pension Fund the SPV-2 form containing information about his work experience during the inter-reporting period. This is information that has not previously been transmitted to the Pension Fund, which means it may not be taken into account in the calculation of pensions.

SPV-2, what is it?

This is a form that is submitted by the employer to the Pension Fund of the Russian Federation at the request of an employee who has the conditions for assigning an insurance pension. Form SPV-2 - “Information on the period of work of the insured person to establish a pension” contains individual information of the employee. Until 2014, at the request of the insured person, the SPV-1 form was transferred to the Pension Fund. Since 2014, a new form of SPV-2 has been registered and put into circulation. This is due to the fact that insurance contributions to the Pension Fund from this period are not divided into insurance and funded pensions due to the imposition of a moratorium on the formation of the funded element of pensions for all citizens of the country. Therefore, SPV-2 indicates only the employee’s insurance length and the fact of taxable payments or their absence. Also, the new form of SPV-2 provides for the reflection of an additional tariff on insurance premiums for employees who have the right to receive an early pension due to special working conditions.

Form SPV-2 for the Pension Fund is submitted by the employer for consideration and calculation of all types of pensions. It can be transmitted to the Pension Fund both on paper and electronically. The document is prepared and sent to the Pension Fund within 10 days from the date of the employee’s application. It is worth considering that information in SPV-2 is submitted to the territorial office of the Pension Fund in which the employer is registered and this form is sent with an inventory of the established ADV-6-1 sample. After sending, the employee is given a copy of the sent document.

Personnel accounting and payroll calculation in 1C 8.3 ZUP 3.1

Hello, dear readers of the zup1c blog. Starting today, I decided to maintain a new information section regarding the software product Salary and HR Management. This section will cover a review of the most significant points in new releases of 1c zup . Today we will review release 2.5.77, in which:

- Accounting for classes of working conditions for workers with early retirement has been implemented;

- The form “Information on the insurance experience of the insured person SPV-2” has been implemented.

Insurance premiums for employees with early pension in the Pension Fund in 2014

✅ How has salary calculation changed in 1C ZUP 3.1 due to the Presidential decree of March 25, 2020 on a non-working week?

Review of the release of ZUP 3.1.13.146 dated 03/31/2020

✅ Watch VIDEO ->>

And I'd like to start by highlighting the key innovations in version 2.5.77. It was published at the end of January and today there is a more recent release 2.5.78, however, it was in 2.5.77 that the 1c developers took into account the Federal Law of December 28, 2013 No. 426-FZ “On the special assessment of working conditions.” According to the law, for contributors who pay additional tariffs and who have carried out a special assessment of working conditions, new tariffs will be applied depending on the class of working conditions.

So, what did 1C offer us in this regard? Firstly, the ability to specify classes of working conditions must be activated in the Accounting Parameters Settings on the Calculation of Insurance Premiums tab. You can familiarize yourself with other settings of this bookmark in my article published earlier here. So, on the Calculation of insurance premiums tab, you need to check the box “Apply the results of a special assessment of working conditions”:

When closing the parameters, do not forget to save the settings you made.

Thanks to this established parameter, we are able to indicate “Class of working conditions” in the information of the organization’s position on the “General” tab:

✅ How has salary calculation changed in 1C ZUP 3.1 due to the Presidential decree of March 25, 2020 on a non-working week?

Review of the release of ZUP 3.1.13.146 dated 03/31/2020

✅ Watch VIDEO ->>

It is worth noting that in cases where the “Class of Working Conditions” for positions with early retirement is not specified, contributions for positions with “difficult” and “harmful” conditions will be calculated based on rates of 4% and 6%, respectively (for 2014 ).

| In order to select “Class of working conditions” for a position, you need to click on the blue link and in the information register that opens, add a line with two fields: class of working conditions and valid from. The class of working conditions is selected from a list predefined by 1C developers. This list can be found in the information register “Contribution rates based on the results of a special assessment of working conditions.” |

These settings will be enough for additional contributions to 1c zup to be calculated based on the results of a special assessment of working conditions. Contributions will begin to be calculated from the month specified in the settings.

ATTENTION!! If jobs with different classes were identified for one position, then it will be necessary to enter different positions for such jobs.

✅ How has salary calculation changed in 1C ZUP 3.1 due to the Presidential decree of March 25, 2020 on a non-working week?

Review of the release of ZUP 3.1.13.146 dated 03/31/2020

✅ Watch VIDEO ->>

In connection with these innovations, in the latest release of ZUP, the document “Calculation of insurance premiums” has also undergone minor changes. On the “Contributions” tab of this document, not only contributions for difficult and harmful working conditions will now be calculated, but also the class of working conditions, if one was specified for the corresponding position.

The list of classes in this document is quite large. However, in 1c programs it is possible to adjust the list of displayed columns if some class is not used at all in the organization. To do this, you need to right-click anywhere in the tabular part and in the context menu that opens, find the line “List settings”. In the window that appears, uncheck the box next to the field that we don’t need to display, and click OK. By the way, in this way you can configure any list in 1c programs and see hidden fields.

As can be understood from the logic of what is happening, the report “Analysis of accrued taxes and contributions” in the version “PFR contributions for employees with early retirement” has also undergone changes. In this option, a grouping of contributions by class of working conditions was implemented.

There are some changes due to this.

New form SPV-2

So, form SPV-2. Let me remind you that the SPV form is provided to the Pension Fund in the event of the assignment or recalculation of a pension to an employee of the organization.

| 1C ZUP has the ability to automatically generate such forms; they can be printed and sent to the Pension Fund of Russia via 1C-Reporting. The main difference of the new SPV-2 form is that it indicates only the fact of accrual of insurance premiums without indicating their amounts. When selecting an employee, the insurance number, date of appointment, the fact of accrual for compulsory health insurance and accrual at an additional rate, as well as length of service are automatically filled in. The link to this document is located on the desktop on the Pension Fund tab. |

It is possible to create printed forms Spv-2 and ADV-6-1.

That's all I wanted to tell you today. See you on the zup1c blog pages.

To be the first to know about new publications, subscribe to my blog updates:

or join groups on social networks, where all materials are also regularly published:

- in contact with;

- YouTube channel;

- classmates.

- facebook;

Best regards, Dmitry Gerasimov!

If you liked the publication, you can save a link to it on your page on social networks. To do this, use the “Share” located just below.

Help SPV-2: sample and rules for drawing up.

This form contains information about the employer, employee, special working conditions (if any), and periods for paying insurance contributions to the employee. Filling out occurs in accordance with the established rules for providing all reporting forms.

But there are features that must be taken into account when drawing up SPV-2.

To do this, you should read the SPV-2 certificate. A sample filling is given below:

- Employer information. In this section, fill in information about the organization that transfers SPV-2:

- Registration number in the Pension Fund of the employer;

- Short name of the organization;

- TIN and checkpoint;

- Employee category code. Filled out strictly according to the code classifier;

- It is worth paying special attention to the “date of compilation” column. The expected date of commencement of pension grounds is entered in the SPV-2 form; in the DD form, the name of the month is YYYY;

- The date of submission to the Pension Fund is filled in by the Pension Fund employee;

- In the “reporting period” paragraph we indicate one of the values: 3, 6, 9, 0 (corresponding to the reporting period for which information is submitted).

- Employee personal information:

- Full name, SNILS;

- The type of information is selected (an “X” is placed next to the required one) – “initial”, “corrective”, “cancelling”;

- Period: indicates the beginning day of the reporting period in which the pension should be assigned and which follows the last day of the reporting period for which the employer has already provided information to the Pension Fund. The end of the period is the expected date of assignment of the pension. Filled out according to the form DD.MM.YYYY.

Procedure and sample for filling out the SPV-2 form (nuances)

Attention! With the entry into force of Resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2017 No. 2p (from February 17, 2017), the SPV-2 form became invalid. See also: “New personalized accounting documents from 02/11/2020.”

The SPV-2 form was approved to replace the SPV-1 form previously submitted (until 2014) to the Pension Fund. The procedure for filling out the SPV-2 form differs significantly from how the previously valid form was filled out. Therefore, we recommend that you read this article to understand how to draw up and to whom to submit a new settlement document.

SPV-2 - what is it?

Form SPV-2 allows Pension Fund employees to find out additional information about the insured for the last 3 months before his retirement. From this document, the Pension Fund will be able to obtain information from the policyholder during the inter-reporting period about the insurance experience of the insured person.

form of SPV-2 in August 2014 was facilitated by changes in Russian pension legislation that came into force. The new form was put into effect by Resolution of the Pension Fund Board of July 21, 2014 No. 237p (hereinafter referred to as Resolution No. 237p).

In accordance with the changes that have come into force, the employer now does not divide contributions into funded and insurance parts, but is obliged to indicate the fact whether contributions were made at an increased rate. The document reflects information about the length of service of the retiring employee and confirms the accrual of insurance contributions made towards the insurance part of the pension for the last three months.

You can get more information about the insurance period by studying our article “What is the insurance period for a pension?”

All this is reflected in the SPV-2 form , which the policyholder submits to the Pension Fund. Without providing all relevant information until the day of retirement, the future pensioner will receive a smaller pension, and recalculation after providing additional information will take a lot of time.

How to fill out Form SPV-2 in the Pension Fund of the Russian Federation - step-by-step instructions

Form SPV-2 2014 in the Pension Fund consists of only one page, unlike other, more voluminous reports. However, when filling it out, you must also maintain order and enter the data correctly. So SPV-2 information is provided for the last three months before the employee’s (expected) retirement date, and not for the entire last year.

You can fill out the new Form SPV-2 2014 in the Pension Fund of the Russian Federation, which came into force on September 30, 2014, on our website.

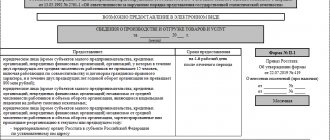

As, for example, in Form RSV-1, in this reporting you also need to indicate the details of the policyholder, that is, a company, individual entrepreneur or other self-employed person, as well as information about the insured and other information as follows:

- company registration number in the Pension Fund of the Russian Federation - contained in the notice of the Pension Fund of the Russian Federation;

- name of the company – a short version in Russian, which is indicated in the constituent and registration documents;

- TIN, KPP - taken from certificates issued by the Federal Tax Service;

- category code of the insured - in accordance with the parameter classifier;

- date of compilation – enter the date of retirement (estimated);

- reporting period - in accordance with the classifier indicated on the form: “3” – first quarter, “6” – half a year, “9” – 9 months, “0” – year;

- Full name (patronymic name, if any) of the insured – similar to those indicated in Form SZV-1;

- insurance number - similar to that indicated in Form SZV-1;

- type of information - in accordance with the indicated designations, an “X” is placed next to: “initial”, “corrective” or “cancelling” (depending on the type of reporting).

You can download Form SZV-1 from the Pension Fund of Russia on our website using this link.

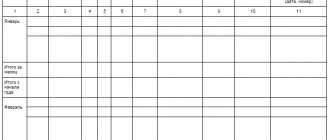

The following is the data for the last 3 months of work:

- the beginning of the period (dd.mm.yyyy) and the end of the period (dd.mm.yyyy) - data is indicated on a monthly basis, and information about days of temporary disability, downtime, etc. is also included;

- territorial conditions (code) - similar to the data in Form SZV-1, if the employee works in the regions of the Far North and equivalent territories;

- special working conditions (code) - similar to the data in SZV-1, if the employee is employed in hazardous and (or) hazardous work;

- calculation of insurance period: basis (code);

- additional grounds (using the code “VRNETRUD”, etc.);

- base(code);

After completing the filling out of the form, it is signed by the manager and the company’s seal is placed on it, if the SPV-2 report to the Pension Fund is submitted in printed form. Exceptions are cases when the entrepreneur pays his own contributions to the fund. And also do not forget that the employer must also attach Form ADV-6-1 to the SPV-2 for reporting to the Pension Fund of the Russian Federation.

You can fill out Form SPV-2 on our website using this link.

What is the procedure for submitting the SPV-2 form for a pension fund?

To obtain the SPV-2 form , an employee who plans to retire in the near future (labor, length of service, disability or other reasons) applies to the employer to submit this document. At the same time, the employee does not need any notifications from the Pension Fund to receive the specified form.

The application is written in free form, its text can be as follows:

“Please provide the territorial branch of the Pension Fund with individual information about my length of service and the calculation of insurance contributions for compulsory pension insurance in the SPV-2 form in connection with the registration of an old-age pension from July 1, 2016.”

The employer must prepare the above document within ten days and submit it to the Pension Fund (clause 36 of the order of the Ministry of Health and Social Development dated December 14, 2009 No. 987n). And the employee himself can submit an application for the assignment of pension payments to him a month before the expected date of retirement (clause 73 of Order of the Ministry of Labor dated March 28, 2014 No. 157n), which means that the future pensioner can contact the employer with a request to submit the SPV-2 form in advance.

The new form does not indicate information on the amount of accrued insurance premiums - this data is displayed in quarterly reporting on the RSV-1 form. And even if an application from an employee with a request to submit the SPV-2 form was received just in time for the preparation and submission of the RSV-1 report, then the document ordered by the employee is still prepared and submitted to the Pension Fund of the Russian Federation along with an inventory in the ADV-6-1 form (para. 3 clause 7 of the resolution of the Board of the Pension Fund of July 31, 2006 No. 192p).

The completed SPV-2 form should be signed by the manager and certified with the seal of the insurer (paragraph 8, subclause 3, clause 4 of Resolution No. 237p). The form is submitted to the territorial branch of the Pension Fund (at the place of registration of the policyholder) on paper or in electronic form. The employer must also provide the employee with a copy of this form.

Employee statement

Information about contributions and length of service for a specific employee is received by the Pension Fund of the Russian Federation from the employer on a quarterly basis. 2 tbsp. 11 of the Law of 01.04.96 No. 27-FZ. However, as a rule, the date of assignment of a pension falls within the inter-reporting period. And the Pension Fund of the Russian Federation does not have information about the employee’s insurance coverage during this time. Therefore, the Pension Fund of Russia will not be able to take it into account when calculating the employee’s pension.

To correct this, an employee who has submitted an application to the Pension Fund for a pension can contact you with an application in any form to submit individual information about him to the territorial body of the Pension Fund during the inter-reporting period. 82 Instructions, approved. Resolution of the Board of the Pension Fund of July 31, 2006 No. 192p (as amended, not entered into force) (hereinafter referred to as Instruction No. 192p). Moreover, the employee is not required to submit any requests from the Pension Fund to you.

Why there was a need to introduce a new SPV-2 form for submitting such information and from what moment policyholders are required to submit information on this form, we were told at the branch of the Pension Fund of the Russian Federation for Moscow and the Moscow region.

FROM AUTHENTIC SOURCES

PRYGOVA Olga Igorevna

Deputy Manager of the Branch of the Pension Fund of the Russian Federation for Moscow and the Moscow Region

“The appearance of the SPV-2 form is associated with changes in legislation, in particular with the introduction of insurance contributions at an additional rate for employees entitled to an early old-age pension due to special working conditions. The new form, unlike the SPV-1 form, does not provide for the reflection of the amount of insurance premiums accrued by the policyholder for the insurance and funded part of the labor pension for the insured person (for the current period, starting from the 1st day of the next reporting period until the date of assignment of the pension). In the SPV-2 form, the policyholder reflects only information about the employee’s length of service and indicates the fact that he has accrued insurance premiums for the insurance part of the employee’s pension for the specified period.

Form SPV-2 has been submitted since 2014 to the territorial body of the Pension Fund of the Russian Federation by the employer at the request of the insured person who has the conditions for establishing a labor pension.

Therefore, if the information is submitted according to the SPV-1 form (even before the publication of the SPV-2 form), we will not accept it.”

Please note that you are required to submit form SPV-2 to the Pension Fund of the Russian Federation when an employee applies for a labor pension not only for old age, but also for any other type of labor pension: both a disability pension and a survivor’s pension. In the latter case, family members of the former employee may contact you.

Form SPV-2 must be submitted to the Pension Fund on paper or electronically within 10 days from the date the employee contacts the employer with an application. 36 Instructions, approved. By Order of the Ministry of Health and Social Development dated December 14, 2009 No. 987n (hereinafter referred to as Instruction No. 987n). However, nothing is said about what days these are - working or calendar and which branch of the Pension Fund of the Russian Federation to submit information to - at the place of registration of the employer or at the place of residence of the employee.

FROM AUTHENTIC SOURCES

“The policyholder is obliged to submit the SPV-2 form within 10 calendar days from the date of receipt of the application from the employee applying for a pension to the Pension Fund of the Russian Federation at the place of his registration, and not at the employee’s place of residence. 36 Instructions, approved. By Order of the Ministry of Health and Social Development dated December 14, 2009 No. 987n (hereinafter referred to as Instruction No. 987n). Information from this form is entered into the database by the Pension Fund of Russia branch at the place of registration of the employer, and can be used in any branch upon request within the system.”

PRYGOVA Olga Igorevna Pension Fund of the Russian Federation

What other documents need to be submitted to the Pension Fund along with the SPV-2 form{q}

FROM AUTHENTIC SOURCES

“Form SPV-2 is accompanied by an inventory according to form ADV-6-1 “Inventory of documents transferred by the policyholder to the Pension Fund of the Russian Federation” p. 82 Instructions No. 192p.”

PRYGOVA Olga Igorevna Pension Fund of the Russian Federation

Please note: even if the submission of information on an employee using the SPV-2 form coincides with the submission of the RSV-1 calculation, the SPV-2 form must still be submitted. Also, do not forget to give the employee a copy of the SPV-2 form within 10 calendar days from the date of receipt of his application to submit this form. 4 tbsp. 11 of the Law of 01.04.96 No. 27-FZ.

Here's what the Pension Fund specialist says about it.

FROM AUTHENTIC SOURCES

“Failure to submit the SPV-2 form by the policyholder will not entail negative consequences for him. After all, this is a settlement form, not a reporting one, so the Pension Fund cannot fine the employer under Art. 17 Federal Law dated 01.04.96 No. 27-FZ. The Pension Fund of Russia can request individual information only based on the results of the quarter.

For employees, with the exception of those entitled to early retirement due to special working conditions, failure to submit the SPV-2 form will also not entail any negative consequences. And for workers engaged in harmful and (or) dangerous work, the consequences boil down to the fact that when assigning a pension, periods of special insurance service from the day following the end of the reporting period (quarter) preceding the reporting period (quarter) will not be taken into account. on which the expected date of establishment of the labor pension falls. And if without this period the employee does not have enough length of service to grant an early pension, the Pension Fund will refuse to grant him one.”

PRYGOVA Olga Igorevna Pension Fund of the Russian Federation

Submission of the SPV-2 form does not affect the submission of quarterly individual information for this employee. They must be presented for the entire reporting period, and not just in the part that is not reflected in the SPV-2 form.

The SPV-2 form in force today, as well as the rules for filling it out, were adopted by Resolution of the Pension Fund Board of June 1, 2016 No. 473p. Its purpose is to transfer to the Pension Fund data on the insurance experience of a retiring employee for the period for which the employer has not yet submitted personalized accounting information. If the Pension Fund does not have such information at the time the pension is assigned, then this length of service will not be credited to the employee, which means the pension amount will be less.

An employee can write an application with a request to provide personal information to the Pension Fund of the Russian Federation in the SPV-2 form in any form addressed to the manager. In turn, the employer is obliged to provide this information to the Pension Fund within 10 days after the employee contacts him (clause 36 of the Instructions, approved by Order of the Ministry of Health and Social Development of the Russian Federation dated December 14, 2009 No. 987n). A copy of the information is transferred to the employee himself within the same period.

The form is submitted to the Pension Fund branch where the employer is registered. In the future, this information becomes available to any department of the Fund, including the one where the employee applies for a pension.

Form SPV-2 is submitted when applying for any labor pension: for old age, for disability, in connection with the loss of a breadwinner, etc.

An individual entrepreneur, when submitting an application to the Pension Fund for the assignment of his pension, also has the right to fill out and submit the SPV-2 form for himself. But it must be taken into account that his insurance record will only include those periods for which the entrepreneur paid insurance premiums.

The company fills out and submits the SPV-2 form to the territorial office of the Pension Fund of the Russian Federation, if an employee who has conditions for the assignment of a labor pension submits a written application with such a request (clause 82 of the Instruction, approved by Resolution of the Board of the Pension Fund of July 31, 2006 N 192p, hereinafter - Instructions).

To prepare and transfer the SPV-2 form to the Pension Fund of Russia, the employer has 10 calendar days from the moment the employee submits the application (clause 36 of the Instructions approved by Order of the Ministry of Health and Social Development of Russia dated December 14, 2009 N 987n, clause 4 of Article 11 of the Federal Law of April 1, 1996 N 27-FZ).

The legislation does not establish a unified form for an employee’s application to submit individual information to the Pension Fund of the Russian Federation using the SPV-2 form. Therefore, the employee can write the application in any form (sample 1 on p. 22).

https://www.youtube.com/watch{q}v=ytcopyrightru

Example 1. Employee R.K. Stologorova works at Cape Town LLC as an operator for the preparation of perfume compositions and liquids. The profession belongs to List No. 2 (special conditions code 27-2, List position code 2241100a-10702). Based on the results of a special assessment of working conditions at the workplace of R.K. Stologorova are recognized as harmful, subclass of working conditions 3.2.

On October 10, 2014, the employee received the right to early assignment of a labor pension.

On October 14, 2014, she submitted to the territorial branch of the Pension Fund the necessary package of documents to assign her a labor pension.

October 15 R.K. Stologorova decided to contact her employer with an application to submit individual information to the Pension Fund of Russia in the SPV-2 form.

How should she write a statement{q}

Solution. An employee can write a statement in any form. It must indicate (see sample 1):

- the date from which she applies for an old-age pension;

- date of application.

Sample 1

—————————————————————————¦ To the General Director of Cape Town LLC¦¦ Cape P.S.¦¦ from the operator of preparation¦¦ of perfume compositions and liquids¦¦ Stologorova R.K.¦¦ ¦¦ Application ¦¦ ¦¦ I ask you to submit to the Pension Fund of the Russian Federation individual information about my¦¦insurance experience in the form of SPV-2 in connection with the early registration of an old-age pension from October 14 2014 ¦¦ ¦¦ Stologorova R.K. Stologorova¦¦ October 15, 2014¦L——————————————————————————

Within 10 calendar days from the date of the employee’s application, the company must submit information about her insurance experience in the SPV-2 form (clause 36 of the Instructions approved by Order of the Ministry of Health and Social Development of Russia dated December 14, 2009 N 987n).

Upon reaching retirement age, the employee turned to the employer for whom he works part-time with an application to submit individual information about him in the form of SPV-2. Should the company provide such information on him {q}

Features of the presentation of the SPV-2 form for individual entrepreneurs

Individual entrepreneurs who independently pay insurance contributions to the Pension Fund can also submit the SPV-2 form in relation to themselves to their Pension Fund branch. This form is submitted to the Pension Fund along with an application for a labor pension.

However, there are often cases where the Pension Fund refuses to accept this form for individual entrepreneurs - this is especially true for those individual entrepreneurs who pay insurance premiums once a year. This is due to the fact that only after payment of contributions the periods of activity indicated in the report are included in the insurance period of these insured persons.

Content details

In the SPV-2 form, the company simply indicates whether insurance contributions have been made for the last three months since the date of submission of the last reports to the Pension Fund. To do this, in the tabular section where this information should be given, “Yes/No” columns are provided. Further breakdown of deductions should be made by Pension Fund employees.

The SPV-2 form is supplemented with columns where information should be indicated on whether additional contributions were accrued to the employee in connection with work in hazardous industries.

This form is not intended to disclose information about the amount of assessed contributions. Pension fund employees learn about this from the quarterly reports of the employing organization.

https://youtu.be/YcfY2tmwQO4

Responsibility for failure to submit the SPV-2 form

If the employer does not submit the SPV-2 form to the Pension Fund, this will not threaten him with any sanctions or other administrative penalties. There is no liability for failure to submit this form, since this is not a reporting document, but a settlement document.

Failure to submit the SPV-2 form by the employer only has negative consequences for the insured person. After all, if he does not have enough work experience without these last months, which would be indicated in the form, then the employee may be denied a pension. Also, if a pension is assigned without a submitted form, the insured will be accrued a smaller pension, since the latest periods (not included in the quarterly report) will not be taken into account.

Certificate SPV-2 - procedure for filling out the document

Form SPV-2 is filled out according to the same principle as other documents for submitting personalized information about insured persons. We are talking about the same procedure for indicating information about the policyholder himself, the insured, the presence of special working conditions, periods for which contributions were not paid.

It is important to indicate the employee’s expected retirement date - when retiring from an old-age pension, this will be the day a man turns 60 and a woman turns 55 (or earlier in accordance with Article 27 of Law 17.12.2001 No. 173-FZ in the part that does not contradict the current pension legislation). If an employee is late in submitting an application for a pension, that is, he did it after his birthday, then SPV-2 indicates the date when this application was submitted to the Pension Fund.

The policyholder should accurately indicate his reporting period - this can be a quarter (3), a half-year (6), 9 months (9) or a year (0). For example, if the expected date of assignment of a pension is in September, then the reporting period code will be 9.

When you fill out the tabular part of the document in the column “Work period for the last three months,” then in the field with the start date of the period you should indicate the number that was the first after the end of the previous reporting period. For example, if the report was given in March, and the SPV-2 form is filled out in May, then the beginning of the period will be April 1.

In the field with the end date of the period, the day on which the pension is expected to be established for the insured person is indicated. If it is necessary to submit individual information on the insured for a period exceeding 3 months (when reports are submitted less than once a quarter), then you will need to fill out several forms of the SPV-2 form indicating information for every 3 months before the expected date of assignment of the retirement pension.

The SPV-2 form uses the codes specified in the classifier approved by Resolution No. 192p, and supplemented by Resolution No. 237p. These codes are used to indicate special periods, for example, to indicate sick time (VRNETRUD), administrative leave (ADMINISTER), downtime due to the fault of the enterprise (SIMPLE) and other situations.