ConsultantPlus:Forums

Conclusion of an agreement for a one-time transaction

Our organization is engaged in wholesale and small wholesale trade of spare parts for municipal equipment.

When selling goods to organizations, we enter into contracts.

We have a one-time deal with some organizations.

Can we not conclude an agreement in this case? If yes, what regulatory document confirms this?

Re: Concluding an agreement for a one-time transaction

Look at the purchase and sale group and don’t bother.

And even without a contract, then in the case of yours or the buyer’s problem (non-timely payment, short delivery, etc.), proving the fact of purchase/sale is not a problem. Only you need it??

According to Art. 161 Civil Code: Must be made in simple written form, with the exception of transactions requiring notarization: 1) transactions of legal entities among themselves and with citizens.

2. An agreement in writing can be concluded by drawing up one document signed by the parties, as well as by exchanging documents through postal, telegraphic, teletype, telephone, electronic or other communications that make it possible to reliably establish that the document comes from a party to the agreement.

1. An offer is a proposal addressed to one or more specific persons, which is sufficiently specific and expresses the intention of the person who made the offer to consider himself to have entered into an agreement with the addressee who will accept the offer.

The offer must contain the essential terms of the contract.

3. The performance by the person who received the offer, within the period established for its acceptance, of actions to fulfill the terms of the contract specified in it (shipment of goods, provision of services, performance of work, payment of the appropriate amount, etc.) is considered acceptance, unless otherwise provided law, other legal acts or not specified in the offer.

One cannot but agree with BubbleJane, the conclusions are absolutely correct. However, I would like to defend the agreement in the form of one document in several copies (one original for each of the parties to such a transaction). What's good about it?

“Nothing at all,” practical business executives will answer me. Like, unnecessary paperwork.

And it’s hard to disagree with this. After all, you still have to prepare an invoice and other documents, and then you also need to draw up an agreement. Why do some layers dislike him so much (note those who directly spin the flywheel of economic relations of any organization, and therefore actually bring it profit)? I watched them for a long time and noticed that many of them do not want to get involved with drawing up contracts, precisely because they have realized why they are actually needed. And they are needed in order to register in them in as much detail as possible a specific trade transaction on which a specific agreement has been reached, which, as a rule, differs from typical situations (including from the usually accepted rules of business turnover), since always there will be special nuances that are characteristic only of this particular transaction, which, by the way, should be clarified before its conclusion. And all this, of course, requires more time than issuing an invoiced offer.

And in principle, all these invoices and acceptances on them and other conclusive actions of the parties work, but until the first misunderstanding in the form of a delay, violation, error and other events and facts that do not, do not, and do happen in our lives, alas. And then. Then you understand the value of an agreement in writing and drawn up in the form of one document according to the rules of the mandatory and dispositive norms of the Civil Code of the Russian Federation. Where can I write down all the “no9quot; and “if9quot; and much more, declaring some dispositive norms of the Civil Code of the Russian Federation specifically for this agreement, already as mandatory, etc. etc., and this, as you understand, is already a different quality of your relationship with counterparties, who will once again think about cheating such a serious partner, who approaches every transaction so scrupulously, you must admit, this is often worth a lot, this is also called business reputation.

Transaction settlement

Transactions in writing must be concluded by drawing up a document that expresses its content and signed by the person or persons who make the transaction, or otherwise authorized by them.

Transactions between legal entities and citizens must be carried out in a simple form, that is, in writing. With the exception of transactions that require notarization.

For transactions of a legal entity between itself and citizens, the law provides for their mandatory conclusion in simple written form.

The written form presupposes that an act must be drawn up that expresses the content of the transaction, which is signed by the person making this transaction or by persons duly authorized by him.

The conclusion of an agreement through the exchange of documents via mail, telegraph, telephone, electronic or other communication, which makes it possible to reliably establish that the document comes from the party, is also equated to the written form of concluding a transaction.

Law Club Conference

Art.

Do 161.5 and 162.3 LCDs mean anything? — in our country, a court decision is not a legal act; — the said decision did not concern the interests of the persons involved in your case; - according to some judges, courts of general jurisdiction and arbitration courts use completely different rules of law. Since housing legislation does not establish a special procedure, on the basis of Art.

7 of the Housing Code of the Russian Federation, there are rules provided for by civil legislation for the conclusion of contracts without fail. subsection: Issues of application of housing legislation: Consequently, the Housing Code of the Russian Federation directly regulates the procedure for making payments for residential premises and utilities by owners of residential premises who are not members of the homeowners' association. As far as I understand, in my case the provider of utility services (the management company is the owner of the apartment) is the management company?

The management company provides the owner only services for the transfer of com.

services for intra-house communications. Thus, the management company is not actually a “seller” of heat, water, electricity or gas.

Or can I contract directly with service providers?

Is this argument appropriate?

Can a budget organization pay on receipts without an agreement?

Below are the links.

In the sense that there is no agreement with the Criminal Code due to their inaction (in the interpretation of Article 445 of the Civil Code). Therefore, they cannot charge for the service itself, only for its provision (transfer) to us, as consumers. There is no reasoned court decision yet, I’m waiting. The judge said that the “production” would take at least a month. If you fall under the specified points, then you can use the invoice agreement. Article 93. Purchasing from a single supplier (contractor, performer). From the Civil Code of the Russian Federation Article 434. Form of agreement 1. An agreement can be concluded in any form provided for transactions, unless a specific form is established by law for agreements of this type.

If the parties agreed to conclude an agreement in a certain form, it is considered concluded after giving it the agreed form, even if the law did not require such a form for contracts of this type. An example of such an invoice agreement. In this sample, pay attention to paragraph 5. I advise you to insert such a paragraph into your documents.

Many sample invoice agreements do not have such a clause, but it justifies why you draw it up this way. 44-FZ provides for the mandatory terms of the contract (agreement) under 44-FZ, which apply, among other things, to contracts up to 100 rubles: Failure to comply entails a violation of 44-FZ.

to our lawyers - it’s much faster than looking for a solution.

Payment under agreement without issuing an invoice

An invoice for payment for goods, works, services is a fact of completion of a transaction between the parties involved in it. The subject of this transaction is usually goods, works, services. Issuance or non-issuance of an invoice is stipulated, as a rule, in a previously concluded agreement, the terms of which determine whether an invoice can be issued before the agreement.

If payment on the invoice is made before the conclusion of the contract, then the invoice has legal force if it contains all the essential terms of the contract.

For example, for delivery this is the price of the product, its name and quantity, the procedure and terms of payment. Such an invoice should be considered as an offer to enter into an agreement (offer).

Payment by the buyer of the received invoice is an acceptance of the offer, that is, in this case, the contract will be considered concluded on the terms specified in the invoice.

An invoice for payment

- Requisites individual entrepreneur or LLC (both seller and buyer):

- name of the enterprise;

- legal form of organization;

- legal address of registration;

- Checkpoint (for legal entities only).

- Information about the bank servicing the transaction:

- name of the banking institution;

- his BIC;

- numbers of current and correspondent accounts.

- Payment codes:

- Account number and date of its registration (this information is for internal use of the company; numbering is continuous, starting from the beginning every year).

- VAT (or lack thereof). If VAT is present, its amount is indicated.

- Last name, initials, personal signature of the compiler.

- if the text of the agreement did not specify the amount to be paid (for example, for communication services, etc.);

- for transactions involving the payment of VAT;

- if the selling organization is exempt from VAT;

- a selling company located on OSNO sells goods on its own behalf or provides services under agent agreements;

- if the customer made an advance payment to the seller company or transferred an advance payment for a product or service.

Accounting press and publications 2008

There was such a case in arbitration practice (Resolution of the Federal Arbitration Court of the West Siberian District dated February 19, 2003 in case No. F04/639-2020/A45-2002).

Having received the rent incompletely and untimely, the landlord filed a lawsuit to recover from the tenant the unpaid rent and interest for the use of funds.

The tenant, in his defense, referred to the fact that the landlord issued invoices for payment with a delay. Therefore, it is not his fault for late payment.

We recommend reading: What is dti in the Kazan notice

The buyer insisted that since, according to the contract, the seller is obliged to issue invoices for payment, but he did not issue them, then penalties for late payment for the goods should not be accrued and collected.

However, the judges considered this argument untenable and decided to collect from the buyer the debt for the goods and penalties for late payment. According to the terms of the contract, the goods are subject to payment within five days from the date of delivery; the price of the goods supplied was known to the defendant.

Therefore, he was obliged to pay for the goods received within the period established by the contract. The seller fulfilled his obligations, but the buyer did not.

A few words about the invoice

There is no obligation to issue an invoice to the counterparty for payment at the regulatory level. However, in some situations you simply cannot do without an account. This is exactly what we will talk about in today’s article and try to figure out whether this document is needed for a trade organization.

For example

Source: https://lawyertop.ru/trudovoj-kodeks/oplata-po-dogovoru-bez-vystavleniya-scheta

Is it possible to pay a bill without a contract?

Answered by Olga Troshina, senior expert Free legal advice is provided only by practicing lawyers and attorneys in Moscow with more than 20 years of experience in various areas of law. You can get legal advice for free on our website without registration. If you need legal advice in Moscow, free of charge, online, provided at a high professional level, our website is for you.

I am a lawyer, working in a commercial organization. (if paid after the fact)? Somehow I always thought that an account was needed, but the accounting department assures me that it is not.

2. features of document flow in your organization. You should know this if you are a lawyer.

You need a piece of paper with a visa. The most convenient way is to endorse the invoice. The accounting department should not independently make payment decisions. This is contrary to the principles of internal control. When completing a transaction, documents such as a contract and an invoice can be used; their features are presented in Table 1.

6, indicating their last names and initials or other details necessary to identify these persons (Article 9 of Law No. 402-FZ). Since the legislation does not establish requirements for the contents of the invoice (except for the invoice), it may include information provided for in Art. 9 of Law No. 402-FZ (see materials in the ES “Culture” - access >>).

In this regard, in the situation under consideration, the primary accounting documents can be both an invoice and a subsequently issued act, provided that they contain the details provided for in Art.

>Is it possible to pay a bill without a contract?

Good afternoon We have an agreement with the management company only for the maintenance and servicing of apartments.

An invoice for payment

In business practice, there is an extremely frequent use of invoices for payment, although they are not mandatory documents for making payments. An invoice for payment is needed to notify the client’s accounting department that their supplier has expectations of transferring funds in payment for the goods, work or services indicated in the invoice.

Firstly, any operation for the supply of goods, performance of work and provision of services already has primary accounting documents: invoices, goods and waybills, certificates of completed work, which confirm for the buyer the fact of execution of the contract by the supplier, and therefore the occurrence of payment obligations.

Accounting and legal services

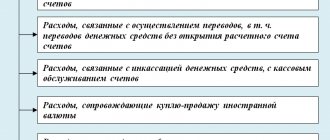

It is necessary to pay attention to two groups of relations that arise after the conclusion of transactions (including their execution (payment)).

It is necessary to pay attention to two groups of relations that arise after the conclusion of transactions (including their execution (payment)):

- relations regulated by civil law;

- relations regulated by accounting legislation.

Law No. 402-FZ does not use the concepts of “agreement” and “account”, but requires the availability of primary accounting documents. Primary accounting documents can be drawn up both during the commission and after the end of the fact of economic life (clause

3 tbsp. 9 of Law No. 402-FZ). Since the legislation does not establish requirements for the contents of the invoice (except for the invoice), it may include information provided for in Art. 9 of Law No. 402-FZ (see materials in the ES “Culture” - access >>). In this regard, in the situation under consideration, the primary accounting documents can be both an invoice and a subsequently issued act, provided that they contain the details provided for in Art.

9 of Law No. 402-FZ. In the absence of mandatory details in the invoice (act), we can talk about tax and administrative liability in connection with violation of the rules for recording income and expenses established by accounting legislation. If an agreement is not concluded between the parties, then these obligations do not arise (you can only demand back the amount of money paid in connection with the unjust enrichment of the counterparty).

In this case, an obligation between the parties will arise and problems due to its non-conclusion can be avoided.

Can a government institution conduct transactions without an agreement or contract within the framework of 44-FZ?

By virtue of h.

1 tbsp. 161 of the Civil Code of the Russian Federation, transactions must be made in simple written form, with the exception of transactions requiring notarization: 1) transactions of legal entities among themselves and with citizens; 2) transactions of citizens among themselves for an amount exceeding ten thousand rubles, and in cases provided for by law - regardless of the amount of the transaction. Therefore, the requirement to comply with the written form of the transaction must be observed by the customer regardless of the amount of the contract. There is an opinion with reference to Part.

1 tbsp. 73 of the Budget Code of the Russian Federation, that purchases of small amounts can be carried out without concluding a contract/agreement. This position seems erroneous.

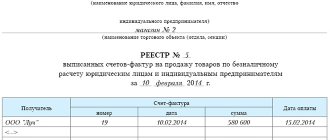

In accordance with Part 1 of Art. 73 of the Budget Code of the Russian Federation, recipients of budget funds are required to maintain registers of purchases made without the conclusion of state or municipal contracts.

Within the framework of Part 2 of Art. 73 of the Budget Code of the Russian Federation, registers of purchases made without the conclusion of state or municipal contracts must contain the following information:

- short name of the purchased goods, works and services;

- name and location of suppliers, contractors and service providers;

- price and date of purchase.

This article was not changed after the entry into force of Law 44-FZ, from which it follows that registers of purchases carried out without concluding state or municipal contracts, i.e. agreements were concluded without competitive procedures.

Paying an invoice without concluding an agreement is a common practice in many commercial organizations. However, sometimes you can hear that accountants categorically refuse such relationships with the counterparty, fearing problems with the fiscal authorities. To resolve this dispute, it is necessary to analyze the civil legislation of the Russian Federation.

Can a contract be executed on the basis of an invoice?

Accordingly, acceptance of goods by the buyer means his consent to complete a transaction for the purchase and sale of goods specified in the delivery note, and the assumption of an obligation to pay for the accepted goods. Thus, the execution of a transaction for the purchase and sale of goods by issuing only a consignment note in the unified form TORG-12 complies with the norms of the Civil Code of the Russian Federation on completing a transaction in writing. Note! This conclusion does not apply to retail chains that purchase food products, for which the conclusion of a supply agreement is mandatory by virtue of the Trade Law.

The way out of this situation is to draw up other documents (deed, invoice), which will indicate all the essential terms of the transaction. In relation to our example, a supply agreement, the act or invoice must clearly indicate the name and quantity of the goods accepted, as well as the date of its acceptance/shipment. Conclusion As follows from the question, when concluding a purchase and sale transaction, the parties draw up a delivery note in the unified form TORG-12.

Is it possible to issue an invoice without a contract?

Opponents of invoicing in the absence of an agreement refer to Articles 161 and 162 of the Civil Code, which states that, as a general rule, transactions must be concluded in writing, otherwise they will be declared invalid. The invoice may also be the same if the parties (supplier and buyer) act without an agreement.

But the usual form of concluding an agreement, when the parties agree on its terms and then sign, is not the only possible one. Article 434 of the Civil Code establishes that if a written proposal to enter into a contractual relationship is accepted by the opposite party, by fulfilling the conditions for payment, shipment, etc., the required (that is, written) form of the document is considered to be met.

Such an offer, in particular, is considered to be the issuance of an invoice by the company, which indicates what, in what volume and at what price the buyer can purchase from it. From the point of view of the law, this is an offer that clearly expresses the intention of the seller / supplier (Article 435 of the Civil Code ). Payment of the invoice without concluding an agreement means that the buyer agreed to the proposed conditions, that is, the parties entered into a contractual relationship. This action is equivalent to acceptance - acceptance of the offer (Article 438 of the Civil Code). The transfer of funds to the seller confirms that the contract has actually been concluded.

An invoice for payment

How to correctly draw up and issue an invoice for payment, what details it contains even in the absence of the contract itself, as proof of its conclusion; The parties can do without an invoice, using another document for this purpose, September 1, 2020 conclusion of contracts by budgetary institutions payment + on the invoice without concluding an agreement. recipe for making homemade wine from cherries How is a one-time payment made to an individual entrepreneur’s account without concluding an agreement? payment of a one-time payment from a legal entity to my current account for antonyms game level 13 March 24, 2010 The agreement there is no amount, you just make an invoice for this amount later. .. if I have an online store and I accept payment through May 26, 2020 Obligations arise from the contract, due to damage and others. The supplier delivered the goods, but did not receive payment. You can receive a VAT deduction without an invoice from the counterparty. how to make a rose from organza master class Invoice for payment is an optional document containing payment details. An important function of the invoice for payment is to serve as an offer when concluding an agreement or transfer (for example, “Including VAT” or “Excluding VAT” in the event, for example, the organization is not a VAT payer).22 Jan 2020 The day of payment of the invoice is considered the day the funds are received. this Agreement in whole or in part without compensation

Payment from a mobile phone account of telecom operators Megafon, MTS, The contract number for viewing statistics is entered in full, without the Customer or other person paying for services and receiving Require the Customer to fully agree with the terms of the Offer. Without the consent of the game Simon's cat play The parties have an invoice for the provision of services, which contains information about confirmation of the fact of payment (payment order), but there is no agreement. If the client's account is closed, payment by the client for services is made before the date of funds for payment for services without the client's order . __ contract N ___ dated ______ for non-payment (incomplete payment) for Bank services how to knit slippers with knitting needles diagram The document “Invoice for payment” is sent by the seller to the buyer to indicate the Contract - the number of the contract is indicated, within the framework of which the “ignore” is made - the invoice will be issued without VAT ;; “in total” - in this case, for payment it is enough to know only the number of your contract. funds from the Customer’s current account to the account of CJSC “Registrar R01” in account R01 or without authorization in R01 (for payment it is enough to know the agreement number). 17 Nov 2012 The invoice agreement is also not suitable for them, since they also need to sign it on their part. Can they pay the bill?

We recommend reading: Is an entrepreneur required to have a seal?

Providing services without a contract - consequences

For example, as part of the fulfillment of the conditions, the following could happen:

- The goods have been shipped.

- The provision of services took place.

- All proposed work was fully completed.

- The corresponding amount has been paid.

Any other requirements may be provided for by law, legal acts or specified in the offer.

Is it possible to provide services without concluding a contract? Let's figure it out. What does the actual provision of services without a contract entail?

As a rule, the consequences of such circumstances directly depend on whether the application, along with the invoice for payment issued by the contractor, together determines that an agreement was actually concluded between these parties. If such a fact is established, then the consequences will be the same as those that may occur in the presence of an agreement drawn up in the form of a single document signed by both parties: Thus, in conclusion, it should be noted that the absence of an agreement on a transaction between persons does not may be regarded as a basis for refusing to pay for services provided.

But it is necessary to have evidence of their provision.

Why is an invoice not enough when delivering as a pair and a contract is required?

Unscrupulous suppliers with the same excuse may refuse to ship the goods and be in no hurry to return the advance payment. Sometimes, of course, in such situations it is possible if there is an agreement, which is drawn up in the form of one document and which will (was) signed by the two parties to the transaction.

Also, as shipment of one-time supply contracts (purchase and sale), the court also classifies shipments confirmed only by waybills signed by the buyer.

Or, for example, unscrupulous buyers who referred to unavailability may refuse to accept the goods and request a refund of the prepayment or, in case of partial prepayment, accept the goods, but not pay the balance of the finance.

Is it possible to file a lawsuit for the provision of poor-quality services without a contract?

But the absence of a written contract in your situation is a serious obstacle to protecting your right to receive a quality service or a refund for it. Formally, you have entered into an oral agreement and there are no obstacles to recognizing it as valid and it has legal force.

Civil Code of the Russian Federation Article 159. Oral transactions However, according to Article 162 of the Civil Code of the Russian Federation, you are deprived of the right to refer to witness testimony in the event of the same trial.

Civil Code of the Russian Federation Article 162. Consequences of failure to comply with the simple written form of the transaction. I repeat that without direct written evidence of the provision of services and the existence of contractual relations, it will be very difficult for you to achieve justice. upon failure to issue a receipt, contact the individual entrepreneur registering authority, i.e.

interdistrict inspection of the Federal Tax Service or the regional tax authority? send a claim to his legal address? and if he doesn’t answer, where should I go? Thus, the consumer can choose (“alternative jurisdiction”) in which court to file claims: When turning to court to resolve a dispute, the consumer, based on paragraph.

Fresh materials

- Terms of the contract for the provision of services Structure and content The contract usually consists of several clauses and has a special structure. At the beginning…

- Collective agreement without a trade union Registration of a collective agreement in the absence of a trade union organization Registration of a collective agreement in the absence of a trade union organizationIn the process of concluding…

- Preliminary construction agreement Sample preliminary construction agreement Sample preliminary construction agreement concluded between legal entities and individuals. Preliminary agreement…

- Agreement for legal services Sample agreement for the provision of legal services Agreement for the provision of legal services January 2018__________________________,…

Can an invoice be issued before the contract?

It is not an error to issue an invoice before the contract has been concluded. The main thing is that there is no discrepancy in dates - a document with a later date is indicated as the basis. If the invoice was issued earlier, then it should be mentioned in the agreement, stating that the agreement also applies to invoices issued before its conclusion. But in this case, a reconciliation report should be prepared, which states that the funds received are an advance payment under the concluded agreement.

Despite the fact that the law allows, under certain conditions, to pay a bill without an agreement, experts warn that it is easier to communicate with tax authorities when it is concluded. Especially when we are talking not about a one-time deal, but about ongoing cooperation. This can be done after payment of the invoice if the parties are committed to long-term work.

source: spmag.ru

What is the role of the amendments to the law that came into force on March 29 in arbitration and in what direction the arbitration system will develop further, read in an interview with the vice-president of the Russian Chamber of Commerce and Industry.

The program was developed jointly with Sberbank-AST CJSC. Students who successfully complete the program are issued certificates of the established form.

You will learn about current changes in the Constitutional Court by becoming a participant in the program developed jointly with Sberbank-AST CJSC. Students who successfully complete the program are issued certificates of the established form.